Lawmakers in Hungary have overwhelmingly voted in favour of banning cultivated meat, even though the EU Commission has called the move “unjustified” and experts have questioned its legality.

After nearly two years of attempts, the Hungarian government has succeeded in its attempt to stifle a food product that isn’t even on the market yet.

In a vote on Tuesday (November 18), Hungary’s parliament voted to ban the production, distribution and marketing of cultivated meat, with 140 in favour, 10 against, and 18 abstentions. Exceptions to the ban are only applicable for medical and veterinary purposes.

In his justification for the ban, the bill cited the need to protect “traditional rural lifestyles and human health” (as well as the environment), warning against the “potential dangers of non-traditional technologies”.

“Food production [must] be linked to the land, as this is the basis of our traditions and culture, and if we move away from this, we will lose our identity,” agriculture minister István Nagy said a day before the vote. “The spread of meat produced in laboratory conditions would result in a lifestyle change that would completely upset European culture, which we cannot allow.”

Hungary is the second European country to vote for a ban on cultivated meat, after Italy in 2023. Its efforts have been directly opposed by fellow EU member states, as well as the European Commission, which has said a ban would damage the free market and was “unnecessary” and “unjustified”.

How Hungary’s ban on cultivated meat materialised

Hungary’s path to the cultured meat ban began in January 2024, when Nagy publicly attacked the industry after meeting Ettore Prandini, president of the Italian farmers’ association Coldiretti, one of the loudest opponents of cultivated meat.

Months later, Prime Minister Viktor Orbán weighed in on the issue in his annual state-of-the-nation speech, stating that the EU “talks nonsense” and is “dumping artificial meat and poor-quality GMO products on us”.

In July, at the EU’s Agriculture and Fisheries Council meeting, Hungary used its presidency to call for efforts to “protect” Europe’s culinary traditions from novel foods like cultivated meat – in other words, it sought to outlaw these proteins.

That sparked an EU-wide debate, including widespread backlash from countries like the Netherlands, the Czech Republic, Lithuania, and Sweden. The latter, for instance, said justifying the move by calling cultivated meat harmful to human health was “unacceptable”, highlighting that Hungary hadn’t provided any risk evaluations or demonstrated that these products might threaten human or planetary health.

One of the top criticisms is that Hungary’s ban goes against EU law. The country submitted a Technical Regulations Information System (TRIS) notification to the EU Commission (a procedure aimed at preventing barriers to the free movement of goods among member states) detailing why it was prohibiting this industry, though its explanation was rejected by the executive body and several member states.

Still, in March this year, Hungary’s deputy prime minister, Zsolt Semjén, submitted a bill to the parliament to attempt to ban cultivated meat, which policymakers voted to adopt yesterday.

“Our country has examined the issue of cultured meat from all sides and has also subjected the regulation to the necessary EU procedures. Our position has not changed, even after these procedures were concluded, and the strictest possible regulation is needed,” said Nagy.

“We only allow its use for medical and veterinary purposes, and in all other cases, we strictly prohibit the production and distribution of cultured meat in our country.”

Hungary’s ban goes against consumers’ wishes

“It is undeniable that traditional food production has a positive impact on agriculture and rural living conditions as a whole,” Semjén writes in the bill, which is now awaiting a final signature from the president (who has five days to do so).

“Technologies and production methods that differ from traditional ones contain potential dangers that threaten our fundamental values. We do not yet have a satisfactory answer to these challenges,” the text adds. “The presumed negative effects justify a general ban on the production and marketing of laboratory-grown meat.”

Along similar lines, Nagy added: “The national government is committed to food production linked to the farmland and strengthening the countryside. Some people have become distant from nature, and a false romanticism is developing regarding wildlife. The majority of society must understand that without farmers, there is no food and no future. Artificial meat is a fabrication, and we insist on our culture.”

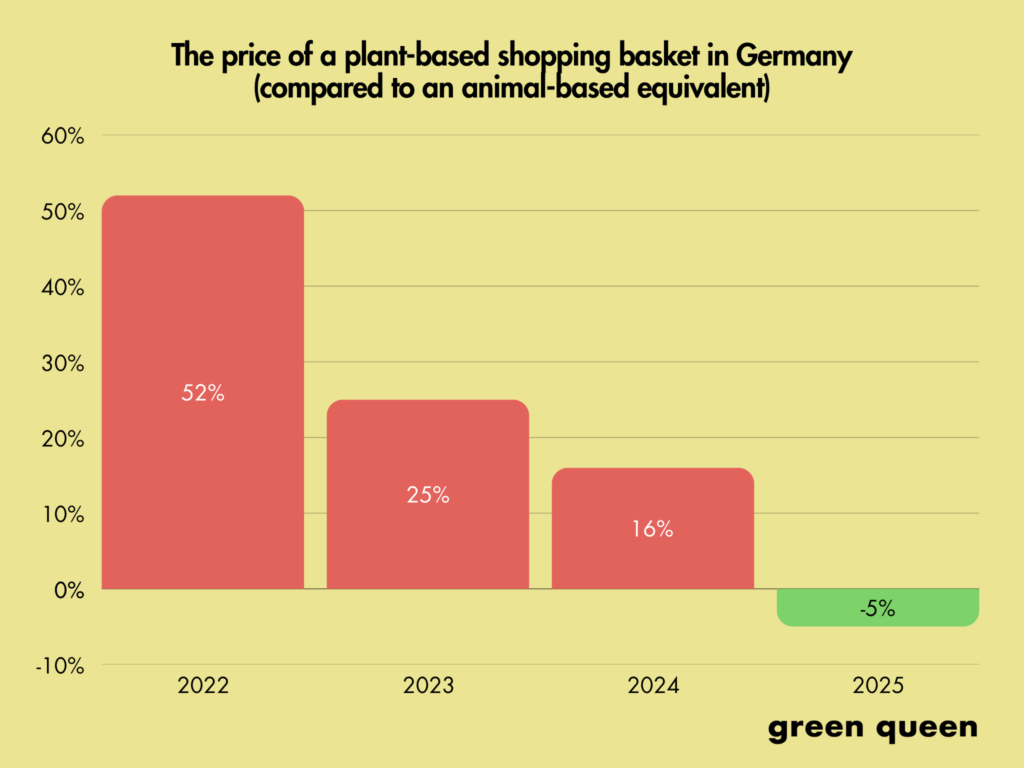

Cultivated meat has been proven to be better for the planet (especially when produced via renewable energy), in addition to supporting animal welfare and, in the longer term, food security. Even farmers are embracing the technology, so to ban it on “presumed negative effects” is befuddling.

Cultural protectionism has been cited as a justification for the ban in Italy, too. At the same time, the safeguarding of livestock producers is the bedrock of the seven state-level bans on cultivated meat in the US. Still, these farmers welcome the competition and have spoken out against placing restrictions on cultured meat.

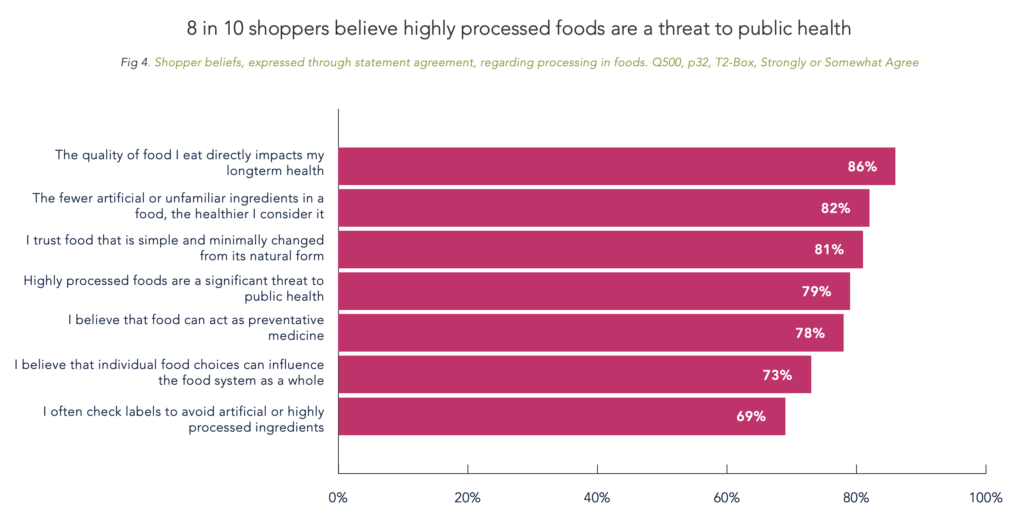

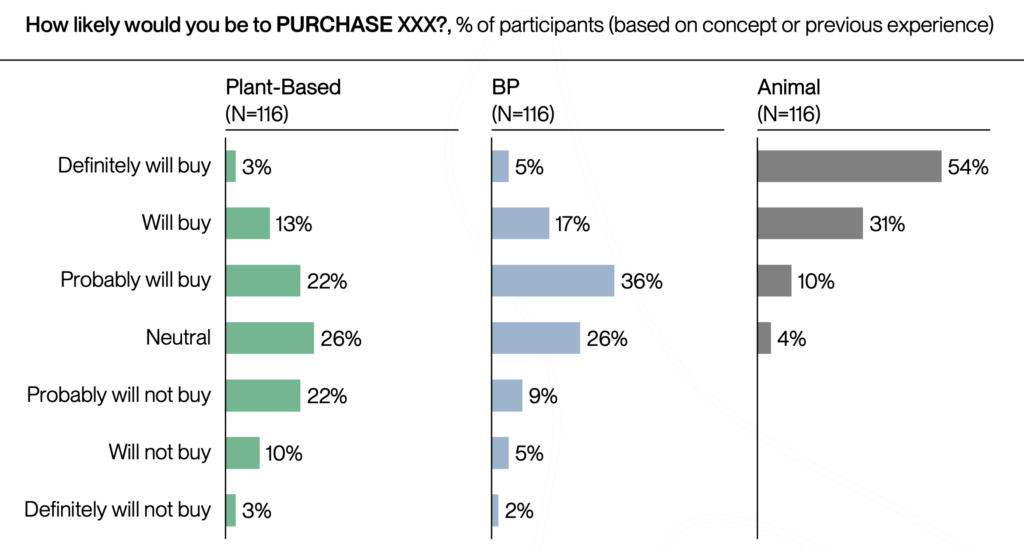

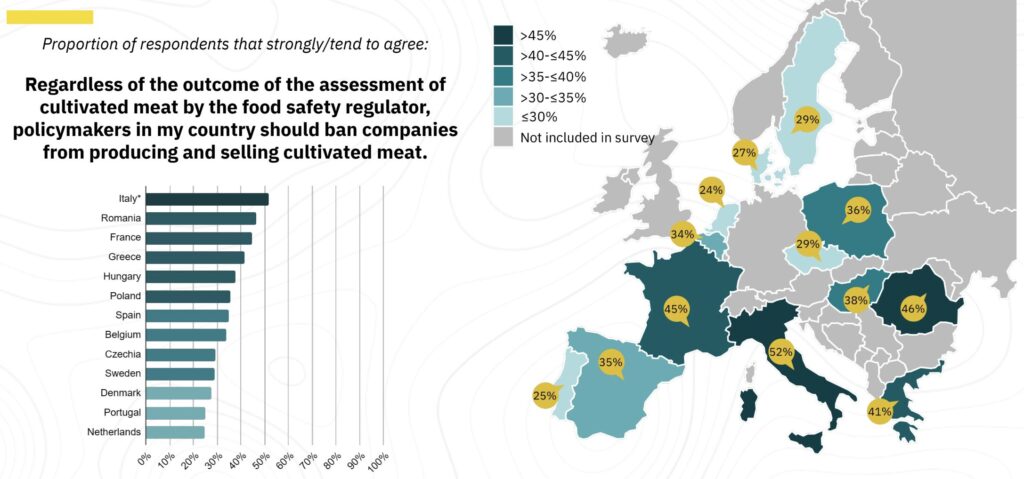

That sentiment isn’t just confined to the farmers. Most European consumers are also against banning cultivated meat, including over 60% of Hungarians. In fact, around 55% of the latter group support the sale of these proteins if they pass safety assessments from food regulators.

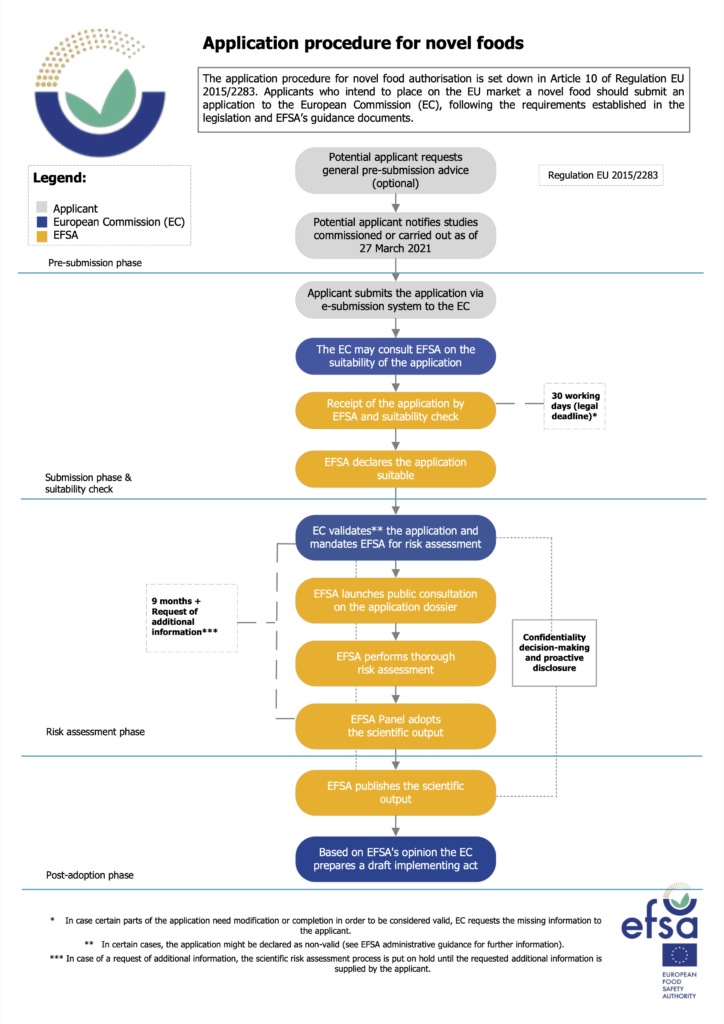

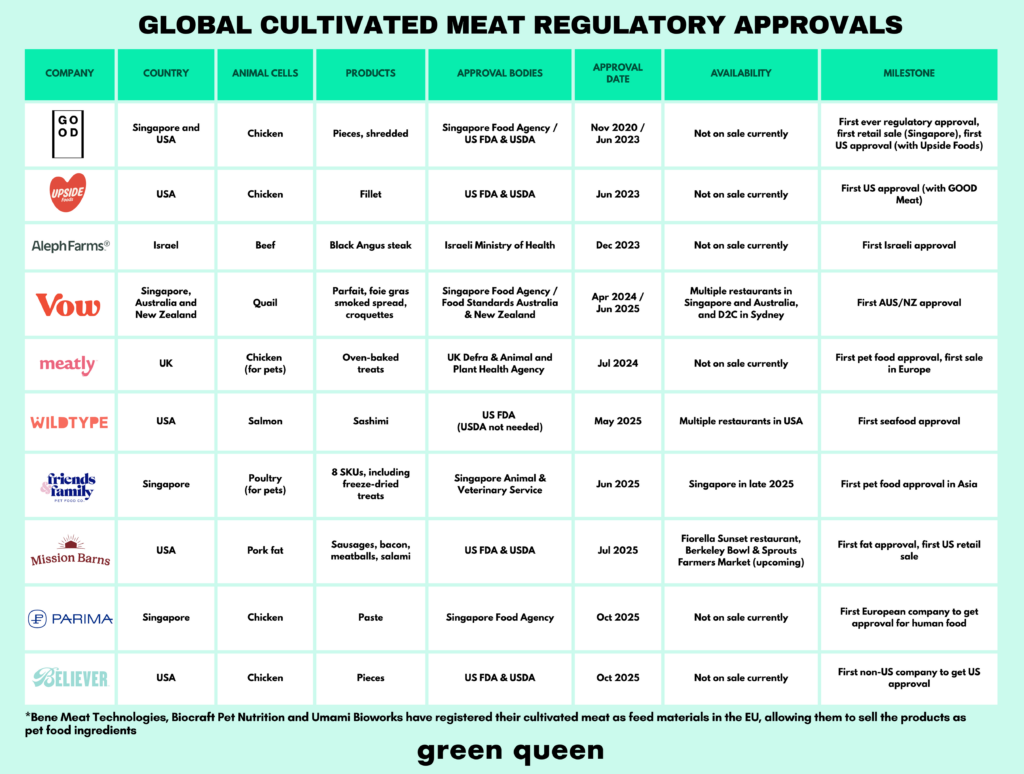

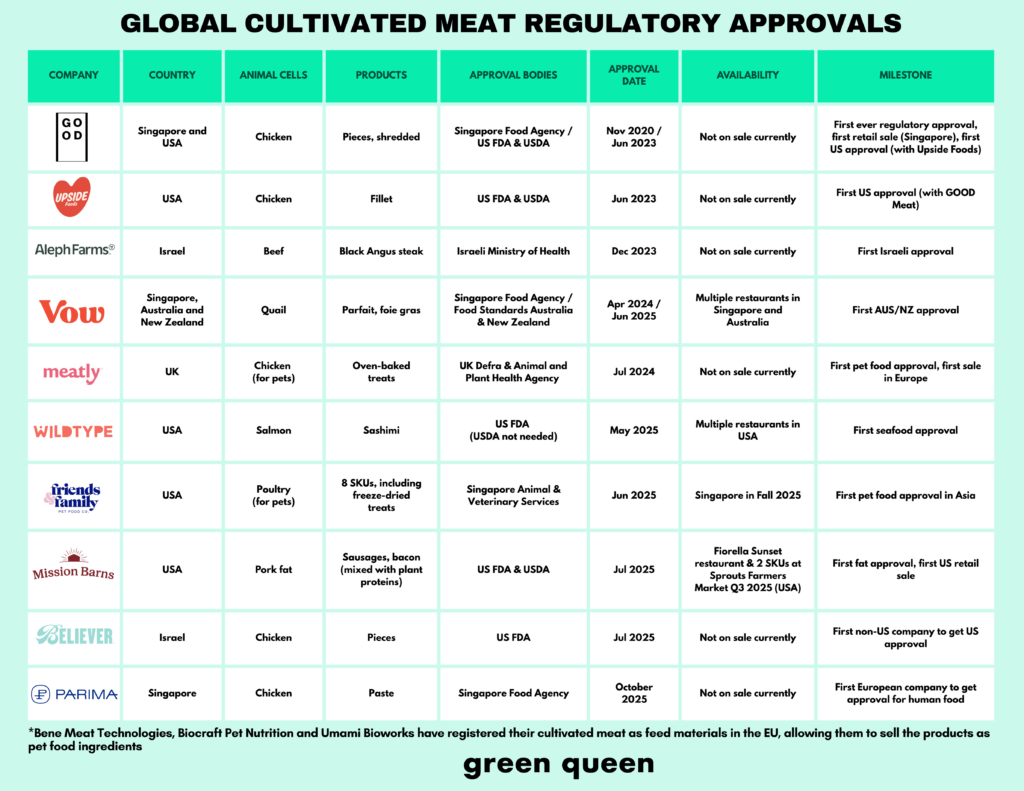

So far, only two companies have filed to sell cultivated meat for human food in the EU: Parima (for cultivated duck) and Mosa Meat (beef fat). Since they’re at least a year away from entering the market, prohibitive decisions like Hungary’s are unnecessary, according to the EU Commission

“A ban is therefore unjustified, since it could pre-empt the harmonised authorisation procedure for novel foods at EU level, which includes a scientific assessment by EFSA,” it said last year.

The post Hungarian Parliament Votes to Ban Cultivated Meat, Despite EU Criticism & Legal Uncertainties appeared first on Green Queen.

This post was originally published on Green Queen.