Ministers from 13 nations are pushing back strongly against the EU’s cultivated meat policy and asking the bloc to rethink its novel foods regulatory process in the interest of safety.

Some countries are resisting the move, but the EU could now revisit its legislation. Here’s what happened at the meeting, and what could come next.

Over the last few months, there has been increased parliamentary activity in governments around the world, specifically focusing on banning the production and sale of cultivated meat. While there are multiple reasons cited, the most common ones found across the board pertain to the safeguarding of national culture, livestock farmers, and consumers’ health.

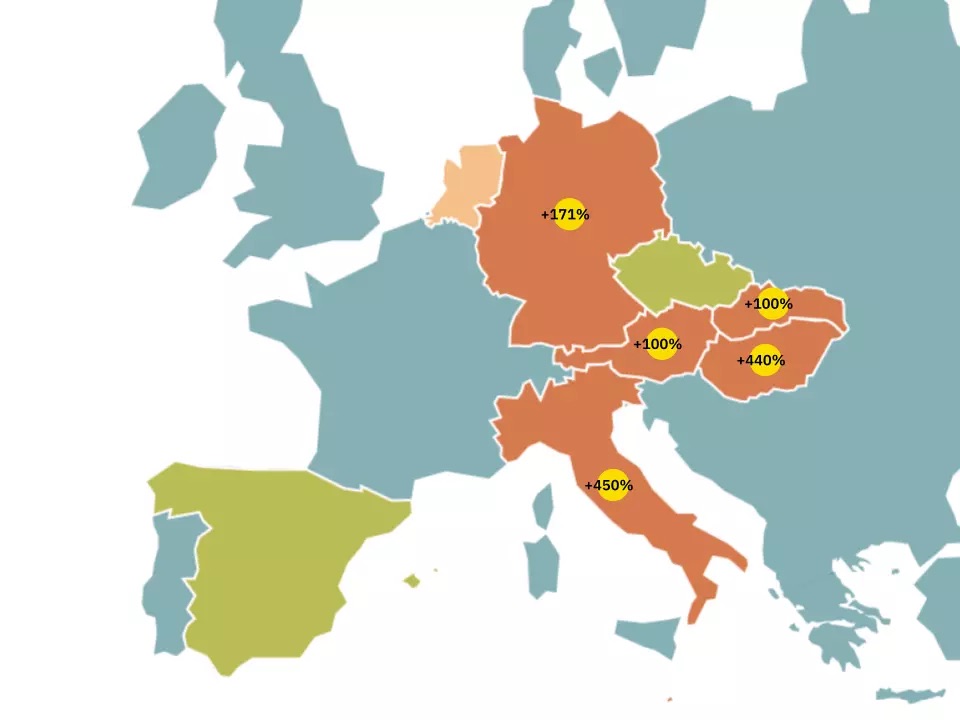

This week, things boiled over. A delegation led by Austria, France and Italy – the latter two of which have already proposed a ban or gone through with it – presented a note to the EU’s Agriculture and Fisheries (Agrifish) Council meeting calling for a radical overhaul to cultured meat regulation in the region. This was supported by the Czech Republic, Cyprus, Greece, Hungary, Luxembourg, Malta, Poland, Romania, Slovakia and Spain.

Critics, however, have highlighted false claims made by the representatives of these nations, labelling the entire exercise as unnecessary. While the note only serves to set out a position and does not trigger any formal follow-up process, some believe that the EU might be considering revisiting its novel foods regulations anyway.

What did the note say, and how was it misleading?

The note states that cultivated meat raises many questions, including ethical, economic, social and legal concerns, as well as sustainability, public health, and transparency. It calls for a public consultation process and a “comprehensive impact assessment” to assess the development of these foods, as well as drawing guidelines based on the regulatory framework for new pharmaceutical products (including pre-clinical and clinical studies). It also touches upon labelling, urging the EU to prohibit these products from using meat-related terms.

“A transparent, science-based and comprehensive approach is necessary to assess the development of artificial cell-based meat production, which in our view does not constitute a sustainable alternative to primary farm-based production,” the ministers write in the note. They add: “We urge the Commission and all member states to take pre-emptive action against the monopolisation of food production and towards the diversification of primary farm-based food production guaranteed by European farmers.”

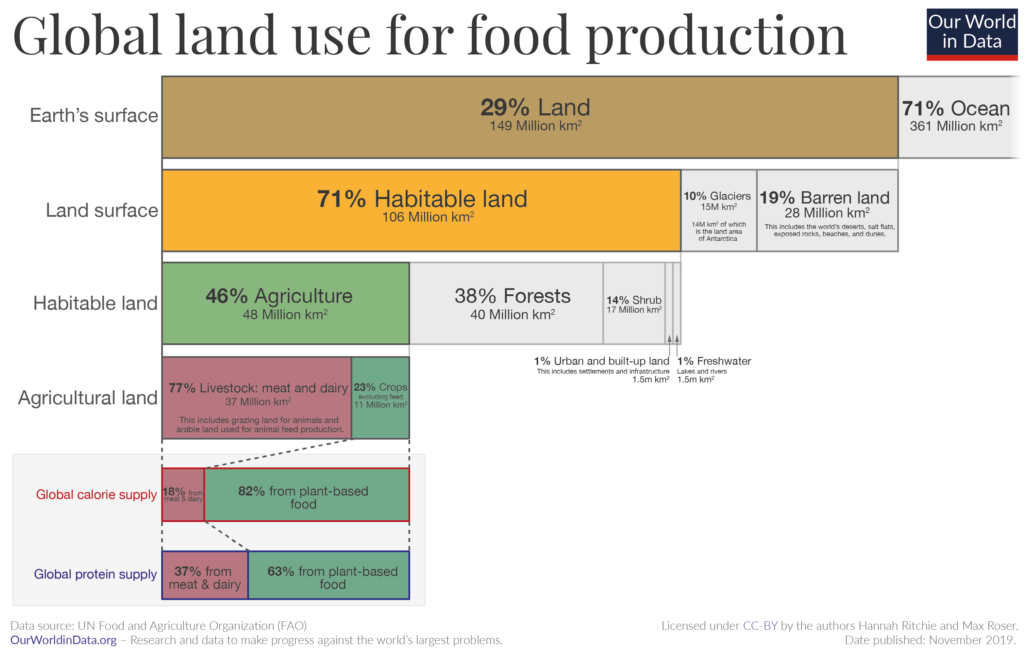

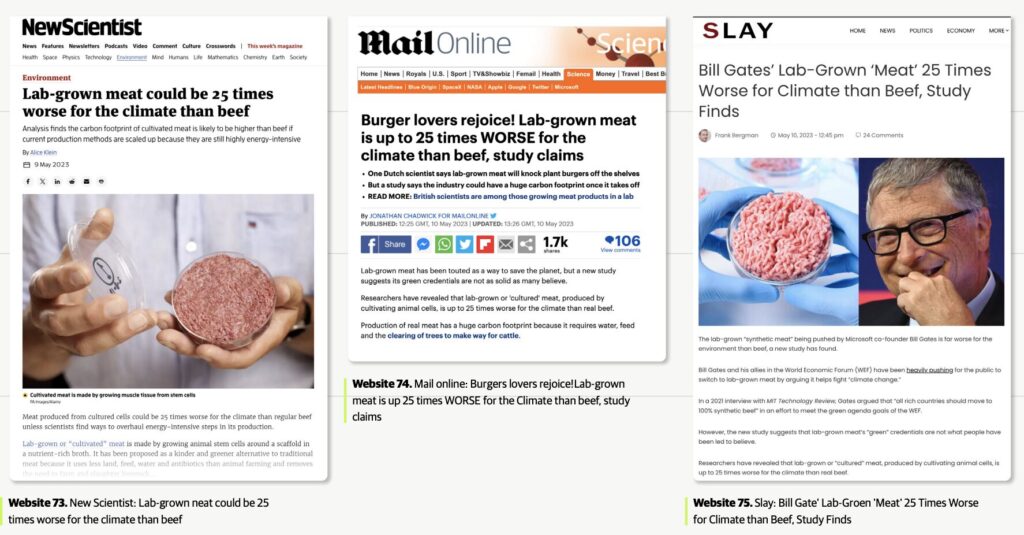

Alternative protein think tank the Good Food Institute (GFI) Europe has pointed out that there are many misleading claims made by the lawmakers. One of them is about cultivated meat’s environmental impact, referencing a non-peer-reviewed, UC Davis study funded by the meat industry, which is “based on incorrect assumptions” and deviates significantly from existing literature. Its findings have driven a major misinformation campaign on social media. Peer-reviewed research has shown that when produced using renewable energy, cultivated meat can account for 92% fewer emissions, 94% less air pollution, and 90% less land use than conventional beef.

The note referenced a 2019 University of Oxford paper too, when research on these novel proteins was “much less developed” and based on energy sources heavily reliant on fossil fuels. This contradicts the most recent data available, which underlines that even the worst-case scenario for cultivated meat greenhouse gas emissions is better than the “best” conventional meat production systems for at least the next 100 years.

The ministers argue that cultivated meat does not have higher animal welfare standards, referring to the use of fetal bovine serum (FBS). But FBS is being phased out by companies globally, and hundreds of animal-free media already exist. Some FBS-free formulations have been approved for sale, like Eat Just in Singapore and Aleph Farms in Israel.

Additionally, there were concerns about cultivated meat “being monopolised among a few large-scale industrial producers” and how that would affect small-scale farmers, but GFI Europe argues that these foods can be made by “companies of all shapes and sizes” (over 50 of the 160+ startups in this space are European), and can work alongside existing farming methods to diversify and strengthen our food supply.

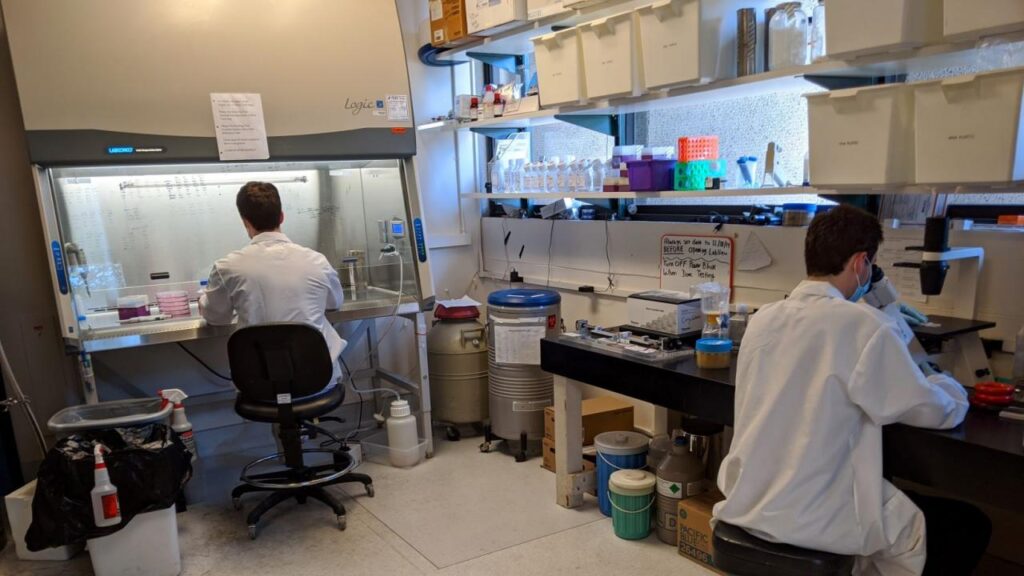

The delegates further questioned the EU’s novel foods regulatory framework, but it is known to be the most robust in the world, which is why companies have found it challenging to file for clearance in the bloc. Other European countries – namely the UK and Switzerland – are already assessing dossiers. And as for the call to regulate cultivated meat as a pharmaceutical product, GFI Europe labels it “nonsensical”, pointing out that it’s “a food that will be made in food production facilities, so it’s essential that it is regulated as food”.

What happened at the council?

The note presented by Austria’s agriculture minister, Norbert Totschnig, made waves on the Agrifish Council floor. There was controversy even with the countries opposing cultivated meat, with Austria’s health ministry – which is responsible for food safety – noting that the move does not reflect the government’s position.

Other countries voiced their disagreement too. In the same week, the Netherlands took one step closer to becoming the first EU nation to allow public tasting events of cultivated meat, its representative stuck his neck out for the novel proteins in the EU Council as well. “We of course understand the concerns with regards to the public health and the future of livestock farmers, but also at the same time, we are talking about how do we secure the global food security, and the world population as we all know is growing fast, and so is the demand for animal proteins,” said Piet Adema, the Dutch food quality and agriculture minister.

“Therefore, we believe that it is important to support innovations that create production methods for animal proteins complementary to, and not as a substitute to, conventional sustainable production. So, more research is needed to ensure the safety and the lower energy use, and therefore, in the Netherlands, we invest in this research, and so I would plea to let’s also look at the opportunities of this development and not only see the threats.”

Similarly, Jacob Jensen, the agrifood minister for Denmark – a leader in protein diversification – said: “We understand the concerns that have been raised under this item, but Denmark remains very positive towards the development of new innovative biotechnological solutions that could lead to new sustainable proteins. And, like the Netherlands, we believe that we must also focus on the upside, and therefore, we look forward to the biotech initiative from the Commission that will look into the opportunities.

“We already have EU regulation on novel food in place. This sets a clear legal framework that is solidly based on science. Denmark sees no reason for hindering the development and marketing of cell-based products, as long as such products are safe and fulfil the legal requirements and as long as they are labelled in a way which is not misleading to consumers. If these requirements are met, it must then be up to consumers if they want to buy these products.”

Meanwhile, Stella Kyriakides, the EU’s health and food safety commissioner explained that the bloc’s existing regulatory framework for novel foods ensures that human health and consumer interests are well protected in a functioning internal market.

What happens next?

EU Commission vice-president Maroš Šefčovič had separately spoken about the need for a strategic dialogue on the future of agriculture, which was outlined by GFI Europe’s senior policy manager, Alex Holst. “As Commission vice president Šefčovič said, we need to ensure our food system is ‘fit for the future’, remains competitive and can respond to issues such as climate change, biodiversity loss and resource scarcity,” he said. “Cultivated meat can play a vital role in achieving these goals, and it’s a positive step that policymakers are becoming interested in developing a better understanding of this food.”

Holst noted how EU countries have already made strides in cellular agriculture, questioning the point of this debate altogether. “The EU’s Horizon Europe programme and countries like Germany, Spain and the Netherlands have already invested in cultivated meat R&D, recognising its potential to improve food security, reduce emissions, and satisfy [the] growing demand for meat,” he explained.

It’s curious that despite investing in cultivated meat, Spain was a part of the note’s supporters. There will be a focus on France and Romania too, as both have proposed bans on cultivated meat. But it’s unclear whether France’s bill will be debated or not, as it’s one of many such bills proposed by opposition parties. As for Romania, the proposal had been voted through by the Senate but is yet to be passed by the Chamber of Deputies.

But Romanians have mulled over the subject, with the Economic and Social Affairs Council of the Senate publishing an opinion on it. Its report on the proposed legislation stated: “The statement of reasons does not explain why synthetic meat should be banned. It is not clear why it could be dangerous to consume this product for the health of the consumers. Moreover, it is not clear why lab-grown meat is considered lower quality than ‘natural’ meat, considering the benefits of meat outlined in the statement of reasons. Therefore, the ban added through Article 5 is excessive, and it is necessary to eliminate it or provide further justifications.”

Meanwhile, Italy’s move to be the world’s first country to ban cultivated meat has been flagged as a violation of EU law, as the bloc is required to be notified to the EU Commission for comments by other member states. Plus, the country will not be able to prohibit the sale of cultivated meat produced outside Italy but within the EU, whose common single market enables the free movement of goods and services.

But changes may be afoot for Italy’s ban. “The Italian Government has committed to updating the law based on any feedback received from the European Commission, meaning there is a legal and political requirement to make changes to the cultivated meat ban if needed,” Francesca Gallelli, Italy policy consultant for GFI Europe, told Green Queen. “We also trust that Italy’s scientific community and civil society groups will play a vital role in holding the government responsible and making decisions based on evidence-based research rather than misinformation.”

Striking a similar tone, Julia Martin, cellular agriculture lead at ProVeg International, told Green Queen: “We hope it will be overturned. But we also hope that Italy will come round to seeing the huge benefits that Europe stands to gain from cultivated meat. The EU needs to support cultivated meat if it wants to bring down greenhouse gas emissions from the food system.”

Austria’s representative eventually tabled the note, which will not lead to any direct legislative changes. But ProVeg said the EU Commission “has the intention to revisit the guidance for novel food applicants”, with Martin further noting how the bloc recently funded FEASTS, the first Horizon Europe project on the impact of cultivated meat and seafood: “These actions should serve to reassure member states that these foods will be safe for consumers and will serve a significant role in addressing the environmental challenges with intensive animal agriculture.”

The post Here’s What Went Down at the EU Agrifish Council Meeting on Cultivated Meat appeared first on Green Queen.

This post was originally published on Green Queen.