22 Mins Read

The below conversation is the transcript of the fifth episode of the podcast miniseries Green Queen in Conversation: Cultivated Meat Pioneers featuring Dr Mark Post, Chief Scientific Officer and co-founder of Mosa Meat interviewed by show host Sonalie Figueiras. This conversation has been edited for clarity and length.

In the fifth episode of Green Queen in Conversation – Cultivated Meat Pioneers, Sonalie Figueiras talks to Dr. Mark Post, Chief Scientific Officer and co-founder of Mosa Meat. Post is arguably THE original cultivated meat pioneer. It was such a privilege to be able to speak to him, and even more so on the 10-year anniversary of when he and his team presented the first-ever cultivated meat beef burger to the world. That moment set the course for the entire industry, and truly changed the future of food and what was deemed possible. In terms of how we produce meat, Dr. Post remains one of the key voices for the industry, and our conversation is full of insights, learnings, and inspiration.

Listen to this episode on Apple, Spotify or wherever you get your podcasts.

Sonalie Figueiras: Welcome and congratulations on this incredibly momentous day! It is August 5th 2023, exactly ten years after you unveiled the first cultivated meatball to the world! How does that feel?

Mark Post: Yeah, it’s a nice anniversary. It’s also especially good because a lot has happened since then. The dream that we had at that time actually came true to a large extent.

Sonalie Figueiras: That’s so special. Let’s start right there. Are you where you thought you would be in terms of Mosa Meat? Do you feel that the industry has progressed the way you anticipated when you first started on this journey?

Mark Post: Yeah, pretty much. I mean, I hadn’t anticipated that by now we would have 150 or 160 companies, that was something that I never imagined. Or that our own company would grow from 12 to 260 people in ten years, because you know, as a scientist, you think about the scientific problems, and not necessarily about all the other activities around it, but that has been very rewarding to see that. Finally, the development has been diverging in different directions, which I hadn’t anticipated either. We are now seeing a range of technologies and a range of product applications that I didn’t envision in the beginning.

Sonalie Figueiras: Do you mean for example that you were working on beef, but now we’re seeing things like pork, chicken, and seafood? Or do you just mean different kinds of supply chain technologies?

Mark Post: Both, actually. In terms of the products- the species, whether it’s chicken, pork, or fish, I knew that. I kind of expected that would happen. But that early on, people would already start trying to make a full-thickness steak like what Aleph Farms is trying to do? Or that people would use cells as an ingredient in mostly plant-based products? I had expected the steak, but not so soon. However, the cells as an ingredient in plant-based food I had not expected.

Sonalie Figueiras: Interesting, and what about things like cell-based milk, or you know, coffee, chocolate? That’s really taking the technology and adapting it to all kinds of parts of our foods.

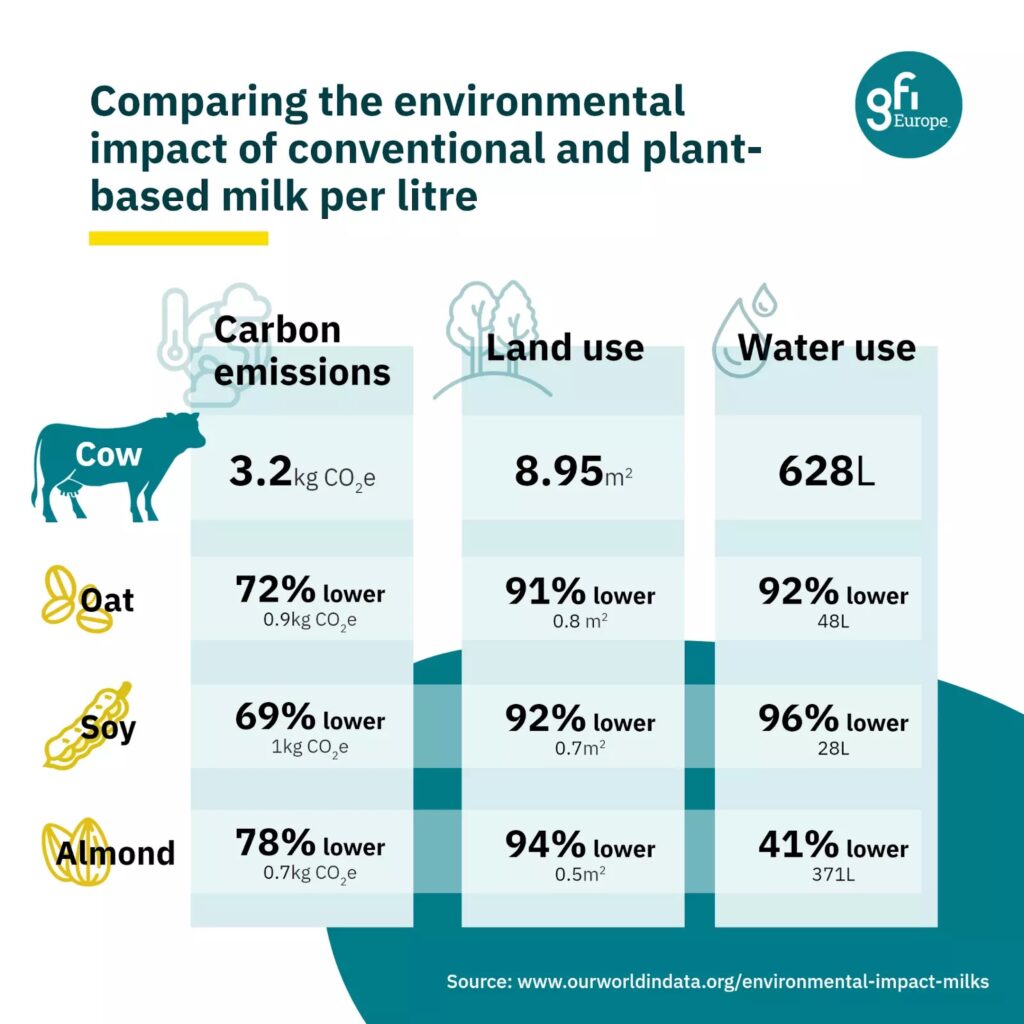

Mark Post: Right, right. For milk, it makes a lot of sense. There are two technologies, and one of the technologies based on precision fermentation to make milk proteins was actually already there at the time we presented the hamburger, it had already started to be developed. So, that also made a lot of sense to me, because yeah, dairy and beef are the most environmentally damaging animal proteins that we consume. Chocolate and even wood, fur and plant cells? I had not expected that.

Sonalie Figueiras: Fur?

Mark Post: Yeah, fur. I got a lot of questions about fur at the beginning. People were asking me: can you make fur? The demand is there, the wish is there. However, for chocolates and plant-based things, is this a supply chain issue? At some point, will we not have enough cocoa anymore? Or enough coffee to secure the supply? Is there an environmental aspect? For the latter, I think not so much- you cannot really be much more efficient than a plant.

Sonalie Figueiras: Interesting. It must certainly feel so rewarding to just see all the directions that your work has inspired. How did the cultivated meat journey become your path?

Mark Post: More or less by coincidence! I was already doing tissue engineering for medical purposes. At some point, there was this guy in the Netherlands, William Van Eelen, who was 82 years old or so at that time. He coerced several scientists to use their technologies to work on cultivated meat. At that time, it was called in vitro meat. I wasn’t even part of the initial consortium, but I stepped in for a sick colleague. So, that’s how I got involved in it. I became very enthusiastic, and I was actually the only one who carried it through after the initial grant had finished.

Sonalie Figueiras: Oh, wow. That’s so interesting. So, someone had a sick day and your life, and the world, changed forever [laughter]?

Mark Post: Kind of, yeah [laughter].

Sonalie Figueiras: What have been some of your proudest moments on this journey? As you reflect on 10 years, you must be in the middle of a lot of looking back and reassessing and reflecting.

Mark Post: I’m usually not that reflective [laughter]. I think there are a couple of things I’m really happy about. One, as I already mentioned, our initial weird initiative to show this hamburger on international television has sparked this entire endeavor, with so many companies and so many activities around the world. So, that’s what we had not anticipated, and it was the right time right place type of thing. Actually, the presentation of the hamburger in London was more born out of frustration than anything else. That created this entire industry. So, that’s remarkable, and it’s also something I’m proud of, because, you know, we just did that, not anybody else.

The other thing that I’m really proud of is the forming of a large group of scientists and other workers in a company that has created a very nice atmosphere to work in. Very innovative people, very driven, and very motivated people that make things happen at a much faster rate than I would have done if I had stayed at the university. Being able to do that – of course, it’s not my work alone- there are a lot of other people involved, but having been able to do that is something that I didn’t think that I had in me, and that worked out quite well, I think.

Sonalie Figueiras: Let’s stay there for a minute, because one of the things that’s most interesting in the cultivated meat history if we can call it that now, is that you and your team were the first to create the burger, but you didn’t incorporate Mosa Meat right away.

The first official company was Memphis Meats, now Upside Foods in the US. So, how did you go from being a scientist-led project in the university to deciding to incorporate a company? Did you know that Memphis Meat had been incorporated? Did that influence your decision?

Mark Post: It was completely independent of Memphis Meats. Of course, we knew that they had incorporated and in fact there were two delays: after we presented the hamburger, which as you know was funded by (Google co-founder) Sergey Brin, he said at that time, “Okay, start a business. Bring this to the market in the next two years.” [laughter]

I said at the time: “Okay, I don’t think two years, I think it takes a little bit more than two years to make that happen.” Anyway, that was the idea. So, this was back in 2013, and there were some delays. I was still working at the university and they considered this an IP (intellectual property) of the university. So, I had to deal with them and with the funding vehicle of Sergey Brin. So it took a couple of years to deal with these external circumstances. I guess my inexperience with starting a business caused that delay.

Sonalie Figueiras: As a scientist, do you enjoy running a business? In the last 20-30 years we have more and more scientists/researchers leading companies. What do you think about that?

Mark Post: I enjoy being in a business because I can do a lot more in a shorter time with a larger crew. So, I find myself like a kid in a candy store, where nowadays I can come up with a problem or a question, and a week later I get an answer, whereas, at the university, that same thing could take three months or six months because of the lack of personnel and the lack of funds. As a business, we can do a lot more in a much shorter time, so as a scientist, that’s wonderful. I actually feel that I’m doing more science now than I did at the university just because of the sheer volume and the speed of it.

I got kind of drawn into parts of running the business because a lot of investors approached me and a lot of other entities approached me, rather than other people in the business who might be more appropriate for that. So, I was kind of drawn into it. There are parts of it that I really like, for example, talking to people about this [technology] and convincing people that this is something that we should do. There are other aspects, such as the whole organizational aspect and the structuring aspect, that I’d rather leave to other people.

Sonalie Figueiras: Yes, you are not the CEO.

Mark Post: Exactly.

Sonalie Figueiras: It’s Maarten Bosch. How does that relationship work? Do you take care of everything to do with product and science, and he takes care of the organizational stuff and operations?

Mark Post: Yeah, it has become much more fluid than that. So together, Martin, Peter [the COO] and myself are a team that almost organically distributes our tasks. If we feel that something needs to be done that was originally the task of the CEO, or Peter [the COO] but I feel that have the time or I can do this, then I do. So we are not very strict. It’s really a team where we can stand in for each other, and of course, I have an emphasis on the scientific part. Maarten and Peter are less involved in the intricacies of biological science than I am. Maerten is much more engaged with investors and with external relations. So, there is a division of tasks, but it’s really a joint effort.

Sonalie Figueiras: It’s been an incredible summer for the industry. After a couple of years of slower progress, we suddenly have two US regulatory approvals that are historic. We have the Dutch government saying cultivated meat tastings are allowed now. Just recently, Aleph Farms, the Israeli company you mentioned filed for regulatory approval in Switzerland. Do you think we’re riding a wave right now, and do you think it’s going to continue? What feels different?

Mark Post: You know, if you have followed these developments as I have, it’s not a surprise. This was coming. There are now a couple of things happening at the same time, which is kind of a coincidence. If you recall, in 2020, the first [cultivated] product was approved in Singapore, that was a milestone. It’s just a matter of time before a lot of these approvals start coming through.

We spoke to quite a few governments, and in various geographies and governments, applications have been submitted. So, it’s a matter of time for these things to come through. My guess is that we’re now just seeing the very beginning of it, and in the next half year, certainly next year, we will see a whole flurry of these approvals in different geographies, even in the Middle East, Australia, China, Korea, Japan, Europe, maybe and probably in South America (I’m less familiar with that). So this is to be expected, and we are just seeing the beginning of it.

Sonalie Figueiras: Let’s circle back on the EU, which takes a more cautious approach when it comes to regulatory approval of what they term “novel foods” than other countries. As a Dutch pioneer in the EU, how do you navigate that? Do you wish it were going faster? Do you understand where they’re coming from? Countries like China are looking to other governments, particularly the EU, to wait and see how they regulate this because there is a sense that the EU is cautious, and overall, that is a good thing for consumer safety.

Mark Post: If you talk to larger food companies, they see the EU as a sort of sign of approval, i.e. a sign of quality if you get approval from there. Not many people know this about the EU, but 12-13 years ago, they already outlined very specifically and precisely how they would regulate cultivated meat, and these documents are public and are used by all the regulatory officials in other countries as an example and guideline for how they would look at this approval.

There are always two parts of a regulatory approval process: One is the scientific part, where people like me, but in the service of the government [scientists], look at the data and the evidence to determine that this is safe. The other part is the political decision-making. Once there is a recommendation from the FDA or whatever, there is an executive decision by the government to allow the recommendation of the scientific committee or not.

The scientific part is pretty much the same everywhere, and it should be, because you know, if something is safe for somebody in Singapore, then it should also be safe for somebody in Spain. So, that should be very similar. Unfortunately, as we know, the political decision-making part in the EU is a lot more complex than in most other countries, whilst in a small city-state like Singapore, it’s very easy. In a 27-member-state union such as the European Union, it’s just hard. It takes time, and that’s a pity, because there’s nothing related to food safety- it’s just a political decision.

Sonalie Figueiras: But as you say, it is a mark of approval, Europe just has that, you know, reputation and validation. So, it’s going to be a really important moment.

Mark Post: Yep.

Sonalie Figueiras: I’m assuming Mosa will be one of the first to apply- do we have an idea of when the EU might grant a first approval?

Mark Post: For that, they will take a year and a half at least. So, as far as I know, there have not been any formal and complete applications in the EU yet, much to their disappointment [laughter]. There has not been a submission yet, as it takes a year and a half at least. When exactly the first submissions are going to be done in Europe is hard to say, but I know our timeline, and this is one of our highest priorities. So, this will be relatively soon. I cannot give an exact date, but it will be quite soon.

Where other companies stand in this regard is less certain. A number of companies [outside of the EU] that have gotten approval now are either using genetic modification, or they are keeping the option of genetic modification open, and that complicates things in Europe. So, those companies that are heavily relying on genetic modification for their bio-processes will be very reluctant to submit [an application] in Europe, I think.

Sonalie Figueiras: It’s interesting that you mentioned seeing potential approvals in the Middle East. I wonder about Israel because it has an inordinate number of cultivated meat companies. Of course, there is an expectation that Singapore will potentially have more approvals later this year. In fact, you have applied in Singapore too.

Mark Post: Yeah. I think most people do this for reasons of getting to the market sooner and getting an idea of consumer acceptance, and how to market [the product]. Singapore is not a very big market, but they are very enthusiastic and very proactive in stimulating this. So companies obviously respond to that.

Sonalie Figueiras: You mentioned consumer acceptance. That’s a big topic that I want to dive into. Do you believe a focus on the science and scaling production is enough? Or do you think that we also need to focus on mass behavioral change theory, in the sense that, you know, a lot of entrepreneurs will say to you, “Well, we solve the problem, which is that we give people “no-kills/slaughter-free meat, and we don’t worry about anything else,” because if you’re giving them meat and it’s no-kill, and it’s better, then they will choose the no-kill meat? There have been some doubts around this way of thinking, and I was wondering how you look at that issue.

Mark Post: Yeah, I’m very optimistic about that. I don’t have that much doubt about this. You need to have a good story and a clear story, and the regulatory approval actually helps in that, because I think the most important question that people have is: “Is this safe or not?”

Throughout the years, we have seen a lot of change in human attitudes towards cultivated meat and similar technologies based on, you know, the realization that there is environmental impact and that it will be a scarce consumer product, and of course, animal welfare for a long time, has already been kind of on the radar.

So, my feeling is that people are looking for a credible alternative to meat that still allows them to have the same behavior without the negative consequences. Even if it’s not always voiced like that, you kind of feel that undercurrent of people trying to, or people waiting for a concept that relieves their conscience when they are eating meat. So, you know, we don’t have a term called ‘meat-shame’ yet, but I guess that’s not far away [laughter].

Sonalie Figueiras: Like the Swedish word for the flight shame!

Mark Post: Exactly! [laughter]

Sonalie Figueiras: You should coin that in Dutch! That would be great! [laughter]

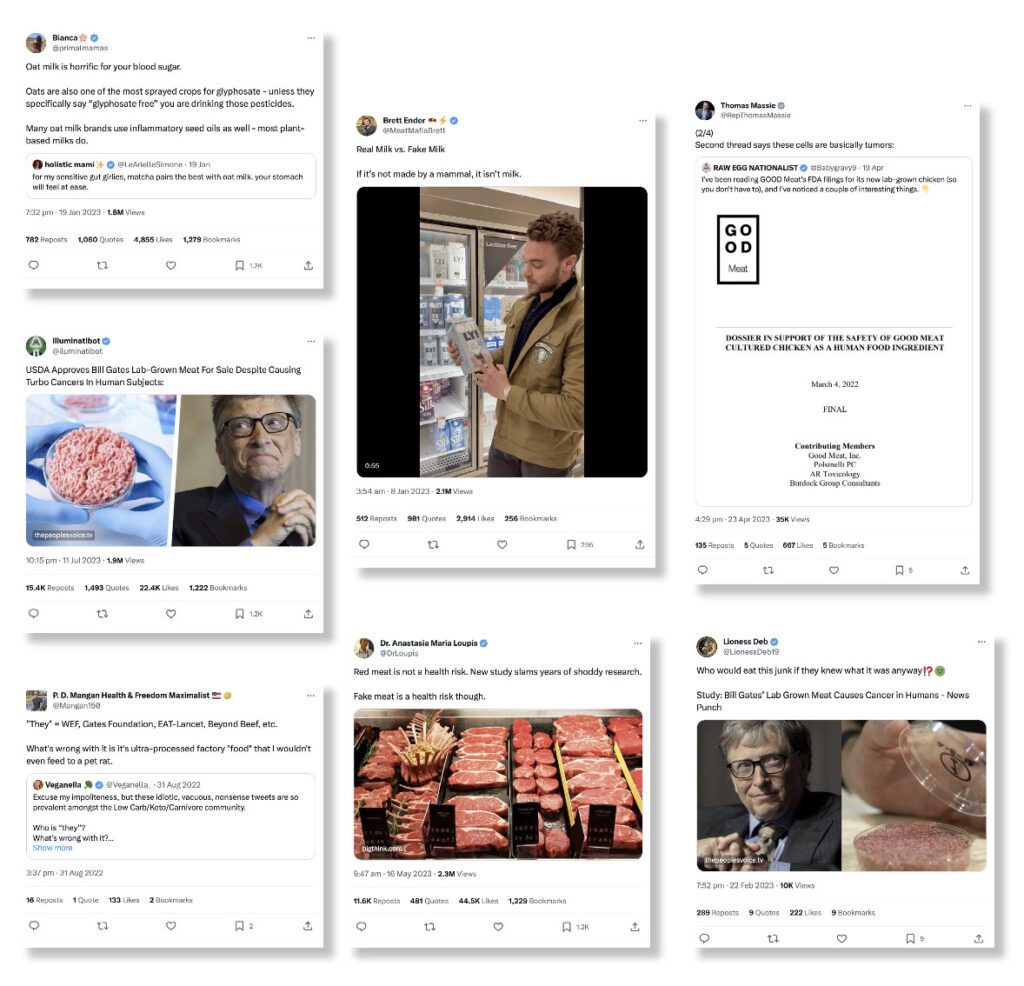

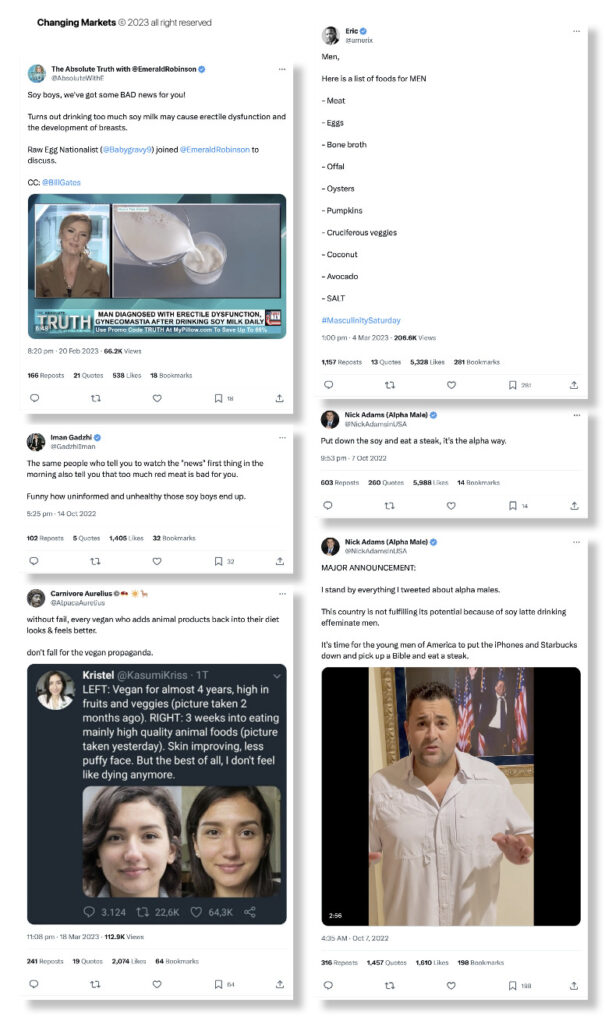

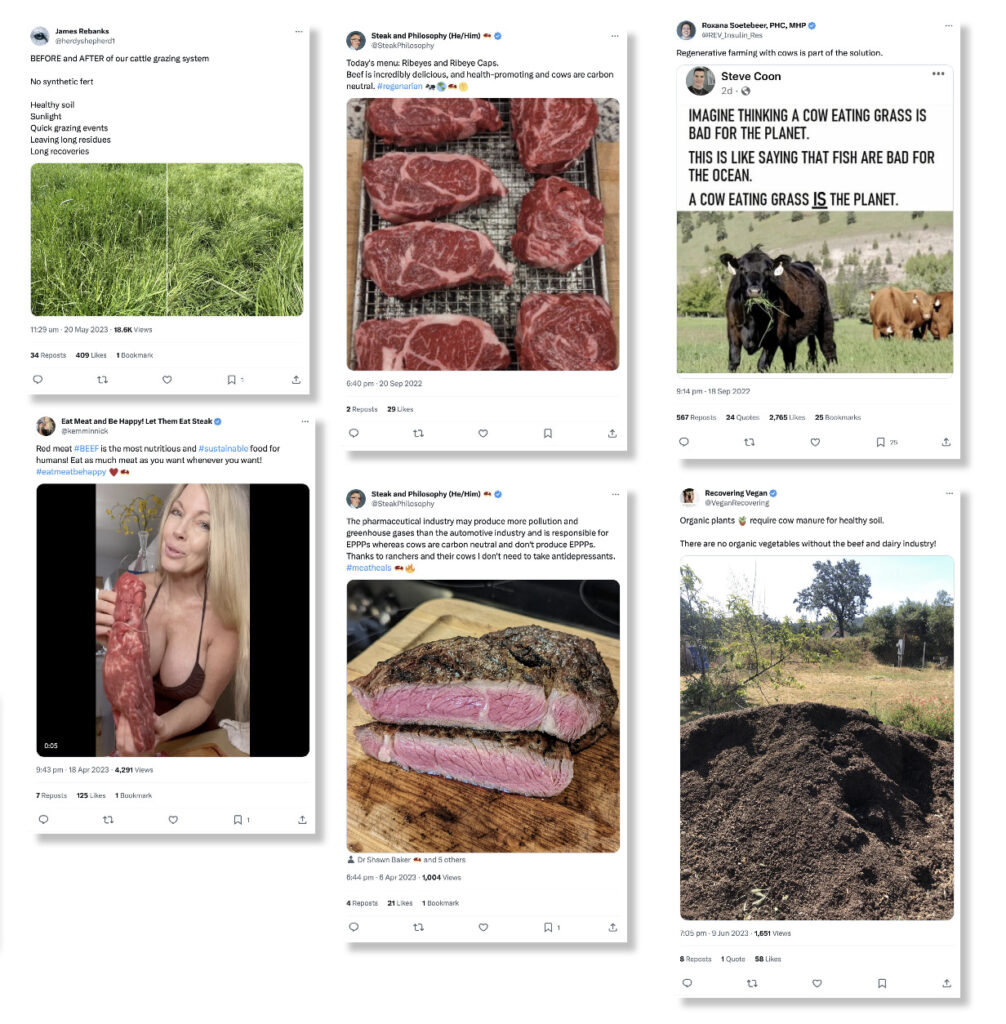

Sonalie Figueiras: It’s interesting that you’re very optimistic, that’s so encouraging to hear, but it’s impossible to ignore that the identity and cultural politics brigade has come out in force around cultivated meat and made this into a hot issue in the media using terms like “lab-grown” in a derogatory way. Italy, for instance, said that they’re going to ban cultivated meats [Editor’s note: this has since happened]. Or a couple of years ago, the former French Minister of Agriculture Jean Denormandie said: “In France, it’s no.” Every time there’s an announcement, there’s this undercurrent suggesting that you’re taking away people’s identity by not letting them eat an animal’s red-blooded meat.

Mark Post: I see these people as, I don’t know how to pronounce this, as Don Quixotes? They’re fighting windmills- basically, [they are fighting] a battle that cannot be won. The whole transition towards a different diet and other kinds of environmental issues is, I think, unstoppable, and should be unstoppable because otherwise, we’re ruining this planet. So, you see the same thing with electric cars. Electric cars are unstoppable, despite a lot of people who are petrol-heads, and it’s for a good reason. I see this in that same vein. For sure, there are a lot of people who want to stick with their old habits and their old consumption patterns, and sometimes governments kind of steer towards sticking to the old stuff too. However, eventually, that’s untenable. It’s an inevitable reality that we cannot continue with meat production and meat consumption the way we have been doing, considering that it’s going to increase in the next 15 to 20 years.

Sonalie Figueiras: Speaking of 15 to 20 years, what kind of timeline do you have in your head in terms of getting cultivated meat to being a mass product on shelves in supermarkets at an affordable price?

Mark Post: Well, there are two main conditions for supermarkets: One is that the quality is good, and the other is that the price is maybe a little bit higher than regular meat, but not by much. So, we see that happening in the next four or five years, that prices will come down to the price of regular meat, assuming that the price of meat will stay stable, which is somewhat unlikely, I guess.

Sonalie Figueiras: You mean you think meat is going to get more expensive?

Mark Post: It has to. It’s a very simple economic law: Production is not going to increase, because we can hardly increase it, and consumption is going to increase, the demand is going to increase in China, India, Africa, and maybe some parts of South America. So, it’s just a very simple economic law that if the demand increases, but the supply does not, the price goes up, and that’s not even talking about how some very progressive governments may institute a meat tax.

Sonalie Figueiras: That was gonna be my next question. That’s very unpopular politically from all the research we have.

Mark Post: Yeah, it is, and I’m actually not really in favor of it myself.

Sonalie Figueiras: Why not?

Mark Post: Because it creates inequality between consumers. I will still be able to consume meat, but you know, other people in a different socioeconomic situation may no longer be able to.

Sonalie Figueiras: I see where you’re going. So, it becomes an economic equity issue.

Mark Post: Right, which in my mind is problematic. Unless you use that tax for a lot of environmental measures, right?

Sonalie Figueiras: So what’s the timeline of getting cultivated meat into supermarkets?

Mark Post: In addition to quality and price, there is one other thing that will take time- the production capacity. If you think about this, this is a huge production capacity that you need to build.

So, the estimate is that you have to increase the current fermentation capacity in the world by a factor of one and a half. That may not tell you much, but if you think about the fermentation capacity like beer, wine, industrial fermentation, and pharmaceutical fermentation, there’s a lot of fermentation capacity currently out there. To increase that by a factor of one and a half is going to be a huge endeavor. A lot of factories will have to be built, people will have to be trained and capital will need to be raised. This takes a lot of time.

Predictions by AT Kearney that in 2040 we will have 35% of the market occupied by cultivated meat- this is pretty optimistic. I hope that we will eventually get there, at that 35% of market share, in the next decades, because we need it.

Sonalie Figueiras: What else does the industry need? Do we need more talent? Is it that we simply just need more funding? I’d love to understand that better. Do you think there should be more public sector money in cultivated meat? Did you think more governments would give more money to the sector?

Mark Post: I’m surprised and disappointed. I have been lobbying for public funding from the very beginning. Mind you, before I started doing this, I was a university professor and was completely dependent on public funding, and nothing else. I see the value of that, I see the continuity, I see the independence, the dissemination of knowledge, but also the training of people. So, there are a lot of aspects of the cultivated meat scientific field that require public funding, and you cannot only rely on private funding.

I see this as a scientific field that will evolve, improve, and expand over the next 30 years. So that, for sure, will require a good base of scientific activity – training of people and dissemination of knowledge. So yes, I see a big role for public funding and publicly-funded research in this.

Sonalie Figueiras: Do you do any work in encouraging younger scientists to get into the field of cultivated meat? Is talent a concern at all?

Mark Post: Scientific talent, not so much. We [Mosa Meat] may be somewhat exceptional, because of the publicity. We never really advertised a job opening, we just put it on the web, and we get applicants from all over the world. Sometimes people apply five times because they really want to work in this field. So, we don’t have that issue.

What will become an issue is once you have those factories, you need a lot of people who are trained to operate bioreactors, and would be working in that part of the food industry, and that will indeed require specific training systems to get there, or retraining of people from other industries.

Sonalie Figueiras: One of the biggest criticisms that has been lobbied at all of the alternative protein and food technologies is: what about farmers? How do we better involve them? Farmers are the bedrock of our agricultural system all over the world. They have difficult lives. They often do not see the upside of the big food companies. What does the future look like for them?

You mentioned that we’re going to need all this new training to help operate these bioreactors. Is that something that we could retrain farmers to do? Do you think about farmers in the future and how we, you know, redirect their skills?

Mark Post: Well, believe it or not, we think about farmers a lot [laughter] and we have been doing this since, pretty much right after the presentation of the hamburger, because obviously you get these questions. I also live in a farming community more or less. My neighbour is a farmer. So, we think about this a lot.

First of all, farmers are entrepreneurs. They go where they can make money off the land. Of course, the cells that we culture also need to be fed. So a lot of farmers, if they are now cattle, farmers or dairy farmers will eventually change their way of farming, while still extracting value from their land. They require time to make that transition, it’s not going to happen overnight. It’s going to take a couple of decades. So, they can transition to that. My neighbor is actually a good example, because he used to be a pig farmer, and then he switched to potatoes. Why? Because he could make more money with potatoes than with pig farming. That’s the essence of a farmer – It’s an entrepreneur who extracts value from the land, and they can still do that.

Hopefully, over the decades, part of this is we will eventually require less farmland because we take a lot of the inefficiencies out of the food system. We require less farmland and less farming. This is a good thing. If you look at the number of farms in the Netherlands where I’m living, that number is steadily going down. Fewer and fewer people are interested in taking up the farming business. It’s just not appealing enough for young people.

Sonalie Figueiras: That tends to be happening a lot in the developed economies, but less so in regions like Asia, South America, and Africa.

Mark Post: Right, but that may be a matter of time, right? The other thing that you see is that farming is becoming more and more industrialized. The farmer in the Netherlands nowadays is more like an organizer than actually somebody who puts a spade in the ground.

Sonalie Figueiras: As you look ahead, what are your major goals for Mosa for the next five years? What do you want the company to achieve in the short term?

Mark Post: Like for any other company: scale up production, get regulatory approval, but most importantly, have a high-quality product on the market that is a lot better than any of the current alternatives for meat, so that it can fill that void of meat alternatives. We see that plant-based meat alternatives are kind of plateauing and this is somewhat of a concern. It’s good to analyze what is happening here. However, I cannot help thinking that part of it is that people just want to have meat, that the meat alternative has to be meat and nothing else. So, the foremost goal of the company is to create a high-quality alternative that is sufficiently credible for consumers to change their behavior away from traditional meat.

Sonalie Figueiras: What’s the format for your first product? Are you doing ground beef?

Mark Post: Yeah, it’s beef, and it’s ground. As a tissue engineer, I love to work on a full-thickness steak. As a practical person, I see that this has more challenges, and will take longer to realize.

Sonalie Figueiras: Do you ever consider that some of your production will be elsewhere in the world, other than the Netherlands? Or are focusing most of your scaling up in the Netherlands?

Mark Post: From the very beginning, we wanted to roll this out to the rest of the world as soon as possible. When we have the full production capacity available, we will license this out to as many third parties in the world as we can, based on our philosophy that we want to make an impact, and not just grow the largest meat factory in the world.

Sonalie Figueiras: My last question is a bigger one. What does success look like to you?

Mark Post: It’s exactly that – Having high-quality hamburgers rolling off the conveyor belt at a reasonable price that people want.

Sonalie Figueiras: I can see it in my mind and I can’t wait.

Mark Post: By the way, we haven’t talked about it, but we are doing the same for leather, which is equally interesting and important, and fewer people are working on it. It’s a different company, but I’m the founder and Chief Scientific Officer of that company as well.

Sonalie Figueiras: Is it in stealth or have you announced it?

Mark Post: It’s not necessarily in stealth, it just got a lot less publicity than Mosa. The company is called Qorium, with a ‘Q’, and it’s another thing I’m working on, a piece of leather coming off the conveyor belts.

Sonalie Figueiras: One of the biggest problems we have today, is for vegan or ethical animal welfare-driven consumers, your choice is either leather, which is a difficult choice, and one you would avoid it, or your choice is plastic, which unfortunately, is absolutely not better.

Mark Post: Right [laughter].

Sonalie Figueiras: So, you essentially have no choice.

Mark Post: Yeah, it’s tough, but you know, making leather is slightly easier than making meat. For sure, there will be a market for that and the fashion industry is looking forward to this. A lot of leather alternatives for shoes and for clothes are not good alternatives.

Sonalie Figueiras: No. They’re all mixed with plastic, they don’t biodegrade, and then we’re back to the same problem in terms of waste.

Mark Post: Right.

Sonalie Figueiras: Thank you for sharing that. You’re solving so many problems. Thank you so much for your time, and a HUGE Congratulations on an incredible decade of progress for yourself, your company, but also for humanity. What a journey!

Mark Post: Yeah, it has been. It’s quite fun and rewarding [laughter]. Thank you.

Sonalie Figueiras: Thank you.

Listen to this episode on Apple, Spotify or wherever you get your podcasts.

Green Queen In Conversation is a podcast about the food and climate story hosted by Sonalie Figueiras, the founder and editor-in-chief of Green Queen Media. The show’s first season, Pioneers of Cultivated Meat, explores cultivated meat, a future food technology on a mission to produce animal protein sustainability. In each of the six episodes, Sonalie interviews the pioneers of the industry, asking the hard questions about one of the most exciting food + climate innovations of our time and sharing the personal story behind each founder’s journey.

Green Queen In Conversation is a co-production from Green Queen Media and Cheeky Monkey Productions. This episode was produced by Joanna Bowers and hosted by Sonalie Figueiras.

The post Green Queen in Conversation: Cultivated Meat Pioneers – Dr. Mark Post of Mosa Meat appeared first on Green Queen.

This post was originally published on Green Queen.

Beef Hot Dog. Hot dogs are a classic American food, and the news signals the company’s intention to appeal to meat-eaters as new customers over vegans or vegetarians who already buy its products. The product will be sampled in New York City during a one-day pop-up event on December 16.

Beef Hot Dog. Hot dogs are a classic American food, and the news signals the company’s intention to appeal to meat-eaters as new customers over vegans or vegetarians who already buy its products. The product will be sampled in New York City during a one-day pop-up event on December 16.