How can we realistically shift away from animal agriculture, incorporate more plant-based foods in our diet, and ensure policies and funding go towards helping the environment and mitigating climate change? Two researchers put forth their ideas in a new study.

Over the years, especially in the last few, a ton of research has shown us time and again the huge impact our diets and eating patterns have on the planet. Our food system accounts for a third of all global emissions, while meat itself amounts to nearly 60% of all emissions from food.

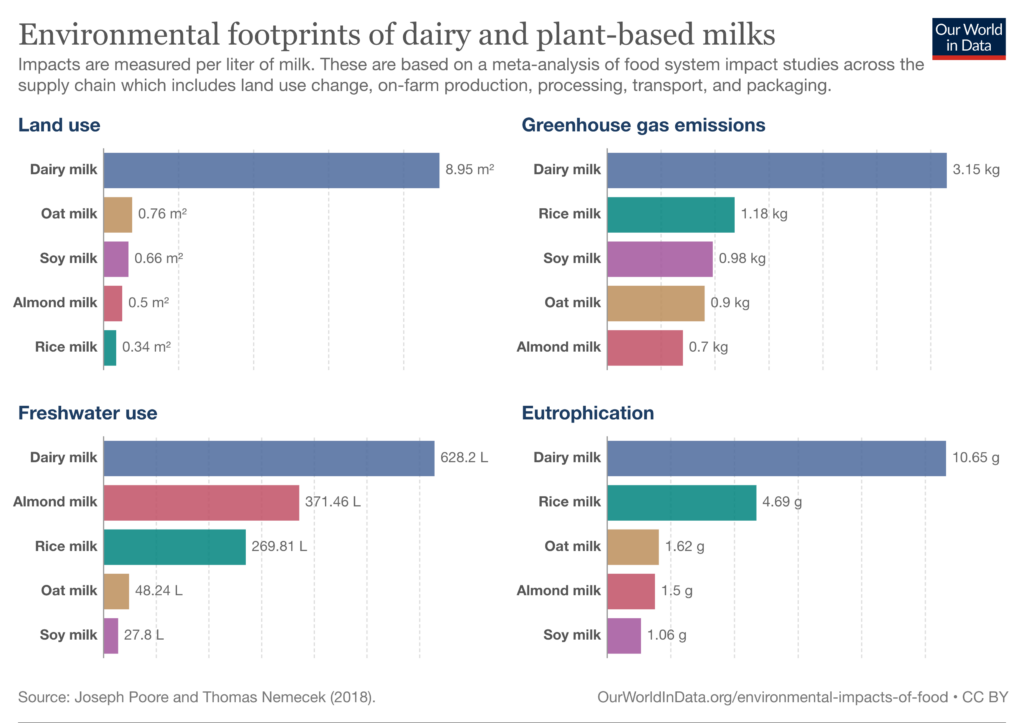

Meanwhile, livestock farming has been found to produce between 11-19.5% of the planet’s overall emissions, and further research has shown that animal-derived foods like meat and dairy cause twice as many emissions as plant-based foods.

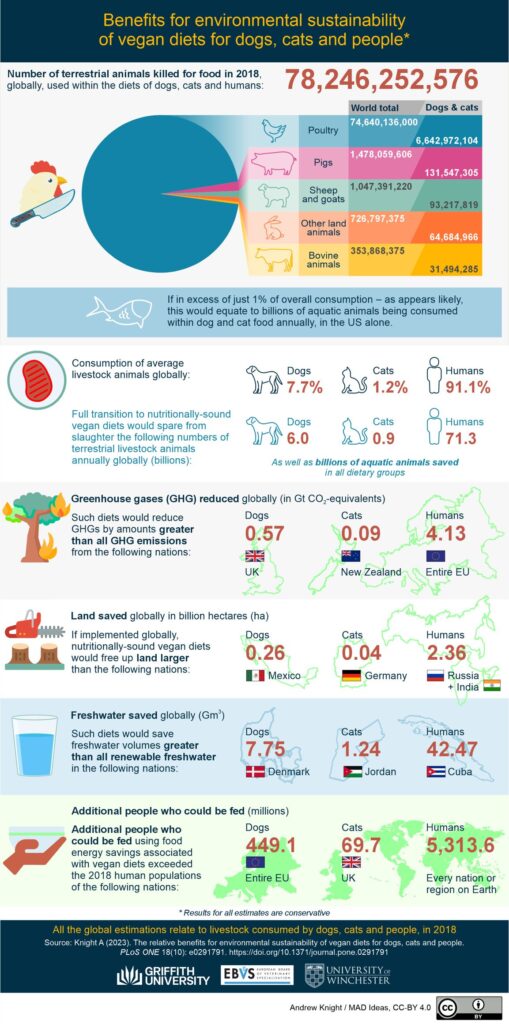

Studies have also shown that vegan diets can reduce emissions, water pollution and land use by 75% compared to meat-rich diets and that replacing half of our meat and dairy consumption with plant-based alternatives could cut agricultural and land use emissions by 31%, reduce the land used for livestock by 12%, slash water use by 10%, and halt deforestation.

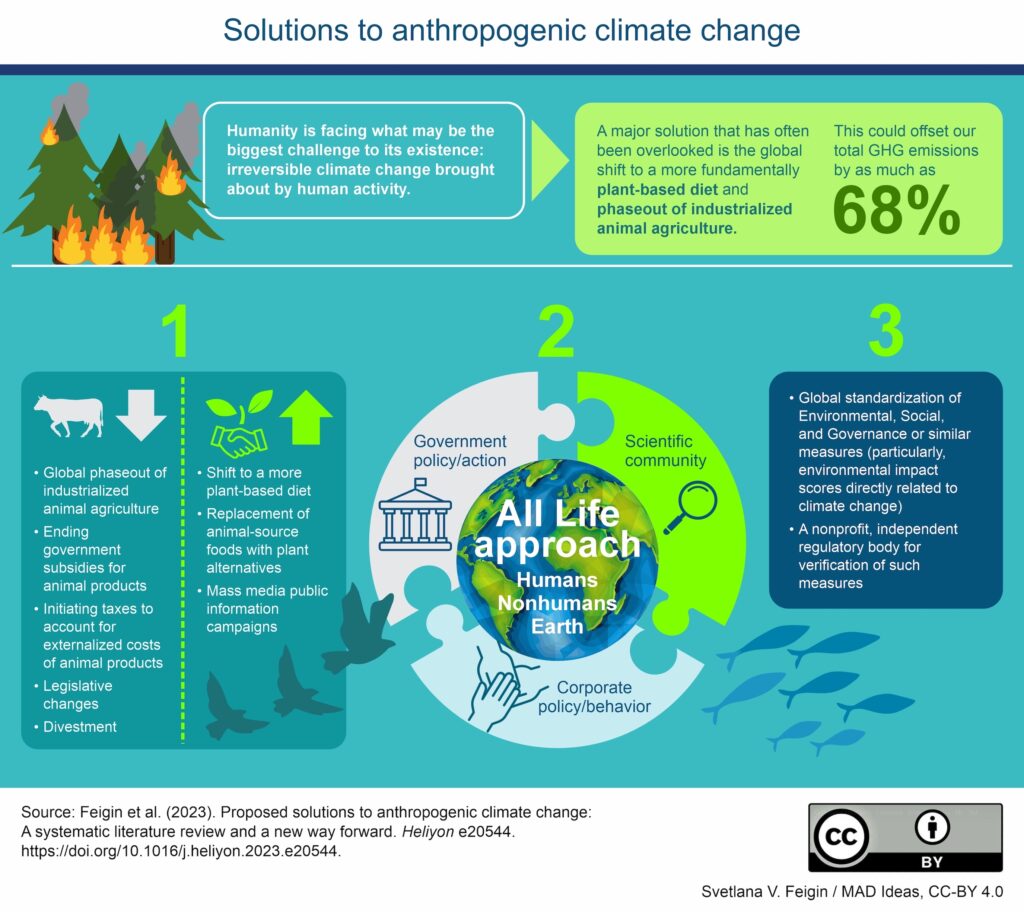

But if we continue in a business-as-usual scenario, demand for meat will rise globally, with people set to be eating 14% more meat by 2030. A new study published in the peer-reviewed Heliyon journal argues that we can’t afford to continue on this path, as we only have seven to eight years to enact meaningful change to mitigate the climate crisis.

It provides a roadmap based on three key strategic approaches: a shift to a plant-based diet with a gradual phasing out of animal agriculture, an ‘All Life’ approach, and a standardisation of environmental, social and corporate governance (ESG) measures. Here are the steps that could help move to a better future for humans and the planet alike:

1. Phaseout of industrialised agriculture

Despite animal agriculture’s climate impact, the authors say the reduction and phaseout of animal agriculture is often entirely overlooked in many climate change solutions. But doing so would provide 52% of the necessary net emissions reduction to limit global warming to 2°C by 2100, with 47% of the benefits of a phaseout of livestock farming accounting for by beef alone, while cow’s milk makes up 24%.

Importantly, a full phaseout of animals from the food industry would substantially cut emissions to a point that even a complete replacement of fossil fuels with clean energy couldn’t achieve. In fact, eliminating industrial animal agriculture could buy us time to develop tech that could affect a fossil fuel phaseout too.

To do so, the researchers say there needs to be a clear distinction between factory farming and other forms of animal agriculture – concentrated animal feeding operations (CAFOs) have a loose definition. In the US alone, most animals are factory-farmed, including over 98% of chickens, pigs, turkeys, hens and fish, and 70% of cows. “Our proposal for the global phaseout of industrialised animal agriculture encompasses factory farming of all land and water animals,” reads the study.

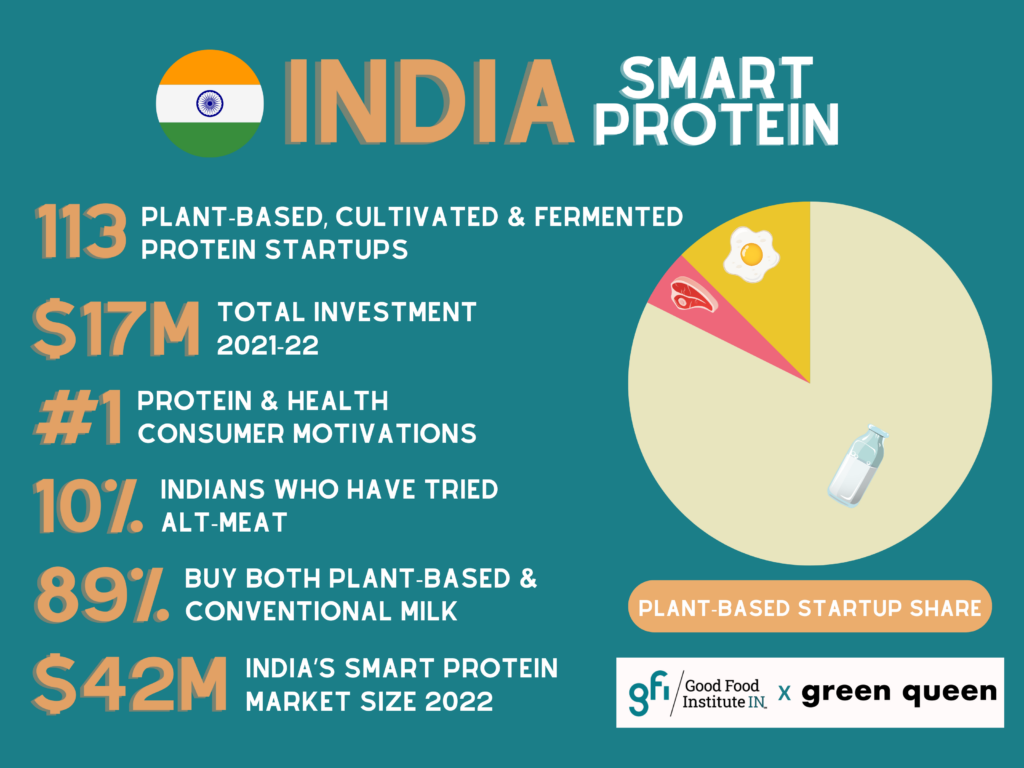

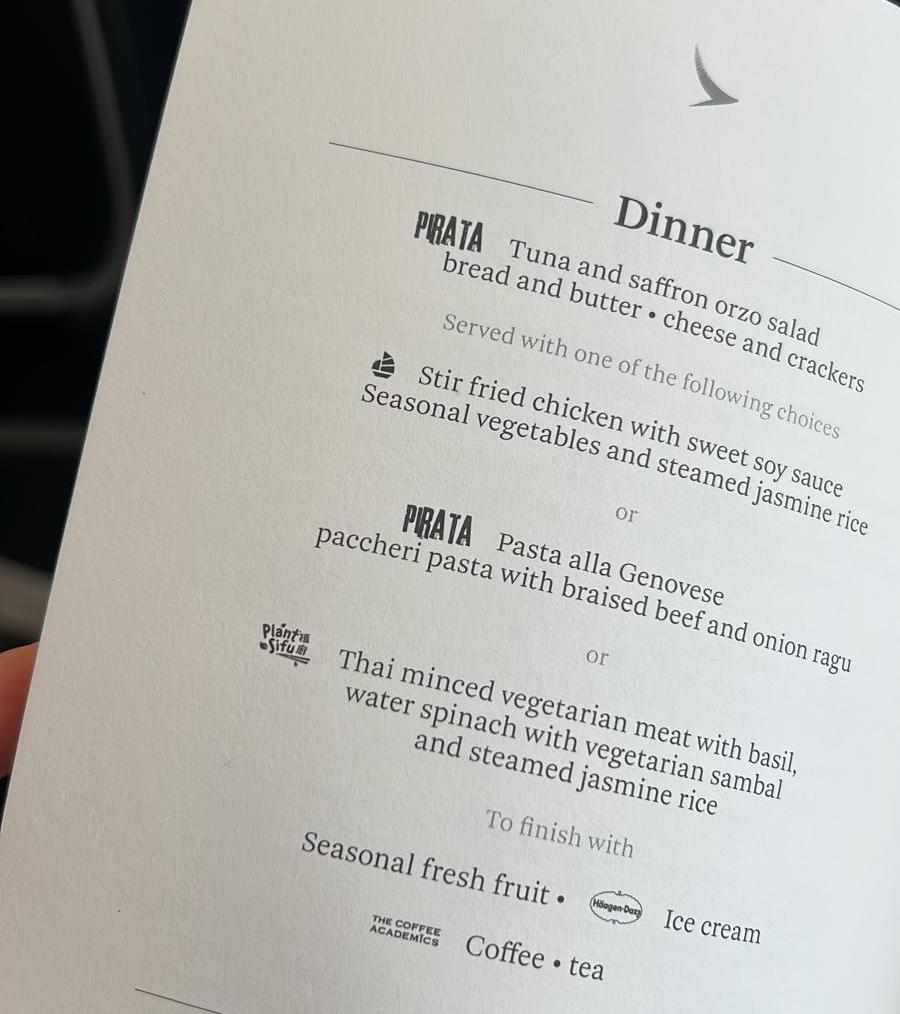

2. Transition to plant-based and cultivated proteins

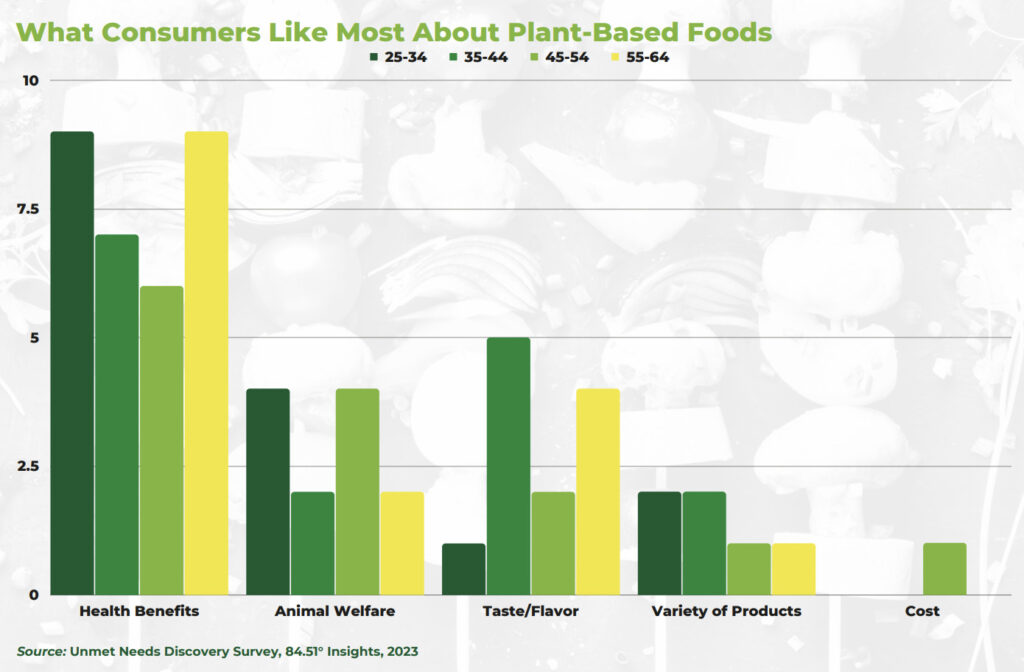

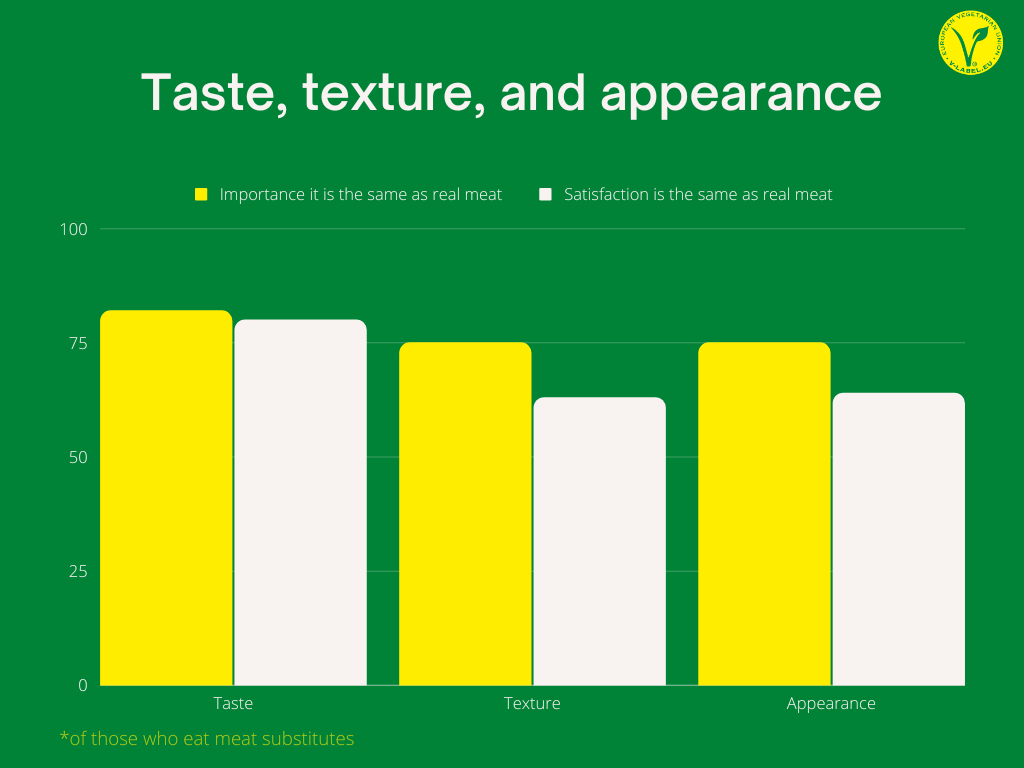

Simultaneously, a shift to plant-based and cultivated alternatives to meat, dairy and eggs is vital. “To achieve this, further developments and investment are required in technologies which allow for the creation of cheaper, more widely available, and tasty meat, dairy and egg alternatives,” the authors say.

They add that additional funding is needed towards plan-based agriculture, which would feed more people and use fewer resources while preserving ecosystems too, as the land freed from animal farming could be used to grow new crops. Investment is also needed to aid a smooth transition for farmers in this space.

3. Ending animal subsidies and introducing meat taxes

In the EU and the US, livestock farming receives about 1,000 times more funding than plant-based and cultivated meat, with the former obtaining up to 97% of all research and innovation spending to improve production. Public money spent on plant-based meat was at $42M between 2014-20 – just 0.1% of the $35B spent on meat and dairy. European cattle farmers receive 50% of their income through direct subsidies.

The authors propose ending these government subsidies for conventional meat, dairy and eggs, and introducing taxes on products to account for the true externalised carbon costs of these products. Taxes could be levied based on the type of food, with differentiated taxes on ruminant meat or milk (being the most climate-damaging), followed by non-differentiated charges on other meat and milk products.

But this could mean an increase in pork and poultry consumption – which, as mentioned above, are almost entirely factory-farmed – so taxes could be applied to all animal products produced via industrialised farming. These taxes would also need to be levied in high-income countries first.

“The taxes and money saved from government subsidies could then be used to develop technological innovations in alternative meat/milk products and aid farmers in their transition from animal agriculture to non-animal agriculture,” notes the study. “The goal is for lab and plant-based alternatives to become competitive with industrialized meat production.”

4. More stringent animal welfare legislation and livestock ag divestment

Along the same lines, government intervention is key. The authors call for “more stringent legislation on animal welfare standards, legislative limitations on where factory farms can exist, as well as mass-media public information campaigns to clearly outline the benefits of vegan food, and the dangers inherent in livestock farming.

They add that corporate investment in animal agriculture is “becoming increasingly high-risk” due to its impact on climate change: “Divestment from companies engaged in industrialised animal farming is critical if we are to achieve less environmentally damaging food sources.”

5. All Life approach: recognizing that all life on Earth is connected

The study suggests the adoption of an all-life approach, referring to a confluence of the scientific community, government policy/action, and corporate behaviour and policy. A change in global mindsets can be achieved through education and awareness.

“An All Life approach recognises the profound interconnectedness of all life on our planet, its protection, and shifts away from a human-centric paradigm to an Earth-centric paradigm,” reads the study, touching upon the importance of collaboration and working together. It adds that this approach stresses that “our health and the health of our planet are intimately intertwined with the health and well-being of all living beings”.

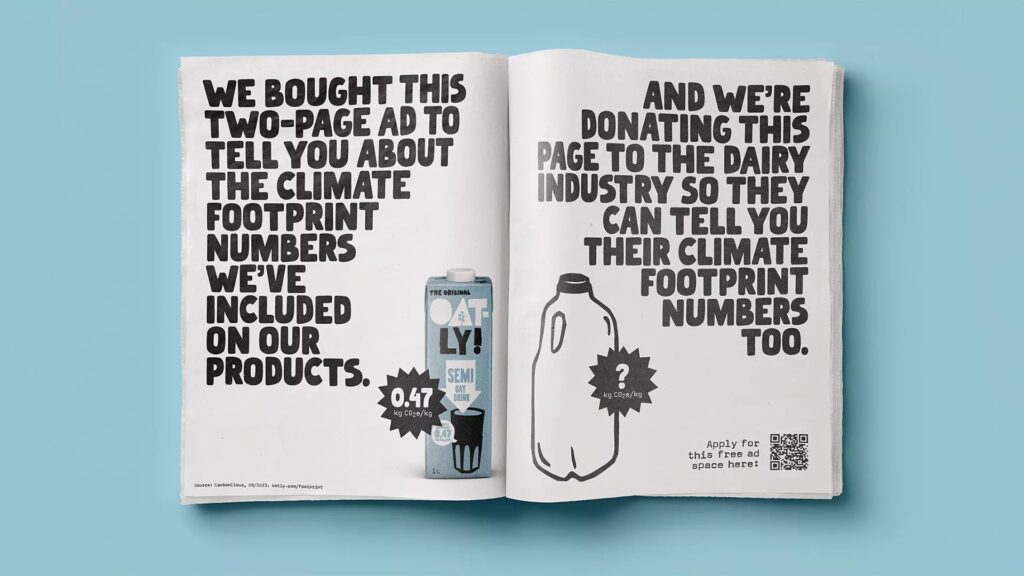

6. Standardize ESG measures and create a regulatory body to curb greenwashing

Finally, the authors outline the importance of standardising global ESG measures, the lack of which impacts the “reliability and validity of ESG scores and rankings, affects the trustworthiness and transparency of company disclosures, and disincentivises companies from improving their scores”.

The study proposes the introduction of a regulator to help verify such measures and curb greenwashing, and to ensure credibility and avoid bias, it must be an independent and non-profit body. “Such measures will have a fundamental impact upon corporate and governmental performance, accountability and effectiveness while providing important guidance for individual and institutional investors,” the study notes.

“We must recognise that by solely focusing on reducing greenhouse gas emissions to limit global warming, we are treating the symptom of the cause, and the cause is major global unsustainability,” says lead author Svetlana V. Feigin. “To achieve long-lasting transformative change, which will benefit current and future generations (and save our planet), we need to change our mindset and behaviour as individuals, communities, businesses, governments, and global citizens.”

The post A Global Roadmap To Address Anthropogenic Climate Change appeared first on Green Queen.

This post was originally published on Green Queen.

ingredient with exclusivity until 2039. Additionally, the company shared early results of a promising AI-led study into the health benefits of its mycelium strain.

ingredient with exclusivity until 2039. Additionally, the company shared early results of a promising AI-led study into the health benefits of its mycelium strain.