13 Mins Read

Sandhya Sriram is co-founder and CEO at Shiok Meats, a Singapore-headquartered cultivated meat and seafood company founded in 2018 that has raised over $30 million in funding. Below, she talks to Green Queen‘s Sonalie Figueiras about where cell-based seafood is going, her views on the future of cultivated meat, how investors should be thinking about the space, and going public with the personal.

Editor’s Note: This interview was recorded live on Tuesday, May 30th 2023 during the City University of Hong Kong’s Webinar Series The Future of Food: Seeking Sustainable Solutions. Watch the full video interview, including a Q&A with questions from students across Asia HERE.

This interview has been edited and condensed for clarity and length.

I’m thrilled to be here with you, one of the pioneers of cultivated meat and seafood. I really appreciate you doing this. You’re always so generous with your time and your expertise and your leadership. I want to start by asking you, one of the early people in the space, and definitely in Asia, one of the first faces that anyone saw, how are we doing in terms of cultivated meat and cultivated seafood in Asia and also globally? Are we where you thought that we would be when you started?

Sandhya Sriram: Sure, that’s a lot of complicated questions. [Laughs]. I think with any startup, any disruptive industry, any novel industry, you expect more downs than ups. And honestly, when I started in 2018, in this industry, I did not expect things to go as well as it went for specifically Shioak Meats and the way Singapore brought up the 30 by 2030 food story, and the amount of funding that went into this industry, and I’m not going to say it was easy capital raising, but definitely it was positive capital raising, with really good investors coming in, and you know, believing in this.

So, I did not expect it to go that positively or that well, as as, as we started the company, I was expecting more down days.

In fact, even with the pandemic, fundraising wasn’t that bad, even with investors, you know, looking at you only on Zoom and not being able to taste your product or visit your facility. But this was the time when capital was easily available, there was plenty of capital and everybody was into food tech, right?

GQ: What’s your outlook in terms of the timeline for the industry over the next few years?

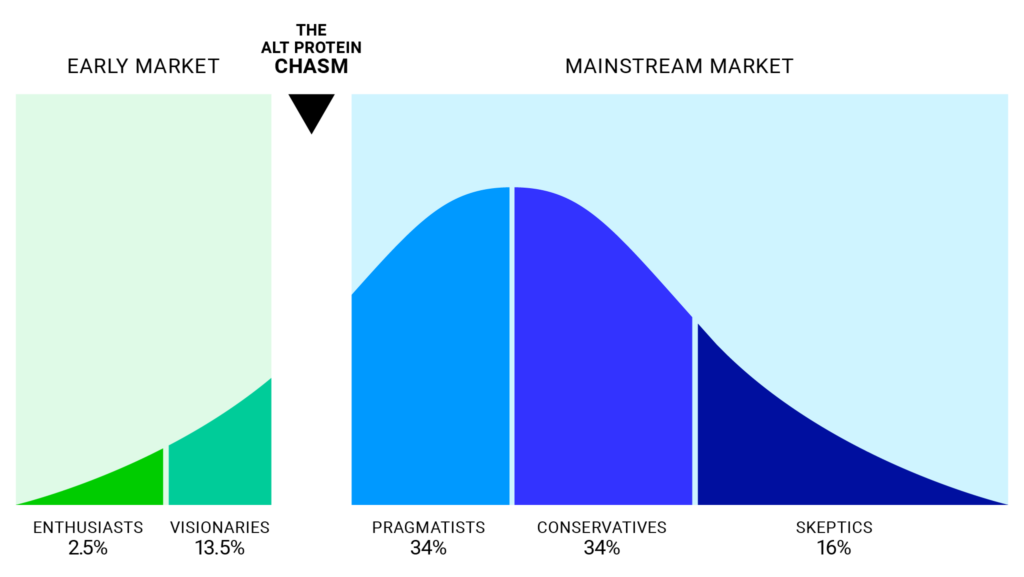

Sandhya Sriram: I used to say this from day one: the world has a cycle of five years for a new technology or industry- it’s extremely sexy for five years. And then after that, it doesn’t go away, it’s still there, but something else is sexy. And when we started in 2018, around 2019, food tech became extremely sexy in Asia, be it the launch of Impossible Foods and Beyond Meat, then Omni Foods, and then a lot of cultivated meat companies coming up, Singapore announcing the 30 by 2030 campaign, and approving the first cultivated product, so everything was extremely “up” for this industry. And we are sort of in the tail end of that five years, as you can see. And that has come with market changes, funding issues, companies not being able to scale…Regulatory-wise, it’s going the right way, but still, not many companies have gotten approval. So I would just say I’m not surprised. I’m not surprised about where we are. I’m not surprised by the challenges we have faced. I’m not surprised that we have seen the bad days.

What I am very mindful of is over-promising by the industry- over-promising with the research that we’re doing or over-promising by the companies themselves. I think the market is correcting itself right now and in the industry, we are all keeping it truthful right now.

But that also comes with a caveat- when you’re fundraising, you can’t tell an investor that you will make money for them 20 years down the line. You have to have some sort of a projection in place for them to see their return on investment. It’s quite complex, how do you talk about timelines when you launch and as you progress.

I’m not surprised as to where we are. The future of alt protein is 100% there, I don’t think it’s ever going away. The next few years are all about who can make it and consolidation. Unfortunately, some companies are dying and some of that technology is dying. But all of that is part of any industry- it is what it is. You can’t expect all 100 [cultivated meat] companies to do well. It’s survival of the fittest.

GQ: It’s very interesting to hear you say that you didn’t think it would go as well as it did. I think it’s also fair to say that there was probably a little bit of hype, there was also probably a lot of capital and interest in a field that let’s face it, most of us didn’t really understand five years ago and didn’t really know much about. In terms of concrete predictions, and I know predictions are a fool’s business to some extent, but just to understand from someone like you who’s in the space- do you anticipate there being more companies being founded in the cultivated industry? And do think more of those companies will be in Asia?

Sandhya Sriram: I don’t foresee many companies starting up now, especially with the markets as they are. And I think the whole industry is going through a bit of skepticism with challenges around scaling and the issues that we’re facing in funding. So I don’t foresee too many companies starting new. But I do foresee ancillary companies starting, for example, media bioreactors infrastructure, a lot more contract manufacturing organizations being set up for scale-up, and offering infrastructure for production. And I also foresee a lot more food like traditional or established food companies coming into this space via consolidation. So that’s what I am sort of forcing for the next decade or so.

GQ: That’s really interesting. Just building on that, one thing that I’ve noticed about cultivated seafood, is that it’s one of the few sub-sectors of alt protein where we’ve seen Big Food companies in Asia, Big Seafood, specifically, get involved. So you Vinh Hoan in Vietnam and Thai Union getting involved in cultivated, whereas you don’t see as many Big Meat companies in Asia getting involved in cultivated meat. Why is that?

Sandhya Sriram: Actually, it’s a good question. Yes, traditional or Big Meat producers haven’t really gotten into the Asian side, but the Western meat companies have, like Tyson and Cargill, right? That’s also because if you look worldwide, seafood production is mainly in Asia, whereas meat production is not. If you look at the numbers, seafood is the most consumed protein in this part of the world and is mostly produced in Asia. So you have the big leagues like Thai Union and CP Food all getting involved here.

It’s interesting because these companies, when they approached us or when we approached them, they said they understand that technology is the only way that they can keep their business long term, [it’s the only way] the way they can live up to the demand and the supply chain issues, that they can make sure that their businesses are still alive in 100 years to come. These companies know that disruption and technology is what’s going to happen.

One of the companies that we were working with, and they are invested as well, they initially used to do proper traditional fishing and everything was done by hand, manually. They realized 10-20 years down the line, okay, this is not going to work because we are producing a lot more, we have larger fish farms, everything has to be automated now. So they set up automated lines for everything from de-heading the fish to scaling them to processing them to the packaging. And I’ve gone to their production facilities and they are extremely impressive- fully automated, much less manpower, very clean, and very well done. But they also know that may not be enough to supply the growing global population [and service] the growing demand in the future.

Given that there are only so many fish farms you can set up, there are only so many animals in the ocean, they realized, okay, plant-based is one way to go, cultivated is another way to go. So why not explore these technologies? But they are not able to innovate internally, so they started investing in companies like ours.

Eventually the idea is for them to use us as a production hub. They will do the distribution and the sales, which is exactly what we are looking for. We are technology people, we are not looking to sell our products large scale, at least I can speak for Shiok means our idea is to license out the technology so that food companies like Thai Union, CP and any other seafood company can use it in the future to actually produce seafood the way we do.

GQ: They get to do what they’re good at, which is logistics, sales, marketing, and you get to do what you’re good at. They are essentially, and you see this in a lot of industries, outsourcing the R&D, to some extent.

You wrote a LinkedIn post a couple of weeks ago that was very moving and very transparent about the challenges that you have faced as a South Asian woman founder in Asia in a deep-tech space, and more specifically, in the cultivated meat and seafood space. I wanted to ask you about writing the post and some of the challenges that you’ve faced on your journey. What’s been the hardest part? What were you thinking about when you wrote that post?

Sandhya Sriram: So I have a rule. I don’t post anything when I’m emotional, when I’m angry when I’m bitter. All those emotions pass through and it’s very easy to get on social media to just express everything at that given point. But you’re not thinking straight when you’re extremely emotional. So I have a rule that I will always think, I will rest, I will take a few weeks, and then I will post something. And anything that I post is well thought-out, it’s not done in a hurry.

I write it, I read it, I go through it, I go back and edit it. I don’t want to hurt anybody. That’s my ultimate aim at the end of the day. But I also want to be sure that I can tell what is my opinion, and I don’t think everybody needs to have the same opinion or agree with me. I think most of them will disagree with a lot of things that I say. But it’s my point of view. And I want to make sure that I’m able to voice it. Because I also realize there are 500 people that are not voicing it. And they’re struggling with the fact that they have to keep it within themselves. So I’m thinking about the 500 people that are probably going through the same thing that I’m going through. Over time, I’ve realized that people actually appreciate my candidness and openness. It’s not very easy as an Asian to do that. Actually in Asia, it’s not very well appreciated.

GQ: Yes…as Asians and Asian women in particular, we are taught not to share our feelings in a public forum.

Sandhya Sriram: I’ve been told by a lot of people in Asia: don’t share your troubles, share only the good things. And I think, well, that doesn’t inspire anybody. On Instagram or social media, we show only the good part of our lives. And we don’t show the bad part. I think, let’s share everything, right? Especially as an entrepreneur, when people are inspired by you, they should know what you’re going through all the things, the bad, the good, the ugly, the best, the better, and everything. And as I said, I don’t post when I’m bitter, angry or emotional. So that post took me three hours to write. And it took me a lot of editing, it took me a lot of back and forth, thinking should I do it? Should I not do it? What will that person think? What will this person think? What will my investors think? What will the media think? And then I said, you know what? I need to listen to myself for once. Let’s just do it because I have things to say. And it is honest things that I’ve been going through. And I personally put it there, it’s my opinion, it’s my experience, it’s personal. And it doesn’t have to essentially agree with all of you. But certain parts of it can agree with you, certain parts can not agree with you, it’s fine. That is what it is.

I would be happy to read somebody else’s thoughts as well about running a company. It’s not easy, running a company of 60 people, then letting go of 30 people. It’s not easy raising $30 million. It’s not easy being a pioneer.

You know, pioneer is used as a positive word, and actually, for me, it’s got a negative connotation. It’s like, oh, my God, you’re the first! And that means you have to break a lot more barriers and a lot more glass ceilings and face a lot more issues.

Essentially, I’m a very resilient and very strong person, I can tolerate a lot. But that doesn’t mean I’m not human. So that post was about being human and being vulnerable. And also telling the world that I may look extremely strong, but I’m human and I have emotions also. And these are my thoughts, from my point of view. It is what it is, if you don’t like it, don’t read it.

GQ: In the post, one thing that really came out was that for the past few years, Shiok has been working on scaling cell lines for the three crustaceans you are addressing, so lobster, shrimp and crab. And in the post, you talk about how it has been very, very challenging to scale those lines. Can you share more about this?

Sandhya Sriram: So I think around last year, we realized, okay, seafood is gonna take longer than [what we thought]. And by then we had already acquired the red meat company Gaia Foods. And honestly, when we acquired them, it was strategic, it was opportunistic, but it was also Plan B for us from day one. We knew that seafood is going to take time.

To give a background to everybody listening here, seafood in general doesn’t have any background research. If you go to PubMed, or you go to Google, you can’t really find any research on stem cells for seafood, because stem cell research was done on animals that are closer to humans, like mammals, so that you understand human biology for human diseases and cancer treatment and all of that. So nobody really looked at stem cells from shrimps.

So when we started Shiok, it was a blank whiteboard. As a scientist, that’s super exciting, because that means you can make new discoveries, new IP, new patents, all of that. But that’s also not the best start for a startup or a company, which needs to make money in three years, five years, ten years- whatever it is.

So I think we went into it, we went into it knowing that it’s going to take time, but we thought it would be about four or five years until we figured it out. But last year, our fourth year, we said, okay, let’s take a pause here. We have tried as much as we can with the scale, and it’s not working, we are facing some issues that we could not have predicted that we would face because unless you scale up to a certain extent, you will not know. Only when you reach that destination, you realize, okay, there’s something wrong there. And then you have to figure out a different path to go for. So we said okay, we went two steps forward, but we also went six steps backwards. So let’s put a pause there. Let’s figure out that first step or second step again.

But in the meantime, we are a startup, and we have raised cash. We are answerable to our investors, let’s try to see what else can be accelerated. We thought of many other things that we could do with our technology. But then we said, well, we have red meat. Red meat is a more established and studied technology. There are many companies that are doing red meat and are closer to commercialization. So why not push that, even though it’s not the most competitive, or the most unique technology? Let’s do that first.

In the meantime, let’s figure out seafood. Nobody’s stopping seafood, we’re not stopping working on seafood, we just need more time. And so that was a conscious decision that we made in the company, to see what can be our first product. The survival of the company is very important.

For me, it came to a point where as a CEO and a founder, I asked myself: should I run a company for X amount of time with 60 people? Or Should I run it for 10x the amount of time with only 10 people? I’m going to choose the latter, right? I want the company to survive, the business to survive, the technology to survive.

So it’s been hard, it’s been extremely hard, as you know from my LinkedIn post, but I think at the end of the day, my fiduciary duty is to the company and the business. So I will make the decision that I make for the company, not for me, not for individuals, it’s for the whole company.

Listen to the rest of the interview here.

The post Shiok Meat’s Sandhya Sriram Gets Personal: ‘As A Pioneer, You Have To Break A Lot More Barriers And A Lot More Glass Ceilings’ first appeared on Green Queen.

The post Shiok Meat’s Sandhya Sriram Gets Personal: ‘As A Pioneer, You Have To Break A Lot More Barriers And A Lot More Glass Ceilings’ appeared first on Green Queen.

This post was originally published on Green Queen.