I made my first visit to Expo West in 1999. More than two decades later, I take a look back.

The way things change over time is fascinating. Watch any movie from the 1940s and you may find yourself astounded that people who look not so different from us today, lived completely different lives less than a century ago. For one, they had no cell phones, computers, or electric cars. Back then, the average woman owned only about seven dresses, whereas today, she’s likely to purchase nearly 70 new garments a year.

The differences are also noticeable in the changes to our food choices. Back then, grapefruits and hard-boiled eggs were mainstays on nearly every breakfast table, lunch was eaten at an Automat, sherry-sipping happened in the late afternoons, and steaks were on most dinner tables.

These days, breakfast tables are more likely to feature avocado toast or overnight oats (that is if you’re not intermittent fasting). Lunch might be a salad, a wrap, or perhaps, a smoothie. Instead of sherry, you may have a kombucha, or maybe a matcha latte — with oat milk, of course. And while steak is still on (far too many?) dinner tables, healthier fare from kale and quinoa to meat successors like Impossible burgers, or the humble, versatile bean, have become equally, if not more, popular.

I was thinking about all of this recently as I reflected back on the spring of 1999, when the Natural Products Expo in Anaheim, Calif., attracted about 31,000 attendees. I was one of them. It was my first trek to the industry trade show (also known as ‘Expo West’ or ‘Expo’). Earlier this month, I made what should have been my 25th visit, but was my 22nd as a result of missing the last three years due to the pandemic.

Prior to the pandemic (which shut the event down for 2020 and 2021, and has slowed traffic in the last two years to around 65,000 attendees), attendance would tip past 80,000 retailers, brands, press, and more — all consumers at heart — clamoring into the ever-expanding Anaheim Convention Center to taste their way through the endless aisles of food and drink, looking for the next big products destined for a supermarket shelf near you.

“The energy on the floor this year makes it undeniable that the innovations at Expo West are not only shaping the future or natural and organic but of CPG overall,” Carlotta Mast, Senior Vice President and Market Leader at Informa Markets’ New Hope Network, said in a statement. “The thousands of new products on display are from an increasingly diverse group of founders and serve a diverse consumer base that cares about ingredients, responsible sourcing, and the greater impact their purchases can have.”

Something for everyone

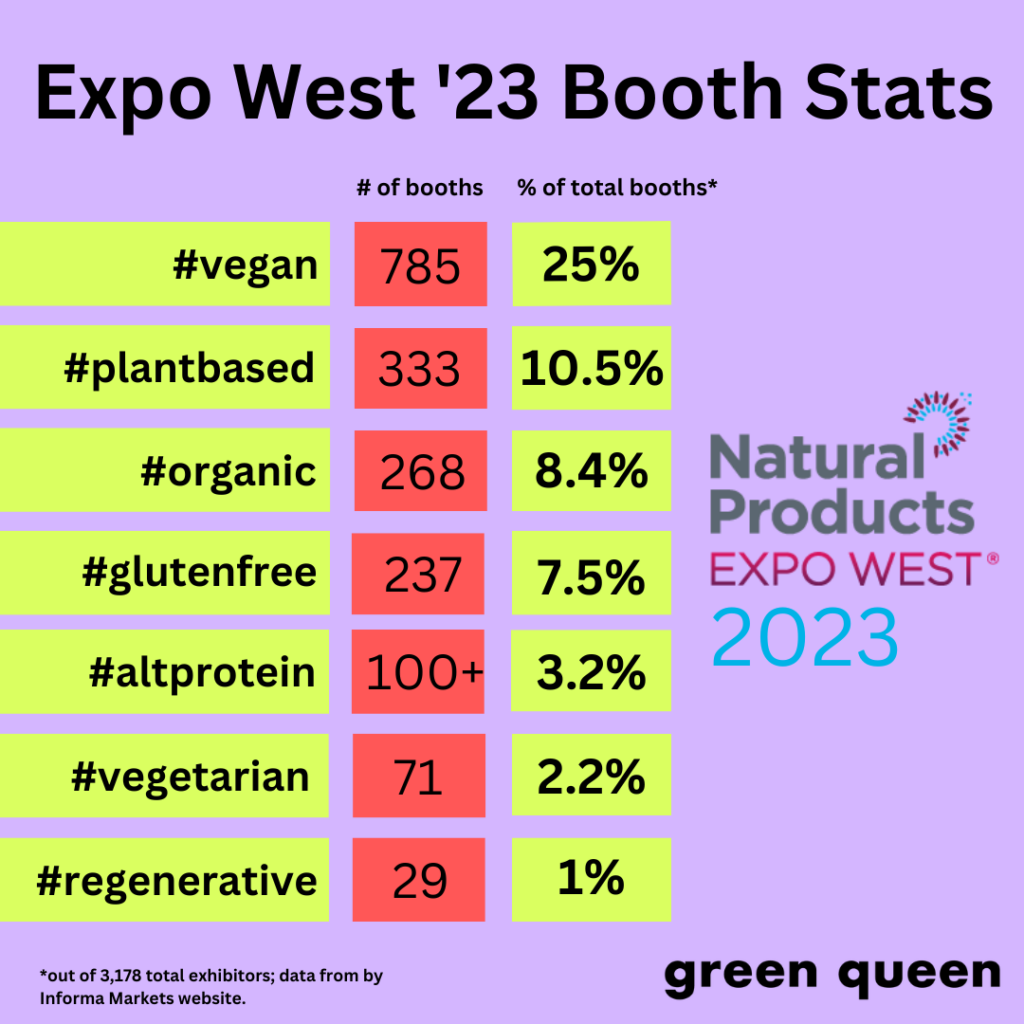

The Expo is not unlike a choose-your-own-adventure book. Are you an organic enthusiast? How about gluten-free? Or, maybe, like me, you’re interested in vegan food. There are other noteworthy considerations like regenerative agriculture, B Corporations, or Fair Trade-certified offerings. Maybe it’s not food you come for at all — there are also aisles and aisles filled with body care products, pet products, vitamins, supplements, and so much more.

In 1999, I attended the event as a grocery buyer for a mid-sized East Coast health food store. While stores have become chains and chains have consolidated into retail empires, grocery buyers are still the holy grail of booth visitors for brands, especially for the young brands spending all of their money to showcase at Expo West, eager to find placement for their new products and, possibly, start a new food revolution as so many have before them.

I wish I could say I remember more of what I saw on the show floor that first year as a retailer. My cell phone didn’t have a camera back then to record all my favorites. I do remember finding a vegan energy bar I was particularly excited about. Those were the days of slimy, congealed Power Bars and the sweet-and-chalky Balance Bars. Clif Bar had created Luna Bar — the nutrition bar designed for women — flipping the script on both the emergent bar category and how to market to untapped demographics. It’s more than 20 years later and I still look at the Lemon Zest bar with the same admiration as I did after my very first bite. This year, though, I looked at the Clif Bar booth a bit wistfully, as the company’s longtime founders recently sold to Mondelez after decades of being proudly independently owned.

Much of the show’s focus in 1999 was on organic, even though it would be a few more years until the USDA officially launched the National Organic Program. Brands were eager then to talk about how they eschewed synthetic chemicals, espousing the benefits of minimal soil inputs. Today, organic is the label de rigueur for any self-respecting brand. Now, if you really want to stop people in their tracks, regenerative certification is the must-have.

Kamut was the hot “it” grain back then, finding its way into pasta and cereal, among other products, boasting a better-for-you replacement for conventional wheat. I don’t think I saw one kamut item this year, or in any recent years, for that matter. But I sure saw a lot of oats and chickpeas.

Hemp was up-and-coming in 1999, but still years away from anything close to going mainstream. Now it’s in everything from soda and soap to supplements and even dog treats.

Dairy made up as big a chunk of the show back then as it does today, with farmers on hand to talk about how loved and cared for their cows are. In 1999, meat was largely absent from the Expo save for the Ostrim craze (it’s ostrich! And beef! And maybe elk!) and all manner of jerkies, which still permeate the show two decades on. I’m still as skeptical today about both as I was in my 20s. (Maybe even more so as animal agriculture is deeply tied to global emissions, deforestation, and human health issues.)

Across the show floor on the supplement side, echinacea was peaking in the late ‘90s, as were other herbal mainstays like ginseng, ginkgo, kava kava, and the buzziest of them all, St. John’s Wort. This year was all about gummies, adaptogens, and something that resembled a Starburst fruit chew, but with melatonin instead of gelatin, which I happily downed several hours later as I climbed into bed fried from the day and too exhausted to sleep. I think it helped.

As I walked the show this year, I was struck by how much had changed and, even more so, just how much hadn’t.

Old and new trends

There were still new energy bars trying to break into the crowded category. This year, it seemed most were aimed at kids. But that could also just be because I now view the show through my mommy goggles. My daughter loved the blueberry-purple carrot snack bar from Yumi that I brought home. Even at age nine, she knows how saturated the category is, telling me, “I didn’t think I would like another kind of bar, but this one was really delicious.” Maybe there’s room for more after all.

Green drinks and powders always seem to be on the cusp of their big breakthrough at Expo. And even though they’re certainly more popular now than they were nearly 25 years ago, the widespread acceptance brands are always hopeful for every year is somehow perpetually still just out of reach.

Water is always at the Expo in one form or another. In the early days, after my years in retail, I worked as a broker. One of our favorite clients was an Idaho water brand called Trinity Springs. For years they’d make quite the Expo splash with their phenomenal story, which I committed to memory like the Pledge of Allegiance (ask me!). That booth was always a popular destination until the show banned single-use plastic water bottles. Then came the paper box water that never quite took off. This year, the show was filled with what seems like the only logical workaround: recyclable aluminum cans and bottles.

Sparkling water and drinks reigned supreme. My favorite product at the show in any category this year was the delicious Schisandra Berry sparkling water from Rishi’s Sparkling Botanicals. There were loads of other options in the category, including the prebiotic soda cohort that has taken health food stores by storm with their nine-plus grams of fiber per can. (But trust me on the Schisandra.)

Plant-based then and now

Then, of course, there were the vegan options. Long gone are the days of Tofurky founder Seth Tibbott sporting his pilgrim costume as he served up his delicious roast. He’s retired now and the company was just recently acquired.

I don’t think it was that 1999 show, but in one of those early years, I remember the thrill of a brand (maybe Lightlife?) having a hot dog cart on the show floor filled with veggie dogs. That was long before you could get a vegan hot dog at a sports stadium or a vegan burger at a fast food restaurant. I probably visited it five times over the weekend.

Amy’s Kitchen was absent this year, but for years, decades, really, it had a buffet of tasty options and cushy booth carpeting for tired feet that gave you two reasons to make multiple visits.

This year saw no shortage of vegan innovations, with Colorado’s Meati causing all kinds of buzz for its minimal ingredient mycelium meat — a far cry from those veggie dogs of years past. The meat was exceptionally juicy, with a dense and chewy texture likely to satisfy die-hard meat-eaters. If you had told me in 1999 I’d still be coming to this trade show 20+ years later and eating mushroom meat on a stick (and taking pictures of it with my phone!), I’d probably have asked you if you’d eaten another kind of mushroom. But here we are.

Meat wasn’t the only place mushrooms made their mark this year, though. The kind folks at Oasis Adaptogens are taking cues from Four Sigmatic and blending mushrooms and other good-for-yous into coffee replacement and a delicious matcha blend. In fact, I think some of those sparkling drinks I loved were filled with mushrooms promising all manner of benefits, too. I can’t help but wonder what Terence McKenna would make of all this mushroom madness.

Climax Foods created a buzz with its plant-based take on classic French cheese — a marbled, stinky blue cheese and creamy, soft brie. I wasn’t a big cheese fan before I went vegan — in fact, I rather hated the stuff — but I’m humbled by the vegan cheese evolution. In 1999, the best attempts at vegan cheese were products from Galaxy Foods or Soymage. And, let’s not beat around the bush: they were all awful, waxy, and not anything like cheese. It’s funny to think that I have only become a cheese lover since going vegan when so many people cite cheese as the reason they won’t go vegan.

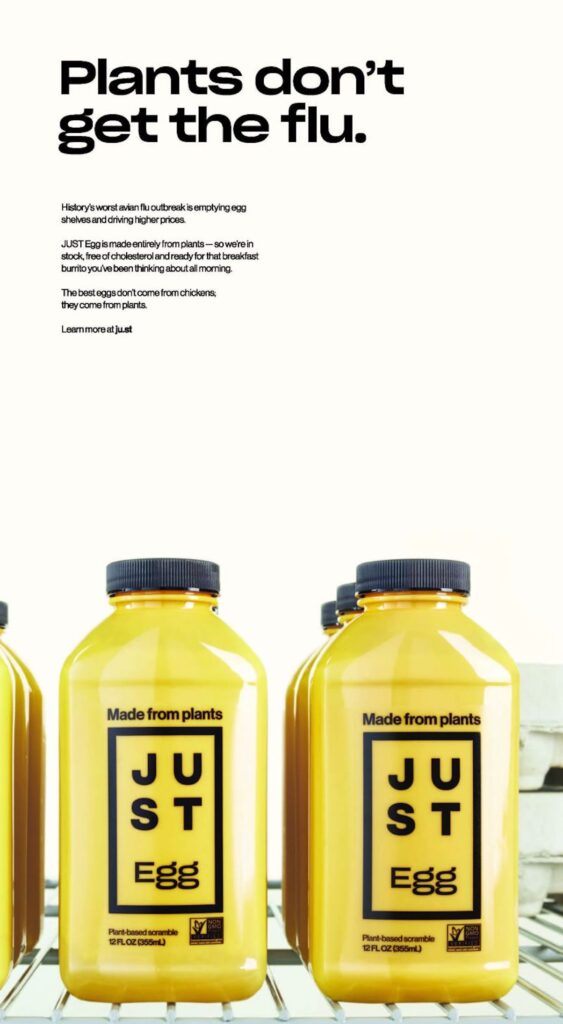

There were scores of other innovations from bee-free honey to more plant-based milk, ice cream, yogurt, and so many vegan egg products. It’s exciting and overwhelming; I feel a sense of duty to my 20-year-old new-vegan self to try it all, but with more than 700 vendors boasting vegan options, it’s a feat most impossible.

Another show favorite is a staple in our house: Gotham Greens. If you haven’t seen this brand yet, you will soon. The company is bringing healthy, local food to urban consumers by growing it in cities, like in its greenhouse located on top of a Brooklyn Whole Foods Market. From fresh produce to the very best vegan pesto you’ll ever have, Gotham Greens is changing the way cities grow and eat vegetables.

A giant returns

The biggest thrill this year was seeing Just Ice Tea make its Expo West debut, or rather, its drop-the-mic comeback. The story is documentary-worthy: in 1998, plucky optimists and iced tea lovers Seth Goldman and Barry Nalebuff launch Honest Tea – a ready-to-drink line of iced tea driven by their hankering for a cold tea product that wasn’t as cloyingly sweet as the category leaders Arizona and Snapple.

They were also activists at heart and wanted to support a brand that spoke to their ethos. (I remember one moving speech by Goldman at Expo East, the autumnal sister event to Expo West, which was held in Washington D.C. for a number of years. He was receiving an award, and during his speech passionately called for the then-named Washington Redskins football team to change their inflammatory, derogatory name. If you don’t follow football, the team did change its name in 2020 to the Washington Commanders. Goldman has always been ahead of his time.)

Honest Tea was a huge success, and a decade after Goldman and Nalebuff founded it, the company sold to its largest shareholder, Coca-Cola. The brand chugged along with placement in mainstream retailers and fast-food chains. But as drink preferences changed, the soda giant announced last year that it was going to discontinue the tea line.

Goldman, who now also serves as Executive Chairman at Beyond Meat, almost immediately announced the tea would return through his Eat the Change snack platform along with Spike Mendelsohn under a new name, Just Ice Tea. Same formulas, same ethos, and nearly the same packaging, but, an even more refreshing sip knowing the brand has its heart and soul restored. (Watch this inspiring video of Goldman and Mendelsohn visiting their tea grower partners in Mozambique.)

The continuum

In 1999, I left that first Expo West with a suitcase full of samples and a sense of awe about an industry I had no idea would become such a defining part of my life. This year, I left with another bag of samples (and a bit worried I had caught covid). I also left with the realization that this industry, while it’s bigger than it ever was, is also still as dynamic as it ever was, and will be even long after I’ve made my last Expo visit. Despite the businesses that have gone under, the mergers, the lawsuits, and those dear friends we’ve lost along the way — just like all of us, food changes. It has to.

New Hope, which produces the event, identified five defining trends to look out for at the show: the intersection of health systems (driven by nurturing microbiomes), delivering on climate commitments, radical transparency, sustainability, and the “subscriptionalization” of everything (think: meal kits).

“It’s always tempting to zero in on the year’s hottest innovations or the latest go-to ingredients, but it’s important to recognize that these trends are reflections and manifestations of the much broader cultural forces that are truly driving today’s natural products industry,” said Jessica Rubino, Vice President, Content at Informa Markets’ New Hope Network. “These big-picture trends exist on a continuum, and Natural Products Expo West offers a front-row seat to observe their evolution.”

It’s refreshing to see Rubino remind us that the trends are part of a systemic continuum — as is everything. We need to widen the lens in order to get the clearest view. It’s like that old Chinese proverb that Alan Watts loved to tell. The story is always a work in progress.

With more than 65,000 attendees, thousands of brands, and new convention center wings to visit, it’s impossible to taste or see everything at a show of this magnitude. The trends (and the trendiest) always bubble up to the surface anyway, making their presence hard to miss. Besides, the more Expos you attend, the more you’ll come to realize that tasting everything isn’t the imperative, it’s catching that glimpse into our ever-evolving food system, and seeing how we’re evolving along with it, that’s the real takeaway.

The post 1999 To 2023: Expo West Then and Now appeared first on Green Queen.

This post was originally published on Green Queen.

includes alternatives to beef and chicken such as a Classic Cutlet, a Crispy Cutlet, a Classic Steak and a Carne Asada Steak. The products will be sold in the frozen meat aisle of Sprouts stores.

includes alternatives to beef and chicken such as a Classic Cutlet, a Crispy Cutlet, a Classic Steak and a Carne Asada Steak. The products will be sold in the frozen meat aisle of Sprouts stores.