The European Parliament’s agriculture committee has voted to prohibit the use of terms like ‘burgers’ and ‘sausages’ on vegan alternatives, paving the way for an EU-wide ban.

Five years after the European Parliament voted against a ban on meat-like terms on plant-based product labels, its agriculture committee has taken the first step to overturn that decision.

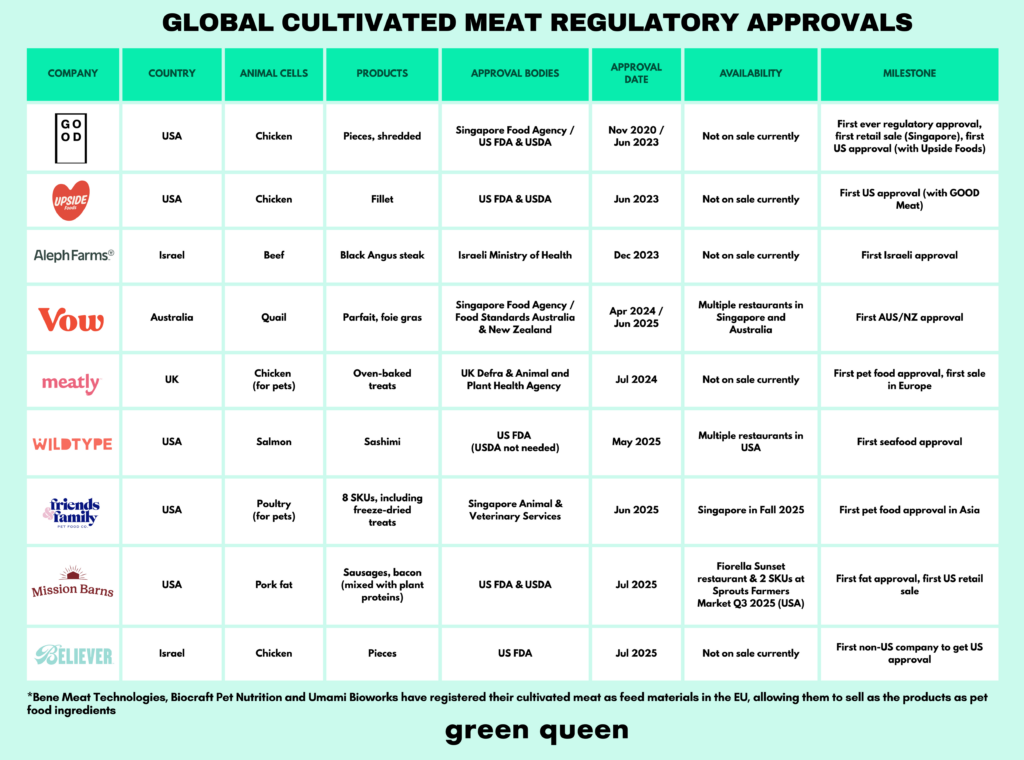

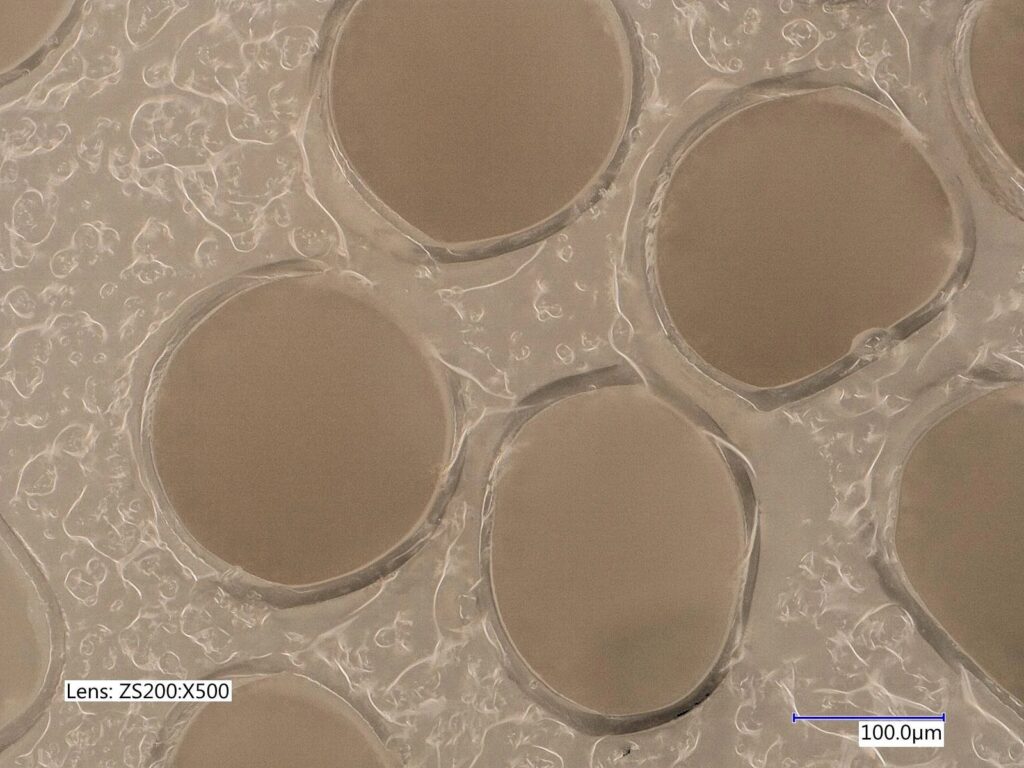

In a vote last night (September 8), the 49-member committee agreed to ban these designations on both vegan and cultivated meat (which hasn’t been sold for human food in Europe yet), moving the legislation forward to a vote with all MEPs.

The proposal was brought by the Parliament’s rapporteur, French lawmaker Celine Imart, in a review of the Common Market Organisation (CMO) regulation in July. It was swiftly followed by a similar proposition in the European Commission, which sought to restrict the use of 29 “forbidden” meat-related terms on the packaging of vegan alternatives – the Parliament’s version is broader.

“The proposal will make it to plenary vote with all the MEPs, probably in October,” Rafael Pinto, senior policy manager of the European Vegetarian Union, tells Green Queen. “If approved there, it will make it to the trilogue negotiations on the file, between the Commission, Council and Parliament.”

He adds: “Although the initial proposal on this file from the Commission or Council had no mention of denominations (it’s out of scope), the Parliament rapporteur, Celine Imart, might try to put it in the final text. It’s unclear how the Commission will react, since they also have a separate proposal, on another file, with different wording.”

EU takes aim at plant-based and cultivated meat, despite no consumer confusion

How veggie burgers are labelled has been debated for nearly a decade in the EU, but there were signs that the discourse would come to an end last year, when the European Court of Justice (ECJ) ruled that no member state can prohibit companies from using these terms on vegan product labels.

The decision noted that such bans can be implemented only if a member state legally defines meat products and descriptive terms first (a lengthy and complex process), and even then, such a ban would only apply to products manufactured within that country. The only other option would be an EU-level ban, which is the goal of Imart’s proposal.

Her suggested amendment to the CMO argues that meat-related terms “shall be reserved exclusively for the edible parts of the animals”, such as ‘steak’, ‘sausage’ or ‘burger’ (notably, these designations aren’t included in the words the EU Commission is seeking to ban).

“The above-mentioned names shall not be used for any product other than the products referred to and shall exclude cell-cultured products,” the proposal reads.

The agriculture committee was in favour of this, seemingly disagreeing with the EU’s highest court, which ruled that existing legislation was sufficient to protect consumers from possible misleading.

“There is no data to support the argument that consumers are confused by plant-based burgers, sausages or any other alternative,” said Pinto. “Policymakers continue to bring up this non-issue, when it’s simply not a problem for citizens.”

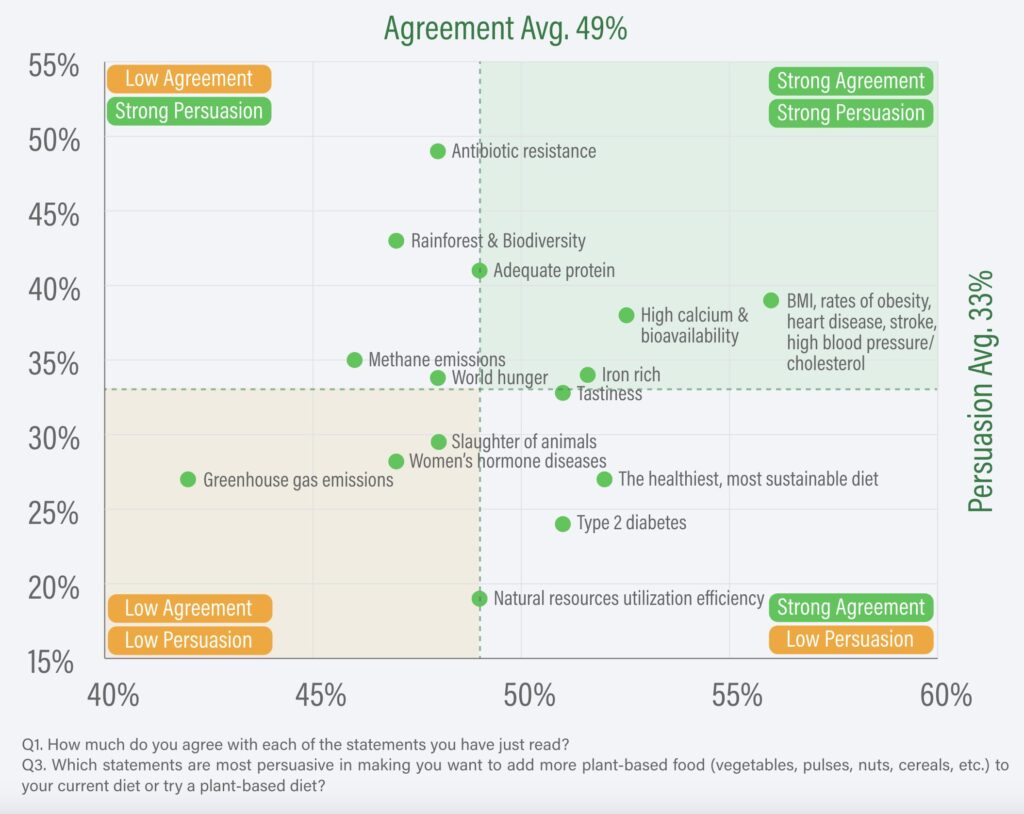

In a large study by the European Consumer Organisation in 2020, 80% of people said plant-based meat should be allowed to use such terms. And in the 2023 Smart Protein survey, only 9% of citizens from nine member states said they didn’t recognise plant-based meat alternatives.

In fact, in an opinion published last September, the ECJ’s advocate-general stated that the use of several different names resulting from such a ban could be more confusing for consumers.

Conservative Parliament could vote for EU-wide ban

The amendment was voted in favour of by 33 members of the committee, with 10 opposing it and five abstaining. It’s meant to strengthen the position of farmers in the food supply chain.

“On the contrary, banning the use of these terms will hurt the farmers producing raw materials such as pea or soy, the companies innovating with new products and hinder consumer transparency with the use of unknown names,” argues Pinto.

“Although this goes against the 2020 plenary vote, it follows the line of the agriculture committee that also voted for the ban before the plenary,” he says, highlighting how a repeat would see the effort to ban meaty terms thwarted.

It’s also an important issue for other EU committees, such as those overseeing internal market and consumer protection, environment and food safety, public health, and industry, research and energy. “We hope they step up to vote it down,” says Pinto.

But he adds: “Unfortunately, this time around with a more conservative Parliament, there’s a significant chance the ban goes through.”

These proposals came amid increasing pressure from a dozen member states to prevent such designations on plant-based meat products. These concerns echo – and are likely driven by – the livestock lobby, which has its arms deep into the EU’s decision-making, especially when it comes to green legislation.

The fact that the proposal made it to an amendment where it’s essentially out of scope raises suspicion of lobbying pressure – very few consumers care about how this debate, as can be evidenced by the fact that Europe is the world’s largest market for plant-based meat.

The Parliament’s move is contradictory to the EU’s promise to diversify protein sources and bolster domestic plant-based production, as well as its new bioeconomy initiatives. The Danish presidency of the EU Council is also focusing on a common EU action plan for plant-based foods. And last week, the European Academies Science Advisory Council (EASAC) published a report recommending policymakers to increase support for meat alternatives for climate, health and food security benefits.

It remains to be seen how the proposal to ban meaty designations holds up in the plenary. As for the Commission’s version of the proposal, the EVU says it’s unclear when the discussion will take place and how it will interact with events in the Parliament, but either way, it notes that this is a “political crackdown on meat alternatives”.

The post EU Agriculture Committee Votes to Ban Meaty Terms on Plant-Based Labelling appeared first on Green Queen.

This post was originally published on Green Queen.