Israeli food tech firm Believer Meats has secured US FDA approval for its cultivated meat, and completed the construction of its manufacturing facility.

Believer Meats has become the fifth cultivated meat startup to secure regulatory clearance in the US, having received a ‘no questions’ letter from the Food and Drug Administration (FDA).

The Israeli startup has also completed the construction of the world’s largest cultivated meat factory in North Carolina, and is the first non-US company to be greenlit by the FDA.

The food safety agency’s letter and scientific memo haven’t been published on its website yet, but the news was confirmed by Believer Meats CEO Gustavo Burger. In a post on LinkedIn, he called it “a transformative moment for Believer Meats and the cultivated meat industry as a whole”.

“This is more than just progress – it’s a defining moment, a bold leap forward in our vision to lead food innovation that cares for the planet,” he said.

The announcement came the same day California’s Mission Barns secured the facility and labelling nods from the US Department of Agriculture (USDA) for its cultivated pork fat.

Believer Meats’ tech could make cultivated meat for $6.20 per lb

Formerly known as Future Meat Technologies, Believer Meats was founded in 2018 by Yaakov Nahmias, a biomedical engineering professor at the Hebrew University of Jerusalem.

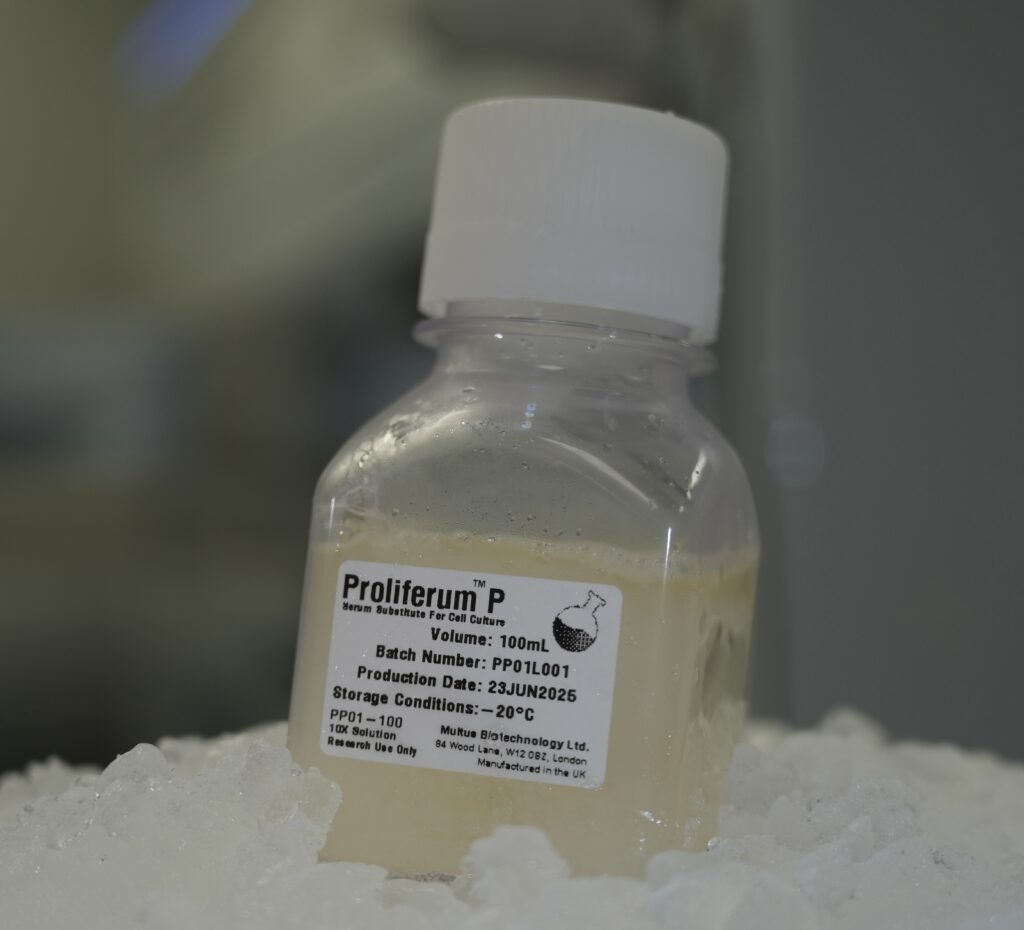

The cultivated chicken maker leverages centrifuge-based perfusion and a cell media rejuvenation process that can optimise cell performance and save water, nutrients, and resources, allowing it to reduce production costs by eliminating byproducts and enabling the reuse of media.

Last year, it demonstrated how tangential flow filtration (TFF), an efficient way to separate and purify biomolecules, can be an effective method for the continuous manufacturing of cultivated meat. It also introduced an animal-free culture medium that cost just $0.63 per litre, further allowing the startup to lower production costs.

Inspired by how Ford’s automated assembly line transformed the auto industry in the early 20th century, their new bioreactor assembly method allowed biomass expansion of 130 billion cells per litre, with a yield of 43% weight per volume. This process of cultivating the chicken cells was carried out continuously for over 20 days, leading to daily harvests of the biomass.

Believer Meats claimed this could bring down the cost of cultivated chicken to $6.20 per lb on a 50,000-litre scale, in line with the retail price of conventional USDA organic chicken.

Getting the FDA green light is the first step towards full regulatory approval. The company will now require USDA’s clearance for its production facility and product labelling before bringing its cultivated chicken to the market.

“As we move forward, our focus remains on execution – advancing cultivated meat from promise to product, and contributing to a more resilient, sustainable food system,” said Burger.

A milestone year for cultivated meat approvals

Believer Meats first announced plans for its $123M facility in late 2022. The 200,000 sq ft plant, located in Wilson County, North Carolina, features an innovation centre and tasting kitchen, and will be able to churn out 12,000 tonnes of cultivated chicken every year.

“Commissioning of the factory is underway now, and we are working with the USDA on the final steps for our facility’s grant of inspection,” the firm remarked on LinkedIn.

It has partnered with German engineering firm GEA to develop processes to lower the costs and emissions of manufacturing cultivated meat. The two entities are focusing on advancements in bioreactor tech, perfusion systems, and media rejuvenation, and adopting strategies like optimised water usage, power consumption, and circular economy initiatives (such as waste stream utilisation).

“With our regulatory progress on track, production facility complete, and clear path to market, we are closer than ever to delivering cultivated meat at scale, strengthening global food security, and helping shape a more sustainable food system,” Believer Meats said.

Four other cultivated meat startups have already received regulatory approval in the US: Eat Just‘s Good Meat, Upside Foods (both for chicken), Mission Barns (for pork fat), and Wildtype (for salmon).

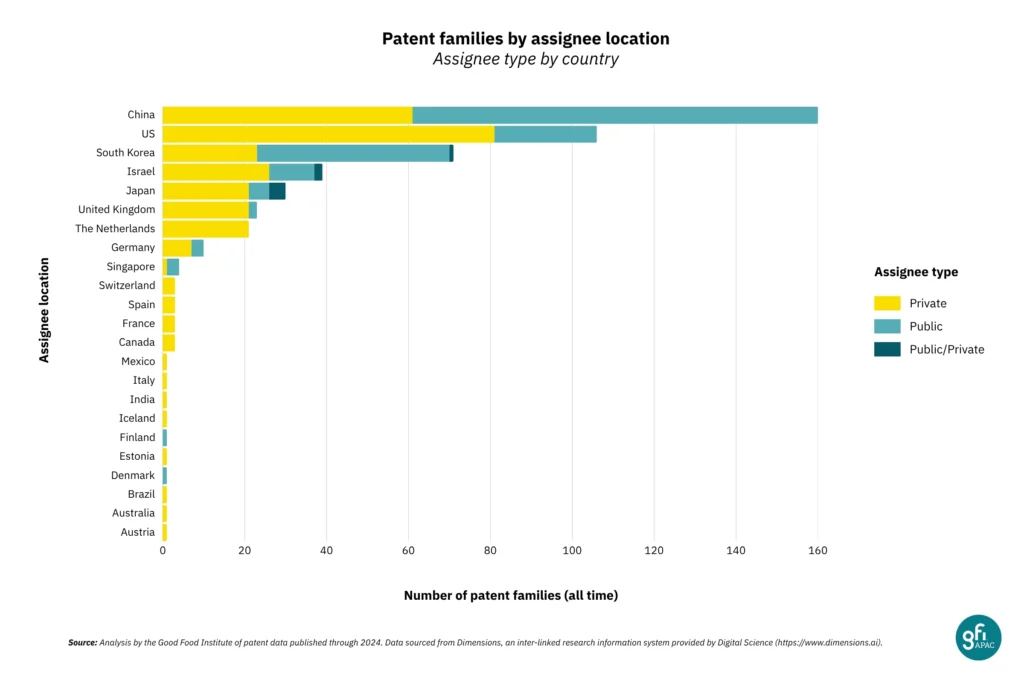

Globally, a handful of startups have been cleared to sell cultivated meat. Good Meat has approval in Singapore, Aleph Farms in Israel, while Vow is cleared to sell in Singapore, Australia and New Zealand. And in the UK, Meatly has commercialised cultivated chicken for pets. Regulators in the EU, Switzerland, Australia, Thailand and South Korea are evaluating applications too, while the UK has created a designated regulatory sandbox.

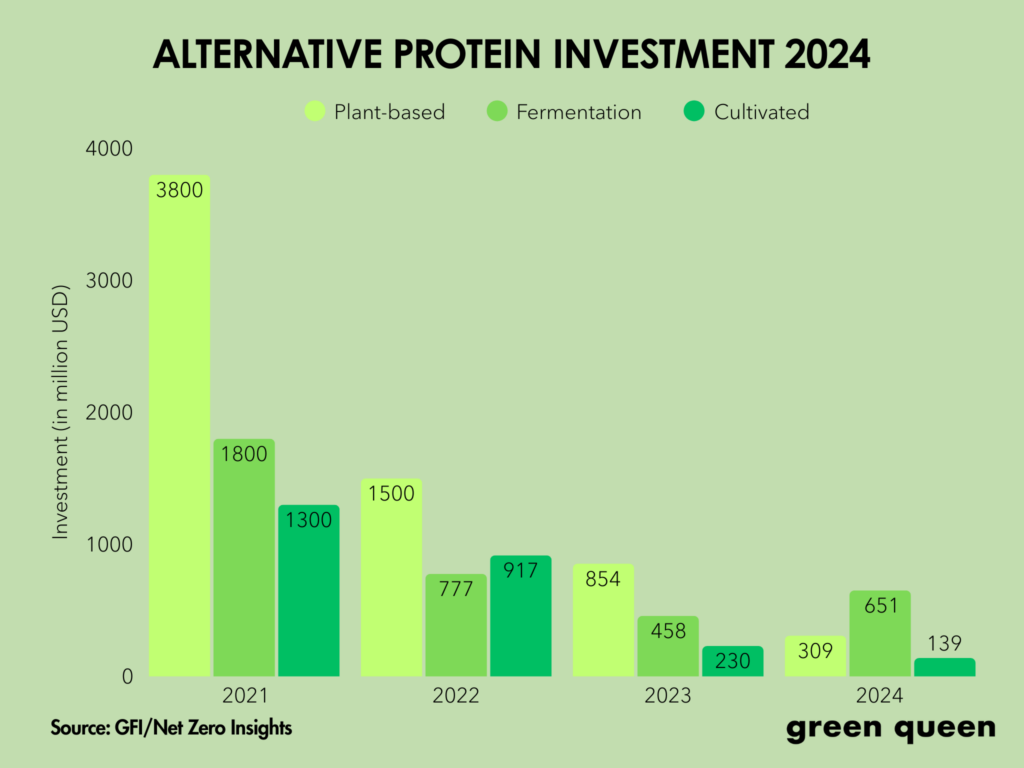

Believer Meats’s approval is the fourth such instance this year, a much-needed boost to a category that has struggled to raise funds and faced political attacks via state-level bans in the US. And all signs point to further regulatory nods in the coming months.

The post Believer Meats Earns FDA Approval & Completes World’s Largest Factory for Cultivated Meat appeared first on Green Queen.

This post was originally published on Green Queen.