AMY GOODMAN: This is Democracy Now!, democracynow.org, The Quarantine Report. I’m Amy Goodman.

We begin today’s show looking at a major provision in President Biden’s $1.9 trillion COVID relief bill that aims to address decades of discrimination against Black, Hispanic, Native American and Asian American farmers, who have historically been excluded from government agricultural programs. The American Rescue Plan sets aside $10.4 billion for agriculture support and allocates about half the funds to farmers of color who were, quote, “subjected to racial or ethnic prejudice because of their identity as members of a group,” unquote.

The U.S. Commission on Civil Rights confirmed, as long ago as 1965, the U.S. Department of Agriculture discriminated against Black farmers, but little was done to address the problem, and the number of Black-run farms dropped 96% in the last century. By 1999, 98% of all agricultural land was owned by white people. In 2010, Congress approved a $1.2 billion settlement for thousands of Black farmers denied USDA loans because of their race. But a 2019 study by the Government Accountability Office, based on the USDA’s own data, shows farmers and ranchers of color continue to receive disproportionately smaller farm loans.

The provision in the new COVID relief package is drawn from legislation introduced by newly elected Democratic Senator Raphael Warnock of Georgia, who is Georgia’s first Black senator and also the first Georgia Democrat to serve on the Agriculture Committee in three decades. Agriculture Secretary Tom Vilsack welcomed the measure.

AGRICULTURE SECRETARY TOM VILSACK: The history of USDA, unfortunately, involved a level of discrimination against a number of minority producers — Black farmers, Native American farmers, Hispanic farmers. And there is an effort, I think, with this package to try to deal not with the specific acts of discrimination, but the cumulative effect over a period of time. When people are discriminated against, they basically get behind, and it’s really hard for them ever to catch up. And the result, of course, is that we’ve seen a significant decline in the number of minority producers around the country. So, this is providing some debt relief for those minority producers, those socially disadvantaged producers, to impact and affect the cumulative effect of — to offset the cumulative effect of discrimination over a period of time.

AMY GOODMAN: But the effort to address the USDA’s history of racism has come under fire from some Republicans, including Republican Senator Lindsey Graham of South Carolina, who lashed out against the measure during a Fox News interview.

SEN. LINDSEY GRAHAM: Let me give you an example of something that really bothers me. In this bill, if you’re a farmer, your loan will be forgiven, up to 120% of your loan — not 100%, but 120% of your loan — if you’re socially disadvantaged, if you’re African American, some other minority. But if you’re a white person, if you’re a white woman, no forgiveness as for reparations. What has that got to do with COVID? So, if you’re in the farming business right now, this bill forgives 120% of your loan based on your race. These people in the Congress today, the House and the Senate, on the Democratic side are out-of-control liberals.

AMY GOODMAN: Senator Graham’s comments prompted a stern response from House Majority Whip James Clyburn, who’s also from South Carolina. He was speaking on CNN.

REP. JAMES CLYBURN: Mr. Graham is from South Carolina. He knows South Carolina’s history. He knows what the state of South Carolina and this country has done to Black farmers in South Carolina. They didn’t do it to white farmers. We are trying to rescue the lives and livelihoods of people. He ought to be ashamed of himself.

AMY GOODMAN: For more on the fight to end discrimination at the USDA and restore land to Black farmers, we go to Boydton, Virginia, to speak with John Boyd, fourth-generation Black farmer, founder and president of the nonprofit National Black Farmers Association.

John, welcome back to Democracy Now! It’s great to have you with us. Can you start off by talking about this $5 billion and what it means? Give us the history.

JOHN BOYD: The $5 billion is historic in nature, Amy — and thank you for having me again — in what it’s going to do to help Black farmers and farmers of color in this country. You know, as you know, we’ve been suffering. And the $5 billion calls for debt relief. So, that would give many Black farmers a jumpstart, if they can get rid of the debt at the United States Department of Agriculture. And there is $1 billion that’s set aside for technical assistance and outreach and to really dig down into the core of the discrimination at the United States Department of Agriculture.

Both of these measures, I’ve been fighting for for over 30 years, so I don’t anybody who’s watching this show to think that this is some new measure or new idea or concept that happened overnight. I’ve been trying to fix this, this measure, for over 30 years at the United States Department of Agriculture. And, Amy, I probably spoke to you about it 10 years ago. So, we’ve been trying a long time. And this is a huge victory for Black farmers and farmers of color, Native Americans and Hispanics, and other socially disadvantaged farmers.

AMY GOODMAN: Can you explain how, over the last century, Black farmers lost 90% of their land?

JOHN BOYD: Yes. And at the turn of the century, we were tilling about 20 million acres of land, primarily in the Southeastern Corridor of the United States, and we were close to 1 million Black farm families strong. And for those who don’t understand the history, every Black person in this country, we’re one or two generations away from somebody’s farm. And we survived slavery. We survived sharecropping. We survived Jim Crow. And here we are in the year 2021, and I’m talking to you about discrimination at United States Department of Agriculture. We lost this land by discrimination, from receiving discrimination at USDA.

And I was one of those recipients, where the government clearly discriminated against me. I have a 14-page letter from them admitting to the guilt in those egregious acts that I faced by this this county official. The person responsible for making farm loans spat on me and used racial epithets, referred to me and other senior statesmen in Mecklenburg County, Virginia, as “boy.” He came to my farm, wanting me to sign a check over to him personally, with a loaded handgun. And I can tell you, Amy, he didn’t treat white farmers that way in Mecklenburg County. He would only see Black farmers on Wednesday. All of us would be lined up in the hallway with the same date and time on it. And he was referring to these elderly Black farmers — many were deacons and preachers and leaders in the community — as “boy” and talking downward towards them. So, this is deep-rooted discrimination that’s been going on in very pervasive ways for a very, very long time.

AMY GOODMAN: Can you respond to Senator Lindsey Graham?

JOHN BOYD: Yes.

AMY GOODMAN: And talk about the history of Lindsey Graham, from South Carolina, when it comes to this issue.

JOHN BOYD: Yes. Well, first of all, I’ve lobbied Senator Graham when he was in the House and in the Senate, and I’ve had meetings with him, in buttonhole meetings, trying to get him to support the Claims Remedy Act of 2010. He has over 6,000 Black farmers in his state. He knows the discrimination that I’m describing. And I’ve spoken to him personally about this discrimination. Amy, he never once used his megaphone to talk about or investigate the acts of discrimination that Black farmers like myself faced.

So, I’m calling for, today, on your show — I want him to apologize to the Black community, to Black farmers, and apologize to this country for his wrong stance on this. Forty-nine members voted on 10 different amendments to strip or lessen the language that was in the COVID spending bill for Black farmers. Forty-nine senators, Republican senators, voted to take that out. And Senator Lindsey Graham was one of them. He has never tried to help. He is divisive. He is wrong for this country. And that message, that concept, the message of hate, hatred and division, that he continues to preach on Fox News, isn’t the American way. That’s not the way to bring America back.

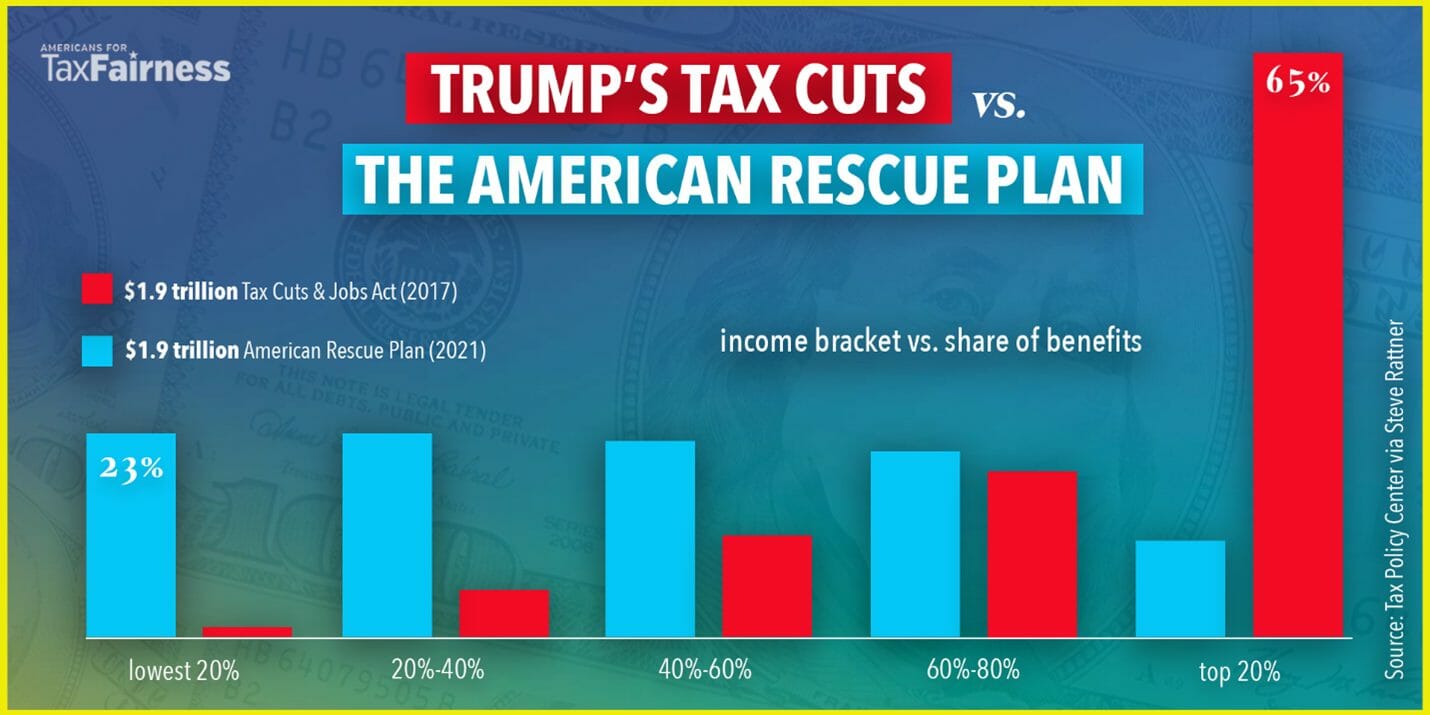

Here we are, for 30 years, trying to get this done. He should have took some time to say, “What can we do to help this measure, to make farming better for Blacks and other farmers in this country?” And he never once spoke about all of the money going to white farmers. Just, for example, under the Trump administration, $29 million — $29 billion, with a B, went to white farmers. What is his definition of that? All of the subsidies and programs and loans and all these incentives at USDA, for all of these decades, have went to white farmers. What is his definition of that?

So, that’s what we’ve been talking about, clearly, for a long time: a system that has discriminated and mistreated and took and stole land from Black farmers for decades. And it went unchecked in this country. If he wanted to check something, he should have been checking about discrimination at USDA. He should have been checking about sharecropping in his historic state, South Carolina. These are things that Senator Lindsey Graham should have been doing.

AMY GOODMAN: And the significance of it being Reverend Warnock, now Senator Warnock, from Georgia, the new Democratic senator, being the one who pushed this forward and sitting on the Agriculture Committee?

JOHN BOYD: Yes. This is a historic nature, and my hat goes off to Reverend Warnock, Senator Cory Booker. For the first time in history, Amy — this is a new day in America — we have two Blacks on the Senate Ag Committee. We have the chairman in the House, Chairman Scott, also from Georgia, a chairman of the [House] Agriculture Committee.

We have now a president, President Biden, and a vice president, who wants to help rectify some of the problems that we’ve faced. And I spoke to the president about this last February. And he committed to me that he would help me fix the issues at the United States Department of Agriculture. So I would like to recognize President Biden for signing that bill and making sure that we stayed in there. So, my hat is off right now to this administration for doing the right thing and having the guts to stand up to people like Lindsey Graham and the other 49 senators, who simply don’t want to help people, Black farmers and poor people in this country.

AMY GOODMAN: I wanted to ask you about Tom Vilsack, the new, once again, head, but also past head, of the USDA. The NAACP has noted Vilsack had lied to conceal decades of discrimination against Black farmers. The NAACP president, Derrick Johnson, responded to Biden’s nomination of Vilsack to head the USDA, calling it “extremely problematic for the African American community.” He cited the 2010 controversy when Vilsack served as agriculture secretary during the Obama administration and fired Shirley Sherrod from her USDA position overseeing rural development, amidst a misunderstanding over racial comments. Vilsack would later apologize. Johnson told The Washington Post, quote, “We think that an individual who unjustifiably fired Shirley Sherrod — who is a civil rights icon, a legend, who worked with John Lewis — should not be considered. … We should not go backward, we should go forward.” Well, in fact, Vilsack is once again the head of the USDA. John Boyd, have you spoken to him? And what are you demanding?

JOHN BOYD: Well, two things. Yes, I have spoken to him. And one of the things that President Biden also committed to me during our one-on-one visit in South Carolina, that there would be change in leadership at USDA. So, when they announced that Secretary Vilsack was coming back to USDA, he was not my pick. And he wasn’t the pick for Black farmers. He was the pick that President Biden wanted to come back. I wanted new blood and new leadership, someone who will take a much more aggressive campaign against this discrimination at the United States Department of Agriculture.

And, Amy, when I lobbied all of those years for the Claims Remedy Act of 2010, that put in place $1.25 billion for Black farmers, Secretary Vilsack was, in my opinion, too slow to act. I didn’t get the help on Capitol Hill, neither in the House or the Senate. And Valerie Jarrett, from the White House, the last five or six months, got on board and began to campaign to help me pass that measure in the House and Senate. So, I didn’t think he was the right person.

But I spoke to him here a couple days ago, and he congratulated me on the measure in the bill. But I also urged him to put in swift action to make sure that these payments and the debt relief and all of these measures, the outreach and technical assistance, reach Black farmers and farmers of color expeditiously, not to sit on it and try to figure out a plan of action. If we can get $1,400 in the mailbox and direct deposit into Americans, then we can disperse and relieve debts for Black and farmers of color expeditiously. And I urged him to do that.

AMY GOODMAN: And finally, you mentioned the Trump administration and Black farmers, farmers of color. How does it fit in to past presidents? How would you assess the Trump administration?

JOHN BOYD: Worst administration in history for Black farmers, since my 38 years of doing this kind of work, Amy. My visit — and I’ve had the opportunity to sit down with every agriculture secretary, both Republican and Democrat, in the cage at USDA. And Secretary — former Secretary Sonny Perdue, in my visit with him, was the worst conversation I ever had. He said, “Mr. Boyd, it’s your farmers, i.e. Black farmers, are going to have to get large or get out of business.”

And when I urged him to have more Blacks on the county committees and all of the USDA commissions, he said he didn’t need people that were lazy and didn’t want to work. How egregious and — for former Secretary Sonny Perdue to say that. I told him that I didn’t know any Black farmers, that are still farming, that have been treated worse than dirt by USDA, that are lazy and don’t want to work. Now, Amy, I work seven days a week, including holidays and Christmas, and I’ve been working all of my life. And that’s the way many Black farmers have. The issue here is, is we haven’t had access to credit the way that the white farmers have.

And for that type of position from the Trump administration, set us back a little further. And not only just in Black farming, but in race relations in this country, the Trump administration set Black people and divided this country. And former Secretary Sonny Perdue was at the core of that, taking land away from Black farmers. He didn’t even have an assistant secretary for civil rights, a position that I lobbied for and campaigned for, for many years, to get into the farm bill. They didn’t even fill that position. So what does that tell you about the Trump administration’s commitment on civil rights and resolving complaints from Black and other socially disadvantaged farmers? Sonny Perdue gets an F from me. And I hope he heads to retirement in politics, because he really done a bad number on Blacks and other farmers of color in this country.

AMY GOODMAN: John Boyd, I want to thank you so much for being with us, fourth-generation Black farmer, founder and president of the National Black Farmers Association.

When we come back, we go to Steve Donziger, the environmental lawyer who sued Chevron for ecological devastation in the Ecuadorian Amazon. After Chevron was ordered to pay billions of dollars, Chevron went after him personally. Donziger has spent nearly 600 days under house arrest. We’ll speak to him at his house. Stay with us.