Every year at the Oscars, attendees leave with gift bags so elaborate they have to be reported as income to the IRS. Luxury skincare, personal training sessions, designer apples that never brown, and extravagant trips are standard issue. But in 2025, Academy Award guests also received a grimmer gift: a yearlong subscription to a white-glove disaster recovery service called Bright Harbor, which has grown popular in the wake of the wildfires that devastated Los Angeles last January.

If your house is destroyed in a fire or flood, the basic logistics of righting your upturned life understandably consume your full attention, even if you’re a movie star. Under this level of stress, navigating the Federal Emergency Management Agency’s byzantine requirements for recovery assistance quickly becomes “a full-time job,” according to Bright Harbor’s chief growth officer, Emily Bush. “We help you understand what your options are and what’s the cost associated with each option that you take.”

Do you stay and rebuild? Does it make more sense to just move? Bright Harbor helps clients freeze their mortgage payments, apply for FEMA aid, navigate seemingly endless paperwork, and secure low-interest small business loans. Bush acknowledged that the company’s luxury services, which can significantly ease the financial burden of disasters, do not come at a cost that all victims can afford to front. (Services started at $300 per month for individuals when the company launched in 2024, but Bright Harbor now sells directly to companies — who purchase coverage for their employees.)

“To be clear,” she said, “I think the government should pay for this.”

It technically does. FEMA money is funneled to disaster relief nonprofits that then hire case managers to guide victims through the recovery process. But even before President Donald Trump took office with an eye toward diminishing the agency, recovery funds couldn’t keep up with victims’ needs. Now, as the administration slashes FEMA funding, withholds aid, and puts more of the onus of recovery onto individual states, victim-assistance organizations feel that they’ve been left totally unprepared, with too few case managers to go around. All of these issues are likely to grow more severe in the coming year, as a review board appointed to reform the agency prepares to make its recommendations.

That a service like Bright Harbor found a strong foothold in the U.S. is not surprising. The private sector’s creeping influence over disaster recovery has been noted since at least 2007, when Naomi Klein published The Shock Doctrine, the book that injected the term “disaster capitalism” into a broader lexicon. But as climate change accelerates and hammers the United States with more billion-dollar catastrophes than ever before, privatization has become more common — and complicated. Private interests can quickly mobilize huge volunteer networks, giving campaigns, and rebuilding efforts in the wake of extreme weather. But, whatever their intentions, such measures are a consequence — and sometimes a cause — of the corrosion of public institutions originally intended to safeguard Americans.

For Klein, Hurricane Katrina was a turning point for disaster capitalism. The Heritage Foundation, the conservative think tank that would go on to draft Trump’s Project 2025 policies, held a meeting on disaster relief in New Orleans just two weeks after the storm in 2005. The group recommended suspending wage laws for recovery contractors, replacing public schools with privately managed charter schools, and halting environmental regulations to reestablish oil and gas production that had been stalled by the storm.

The vision they set forth would shape disaster recovery for decades. In New Orleans, public housing was demolished, the public hospital was shuttered, and the federal government rapidly took over the public school system and set about turning it over to a charter network funded largely through private philanthropy. Over 7,000 teachers and staff members were fired, forcing veteran educators to reapply for their jobs, competing against a flood of Teach for America recruits who were largely whiter, less experienced, and from outside the city.

Mario Tama / Getty Images

Many residents saw this as a mercenary response to the storm, made possible by decades of disinvestment in city services, but they weren’t unilaterally opposed to the charter system. “I think it’s important to avoid romanticizing the system pre-Katrina,” said Jesse Chanin, a professor of sociology at Tulane University and the author of Building Power, Breaking Power: The United Teachers of New Orleans, 1965-2008. Before Katrina, the school district was so underfunded that teachers didn’t have enough books and desks for their students. “A teacher told me the other day, ‘Once, I was walking and my foot just went right through the floor,’” said Chanin. The high school graduation rate hovered around 50 percent, truancy was rampant, and corruption was so widespread that the FBI had set up an office within the New Orleans Parish school board.

But while the charter network was an improvement in many ways — private philanthropy poured money into the new schools and test scores and graduation rates markedly improved — it was also marked by instability. The system ran on a portfolio model: Schools that performed well received increased funding, while schools that struggled were shuttered, their students transferred elsewhere. Because there was such a strong incentive to keep test scores up, struggling students were often pushed out of the best schools into charters that would quickly fold. Such measures, and specifically a lawsuit alleging that the schools were not providing adequate special education services, led the federal government to monitor the city’s charter schools for the past 15 years.

The fact that the charter schools are so siloed — some belong to larger networks, while others operate as one-off schools — has also undermined the strength of the teachers’ union. Critics say that all of this has allowed charter schools to pay employees poorly, eliminate transparency, and provide uneven and inequitable education in exchange for moderately improved test scores. “I think it’s really hard to attribute test score success to the model of charter schools and not to the incredible influx of money and resources into the district,” Chanin said. But Chanin added that undoing the charter system and starting from scratch might not be the answer, either. The city opened its first district-run public school since the storm, and it’s already facing serious challenges.

Schools weren’t the only service that succumbed to the shock doctrine in post-Katrina New Orleans. The Department of Housing and Urban Development, or HUD, shut public housing residents out of their buildings shortly after the storm. Protests erupted, but pleas for help fell on deaf ears. “Many of the powerful players were basically announcing that this [was] the silver lining,” said John Arena, a professor of sociology at the College of Staten Island who was a housing activist in New Orleans at the time. “This is a horrible opportunity to do things that we couldn’t do under normal conditions.” Seventy percent of public housing was ultimately destroyed and replaced with mixed-income developments built by private developers. Reports estimate that roughly half of public housing residents were permanently displaced in the wake of Katrina.

“’Recovery’ has become kind of a misnomer,” said Luis Miron, the former director of Loyola University’s Institute for Quality and Equity in Public Education. “People still haven’t recovered.”

More than 20 years later and 2000 miles away, disaster capitalism is picking up steam in Puerto Rico. In September, Governor Jenniffer González Colón held a press conference announcing a new law that would allow more residents of the archipelago to obtain property titles to their homes. Land in Puerto Rico is often passed down through individual families without any formal documentation. This caused a crisis after Hurricane Maria struck in 2017, as many residents couldn’t prove they owned the land they’d lived on for years, and therefore could not collect disaster relief funds.

But in the middle of the press conference, the lights abruptly went out.

Puerto Rico’s electrical grid was in bad shape before Maria, but blackouts have become routine in the years since the storm. Maria hit Puerto Rico as a Category 4 hurricane with winds of 155 miles per hour, destroying the archipelago’s power grid, knocking out power for 80 percent of residents, and setting off the largest blackout in United States history.

For many, it took nearly a year for power to be restored. The Puerto Rico Electric Power Authority, or PREPA, declared bankruptcy and became the subject of a federal investigation after it was revealed that the utility operator had handed a $300 million contract to rebuild the grid over to a tiny, two-person Montana-based company called Whitefish Energy, which had little experience and close ties to Trump’s Interior Secretary at the time, Ryan Zinke. PREPA was later embroiled in a number of bribery scandals, plus instances in which it extorted customers in exchange for reconnecting them to power after Maria and bought low-quality oil while charging ratepayers high-quality oil prices for roughly three decades. Given the internal drama at PREPA, it wasn’t difficult for authorities to make the case that privatization was the only way to modernize the grid.

“I call it the predator economy,” said Carmen Yulín Cruz, the former mayor of San Juan. “My grandmother used to say, ‘When people are so desperate, they will drink sand if someone markets it the right way.’” In 2021, then-governor Ricardo Rosselló announced that the transmission and distribution of electricity, along with the reconstruction of the grid, would be handed off to a company called LUMA — a Canadian-American company that has thus far failed to fulfill its promises to deliver reliable electricity. Blackouts and power surges (which often destroy electrical devices) are common.

The result is that Puerto Rico has become “generator island,” said Gustavo García-López, an assistant researcher at the Center for Social Studies at the University of Coimbra. “The pollution levels of generators are really high — not only air pollution, which is the main concern, but also noise. I remember after Maria, living in the city with the generators around, the smell and the noise that they make is really unbearable, especially at night.” And even though the grid is often nonfunctional, residents’ power bills have nearly doubled since the storm. The change was sold “under the auspices of ‘if it’s private, it’s better,’” said Cruz. “But, my god — LUMA could not suck more if they tried.”

Angel Valentin / Getty Images

LUMA took control with a vow to decentralize the grid and incorporate more renewable energy, keeping generation in line with Puerto Rico’s 2019 Energy Policy Act, which set a goal of 40 percent renewables by 2025. But as of late 2024, fossil fuels still generated 93 percent of the archipelago’s energy. LUMA has argued that it inherited a crumbling grid and a power supply that’s insufficient to meet customer demand. The territory’s power plants are managed by Genera Energy, a subsidiary of the troubled New Fortress Energy, a natural gas company that critics say has kept the territory dependent on fossil fuels at the expense of reliability. According to PREPA’s most recent fiscal plan, performance has grown steadily worse over the past few years, with customers seeing approximately 15 percent more service interruptions and 21 percent longer outages in December 2024 compared to March 2023.

As in New Orleans, Puerto Rico was vulnerable to these tactics because of years of disinvestment. In June 2016, former president Barack Obama signed into law the Puerto Rico Oversight and Management Economic Stability Act, or PROMESA, which would essentially lead the territory through a court-supervised bankruptcy process. Eight years later, Puerto Rico is still primarily controlled by the unelected financial oversight board established by PROMESA. The board handed many assets over to private interests after the hurricane. Charter schools, previously shut out of Puerto Rico, began to make inroads; the water system was nearly privatized; and toll roads were sold off to multinational corporations like Goldman Sachs.

“There’s a debt crisis, so there’s no public funds to fix anything,” said Marisol Lebron, an associate professor at the University of California, Santa Cruz, and the author of Aftershocks of Disaster: Puerto Rico Before and After the Storm. “Puerto Ricans are left holding the bag in a lot of ways, for both the failures of the state, but also the failures of these private entities that are claiming to be able to do the job better and cheaper than the government.”

But even privatization has its limits. While major cities and territories are lucrative targets for private interests, disasters often devastate remote regions, where asset values are low and labor is hard to come by. “For small towns, the private sector is not going to step in if it’s not a money-making business,” said Divya Chandrasekhar, a professor of city and metropolitan planning at the University of Utah, adding that depopulating areas in particular struggle to attract private investment. In remote parts of California, for instance, an alarming firefighting staffing crisis has left many small towns without adequate protection. Offers of private firefighting services — hired by insurance companies to protect their assets, or the very wealthy to protect their property — have risen accordingly. Critics, including city and state firefighters, have called for the regulation of these private services, arguing that they can hamper rescue efforts and pull badly needed water from public hydrants. During the Los Angeles fires in January, billionaire Rick Caruso hired a private company to protect the Palisades Village mall, which he owns, while nearby homes burned.

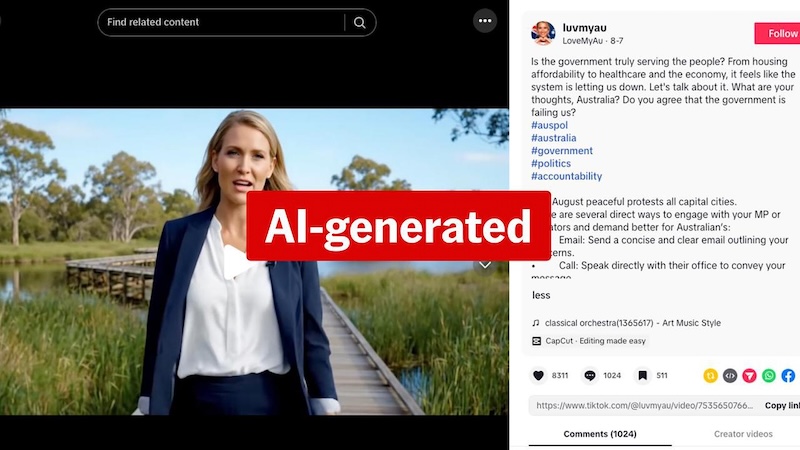

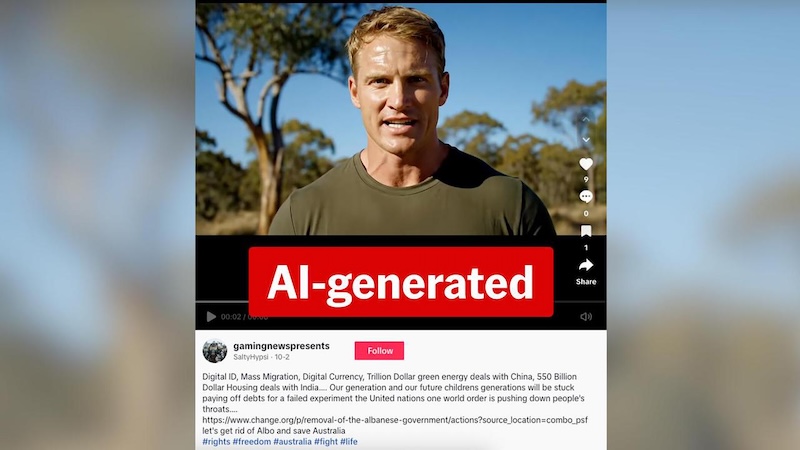

While climate change is poised to exacerbate familiar inequities like these, experts point to the opacity of privatized public services as a cause for growing concern. As more companies begin to incorporate artificial intelligence into their daily operations, it’s important for municipalities to look very carefully at the restrictions being placed on contractors and public-private partnerships.

“You can imagine a situation where a community has been impacted by a natural disaster. We’re going to give temporary housing to people, but this AI system is going to make the determination whether they qualify for this or not. I mean, that could be really problematic,” said Shahrzad Habibi, the research and policy director at In the Public Interest, a nonprofit that studies public goods and services. “I just think there’s an interesting philosophical underpinning on all of this. What are public goods? What do we, as a society, think everybody should be entitled to? And when do we, as a society, think you’re on your own?”

This story was originally published by Grist with the headline What happens when disaster recovery becomes a luxury good on Dec 23, 2025.

This post was originally published on Grist.