Australia giving Israel’s bomb-maker Elbit Systems a $917m defence deal is just the latest in a long and secretive history of military and aerospace activity. For the first time, Jommy Tee investigates Australian Zionist corporate connections with Israel which stretch to Australia’s most powerful lobbyist Mark Leibler.

Senior executives of peak the Zionist Federation of Australia (ZFA) and the Australia Israel Jewish Affairs Council (AIJAC), have been associated with companies that had business links with the Israeli military and aviation company, Israel Aerospace Industries (IAI) – formerly known as Israel Aircraft Industries.

The previously undisclosed links, which stretch back as far as 1980, mean prominent Zionist lobbyists – including the doyen of the Australian Jewish community, Mark Leibler – were engaging with Australian and Israeli politicians and senior government officials, while at the same time companies they established, or were directors of, conducted business with the aviation, drone, military aircraft and weapons behemoth, IAI.

Israel Aerospace Industries and its subsidiaries, won numerous lucrative Australian government defence contracts while the business relationships were in place.

IAI sales to the ADF include: Electronic Warfare (EW) systems for AP-3C Orion aircraft, Maritime Patrol Radar for Orion aircraft, supply of the Heron UAV systems to the RAAF which were operational in Afghanistan for 5 years, ECM pods for FA/18 Classic Hornets, Wedgetail ESM and many others.

On behalf of IAI, the companies acted as sales, marketing and distribution representatives, political lobbyists, and as a corporate agent.

There is nothing illegal in any of the arrangements and there no suggestion that the companies and its executives or its employees were involved in any wrongdoing.

However, it raises questions about potential conflict of interests and whether those interests were disclosed to relevant Australian federal and state government ministers and officials, and the Zionist organisations, over the decades.

Any discussion regarding bilateral links between Australia and Israel involving technology, trade, defence and security potentially was a potential cross-over point.

The complex web of business arrangements can only be understood by detailing the intersection of Mark Leibler and his firm Arnold Bloch Leibler, and the Intercorp group of companies and the Lipshut family and their respective relationships with IAI.

In the beginning, there was 1980

A shelf company was formed in late June 1980. The company went by the innocuous name of Eastfleet Pty Ltd. The paperwork was lodged by law firm Arnold Bloch Leibler (ABL) and the directors of the company were three ABL solicitors, including Arnold Bloch and Mark Leibler. The secretary of the company was Mark Leibler.

Within a month, Eastfleet changed directors with Sonnie Lipshut (and another business partner) becoming the directors. The company’s name was changed to Intercorp (Australia) Pty Ltd.

Israel, Gaza and Australian politics: master lobbyist Mark Leibler reveals how power really works

Documents lodged by Intercorp (Australia) with the corporate regulator declare the company to be “Trustee – Import/Export Consultants”.

The company predominantly flew under the radar, aside from an occasional mention in the Australian jewish press where the company was described as an importer of high technology products from Israel.

On September 4, 1984, the company took onboard two additional directors – the respective spouses of the existing directors. The change saw Sonnie Lipshut’s spouse – Pearl Lipshut – becoming a director.

1984 – a new(ish) executive broom at the Zionist Federation of Australia

In April 1984, Mark Leibler was elected president of the ZFA, it followed a stint a vice-president of the organisation and as president of the State Zionist Council (SZC) Victoria.

Joining Leibler at the ZFA, was Pearl Lipshut who took up the role of executive director.

It was no surprise that the president and executive director formed a strong team, as they had previously worked together at the State Zionist Council in identical roles. Pearl Lipshut was executive director of the SZC from 1977 to 1984 while Leibler was president between 1980 and 1984.

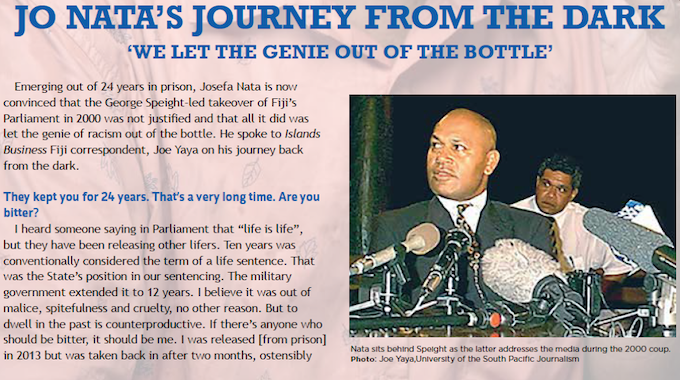

Mark Leibler at IAI visit. Source: SMH

Pearl Lipshut described it as: “Working with Mark Leibler (then State Zionist Council president) meant keeping my mind switched on in top gear. It was a natural progression to go from there to the Federation when Mark became its president, as we agreed we worked well together.”

In an interview with the Australian Jewish News published on September 14, 1984 – ten days after she was appointed director of Intercorp (Australia) – she said her husband represented “several hi-tech Israeli companies in Australia”.

There was no mention of her directorship in the company.

1985: the incredible flights of VH-JJA

Aside from manufacturing military aircraft, IAI also produced corporate jets including the Westwind 1124A. Historical aircraft society websites detail a Westwind, with the registration number VH-JJA, being registered to Pel-Air Aviation, a Sydney-based firm, in March 1984.

At the beginning of 1985 the plane made several flights to and from Papua New Guinea. Some of those flights came under the investigation of law enforcement officials and were the subject of a PNG Commission of Inquiry.

VH-JJA was chartered by Peter Johnstone with the intention of flying from Sydney to Bangkok return by January 30, 1985. Johnstone, living in Cronulla, and a man of little obvious wealth, hired the jet at the rate of $1500 an hour – at an all up cost of $52,000.

Johnstone had links to various Sydney criminals, drug traffickers, corrupt NSW police and assorted con-men.

The Westwind jet, crewed by two pilots, left Sydney on 14 January and flew to Singapore via Darwin. The plane stopped in Darwin and picked up two sets of diving equipment and seven oxygen bottles.

The pilots met up with Johnstone, who had flown to Singapore the day before on a commercial flight. From there Johnstone again flew on ahead to Bangkok and where he again rendezvoused with the pilots of VH-JJA on January 18. The party of three spent 48 hours in Phuket, and picked up four Dutch people Johnstone had befriended in Bangkok. Johnstone picked up the tab for his 6 friends.

The group then returned to Bangkok, where Johnstone met with a business acquaintance described by the PNG Inquiry chief as one of the world’s biggest drug exporters.

Business apparently went well and Johnstone instructed his Westwind crew to fly to Palau – a world class diving destination. VH-JJA departed Bangkok on January 25 and landed in Palau.

After four days of scuba diving, Johnstone then instructed the pilots to fly to Wewak in north PNG. Johnstone changed his mind en route and directed the pilots to instead fly to Port Moresby. From there, the plane was to fly to Sydney, but just before the plane was to depart Johnstone turned to his two pilots and said “Hey, I think I’ll get off here. I have some business to attend to….”. The jet departed Port Moresby, sans Johnstone, and landed in Sydney where there was a brief and cursory search of VH-JJA at Sydney airport. Nothing was found.

Johnstone having bailed from VH-JAA, spent the night in Port Moresby before returning to Sydney the next day on an Air Niugini flight.

The Commission of Inquiry found the likely purpose of Johnstone’s trip was to collect drugs in Thailand. He had been careful not to fly out of Australia, or back in, aboard the Westwind jet, knowing he was likely under police surveillance.

As Pel-Air Aviation regularly flew in and out of PNG delivering freight a routine flight by the Westwind was unlikely to arouse much suspicion. The inquiry reported: “We think the purpose of the trip was to pick up drugs in Thailand … and we believe that he may have succeeded”. The inquiry raised the possibility that the drugs could have been concealed in the diving tanks.

The drama for VH-JJA was not yet over, barely a month later it was embroiled in further drama.

The anonymity of Intercorp (Australia), and its business dealings shattered on the runway of Port Moresby on March 6, 1985. Sonnie Lipshut was returning from Papua New Guinea after meeting Prime Minister, Michael Somare.

Hot-footing it

The trip turned out to be anything but an “under the radar” business trip.

Together with two other Australian businessmen – John Johnson and John Aston – Lipshut had flown to PNG to discuss a series of aviation deals with Prime Minister Michael Somare.

Johnson and Aston were connected to companies associated with Pel-Air Aviation who were seeking new air freight services.

As the three men were on the Pel-Air plane – an Israel Aircraft Industries Westwind jet with registration VH-JJA – a drug search was conducted, or attempted, depending on conflicting official reports.

The attempted search by PNG police and customs, followed a tip-off from the Australian Federal Police. Official reports from the PNG National Drug Squad and Customs make for incredible reading.

PNG Police and Customs drug detection dogs gave positive signs when sniffing out a panel in the cabin of the plane and when sniffing out baggage but no drugs were found.

The passengers of VH-JJA rang Somare advising him the plane had been detained. Somare, together with his Foreign Affairs Minister, the Minister for Justice and several Prime Minister’s Department officials hot-footed it out to the airport, getting there after the search ended.

The official reports also detail how police were unable to search another Pel-Air plane which had left earlier in the day. The respective pilots of VH-JJA and the other Pel-Air had previously been seen leaving the airport and taking a rental car – rented in the name of one of the VH-JJA passengers.

The political heat was such that a commission of inquiry was established to investigate the business deals and the circumstances surrounding the search – and then later extended to include investigation of drug trafficking operations.

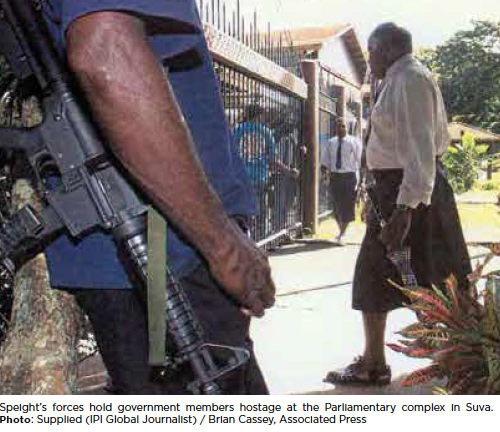

Source: SMH

The reporting of the allegations and the inquiry shone a light on Sonnie Lipshut and Intercorp (Australia). According to media reports, Johnson and Aston introduced Lipshut to the PNG Government.

Intercorp intrigue

Lipshut was there in PNG to ink a deal for the PNG defence force to purchase three Israeli Arava planes. Intercorp Australia was the Pacific agent for Israel Aerospace Industries – the manufacturer of the Arava planes.

This was the first public mention that Intercorp (Australia) was connected to IAI.

The official report from the PNG police named Mr Sonnie Lipshut as being employed by Intercorp Australia.

Lipshut’s name appears to have been formally revealed by the Australian press as being a passenger on the plane in September 1985 – some 6 months after the incident.

Somare was forced to make a statement to the PNG Parliament in June 1985 advising Intercorp acted as a sub-agent for Israeli Aircraft Industries.

The PNG Prime Minister added that the three Aravas were purchased because “IAI provided a package – and a contract – which we found acceptable and which our defence and other advisers [found] acceptable.

PNG “conned”

The Commission of Inquiry heard PNG had been “conned” in buying the three Arava military aircraft for $A14 million – had the PNG government bought the planes direct from IAI they would have saved $A1.3 million. Counsel assisting the Inquiry however said there was insufficient evidence to prove there had been irregular commissions paid. Nonetheless, the Inquiry found two Australian businessmen had split $235,000 for acting as go-betweens in the sale of the Israeli aircraft.

In the end the Inquiry cleared the parties of any impropriety associated with the aviation deals. the inquiry also criticised Somare for questionable decision-making for intervening in the drug search, however there was nothing untoward in his intervening in the search.

The Inquiry was unable to confirm or deny that planned heroin shipment landed in Australia

Shady back stories

There are however back stories to both John Johnson and John Aston concerning the company they kept and their business respective dealings.

Before being associated with Pel-Air Aviation, Johnson was managing director of Jet Charter Airlines, which both traded under the name WIngs Australia and morphed into Wings Australia Pty Ltd – a company that was wound up in December 1984 owing more than $6 million. The assets of Wings Australia were sold to Peldale Pty Ltd – which then changed its name to Pel-Air Aviation.

Sydney accountant, Henry Victor, in 1981 set up a tax shelter to lease jet aircraft in association with Wings Australia. Wings Australia was part of a tax shelter involving leased jet aircraft created in 1981 by Sydney accountant, Henry Winter.

Aston’s chequered past, included adversely being named in the 1983 Stewart Royal Commission into drug trafficking. At the time he used his solicitor’s trust account to launder money from the notorious Nugan Hand bank and diverting money to members of the Mr Asia drug syndicate.

Employees of Wings Australia and its Phoenix-like reincarnation, Pel-Air Aviation, had been on the radar of crime fighting authorities on suspicion of drug trafficking at the time.

The plane boss, the plane!

According to historical aircraft society websites, the Israel Aircraft Industries Westwind 1124A corporate jet was first registered on 28 March 1984 and given the registration number VH-JJA.

The aircraft’s operator/owner was listed as Wings Australia, although some aviation sites listed the owner as Pel-Air Aviation, the successor company to Wings Australia. But what became of the now infamous IAI Westwind corporate jet, officially registered as VH-JJA?

The plane’s registration was transferred back to the manufacturer Israel Aircraft Industries sometime in March 1985, the same month as the infamous PNG runway kerfuffle.

An updated listing of Australian civil aircraft register – sourced from material from the then Department of Aviation – lists IAI’s address as “c/- Arnold Bloch Leibler”.

One account suggests the plane while in Australia was only ever a demonstrator – the plane returned to Israel in September 1986.

April to May 1985 – Intercorp V2.0, V2.5 … bye bye Intercorp V1.0

Immediately after Intercorp (Australia), acting as a sub-agent for IAI, sold three IAI Aravas to the PNG defence forces, the brand expanded.

Two more companies were created. The first was set up on April 29, 1985, and simply called Intercorp Pty Ltd. The directors of the newly formed company were exactly the same as Intercorp Australia – namely Pearl and Sonnie Lipshut and two other business partners holding the directorships.

Pearl Lipshut. Source: SMH

The company in annual returns supplied to the corporate regulator listed itself as “Trustee – Commission Agents”.

A month later the paperwork for Astra Aviation was lodged. Astra Aviation was created to predominantly to sell IAI’s Astra executive jet into the Pacific region, Astra Aviation having acquired the rights to distribute the jet.

Only Sonnie Lipshut and the same two other business partners were directors of Astra Aviation.

Press reports stated by acquiring the rights for Astra and Westwind planes it was the final piece of the jigsaw for Intercorp – now being the distributor of “the total range of IAI products”. The reports stated the Intercorp Group had been representing IAI since 1980 and “for marketing IAI aircraft to various governments and Defence departments”.

Corporate juggle demonstrator

Press reports stated that Astra Aviation had based a Westwind 2 demonstrator aircraft in Sydney to assist in marketing and establishing the plane’s identity in Australia. Full spare parts and maintenance support for the new arrangements were to be provided by Pel-Air.

A decade later, Astra Aviation would change its name to Intercorp Telecommunications. Arnold Bloch Leibler was not involved in establishing either Intercorp or Astra Aviation.

The upshot of the corporate structuring to act on behalf of IAI was Sonnie Lipshut being a director of all three companies with Pearl Lipshut being a director of two (Intercorp Australia and Intercorp).

1985 was also the year that Intercorp (Australia) stopped trading. Documents subsequently lodged with the corporate regulator in 1989 – when the company was liquidated – claimed the company had stopped trading since 1985 and held no assets.

For reasons unknown the company changed its name to Rampante Investments in July 1987.

The liquidation documents showed a liability to PNG Aviation Services and pending legal claim of $605,785, unspecified damages, and interest in respect of a breach of contract.

PNG Aviation Services previously acted as the PNG agent for IAI. It was also the subject of the previously mentioned PNG inquiry with regard to its role in selling the government’s corporate jet. The Inquiry cleared PNG Aviation Services and the company and directors won a subsequent defamation case against Prime MInister Michael Somare when in parliament he alleged the company was criminal and negligent. The comments were subsequently reprinted in a government advertisement a few days later and hence the lawsuit.

1987: Tel Aviv time

As IAI was gaining a foothold into the Australian and Pacific market, Mark Leibler and Pearl Lipshut wearing their Zionist Federation of Australia hats were busily engaging with politicians of all persuasions in Australia and Israel – successfully pushing pro-Israel policies.

Leibler and his executive director, Pearl Lipshut, often attended high level meetings together, both in Australia and when travelling to Israel as part of Australian Zionist delegations to Israel.

One such trip saw a delegation, including Leibler and Pearl Lipshut, landing in Tel Aviv in mid-1987. Press accounts detail some of their journey, including a visit by Leibler to IAI.

Leibler was a guest of Moshe Keret, the president of IAI – apparently “in appreciation of his efforts in assisting trade between Australia and Israel”.

The erstwhile president of the Zionist Federation of Australia, met with senior IAI marketing executives and toured the Bedek division of the company which refurbished aircraft worldwide and an inspection of an Air Force base.

The head of the IAI, Moshe Keret presented Leibler with a wall clock inscribed “Mr Mark Leibler, A.O., on the occasion of your visit to Israel Aircraft Industries for all your endeavours”.

For context, Mark Leibler, through his law firm, Arnold Bloch Leibler (ABL), had in 1980 created the shell company that became the first Intercorp company – Intercorp (Australia) that was acting as distributor of IAI product into Australia. As aviation records also indicate ABL was the contact address for IAI’s registration (VH-JJA) of the Westwind plane that gained notoriety in PNG.

On the other hand, Pearl Lipshut, the executive director of the ZFA, was also a director of two of the three Intercorp companies representing IAI in Australia – while her husband was managing all three companies.

1988: ZFA director departs – Australia awards $50m contract to Israel Aerospace

The longstanding working relationship between Mark Leibler and Pearl Lipshut ended in July 1988. The presidential and executive director team had been together for 8 years, spanning two Zionists organisations – the State Zionist Council of Victoria and the Zionist Federation of Australia.

Pearl Lipshut flagged her departure in March and retired in July. During her professional career she made 20 visits to Israel. Mark Leibler was generous with his praise for his trusty lieutenant declaring she has been a magnificent asset to the Federation and much of what we (ZFA) succeeded in doing would not have been possible without her”.

Pearl Lipshut would still be involved with the ZFA for another four years, but in an honorary capacity, including responsibility for public relations.

The same month as Pearl Lipshut’s retirement, and a year after Mark Leibler’s visits to IAI, the state-owned Israeli company struck pay dirt and won a $50m Australian government contract to supply airborne refuelling systems to RAAF for its fleet of Boeing 707s.

The deal was, at the time, the biggest ever contract for arms-related equipment from Israel.

It was also the “first major defence contract awarded to Israeli industry”.

The contract was awarded ‘despite a series of Australian diplomatic protests” to the Israel government over its treatment of Palestinians. At the time Australia press reports listed IAI as being “publicly owned” when in reality the company was Israeli state owned.

The alleged “public ownership” of IAI was used by the Australian government as a justification in support of the IAI deal – claiming the offer came from “a company without direct links to the Israeli government, and was not tied to any other involvement with Israeli military technology”.

In fact IAI had since the 1960s made military technology – the Gabriel sea-to-sea missile (1964), created a subsidiary company, the defence electronics manufacturer Elta Electronics (1967), built the Nesher fighter aircraft (1970), built fighter bombers for the Israeli airforce (1975), and built the Scout unmanned aircraft (1979).

Enter Kim Beazley

Defence minister Kim “Bomber” Beazley was quoted as saying the Israelis had offered the best deal, beating the US multinational Boeing for the job. Boeing would have offered the advantage of “total familiarity with the conversion of its own aircraft design”.

Instead, the Israeli conversion by IAI’s Bedek Aviation Division – the very same division that Mark Leibler had visited a year earlier – was going to carry out the work, involving the overseas purchase of the equipment with Australian content comprising installation and manufacturer of some parts via Hawker de Havilland.

According to one scribe, the inflight refuelling project was a “pet project” of the RAAF and Defence Minister Beazley.

The deal caused internal friction within ALP, especially from the left-wing of the party, in particular Canberra MP, John Langmore. The decision also caused diplomatic frisson, provoking a protest from the PLO representative in Australia, asking the Australian government not to sign the deal with IAI.

Both the internal political and diplomatic tension held no sway and the deal proceeded.

1989: Intercorp V3.0 …. and another contract to IAI, Hawkey and Hawker

During May 1989, the law firm Arnold Bloch Leibler, established another shelf company – Elderton Pty Ltd, with Mark Leibler a director, as well as secretary of the company.

On August 10, the corporate regulator was informed the company had changed its name to Intercorp Defence Industries Pty Ltd. The application for reserving the new name – Intercorp Defence Industries – was lodged with the regulator on 20 July and personally signed by Mark Leibler.

The documentation lists the company (renamed from Elderton) as “defence technology suppliers and joint venturers”. Additionally, Intercorp Pty Ltd had provided consent to the proposed name of the newly formed company – no surprises there given the same directorship and ownership interests.

The day after Leibler signed the name reservation form, he vacated his directorship with Intercorp Defence Industries having Sonnie and Pearl Lipshut and their two business partners from the other Intercorp group of companies stepped into the directorship roles of the new company.

Roll forward a few months and In November, just ahead of the South Australian state election, Prime Minister Bob Hawke together with South Australian premier, John Bannon, attended the opening of the Australian Submarine Corporation’s construction site in Adelaide.

As often happens the occasion was used to electioneer. Hawke announced the awarding of $90 million defence contract to a South Australian company, AWA Defence Industries. The contract was for the installation of new electronic equipment for the RAAF’s P3C Orion Maritime Patrol aircraft.

$40 million of the contract was to be spent in South Australia, “with much of the work being undertaken by AWA Defence Industries and Hawker de Havilland”.

In late November a report in the Israeli newspaper Ha’aretz surfaced with a story that Elta Electronics – an IAI subsidiary – had won a tender to supply $US60 million worth of electronic and other warfare systems to Australia. The report alluded to an agreement signed with an Australian commercial company to deliver the equipment.

Confirmation that IAI subsidiary, Elta Electronics, was the principal sub-contractor to AWA Defence Industries was revealed in an article RAAF News in February 1990. “Much of the Electronic Support Measures (ESMs) will come from the principal sub-contractor, ELTA, an Israeli company which is a world leader in this field”.

It was heady days for IAI and for all those involved.

1990s to 2007 – the Interregnum

As the focus of this story is the connection of individuals – while they were officials of Zionist organisations – and their involvement, or their companies involvement, with IAI, our story resumes apace from 2008 onwards.

The intervening years did contain some events which add context.

Intercorp (Australia) – the first company in the Intercorp stable and spawned from a Mark Leibler-established shelf company (Eastfleet) – was formally liquidated in 1990.

Pearl Lipshut was director of the company from 1984 up until its liquidation, while at the same time being executive director of the Zionist Federation of Australia. Pearl Lipshut’s active involvement with Zionist organisations ended in approximately 1993.

However, she remained a director of Intercorp Pty Ltd until 1996 concluding the last of her director’s role with any of the Intercorp-badged companies. Her sons, Garry and Daniel, then became directors of the company and remain so to the present.

The other business partners (who we have decided to not name) left Intercorp Pty Ltd in 2003. One of the partners remained onboard with Intercorp Defence Industries and Intercorp Telecommunications until 2007.

Leibler from ZFA to AIJAC

Meanwhile, Leibler moved from being President of the ZFA in 1994 to become National Chairman of the Australia Israel Jewish Affairs Council – a position he still holds today.

For its part, IAI – the Israeli military aviation equipment manufacturer – that was ably represented by in Australia and the Pacific by the Intercorp group of companies registered as a foreign company with the Australia corporate regulator in 1992.

The nominated corporate agents for the company were Israelis operating out of Canberra. Historical phone directories show that in at least the early 2000s Intercorp was listed in the Canberra phone directory at an address which was also the nominated address IAI had given to the corporate regulator.

Over this period, Intercorp continued to rep for IAI. IAI continued to sell either directly or indirectly (through subcontractor or joint venturer arrangements) into the Australian government defence market.

The Lipshut family even established an annual bursary and scholarship in 2000 for the Australian Air Force, providing aviators below the rank of corporal to complete full-time studies with a view to commission.

And like sand through an hour glass, Mark Leibler continued to be perhaps Australia’s most effective lobbyists for Israel, gaining the confidence of many an Australian prime minister. All while advising some of the wealthiest members of Australia’s Zionist community such as Frank Lowy’s Westfield group on tax minimisation.

One of the key initiatives the AIJAC introduced was the so-called Rambam fellowships. The program ran, and continues to run, sponsored trips for Australian politicians, journalists and senior political staffers – see our previous article.

The caravan to Israel – journalist jaunts, political passengers, diplomatic dispatches and jobs lost

Coincidentally, the program was launched by former Defence minister, Kim Beazley in 2003, who while Defence Minister had awarded a $50 million contract to IAI back in 1988.

2008 – the political lobbyists

In 2008, the first genuine lobbyist register was introduced. Prior to that time, a weak and ineffectual register had been introduced by the Hawke government in 1983 – a register that was voluntary and not able to be accessed by the public. It was so ineffectual it was abolished in 1996 by the Howard government with nary any opposition.

The Lobbying Code of Conduct of 2008 established the rule of contact between lobbyist and government.

On June 5, Intercorp Pty Ltd registered as a political lobbyist and advised that Israel Aerospace Industries was a client (NB: IAI changed its name in 2006 replacing the “Aircraft” with “Aerospace”).

This was of no real surprise given that the business interests of Intercorp and IAI had been bound together since the early 1980s. Historical entries of the register show that IAI has been a continuous client of the registered political lobbyists since that time to the present.

The new joint venture …

In 2008, Intercorp formed an informal partnership with Melbourne-based advisory firm SLM to form SLM/Intercorp. When the partnership was formed, Intercorp was spruiked as a company with an “unparalleled track record of success”.

Since 1980, the company managed the commercial and marketing needs of Israeli companies including, Israel Aerospace Industries and other defence companies: Rafel, ECI Telecom, and Israel Military Industries “concluding more than $750 million of business”.

No doubt a tidy bit of work and juicy earner for the company listed as a “Trustee – Commission Agent”.

The partnership between SLM and Intercorp petered out in approximately 2012.

Another big deal

Business got a whole lot better for IAI’s wholly owned subsidiary, Elta Systems, when it was awarded $80 million deal in June with the Australian Defence Force to supply radar jamming electronic countermeasure equipment for military aircraft.

The contract – the subject of several variations over the ensuing months (and not an uncommon thing in Defence procurements) within the space of a year – eventually settled at $200 million.

Arnold Bloch Leibler: agents for IAI (2010-2020)

Business was good for IAI and for whatever reasons they pulled out their local corporate agents at the beginning of 2010. Between 1992 and February 2010, IAI had four different local corporate agents all with ties to the company and all based in Canberra.

Things changed in February of 2010.

ABL, the law firm that bore its senior partner’s name took over the role of the local corporate agent for the Israeli state-owned military and aviation company. To be precise, ABL Fiduciary Corporation Pty was nominated as local agent with corporate regulator. The directors of ABL Fiduciary comprise the legal partners in ABL.

A local agent is liable for all acts and matters of the company and acts as the contact point in all matters pertaining to the corporate regulator.

The address of IAI for corporate regulatory purposes was given as Arnold Bloch Leibler (ABL). It is of course not the first time ABL had directly represented IAI – we go back to 1985 when ABL’s address was provided with regard to the registration of the infamous Israel Aircraft Industries’ VH-JJA Westwind corporate jet.

This arrangement does not appear to have been an interim measure until IAI sent across another representative from the company, seeing as ABL was appointed to the role for a whole decade (2010 – 2020).

Mark Leibler and his firm’s direct involvement can be traced back to 1985, and indirectly through the creation of shelf companies for IAI’s Australian agents/import export consultants/marketing and distribution representatives/political lobbyists – the Intercorp group of companies.

A decade that many believe was a golden decade for Australia-Israel bi-lateral relations.

A golden decade of bilateral policy

The decade from 2010 witnessed much churn across the Australian political landscape. No less than five prime ministers and more than a dozen different defence ministers – the vast majority at some stage during their parliamentary careers having accepted sponsored travel from pro-Israel lobby groups such as the AIJAC.

When Australia-Israel relations are in play there is little doubt Mark Leibler, and the association he heads, the AIJAC, throw themselves into the policy fray both publicly and privately. The same could be said for the Zionist Federation, of which Jeremy Leibler – Mark’s son and also a partner in ABL – has been the chair since 2018.

Some of the policy initiatives that were orchestrated during the decade – the latter half of the decade in particular – cover aviation policy, defence policy, technology and innovation, cyber-security, and trade policy.

From 2016, Israel and Australia signed an Air Services agreement. In 2017, a technological innovation cooperation agreement was signed. This was soon followed by expanded cooperation on national security, defence and cyber security – including strategic talks between officials in 2018 and 2019.

Australia also opened an Australian trade and defence office in West Jerusalem with intention of facilitating trade, investment and defend industry partnerships. A memorandum of understanding on cyber security cooperation was also signed.

In 2019, a tax treaty to prevent double taxation and tax avoidance was signed.

During the decade, major Israeli military hardware companies, including IAI and Intercorp, participated in defence and aviation trade shows. Israeli weapons and military hardware companies were regular participants in the trade shows.

While the AIJAC and the ZFA were advocating for greater and improved relations between the two countries, often in areas which overlapped with business interests of Israeli military and defence companies, its most senior representative – through ABL – were acting for the state-owned IAI.

What of Intercorp during the decade?

Just before the decade commenced, Intercorp Telecommunications (previously Astra Aviation) was deregistered. In 2011, Intercorp Defence Industries (previously the ABL-established shelf company Elderton) was deregistered.

Another Intercorp branded company, Intercorp Technology, was established in 2012; the directors being the sons (Garry and Daniel) of Pearl and Sonnie Lipshut.

For its part, Intercorp Pty Ltd, the company established in 1985, went about its business of repping for IAI and being the registered political lobbyist for IAI. At the same time, according to Daniel Lipshut’s CV, while being the managing director of Intercorp, was over the period 2012 to July 2019 the “Managing Director – Australia” for IAI North America.

Intercorp also starting winning tenders with the Australian government in its own right including a $2 million military science and research contract. On the philanthropy front the Lipshut Family Bursary continued to be given out each year to a worthy Royal Australian Air Force recipient.

The Australian defence procurement system can be characterised by a revolving door of politicians, lobbyists, consultants, former political staffers, former senior military officers and bureaucrats.

The complex web of legitimate business and legal interactions between IAI, Intercorp and ABL demonstrates this.

However, the overlap between the Zionist representation role of the individuals concerned, the potential conflicts of interest between that role and the roles of the companies for which they acted, and how these were managed, and whether they were revealed to governments, suggests a more shadowy underbelly.

Client State: Australia the “51st state of the US” for deadly weapons production

This post was originally published on Michael West.