The future food industry has seen plenty of victories this year, spanning regulatory approvals, supermarket pledges, and women’s wellness. Here are the 10 biggest wins for food tech in 2025.

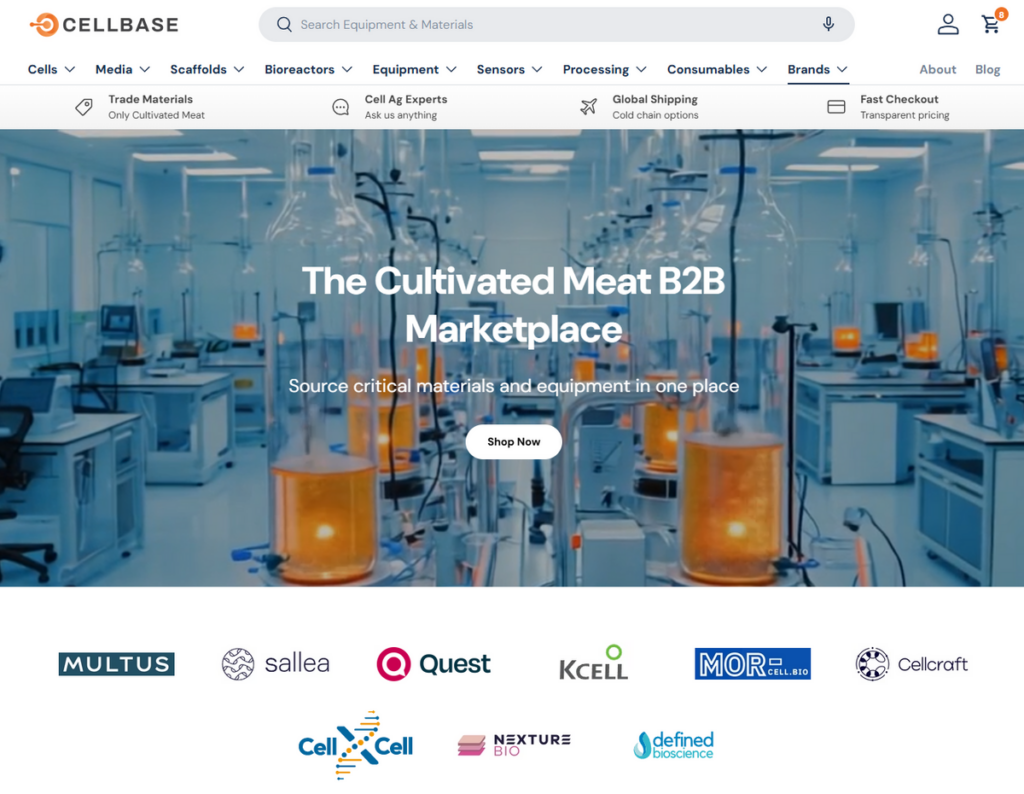

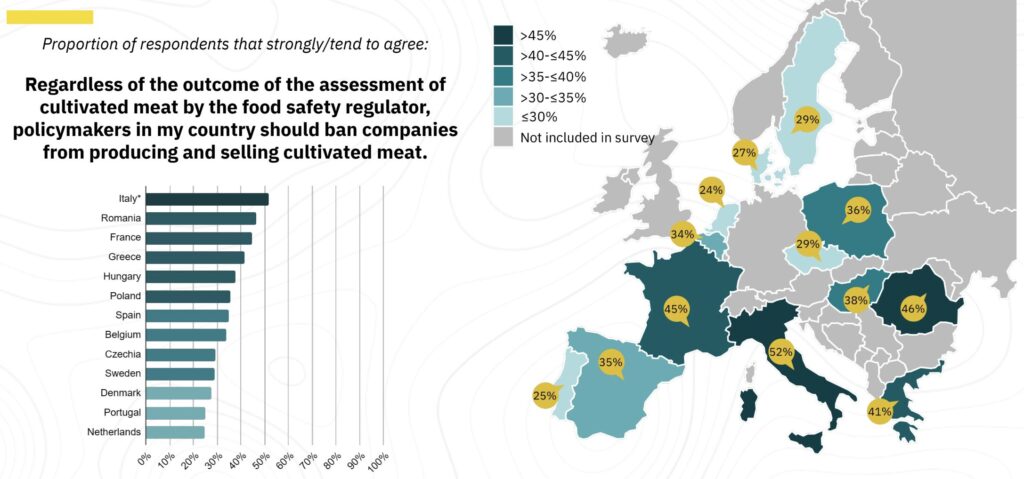

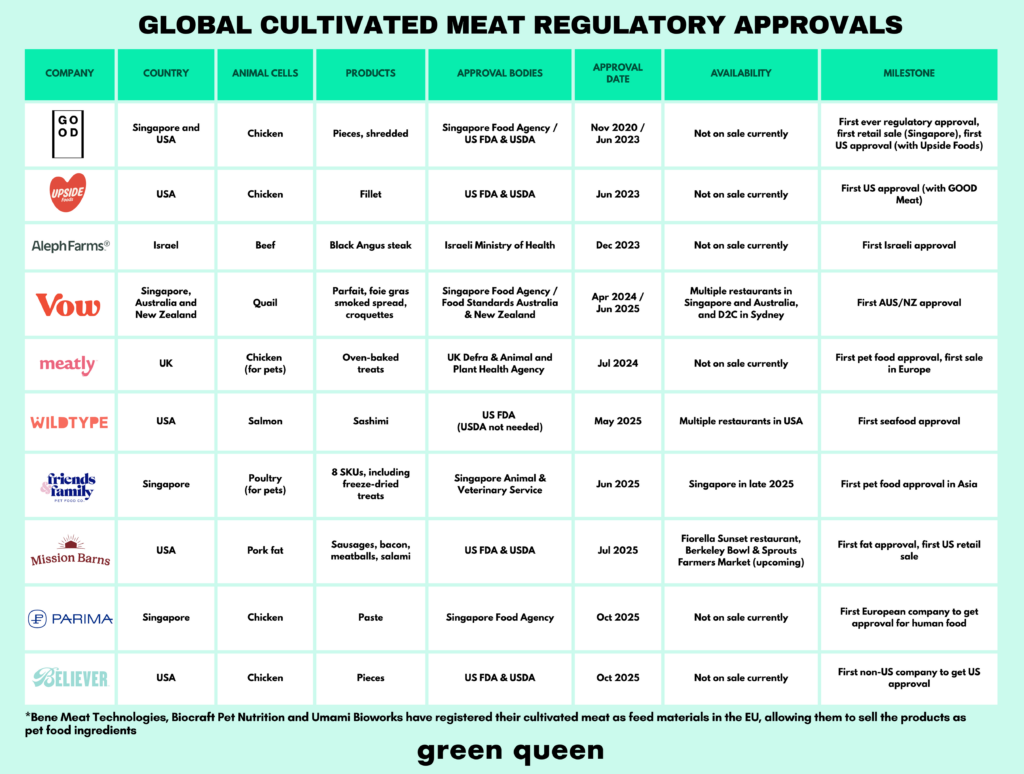

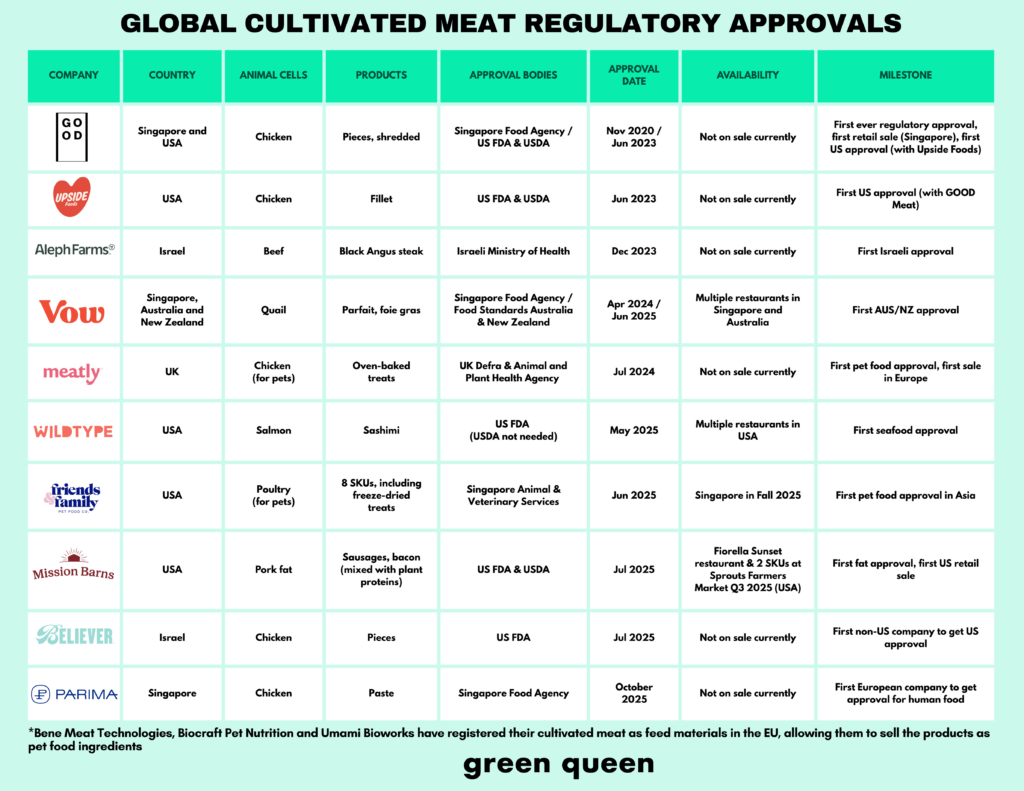

1) Cultivated meat approvals accelerated

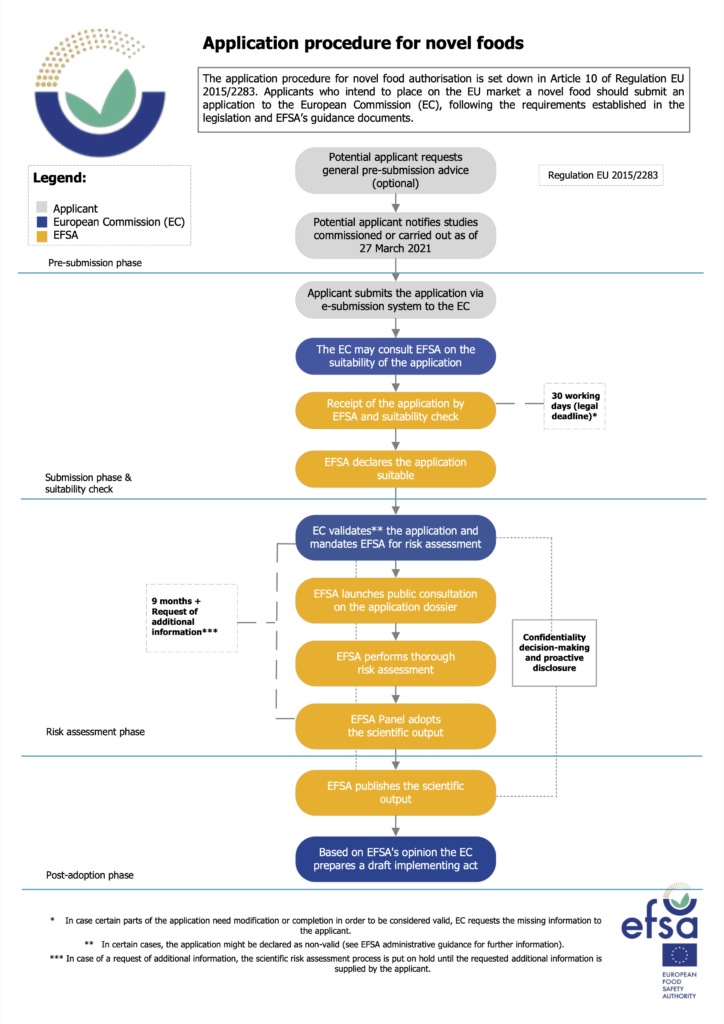

No other year has seen as many regulatory approvals for cultivated meat as 2025. In the US, Wildtype, Mission Barns and Believer Meats were cleared to sell their proteins (though the latter has since shut down). And in Asia, Singapore granted its second cultivated meat approval for human food to Parima, and Vow earned the go-ahead in Australia and New Zealand.

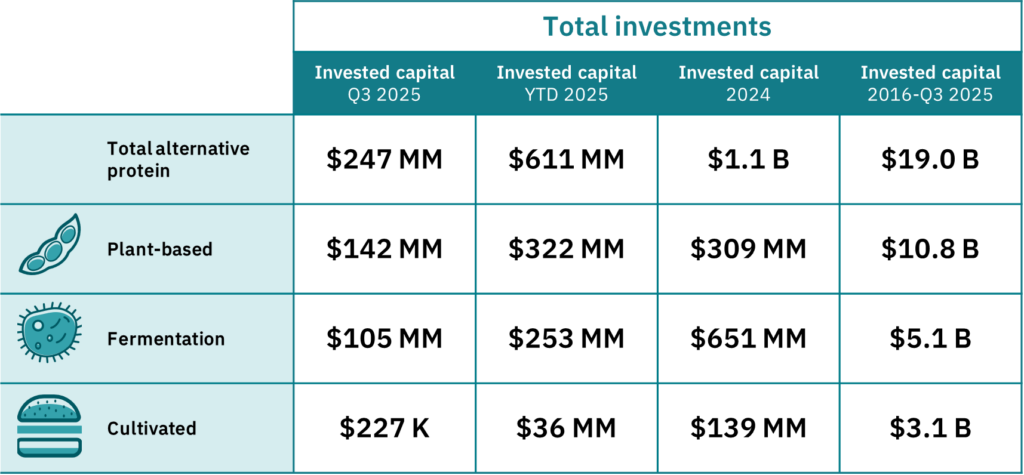

2) Fermented proteins continued to gain traction

A spate of regulatory approvals was reserved for fermentation-derived foods, such as Fushine Bio‘s mycoprotein in China, and Nourish Ingredients, Verley and Onego Bio in the US. Seven of the top 10 funding rounds were carried out by fermentation startups, including The Every Company ($55M) and Formo (€35M). Plus, Israel’s Imagindairy and Remilk teamed up with local food giants to introduce products made from their precision-fermented dairy proteins.

3) Alternative protein pet food found its feet (*paws)

This year saw the first sale of cultivated pet food, with London’s Meatly teaming up with The Pack to offer dog treats at Pets At Home stores. In Singapore, Friends & Family Pet Food Company obtained regulatory approval to sell cultivated meat for dogs and cats, while Umami Bioworks and Biocraft Pet Nutrition registered their ingredients in the EU (allowing them to sell). And when it came to plant-based pet food, Germany’s Vegdog raised $10.2M after seeing sales shoot up by 66% in 2024.

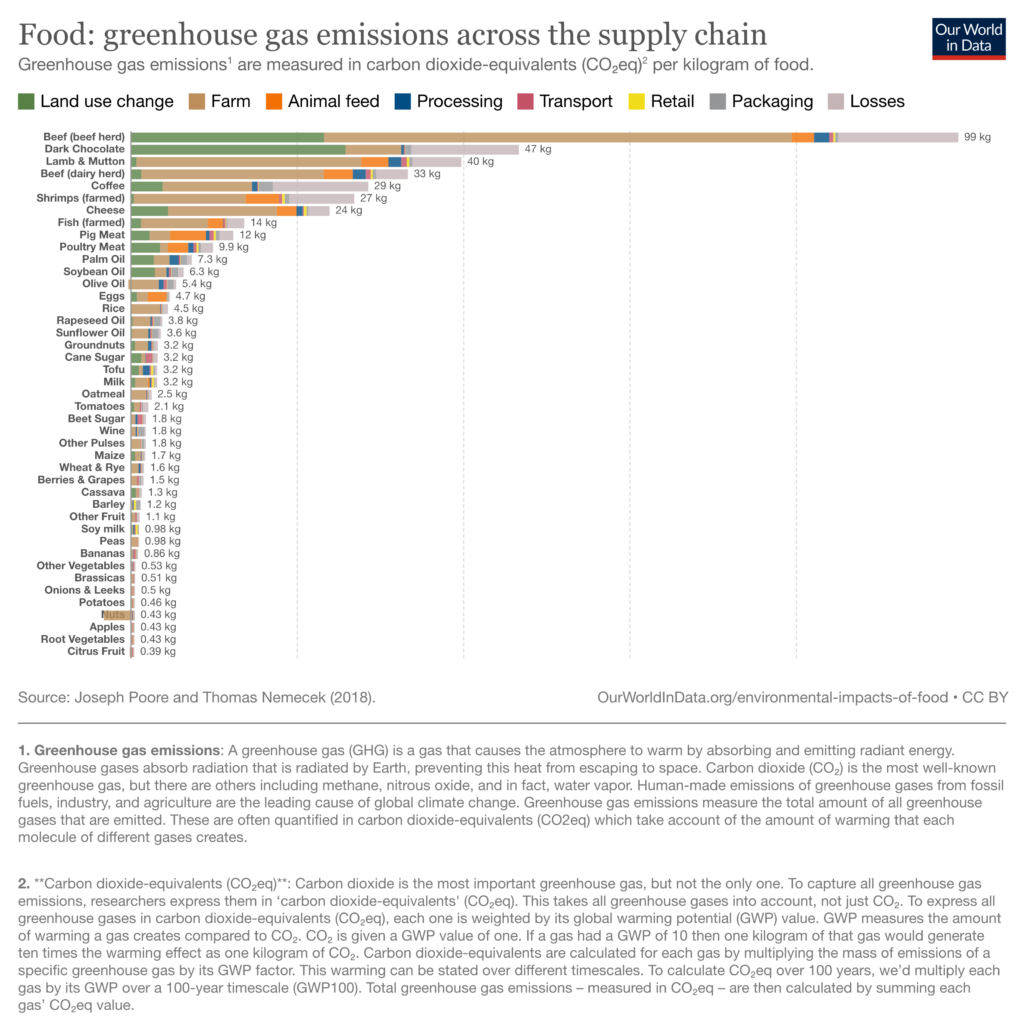

4) Big Chocolate embraced cocoa-free and cell-based alternatives

As the chocolate industry continued to struggle with the effects of climate change, some of the sector’s biggest players hedged their bets on future-friendly alternatives. Lindt invested in a startup producing cocoa via plant cell culture, and Barry Callebaut signed a deal with cocoa-free chocolate maker Planet A Foods. Mondelēz International-backed Celleste Bio, meanwhile, unveiled a cell-based cocoa butter, and Bühler Group named the winners of its New Chocolate Challenge for climate-resilient cocoa ingredients.

5) Beanless coffee won over investors

Cocoa wasn’t the only bean getting a makeover in 2025. The coffee industry, equally damaged by the climate crisis, has been embracing bean-free alternatives. Seattle-based Atomo raised $7.8M to ramp up sales of its 50:50 coffee blend and expand into the UK, and Singapore’s Prefer secured $4.2M and announced partnerships with Ajinomoto and The Coffee Ferm. Elsewhere, Belgian startup Koppie emerged from stealth with pre-seed funding for its fermentation-derived alternative.

6) Alternative fats edged closer to the mainstream

Alternatives to animal fats and tropical oils (like palm) were all the rage this year. Savor launched its carbon-derived butter in the US, Nourish Ingredients received approval to sell its fermented fats in the US and set up a global hub in Europe; NoPalm Ingredients signed several partnerships and announced a new factory; Äio bagged multiple government grants for its waste-derived yeast fats; and Time-Travelling Milkman, Melt&Marble, and Terra Oleo all bagged fresh funding.

7) GLP-1 brought fibre and protein to the fore

As weight-loss drugs expanded their market share, protein and fibre became the two macroingredients in focus. Food producers that centred their product reformulation on these emerged as the biggest winners, like Danone (through Kate Farms and Silk Protein), Chobani (via its acquisition of Daily Harvest), and pet food makers Omni and The Pack.

8) Products designed for women—sans the misogyny—finally in the spotlight

Women spend 25% more time in “poor health” than men, but most wellness products have long ignored them. 2025, however, saw a shift. Levelle Nutrition introduced menstrual-cycle-syncing protein powders with cow-free lactoferrin protein from Helaina, which also forms the base of Kroma Wellness’s colostrum. TurtleTree launched a consumer brand, Intentional, combining lactoferrin with prebiotics, and Minus Coffee introduced a beanless coffee latte geared towards women’s wellness and cortisol balance

9) Alternative protein companies took on the egg crisis

With egg prices breaking all-time records due to avian flu outbreaks, a host of startups came out with next-generation functional alternatives to replace chicken eggs in food products, including Revyve, Meala, MOA Foodtech and The Very Food Co. And Eat Just, the company behind the mung-bean-based Just Egg, saw sales grow faster than ever before.

10) Supermarkets embraced the protein transition with blended meat and dairy

A host of European supermarkets committed to protein diversification in 2025, led by Lidl‘s pledge to increase plant-based food sales by 20% globally. Albert Heijn, Rewe Group and Wolt Market have set ‘protein split’ targets. Retailers are also championing the transition by rolling out blended meat and hybrid dairy products, a shift spearheaded by Albert Heijn, Colruyt Group, Lidl and Aldi.

The post 2025 Wrapped: The Top 10 Food Tech Wins of the Year appeared first on Green Queen.

This post was originally published on Green Queen.