Israeli startup Kokomodo has emerged from stealth with a $750,000 investment to produce cocoa and chocolate products via cellular agriculture.

As the future of chocolate becomes increasingly uncertain, Kokomodo is the latest startup innovating to protect cocoa from climate change, and climate change from cocoa.

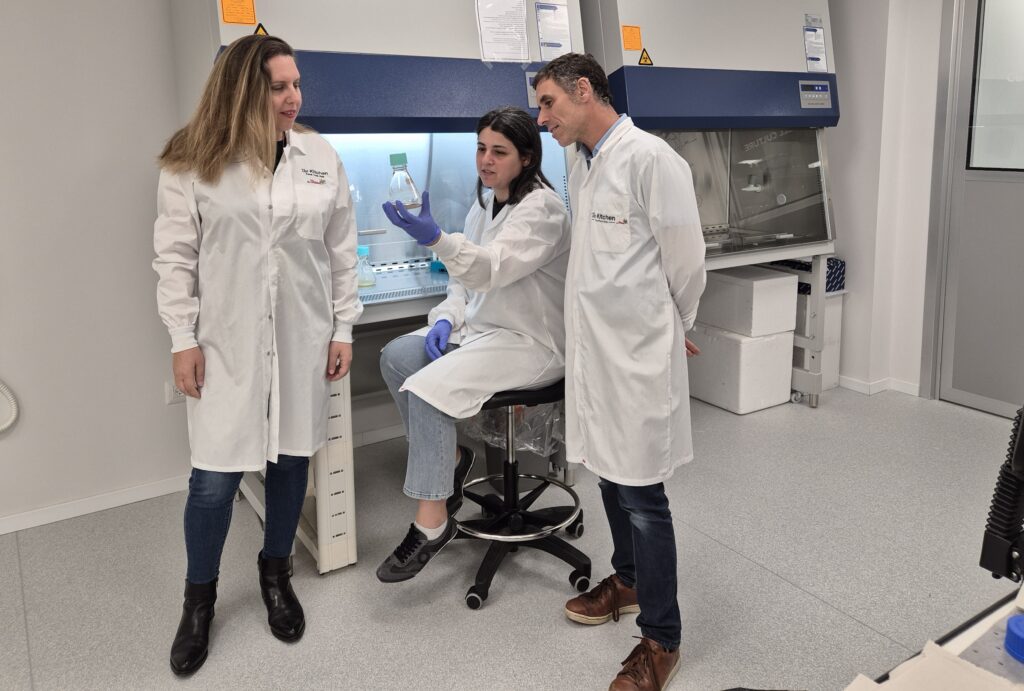

Armed with a $750,000 investment from The Kitchen FoodTech Hub and the Israeli Innovation Authority, the Rehovot-based player has come out of stealth to produce cell-based cocoa for the food and beverage, supplements and cosmetics industries.

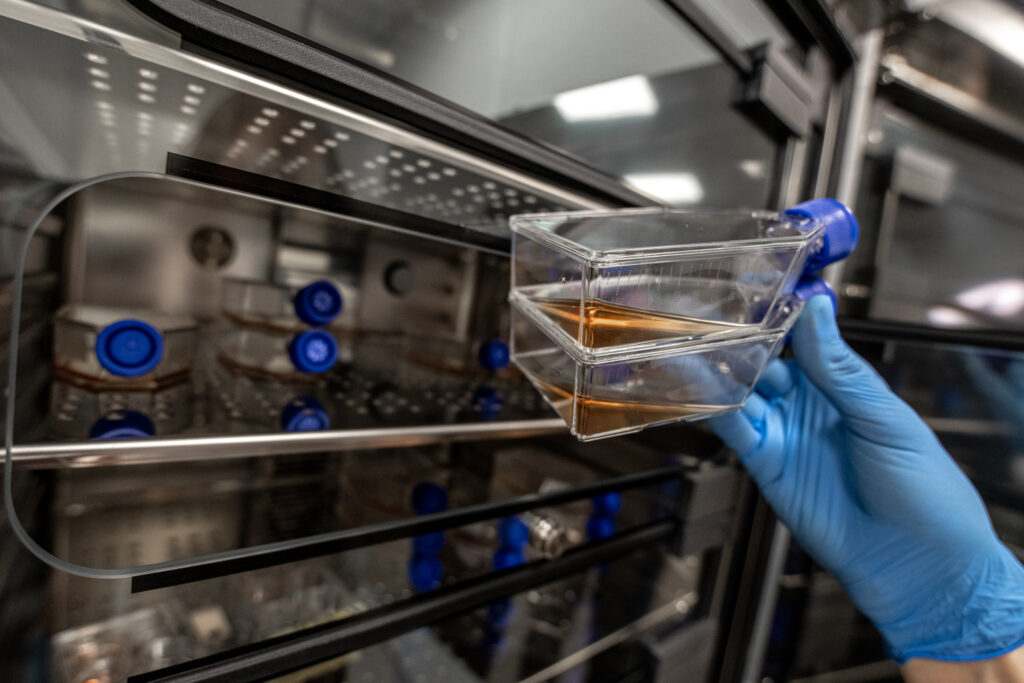

Kokomodo derives its climate-resilient product from the cells of premium cocoa beans grown in Central and South America. Having successfully completed lab-scale production, it will use the capital to expand to pilot scale and utilise its bioprocessing systems to get closer to price parity with conventional chocolate, according to co-founder and CEO Tal Govrin.

“We are moving to produce biomass in a scalable bioreactor to further increase production volume and optimise it,” she tells Green Queen. “In 18 to 24 months, we plan to produce hundreds of litres in bioreactors, working toward reaching commercial scale.”

Speaking about the funding round, she added: “We will also focus on client engagement and widening our range of products, as well as regulations and IP submissions to extend our go-to-market.”

Why Kokomodo is making cell-based chocolate

Kokomodo is the result of a joint venture between The Kitchen FoodTech Hub and Tel Aviv-based Plantae Bioscience, whose technology has been developed behind closed doors for the last two years. “Kokomodo is promoting a variety of causes such as preservation of cacao, fair trade and shorter supply chains, to name only a few,” said Amir Zaidman, chief business officer of The Kitchen FoodTech Hub.

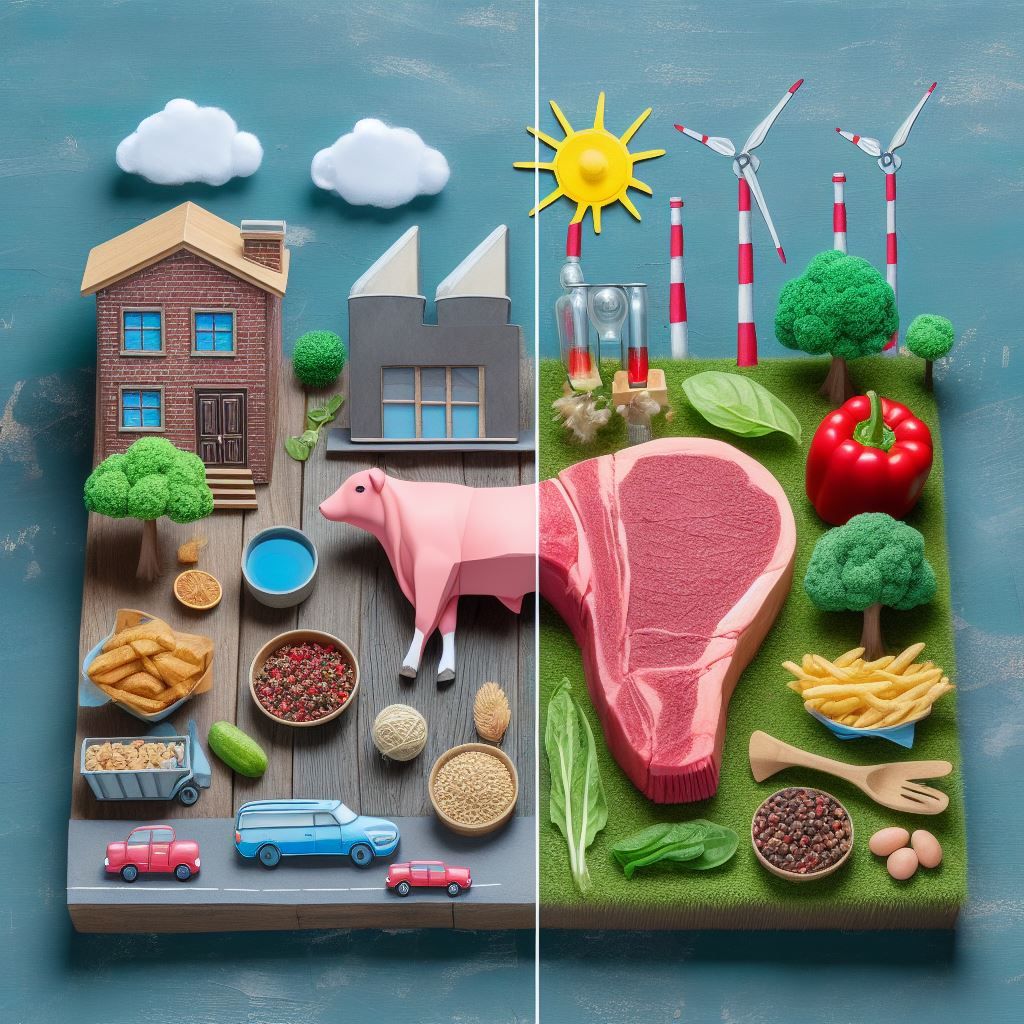

As an industry, cocoa is getting decimated by climate change, with scientists saying a third of cocoa trees could die out by 2050. Extreme weather events have ruined harvests and led to a shortage of cocoa, pushing prices up to all-time highs this year. In April, a tonne of cocoa was priced at over $12,000 – for context, it was under $2,500 in January 2023. Farmers in Ivory Coast, the largest cocoa producer, are truly feeling the heat, where more than 85% of the forest has been lost since 1960.

Meanwhile, producing cocoa products themselves has a highly detrimental impact on the planet. Only beef pollutes the atmosphere more than dark chocolate, and cocoa beans have one of the highest carbon opportunity costs (the amount of carbon lost from native vegetation and soils to produce food).

“Kokomodo was born from a profound passion for preserving the supply of cocoa,” says Govrin. “Our cellular agriculture technology ensures a steady flow of premium, health-boosting cocoa, aligning consumer enjoyment with global responsibility.”

Current trends point to price parity potential

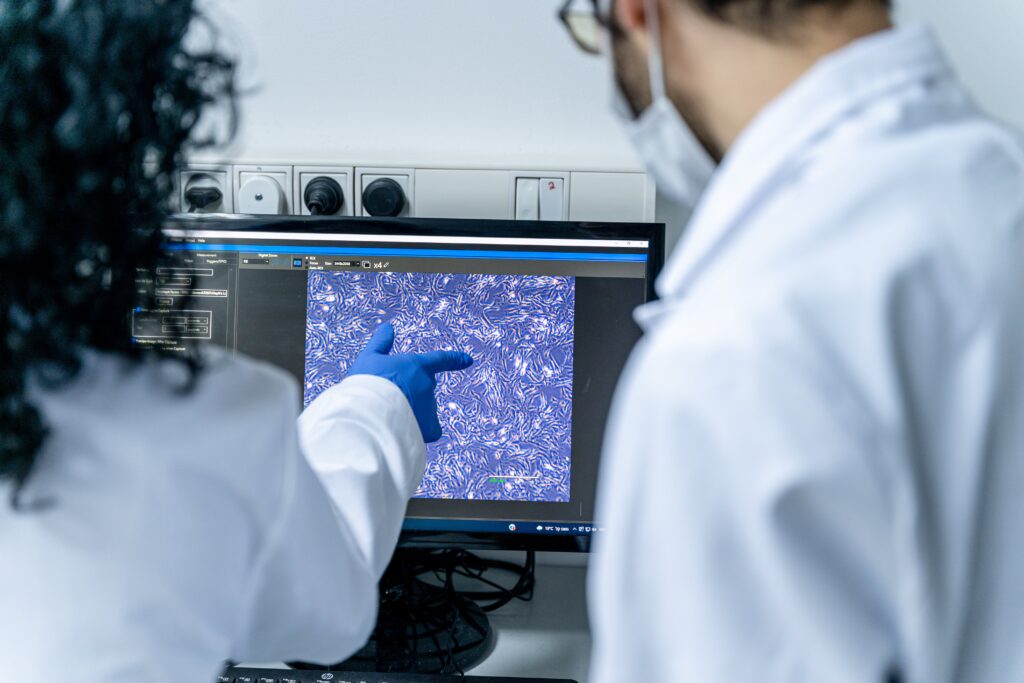

The startup chose to source from Latin America as the region is known for its premium cocoa beans. “We aimed to obtain different varieties and genotypes to explore and take advantage of the potential of natural variance. We also obtain different cell lines originating from different parts of the cacao seedling while creating a cacao cell library and analytical capabilities to seek out the best cacao cells to produce,” explains Govrin.

“These carefully chosen cells are then cultivated using state-of-the-art cellular agriculture technology, nurturing them into a thriving cell culture. As the biomass grows, the production process moves to advanced bioreactors, where the cacao is harvested and processed according to the specific requirements of each application.”

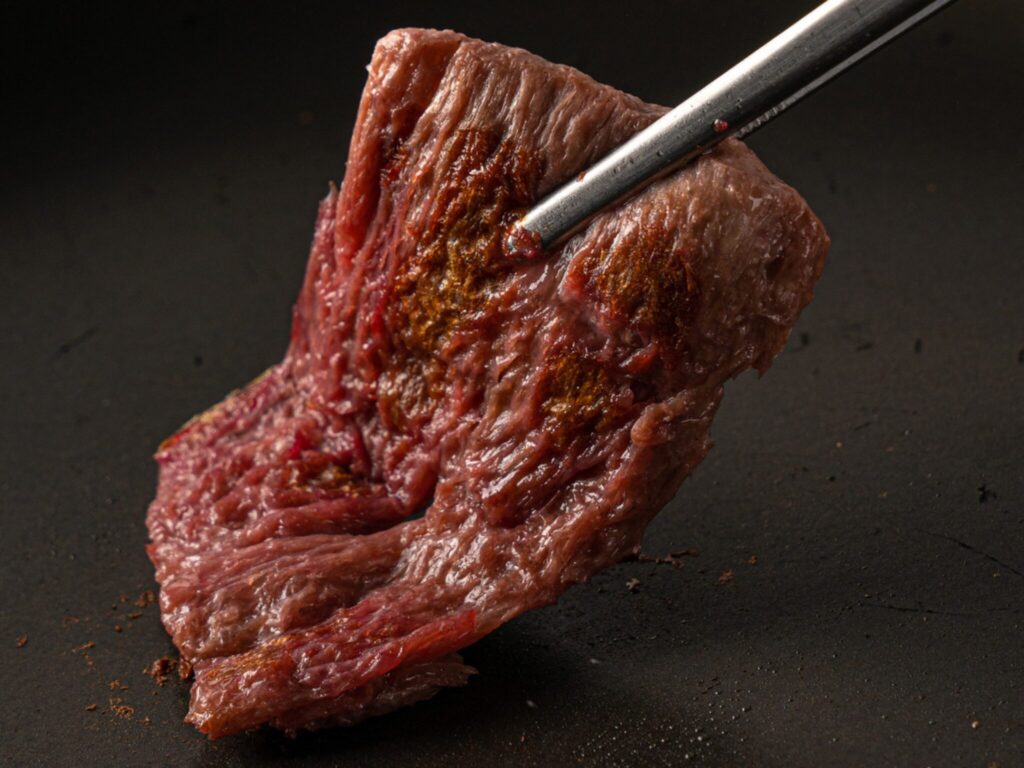

She adds that Kokomodo’s “technologically systematic” approach ensures that its cocoa retains the quality and authenticity of the beans. “Through the company’s technology process, Kokomodo ensures cocoa that matches traditional chocolate flavours and textures, offering the genuine taste and characteristics of real cocoa (aroma, flavours, and sweetness), while capturing the nutraceutical values and health benefits of cacao.”

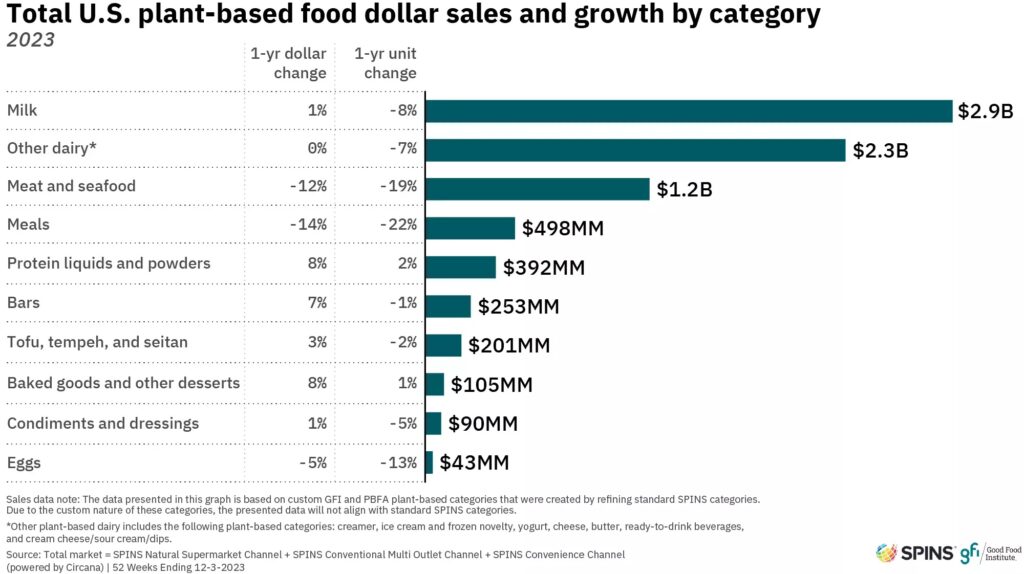

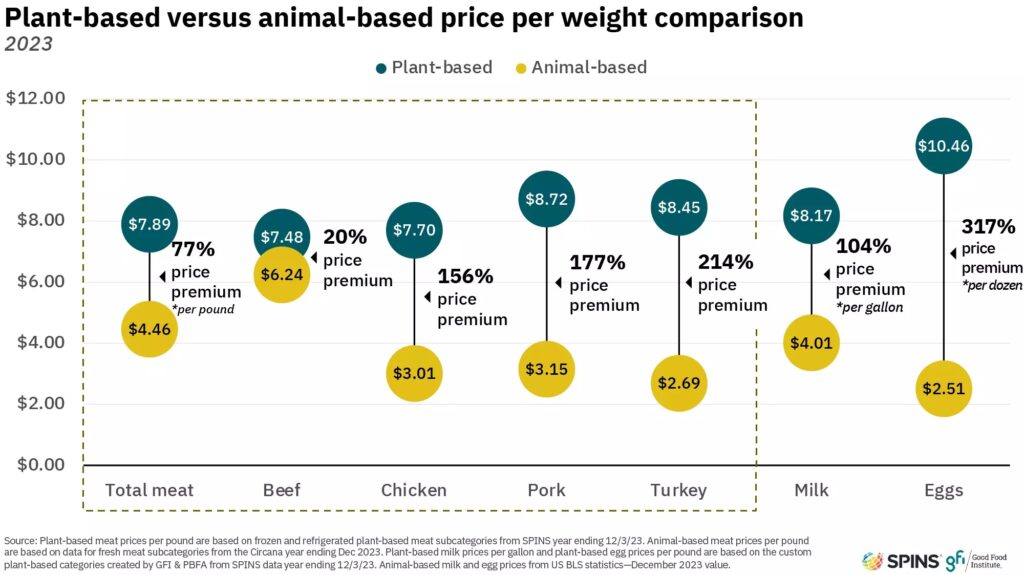

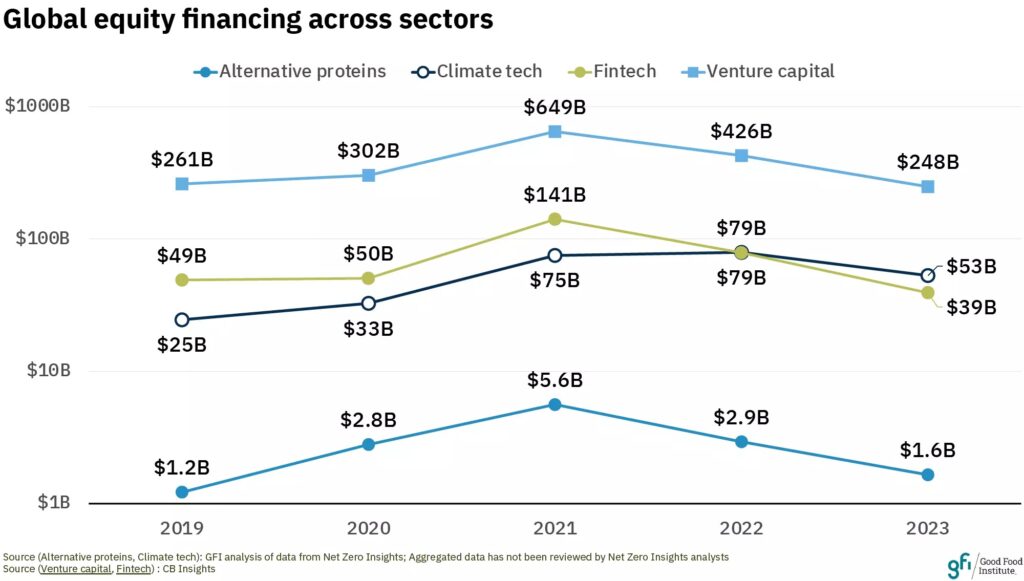

One of the biggest hurdles for any cellular agriculture company – but particularly one aiming to disrupt an already volatile market – is cost. While cocoa prices have been skyrocketing, matching it on price is still a tall order for cell-based producers.

But Govrin believes cell-cultured cocoa can be price-competitive due to two trends. “On one hand, the scalability of cell culture cacao production is expected to increase, leading to lower prices as the technology matures,” she says. “Simultaneously, traditional cocoa farming faces mounting economic and environmental pressures, which could drive up the prices of conventionally grown cocoa.”

She adds: “As the rising prices, costs and supply challenges of traditional cocoa cultivation intensify due to climate change impacts, disease, and overreliance on a few producer countries like Ghana and Ivory Coast, cell-cultured cocoa will provide a more sustainable and resilient solution for the industry.”

Choosing a non-agricultural solution over cocoa-free chocolate

Govrin suggests that Kokomodo is targeting premium brands that prioritise sustainable and ethical cocoa products, while actively exploring innovative technologies for cocoa cultivation. Its first product is a “high-value cocoa powder” that can be integrated into various products, followed by cocoa butter.

The idea is to use its cell-based cocoa products across different CPG categories, including chocolate, beverages, spreads, and protein bars. Its potential customers can get access to “custom-fit cocoa for diverse market demands”, the CEO says.

But before any of that, the company will need to pass regulatory barriers in the countries it wants to commercialise in. Govrin indicates that a US launch may be more suitable, given that the self-affirmed GRAS process there is much simpler and quicker than the EU’s novel food regulations. “We are currently working with regulation advisors who can provide the required support to build our regulation strategy and application. Submission will take place once the growth process in bioreactors is established,” she reveals.

Kokomodo is among just a handful of companies working on cell-based chocolate, alongside fellow Israeli startup Celleste Bio, US producer California Cultured, and Finnish giant Fazer. More companies – such as Voyage Foods, Planet A Foods, Win-Win and Foreverland – are instead making cocoa-free alternatives to chocolate, using plants and fermentation to create chocolate-like products.

What does Govrin think about this approach? “We master the very essence of cacao as we select and cultivate cacao cells from a variety of real premium beans. It is the real thing. Not ‘like’ cocoa, nor is it a ‘substitute’,” she says, reiterating the nutraceutical values of cocoa to illustrate how Kokomodo’s innovation differs from “chocolate substitutes that contain a high level of refined sugar and vegetable fat”.

“Kokomodo uses science and technology to develop real cocoa in a way that is most impactful to human health and makes it readily available for use in consumer products. Cellular agriculture technology is a game changer in being able to bring cocoa to the market all year round,” she adds.

“With climate change threatening cocoa, a non-agricultural solution to produce it could ensure its survival for future generations, as we don’t want to give up on this powerful plant.”

The post With $750,000 in Funding, Kokomodo Emerges as Latest Cell-Based Chocolate Player appeared first on Green Queen.

This post was originally published on Green Queen.