Our weekly column rounds up the latest sustainable food innovation news. This week, Future Food Quick Bites covers Gordon Ramsay’s partnership with Becel, a new vegan egg in Italy, and Spain’s plant-based school meal decree.

New products and launches

Celebrity chef Gordon Ramsay has taken his partnership with plant-based dairy giant Flora Food Group global, appearing in a replica Skip the Cow ad (minus the expletives) for its Canadian dairy-free butter brand Becel.

In the UK, Quorn has added two new flavours to its mycoprotein-based deli slices range. The tomato-basil flavour can be found at Sainsbury’s and Asda, and the garlic-herb variant at Tesco, both for £2.60.

As whole-food plant-based food surges in the UK, The Tofoo Co introduced a Thai Burger and Southern Fried Pieces, which will retail at Waitrose and Tesco, respectively, for £3.

Speaking of whole foods, vegan seafood player Happiee! has launched what it claims is the UK’s first ready-to-cook lion’s mane mushroom chunks. They’re available in original and teriyaki flavours, retailing for £4 per 180g pack at 240 Sainsbury’s stores.

Confectionery giant Mars has rolled out a new Honeycomb for its dairy-free Galaxy range in the UK. Combining cocoa and hazelnut paste with honeycomb pieces, the bar is available at Sainsbury’s for £1.50.

Ice cream maker Oppo Brothers has launched a better-for-you vegan sorbet range called Oppo Refresh, available in Sicilian Lemon & Strawberry, Alphonso Mango & Passionfruit, and Raspberry Coulis Swirl flavours for £3.75 per three-pack.

Also in the UK, oat milk brand Minor Figures has launched the Hyper Oat line it had unveiled at Expo West. Available in berry, turmeric, matcha, and mango variants, the milks contain adaptogens and nootropics. The berry and mango flavours are available at Waitrose for £3 per 750ml bottle, followed by a wider launch in the coming months.

In Spain, plant-based meat leader Heura has rolled out a Fine Herbs chicken burger to cater to the country’s affinity for white meat, one of several products planned for this year.

Italian plant-based producer The Bridge has launched a vegan liquid egg called Veg Egg, which is made from soy milk and soy protein.

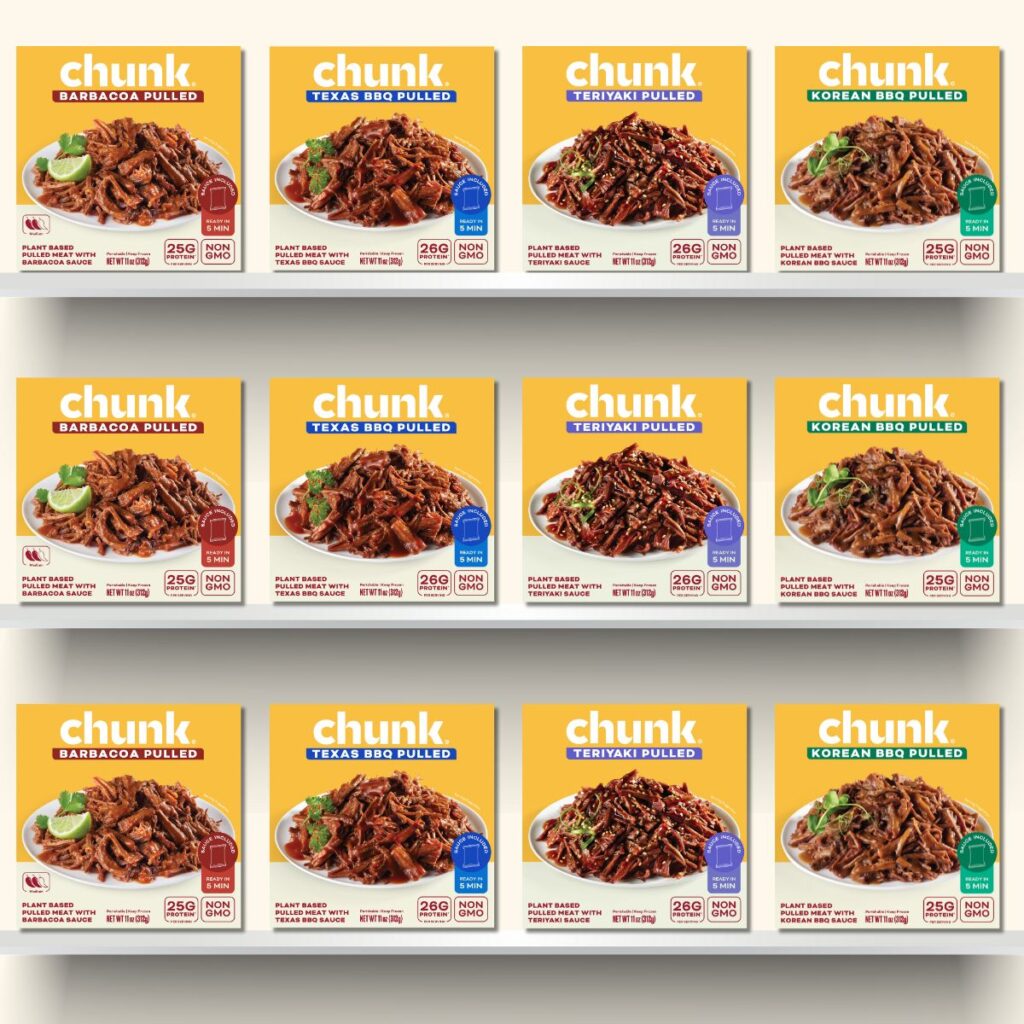

Across the Atlantic, South Korea’s Unlimeat has brought its flagship Korean BBQ Bulgogi and Pulled Pork Original products to 300 Kroger-affiliated stores in the US, including Ralphs, Fred Meyer, King Soopers, and Smith’s.

Californian biotech firm Checkerspot has developed what it says is the world’s first high-oleic palm oil alternative made entirely via microalgae fermentation.

Company and finance updates

US animal-free dairy startup DeNovo Foodlabs has formed a 50:50 joint venture with Earth First Food Ventures called PFerrinX26 to scale up the production of precision-fermented lactoferrin protein. They will announce a manufacturing partner soon, and plan to build facilities to produce 300 tonnes of the protein within the next decade.

LoveRaw, the cult-favourite British vegan chocolate brand known for its Ferrero Rocher and Kinder Bueno copycats, has been rescued from administration by Bulgarian plant-based producer Smart Organic, after investment and supplier challenges disrupted the former’s operations and revenue.

Mycelium Technologies, the French parent company of mycelium protein brand Mycfoods, has kickstarted its first fundraising round, with a €750,000 target. It plans a subsequent €4.5M round next year.

French plant-based companies Hari&Co, Accro, HappyVore, La Vie and Swap Food have formed InterVeg, a coalition aimed at accelerating the transition to a plant-based diet via constructive dialogue with policymakers and promotional campaigns.

Policy and research developments

In a big win for the protein transition, Spain’s Council of Ministers has approved the Royal Decree on Healthy and Sustainable School Cafeterias, which contains a provision to protect children’s right to a 100% plant-based menu in schools, as well as increase legume consumption.

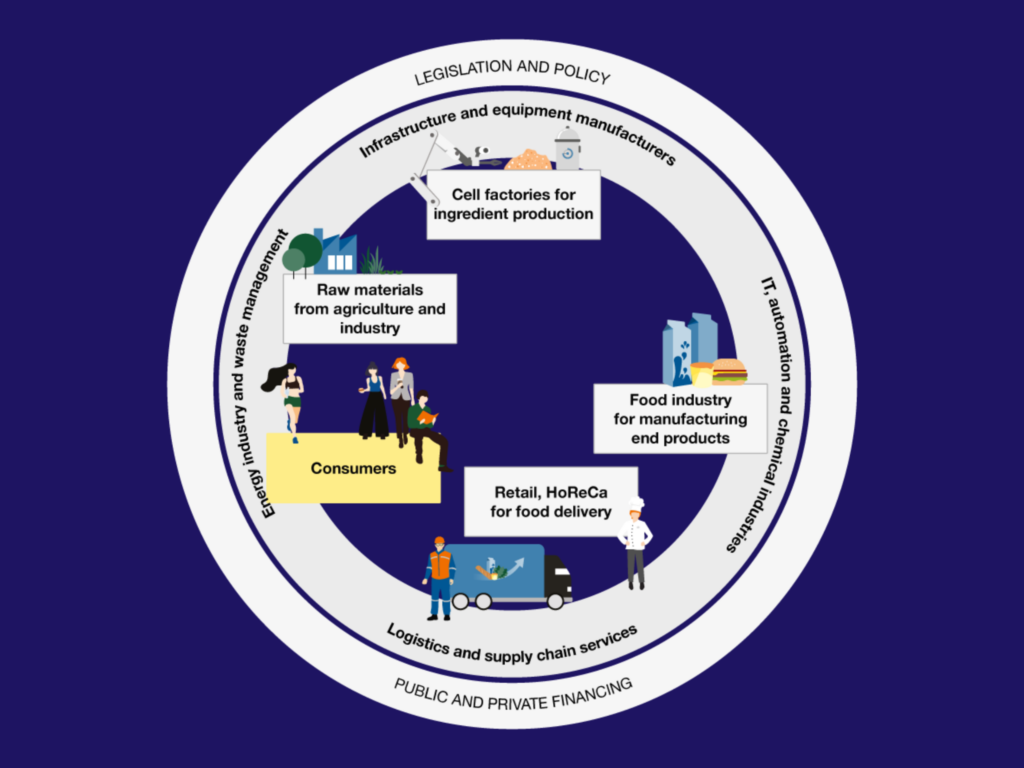

What makes a lean startup? Singaporean sustainable food production platform Nurasa and AI-based precision fermentation facilitator New Wave Biotech have released a whitepaper to help ingredient manufacturers “reimagine the five core lean startup principles” for the food tech world.

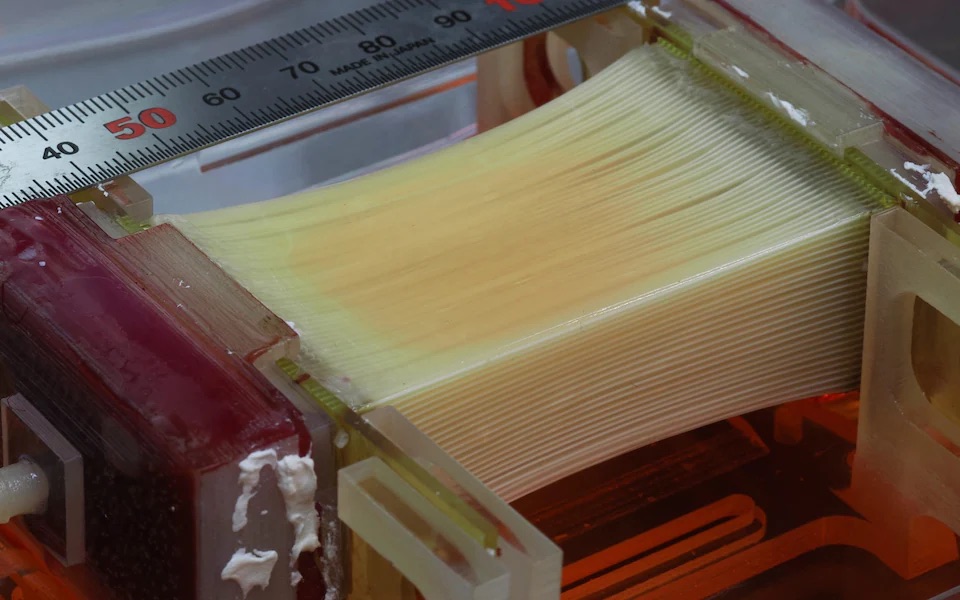

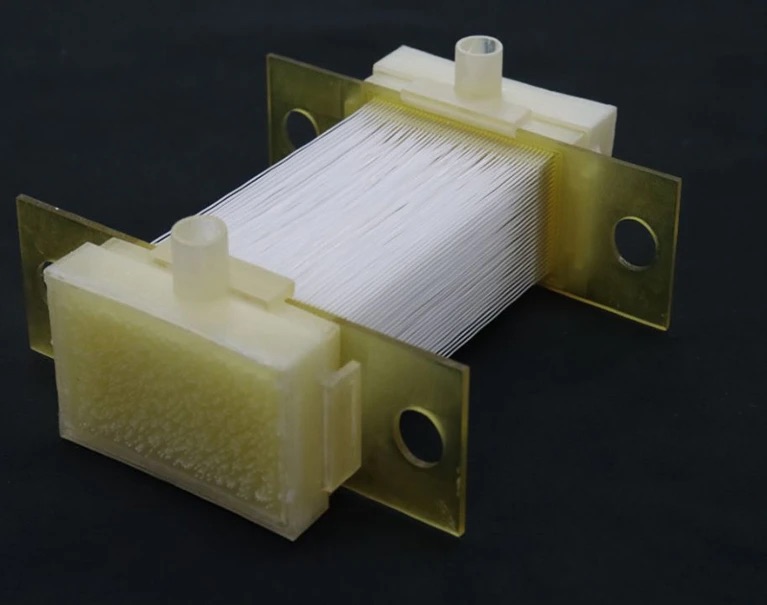

Researchers from the US have devised a new 3D printing process to make vegan calamari, using mung bean protein isolate, powdered light-yellow microalgae, gellan gum, and canola oil.

At the University of Florida, researchers are testing a new kind of cattle feed that could help dairy cows release less methane and use nutrients more efficiently.

Finally, in Norway, scientists are proposing kelp and other seaweed species, as well as plant residues, as an alternative to blood and other animal-derived inputs to use as culture media for cultivated meat.

Check out last week’s Future Food Quick Bites.

The post Future Food Quick Bites: Gordon Ramsay x Flora, Hyper Oat Milk & Vegan School Meals appeared first on Green Queen.

This post was originally published on Green Queen.