Our weekly column rounds up the latest sustainable food innovation news. This week, Future Food Quick Bites covers Magnum’s revamped vegan recipe, Heura’s new Tex-Mex Chunks, and a cultivated seafood tasting in Japan.

New products and launches

Unilever has changed the recipe for its vegan Magnum ice cream range, replacing pea protein with soy. It has also refreshed its packaging to a more premium design, after sales of the dairy-free ice creams grew by more than 75% in the UK last year.

Shortly after raising $4M from investors, California’s PlantBaby has gained a listing at Sprouts Farmers Market for Kiki Milk, its kid-friendly plant-based milk line. The 32oz packs are now available at all 440 locations nationwide for $6.99.

Also in the US, Nepra Foods has developed a proprietary hemp protein initially targeted for the egg-free baking sector, with early production already underway. The technology, set to be patented, is shared with an unnamed industry expert.

San Antonio-based Good Eat’n, owned by NBA star Chris Paul, has launched Dairy Free White Cheddar Popcorn. After debuting at Expo West in March, it will be available on its website and GoPuff for $4.99 per 4.40oz bag and $1.99 for 1oz bag.

Spanish plant-based meat leader Heura has added a Tex-Mex flavour to its chicken chunks, which contain 27% of the daily recommended intake of protein.

British meat-free brand Cock & Bull has secured a listing with wholesaler Cotswold Fayre, with six of its products – from a Traditional Porky Pie to a Saus-ish Roll – sold unbaked and frozen, alongside a packaged range for retail.

Dutch retailer Jumbo has rolled out a range of dairy-free yoghurts made from whole soybeans, which help retain a greater amount of protein and fibre. Produced by De Nieuwe Melkboer, they’re marketed under the supermarket’s Direct van de Boerderij label, and come in natural, vanilla, and first fruit flavours.

Japan’s largest airline, All Nippon Airways, has introduced two vegan ANA Original Ramen options for First and Business Class flyers on international routes. Flights departing from Japan will serve the Negi Miso Ramen, and those coming from overseas will feature the Tonkotsu Style Ramen.

Company and finance updates

French firm SeaWeed Concept has received €2M from investors to develop its lacto-fermentation process, which would be able to produce 5,000 tonnes of algae per year.

Scottish biotech startup uFraction8 has raised £3.4M in a financing round for its microfiltration technology, which optimises cell and biomass production and provides an energy-efficient alternative to conventional manufacturing methods for bio-based food products.

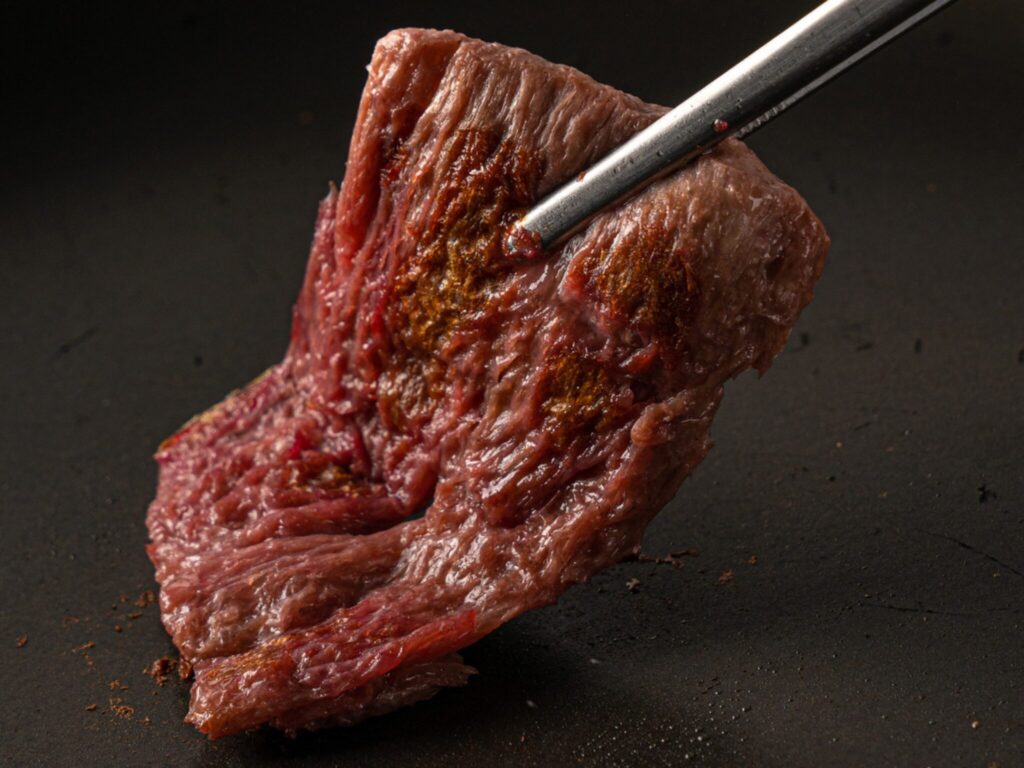

Israeli startup Forsea Foods hosted a tasting for its cultivated unagi in Japan, the world’s largest market for freshwater eel, with support from the Israeli embassy in Japan and the Israel Export Institute.

Fellow cultivated meat producer Simple Planet – based in South Korea – has successfully developed a serum-free culture medium that can potentially reduce costs by 99.8%. It is also working with the Halal Science Center at Thailand’s Chulalongkorn University to achieve halal certification for its cultured meat products.

Germany’s Esencia Foods, which makes whole-cut seafood analogues from mycelium, has received €2M in funding as part of the European Innovation Council’s blended finance scheme. It comes months after it won a €50,000 grant at EIT Food’s Next Bite event.

Plant-based meat giant Impossible Foods has appointed Meredith Madden as its new chief demand officer. She previously worked at Chobani with current Impossible Foods CEO Peter McGuinness.

Its chief rival Beyond Meat is looking to borrow up to $250M from private credit lenders to shore up liquidity and tackle some of its $1.15B of convertable bonds due in 2027. It is the firm’s second such attempt in 12 months.

Finnish gas protein pioneer Solar Foods has begun pre-engineering work on its Factory 02, which is set to be operational by 2028. Along with the Factory 01 opened last year, it will produce Solein protein on a commercial scale.

British artisanal vegan cheesemaker I Am Nut OK has experienced a 24% hike in year-on-year sales in 2024, with a 39% uptick in January 2025 thanks to Veganuary.

Plant-based ingredients supplier Nutraland USA has joined the National Animal Supplement Council as a Preferred Supplier, which recognises its dedication to ingredient quality, safety and efficacy for pet food.

After being selected in Nestlé’s Unleashed by Purina 2025 accelerator programme, Singaporean firm Umami Bioworks has introduced a cultivated seafood protein platform to tackle supply chain instability, nutrition and sustainability challenges in the pet food sector.

Swedish oat milk giant Oatly has collaborated with Madrid’s East Crema Coffee to set up a coffee bar at the Mercedes-Benz Fashion Week Madrid (February 20-23).

Policy and research developments

Austrian precision fermentation startup Fermify has submitted a regulatory dossier for its animal-free casein to the Singapore Food Agency. It comes months after it earned self-determined GRAS status in the US.

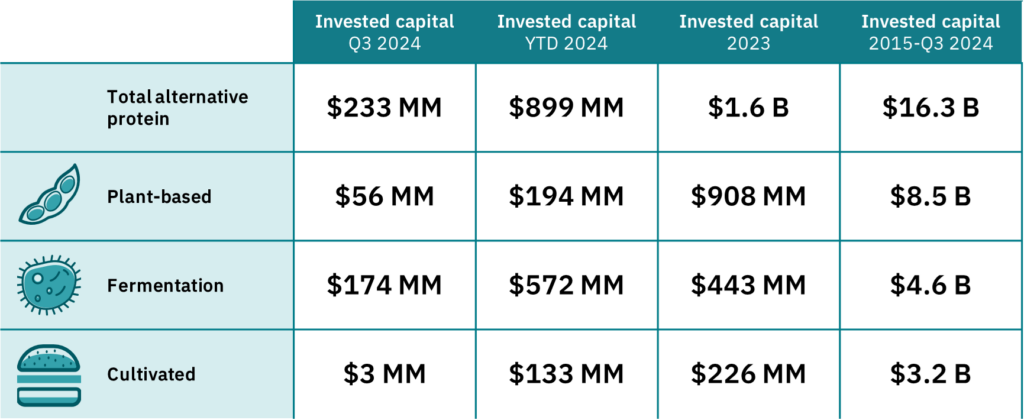

In Europe, the number of alternative protein patents has surged by 960% since 2015, surpassing 5,300 in total. In 2024 alone, 1,200 patents were published, according to analysis by the Good Food Institute Europe.

British food producer Ark34‘s Tater Cheezz Nuggetz, made from Dutch supplier Aviko Rixona‘s potato-based cheese alternative, has won the Best Frozen Product award at Gulfood 2025.

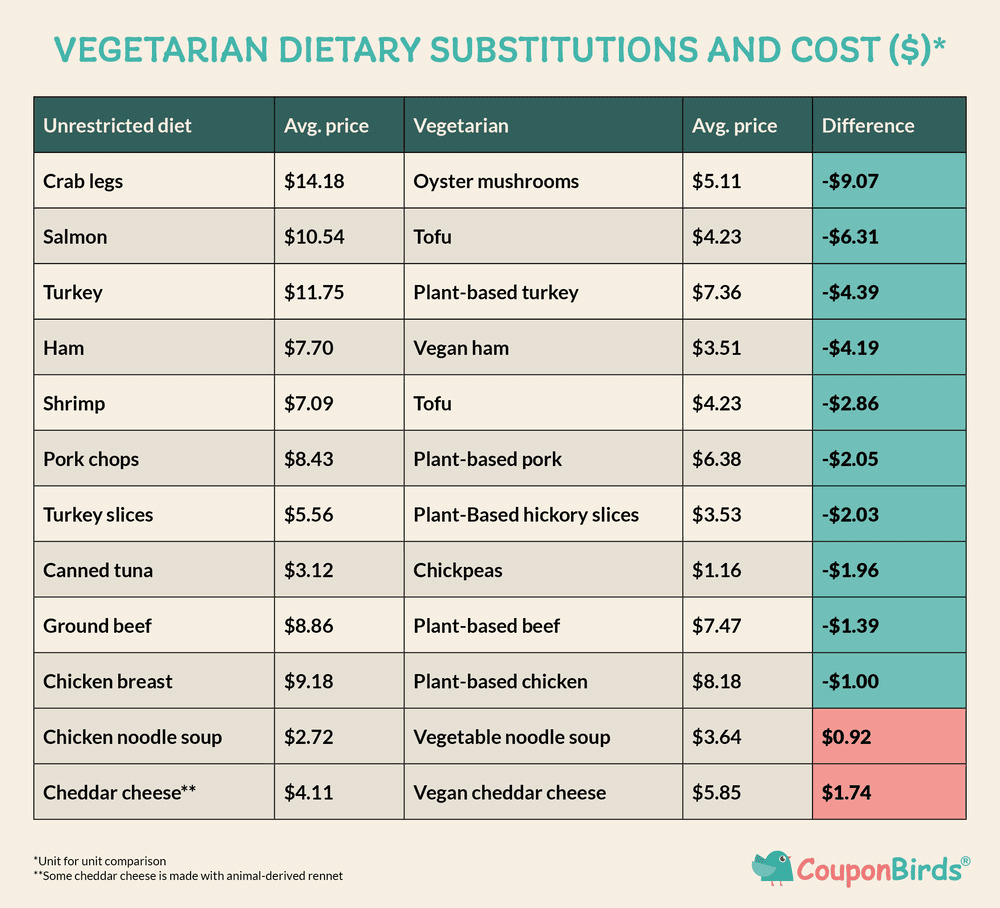

Meat-free diets are among the most affordable in the US, with the average vegan shopper saving $34.24 per month on groceries, according to research by CouponBirds.

Scientists in Israel have developed a way to use aloe vera as a natural scaffold to grow bovine fat tissue for cultivated meat production, which could address cost and scalability issues.

Check out last week’s Future Food Quick Bites.

The post Future Food Quick Bites: Vegan Magnum, Airline Ramen & Dairy-Free Popcorn appeared first on Green Queen.

This post was originally published on Green Queen.