Singaporean cultivated seafood producer Umami Bioworks has expanded operations to the UK, and is in talks with the country’s regulator as it maps a path to market.

Umami Bioworks’s international expansion rages on, with the cultivated seafood startup now setting up operations in the UK, the land of fish and chips (and overfishing).

The UK is the latest in a growing list of countries on Umami Bioworks’s radar, which include South Korea, India, Malaysia, the US, and Singapore. “Over the past year, we’ve been evaluating a variety of strategies to bring our platform to the European market to address the growing challenges with seafood supply shortages and rising costs,” Umami Bioworks founder and CEO Mihir Pershad tells Green Queen.

It comes just a day after the UK government invested £1.6M for the Food Standards Agency (FSA) to fast-track testing and regulatory approval of cultivated meat, and three months after it became the first European country to greenlight such a product for sale (albeit for pet food).

“We’ve been in contact with the regulators at the FSA, exploring the path to commercialisation in the UK market,” reveals Pershad. “We’re excited to be moving forward in the UK market after assessing the market needs and multiple conversations with regulators and potential partners.”

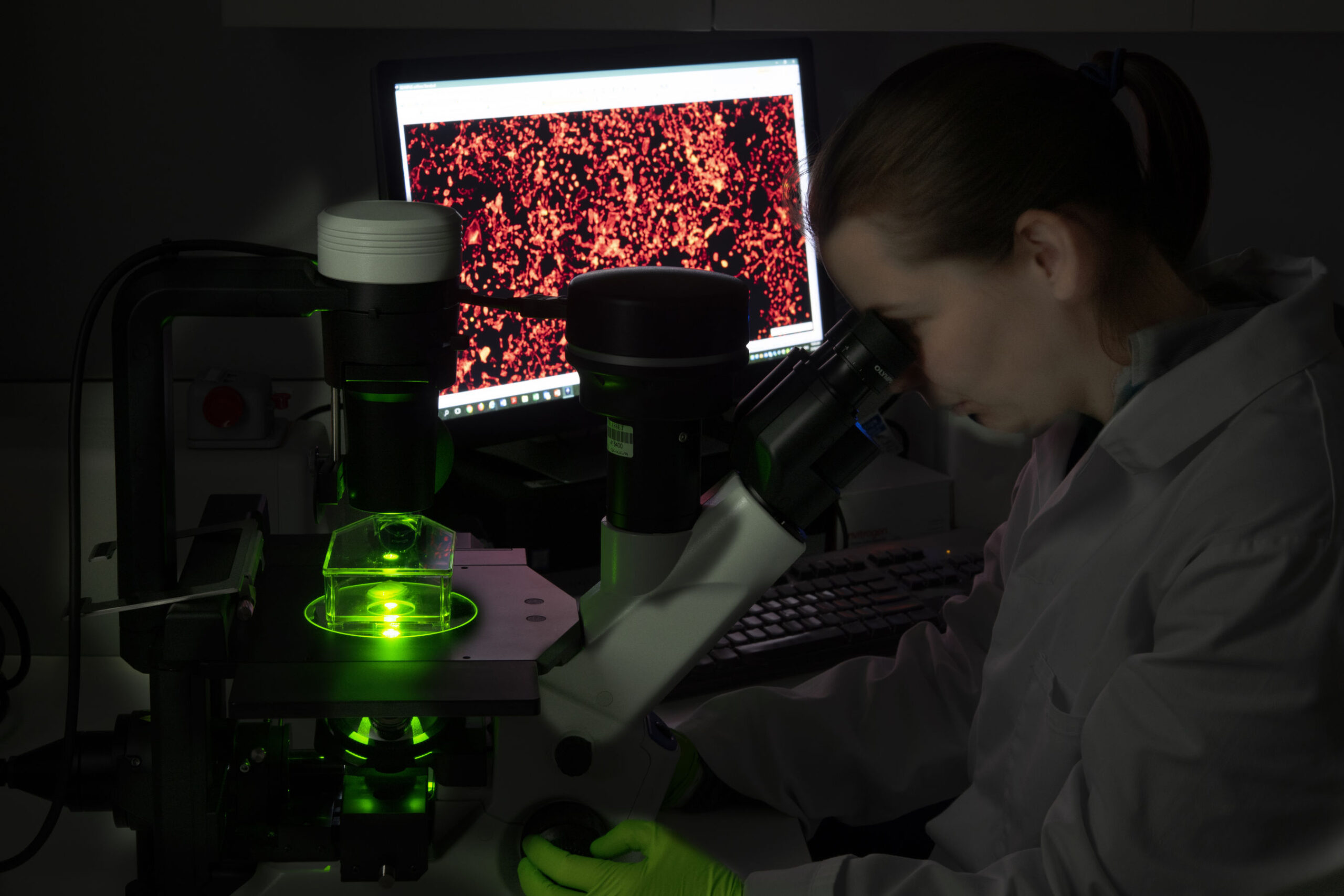

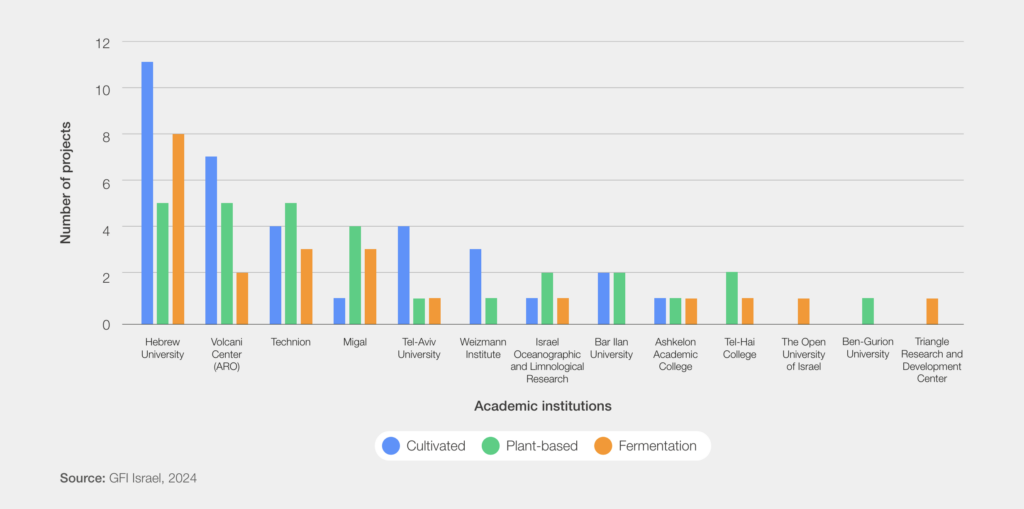

Those partners include institutes like University College London and Imperial College, which is also the site of one of Bezos Earth Fund‘s Centres for Sustainable Protein. “In general, we work with university collaborators on frontier projects to help unlock new innovations cultivated solutions more scalable and more affordable,” says Pershad.

“Our collaborations span a wide range of activities, from establishing new species for cell cultivation to the development of novel machine learning solutions that enhance the speed of development and scalability.”

Battling the UK’s big overfishing problem

The company’s model in the UK mirrors its scale-up approach globally. “We intend to partner with an established food company to establish domestic production built upon Umami’s technology platform, producing seafood that meats UK consumer tastes and desires,” explains Pershad.

While the production capacity hasn’t been determined yet, he adds: “We see Umami’s role in the ecosystem to primarily be commercialising and scaling near-term cultivated solutions, but we also see tremendous value in seeding the future of the industry in partnership with academic collaborators.”

Umami Bioworks, which merged with fellow Singaporean cultivated seafood firm Shiok Meats in March, is among a number of startups using cellular agriculture to tackle the global overfishing crisis. Nearly 90% of the world’s fish stocks are now 80% of the planet’s fisheries have been fully exploited, over-exploited or depleted, according to the UN FAO.

One study suggests that we could be heading towards a complete collapse of ocean life by 2048, driven primarily by overfishing for human consumption, as well as marine pollution and climate change.

Looking locally, over a third of UK fish populations are being overfished, and a quarter have been depleted to critically low population sizes, marine protection organisation Oceana UK found. The government’s own scientists have said that 54% of the country’s catch limits set by lawmakers are at unsustainably high levels.

The UK relies heavily on 10 key fishing stocks, five of which are either being overfished or reaching critically endangered population levels. Of these 10 stocks, six are whitefish, the same type Umami Bioworks is first focusing on for its UK plans.

“We will be bringing production technology and capability for both premium seafood and companion animal products to the UK, and will determine the order of launch for various products in collaboration with our local partners,” says Pershad.

Umami Bioworks praises UK government’s effort to advance cultivated meat

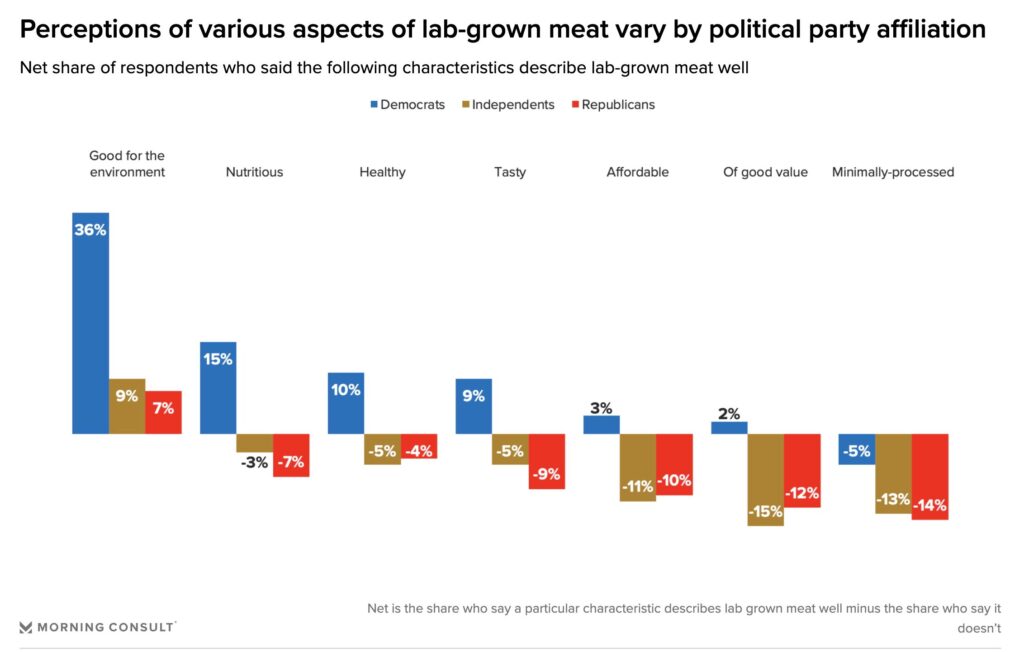

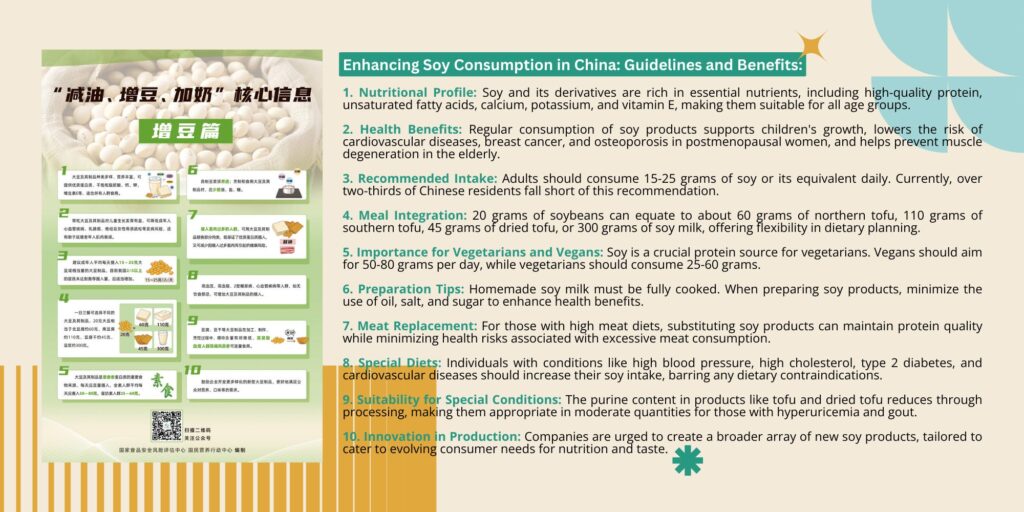

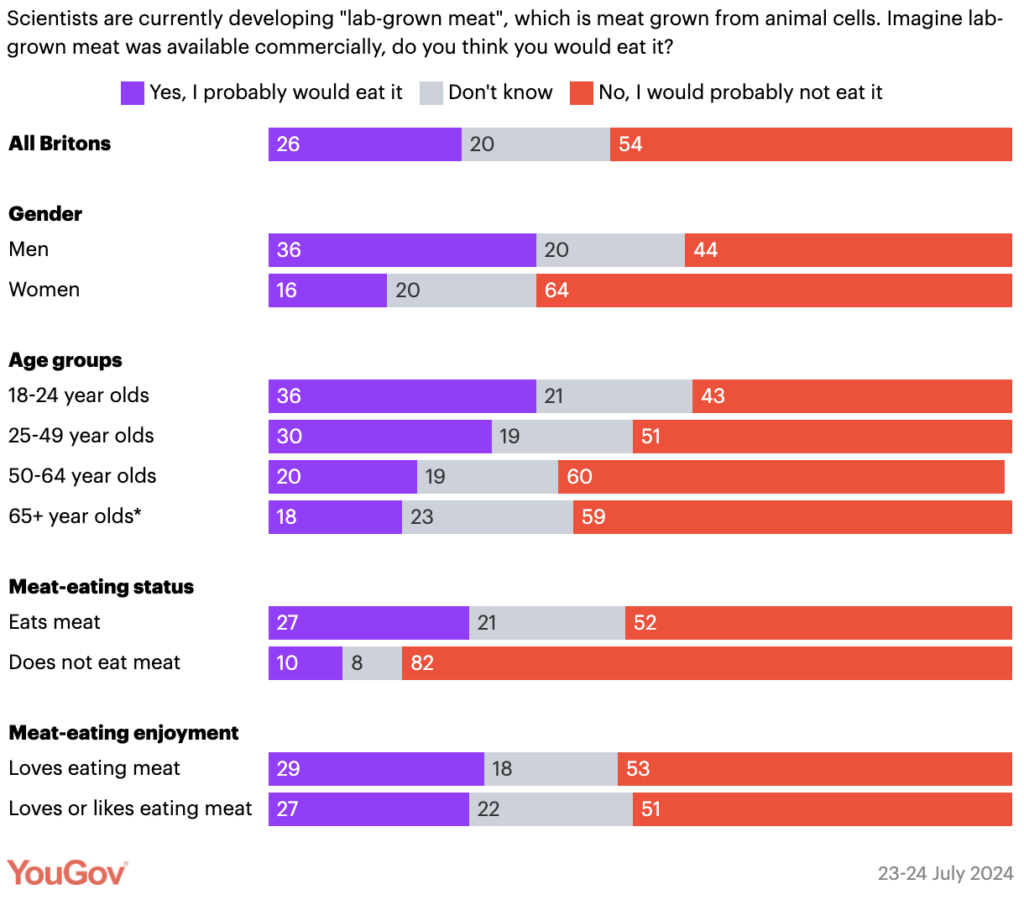

Britain’s appetite for cultivated meat may not be huge – a government-backed survey suggested that only a third would be open to trying these proteins – but it is certainly growing. YouGov polling shows that the number of Brits who would give cultivated meat a go has grown from 19% in 2012 to 26% now.

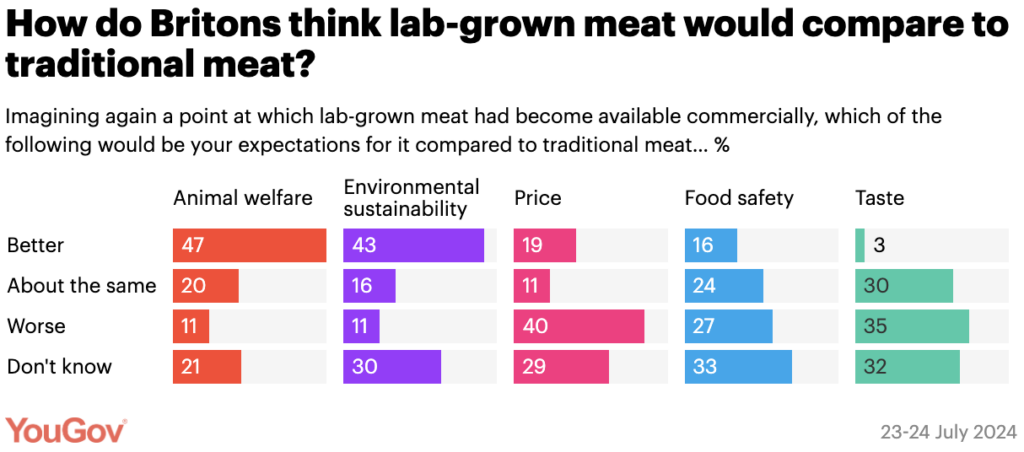

This is likely aided by the growing awareness about cultivated meat – nearly three-quarters (74%) of UK residents have heard about these foods. But while they generally consider them to be better for animal welfare and planetary health, concerns around taste and price remain.

Additionally, more people feel cultivated meat (27%) is less safe to eat than those who think it’s better (16%), although a third (33%) are unsure about the food safety aspect. It highlights a critical gap in consumer education and communication for the industry.

This will be remedied in part by the government’s aforementioned efforts to create a regulatory ‘sandbox’, which would provide application support to cultivated meat startups, speed up regulatory approval timelines, and expand the safety and nutritional knowledge of novel foods, all while maintaining the FSA’s safety standards.

“Ensuring consumers can trust the safety of new foods is one of our most crucial responsibilities,” said Prof Robin May, chief scientific advisor to the FSA. He added that the initiative “will enable safe innovation and allow us to keep pace with new technologies being used by the food industry to ultimately provide consumers with a wider choice of safe foods”.

Pershad says Umami Bioworks is “delighted” to see the FSA’s ambitions of creating a sandbox be realised: “We are strong proponents of sandbox approaches because we believe they enable companies and regulators to learn together and to share openly in a way that builds more robust and tailored regulatory frameworks when new technical approaches are involved.”

So where next for the company? It’s setting up production lines in Malaysia and South Korea, collaborating with research initiatives in India, and working with a pet food company to bring cultivated fish treats for cats to the US market next year. “We are in active review with documents submitted to regulators in major markets across America, Europe, and Asia,” Pershad told Green Queen last week.

“Of course, the EU is a significant seafood market and one that we are assessing closely,” he says now. The EU’s novel food regulation (which the UK is now moving away from, nearly five years after Brexit) has long been a major barrier for startups in the space. So far, only France’s Gourmey has filed for approval. “We don’t yet have a timeline or firm plans to announce for regulatory submission or market entry into the EU, but we expect to solidify those plans this quarter.”

The post Umami Bioworks Heads to the Home of Fish & Chips, Seeking UK Regulatory Filing for Cultivated Seafood appeared first on Green Queen.

This post was originally published on Green Queen.

(@newveganfooduk)

(@newveganfooduk)