Dutch food tech startup Mosa Meat conducted the first public tasting of cultivated beef in the EU, another milestone for novel foods amid fierce debate in Europe.

Mosa Meat, the Dutch startup that produced the world’s first cultivated meat burger over a decade ago, hosted a public tasting of its cultivated beef at its test kitchen in Maastricht last week (July 15).

Convening Dutch cattle farmers, food product developers and industry representatives, it marked the first time public members tasted cultivated beef in the EU. It follows the Dutch government’s establishment of a Code of Practice last year, which paved the way for startups to conduct tastings of cultivated meat and seafood before being approved for sale in the EU.

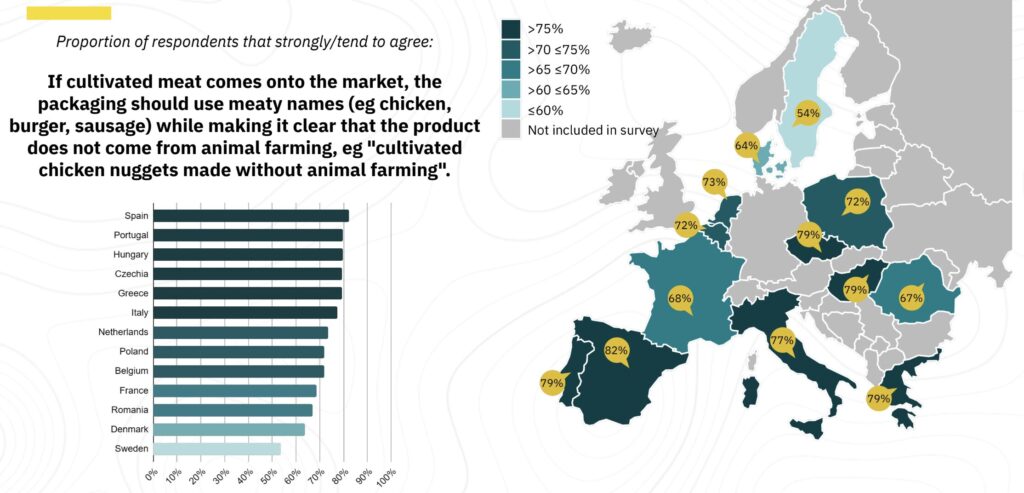

The attendees tasted hybrid beef patties, which combined cultivated beef fat with a custom plant-based mix made in-house by Mosa Meat’s product development team. Much like conventional minced beef that has varying degrees of fat (80/20, 90/10, etc.), the company is still experimenting with the optimal proportion of cultivated fat and plant-based ingredients (which are already widely accepted as food-grade and safe to eat).

“We specifically evaluated the potential of cultivated beef fat as an ingredient in a blend with plant-based ingredients as we know it is responsible for the flavour, aromas, mouthfeel and even sizzle people love from beef,” said Maarten Bosch, co-founder and CEO of Mosa Meat, which is awaiting regulatory approval in Singapore.

“We’ve been able to conclude that our cultivated fat has a very positive impact on the product quality,” he said. “This means that in addition to the cultivated beef for which we have submitted a regulatory approval request in Singapore, we can also elevate the culinary experience of plant-based products and delight more beef lovers faster.”

The development comes just three months after fellow Dutch startup Meatable hosted the EU’s first cultivated meat tasting, serving its hybrid pork sausages to chefs, journalists, industry stakeholders and public officials.

Cultivated beef burger impresses taste-testers

Mosa Meat said the purpose of the tasting was to the market readiness of products and collect feedback from culinary experts for product development purposes. “We are delighted to finally share our burgers with experts outside of the company, so they can help us create the best burgers possible,” said Bosch.

“The burger really tasted like meat,” said one attendee. “Usually I don’t eat meat, but I miss the taste of meat a lot, and this is the way to ultimately add it back to my diet, I hope.”

Another added: “I thought the burger was delicious. It was juicy, nice and succulent.”

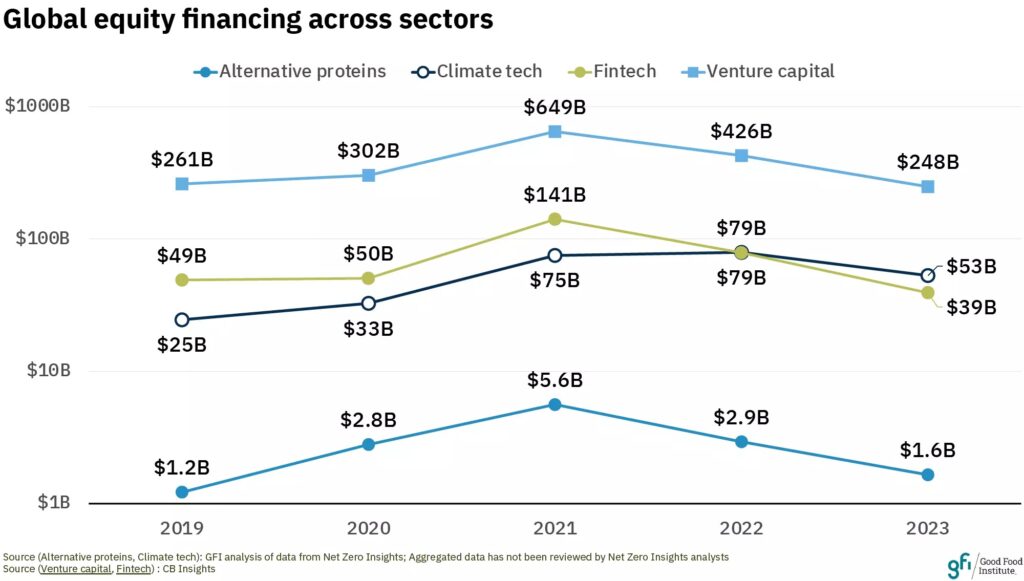

The tasting follows the company’s latest €40M ($42.4M) fundraising round in April, which was the largest investment in a cultivated meat company since November 2022. It took total investment in the company to over $135M, and is helping Mosa Meat scale up its production processes and accelerate its route to market.

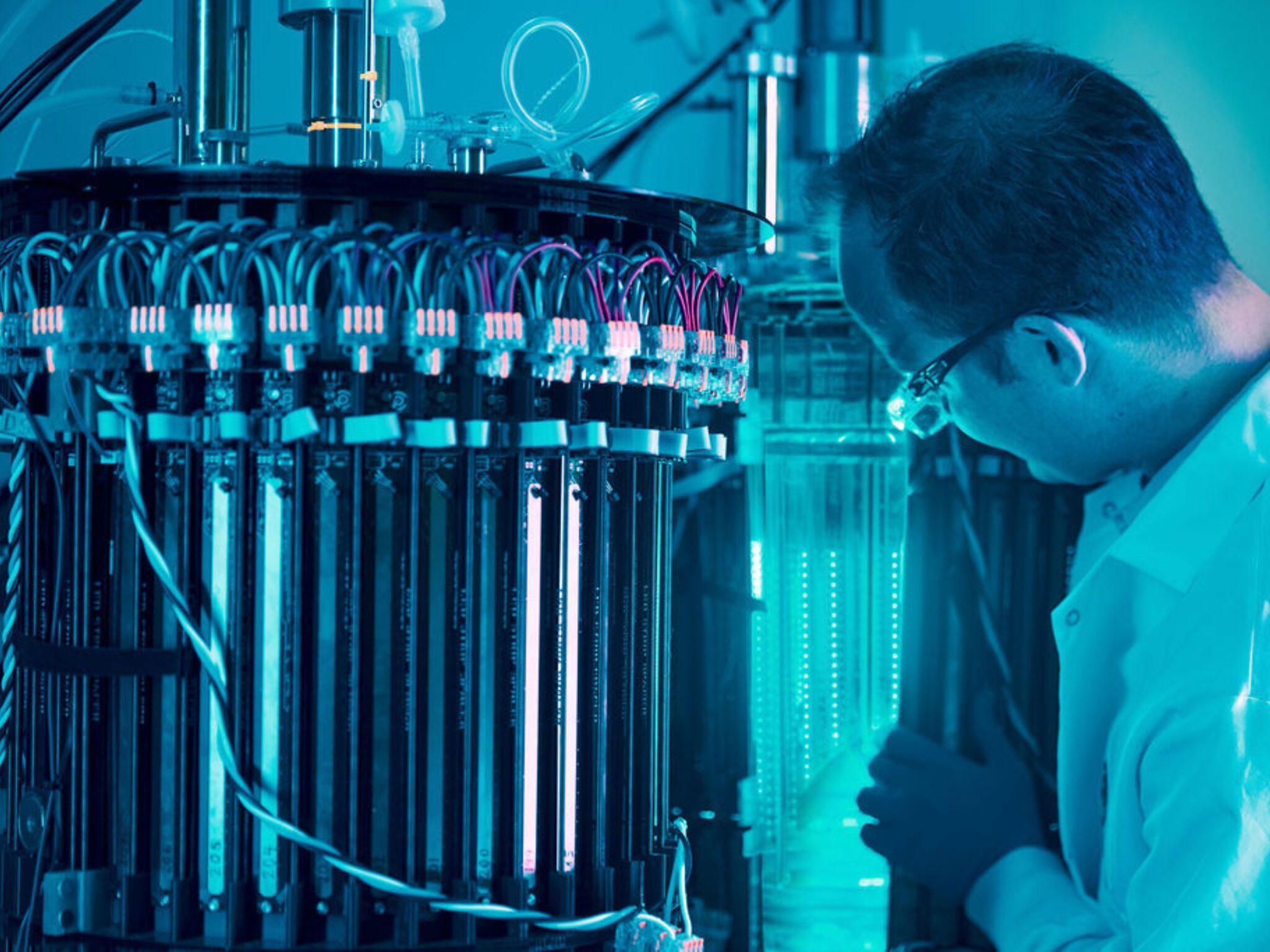

In May 2023, the startup opened what it claims is currently the world’s largest cultivated meat facility in Maastricht. This “cultivated meat campus” is its fourth plant, expanding its footprint to 7,340 sq m (79,007 sq ft), and has a 1,000-litre bioreactor scale that can produce “tens of thousands of cultivated hamburgers”.

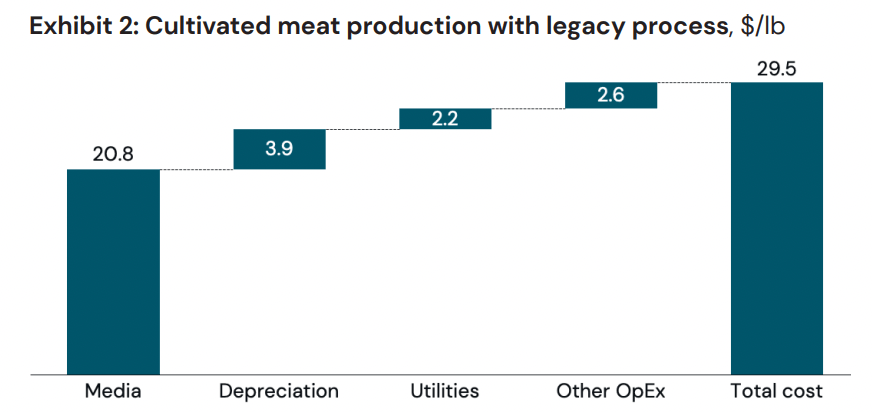

When Mosa Meat first unveiled a cultivated meat burger in 2013, the two proof-of-concept patties cost $330,000. Since then, the company has since managed to slash costs repeatedly. In 2020, it brought down the price of its own growth medium by 80-fold, and the following year, it reduced the cost of its fat medium cost by 66 times.

To further these efforts, it secured a €2M grant from the EU to cut production costs by 100-fold in 2021. And in 2023, it partnered with its investor Nutreco to create a cell feed supply chain and shift to food-grade amino acids to achieve this reduction without affecting yield.

While its exact production costs are not known, the company has indicated that these have continued to decline rapidly, and it’s confident that it will enter foodservice at a price point that works for chefs and restaurants.

Mosa Meat advocates for speed efficiency in EU novel food regulation

Mosa Meat’s beef is still undergoing evaluation by the Singapore Food Agency, which was the first regulator to clear cultivated meat for sale with Eat Just’s Good Meat chicken back in 2020. It has since greenlit cultivated quail made by Australia’s Vow.

But the original nine- to 12-month timeline Singapore has touted has been hard to realise for multiple applicants. Apart from Mosa Meat, it’s also assessing dossiers from Meatable, Aleph Farms and Vital Meat, among others.

Like others, Mosa Meat is planning to enter the market via foodservice too, allowing chefs to bring out the true potential of its cultivated beef when consumers first try it. This also allows breathing room to expand operations and meet the volume demands of retail contracts.

While it awaits the regulatory nod in Singapore, Mosa Meat will concurrently submit applications in other markets in 2024, and has highlighted the US, the EU, Switzerland and the UK as top targets. These regions have established regulatory frameworks and represent a billion consumers combined, which would allow the company to make a larger impact.

The UK just issued its (and Europe’s) first approval to cultivated pet food maker Meatly last week. But no company has so far received clearance in the EU, where the European Food Safety Authority (EFSA) has a complex and stringent framework, thanks in part to the fact that it has 27 member states.

“We embrace the robust nature of the Commission’s review because we know it is the gold standard in the world and will inspire broad consumer confidence,” Robert E Jones, VP of public affairs at Mosa Meat, told Green Queen. But he added: “There are some efficiencies that can be achieved in the speed at which dossiers are reviewed without sacrificing safety, and we continue to work with regulators on implementing those administrative reforms.”

One example of this is the EU’s updated guidance documents for novel foods, which reflects recent advancements in the sector and capitalise on the EFSA’s increased experience in assessing novel foods. The document is set to be published in September, and was built on multiple rounds of feedback by groups like Cellular Agriculture Europe. Jones, who is president of this trade association, said: “We see it as a step in the right direction and an indication that the EU is hearing our feedback about ways to improve efficiencies in the novel food process.”

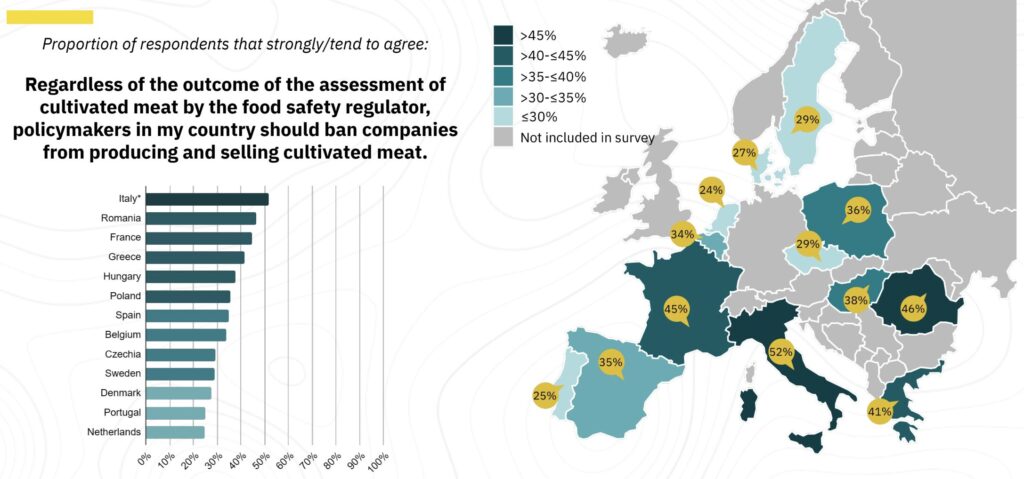

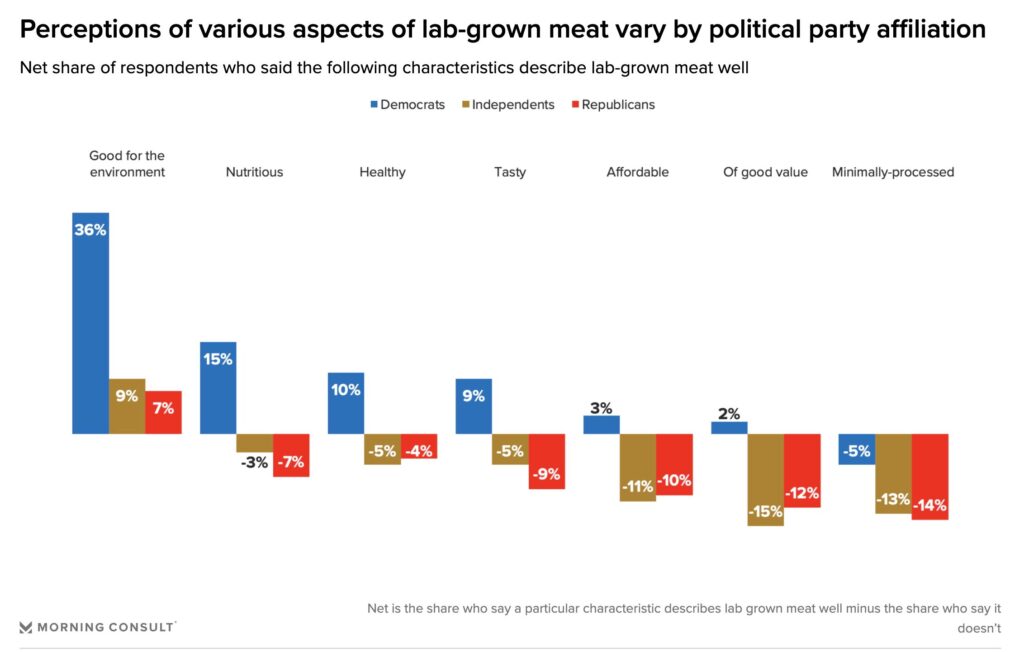

Several other hiccups exist for cultivated meat. In the US, Florida and Alabama have banned cultivated meat, and a number of states are proposing similar measures. But these were preceded by Italy, which announced a ban last November, the first of its kind anywhere in the world. France, Romania and now Hungary are all thought to be mulling restrictions too – despite consumers largely expressing support for these foods.

“While some right-wing governments insist on inserting cultivated meat as a topic in their populist culture war, they are not representative of the vast majority of the European Union,” stated Jones. “The consensus among member states remains to be that innovation and conventional agriculture can coexist in order to boost European competitiveness and food security. I am confident that viewpoint will win the day.”

The post Dutch Startup Mosa Meat Hosts First Cultivated Beef Tasting in the EU appeared first on Green Queen.

This post was originally published on Green Queen.