Florida Republican Gov. Ron DeSantis’s administration is planning to use $92 million of leftover COVID-19 federal relief funds to help pay for a highway interchange, a project that directly benefits one of his major donors, a new report finds. According to The Washington Post, which filed an open records request to uncover much of the information in its reporting, an interchange project near…

-

The marked disruption that characterized the initial years of COVID-19, while distressing and destructive, also bore with it some radical implications. Jarred out of the course of our everyday lives, it seemed as if we might reexamine our assumptions and perhaps demand that the limited state assistance on offer continue, or even grow? So it had seemed, but those possibilities were soon foreclosed.

This post was originally published on Latest – Truthout.

-

During the pandemic, hundreds of billions of dollars in federal aid from both the Trump and Biden administration flowed to state and municipal governments, allowing for assistance to struggling businesses, expansion of unemployment benefits, emergency assistance for schools, and public health needs. This also became an unexpected time of power for workers, as tight labor markets gave them greater…

This post was originally published on Latest – Truthout.

-

By: Josiah Bates

In the wake of the economic crisis driven by the COVID-19 pandemic, cities explored universal basic income programs to help those affected financially.

Guaranteed income was a lifesaver for one single Atlanta mother.

When the city of Atlanta launched the Income Mobility Program for Atlanta Community Transformation (IMPACT) last January, this Black 29-year-old mother of two, who requested anonymity, says she applied for the program the moment she heard about it.

“Every day was a struggle,” said the young woman who earns about $18,000 a year working at a department store. “I have two kids. I work as much as I can, and it still wasn’t enough.”

The IMPACT program provides $500 a month to qualified residents who are at least 18 years old and have an income that is up to 200% of the federal poverty line which was $13,590 in 2022. The young mother started getting payments last March and used the money for necessities like groceries, clothing and transportation. She’s even saved a little bit of money.

“This has meant everything to us this past year,” she says.

But she and hundreds of poor Black families are about to lose that small safety net.

Several guaranteed income pilot programs, including ones in Chicago and Atlanta, are scheduled to end this year, despite encouraging data that shows how important they’ve been. The mom in Atlanta is scheduled to receive her last payment in March. She has not heard anything about the city extending the program. Atlanta officials did not return phone calls about the future of the pilot.

In the wake of the economic crisis driven by the COVID-19 pandemic, cities explored universal basic income programs (or more appropriately guaranteed income plans) to help those affected financially. The programs provide cash payments to low-income families.

At least 45 cities in the country started some kind of guaranteed income pilot program in 2020 or a few years preceding. The number of programs increased in the pandemic’s wake. Generally, a lottery determines recipients from a pool of eligible applicants. Payments vary from $200 to $1,000 a month. Some cities issue bi-weekly payments.

“I was headed towards a deep depression, literally just a week prior to getting the call that I was accepted to the program,” Shamonique Jones, a Newark, New Jersey, resident told ABC News. Jones is a single mother who lives with her four children in a one-bedroom apartment. “I didn’t know how I was gonna get my kids’ uniforms [for school] … I was able to use that to get them their uniforms for school and be able to help us with the holidays and be able to provide Christmas presents for them. It just saved our lives.”

Tashonna, a 24-year-old Louisville woman, told the Courier-Journal that her monthly payment of $500 from the city’s guaranteed income program lightens her burden. “It gives you a really big cushion to just make those decisions. If I have $500, do I still need another job or is this enough for me?”

The pandemic disproportionately affected Black households, a number of which already survived in poverty. Before the outbreak, the unemployment rate for Black citizens in America was just over 6%. By the time COVID-19 hit, it exceeded 16%.

Mayors for Guaranteed Income, a coalition that advocates for more cities to adopt guaranteed income programs, released a dataset that included demographic details and spending information on 20 pilot programs in America. Forty-one percent of the program participants were Black, and 77% of them were women.

Since many of these programs are pilots, they have an end date. Atlanta, which has the highest income inequality among the largest U.S. cities, started its guaranteed income program in early 2022. The Urban League of Greater Atlanta, which did not respond to requests for comment about the program’s future, distributed the funds. The program is scheduled to end this May. The Chicago Resilient Communities Pilot program ends in August. Participants get $500 a month.

“I’m not sure what we’re going to do when we stop getting [these] payments,” the Atlanta mother said. I’m not looking forward to that.”

This post was originally published on Basic Income Today.

-

Originally published by ProPublica. Financial technology firms at the front lines of approving loans through the Paycheck Protection Program — intended to help small businesses survive during the pandemic — lacked fraud controls, chased high fees to the detriment of some borrowers and sometimes exploited their business relationships to arrange suspect loans for the companies’ own executives.

This post was originally published on Latest – Truthout.

-

Senate Republicans on Tuesday threatened to tank a new $10 billion coronavirus relief package unless Democrats allow a vote on an amendment to preserve Title 42, a Trump-era border expulsion policy that the Biden administration is moving to end after months of sustained pressure from immigrant rights groups.

Late Tuesday, Republicans in the upper chamber blocked a procedural effort to begin consideration of the bipartisan Covid-19 aid measure, which includes money to help the U.S. purchase coronavirus test kits, therapeutics, and vaccines. Public health advocates have criticized the bill’s exclusion of funds to combat the pandemic globally.

“I think there’ll have to be an amendment on Title 42 in order to move the bill,” Senate Minority Leader Mitch McConnell (R-Ky.) told reporters ahead of Tuesday’s procedural vote. “There’s several other amendments that we’re going to want to offer, and so we’ll need to enter into some kind of agreement to process these amendments in order to go forward with the bill.”

Senate Majority Leader Chuck Schumer (D-N.Y.) accused Republicans of holding coronavirus relief “hostage for an extraneous issue.”

The GOP’s stonewalling comes as the Biden White House is urgently requesting Covid-19 funding to keep critical pandemic response programs alive. The administration has already been forced to wind down a program that covered coronavirus testing and treatment for the uninsured.

One private testing company, Quest Diagnostics, quickly seized the opportunity to announce that patients without Medicare, Medicaid, or private insurance coverage will be charged $125 for one of its PCR kits.

Politico reported Tuesday that Republican obstruction over Title 42 “could stall for weeks what Biden called much-needed coronavirus aid, unless senators can reach a deal before they plan to leave on Thursday or Friday.”

“Without a breakthrough, the aid won’t be approved until late April or perhaps May,” the outlet noted.

First issued by the Centers for Disease Control and Prevention (CDC) in March 2020 despite internal objections from experts, the Title 42 order allows immigration authorities to quickly expel migrants and asylum seekers at the border, using the coronavirus pandemic as a justification. Such a policy was long advocated by Stephen Miller, former President Donald Trump’s xenophobic immigration adviser.

For months, the Biden administration rebuffed calls from rights groups and legal experts to end Title 42, under which more than a million migrants have been turned away at the southern U.S. border and often sent back into dangerous conditions in their home countries.

Last week, the CDC announced that Title 42 would no longer be in effect as of May 23, outraging anti-immigrant Republicans and drawing objections from some Democratic lawmakers, including Sens. Joe Manchin (D-W.Va.), Mark Kelly (D-Ariz.), and Catherine Cortez Masto (D-Nev.).

It’s not clear whether those Democrats would be willing to vote with Republicans to push a Title 42 amendment into the Covid-19 funding bill.

The inclusion of such an amendment would likely endanger the legislation’s prospects in the House. Late Tuesday, the Congressional Hispanic Caucus (CHC) — which has dozens of members in the lower chamber — said it “opposes any amendment to the Covid relief package that would attempt to reinstate the Trump-initiated Title 42.”

“The pandemic was used as an excuse to implement Title 42 and deny asylum-seekers their legal right to due process,” the CHC added. “Title 42 should not be used as border policy. Instead, we must work to address the root causes of migration, border efficiency, legal pathways to citizenship, and update our outdated immigration laws through immigration reform to address cyclical migration patterns.”

This post was originally published on Latest – Truthout.

-

Former President Donald Trump’s golf resorts in Scotland claimed nearly $4 million in COVID aid from the British government while he was in office, financial filings in the U.K. show.

The ex-president’s struggling resorts, Trump Turnberry in Ayrshire and Trump International Scotland in Aberdeenshire, lost millions last year amid the pandemic (whether counted in dollars or pounds) and received hefty furlough payments after slashing their workforce. The U.S. Constitution’s emoluments clause prohibits federal officials from taking payments from foreign governments, although Trump got around that by ostensibly turning over control of his company to his children while he was in office, although he retained his financial interest in his family-owned companies.

The British government provided the payments after the Turnberry and Trump International resorts reported $8.9 million in losses in 2020. The company’s filings partially blamed the losses on Brexit — the U.K.’s withdrawal from the European Union, which Trump ardently supported — saying it had disrupted supply chains, the BBC first reported.

“Brexit has also impacted our business as supply chains have been impacted by availability of drivers and staff, reducing deliveries and availability of certain product lines,” one filing said, according to The Independent.

The company also blamed the British government’s lockdown policies. Even though 273 workers at the two courses were let go, Eric Trump said in one of the filings that government COVID aid was “helpful to retain as many jobs as possible” but that “uncertainty of the duration of support and the pandemic’s sustained impact meant that redundancies were required to prepare the business for the long term effects to the hospitality industry.”

A review by The Guardian found that the filings show that the two Scottish resorts owe nearly $180 million to Trump personally, even though their combined assets are currently valued only at about $133 million.

Trump opened the Aberdeenshire resort in 2012 after a legal fight with local residents and environmental activists. It has lost money every year since it opened. The Trump Organization bought Turnberry in 2014 for a reported $60 million and said it has spent $150 million to develop it. That resort has similarly failed to post a profit in any year since the Trump purchase.

Those transactions have raised various suspicions over the years. Though Trump has long financed purchases with borrowed money, he ponied up $60 million in cash for the Turnberry property just as he was defaulting on a $640 million loan from Deutsche Bank, and suing the bank claiming an inability to pay. The Avaaz Foundation, a U.S.-based human rights watchdog group, issued a report in 2019 calling on the Scottish government to use its laws against money-laundering to investigate the purchase.

The Avaaz report suggested that Trump had acquired the Turnberry property during a “cash buying spree” and that his transactions had links to “locations highly conducive to money laundering such as Panama and the former Soviet Union.” A Scottish lawmaker in February called for an “unexplained wealth order,” which would allow authorities to investigate where the purchase funds had come from, but that motion was defeated in the Scottish parliament. (Although still part of the U.K., Scotland has its own legislature and considerable autonomy in internal matters.) Avaaz asked a Scottish court to force lawmakers to investigate but a judge ruled against that request last month, while leaving the door open for the parliament to approve a probe if its members chose to.

“I wish to make it clear that I express no view whatsoever on the question of whether the [criminal law] requirements were or appeared to be met in the case of President Trump,” the judge wrote. “Further, for aught yet seen the Scottish Ministers may still make a UWO application in relation to President Trump’s Scottish assets.”

Lord Advocate Dorothy Bain, Scotland’s top prosecutor, will now decide whether to pursue a criminal investigation against Trump or his company.

“The law may have been clarified, but a cloud of suspicion still hangs over Trump’s purchase of Turnberry,” Nick Flynn, the legal director for Avaaz, said in a statement. “By any measure, the threshold to pursue a UWO to investigate the purchase has easily been crossed. The Lord Advocate should take urgent action in the interest of the rule of law and transparency, and demand a clear explanation of where the $60m used to buy Turnberry came from.”

The Trump Organization dismissed the effort as a “ridiculous charade” and “self-indulgent, baseless nonsense.”

Trump, who faces a criminal investigation in Manhattan related to his business practices and a separate probe by the New York state attorney general, is also facing a new criminal investigation by the Westchester County district attorney into the Trump National Golf Club in Briarcliff Manor, New York (about 30 miles north of New York City). Prosecutors are looking at whether the company “misled local officials about the property’s value to reduce its taxes,” according to The New York Times, which is a subject of inquiry for other prosecutors as well, in relation to other Trump businesses.

Former Trump Organization vice president Michael Cohen, who served prison time after pleading guilty to numerous federal charges, testified to Congress in 2019 that it was routine for the company to provide misleading numbers.

“It was my experience that Mr. Trump inflated his total assets when it served his purposes, such as trying to be listed amongst the wealthiest people in Forbes,” Cohen told Congress, “and deflated his assets to reduce his real estate taxes.”

This post was originally published on Latest – Truthout.

-

As the White House prepares for a U.S. Supreme Court order that could invalidate the new federal eviction moratorium, data released Wednesday revealed that state and local governments have disbursed just 11% of the funds that Congress allocated to help pay off debts accrued by renters during the Covid-19 pandemic.

According to the U.S. Treasury Department, which oversees the Emergency Rental Assistance Program, only $1.7 billion was distributed in July. The New York Times reported that last month’s amount “was a modest increase from the prior month, bringing the total aid disbursed thus far to about $5.1 billion.” That’s a small fraction of the $46.5 billion that Congress appropriated for rental assistance in two coronavirus relief packages passed in the last year.

“This is unacceptable,” Rep. Mondaire Jones (D-N.Y.) said in response to the new figures. “We fought to extend the eviction moratorium to give states a chance to distribute these funds, but time is of the essence.”

Just weeks ago, a group of progressive lawmakers led by Rep. Cori Bush (D-Mo.) held overnight rallies outside the Capitol to pressure President Joe Biden to extend the Centers for Disease Control and Prevention’s nationwide eviction moratorium. While Biden let the previous CDC order lapse on July 31, sustained direct action pushed his administration to implement on August 3 a new, more limited 60-day ban on evictions to give state and local governments more time to distribute rent relief.

Jones said Wednesday that “states… must immediately get these funds to renters with the urgency this crisis demands.”

The Times noted that the new data came as the Biden administration “mapped out policy contingencies if the Supreme Court strikes down the moratorium, which is the administration’s principal safeguard for hundreds of thousands of low-income and working class tenants hit hardest by the pandemic.” The White House anticipates a decision as soon as this week.

According to the Times, Treasury Department and White House officials said during a Tuesday night conference call that while some progress has been made this month, states are delivering rental aid at such a slow pace that an eviction surge is likely even if the high court allows the new ban to continue until its scheduled October 2 expiration date.

The newspaper added:

On Wednesday, the Treasury Department rolled out a slate of incremental changes intended to pressure states to move more quickly. But administration officials continue to blame the program’s struggles on local officials, many of whom are reluctant to take advantage of the program’s new fast-track application process, which allows tenants to self-certify their financial information.

In recent weeks, local officials have complained that moving too fast on aid applications could lead to errors, fraud, and audits; the White House has countered by telling them those risks are insignificant compared with a wave of evictions hitting tenants who did not get their aid quickly enough to keep a roof over their heads.

Journalist Brian Goldstone argued that the unwillingness of local agencies to expedite the allocation of funds, including by giving money directly to renters, means that “they trust landlords — but not tenants — to tell the truth.”

The program's failure is being "blamed on local officials, many of whom are reluctant to take advantage of the fast-track application process, which allows tenants to self-certify their financial information."

Translation: They trust landlords—but not tenants—to tell the truth. https://t.co/So2V8Il1Pj

— Brian Goldstone (@brian_goldstone) August 25, 2021

The Times noted that many landlords “have rejected the federal aid, arguing that evicting nonpaying tenants is not only their right but the most effective way of ensuring their revenue is not interrupted in the future.”

Matt Ford of The New Republic called the situation “a colossal failure of governance.”

This post was originally published on Latest – Truthout.

-

Last June, with the spectre of a COVID catastrophe looming over Palestinians, Canada’s largest private relief agency refused a $165,000 donation for emergency medical support in the Occupied Territories.

The rejected funds were the product of a months-long fundraising effort by the Canadian Palestinian Organizations Coalition (CPOC) and the CJPME Foundation: an independent charity launched by my human rights education and advocacy organization Canadians for Justice and Peace in the Middle East (CJPME), which is dedicated to “enabling Canadians of all backgrounds to promote justice, development and peace in the Middle East” in accordance with international law.

The groups approached World Vision Canada (WVC) about the donation last April, and were told by the director of Fragile and Humanitarian Programs that the relief agency was “definitely open” to discussing the “possibility of a partnership.”

Yet after two months of an initially encouraging back-and-forth, WVC announced that it would not be accepting the grant — even though World Vision staff on the ground in Palestine had earlier affirmed that “there is scope for more assistance in the health sector.”

“Assistance” is desperately necessitated, in fact, by the evisceration of the Palestinian health sector under Israel’s occupation policies and periodic military assaults, which have left hospital beds, ventilators, vital medicines, and access to clean water and electricity in perilously short supply.

In a subsequent meeting in October with the rejected donors, WVC CEO Michael Messenger explained that there was a previously unannounced organizational “freeze” on all external grants for the West Bank, Jerusalem and Gaza: an extraordinary condition, which he admitted applies exclusively to Palestine.

The decision to refuse the donation was not determined by general World Vision International policy, but at the discretion of the Canadian office. According to a recording of the meeting, Messenger acknowledged that the decision “came right up to [his] desk” and was made “on the fly,” impelled by a desire to “take a risk-averse approach” and “keep a lower profile during this time.”

According to Messenger, WVC implemented the freeze due to Israel’s ongoing prosecution of former World Vision Gaza Operations Manager Mohammad El Halabi, further compounding the injustice of the prosecution by depriving Palestinians collectively of aid.

Israeli security services have accused El Halabi of funnelling seemingly impossible sums of money from World Vision to Hamas, amounting to more than twice the charity’s operating budget in Palestine for the previous 10 years.

Independent audits by World Vision International, the Australian and German governments, and the U.S. Agency for International Development all failed to find any evidence of financial impropriety on El Halabi’s part. When questioned about the improbable math behind the case, an Israeli government spokesperson responded that the exact numbers are “not really relevant.”

Also irrelevant in Israel’s eyes, apparently, are basic due process guarantees for the accused, who has been subjected to one of the longest security trials of a Palestinian in Israeli history — 165 hearings so far over more than five years. El Halabi was tortured and detained incommunicado without access to a lawyer for 50 days, his lawyer has been denied access to key pieces of the prosecution’s “evidence,” and defence witnesses from Gaza have been barred entry into Israel for testifying.

Undeterred by the paucity of the evidence, the judge presiding over the trial advised El Halabi that he should just plead guilty since there is “little chance” he will not be convicted — a Kafkaesque demand to which he has refused to acquiesce.

Following El Halabi’s indictment, Israel’s Foreign Ministry initiated a campaign to “spread the news among liberal and religious groups who support World Vision,” and discredit the humanitarian aid sector in Gaza as a whole. The fires of this witch-hunt have long been stoked by Israel advocacy organizations Shurat HaDin (the Israel Law Centre) and NGO Monitor — contributions to both of which continue to flow freely, lubricated by charitable tax status in Canada and the U.S.

Despite the pressure exerted by the El Halabi trial, other World Vision branches — specifically World Vision Germany — have continued to accept grants for Palestine, according to Messenger himself.

Indeed, the United Nations Office for the Coordination of Humanitarian Affairs’ Financial Tracking Service has recorded four significant grants to World Vision globally for its work in the Occupied Territories since the onset of the trial in 2016. Two of them — $500,000 from the Bill and Melinda Gates Foundation in 2019, and $588,928 from the European Commission’s Humanitarian Aid and Civil Protection Department in 2020 — are marked as new commitments.

In 2020, World Vision’s field office for the West Bank, Jerusalem and Gaza reported spending over $2 million to support West Bank schools, including $981,927 for COVID response: the precise need which the $165,000 raised by the CJPME Foundation and CPOC was intended to fulfill.

Just days after Messenger insisted there was a “freeze” on Palestine, World Vision Canada itself finalized arrangements with ultramarathoner Russell Lavis for a fundraiser to “support [them] in their work to protect in West Bank, Gaza, and Jerusalem,” which ultimately raised almost $10,000. This suggests that the supposedly general “freeze” may have been a more targeted chill against Palestine solidarity and advocacy organizations.

When asked about the apparent discrepancy, WVC responded that the restriction was not in fact a blanket one, as originally communicated, but only covered “large organizational grants in the region.”

“For two months, we met inexplicable delays, were falsely told that ‘administrative steps’ had to be conducted, and were seemingly falsely told that a ‘freeze’ on external grants for the [Occupied Palestinian Territories] was in place,” the CJPME Foundation and CPOC wrote in a complaint to Cooperation Canada, an umbrella group of international development and humanitarian organizations including World Vision Canada. “While no charity is obliged to accept all grants, WVC has failed to do so in a way which is clear, consistent and justifiable.”

The complaint outlined several apparent breaches of the Code of Ethics to which all Cooperation Canada members are required to adhere — including lack of transparency with donors, lack of accountability to on-the-ground partners in Palestine and failure to act with fairness.

WVC’s behaviour also possibly violated the four internationally recognized principles of humanitarianism: impartiality (non-discrimination on the basis of nationality, race and religion); neutrality (between opposing parties in a conflict); independence (from political, economic and military objectives); and humanity (to relieve human suffering wherever it is found).

Yet after discussing with WVC, Cooperation Canada informed the complainants that it “will not be pursuing this topic further,” dismissing it as a matter of “miscommunications” and “misunderstandings.”

In a prior meeting with the CJPME Foundation and CPOC, Cooperation Canada CEO Nicolas Moyer even proposed that by declining the donation from Palestinian and Palestine-solidarity organizations, WVC may have upheld rather than compromised its neutrality and impartiality.

WVC’s decision may have been “a way to demonstrate in fact neutrality and impartiality, by taking away the risk of being associated to other influencers,” Moyer said, according to a recording of the meeting. “Whether they passed judgement on CJPME, I don’t know…. But does that actually mean they didn’t live up to impartiality and neutrality principles? It may mean the reverse.”

Perversely, support for Palestinians’ basic rights under international law is cast as a sign of partiality rather than impartiality. “Neutrality” is deployed, yet again, as a shield for the status quo — one in which political solidarity with Palestinians is systemically repressed.

In Canada, as across North America and Europe, lawyers, academics, trade unions, teachers, students, journalists, artists and human rights organizations — including CJPME — have been smeared, physically attacked, threatened with professional disciplinary measures and censored for advocating for justice for Palestinians: the “Palestine exception” to free speech.

Last year, the University of Toronto’s Faculty of Law rescinded a job offer to international human rights scholar Valentina Azarova after a sitting judge complained about her research on Israel/Palestine; and in May, the Canadian Judicial Council refused to remove the judge involved for bias: the “Palestine exception” in justice.

As the WVC case illustrates, there is also a “Palestine exception” in aid, produced and perpetuated by multiple layers of oppression.

First is Israel’s occupation — which creates the need for aid to Palestinians in the first place. The occupation sucks billions of dollars from the Palestinian economy each year, as documented by the UN Conference on Trade and Development, rendering 50 percent of Palestinians dependent on aid. Meanwhile, Israel has abdicated its legal responsibility as an occupying power under the Geneva Conventions to protect the welfare of the occupied. For instance, during the pandemic, Israel has widely vaccinated its own population but refused to provide vaccines for Palestinians: a state of “medical apartheid” further intensified by Israeli forces’ destruction of hospitals and the only COVID testing lab in Gaza in May.

Second is the demonization and securitization of the humanitarian sector that steps in to fill the void — emblematized by Israel’s Potemkin trial of El Halabi for terrorism, and general targeting of humanitarian and human rights workers as “terrorists in suits.”

Third is the co-optation of international donors into propping up the occupation — whether by providing better paving for apartheid roads, or reinforcing Israel’s roadblocks to support for Palestinians. Ultimately, aid is not only a “lifeline” for Palestinians — which Israel boasts of generously permitting — but also a cash pipeline for Israel: 78 percent of international funding to Palestine ends up back in the Israeli economy, covering at least 18 percent of the costs of the occupation.

Fourth is the skewed regulation of charities in countries like Canada and the U.S. — so that while donations to Palestinians have been prevented, or even punished as “terrorism,” tax-deductible contributions to organizations bolstering the occupation (Shurat HaDin, NGO Monitor and others) are effectively subsidized by the state.

And fifth is the pervasive racism and dehumanization against Palestinians — which sustains and normalizes this pathological situation.

In the words of critical geographer and development scholar Omar Jabary Salamanca, aid is used to “lubricate the prison-door hinges of settler occupation,” while efforts to dismantle the prison continue to be harshly suppressed.

Disclosure: Azeezah Kanji is on the board of Canadians for Justice and Peace in the Middle East, but was not involved in the events described in this article.

This post was originally published on Latest – Truthout.

-

Last week, the Urban Institute released stunning data on how the huge infusion of government assistance to counter the economic effects of the pandemic had reduced poverty in the U.S. The researchers found that because of enhanced unemployment benefits, rent assistance, eviction moratoriums, increased access to food stamps, tax credits and stimulus checks paid directly to families, the U.S. poverty rate (a conservative, and at times inadequate, estimate of poverty, but one used by poverty scholars for generations) had plummeted to a projected 7.7 percent for 2021. This contrasts with an official poverty rate, calculated by the U.S. Census, of 10.5 percent in 2019; and an Urban Institute estimate that by the end of 2020, the poverty rate had declined to 9.5 percent, largely because of federal and state government interventions to support the income of huge numbers of Americans. That trend continued into 2021: The Urban Institute researchers concluded that child poverty has now declined to 5.6 percent, a far lower number than ever previously recorded in the U.S.

On one level, the data was entirely counterintuitive. After all, as the COVID crisis has raged the past 18 months, we have witnessed Great Depression-era level spikes in unemployment and unprecedented increases in housing and food insecurity. On the other hand, it oughtn’t to have been entirely surprising, because in 2020 and 2021, Congress, despite its general dysfunction, managed to pass into law several pandemic relief packages worth trillions of dollars — and much of that money ended up flowing, often at speed, to households around the country.

The lesson is clear: Ambitious, outside-the-box government programs and investments can be extraordinarily effective in helping vulnerable Americans escape poverty. The Urban Institute’s research concludes that absent these interventions, the poverty rate at the end of 2020 would have been above 20 percent of the population.

There’s a historical precedent for big-thinking and big-spending government programs successfully driving down the poverty rate: At the height of the “war on poverty,” in the 1960s and early 1970s, the United States also began posting huge drops in the number of residents living in poverty — though at a slower pace than occurred in 2020 and 2021.

From 1964 to 1973, from the year Lyndon Johnson began putting in place the building blocks of his anti-poverty programs to the year that Richard Nixon began shifting the emphasis away from these programs and toward more punitive social policies such as the “war on crime” and the “war on drugs,” poverty in the U.S. declined by 42 percent.

But, as political priorities shifted, and as the moral language around poverty morphed from the LBJ-era notions of poverty being a societal problem to the Reagan-era notions of poverty being the fault of poor people’s behavior and choices, the needed investments in social infrastructure began to wane. From the 1970s on, for most groups of Americans, the poverty rate either plateaued or increased. The numbers waxed and waned somewhat, but by and large, for most of the past half-century, with the exception of dips in 2000 and in 2018-19 triggered by historically low levels of unemployment, between 12 and 15 percent of Americans in any given year have lived in poverty — with a shockingly large number of those living in what economists term “deep poverty,” where their incomes only take them to (at most) half of the poverty threshold, and where significant physical and mental health impacts are most likely to occur.

Of course, poverty has never been distributed evenly. Thanks to this country’s foundations in slavery and colonialism and its ongoing practices of systemic oppression, African American, Indigenous and Latino communities have long had far higher poverty rates than whites. And until the most recent anti-poverty interventions, young people, especially those living in single-parent households, were more likely to live in poverty than were older Americans.

In fact, during these decades, for the elderly — who benefited from the creation of Medicare and a series of other targeted efforts — poverty plummeted, and continued to decline even after the broader war on poverty ended. At the start of LBJ’s anti-poverty efforts, more than one in four seniors lived below the poverty line. A half-century later, with Medicare, Supplemental Security Income and other benefits having been cemented into the social compact, fewer than 1 in 10 seniors were in similar straits.

Of course, some of this data should be taken with a grain of salt: For decades, experts have critiqued the government’s definition of poverty, and the threshold that it uses to determine whether individuals and families are income-insecure as failing to fully measure economic hardship. Most poverty measures used by the federal government don’t, for example, fully take into account the high cost of housing in states such as California or New York; nor do they fully recognize that things such as affordable broadband access are now necessities of life rather than luxuries. Certainly, during the Trump era, falling official rates of poverty masked deepening fissures of inequality and deepening financial straits faced by those at the bottom of the economic pyramid.

When the government invests in anti-poverty programs, across-the-board measures of poverty show that these programs can work to improve the financial condition of millions of Americans. Yet, despite that, too often those programs fail to sustain popular support over the long-term.

In fact, historically, across-the-board anti-poverty programs have only ever attracted lukewarm political support from U.S. leaders. Poverty embarrasses those in power. They don’t like to talk about it or admit its durability. In the 1960s, the sociologist Michael Harrington wrote of a poverty that was rendered invisible by the broader affluence that hemmed it in. As a society, we have, over the decades, been remarkably willing to sweep our poverty crisis under the rug and pretend it doesn’t exist.

Harrington’s book, The Other America, helped trigger a political and cultural awakening around poverty. It helped open eyes and create the conditions in which it was possible to put in place interventions such as Medicare and Medicaid, an expansion of food stamps, free and reduced school meals, increased job training and housing programs in poor neighborhoods, and so on. But, over time, the public’s appetite for these programs — and the costs of maintaining them — waned, and poverty rates began creeping up again.

Today, in 2021, the country has a huge opportunity. Out of the pandemic, remarkably creative economic and political thinking has emerged about how to reduce poverty. Federally, one-year child tax credits are now in place that will massively reduce child poverty this year. At a state level, states like California are implementing universal pre-K education. Ideas around creating guaranteed income programs are no longer dismissed as being utopian or un-implementable. A dramatic expansion of unemployment benefits was shown not only to be possible, but to be remarkably effective at keeping unemployed people afloat economically.

Yet all of these changes are as fragile as were so many of the programs of LBJ’s war on poverty. Already, Republican states have dismantled their expanded unemployment benefits. Already, Congress and President Biden have allowed the federal eviction moratorium to sunset — despite millions still struggling to pay their rent. Already, there is a political battle underway about whether or not to continue the child tax credits beyond this current year.

Take these tools away, and poverty could all too easily boomerang back up to pre-pandemic levels within months. That would be a tragedy of historic proportions — and an entirely avoidable one at that.

This post was originally published on Latest – Truthout.

-

Across the country, an unprecedented combination of stimulus checks and tax credits is helping families to weather the longstanding impacts of the Covid-19 crisis.

By: Brigid Boyd

Across the country, an unprecedented combination of stimulus checks and tax credits is helping families to weather the longstanding impacts of the Covid-19 crisis. Families are using these funds, which are being deposited directly into their bank accounts, to pay rent, utilities, medical bills, and to go to grocery stores instead of food pantries.

Locally, the City of Chelsea is giving its most vulnerable residents another form of “no strings attached” assistance.

Through a partnership led by the Shah Family Foundation, United Way of Massachusetts Bay and Merrimack Valley, and Massachusetts General Hospital, 2,000 families are receiving $200–$400 per month in the Chelsea Eats “guaranteed income” pilot to help pay for their essential needs.

The heart of both efforts is the same – in the context of crisis, both are addressing the essential needs of vulnerable people not typically served by our social safety net and doing so in ways that keep funds spent in the local economy where they will benefit small businesses.

“SOMETHING HAD TO CHANGE”

Even before the pandemic, more than 60% of Chelsea residents were food insecure and nearly 1 in 5 were living in poverty. At the onset of the crisis in March 2020, the City of Chelsea began distributing 800-900 pounds of food per day to 10,000 residents.

But as he looked out at the lines for food and ahead to the cold winter months, Chelsea City Manager Tom Ambrosino knew something had to change.

“This was an undignified way for people to meet their needs,” Ambrosino said. “To see lines wrapped around the building, to see frail, elderly people waiting outside just to be handed a heavy box of food to carry home, we thought, there has to be a more humane way to meet this need.”

The Shah Foundation, City of Chelsea, United Way and Massachusetts General Hospital seeded Chelsea Eats.

More than 3,600 eligible Chelsea residents applied for the program, and 2,000 were selected by lottery to receive a pre-paid debit card with $200-$400 per month.

The Shah Foundation also partnered with Jeff Liebman of the Harvard Kennedy School to conduct the research and evaluation of the project.

CAN CASH ASSISTANCE REDUCE POVERTY AND IMPROVE FOOD INSECURITY?

The short answer is yes.

During a recent CommonWealth Town Hall co-hosted by United Way, the Cambridge Community Foundation and the Shah Family Foundation and moderated by CommonWealth Editor Bruce Mohl, Liebman shared his research and findings to date:

- In September 2020, 89% of those participating in Chelsea Eats reported they had lost their job or had their hours reduced.

- Over 50 percent of the Chelsea Eats participants reported sometimes or often not having enough food to eat, compared to 7 percent statewide.

“The job loss carried right over into food insecurity, Liebman said. “I have never seen a US population before with this level of food insecurity.”

- When the participants were surveyed again in December 2020, the number of residents who reported sometimes or often not having enough to eat dropped from over 50 percent to 26 percent.

- The transactions were also reviewed as part of the research and evaluation. Overall, more than 75 percent of the money was spent on food; more than half of that was spent locally in Chelsea-based markets, while another 17% in neighboring communities of Revere and Everett.

“The issue isn’t that people don’t know how to manage money, the issue is that they do not have money to manage,” said Michael Tubbs, founder of Mayors for Guaranteed Income.

CAN $400 A MONTH CHANGE LIVES?

Sarah Arnan works at GreenRoots, one of United Way’s partners in Chelsea. Arnan helped to identify eligible families to participate in Chelsea Eats, and says giving people cash can change lives.

“It is empowering,” Arnan said. “It is an investment in community members, in trust and in agency. It is saying to them that we trust you are making the right decisions for you and your family. We know that you ultimately know what is best for yourselves.”

“People don’t realize how far people in need can make $400 a month stretch,” added Bob Giannino, President and CEO at United Way of Massachusetts Bay and Merrimack Valley. “It can be a lifeline, and lifesaving, to help meet needs that are unexpected.”

Liebman will continue his research throughout the summer to determine whether residents who receive the food debit card end up better off financially than those who do not over the course of the pilot. If yes, the study will also look to quantify by how much – and in what ways – the card recipients are better off than the control group of non-recipients.

The study will also capture how residents’ lives are impacted by the additional money over time. It will focus on measuring outcomes in food access; nutrition, saving; spending behavior, impact on work (flexibility to choose a safer job, better hours, better commute), debt, family support, and increased time with children.

“IT’S A SIMPLE CONCEPT.”

“The way we have been administering public assistance for 50 years since we launched the War on Poverty is not working,” said United Way’s Giannino. “We’ve lost the war, and now it is time to rethink how the safety net and benefits are deployed.”

United Way is particularly committed to this work because it builds on the deep involvement United Way has led with the City of Chelsea and community-based organizations since last April through the One Chelsea Fund. To date, the One Chelsea Fund has raised more than $1.3 million and has provided financial assistance to more than 4,100 households in Chelsea.

The City of Cambridge also recently announced it will pilot a guaranteed income program in partnership with the Cambridge Community Foundation for 120 single caregivers beginning in August.

“Our mission is to amass a body of evidence to demonstrate that guaranteed income is the best investment you can make in human potential,” said Cambridge Mayor Sumbul Siddiqui. “Poverty is a policy failure, not a personal failure.”

Covid-19 has illuminated and widened existing cracks in our human services safety net and education system like no other point in time in our history. But it is also a once-in-a-generation opportunity to reimagine how we meet the needs of our most vulnerable residents and empower our communities to emerge stronger, equitable and more prepared for the future.

“This is one of those moments, one of those opportunities,” said Giannino.

“What’s so appealing about guaranteed income is that it is not a patchwork of programs wrapped in bureaucracy, each tailored to meet a specific need with government restrictions,” said Jill Shah, President at the Shah Family Foundation.

“It’s a simple concept,” Shah added. “It is administered with virtually no red tape or administrative costs. It gets money directly to people who need it most and empowers them to spend it in ways that best meet their needs. It also may be the single most effective way to stimulate local economies at a time when that is more important than ever.”

Learn more by watching the full CommonWealth Town Hall: Does Giving People Money Make for Good Policy? Assessing the Impact of Guaranteed Income, cohosted by United Way, or read Commonwealth Magazine’s coverage of the event.

The post Monthly unconditional cash program in Chelsea has cut food insecurity in half appeared first on Basic Income Today.

This post was originally published on Basic Income Today.

-

Late last summer, after churning along through the pandemic with only a two-week pause, managers at FreightCar America called hundreds of workers into the break area at the company’s factory near Muscle Shoals, Alabama, to tell them that the plant was closing for good.

For some employees, the news wasn’t a shock: They’d been hearing rumors that management would move the work elsewhere for years. The timing, however, seemed odd. Only a few months earlier, the publicly traded company had received a $10 million Paycheck Protection Program Loan — the maximum amount available under a pandemic relief program designed to keep workers employed. Some had believed the funds would keep the doors open for a little while longer.

Nevertheless, the plant’s managers announced that all production would move to FreightCar’s new facility in Mexico, which meant most of the assembled workers would lose their jobs.

Jim Meyer, FreightCar America’s CEO, told ProPublica in an email that he had not intended to shutter the plant when he received the PPP money, and that it had allowed the company to keep workers on the job through most of 2020 despite a sharp dropoff in new orders.

Robert Bulman, however, thinks the $10 million just helped FreightCar’s Shoals plant keep producing while company officials got ready to shut it down.

“When the Mexican plant opened, we were told at the beginning they would just be helping Shoals and making parts for the trains,” said Bulman, who worked at the Alabama plant for seven years before getting laid off last year. “But the whole time, it was a setup, we were gone.”

FreightCar America isn’t the only large company to have taken out a multimillion-dollar Paycheck Protection Program loan and then laid off a substantial chunk of its workforce. An analysis of applications for trade adjustment assistance, which the federal government provides to workers whose jobs have disappeared due to imports, shows that at least half a dozen companies that applied for more than a million dollars apiece in PPP loans terminated more than 50 workers in 2020 after their aid was approved.

To be clear, the companies may have complied with program rules, which put a premium on getting money out fast. The regulations changed frequently in the months after the Congress established the PPP as part of the CARES Act in March 2020, and the law was later amended to allow more of the money to be used for non-payroll expenses. The law also contained many exemptions that stretched the definition of what qualifies as a small business.

A paper mill in northeast Washington state called Ponderay Newsprint, for example, went bankrupt and laid off 150 workers, two months after being approved for a $3.46 million loan. Its bankruptcy trustee John Munding said the money was used to pay workers and the government forgave the loan, while the company’s assets were acquired by a private equity firm.

A Nebraska aircraft parts manufacturer called Royal Engineered Composites was approved for $2.74 million in April 2020 in order to support 250 jobs, but laid off 99 workers by mid-May. The company declined to comment.

Canadian-owned Supreme Steel took $1.69 million in May 2020 for its plant in Portland, Oregon, which it closed five months later, terminating 112 employees. Spokesperson Rhandi Berndt said that “the closure was the result of market forces” and declined to answer further questions.

In order for PPP loans to be forgiven, the federal Small Business Administration initially required borrowers to spend 75% of the funds on payroll over eight weeks. Since the maximum PPP loan amount was for 2.5 times companies’ average monthly payroll in 2019, that should have guaranteed that wages and hours could be maintained, as required by the CARES Act.

In the case of FreightCar and some other borrowers, the original eight-week “covered period” of the PPP loan passed before layoffs occurred, allowing the companies to have their loans fully forgiven. But the other cases may have easily qualified as well, because Congress changed the rules.

Last June, after businesses protested that they couldn’t spend their PPP money fast enough in a stalled economy, the legislation was amended to require only that 60% of a loan go toward workers’ pay, and the covered period was extended to 24 weeks. Since borrowers had to spend less of the loan on payroll over a longer period to keep the money, they had wide leeway to let people go as they saw fit.

“It wouldn’t be difficult to lay off 50% of your workforce and still get full forgiveness,” said Eric Kodesch, an attorney at Lane Powell who has helped many clients with their PPP applications.

The SBA has not publicly released data on forgiveness of specific loans, but aggregate statistics show that so far, out of all applications processed, more than 99% of the total dollar value has been forgiven. The SBA declined to comment on individual borrowers or identify loans that have been forgiven.

There’s another reason why a casual reader of the CARES Act might think companies would not qualify for PPP money: Many are actually very large businesses.

In general, the CARES Act set an upper size limit of 500 employees. With a few exceptions, the law required SBA to count all “affiliate” companies toward that total. That would include companies owned by private equity firms as well as subsidiaries contained within holding companies. It exempted hotels, restaurants and franchises, but no other industries. (That’s why Shake Shack and Ruth’s Chris Steak House qualified for loans, though each returned the money after a barrage of negative press coverage.)

However, a number of program nuances allowed large companies to obtain PPP loans.

FreightCar laid off 550 people with the Shoals plant shutdown, according to a notice filed with the state of Alabama. Along with its headquarters employees, that alone would exceed the PPP’s ostensible 500-employee cap. But FreightCar availed itself of a loophole baked into the PPP. The SBA’s alternative size standards, a complex set of industry-by-industry thresholds that have been debated for decades, allowed it to qualify with up to 1,500 workers.

Originally, the SBA allowed foreign-owned applicants to count only their U.S.-based employees under the 500-person cap. That guidance changed last May, requiring foreign-owned applicants to count their entire global workforce. But plenty of companies had already gotten PPP loans, and were allowed to keep them.

For example, Ledvance LLC, a Chinese-owned global lightbulb manufacturer operating in the U.S. under the brand name Sylvania, was approved for a $9.36 million PPP loan in April 2020. Then, between May and July, it laid off 50 people while closing down a distribution center near Bethlehem, Pennsylvania. Ledvance spokesperson Glen Gracia said in an email that the layoffs were “unrelated to the pandemic and in full compliance with LEDVANCE’s participation in the Paycheck Protection Program.”

Then there’s Chick Master Incubator Company, which took $1.34 million in April 2020. In June, its corporate parent — a Zurich-based private office that invests the fortune of a long-established industrialist family — announced it would combine Chick Master with its other hatchery holdings and close the plant, laying off 68 people in Medina, Ohio, by year’s end. Chick Master didn’t reply to a request for comment.

One type of applicant, however, still likely should not have qualified: companies controlled by private equity firms whose total holdings exceed the SBA’s size standard for the borrowers’ specific industries. Cadence Aerospace, a supplier of aerospace and defense parts that itself has bought three companies in the last three years, is majority-owned by Arlington Capital, a private equity firm managing billions of dollars. Cadence was approved for a $10 million PPP loan in April 2020, and later that month laid off 72 people at its Giddens Industries subsidiary in Washington state, according to a notice filed with the state. Arlington Capital did not respond to a request for comment.

The Shoals plant was the last remaining U.S. manufacturing facility for FreightCar, a 120-year-old company headquartered in Chicago that had been shrinking its U.S. footprint for years. In 2008, it shuttered its plant in Johnstown, Pennsylvania. In 2017, it shut down its factory in Danville, Illinois. In 2019, it closed its plant in Roanoke, Virginia and announced it would open a new facility under a joint venture in Castaños, Mexico. When executives informed investors in September that the Shoals facility would also close and manufacturing would shift to Mexico, they projected $25 million in overall savings, including a 60% reduction in labor costs.

“Our manufacturing transformation is now largely complete, and we have taken control of our own destiny,” Meyer said on an earnings call in March. “We have dramatically repositioned our competitive profile and in so doing created a new company, one that is able to win.”

In 2013, the future looked different. When the Shoals plant opened, it offered about $12 an hour to start and a chance at advancement. One worker, who asked not to be named in order to protect her future employment prospects, left a tile-making job to become a welder, constructing a variety of rail cars, from hoppers to gondolas. Soon, she moved up to air brake tester, sliding underneath the massive steel vehicles to fix pipes.

“I went to FreightCar to retire,” said the worker. “I wasn’t planning on leaving when I got there.”

In the following years, safety, pay and management concerns led to a union drive. During the campaign, anti-union employees circulated flyers warning that the plant would shut down if workers voted to organize, and in 2018 they voted decisively against it.

As it turned out, the Shoals facility wouldn’t last long anyway.

Leading up to 2020, FreightCar touted the Shoals plant’s competitiveness. A marketing video showed production lines run by industrial robots and skilled workers. “This is the largest, newest, most purpose-built factory in North America,” boasted Meyer. “A modern, state-of-the-art factory in every sense of the word.”

But the company was still losing money, to the tune of $75.2 million in 2019. When the pandemic further slowed down orders, executives started talking up the new facility in Mexico instead.

“The Mexico labor rate is approximately 20% of that in the U.S.,” Meyer said on an earnings call in August 2020. “And the new plant provides other sources of savings beyond just labor.”

Also on the August earnings call, executives explained that loan proceeds had made up for some of the cost of the company’s move to Mexico. Chris Eppel, then the company’s chief financial officer, said that the money also “partially offset” operating losses and inventory purchases. Meyer still got his $500,000 base salary in 2020, plus stock options worth nearly that and a $1 million bonus for securing a $40 million loan from a private investment company.

FreightCar did not take out a second-draw PPP loan; updated rules excluded publicly traded companies.

After the plant closure announcement, the air brake tester found a job making dashboards and bumpers for Toyota. It takes three times as long for her to get to her new job as the 20-minute drive she had to FreightCar, and she’s paid six dollars less per hour. Although FreightCar gave employees a few thousand dollars in severance payments, she said all of hers went towards bills.

“It’s like starting all over again,” she said. “If they did right by us like they did their supervisors, maybe we’d be in more decent shape than what we’re in now.”

This post was originally published on Latest – Truthout.

-

The third round of coronavirus relief checks, which have been sent to 159 million households so far, were directly linked to an historic rise in household income, according to reporting by the Wall Street Journal.

Household income rose 21.1% in March after President Joe Biden signed the $1.9 trillion coronavirus relief package into law, following months of stonewalling by Republicans, who spent much of 2020 claiming that additional aid to help families struggling to pay for housing and other necessities was unaffordable.

The immediate rise in household income from the previous month represented the largest increase since 1959, the Journal reported, citing data from the Commerce Department’s Bureau of Economic Analysis.

“This is what happens when you opt for investing in working people over trickle-down economics,” said the grassroots organization Tax March.

Stimulus checks and increased vaccination access are fueling this recovery. This is what happens when you opt for investing in working people over trickle-down economics. #BuildBackBetterhttps://t.co/HSpEh7ve5H

— Tax March (@taxmarch) April 30, 2021

Economists expect household income—the amount Americans received from wages, investments and government programs—rose 20% in March from the previous month. That would mark the largest monthly increase for government records tracing back to 1959. https://t.co/LeZnPfYPAa

— Linda Hill (@bulldoghill) April 30, 2021

The report follows two studies conducted last year after the first round of relief checks were shown to markedly alleviate poverty — illustrating the fact that “poverty is a policy choice,” according to advocacy group People for Bernie.

The new data regarding the latest round of checks shows “the fiscal stimulus was a roaring success,” tweeted CNBC reporter Carl Quintanilla.

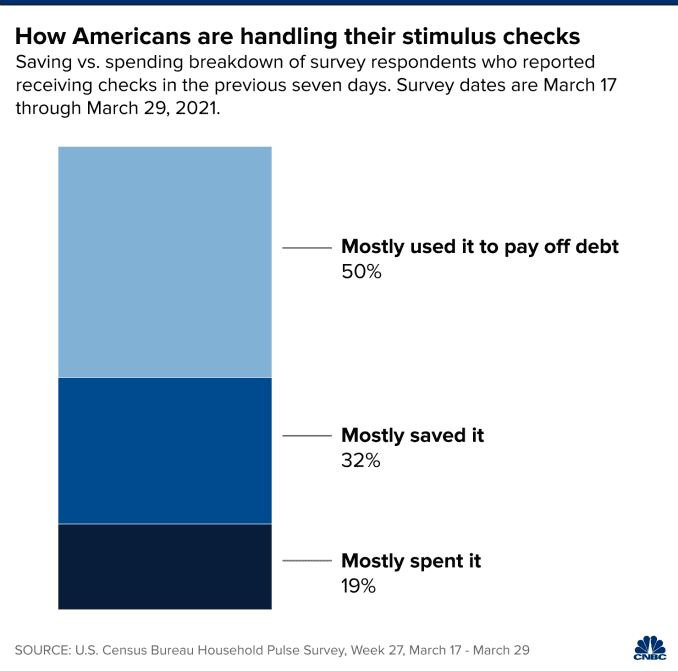

Households were promptly able to save significantly more money following the release of the checks, with the rate of personal savings increasing from 13.9% in February to 27.6% in March, according to the Journal.

Spending rates also saw the largest month-to-month increase since last summer, rising by 4.2%.

“Stimulus checks work,” tweeted Baltimore attorney Katelynn Brennan.

breaking news, stimulus checks work https://t.co/e0SnxHrqPJ

— Katelynn Brennan (@kbrennanesq) April 30, 2021

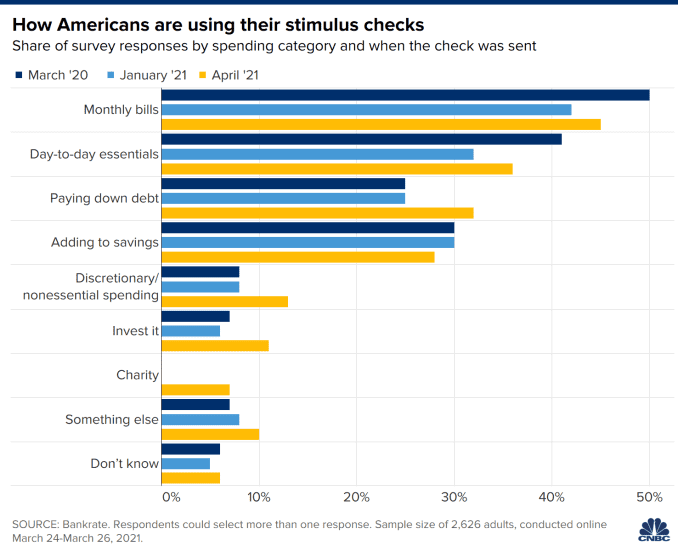

As NBC News reported earlier this month, a plurality of households have been spending their relief checks on groceries, rent, and other necessities. Forty-five percent of respondents to a survey by Bankrate.com said their checks went to monthly bills, while 32% said they were using them to pay down debts.Just 13% reported they were using the money for discretionary spending.

Federal Reserve Chairman Jerome Powell told reporters that while higher rates of spending could drive inflation in the coming months, “an episode of one-time price increases as the economy reopens is not the same thing as, and is not likely to lead to, persistently higher year-over-year inflation into the future.”

“Indeed, it is the Fed’s job to make sure that that does not happen,” Powell said.

This post was originally published on Latest – Truthout.

-

Guaranteed income programs, no matter whom they support, must frequently battle the same zombie ideas.

By Lily Janiak

When the city announced last month that it planned to launch a pilot program to give more than 100 artists $1,000 monthly payments for six months, my hope for all the performers I write about and love was tinged with worry. I frequently see a couple of bad-faith arguments in response to the idea of state support of the arts, and I didn’t want them to hijack the conversation about a promising idea:

- Bad-faith argument No. 1: Artists’ work isn’t real work, and if they can’t support themselves in the market, their art must be mere hobby.

- Bad-faith argument No. 2: If the city is sending unrestricted cash to artists, could any Joe Schmoe throw some finger painting together and become eligible?

The latter is further complicated by the idea that I want Joe Schmoes to have all the access to finger painting that their little fingertips desire; that I believe in all the Joe Schmoes’ potential to, one day, get so good at finger painting as to change the world with it, or at least change their own lives. My challenge, then, is to hold and articulate simultaneously two ideas that can seem contradictory:

Everyone should have access to the arts as leisure, and some professional artists merit public funds for their art as work.

Dorian T. Warren, an expert on guaranteed income, says the concept faces bad zombie arguments that won’t die.

Photo: Community Change,When I shared my concerns with guaranteed income expert Dorian T. Warren, he reminded me of a felicitous phrase from New York Times columnist Paul Krugman: zombie ideas. These are bad arguments that just won’t die, no matter how much data disproves them.

“They’re not grounded in evidence,” says Warren, the president of Community Change and co-chair of the Economic Security Project, both nonprofits, and co-host of the podcast “System Check.”

“They’re grounded in mythology.”

Guaranteed income programs, no matter whom they support, must frequently battle the same zombie ideas. Warren trots them out with a sigh: “It’s going to make people lazy. They’re not going to want to work. They’ll spend it on drugs and alcohol.” All stem from centuries-old prejudices that the poor are poor by choice or moral failing, and that they won’t work jobs unless you punish or force them. Those prejudices mix with racial and gender bias, hence the persistent myth of “the welfare queen,” he adds.

“It really goes to core distinctions of who is deserving and who is undeserving of support, particularly support of the government, and that is related to fundamental notions of who belongs and who doesn’t,” he says.

“Do we think you belong in this political community we call the United States of America? If you don’t, you don’t deserve what the rest of us, who do belong, get.”

That notion of belonging also applies to artists, whom our country frequently demonizes as some kind of “other.” It’s a lot easier to say someone doesn’t deserve to have their basic needs met if you make them out to be fundamentally different from you. It’s a lot easier to say artists don’t deserve a living wage for the TV shows you watch, and the music you listen to, if you write them off as weird or deviant.

Lorrine Paradela, a single mother of two, is one of 125 Stockton residents receiving monthly cash disbursements, with no strings attached, as part of an attention-grabbing experiment on guaranteed income.

Photo: Yalonda M. James, The Chronicle 2019Data from a slew of guaranteed income pilot projects across the country might help weaken, if not defeat, some of these zombie ideas. In addition to San Francisco’s program for artists, Oakland and Marin County both recently announced their own programs for people of color, and in 2019, the city of Stockton launched the Stockton Economic Empowerment Demonstration, a guaranteed income program for 125 city residents.

In Stockton, preliminary results released in March show that not only are these zombie ideas wrong; at times, they’re backward. For instance, guaranteed income recipients were twice as likely to gain full-time employment as a control group, says Sukhi Samra, the director of SEED as well as the director of a new group, Mayors for a Guaranteed Income.

She attributes that finding to two factors: “When you give people $400 or $500 a month, and it’s reliable, not only are they able to do the tangible, physical things, like put gas in their car to get to the job interview, but they also have increased mental capacity for goal-setting,” she says. “When you’re experiencing poverty, and each paycheck’s dollar is accounted for in terms of which bills it’s going to pay, you just don’t have the mental capacity to plan for your future.”

Take all the time our artists spend on hold with the unemployment office, all the brain space they exhaust checking their bank account to make sure they don’t overdraft between freelance payments, all the bureaucratic hoops they jump through to make sure they have health insurance between gigs. Why, in the richest country in the world, do we demand artists waste so many of their resources? What if they could instead spend that time and energy composing a new symphony? Or dreaming up a new artistic form altogether?

Chris Steele in Cutting Ball Theater’s “Utopia.” Steele is among those applying for San Francisco’s guaranteed income program.

Photo: Nic Candito, Cutting Ball TheaterIn Bay Area theater, even artists at the pinnacles of their careers make minimum wage or less. For many, $1,000 per month would help to remove food and housing insecurity. Preliminary data from SEED shows that program recipients experienced not just less psychological difficulty, but less physical pain than a control group.

San Francisco theater maker, drag queen, makeup artist and Poltergeist Theatre Project co-founder Chris Steele is applying to the city’s guaranteed income program partly for those reasons.

“All of the times that I haven’t been able to rise to the occasion of my art have come from the fact that I have to do so many exhausting things in order to just have a roof and food and be able to live,” Steele says.

“That kind of stress, that kind of constant anxiety not only changes your DNA, but it is just antithetical to the spiritual and mental place that you need to be in to create art.”

Poltergeist Theatre Project’s “The Julie Cycle” creators and actors Britt Lauer (left) and Chris Steele in San Francisco.

Photo: Paul Kuroda, Special to The Chronicle 2019Guaranteed income is different from other social safety net programs in that there are no strings attached. Once you’re enrolled, you don’t have to prove anything to keep it and you can spend the money however you want. In Stockton, Samra says, recipients spent their funds on groceries, rent and utilities.

The concept is built on trust, Warren says. We don’t demand corporations spend their subsidies or tax breaks in a particular way, so why do we treat the poor differently?

“That means you don’t trust me,” he says, putting himself in the place of a welfare recipient, “and that means you don’t respect me, and that means I have no dignity.”

Distrust comes from a scarcity mind-set, a sense that resources are scarce and we’re all competing with one another. And who is it that helps us shift to an abundance mind-set? To see the world as full of wonder and possibility and joy?

It’s artists. What a coincidence.

_____

To see original article please visit: https://www.sfexaminer.com/news/sf-launches-guaranteed-income-pilot-program-for-130-artists/

The post As some San Francisco artists get basic income, how do we head off bad-faith arguments against it? appeared first on Basic Income Today.

This post was originally published on Basic Income Today.