Scattered across the United States, hundreds of thousands of abandoned mines scar the earth, posing a safety hazard to passing hikers and a health risk to nearby communities. But cached inside piles of refuse and ponds of toxic waste, there are also elements as critical for the 21st-century economy as coal was for the industrial revolution. Now, an obscure federal government program known as the Earth Mapping Resources Initiative, or Earth MRI, is identifying the high-tech minerals concealed in these mines — as well as those hidden beneath the Earth’s surface.

Developed by the U.S. Geological Survey, or USGS, during the first Trump administration, Earth MRI aims to comprehensively map the nation’s underground deposits of “critical minerals” — an ever-growing list of elements and compounds considered vital for national security and the economy. In 2021, Earth MRI received a massive funding boost through the bipartisan infrastructure law, accelerating federal scientists’ efforts to figure out which parts of the country are rich in minerals used in clean energy technologies, semiconductors, and high-tech weaponry. While the Trump administration has moved aggressively to reverse most of former President Joe Biden’s climate policies, it appears to agree with the prior administration’s desire to locate — and, eventually, mine — more of these resources.

Many Biden-era climate and energy initiatives remain in limbo following the Trump administration’s freeze on the disbursement of grant funding and mass firing of federal employees — but Earth MRI got an early greenlight to resume operations.

“This is a program that has survived both the Trump and Biden administrations,” Peter Cook, a critical minerals policy expert at The Breakthrough Institute, an environmental solutions research organization, told Grist. “They’re both definitely interested in critical minerals.”

USGS

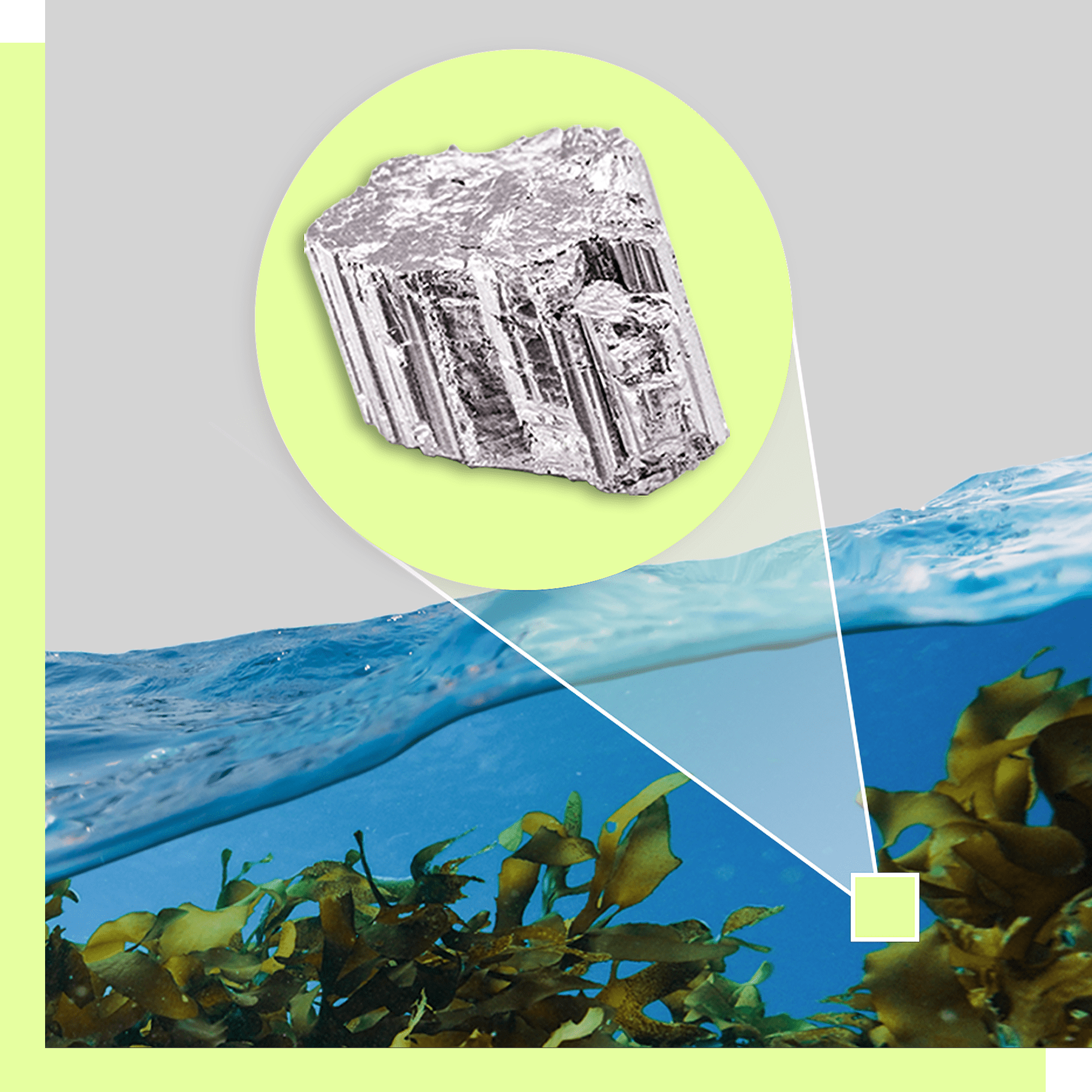

Minerals like lithium, graphite, and the group of 17 metallic elements known as rare earths are essential for a wide range of technologies, including those at the heart of the clean energy transition. The lithium-ion batteries that store renewable energy and power EVs can contain lithium, graphite, nickel, cobalt, manganese, and more. Electric vehicle motors and some wind turbine generators contain magnets that require the rare earth element neodymium, and often smaller amounts of dysprosium and terbium. Certain solar panels require gallium, germanium, indium, and tellurium. The clean energy sector’s appetite for these metals is expected to surge as the energy transition accelerates: A recent report by The Breakthrough Institute found that EVs alone may account for two-thirds of future national demand of many key minerals. At the same time, critical minerals are vital for high-tech military technologies, advanced semiconductors, and more.

Despite these diverse needs, U.S. output of many minerals is limited. A 2020 report by the Commerce Department found that of an initial list of 35 critical minerals, America’s supply of 31 of them came mostly or entirely from foreign sources. Production of many critical minerals is dominated by China, which is engaged in a trade war with the United States that has involved tariffs and export restrictions on several metals. For some particularly scarce metals like gallium, used in advanced semiconductors, the U.S. has no domestic production at all.

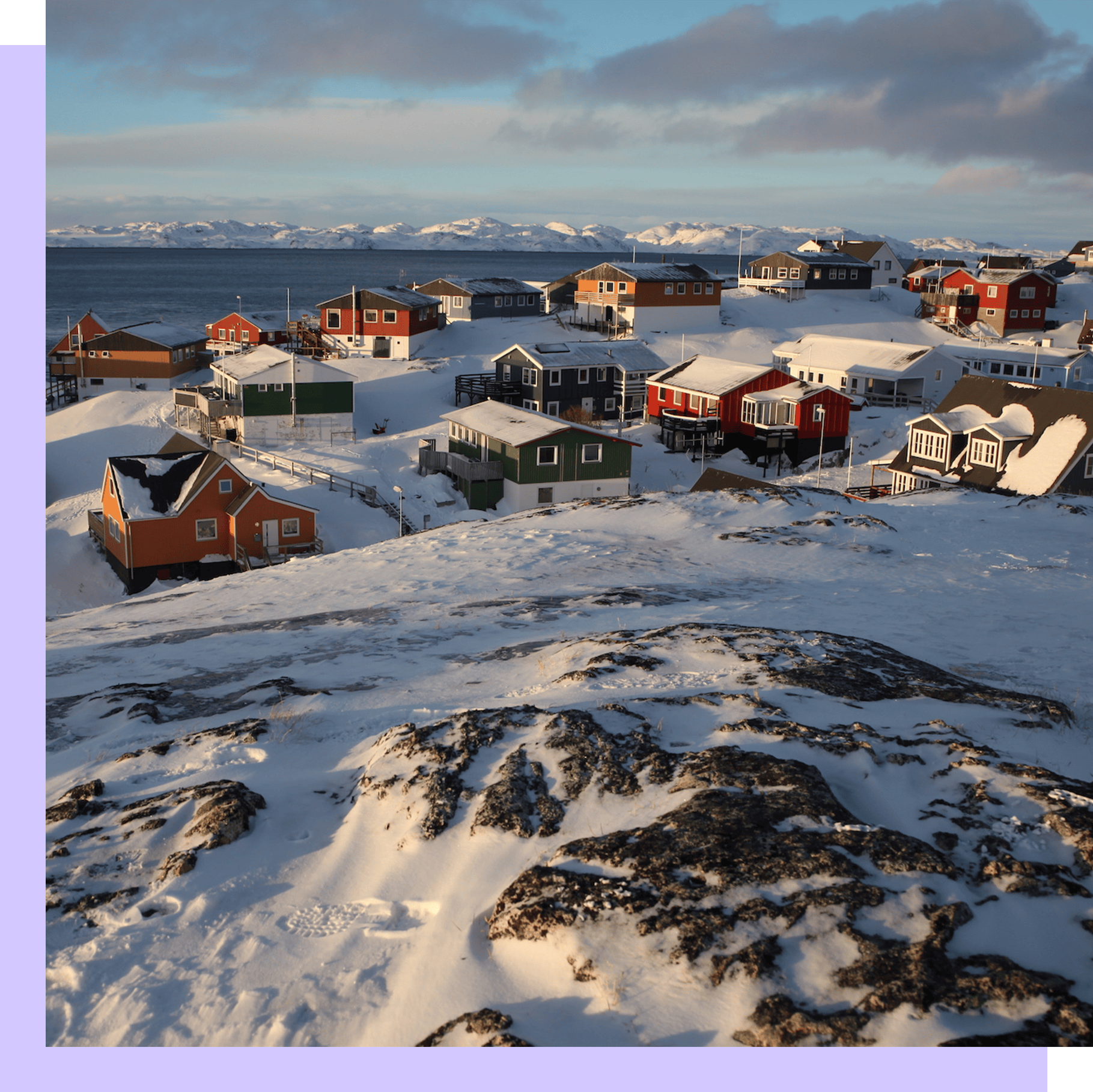

While Biden saw domestic mineral supply chains as a key pillar of a U.S. clean energy manufacturing economy, Donald Trump’s interest in critical minerals appears more related to their military uses and national security implications. That interest can be seen in everything from a foreign policy focused on mining deals to a domestic agenda that includes cutting bureaucratic red tape to fuel additional mineral extraction. While Earth MRI hasn’t garnered the same level of attention as, say, Trump’s desire to buy Greenland for its rare earth resources or bargain with Ukraine for its minerals in exchange for military aid, the existence of the program reflects a long-standing focus on shoring up U.S. mineral supplies.

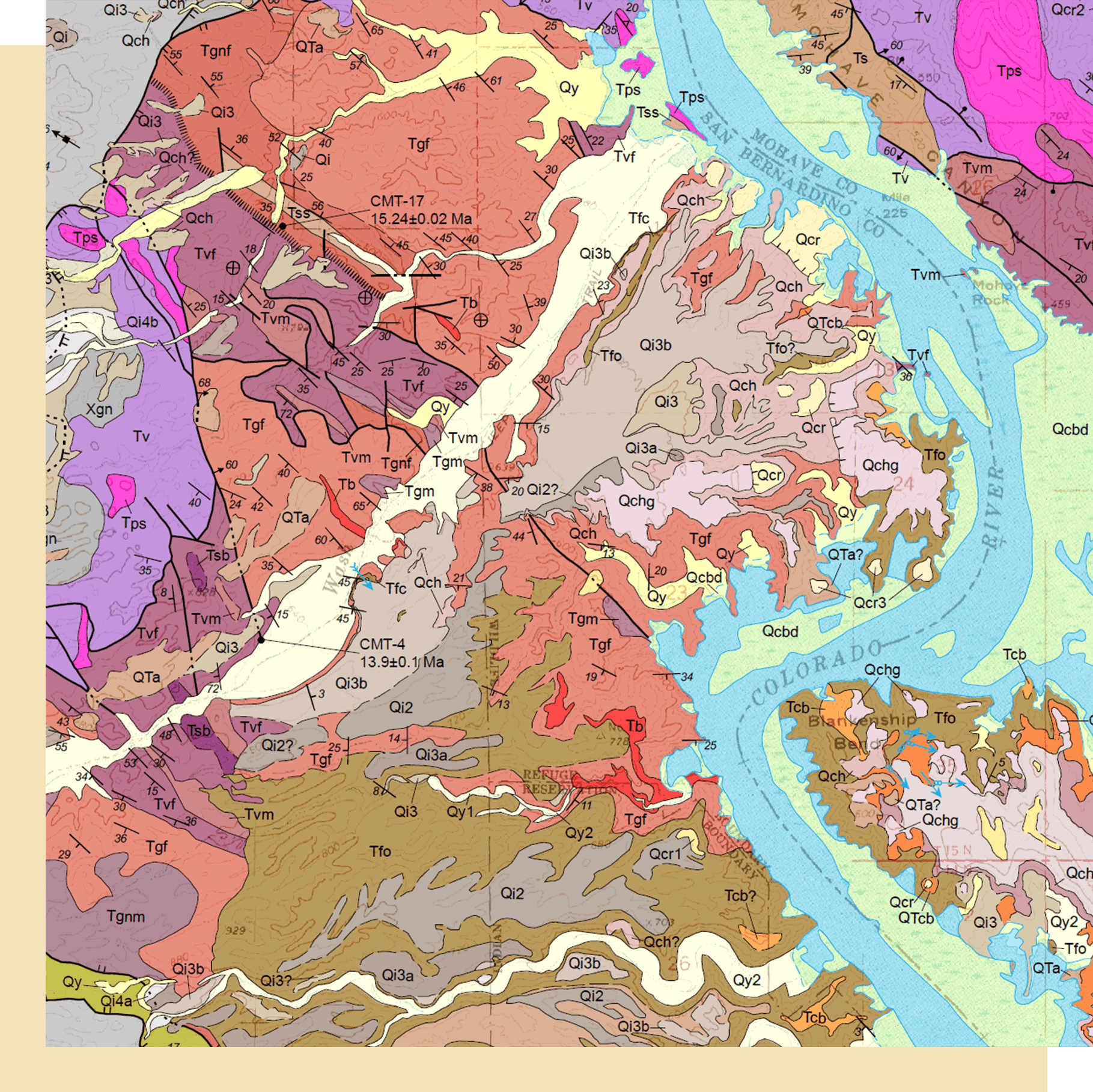

The USGS established Earth MRI in 2019, following a Trump executive order that called on federal agencies to address vulnerabilities in the nation’s critical mineral supply chains. Initially, the program had a modest annual budget of about $11 million, which USGS scientists, in partnership with state geological surveys around the country, used to launch a national critical minerals mapping campaign that included a mix of airborne surveys and on-the-ground fieldwork. But the bipartisan infrastructure law, or BIL, allowed Earth MRI to kick into overdrive, with a $320 million funding boost spread over five years. In 2022, the program’s yearly budget jumped to $75 million, a level at which it will remain through 2026.

“We’re transforming the data landscape, and we’re transforming it in a big and consistent way through the sustained funding,” Earth MRI science coordinator Jamey Jones told Grist in an interview.

Earth MRI’s recent list of achievements is impressive.

When the BIL passed into law in late 2021, scientists had collected high-quality geophysical data across only about 10 percent of the United States; by late 2024, that figure had jumped to nearly 25 percent. In the past two years alone, Jones said, Earth MRI scientists have conducted airborne magnetic surveys — which measure variations in Earth’s magnetic field to detect different subsurface rock types and identify features like faults — across an area twice the size of Montana. Late last year, Earth MRI and NASA completed the world’s largest high-quality hyperspectral survey over California, Nevada, and Arizona. Hyperspectral surveys, which measure reflected sunlight outside the range of human vision, can be used in arid regions to produce detailed mineral maps of the Earth’s surface. This year and next, NASA and Earth MRI will expand the survey to include parts of Texas, New Mexico, Utah, Wyoming, and Oregon.

In addition to mapping minerals still in the ground, Earth MRI is taking a closer look at ones that have already been extracted. In 2023, the program’s scientists accelerated their efforts to explore the critical mineral content of mine waste located in tailings ponds and rock piles around the country. Mine waste is considered a potentially valuable source of many important metals and minerals, but they have never been systematically studied. Thanks to BIL funding, Jones says that the USGS recently completed the first-ever comprehensive national inventory of abandoned mine lands, which it anticipates publishing later this year. In partnership with state geological surveys, Earth MRI is now in the process of dispatching researchers to abandoned mine sites to collect samples of waste rock that can be analyzed in the lab to assess their critical mineral content. “Eventually, we hope to produce a national assessment of critical mineral resources in mine waste,” Jones said.

USGS / Wisconsin Dept. of Agricultural, Trade, and Consumer Protection; Wisconsin Dept. of Natural Resources / Wisconsin Geological and Natural History Survey

The data Earth MRI is collecting does not indicate which exact spots in the ground are the most attractive to mine. Rather, it supplies just enough information “to attract the private sector into an area” to conduct more detailed exploratory work, said Simon Jowitt, who directs the Nevada Bureau of Mines and Geology and is Earth MRI’s primary point of contact for the state. The effort involved in collecting this preliminary, or “pre-competitive,” data often has an outsized economic benefit, Jowitt says. Research in other countries shows that for every dollar governments spend on it, tens to hundreds of dollars are returned to the economy through private investment in exploration and mining.

“If we want to have more mineral exploration, more secure domestic supply chains of metals and minerals, then we need to have these data,” Jowitt added.

Mining proposals often attract intense public opposition, due to fears about damage to ecosystems and water supplies. But both Trump and Biden — as well as members of Congress on both sides of the aisle — appear to support more of it. While it’s still too early to say how much of an impact Earth MRI will have on domestic mining — it often takes a decade or more to permit or build a mine even after all the exploratory work is complete — there are signs that private industry is taking a keen interest in its data. For instance, Jones said an exploration company in Nevada told the agency that it has discovered new lithium deposits based on geochemical data Earth MRI released.

Even as Trump has sought to kneecap other federal agencies and projects, funding for Earth MRI never appeared to be in serious jeopardy. On his first day in office, Trump signed an executive order that called for “terminating the Green New Deal” by pausing the disbursement of all funds appropriated through the BIL and the 2022 Inflation Reduction Act — a move that multiple judges have found to be illegal. But the same order directed the interior secretary to “prioritize efforts to accelerate the ongoing, detailed geologic mapping of the United States, with a focus on locating previously unknown deposits of critical minerals.”

“I think it was pretty quickly recognized that the priorities [of the order] would outweigh the freeze,” Jones said. After a four-week pause, the Trump administration restored Earth MRI’s funding on February 18. And this month, Trump issued another executive order calling for agency heads to identify “as many sites as possible” on federal land that may be suitable for critical minerals mining and invoking the Defense Production Act to accelerate mineral development.

While the mapping program is moving full steam ahead for now, it remains to be seen what will become of it once BIL funding sunsets after 2026. Barring an additional infusion of cash from Congress, Jones says the most likely scenario is that the program’s budget will return to its pre-2022 baseline of about $11 million a year — a roughly 75 percent cut.

Jowitt, the Nevada state geologist, says he’d “like to be optimistic” that Congress will authorize additional funds for Earth MRI so that scientists can continue to fill in the gaps in the nation’s geologic maps. But considering the Trump administration’s recent efforts to dramatically shrink federal spending, he isn’t sure what will happen.

One thing is clear: There will be more work left to do after the BIL coffers are emptied. By 2027, “we can tell you exactly how much [geological data] coverage will have increased in the country for all of our different techniques,” Jones said. “And none of those numbers add up to 100 percent. Our job will not be complete.”

Read the full mining issue

A guide to the 4 minerals shaping the world’s energy future

Chile’s lithium boom promises jobs and money — but threatens a critical water source

Most critical minerals are on Indigenous lands. Will miners respect tribal sovereignty?

The energy transition could turn Greenland into a mining mecca. Would it be for better or for worse?

Digging for minerals in the Pacific’s graveyard: the $20 trillion fight over who controls the seabed

Mining is an environmental and human rights nightmare. Battery recycling can ease that.

Tradeoffs of the green transition: Is mining critical minerals better than extracting fossil fuels?

Why Biden and Trump both support this federal mineral mapping projecty

The weirdest ways scientists are mining for critical minerals, from water to weeds

In the race to find critical minerals, there’s a ‘gold mine’ literally at our shoreline

This story was originally published by Grist with the headline Why Biden and Trump both support this federal mineral mapping project on Mar 26, 2025.

This post was originally published on Grist.