Finland’s Solar Foods has signed a letter of intent to commercialise up to 1,650 tonnes of its Solein gas protein, with plans to have its new factory fully operational by 2030.

Amid its ongoing efforts to launch in the US, Finnish gas protein firm Solar Foods has signed commercialisation deals that could account for half of the production capacity of its upcoming facility.

The company, known for its yellow-hued Solein protein, has secured a letter of intent with a leading international health and performance nutrition brand. If it leads to a binding agreement, the commitment would see 500-1,650 tonnes of the gas-fermented protein enter the market annually between 2026 and 2030.

This is also the year Solar Foods is aiming to make its ‘Factory 02’ fully operational. The facility is set to have a capacity of producing 12,800 tonnes of Solein every year, around a hundred times greater than its Factory 01, located near Helsinki.

This means that the higher end of the volume commitment in the latest letter of intent – 1,650 tonnes per year – would correspond to around 13% of the full production capacity of Factory 02, which is now in its pre-engineering phase.

Solar Food secures deals worth half of its production capacity

Solar Foods opened Factory 01, its demo plant, in April 2024, with an initial capacity of 160 tonnes of its fermentation-derived protein per year. This is set to rise to 230 tonnes by 2026.

But to meet the demand for Solein, it has been working on the industrial-scale Factory 02 for years. It plans to build the plant in three phases to ensure an efficient cost structure and optimised unit economics. The first phase is set to be operational by 2028, and the following stages in 2029 and 2030.

The company’s final investment decision for Factory 02 is set to be made in 2026, but it has already raised around €83M in equity and debt funding for its two facilities, with backers including the EU Commission and Business Finland.

The latter, Finland’s official trade agency, has made a total of €110M in grants available to Solar Foods until 2035, and has already injected over €43M. It has set aside a total of €76M to help with the construction of Factory 02, if built on European soil.

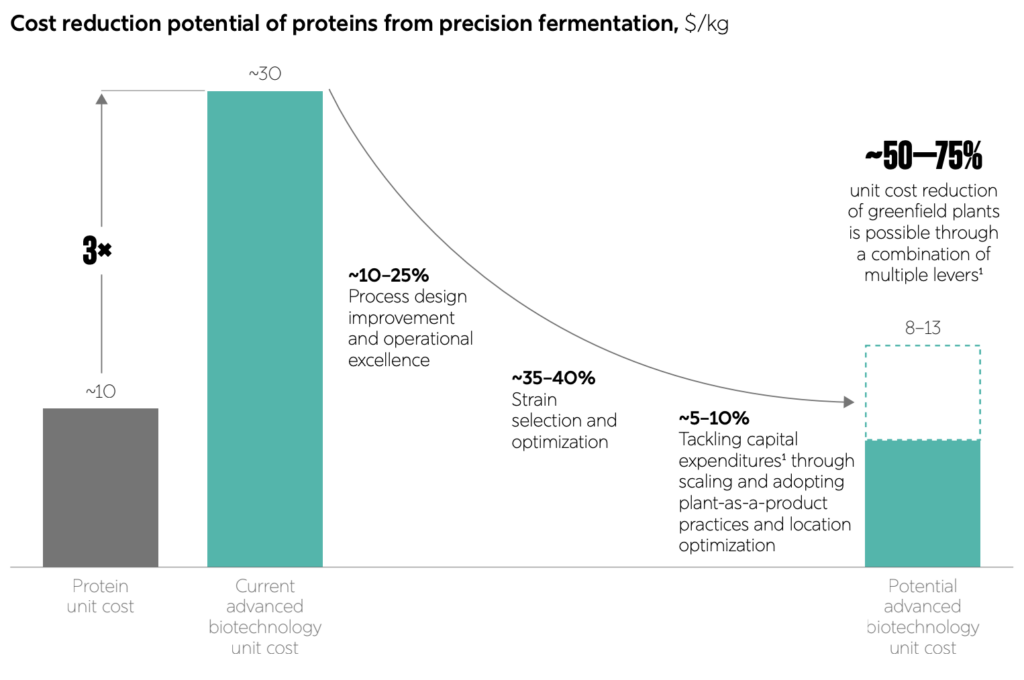

The upcoming facility, currently in its pre-engineering phase, is expected to be able to produce Solein at a cost of €4.30-5.20 per kg, and generate net sales of €80-200M.

In May, Solar Foods signed two MOUs to commercialise a total of 6,000 tonnes of Solein annually. Combined with the new letter of intent, the volume commitment of all three deals would correspond to around 50-60% of Factory 02’s full capacity.

“These agreements strongly validate Solein’s commercial potential, and should the collaborations lead to binding agreements, they would correspond already to a major share of the production capacity of Factory 02,” said Rami Jokela, who took over as CEO in April. “Customers’ interest towards Solein also plays an important role in preparing for the final investment decision for Factory 02.”

Targeting the health and performance nutrition market

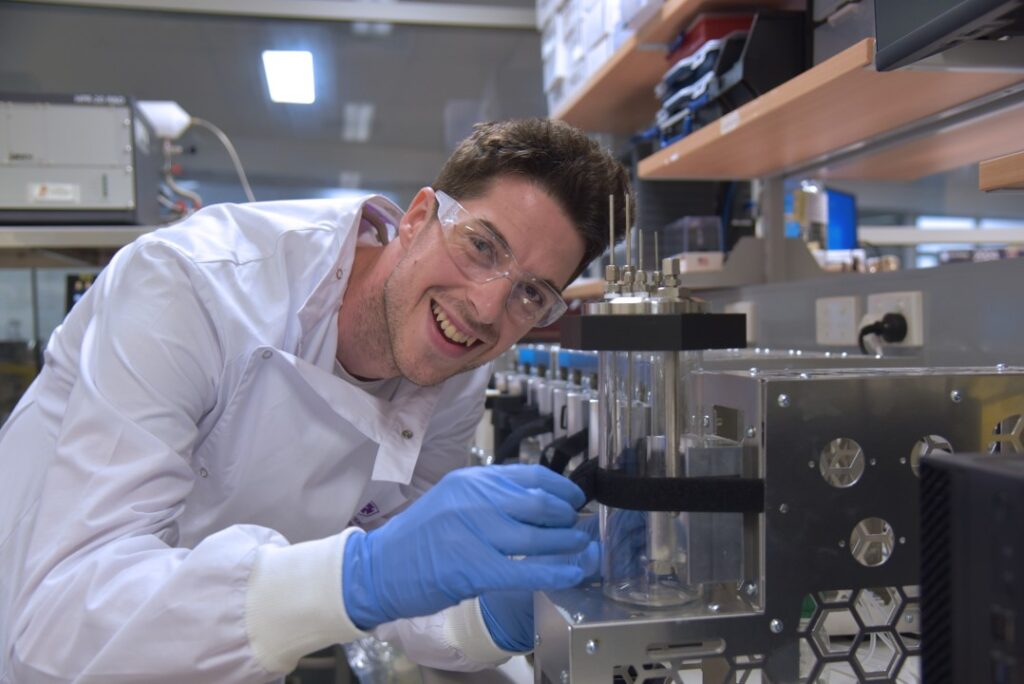

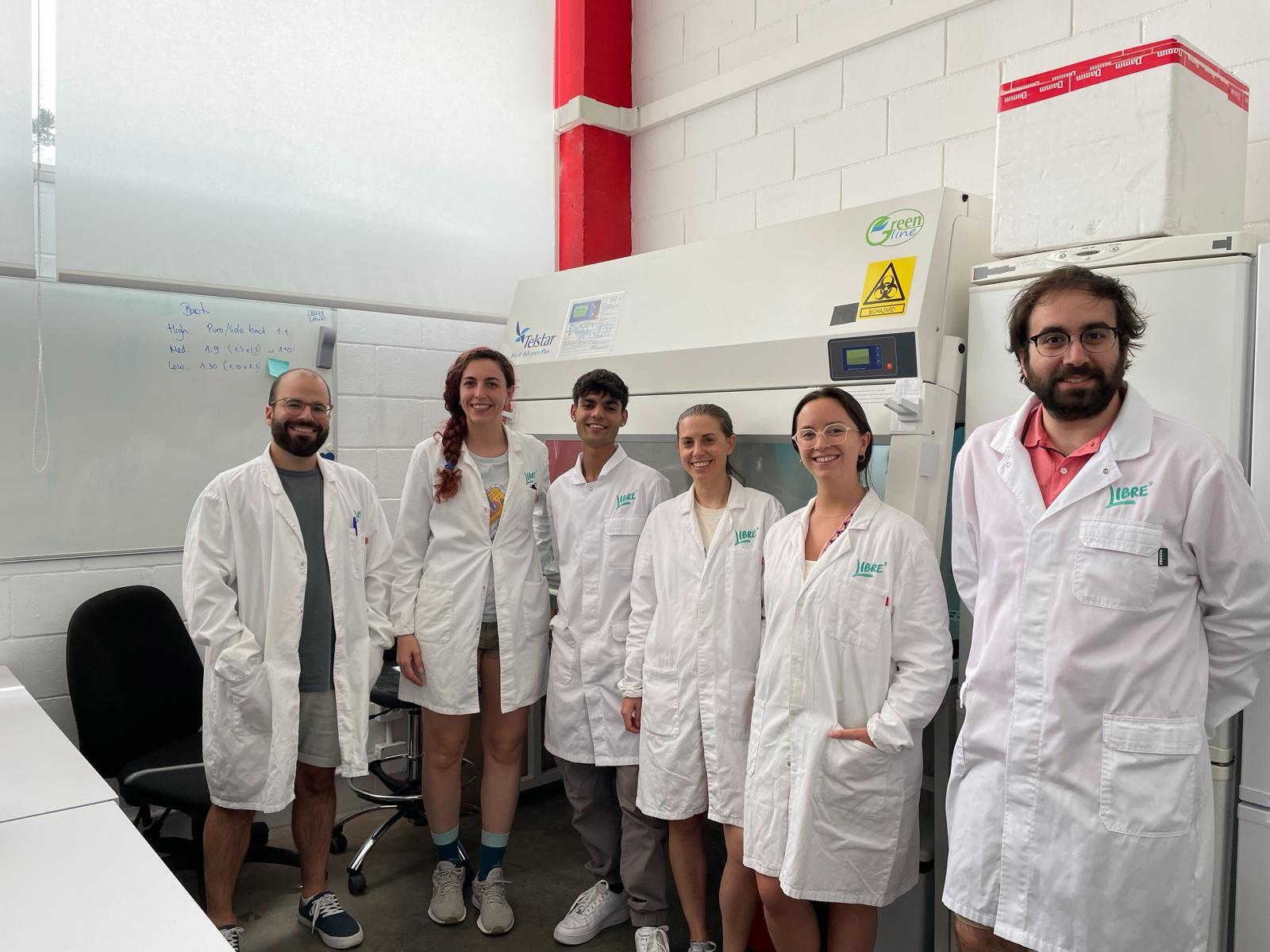

Solar Foods produces Solein by feeding carbon dioxide, hydrogen and oxygen to microbes, instead of sugar, which eliminates the need for farmland, water for irrigation, and fertilisers and pesticides.

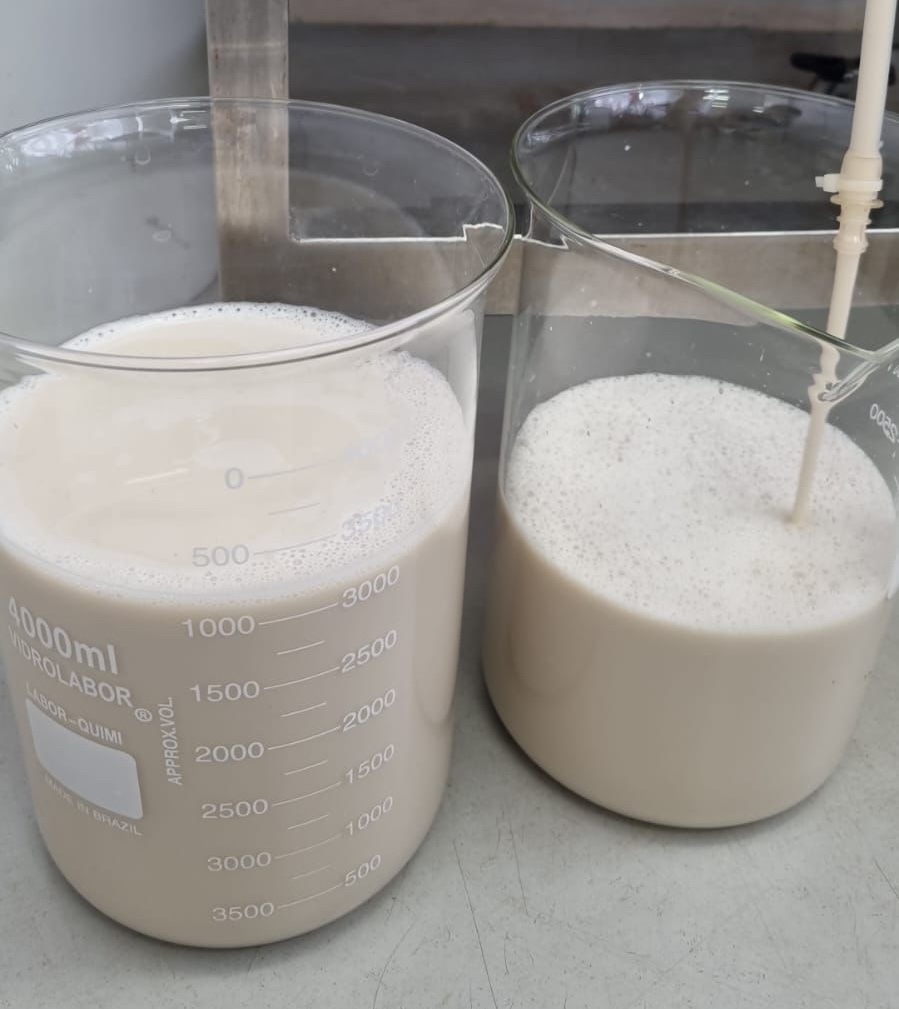

The microbes are grown in a liquid form, and later dried into a flavourless powder that has 78% protein, 6% fat, and 10% dietary fibre. Its macronutrient profile is said to be akin to dried soy or algae, and it contains iron and B vitamins.

Solar Foods calls Solein the “most sustainable protein” on Earth. The main raw materials for production are carbon dioxide and renewable energy, resulting in emissions equal to just 1% of those generated by conventional meat, and 20% of plant proteins.

The ingredient received novel food approval in Singapore in 2022, debuting as part of a vegan chocolate gelato at Italian eatery Fico. In addition, it was the base of a Taste the Future chocolate snack bar released by Fazer (a majority shareholder of Solar Foods) in the city-state, and a line of mooncakes and ice cream sandwiches rolled out by Japanese food giant Ajinomoto.

The company achieved self-determined Generally Recognized as Safe (GRAS) status in the US last year, and registered Factory 01 with the Food and Drug Administration to import Solein protein stateside. Here, its commercialisation strategy centres on the health and performance nutrition market.

The new letter of intent was signed to advance product development and explore integration into end-consumer offerings in these categories, with products like protein shakes and bars.

Solar Foods recently launched a ready-to-mix protein shake powder with Solein, aimed at athletes and gymgoers looking to enhance their performance and recovery. It has also signed supply partnerships with US-based GLP-1 wellness company Superb Food (worth €1.39M) and Italian food firm KelpEat (worth €500,000).

“Our goal is to develop products that meet consumer demands for nutrition, taste, and functionality – while delivering a distinct advantage in sustainability and future supply security,” said Jokela.

The post With New Factory in Sight, Solar Foods Signs Latest Deal to Bring Solein Protein to Market appeared first on Green Queen.

This post was originally published on Green Queen.