I love coffee. I drink it every day. It’s part of my culture, my mornings, my memories. But behind each cup is a fragile system, and that system is breaking.

Coffee and cocoa are daily rituals for many of us, but behind every cup or chocolate bar lies a fragile system under increasing stress. What used to be distant projections of climate disruption are now real-time events: volatile harvests, surging prices, and shrinking yields.

In 2024, cocoa prices quadrupled. Coffee hit a 50-year high in 2025. Farmers are leaving these crops behind. Hedging no longer works. And the effects are rippling across the supply chain.

If your business depends on these ingredients, whether in chocolate bars, coffee blends, or ready-to-drink beverages, this isn’t a passing blip. It’s a structural shift.

The supply chains are broken (and it’s costing you money)

Cocoa prices exploded from $2,500 per tonne in 2023 to over $10,000 in 2024, the highest in 46 years. Even after retreating slightly, prices remain three times higher than historical norms.

Coffee futures hit $4.24 per lb in 2025, a 50-year high, as droughts in Brazil and Vietnam (which together supply 50% of global beans) slashed yields.

Why does this matter for businesses? Input costs are rising and increasingly volatile, putting pressure on margins and making it harder to forecast. Hedging can’t keep up. But the biggest risk isn’t just price, it’s access. As supply becomes more unstable, securing reliable ingredients is becoming harder by the season.

This isn’t a temporary squeeze. The narrow equatorial zones where these crops grow are becoming unpredictable. Rising temperatures, erratic rainfall, and disease (like swollen shoot virus in West African cocoa) are systemic threats.

Bottom line: If your products rely on coffee or cocoa, your margins and supply security are at risk.

Traditional solutions are too slow

The industry’s playbook – breeding hardier plants, shifting farms north, and promoting regenerative practices – is critical, but too slow. New coffee varieties take 10-15 years to develop, test, and scale. Cocoa trees require three to five years to mature, if they survive pests and drought.

Meanwhile, land availability is shrinking. World Coffee Research estimates that 50% of current coffee-growing land could become unproductive by 2050.

The overlooked solution: alternatives that work

Here’s the truth: businesses don’t need perfect replacements. They need ingredients that are functional, cost-stable, and compatible with today’s supply chains. Ours delivers on all three – and tastes great while doing so.

At Compound Foods, we’re building beanless coffee and cocoa ingredients designed to:

- Reduce exposure to price spikes (no dependency on fragile origins)

- Slot into existing manufacturing (no reformulation headaches)

- Meet sustainability targets (up to 70% lower carbon footprint vs conventional coffee)

How we do it

Our journey began with a simple but powerful question: what makes coffee and cocoa what they are?

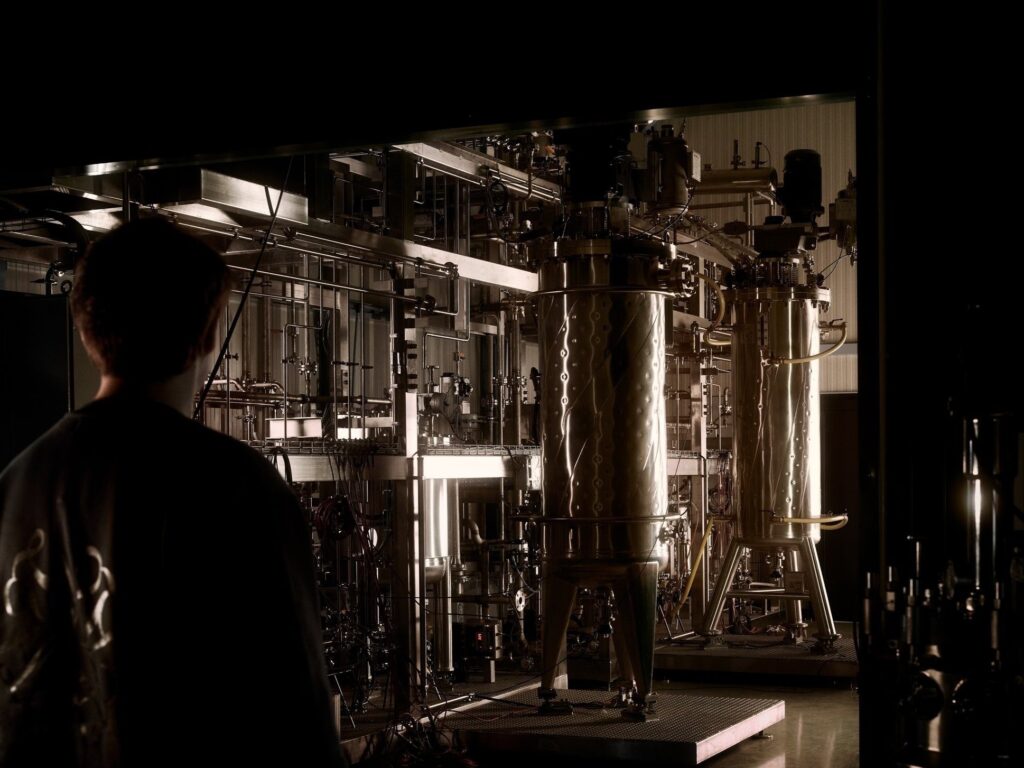

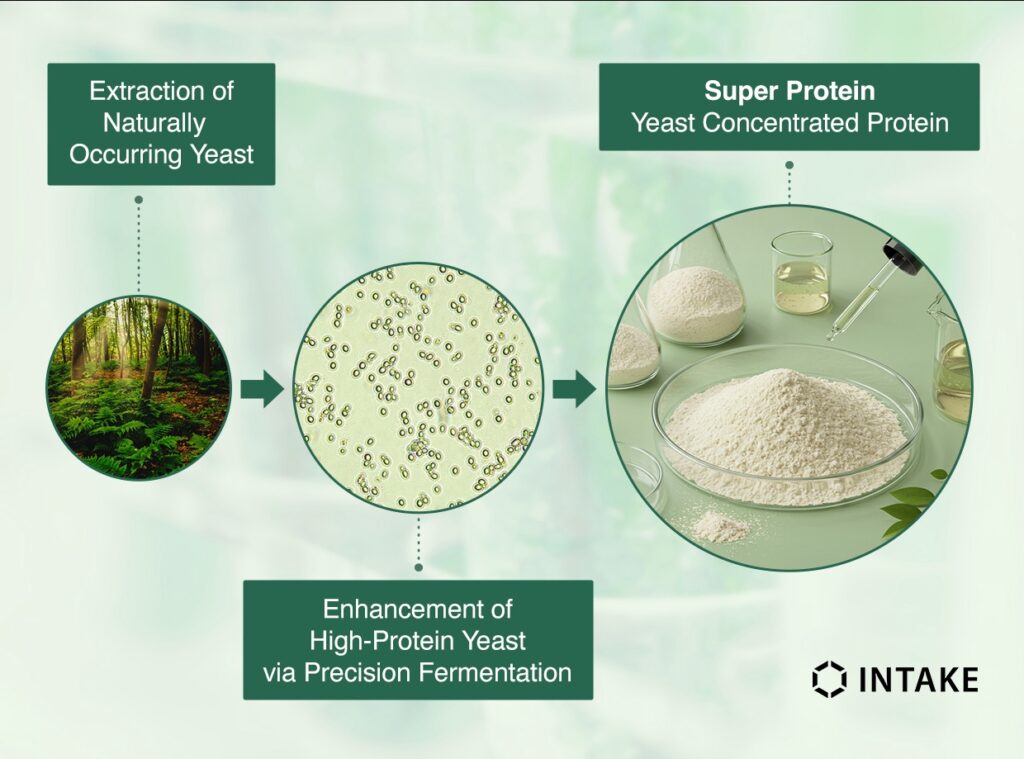

We mapped over 800 compounds that create coffee’s flavour and aroma. Then we asked: can we replicate those experiences using what we already have? We explored byproducts from other food processes, seeds, cereals, and fibres, and applied food science, fermentation, and formulation design to transform them.

Our first hypothesis was to use precision fermentation to recreate specific key compounds. But we quickly learned that no single compound could replicate the complex sensory experience of coffee. Even chlorogenic acid, a major coffee molecule, didn’t move the needle alone.

So we took inspiration from nature, from how coffee farmers use fermentation to influence flavour. We built a base using whole foods that mimicked the coffee cherry. We identified ingredients with molecular overlap, tested them in the lab, and developed a fermentation process using microbial strains sourced from global coffee cherries.

Over time, and with input from baristas, Q graders, and sensory scientists (including blind testing with Purdue University), we created a formulation that could rival the complexity and acidity of high-quality coffee. In one study with 120 tasters, 60% preferred our coffee over Blue Bottle and Stumptown.

We also explored cell culture, partnering with a lab in Costa Rica to grow coffee plant cells. The result? It still required roasting and fermentation, and sensory performance fell short. After years of testing and iteration, our current method delivered the best outcomes across flavour, cost, and scalability.

And what began with coffee, we Bean-Free, Climate-Ready: Compound Foods Expands Sustainable Coffee & Cocoa Ingredient Platform, developing high-quality alternatives in half the time, leveraging the ingredient database and expertise we built.

Why it matters now

The current market dynamics are creating an opening. Brands are open to alternatives. Especially in cocoa, where consistency and cost have become pain points, ingredient diversification is no longer niche: it’s a strategy.

Coffee has more emotional complexity. We get it. I love specialty coffee. It’s the only coffee I personally drink. The industry’s commitment to quality, soil health, and fair practices is unmatched. But specialty coffee accounts for just 10-15% of the market. The rest is commodity-driven, and that’s where the greatest risk lies.

Let’s be clear: we are not trying to replace specialty coffee. If all coffee could be produced with the same care and ethics, we’d be in a very different place. But for the vast majority of brands and manufacturers, cost and consistency are non-negotiables.

That’s why we’re offering a solution:

- for small brands looking to reduce formulation costs;

- for CPG companies protecting margins;

- for distributors needing a backup supply.

The path forward

This isn’t about replacing coffee or cocoa. It’s about making them more resilient and closing the future gap between supply and demand.

- Blending: Stretch expensive commodities by combining with alternatives.

- Hedging: Secure secondary supply, insulated from climate shocks.

- Innovating: Partner with food scientists to build future-proof products.

If cocoa stays above $8,000 per tonne, alternatives save millions. If coffee yields drop another 20%, blends protect revenue.

Securing the future of coffee and cocoa through partnerships

The coffee and cocoa industries won’t disappear, but business models built on low-cost, resilient, abundant supply will.

Companies that thrive will be those that:

- Diversify ingredients now

- Invest in supply-chain resilience (not just sustainability optics)

- Partner with innovators to bridge the gap

At Compound Foods, we’re giving businesses the tools to act today. Because in a climate-disrupted world, the biggest risk isn’t change, it’s waiting too long to adapt.

I want to drink coffee every morning. I want to indulge in cocoa treats forever. But the future of these crops won’t be built on nostalgia. It will be built by those willing to evolve. And the time to do so is now.

The post Opinion: The Coffee & Cocoa Crisis Is Here. Here’s How Business Can Adapt appeared first on Green Queen.

This post was originally published on Green Queen.

BLG already secured, Vivici is uniquely placed to capitalise on that growth.”

BLG already secured, Vivici is uniquely placed to capitalise on that growth.”