Californian food tech startup Mission Barns has become the third cultivated meat firm to receive regulatory approval in the US, with a planned rollout at Sprouts and Bay Area restaurant group Fiorella.

Mission Barns has earned US regulatory approval to sell its cultivated pork fat in the US, after securing a ‘no questions’ letter from the Food and Drug Administration (FDA) on Friday.

It is the third company to have received the green light to sell cultivated meat in the US – after fellow Californian firms Upside Foods and Eat Just in 2022 and 2023, respectively – and the first to be cleared to sell cultivated pork anywhere in the world.

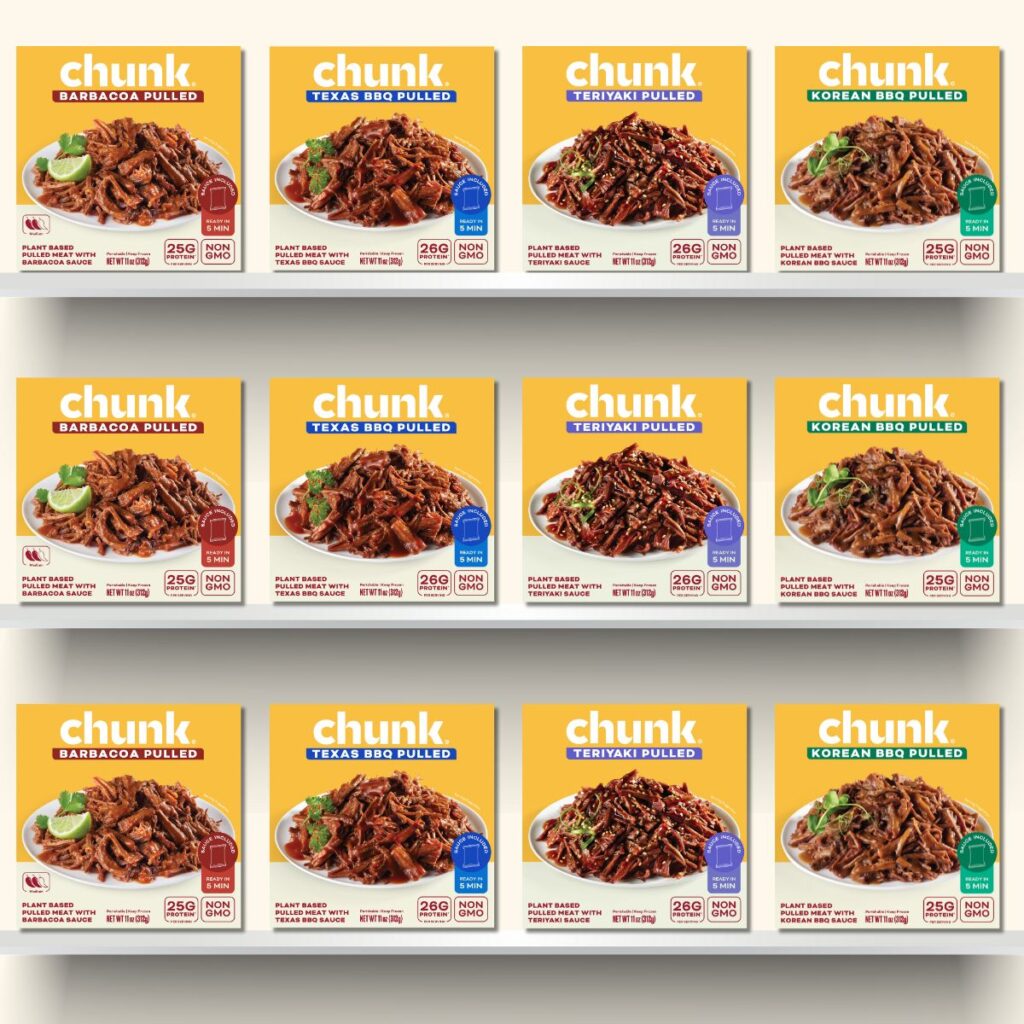

The cell-cultured fat will be mixed with plant-based ingredients in Italian-style meatballs and applewood-smoked bacon, which will be debuted at San Francisco restaurant group Fiorella and Sprouts Farmers Market – marking the first time cultivated meat will be sold in a US supermarket.

According to its letter, the FDA “did not identify a basis” to conclude that Mission Barns’s process would result in substances or microorganisms that would adulterate the food.

“We have no questions at this time regarding Mission Barns’ conclusion that foods comprised of or containing cultured pork cell material resulting from the production process […] are as safe as comparable foods produced by other methods,” the agency wrote, concluding a consultation process that began in May 2022 and underwent 18 amendments.

Before it is officially launched, Mission Barns would require approval from the US Department of Agriculture (USDA) for its pilot plant and product labelling, in addition to the FDA letter.

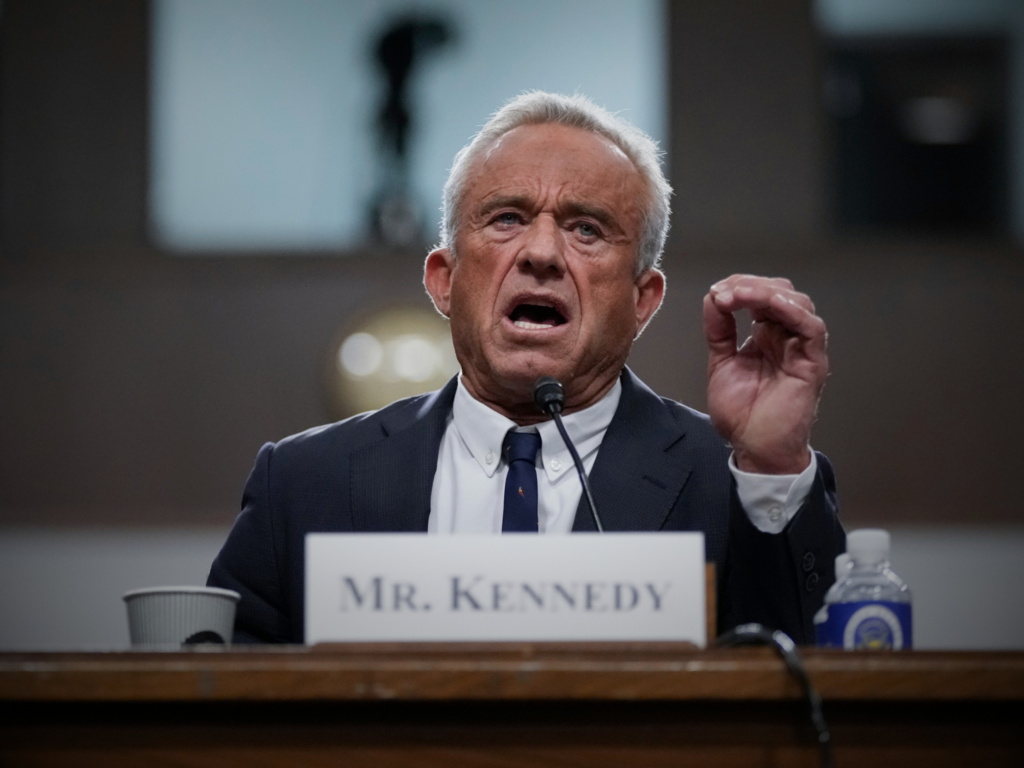

The FDA approval comes during a period of turbulence for the cultivated meat industry, which has faced both financial and political challenges in the US – over 20 states have attempted to ban or restrict these proteins, and two of them have been successful. And with Robert F Kennedy as health secretary, there have been suggestions that the regulatory pathway for cultivated meat is now harder to chart.

New bioreactors a precursor to large-scale facility

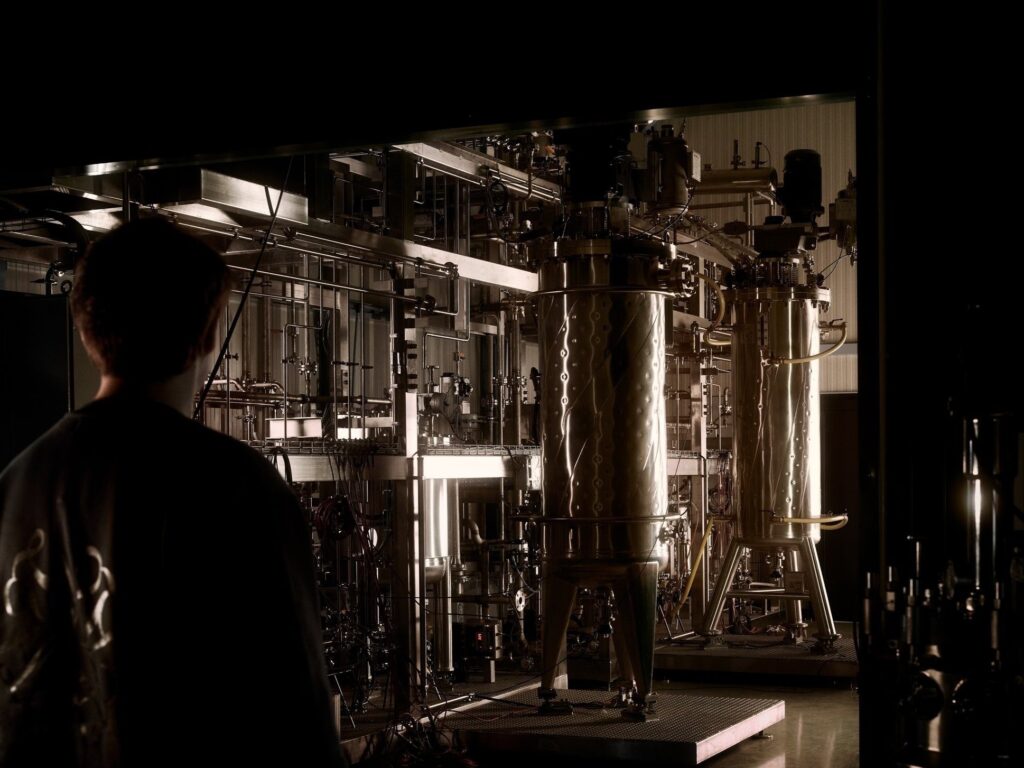

Founded in 2018 by CEO Eitan Fischer, previously the cultivated meat head at Eat Just, Mission Barns uses belly fat cells from domestic Yorkshire pigs and grows them in bioreactors to make cultivated pork fat for hybrid meats like bacon, meatballs, pepperoni and chorizo.

It has a pilot plant in the Bay Area that can “produce enough product to supply a handful of restaurants and retailers”, according to Bianca Lê, head of special projects and external affairs at Mission Barns.

She had hinted about the startup’s approval and market entry plans in an interview with Green Queen in October, revealing: “We have a number of exciting partnerships confirmed with major US grocery stores, restaurants and food distributors who we have partnered with to sell our products.”

The company had developed a novel bioreactor that makes a departure from the single-cell suspension tanks of the biopharma sector, making cultivated meat production more efficient, easier to scale, and cheaper. Its appliance recreates the same adherent growth conditions inside an animal’s body, and can cultivate both muscle and fat cells, or tissue, from any species.

It is now looking to build a commercial-scale manufacturing facility. “Our current plan involves having bioreactors with working volumes in the tens of thousands of litres at commercial scale, when we’ll be outputting tens of millions of pounds of final product per year,” explained Lê.

Mission Barns is among a number of companies taking the cultivated fat route, which is seen as a more viable way to commercialise cell-cultured meat in the medium term. This includes Hoxton Farms, Steakholder Foods, Genuine Taste, and Mosa Meat (which has applied for approval in the EU).

“Consumers won’t eat food that isn’t absolutely delicious, which is why we chose to pursue a fat-first approach,” explained Fischer. “Not only is fat the main driver of flavour and juiciness, but it is also less costly and faster to produce than lean meat.”

He added: “We believe in giving consumers more choice – people looking for delicious, healthy, and responsibly produced meat are excited to try our products. By advancing cultivated meat production, we are helping to create a more resilient and reliable food system and reinforcing American leadership in food innovation.”

A win for cultivated meat amid political upheaval

According to a scientific memo published by the FDA, Mission Barns’s ingredient has similar unsaturated and saturated fatty acid content to conventional pork fat, and no trans fats. The agency said it will conduct another inspection after the company begins commercial production to “help ensure that potential risks are being managed and that the food is safe and not adulterated”.

Only a handful of firms have been able to climb the regulatory ladder to be cleared to sell cultivated meat globally – Mission Barns is only the sixth. Aside from Upside Foods and Eat Just, the list comprises Aleph Farms (in Israel), Vow (in Singapore and Hong Kong), and Meatly (in the UK). Regulators in the EU, Switzerland, Australia and Thailand are evaluating applications too, and judging from its inventory, the US FDA seems to have received at least five others.

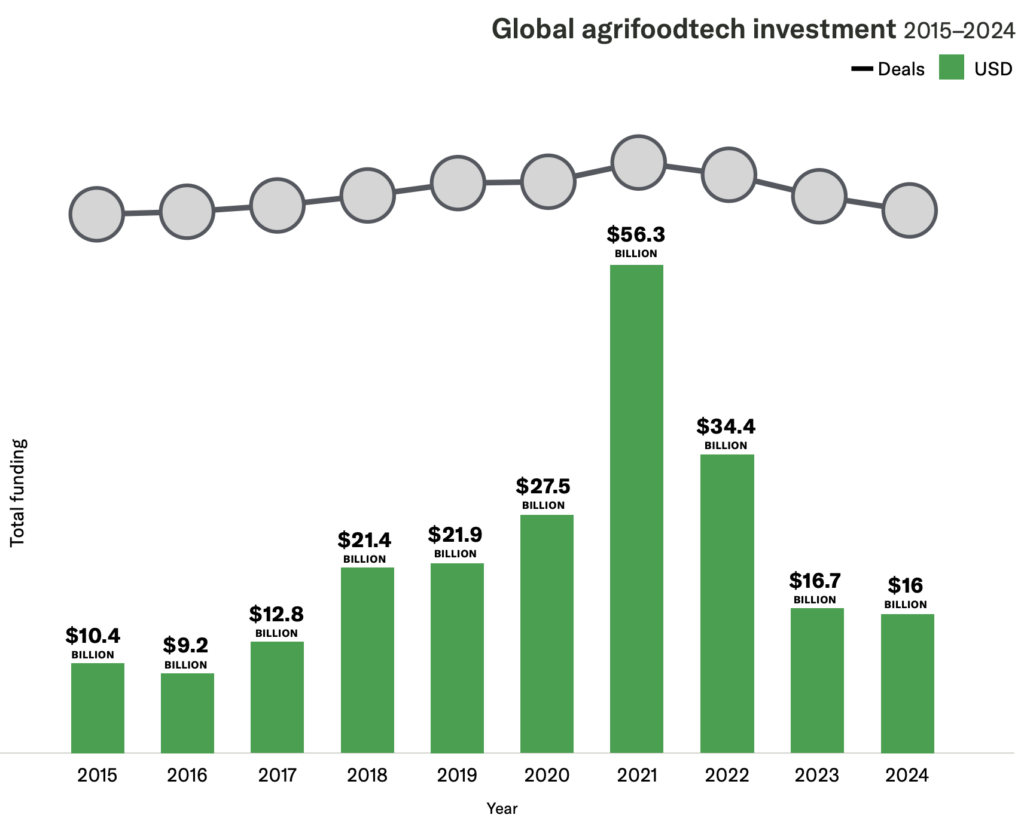

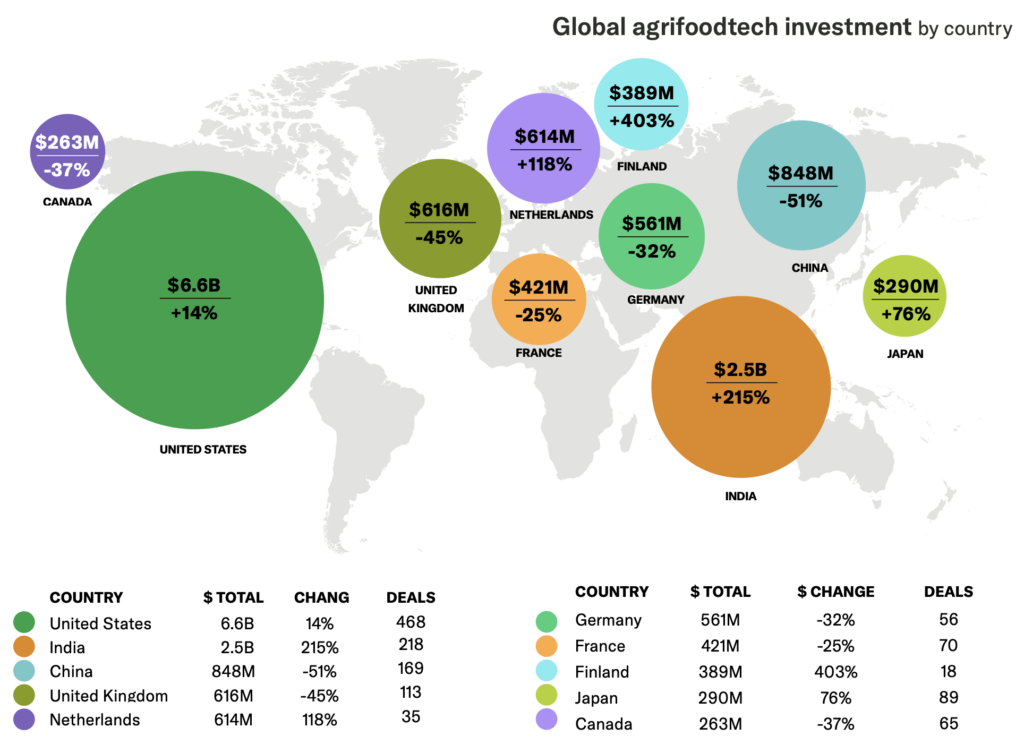

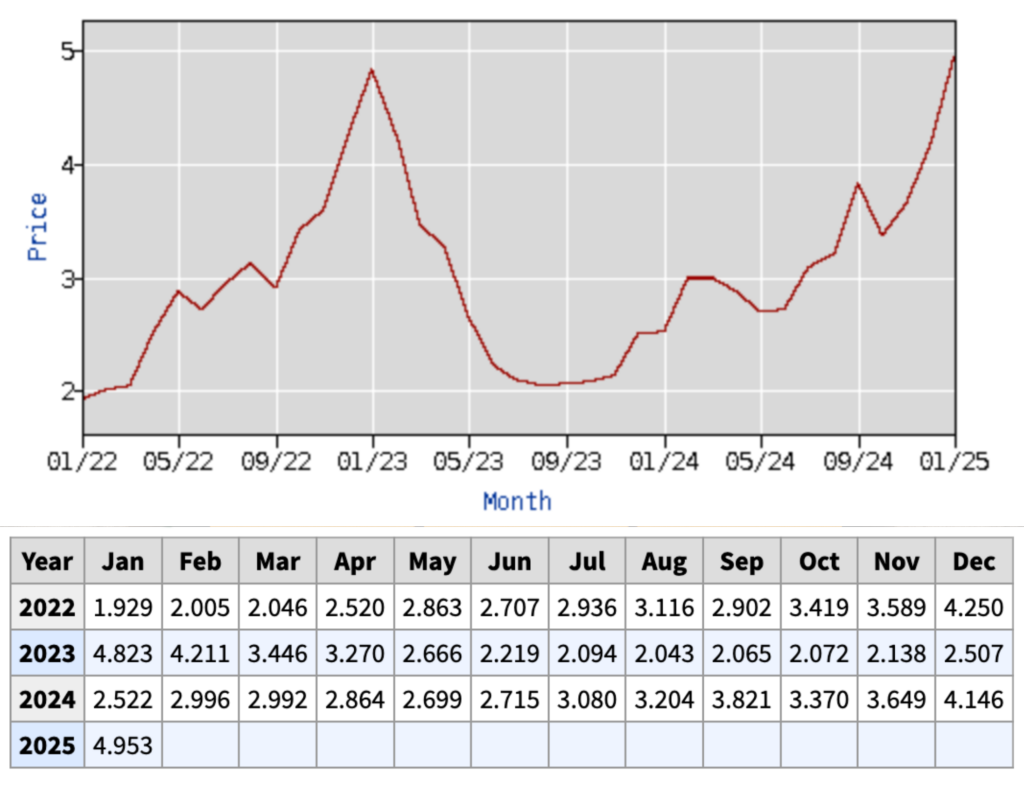

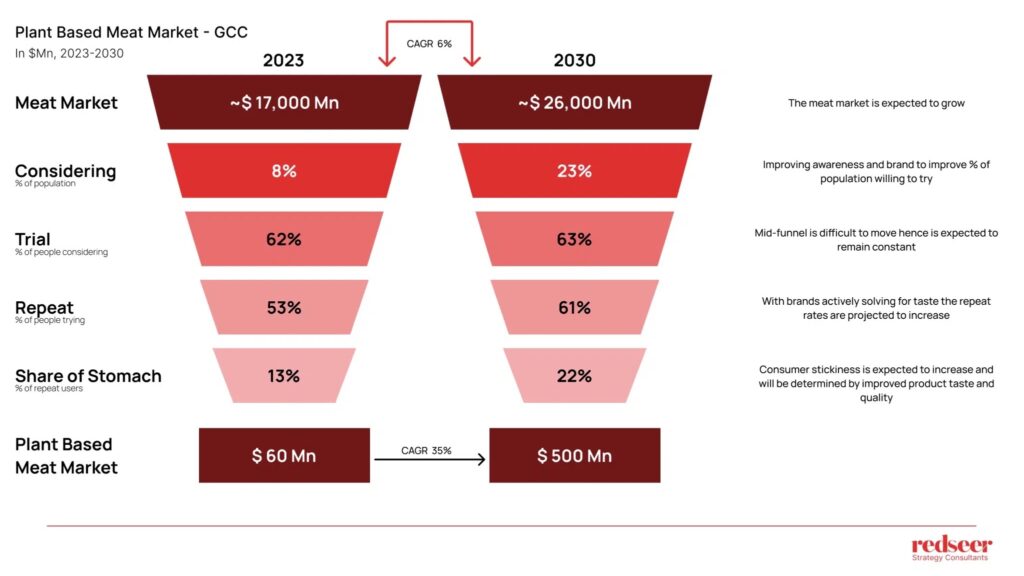

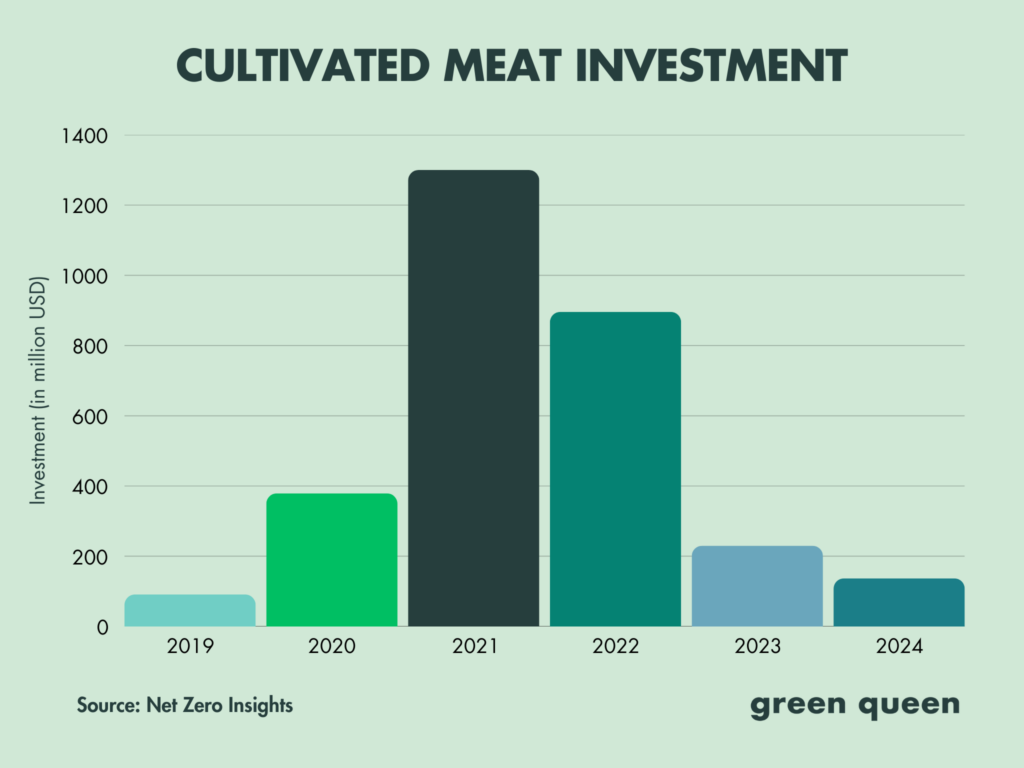

Cultivated meat is undergoing a trough of disillusionment. After VCs pumped $1.3B into the category in 2021, investment has dipped dramatically. In 2023, funding fell by 75%, followed by another 40% drop in 2024, reaching just $137M, according to Net Zero Insights data obtained by the Good Food Institute. It has forced some cultivated meat startups to shut down, and others to make cutbacks.

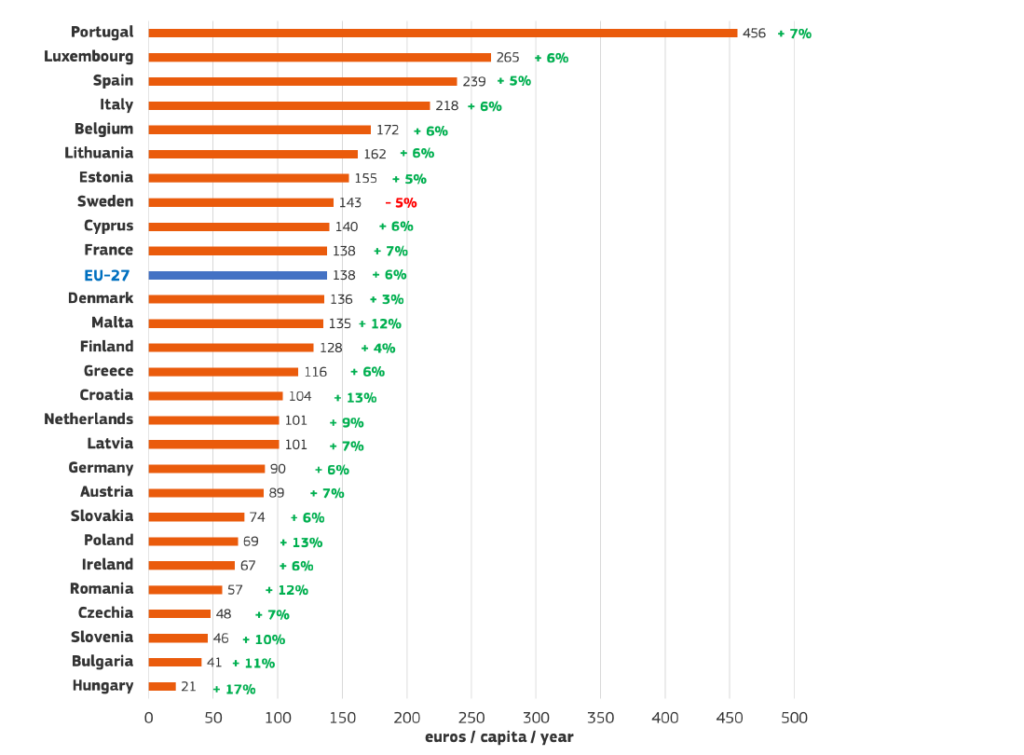

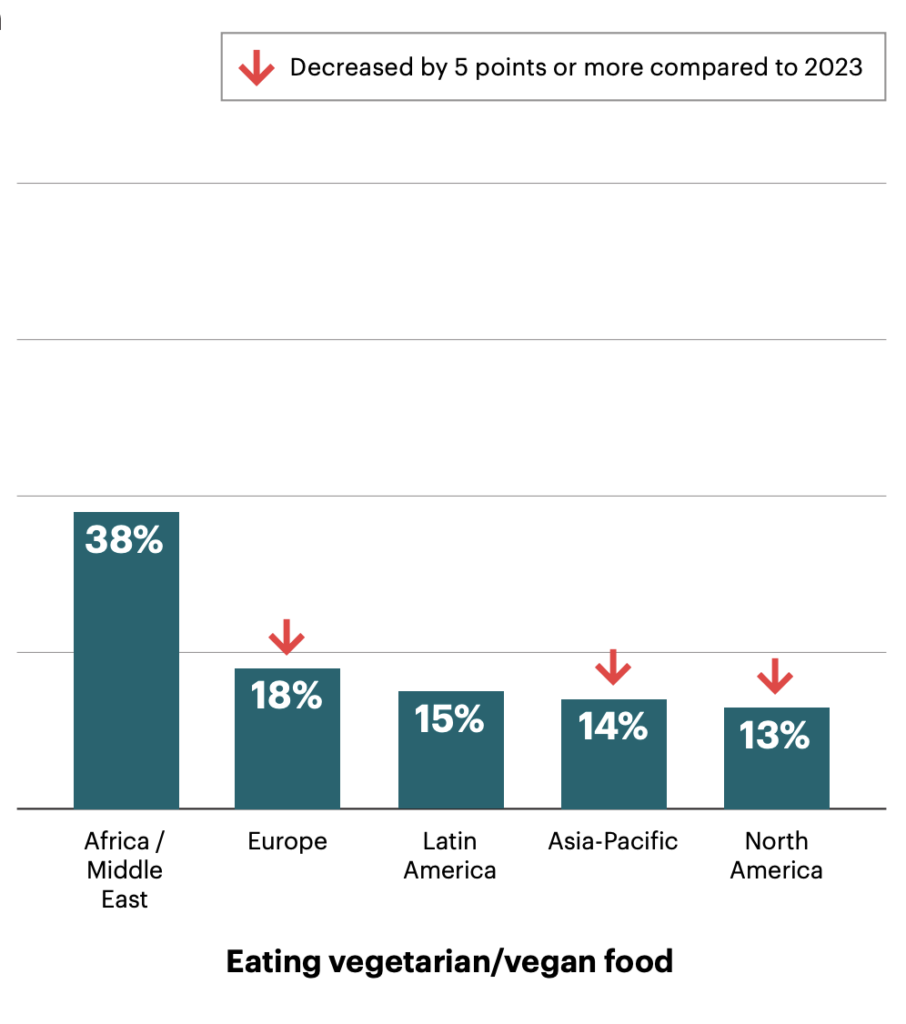

At the same time, a host of legislative efforts to ban or restrict cultivated meat in the US and Europe are ongoing. Italy decided to ban these proteins in 2023 (before other EU attempts were thwarted), while Florida and Alabama followed suit last year. Several states have floated similar bills in the current legislative session, though some have hit a snag, mirroring the fate of bills introduced in a number of other states over the last two years.

“Unlike other meat production, cultivated meat has federal regulatory oversight by both the FDA and USDA,” the Association for Meat, Poultry, and Seafood Innovation, a cellular agriculture trade group, said in a statement.

“As more companies progress through this rigorous regulatory pathway, the United States has an opportunity to be a global leader in the emerging industry. American-made cultivated meat and seafood will create high-skilled jobs throughout the value chain, enhance US food security, and expand consumer choice [by] filling gaps in supply shortages,” it added.

Fiorella co-founder Brandon Gillis also touched upon the “vulnerability of our global food supply chain”, which has impacted the restaurant’s ability to source ingredients and increased menu prices: “I’ve been keeping tabs on the cultivated meat industry as a potential solution, and after meeting with Mission Barns and tasting its products, I wanted to make sure we created a partnership for this historic moment.”

The post Mission Barns Gets FDA Approval to Sell Cultivated Pork in US Supermarkets & Restaurants appeared first on Green Queen.

This post was originally published on Green Queen.