Eat Just CEO Josh Tetrick says soaring egg prices have driven up demand for its mung-bean-derived Just Egg, with sales hikes unlike what the firm has seen in the past.

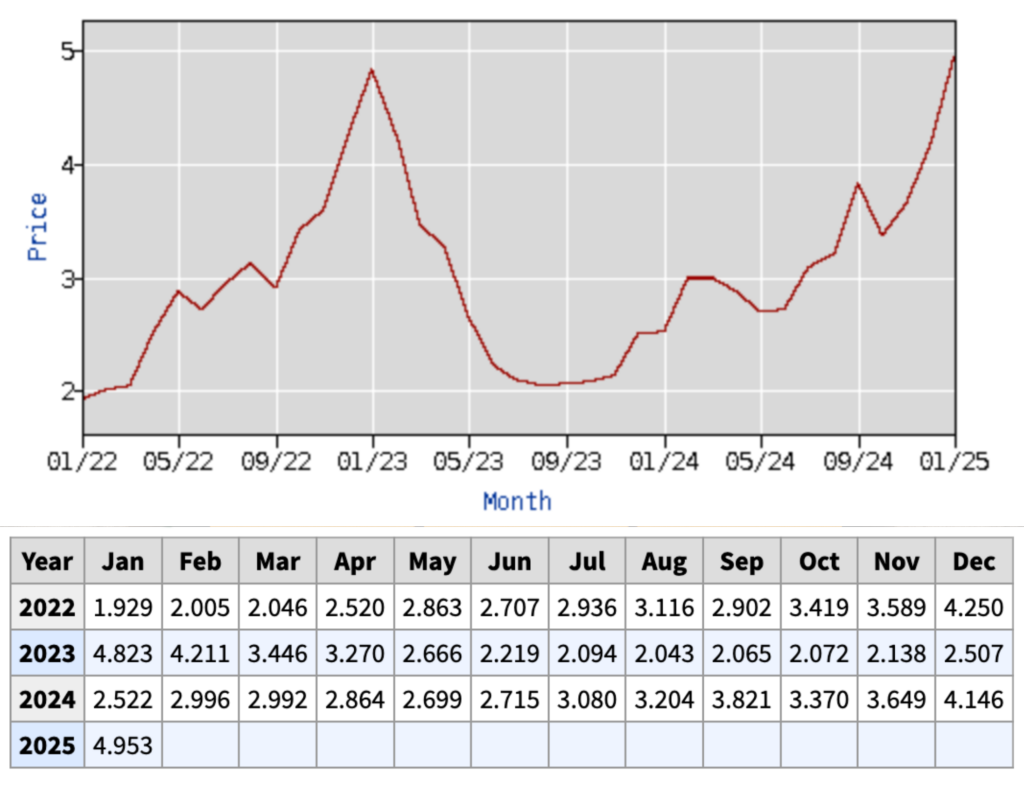

Eggs have never been more expensive in the US. According to consumer price index data released by the USDA last weekend, average retail Grade A egg prices reached $4.95 per dozen last month, surpassing the previous high recorded in January 2023.

The new record came just as 23 million birds were culled in January due to this latest wave of avian flu (taking the total to nearly 160 million since February 2022). “It’s the most serious bird flu crisis in history,” says Josh Tetrick. “It’s spreading faster than ever before.”

Tetrick is the co-founder and CEO of Eat Just, the company behind Just Egg that is very much meeting the moment. “Egg shelves are empty, except for one product, and it happens to be made from plants,” he tells Green Queen on a phone call. “It’s both an extraordinary and strange moment.”

This is because millions of Americans are being exposed to a vegan egg for the very first time, he says, and his company takes up 99% of that market. “If they want eggs, they [only] have a few choices,” notes Tetrick. “One, don’t eat them. Two, you know, have applesauce. Or three, have Just Egg.”

This time last year, the firm said it had sold the equivalent of half a billion chicken eggs since its launch in 2019. Now, with the egg shortage more dire than ever, Eat Just’s mung-bean-based version is “seeing increases in sales like we didn’t see in the past”.

In January alone, Just Egg’s sales grew five times faster than in the past year, while 56% of shoppers have returned to buy more (a three-point increase from 2024). At one of the country’s largest retailers, its sales are up by 70% compared to the same week last year.

The plant-based company makes a refrigerated liquid alternative, a frozen omelette-style folded product and a just-relaunched mayonnaise range.

“We have some of the largest chains in the country reaching out to us – on the foodservice side, the convenience store side – saying they don’t know when this is going to end, and they want to bring in something that’s more reliable and more permanent, i.e., what we’re doing,” says Tetrick.

Restaurants are feeling the pinch, too. Popular breakfast chain Waffle House has introduced a temporary 50-cent surcharge per egg, and some bakeries are switching to vegan eggs. One local cafe in Philadelphia – 90% of whose menu depends on eggs – told the Guardian that a plate of bacon, eggs and toast with coffee now costs twice as much as it did last year.

This, Tetrick feels, is a moment for the sustainable protein sector – to show that there’s a different, safer, healthier and more reliable way to produce eggs than farming birds in concentrated feeding operations: “This is a real moment in time for the plant-based industry to prove that it’s up to the challenge.”

Eat Just offering free cases to restaurants and retailers

Eat Just is witnessing greater demand across retail and foodservice, including local diners and cafés, mom-and-pop stores, and caterers that supply to universities (like Sodexo). “People are wanting to order more because consumers are going through the product faster because there are fewer options – i.e. chicken eggs – available,” says Tetrick.

Currently, more than 70% of its sales come from the retail channel, with the pourable liquid format its most popular product (followed by the foldable egg patty).

To expand its uptake, though, Tetrick says Eat Just is incentivising restaurants and retailers by providing them with a free case of Just Egg and other discounts. This helps them bring the product in for the first time and ensure they have a supply of eggs, which they struggle to do “when they’re only relying on chickens”.

While it’s hard to find eggs on supermarket shelves right now, Just Egg is available in over 40,000 stores today. “Almost every major retailer carries Just Egg. But we do have gaps, and we expect to fill more of those gaps in the next few months,” he says.

The firm’s manufacturing facility in western Minnesota has enough capacity to double its production if needed – though it’ll need to be expanded if it needs to produce more than that. “Then we have partner facilities that we work with. We send the protein, and they have plenty of capacity also,” says Tetrick.

He adds: “We are scheduling more days of production. We’re ordering more materials, like packaging, ahead of time to ensure that we’re prepared for even more orders than we might even anticipate.”

Tetrick says that Just Egg is cheaper than chicken eggs in some parts of the country (its 16oz liquid egg carton, equivalent to about 10 eggs, retails for US$7.36 at Walmart) right now. In some places, consumers and restaurants are paying up to $7 per dozen for the latter, while wholesale prices of white-shell eggs now stand at $8 per dozen.

Recently published research suggests that undercutting the cost of animal proteins is the most effective purchase driver for plant-based food, so Eat Just needs to find a way to continue to lower costs and stay cheaper beyond the current egg price hike caused by supply shortages.

Tetrick says the company is working on it. To make its egg alternatives, Eat Just separates protein from mung beans, a process responsible for roughly half of the cost of production. “The more efficiently we can [do that], the lower our cost is,” Tetrick explains. “So we’re devising more and more processes to reduce the cost of protein, using techniques to yield up and having a higher throughput.”

Chicken egg makers stuck in a cycle

Nearly all Americans (94% of them) eat eggs. It’s by far the most widely consumed animal protein in the country. “I don’t remember a time in the United States when a major animal protein is literally not on shelves anymore, in many of the biggest grocery stores,” Tetrick points out. “People have a hard time finding it.”

It’s not the first big wave of bird flu to hit the US egg industry in recent years. And when prices skyrocketed last time, they returned to normal levels in the months that followed. However, this wave appears worse.

This time, the avian flu is “objectively” bigger, in terms of the number of birds affected, and the impact on egg prices and the supply chain. Tetrick believes this is happening because of the “inherent nature of the system”.

“To make eggs for a country of 350 million people, it means one very basic thing: you have to pack lots of animals in small spaces. And when you do that, because basic biology is a thing, those animals will just get sick, and that’s going to keep happening,” he says.

“The industry can’t get out of that cycle. Move them closer. They get sick. Then there’s avian flu, and then you’ve got to kill lots of them. And then the egg shelves are empty. And here we go again,” he adds. “More and more retailers are realising that that is a fact, and they’re beginning to think through what the world will look like when that continues to happen.”

In Tetrick’s ideal world, you’ll have more pasture-raised eggs at higher prices, and a greater number of plant-based alternatives.

He acknowledges that the current reality is far from his vision. “It’s quite different from what the egg shelves look like today, though,” he says.

An inflection point for the plant-based industry

To date, Eat Just has raised over $850M in venture capital, with existing investor VegInvest/Ahimsa Foundation pouring in $16M in the last publicly announced investment in 2023. At the time, there were suggestions that the company was facing a cash squeeze.

But Tetrick confirms that the company has healthy cash flow and isn’t looking to fundraise at the moment: “We sell every Just Egg product at a positive margin, and it’s able to support the key functions of the company, so it can continue to grow faster.”

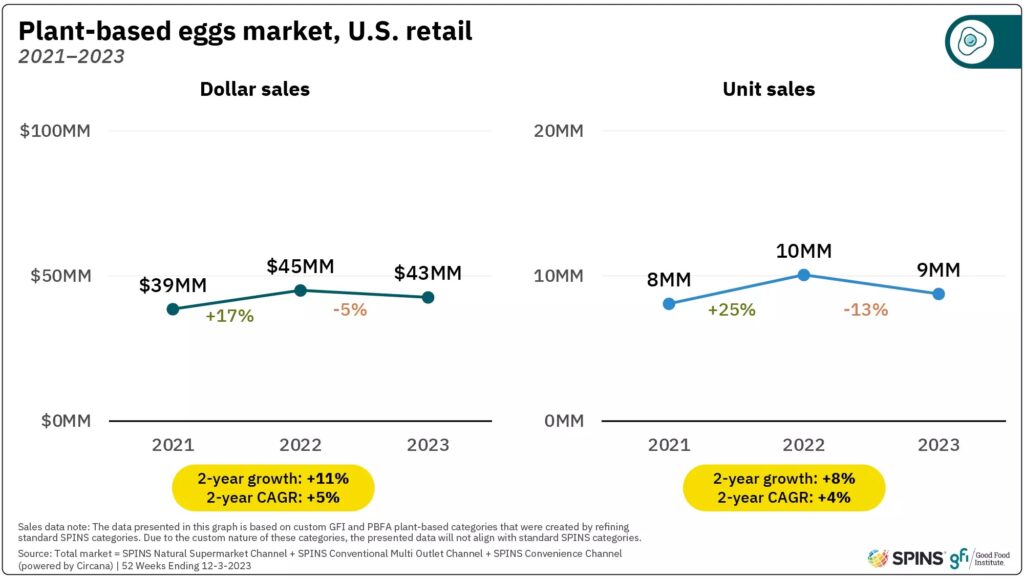

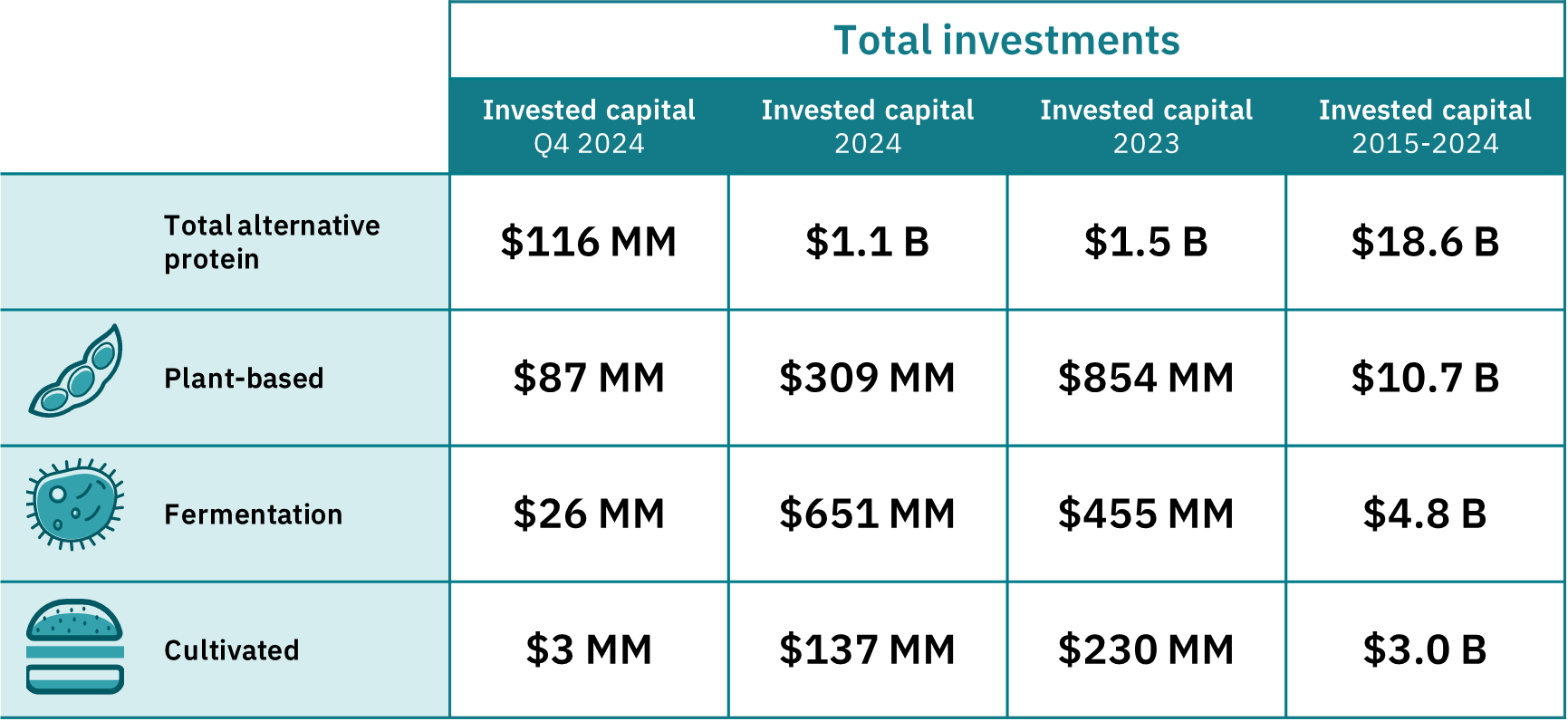

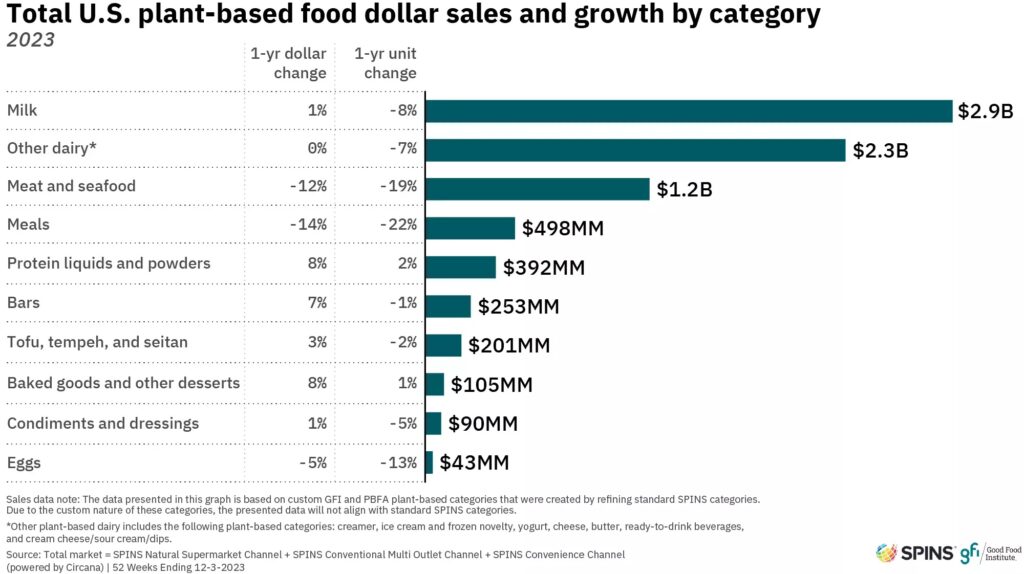

Chicken-free eggs made up just 0.5% of the plant-based retail market in the US in 2023, having been bought by just 1% of households. However, with bird flu and soaring chicken egg prices, the category is set to expand faster now.

According to Tetrick, Eat Just is the 17th largest egg company in the US today: “And we’re growing everywhere – retail, foodservice, everything.”

This is a moment for the sustainable protein sector to prove itself. “We have to prove that we can be in stock. We have to prove that we can make a nice omelette. We have to prove that we can continue to do it consistently,” he says. “And if we do that, we think this could be a real inflection point where millions of people move from a conventional egg to something that we think is a lot better. And it’s a broader statement about what plant-based can be.”

Just Egg makes up “99.999% of our sales”, says Tetrick – the rest comes from its cultivated meat arm, Good Meat. “We are the reliable egg today, and we cannot let this moment pass,” he says. “We’ve got to deliver on time, and in full. We’ve got to make sure that we’re making sufficient product. We need to make sure that if there’s any out-of-stocks around the country that we even hear of anecdotally, we’re on top of it, within hours.

“When we look back 20 years from now, I think it’ll be one of the most important moments in the plant-based industry. And I hope we meet it.”

The post Chicken-Free Moment: Eat Just Sees Sales Boom Amidst ‘Great American Egg Shortage’ appeared first on Green Queen.

This post was originally published on Green Queen.