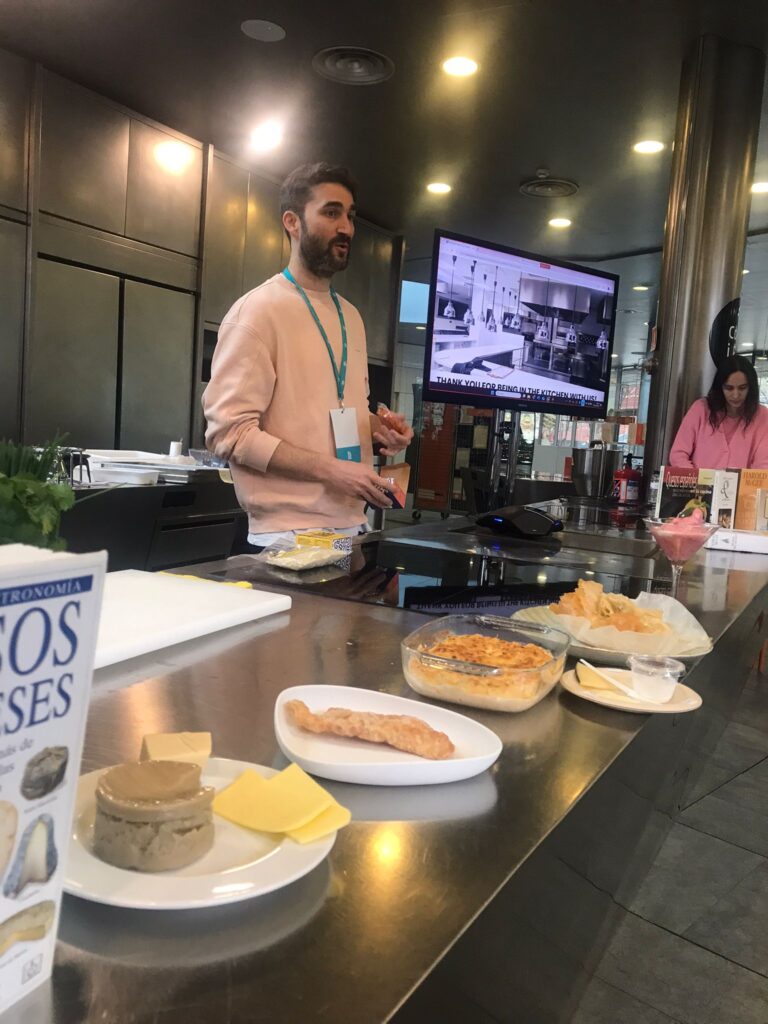

Nourish Ingredients CEO James Petrie explores the decline of VC investment in food tech, and how the sector can chart a course forward.

As we navigate through what some might call a “food tech funding winter,” I find myself in an interesting position as both a founder and industry participant. The headlines are hard to miss: down rounds, struggling valuations and a general pullback in investment across all sectors and, most notably, food tech. Yet, as someone deeply embedded in this space, I see a stark contrast between current market dynamics and the long-term inevitability of industry direction. More importantly, I believe that investors see this too.

The fundamental transformation of our food system isn’t a question of if but when. The current market correction is real and necessary but it is important to distinguish between cyclical challenges and the undeniable momentum of an industry addressing one of humanity’s most pressing challenges – feeding a fast-growing global middle-class population.

The Great De-Unicorning

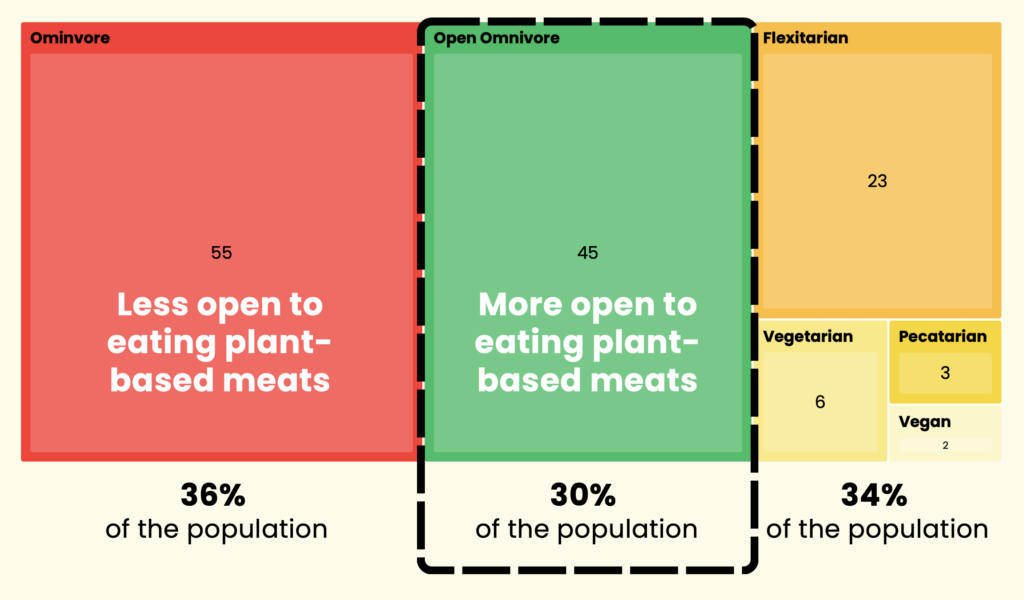

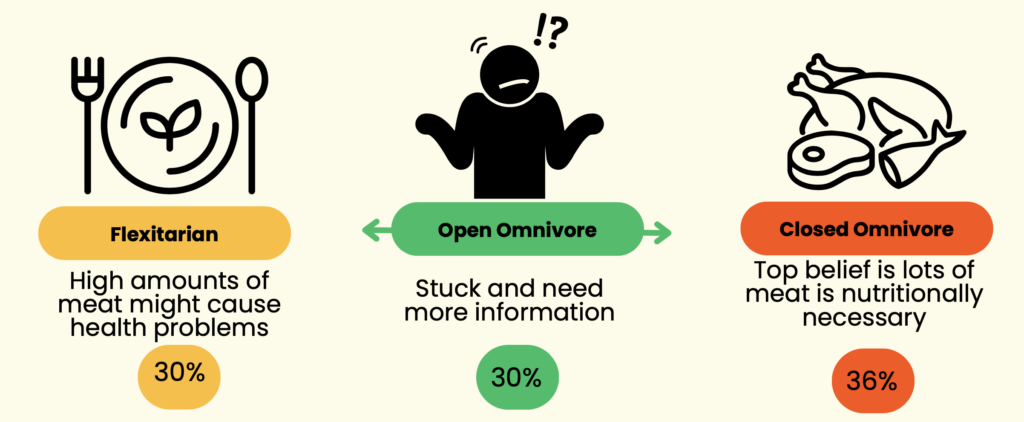

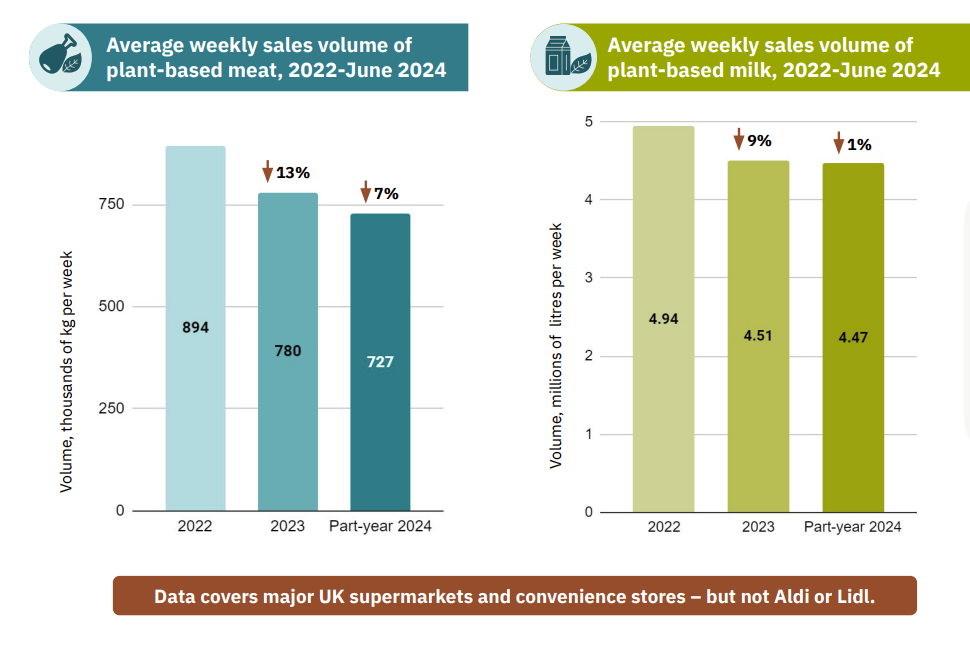

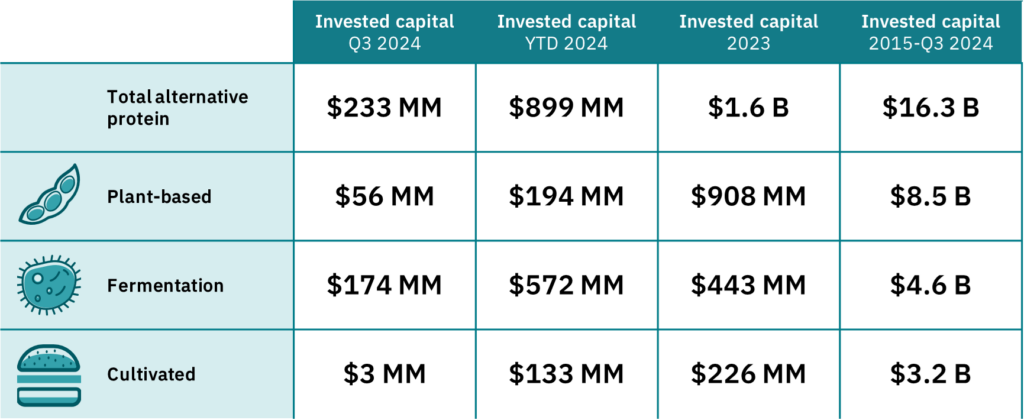

The food tech sector, particularly in plant-based and precision fermentation, is experiencing a significant correction. We’re seeing companies that once commanded huge valuations facing massive down rounds or recapitalisations. Investment in the plant protein sector was particularly enthusiastic in recent years and we have seen expectations return to earth with a thud.

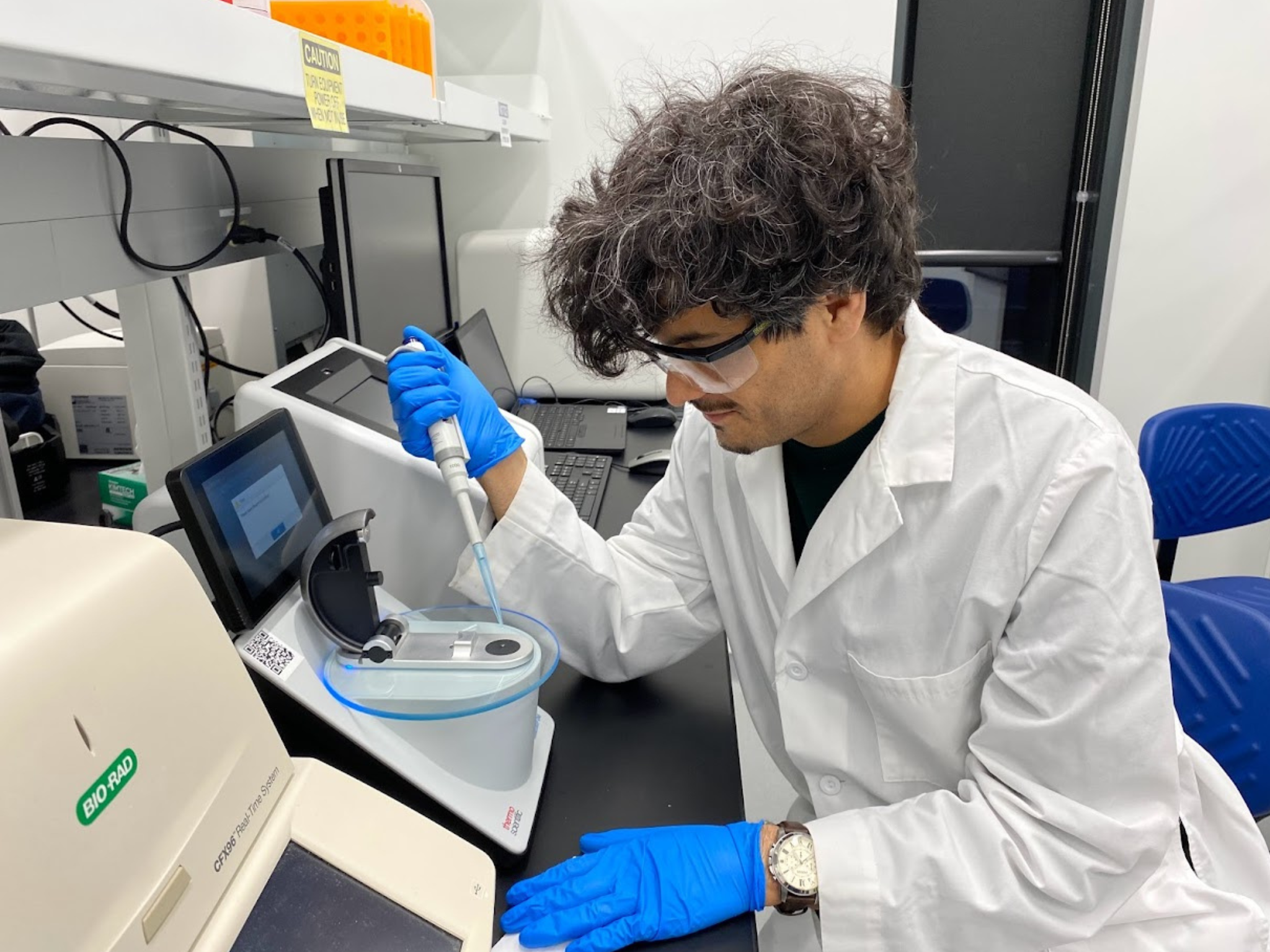

Similarly, the precision fermentation space faces challenges because of the sector’s capital-intensive nature. This has created understandable caution among investors. These are the growing pains of an emerging industry learning to balance ambition with execution, needing to rein in their capital plans to better balance their revenue forecast.

The days of raising significant capital on potential alone are behind us. That is not necessarily a bad thing for a sector that badly needs to mature. Investors have shifted their focus from promises of transformational products toward clear, tangible paths to revenue and offtake deals. This creates a particular challenge for companies that have blown their wad on CapEx before firming up customer demand, but this simultaneously creates opportunities for those willing to be patient and strategic.

Follow the trend

It is important to distinguish between a correction and a trend. I believe that investment in the food tech space is fundamentally sound because the drivers for food tech solutions are not cyclical. Rather, they are existential and inevitable. Climate change is not a theoretical dragon on the map but is beginning to bite and we are starting to see permanent shifts in food production practices.

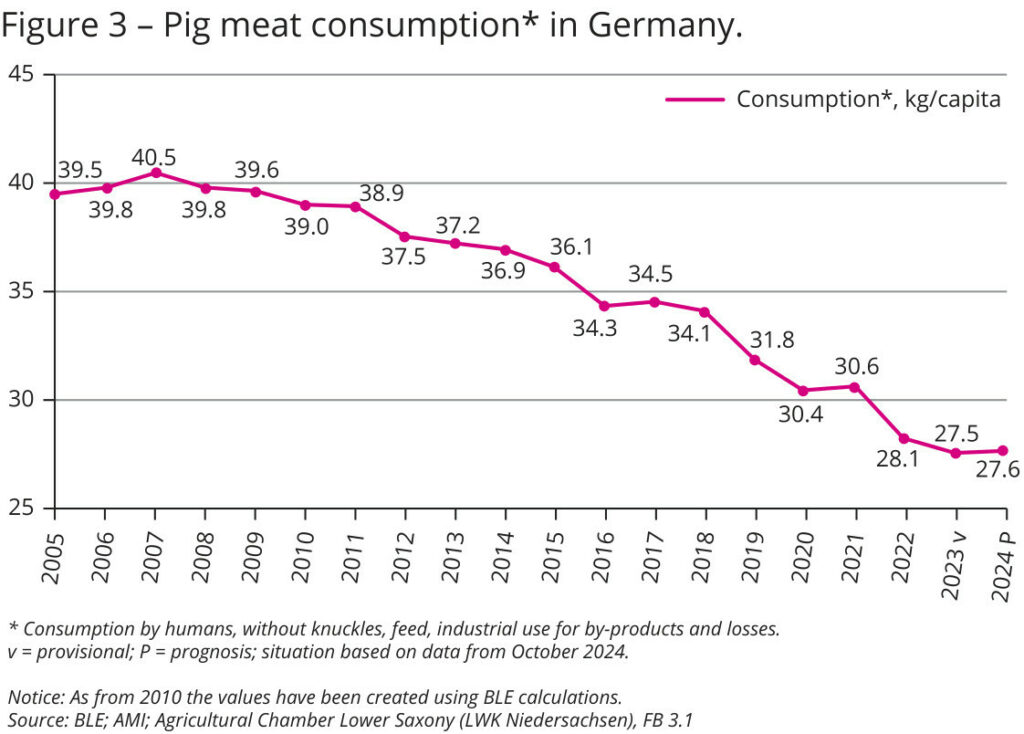

Traditional food supply chains are showing their vulnerabilities, from extreme weather events disrupting agriculture, to water stress, to decreasing herd sizes in many parts of the world. “Peak milk” is something you will hear about in the coming years and this is just one example of how resource constraints are limiting conventional food production.

Meeting consumer expectations without sacrifice

Our global middle classes are expanding rapidly and these people want to eat animal products. Unfortunately, the math is simple but stark in its lack of scalability: Animal agriculture consumes 77% of agricultural land but produces only 17% of our food. This isn’t only about market timing; it’s about physics, chemistry and biology.

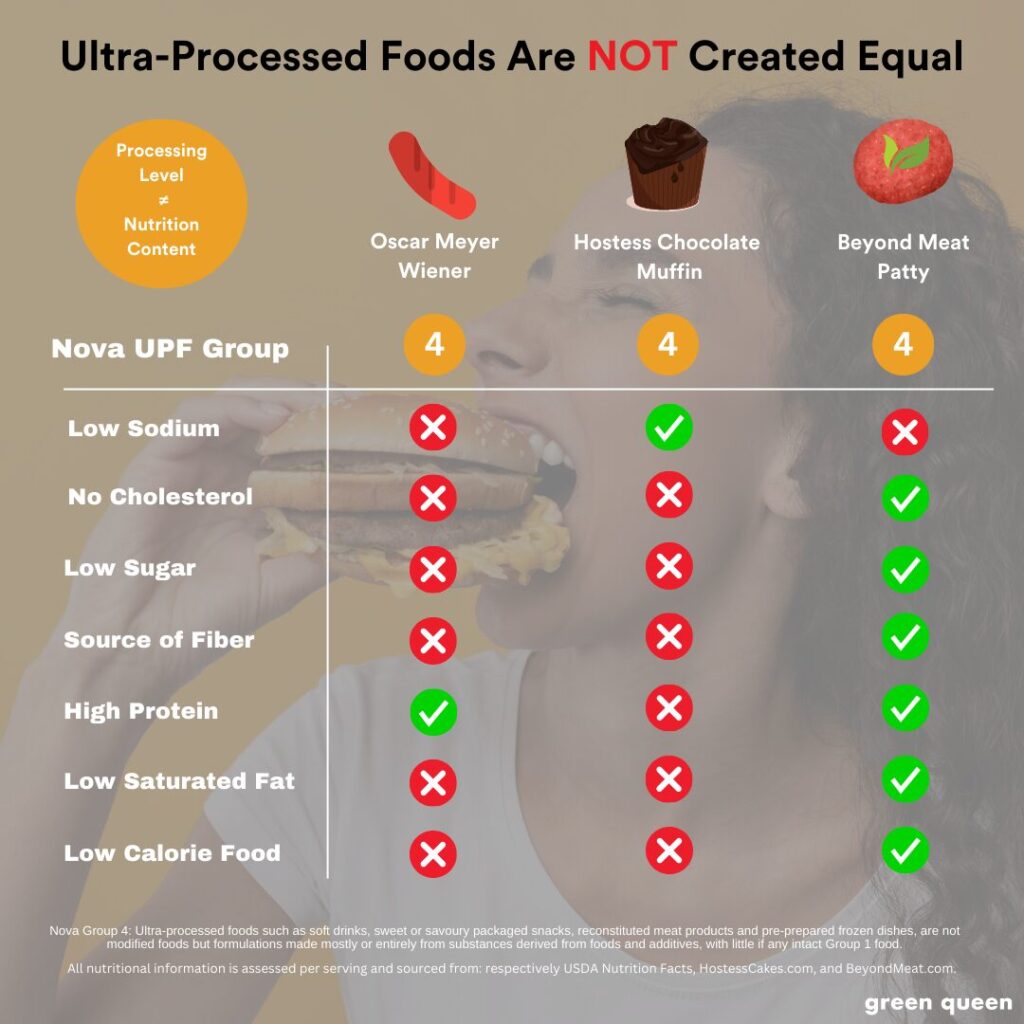

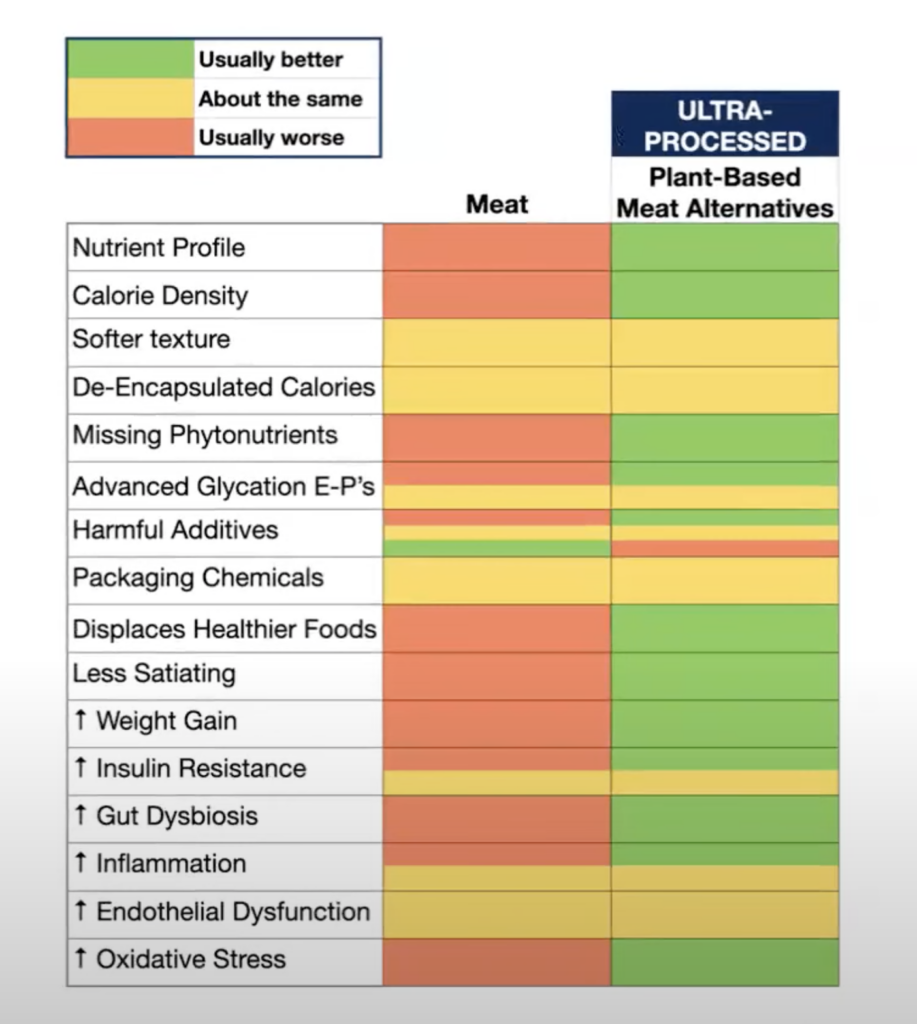

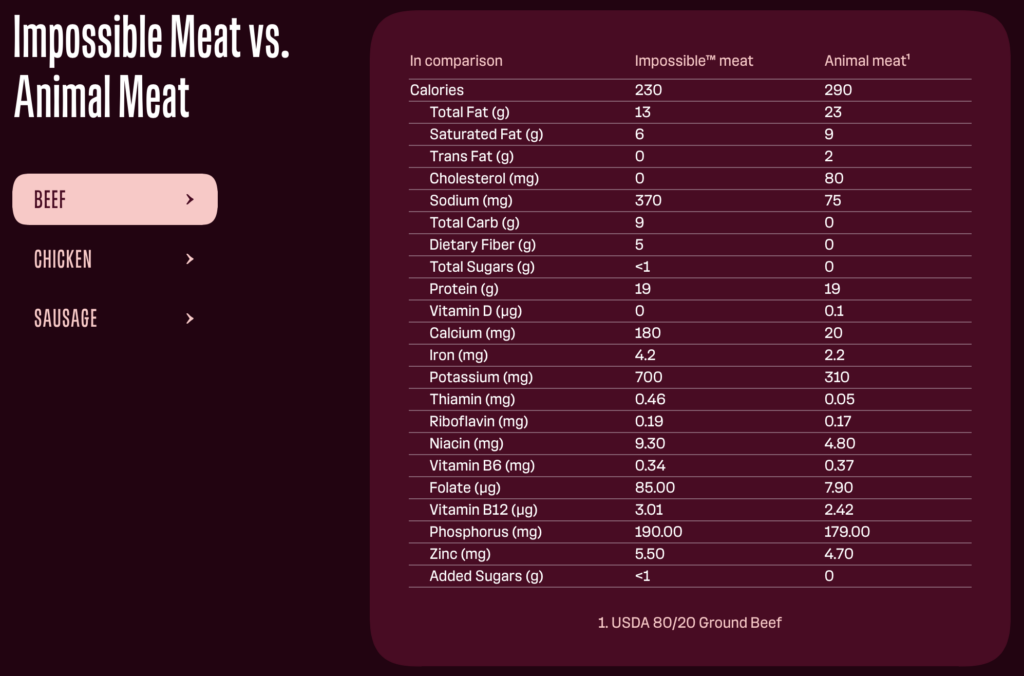

How do we meet the growing demand? How do we meet not only calorie and nutrient requirements but also give these people the foods they want to eat? The answer lies in deep tech, in clever ways of stretching out existing animal food supplies by supplementing the growth-limiting ‘sub-ingredients’ that are currently difficult or impossible to replace without losing authenticity. Blended or hybrid foods are a massive market opportunity that helps us address new demand with climate-resilient supply.

A new playbook

And so we return to investment in these tangible market opportunities. Commercial traction – real customers making real commitments – should top the list of investor requirements. Strategic partnerships and offtake agreements are particularly telling; they indicate that established players see enough value to put skin in the game, even ahead of full-scale commercial readiness. The best technology in the world means nothing without a validated path to commercial adoption.

Historical parallels are telling here. Every transformative industry has gone through periods of correction and consolidation. Current valuations, while challenging, create attractive entry points for new investors.

So, what’s next?

Success in this environment requires a laser focus on solving real problems. At Nourish Ingredients, we’ve doubled down on developing solutions that address specific industry challenges, particularly around taste and functionality and building commercial relationships early on in our journey.

The ability to tell the right story – one grounded in reality but also inspirational – has never been more important. The companies that emerge strongest from this period will be those that have combined technical innovation with commercial execution, supported by investors who understand the sector’s deep drivers and potential and, most importantly, can see beyond the reset.

The post Op-Ed: Amid A ‘Funding Winter’, How Does Food Tech Reset? appeared first on Green Queen.

This post was originally published on Green Queen.