French consumers are eating more legumes, vegetables, and vegan meat and dairy – but concerns about prices and health are major barriers to the latter.

Veggie burgers have been at the centre of a fierce debate in France, where legislators have been trying to ban companies from using meat-related terms on plant-based products. Their efforts are proving to be unsuccessful, with the proposal being reprimanded by the EU’s highest court.

But while meat analogues continue to divide opinion in the republic, whole foods like legumes and grains enjoy a more favourable perception among the French.

Having grown up on boeuf bourguignon and coq au vin, meat still remains king in France. But more than a third (35%) of its residents now rate legumes and pulses among the richest sources of protein, and two-thirds (66%) eat foods like beans, grains, lentils and wheat weekly, according to a new survey.

This is driven by a perception that these foods are healthy (a view shared by 73% of respondents), natural (67%), and contribute to a balanced diet (66%).

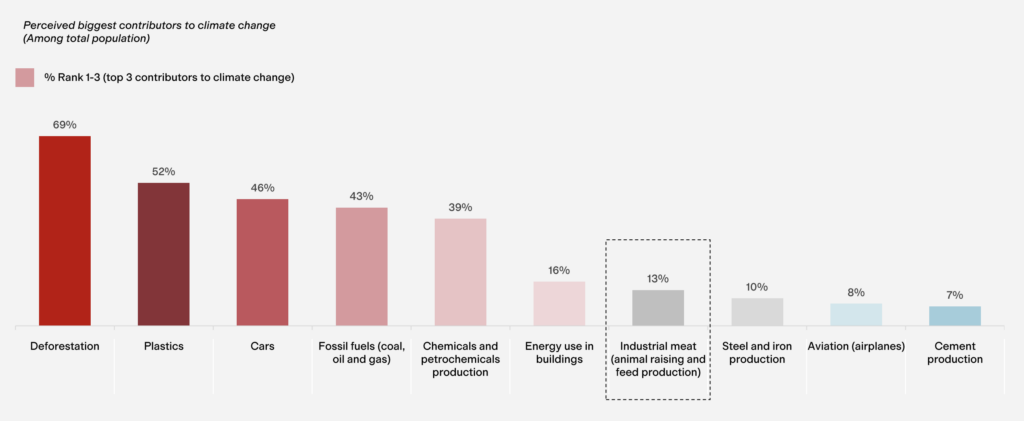

While separate research suggests that meat intake has fallen over the last two decades, this poll reveals that nearly a quarter (23%) of French nationals have been eating more legumes recently, with 34% citing their nutritional benefits as the key consumption driver. That said, 27% of them are unaware of these health gains, and 44% are not familiar with the environmental advantages of these foods over animal proteins.

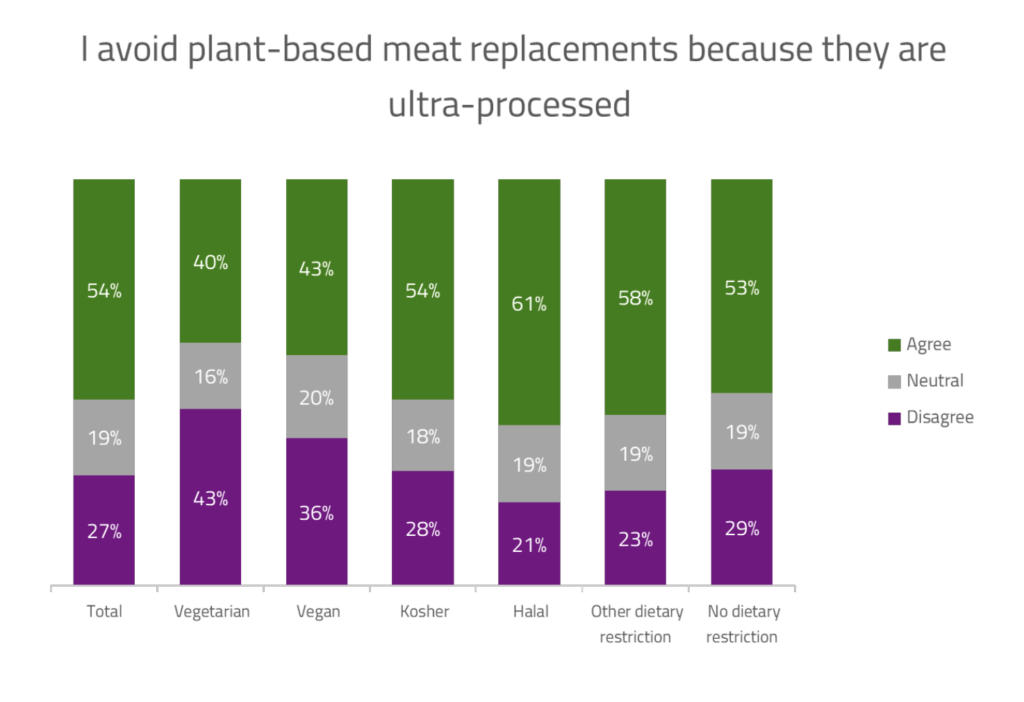

It’s reflective of a larger challenge facing the plant protein ecosystem – six in 10 people in France aren’t familiar with vegan alternatives to meat and dairy, and two-thirds view them as trendy. Crucially, 44% feel they don’t taste as good as animal proteins.

“French consumers often lack sufficient knowledge about nutritional recommendations. The benefits of plant-based proteins, while significant, remain underappreciated and misunderstood by the broader public (daily protein intake, how to combine them, etc.),” says Alice Meullemiestre, CEO of plant-based consortium Protéines France, which conducted the survey in collaboration with vegetable oil and proteins association Terres Univia.

The 1,000-person poll is the seventh edition of their joint Consumer Barometer project, which aims to analyse the knowledge, perceptions, and practices of French consumers around traditional plant proteins as well as novel sources.

Why the French are swayed by cost and nutrition

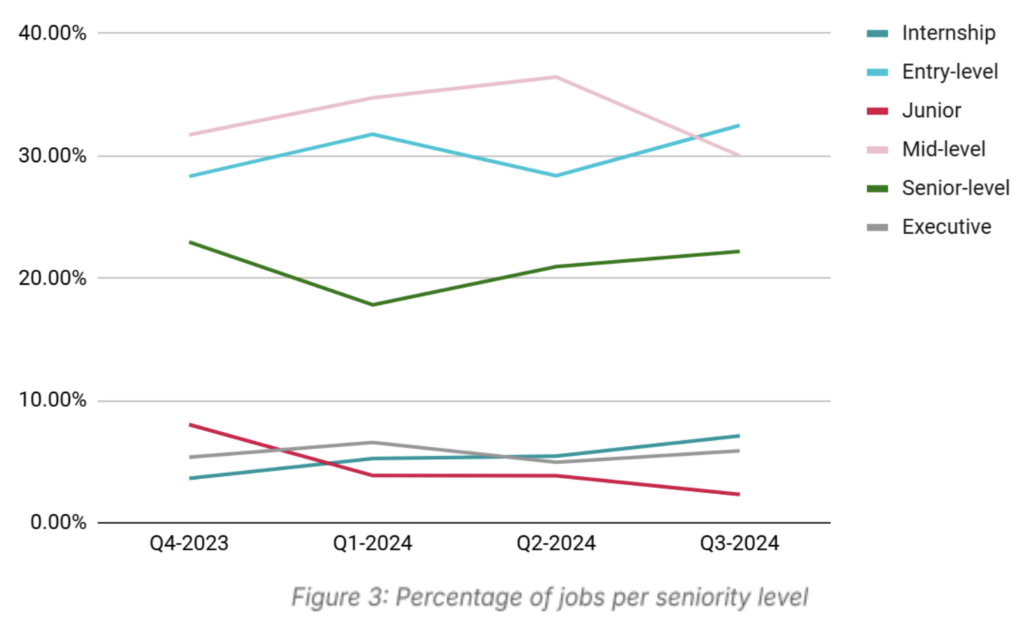

The survey revealed that 65% of French consumers still identify as omnivores, but the number of flexitarians is growing and now makes up 31% of the population.

A quarter of respondents say they’ve changed their eating habits. For 45% of this section, rising costs have been the primary motivator for this shift. Health and nutrition concerns have pushed another 41% to do so, while 11% have changed how they eat to reduce their environmental impact (diets are responsible for 22% of France’s emissions).

At the same time, French people’s dietary priorities revolve around balanced nutrition (cited by 59%), diversity in food products (47%), and seasonality (43%). And over a third of them are eating more vegetables now.

Meullemiestre believes the importance of cost and nutrition is driven by both economic and societal factors. “Many consumers are facing an economic context of inflation, making affordability a key consideration in their food choices,” she says.

“Simultaneously, there is growing attention to the quality of diets, with individuals prioritising nutritionally balanced foods that contribute to their health and carefully considering the origin and sustainability of the products they consume. This has brought plant-based proteins into focus, as they are often perceived as healthier, more sustainable, and cost-effective options.”

France’s citizens eat about 1,600g of meat per week, much higher than the current dietary guidelines, which recommend a maximum of 500g of red meat and 150g of processed meat weekly.

The French Nutrition Society (SFN), a group that comprises public and private sector nutrition experts, has called on the government to suggest cutting meat consumption by at least 25% each week – a total of 450g – in the forthcoming update to the national guidelines.

But the poll suggests that French consumers generally remain poorly informed about nutritional guidelines, with three in four not knowing the daily protein recommended.

Meeting labelling expectations can drive plant-based consumption

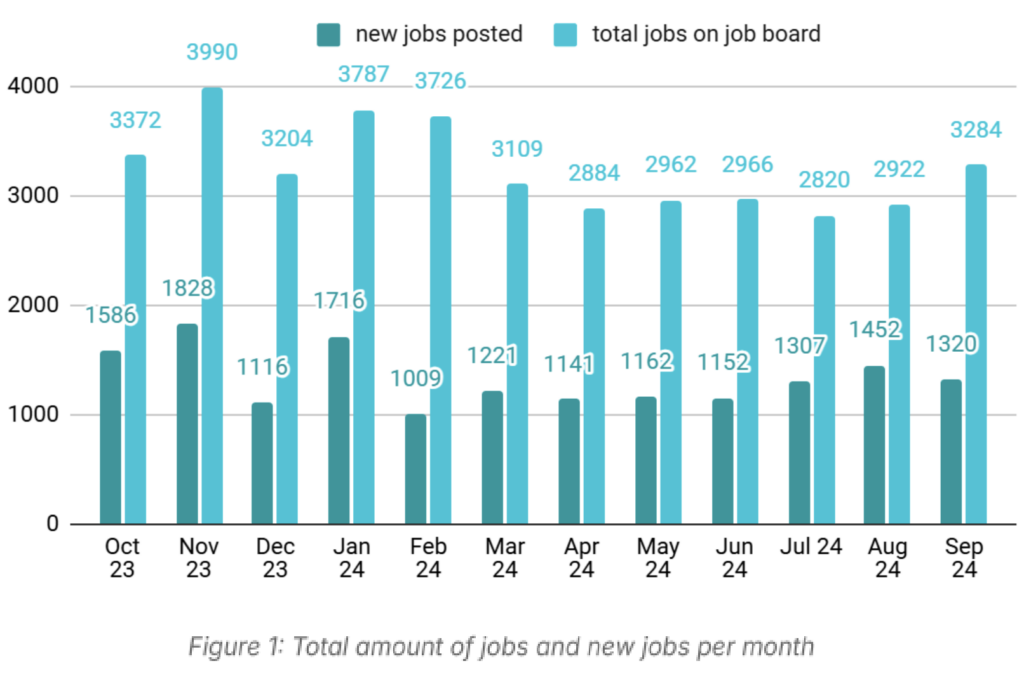

Interest in plant-based products is growing, with a quarter of people eating meat and dairy alternatives weekly, and 14% doing so several times a week – a three-point increase from the 2022 and 2022 Consumer Barometers.

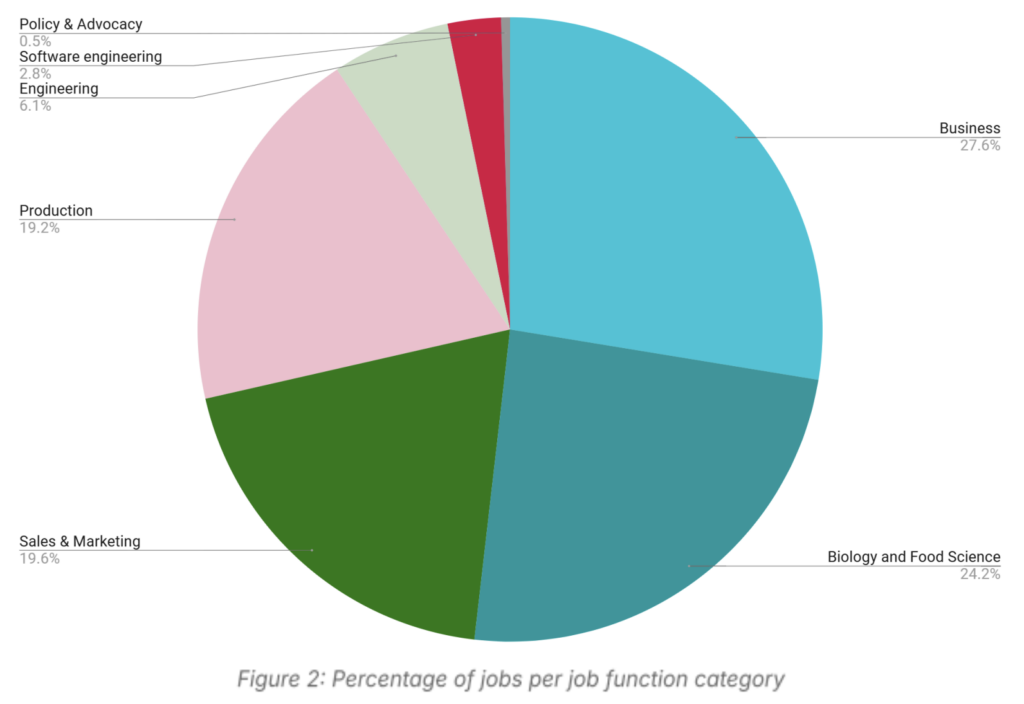

French consumers seem to have a sweet tooth, with 31% consuming vegan desserts at least weekly. This is followed by meat analogues (28%), ready meals (22%) and plant-based milk (22%).

The respondents also showcased an interest in newer protein sources, albeit with some caution. Half would be willing to try products derived from algae, while four in 10 say the same for mycelium or yeast-based proteins.

But as indicated above, there’s a knowledge gap around the nutrition and sustainability of plant proteins, combined with a perceived inferior taste. So how can brands overcome this barrier?

One way would be to meet consumers’ expectations on product labelling – though, with the legislative battle around meaty terms, this remains a thorny subject. The survey found that France’s population places high emphasis on ingredient lists, with 47% of respondents calling them key purchase drivers.

Similarly, the origin of products and ingredients is important for 41%, and vegan labels and certifications like Nutri-Score are key for another 37%. Nutritional information, meanwhile, on food products influences a further 35%.

“Consumers need transparency and to be informed,” says Meullemiestre. “Addressing this gap is a priority for Protéines France and Terres Univia. Together, we are working to improve consumer education through enhanced communication, awareness campaigns, and broader initiatives to promote plant-based proteins, aiming to engage and better inform the public.”

She adds: “We are investing in educational initiatives to raise awareness of the nutritional, environmental, and economic benefits of these solutions. Diversifying product offerings and improving their accessibility in terms of taste, affordability, and availability is a critical focus. Significant efforts are being made to innovate in taste and texture, which remain vital factors for gaining broader consumer acceptance.”

The post Legumes Take Centre Stage in France, Where Rising Prices & Nutrition Concerns Drive Dietary Change appeared first on Green Queen.

This post was originally published on Green Queen.