US biotech startup Pureture has developed an innovation that cuts the production time for its yeast-derived casein protein by 30%, and enables clean-label alt-dairy formulations.

As part of a rapidly expanding market for animal-free casein, US startup Pureture has improved the cultivation process of yeast protein, the base ingredient of its fermentation-derived offering.

By boosting yeast growth and activity via novel ingredients, the company is now able to produce its casein 30% faster than before, bringing in both time and cost savings. Additionally, while traditional yeast cultivation methods lead to foam formation – requiring the use of additives like antifoaming agents – Pureture’s new patent-pending tech “virtually eliminates” this, meeting the growing demand for cleaner-label formulations.

But despite the lack of additives, the startup says the casein maintains its emulsifying and thickening properties, and so products made from the casein retain their taste and functionality.

The case for clean-label casein

Casein comprises 80% of the total protein content found in milk, and is responsible for emulsification – preventing water and fat from separating and giving the cheese its melty and stretchy properties. The ingredient can be used to make superior vegan products like cheese, milk and yoghurt analogues, as well as protein shakes.

Currently, most plant-based dairy products use additives to replicate the functions of casein, but consumers are increasingly looking for foods free from artificial ingredients and with short ingredient lists. According to Innova Market Insights, more than two in three consumers are influenced by clean product labels, with respondents in the Americas and Europe specifically looking for additive- and preservative-free options.

Meanwhile, around half of consumers would pay more for clean-label products. And a separate survey by Ingredion shows that clean-label and natural ingredients were the factors that gained the most importance for CPG purchases between 2020 and 2022. This is perhaps why the research predicts 70% of all food and drink portfolios to be clean-label within the next two years, given that 99% of European manufacturers find them essential to their business strategies now.

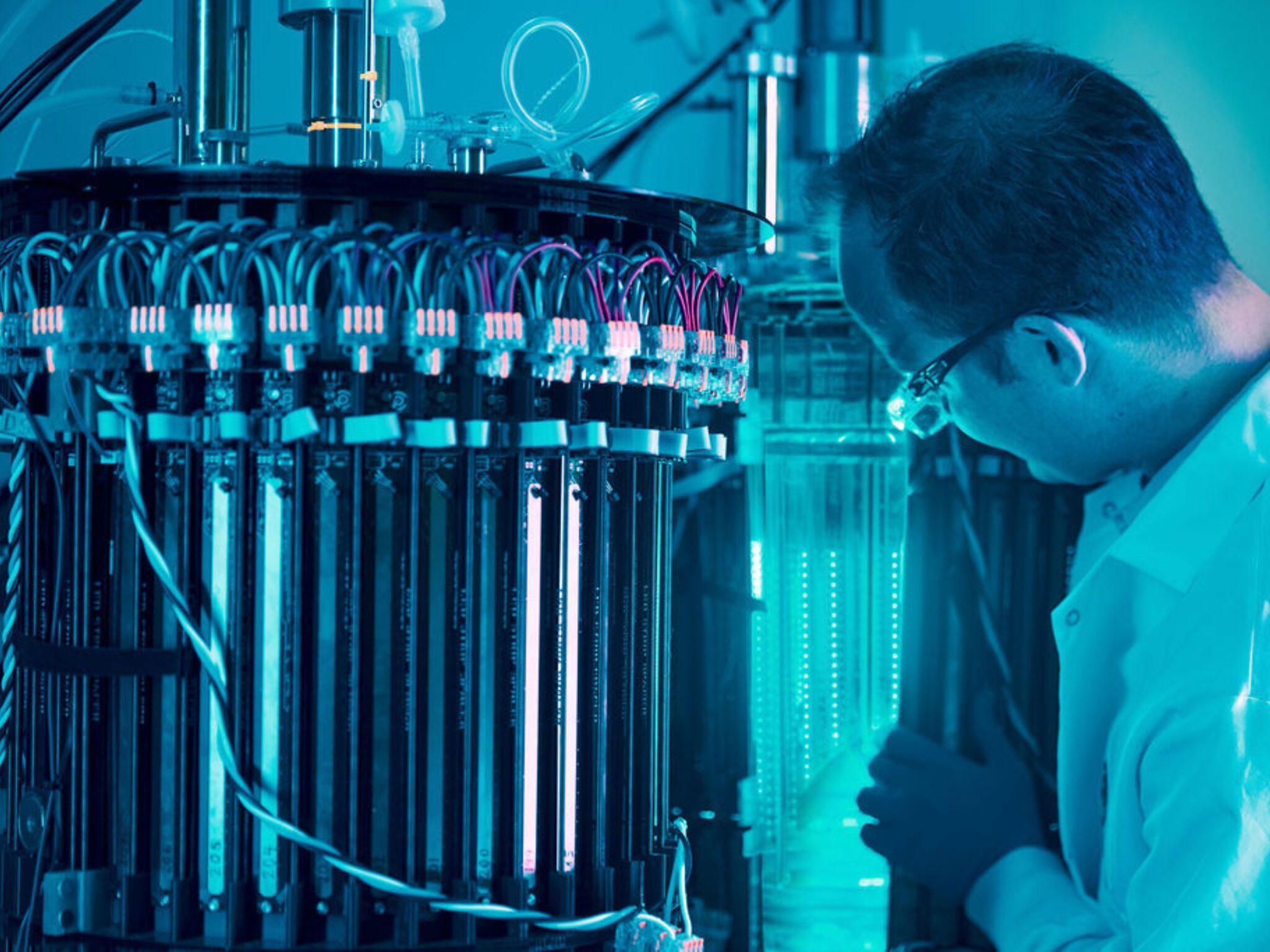

Pureture’s casein protein is said to offer a cleaner alternative, as it eliminates the need for starches, gums, and emulsifiers. The company employs a six-step liquid fermentation process that combines yeast with plant-based ingredients.

It begins by cultivating a yeast strain and enriching it. Then, it separates the protein and tests the emulsification functionality, before sterlising and drying the casein. Pureture has one 50-litre fermentation tank for seed cultivation, three 500-litre vessels for the first cultivation, and a further three 30,000-litre tanks for the second cultivation. This means it can produce up to 2,400 tonnes of protein annually.

Pureture’s cheaper-than-dairy casein could attract climate-conscious companies

Pureture has its roots in South Korea. It was founded in 2022 as Armored Fresh Technologies by Rudy Yoo, who rebranded the business in May last year to separate it from his other alt-dairy startup, Seoul-based Armored Fresh.

Its animal-free dairy protein provides health gains too, offering a protein digestibility-corrected amino acid score of one, matching the digestibility of conventional milk. Additionally, since the entire process of yeast fermentation, protein recovery and emulsification is carried out continuously, Pureture’s protein can be supplied at a price 30-40% lower than conventional dairy versions.

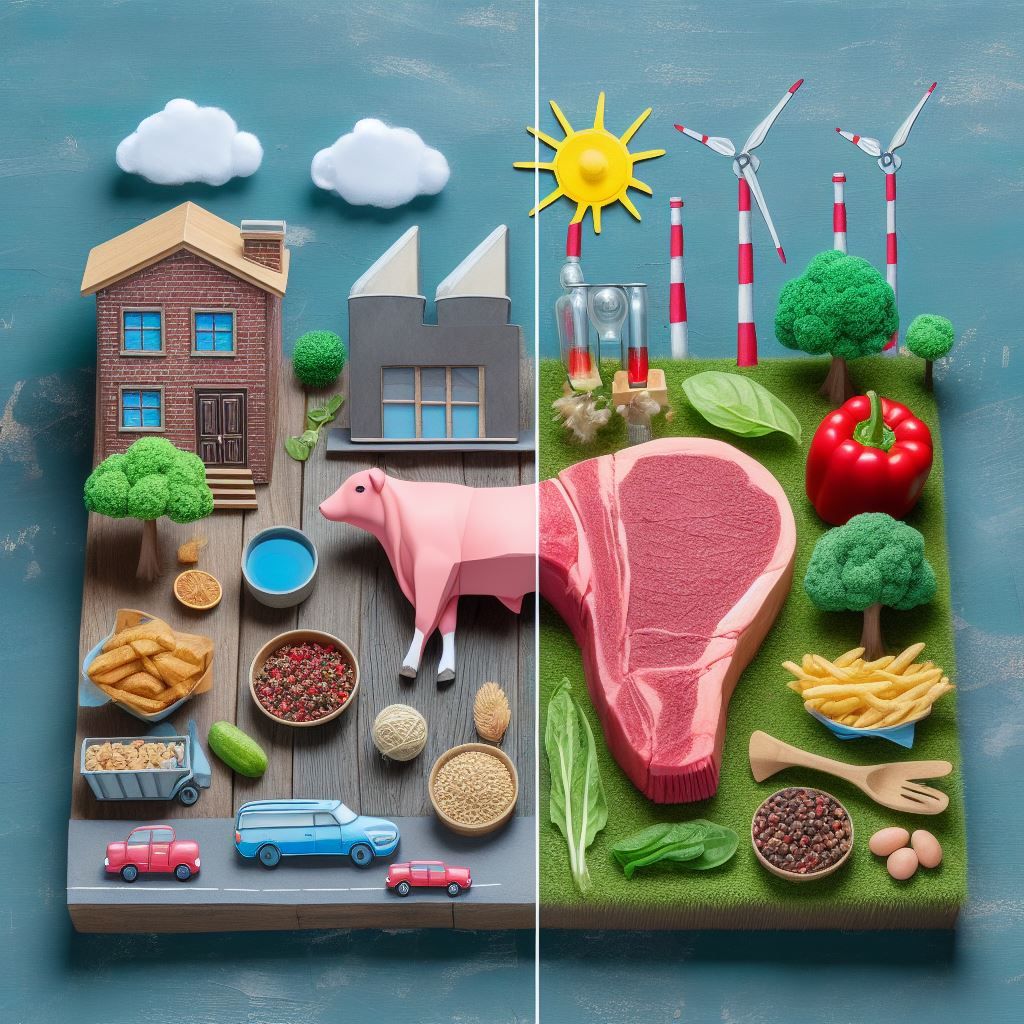

This will be attractive to companies looking to streamline their ingredient lists and lower their climate impact. According to an independent life-cycle assessment (LCA) by Standing Ovation, which employs precision fermentation to produce its protein, animal-free casein needs up to 94% fewer greenhouse gas emissions (although the LCA was done at pilot scale, and an industrial-scale analysis would provide a more rounded picture).

Pureture has previously outlined its aim to collaborate with major dairy companies to co-brand its yeast-derived casein, and with global ingredients vendors to expand its use. To that end, in January, it partnered with South Korean food giant Namyang Dairy Products, which will develop a new vegan range with Pureture’s casein protein. Dairy is the third most-consumed protein source in South Korea, but the country’s national action plan now promotes plant-based foods.

Casein is a $2.7B market, and a host of startups are attempting to disrupt the space with planet-friendly innovations. New Culture, Change Foods, Fermify and Zero Cow Factory are all using precision fermentation (like Standing Ovation), while Alpine Bio, Finally Foods and NewMoo are tapping into molecular farming to grow casein in plants.

The post Pureture Develops Technology to Produce Clean-Label Vegan Casein in 30% Less Time appeared first on Green Queen.

This post was originally published on Green Queen.