In our weekly column, we round up the latest news and developments in the alternative protein and sustainable food industry. This week, Future Food Quick Bites covers Mission Barnes’ newest cultivated meat, Waitrose’s whole-food plant-based plunge, and Odd Burger’s new locations.

New products and launches

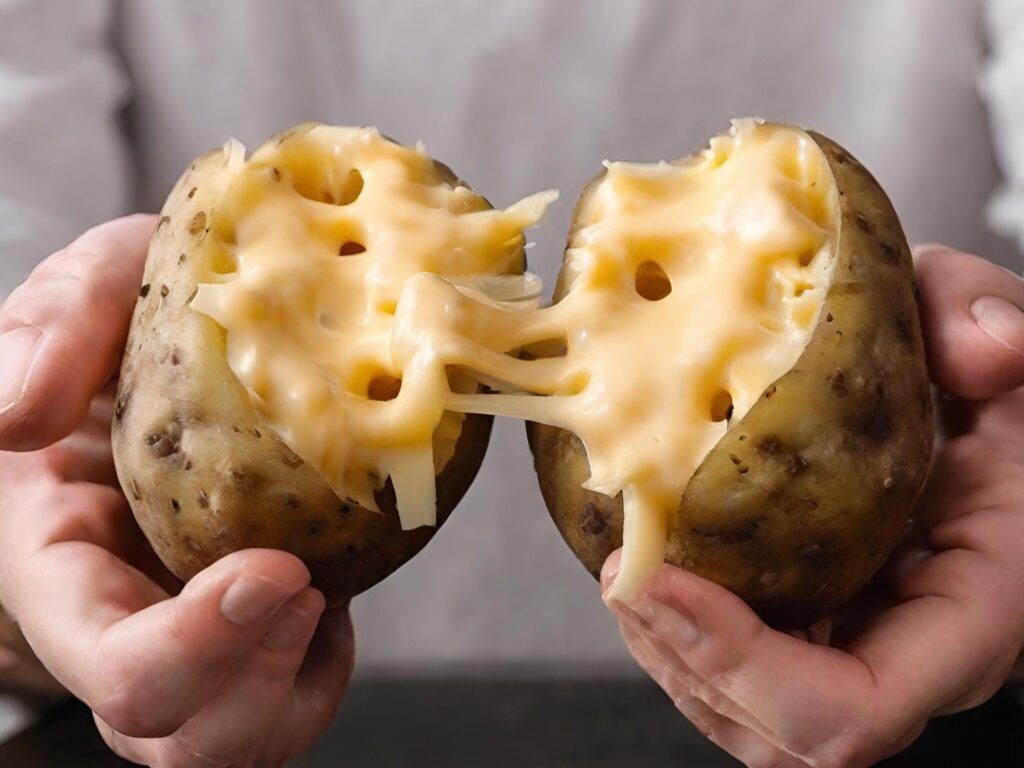

For the pizza lovers, cultivated meat producer Mission Barnes has announced its latest innovation, a hybrid pepperoni mixing combining pork cells with pea, fava bean and flaxseed proteins.

Israeli food tech company Yo Egg, which debuted its vegan sunny-side-ups and poached eggs in Los Angeles retail in March, is now available nationwide in the US via PlantX.

The Plant Based Seafood Co has partnered with supermarket chain Wegmans to place its Mind Blown range of vegan crab cakes and dusted scallops on the retailer’s shelves in 80 stores across the US.

Tacotarian, the California-based vegan Mexican restaurant chain, has introduced a line of shelf-stable taco fillings made with Beyond Meat. The first products will be jackfruit barbacoa and jackfruit Birria, which will be available online and at various retailers.

Bee-free honey maker MeliBio, which launched its Mellody plant-based honey through a collaboration with Eleven Madison Park last year, has renewed its partnership with the three-Michelin-starred plant-forward eatery, whose Tea and Honey Gift Box contains the brand’s vegan honey.

US tofu giant Nasoya has launched two plant-based chicken products under its Plantspired range, available in Kung Pao and Bee-Free Honey Garlic (which uses agave) initially at Albertsons and Meijer.

Speaking of tofu, Berlin-based Omami has debuted a three-ingredient chickpea tofu range in Germany in Tasty Nature, Black Pepper, Sweet Chilli and Smokey Twist flavours.

Vegan whole cut meat maker Chunk Foods will showcase two new SKUs – Chunk Cubes and Slabs – at the National Restaurant Association Show (May 18-21) in Chicago. The Cubes are meant for fast-casual restaurants, while the Slabs are touted to be the largest whole-cut plant-based meat to hit the market, weighing over 3 lbs.

In the UK, Costa Coffee has extended its partnership with vegan influencer duo BOSH! with the launch of a vegan Falafel and Houmous Wrap and Gingernut Loaf Cake.

British retailer Waitrose has expanded its private-label PlantLiving range with 12 new products that focus on flexitarians and whole foods over processed plant proteins, after sales for canned lentils, marinated tofu and vegan salad rose exponentially.

And in Australia, the iconic Chippendale Hotel (The Chippo, if you’re local), has opened the country’s first fully vegan pub in Sydney.

Financial developments

Canadian cellular agriculture company Cult Food Science has closed a private placement of C$800,000 ($585,000), which will be used for working capital and general corporate purposes.

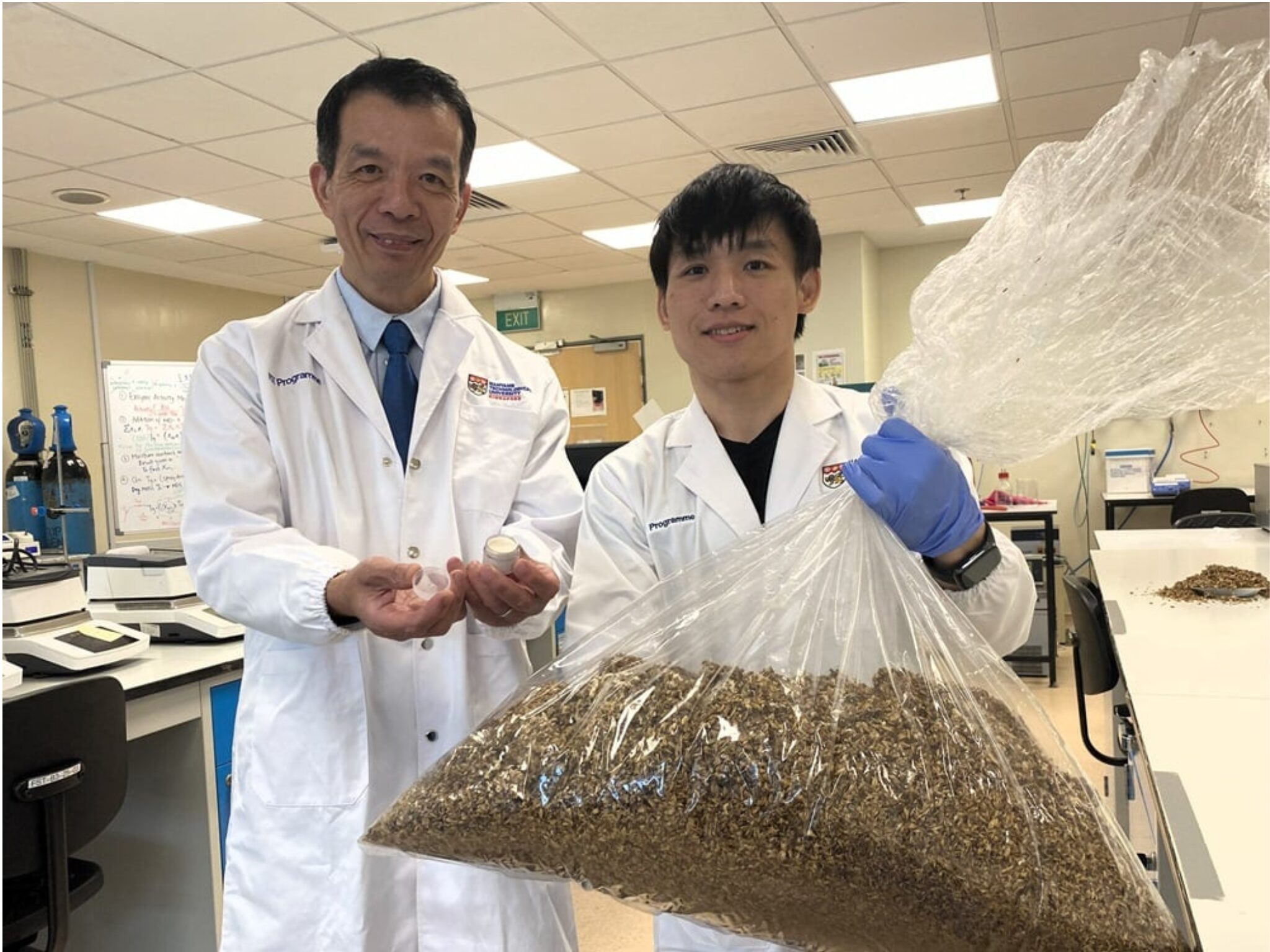

Fellow Vancouver-based startup Maia Farms has secured $2.3M in pre-seed and grant funding for its mycelium protein (which has 5.5 times the iron content of beef), which recently won NASA and the Canadian Space Agency’s Deep Space Food Challenge for its CanPro ingredient.

Latin American startup Peruvian Veef has raised $320,000 to expand its foodservice and retail footprint across the continent.

Swedish startup OMG Plantbased Food, which trades as Oh Mungood!, has secured an undisclosed sum in a funding round.

New Zealand microalgae protein startup New Fish, whose first product is called Marine Whey, has rebranded to Nutrition from Water (NXW), and has received an investment from Olympic gold medallist sailor Pete Burling.

Seitan startup Blackbird Foods, which makes vegan pizzas and wings, has launched a crowdfunding campaign on StartEngine, with investment opportunities starting from $249. It follows a 60% year-on-year growth in sales.

Brooklyn-based Caladian Bio, which is building next-generation, low-cost benchtop bioreactors for enhanced data capture and experimentation throughput, has raised $5M in seed investment.

Manufacturing and company updates

Alternative protein leader Eat Just has had an update on its lawsuit with contract manufacturer ABEC over unpaid bills by its cultivated meat arm, Good Meat. The judge in Pennsylvania has granted several of ABEC’s motions and denied others, while also dismissing some of Eat Just’s counterclaims. But it sided with the latter on one of its claims, which will now proceed to trial.

Fellow cultivated meat pioneer UPSIDE Foods has launched a petition in response to Florida’s ban on the novel proteins, urging people to show lawmakers from other states that they don’t agree with the policy.

Mush Foods, the mycelium meat startup making solutions for blended meat, has released the results of a life-cycle assessment, which found that its 50CUT product produces negligible GHG emissions (0.02kg per patty). This means blending it with conventional meat would halve its carbon footprint.

E-learning platform GenConnectU has announced an on-demand course focused on impact investing in the plant-based sector, facilitated by VegTech Invest CEO Elysabeth Alfano.

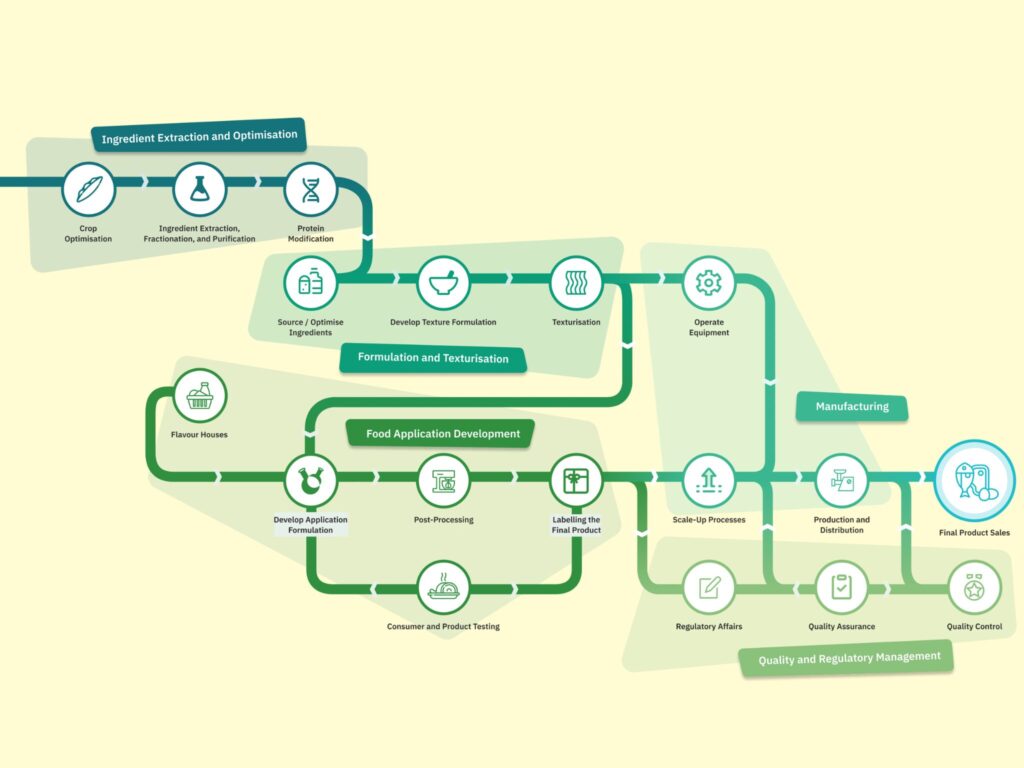

VC firm Big Idea Ventures has launched PlantSustain, its fifth portfolio company through its Generation Food Rural Partners fund, which will focus on commercialising bio-based research for more sustainable products and agricultural solutions.

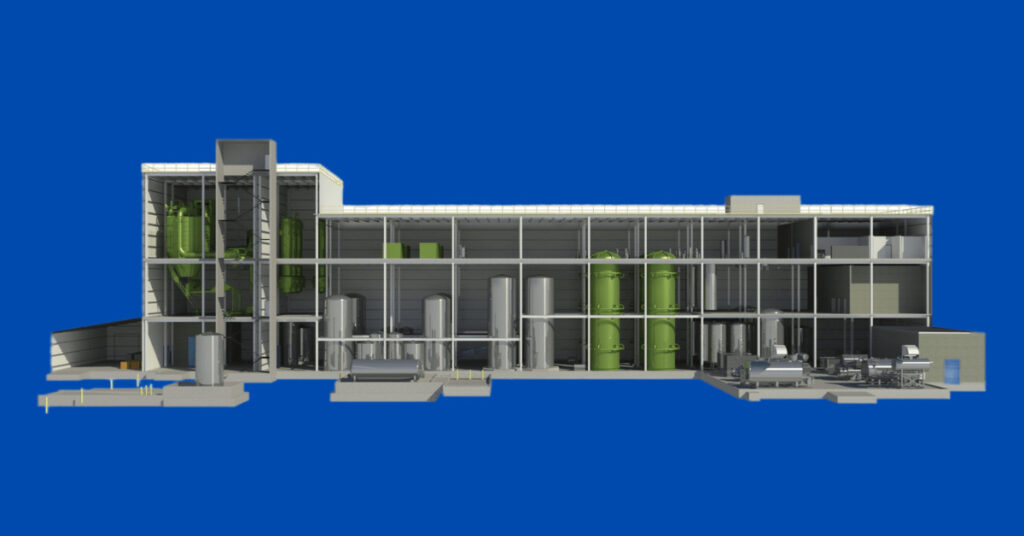

Danish bioproduction leader 21st.BIO has unveiled its pilot plant facility in its Copenhagen headquarters, which has a fermentation capacity of over 3,000 litres of fermentation capacity and will help companies scale up production of recombinant proteins and peptides for the nutrition, food, agriculture, biomaterials, and biopharma sectors.

US vegan fast food chain Odd Burger will open three new locations in Alberta and British Columbia this month (taking its total to 16), and has signed a consulting deal with the Ahimsa Foundation, which will receive 1.5 million stock options at a price of 15 cents.

Finally, global vegan certification body V-Label has launched a new advisory board and is calling for applications from individuals with divser backgrounds and expertise in fields including sustainability, sales and finance, marketing, consulting, and business development.

Check out last week’s Future Food Quick Bites.

The post Future Food Quick Bites: Cultivated Pepperoni, Odd Burger & A Vegan Pub appeared first on Green Queen.

This post was originally published on Green Queen.