New York-based Pureture has teamed up with South Korean food giant Namyang Dairy Products to create products using the biotech startup’s vegan casein ahead of an upcoming $12M seed funding round.

Pureture, which makes a GMO-free, yeast-based casein using liquid fermentation, has partnered with Namyang, South Korea’s third-largest dairy producer. The collaboration will see Namyang develop an entirely new plant-based range with Pureture’s casein.

Casein is the main protein found in milk – comprising 80% of the total protein content – and is responsible for emulsifying attributes, which help prevent water and fat from separating and give the cheese its melty and stretchy properties. Pureture’s plant-based version is said to offer a cleaner alternative as it eliminates the need for starches, gums, and emulsifiers.

Namyang hopes to move past two rocky years

“At Namyang, we’re aiming to make strides towards the future, as well as learn and grow with the dairy industry,” said Namyang CEO Myko Kihyun Nam. “We’ve had our eyes on the plant-based industry for a while, but knew we needed the right ingredients.”

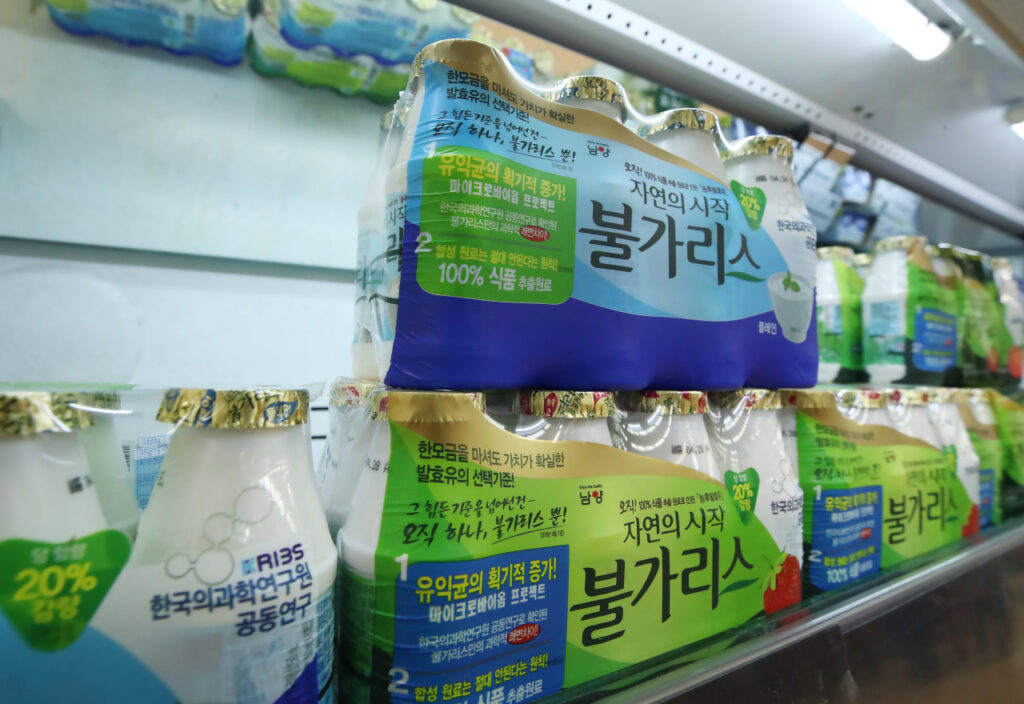

It’s part of a new dawn at Namyang, which was taken over by Korean private equity firm Hahn & Company earlier this month after a protracted, two-year-long legal battle. It began after the dairy giant was subject to huge public condemnation in 2021 when it exaggerated the health benefits of its Bulgaris yoghurt and claimed that it could prevent Covid-19. The company was also notified by a provincial government of a two-month suspension of operations at its production line. It led to its chairman resigning and more than 60 years of family ownership coming to an end with the eventual takeover.

Namyang, which makes cheeses, yoghurts, milk, creams and soy milk, has been saddled with controversy lately, including coercive sales to distributors, demoting a female employee who took childcare leave, and a drug scandal involving the founder’s granddaughter. In 2020, its revenues fell below one trillion won ($747M), and have declined for three consecutive years. In the first three quarters of last year, it accumulated an operating loss of 28 billion won ($21M), according to local media.

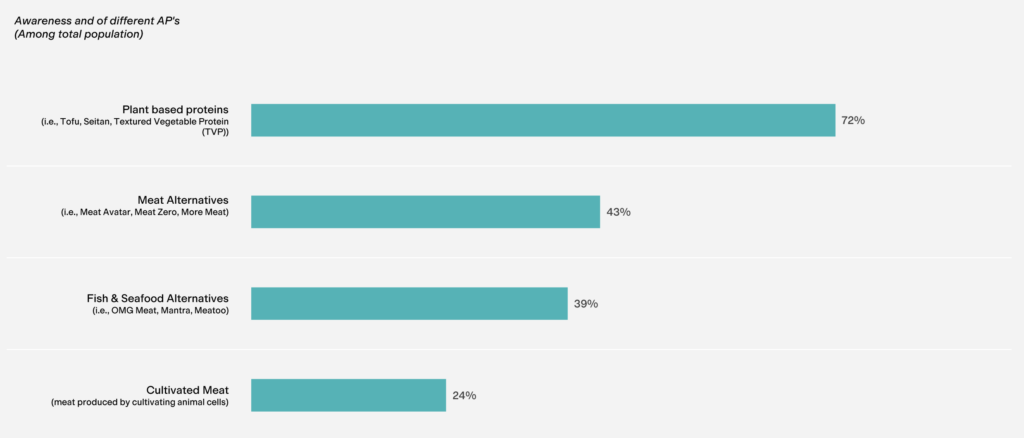

But with the takeover by Hahn & Company, Namyang will hope to turn over a new leaf. Dairy remains the third most-consumed protein source in South Korea, after meat and eggs, but with growing consciousness about sustainable diets – as well as the country’s national action plan to promote plant-based foods – veganism is high on the agenda.

“With Pureture and its casein, which mimics traditional milk’s taste, texture, and functionality, we’ve found the perfect partner for our growth into the category,” said Kihyun Nam. “With the partnership with Pureture, we will now be able to offer dairy-free, 100% plant-based products without any sacrifice from the consumers regarding taste, nutrition, and cost.”

Pureture close to finalising seed funding round

While based in New York, Pureture also has its roots in South Korea. It was founded in 2022 as Armored Fresh Technologies by Rudy Yoo, who rebranded the business in May last year to separate it from his other company, Seoul-based alt-dairy maker Armored Fresh (which is expanding its presence in the US).

A portmanteau of ‘pure’ and ‘future’, Pureture espouses a six-step traditional liquid fermentation process to make its animal-free whey, which eschews the need for novel foods regulatory approval. It begins by cultivating a yeast strain and enriching it. Then, it separates the protein and tests the emulsification functionality, before sterlising and drying the casein. The company can produce 200 tons of the protein per month, or 2,400 tons annually.

Apart from functionality – it offers a protein digestibility-corrected amino acid score of one, matching the digestibility of conventional milk – a major advantage of this plant-based casein is the cost. Because the entire process of yeast fermentation, protein recovery and emulsification is carried out continuously, Pureture’s protein can be supplied at a price 30-40% lower than bovine dairy production.

“Our mission at Pureture is to develop technologies and further foods that will contribute to a more sustainable future, and we couldn’t be prouder to partner with Namyang with this breakthrough protein, working closely with them as they grow their plant-based offering,” said Yoo, who is also the CEO of the business.

Additionally, Pureture is close to finalising an oversubscribed seed funding round, with a $12M goal. If it manages to secure the capital, it will be used to build manufacturing facilities and further develop the brand’s sustainability credentials.

The casein market is projected to reach $45B in 2032, and Pureture isn’t the only company hoping to disrupt it with planet-friendly alternatives. Other players in the animal-free casein space employ precision fermentation tech, including fellow US brand New Culture, Aussie-American producer Change Foods, Austria’s Fermify, Indian startup Zero Cow Factory, and Paris-based Standing Ovation. Meanwhile, California’s Nobell Foods makes soy-derived casein using molecular farming.

The post Startup Partners with South KoreanDairy Giant to Launch Vegan Casein Products Ahead of $12M in Seed Funding appeared first on Green Queen.

This post was originally published on Green Queen.