45 Mins Read

The below conversation is the transcript of the sixth and final episode of the podcast miniseries Green Queen in Conversation: Cultivated Meat Pioneers featuring Uma Valeti, CEO and co-founder of Upside Foods interviewed by show host Sonalie Figueiras. This conversation has been edited for clarity and length.

In the sixth episode of Green Queen in Conversation – Cultivated Meat Pioneers, Sonalie Figueiras talks to Uma Valeti, CEO and co-founder of Upside Foods.

This next interview is with Dr. Uma Valeti, the founder and CEO of Upside Foods. When we first started to plan this show, we did not realize that during our recordings, the US government would grant the final approval for cultivated meat to be sold, and one of the two companies to be given approval was, in fact, Upside.

The conversation you’re going to hear is very personal, full of moments of life-affirming inspiration. It’s a must listen. Upside Foods was the first cultivated meat company in the world. Uma and the company have played an outsized role in the history of cultivated meat, and there’s no telling this story without them. After chronicling their seven-year journey of building this company, to be able to hear him share his joy, his journey to date, and the milestone of watching the first customer at a restaurant eat the chicken that he and his team grew without animal slaughter was so powerful.

Listen to this episode on Apple, Spotify or wherever you get your podcasts.

Sonalie Figueiras: Uma, it’s so great to be here with you. Thanks for joining us on how are you doing?

Uma Valeti: I’m great to be here. I’m looking forward to this conversation.

Sonalie Figuerias: These certainly are exciting times – I’ve been calling it, “The summer of cultivated meat”, because there have just been so many developments. Of course, the most exciting in many ways is, Upside Foods getting US regulatory approval. How did it feel to receive that approval, and how did you celebrate?

Uma Valeti: Oh, it felt like a dream come true, no question, because this has been in the making for seven years, and less than ten years ago, this whole field was in the realm of science fiction- literally, nobody in the public sector had heard about it. Now it’s out there in the real world, where people can go to a restaurant and enjoy cultivated chicken! So, I can only say it’s like a dream come true, but it’s one of the many dreams that we have as we bring cultivated meat into the world. I’d say this first part of the dream has been completed, we paused for a minute to celebrate, and now we’re back at it, going after the next part of the dream that we have.

Sonalie Figueiras: So how did the team celebrate? Did you all take a bite of cultivated meat? [laughter]

Uma Valeti: [laughter] Well, that would be a great way to celebrate, because I think tasting is magical, and it’s absolutely one of the things that every team member comes in and signs up for. We’ve done a few things to celebrate: One, we really celebrated this together with the team on the day of approval from the FDA in November 2022, and the USDA approval in June 2023. Then, the moment of the launch in July 2023, was absolutely fantastic. We had contestants across the US compete to come and do the first-hour tasting of cultivated chicken in San Francisco. We flew in all the contestants from everywhere around the world, and from the US especially. We were there as a team to watch them take their first bite, and hear them tell their stories of how they felt biting into this magical piece of chicken (which was a lot more than a piece of chicken). Just watching somebody else pay $1 to buy something that the team had been working incredibly hard to bring into the world was absolutely magical!

Sonalie Figueras: You were there with the diners: tell me about the reactions, tell me what people were feeling.

Uma Valeti: I was there. I think they felt that they were at a place in the world where there was a sense of history being made. You could literally feel that sense in the room, whether you were looking at it, or whether you were seeing the excitement of them hearing the chefs cook the chicken and unveil the dish in front of them. You could literally just feel it in the room with every sense, that history was being made, and it was happening at that moment. After thousands of years, we were like, “Okay, we could bring meat that we love to the table, through a process that we can also fall in love with,” and I think that was very clear.

As they were waiting for their first bite, they were wondering, “What does it really taste like?” The reactions from that anticipation to the excitement to the trepidation as they were putting their first piece into their mouth were something to watch. They would bite into it, and there would be a pause. Then they took their second bite, and then a third bite, and you can see little neurons flashing in their mind. It led people to start saying, “Wow, this is amazing! Is this really happening?” People had tears in their eyes and used the most delightful, four-letter words of appreciation. All of these reactions were happening at the same time. Then, seeing the chef who cooked it, and the satisfaction on the chef’s face that said, “Look, I served this experience to you!”

Obviously, we are living in a world of social media, so everybody whipped out their cell phones and started to take pictures and videos of them [the chicken], calling their loved ones and sending them photos and videos. It was just amazing! It was just like, this is food, but it’s bringing people together as it’s always meant to be. You saw all these contestants from different parts of the country, becoming friends and bonding over that meal. So, I couldn’t have scripted this better. We did not know how it was going to go, and it was amazing!

Sonalie Figueiras: These were people you chose at random? Did they have to fill out an application, did they have any special dietary backgrounds? Or were these omnivores as well as potentially vegans?

Uma Valeti: We basically announced a contest saying: “Tell us why this matters to you.” Then, we screened the submissions that they had, and the team said, “Hey, these are the best submissions we have.” So, we picked the contestants with the submissions that best expressed why they were excited about this feature for food and invited them to come over. So, there were hardcore meat-eaters, omnivores, people who were vegetarian or vegan – just a mix.

Sonalie Figueiras: Incredible, what a feeling! It’s been an interesting and long journey to get here. I mean, if you think about it, I think Winston Churchill mentioned the idea of growing meat outside of animals over 100 years ago. Then, the Dutch scientist William Van Eelen wrote about the research. Then, ten years ago, Dr. Mark Post showed the world the first “In Vitro Burger”.

Now here we are, with multiple companies, with prototypes, hundreds even, three with regulatory approval, with more potentially coming soon. How did you end up on this path in history in the food world, especially since you are a “card at heart”? You are a cardiologist, is that right?

Uma Valeti: That’s right. Look, I think these are people who have been motivated by an opportunity in the world. Irrespective of which generation it happened in, it’s great to know that people across multiple generations felt like we can do better, we can bring meat to the table in a way that makes ethical sense, environmental sense, economic sense, with people coming from various angles arriving at the same conclusion. I think it’s just incredible. I’d say when Winston Churchill said that in 1932, I think he was looking at how to feed a growing population economically, and he thought, “Why can’t we just grow the parts of a chicken that we really like to eat, as opposed to growing the full chicken?” When William Van Eelen looked at how animals were being raised, he thought, “What if we could do this without having an impact on animals?” Then, ten years ago when Mark Post made the burger, he said: “Well, let’s see if we can do this in a scientific setting,” and I feel it is fantastic seeing different people at different stages.

About my path: I grew up in India, I grew up in a family that loved eating meat. When I was 12 years old, I went to a friend’s birthday party, and we were celebrating his birthday at the front of the house with fun music and dancing, and just being around family. Then, I walked to the back of the house where they were slaughtering the animals to feed us at the front. It was an incredible moment in my life, where I came face to face with the duality, or the paradox of meat production, where we have this incredibly joyful event at the front, celebrating a birthday, and the incredibly terrifying and scary event in the back, watching a death, and both of them were happening at the same time. That moment stuck with me as a kid, and I didn’t know what to do with it. I think I just kept thinking about it but did not do anything – I kept eating meat, loved eating meat, and still love eating meat.

When I went to medical school, I came across the same thing again, but in a larger and industrialized slaughterhouse, where there was a confined animal feed operation. We went to the slaughterhouse to pick up meat, to cook in our cafeteria for the medical students, and that’s when I saw the process, and I felt: “Oh my gosh, this is intense!” It was really hard to wrap my mind around, and at that point, I decided that, even though I loved eating meat, I was going to give it up. That continued for 20 years afterward. Then I went to the Mayo Clinic to train in cardiology, and that’s what I wanted to be when I grew up. I only wanted to train at the Mayo Clinic, and I ended up going there.

During my training, I was exposed to working on stem cells, and later on, in my practice in the Twin Cities in Minnesota, I was using those stem cells to inject into patients’ hearts to regrow the heart muscles for people who had a heart attack or cardiac arrest. Given this love for eating meat, and the “paradox” of how all this came to the table, along with what I was doing in medicine and cardiology, all of these moments kind of came together where I started asking the question: “Why can’t we grow meat from animal cells?” That was the beginning of the idea in my head, and that was approximately in 2005. Come to think about it, it was almost 18 years ago.

I kept researching and talking about that with people and saying, “Hey, this should be done, this should be done, this should be done.” People kept saying it was possible to do, and they pointed me to the work already done [on growing meat from animal cells], such as the Winston Churchill code. At that point, Mark Post had not done the burger yet. People kept saying, “Hey, there’s NASA research that’s happening,” where they were growing cells, I think, from a fish, and they started pointing to some of these literature papers.

So, I decided to see if I could encourage people to start companies in the space, and joined a group called New Harvest, where the founder, Jason Matheny invited me to join the board. I thought I could continue to convince people to do more work in the space, but realized very quickly that people were happy to do this more as side projects in their laboratories. This was around 2013, when the BBC covered Mark Post’s laboratory in the Netherlands, and showed the in vitro beef burger being made.

However, people were just not willing to take the leap and get this [cultivated meat] into the real world. I felt like if this has been in academia for decades, it would only make a meaningful impact in the real world. So, after failing to convince a number of researchers to do this in the real world, I decided to start a basic science lab myself at the University of Minnesota, and the more work we did in that area, the more it became very clear that this should not just be within academia, it should also exist in real life. It became a call to action. My family said, “Why are you not doing this,” and that was a great question to ask. Personally, that was a moment of truth for me. That’s when my kids asked me, “Why are you not doing it, you’ve been talking about it for more than ten years?”

Sonalie Figueiras: When was that, exactly?

Uma Valeti: That was in 2015.

Sonalie Figueiras: So, your kids/your family wanted you to do this? When you started that lab at the University of Minnesota, were they supportive?

Uma Valeti: I had a very supportive chairman of the department who said, “Look, this is an incredible idea, you should keep working on it!” So, I used all the work that I’d done talking to researchers across the field in this area of growing animal cells, but I was also keeping my eye on cardiology – We were growing cells to reinject into human hearts, there was an entire body of work that’s been happening in medicine, especially in cardiology and what we call, regenerative medicine, or growing organs; I was very close, you know, following that work from the days I was at the Mayo Clinic, to being at the University of Minnesota and continuing my practice there. So, there was already a body of work I had been following, and yeah, once there was this incredible support from my wife and kids saying, “You can go ahead and start doing this,” it just became a lot more freeing and liberating to say, “Yes, I could go there myself and do this!”

I had a postdoc in my lab, who was my co-founder for the company when we first started. We sent a proposal to one of the venture capitalists in the Bay Area saying, “Here’s the idea. Would you like to learn more about it?” This was one of the earliest things that I had done in 2015, just a simple email, and within an hour of sending that email, the group from San Francisco was on the phone saying, “Hey, could you move the team to the Bay Area?” So, that started our journey. I said, “Okay, let me take a small group there, and let’s see if we can do this, and do a proof of concept.”

At that point, I wasn’t planning to quit cardiology. I was thinking I could go back and forth. In fact, I didn’t even have a role in the company. I just supported the team that came together. However, these were the very early days, there was not a single company in the world in this space.

Sonalie Figueiras: Right, you were the first.

Uma Valeti: Right, there was no one. There were people doing academic research in the laboratories, and Mark Post was doing it from another lens. I think there were a few groups doing adjacent research, but there was no company in the space. No one wanted to make this into a commercial product, go through a regulatory process, start showing that this is an area where investors can kind of come in, and if they can bear the long-term view that this would transform the industry – none of this existed. Those were very scary days when people literally laughed me out of the rooms.

Sonalie Figueiras: So not everybody bought the idea. You had a very supportive family, your lab, your lab chairman, you had this venture capitalist group that had said yes, but you also encountered some people who thought this was crazy.

Uma Valeti: Yeah, I’d say I could count on a single hand the number of people who did not think it was crazy. But that was enough because those were the people I deeply believed in and trusted. I fel like: “Look, if we start putting one foot in front of the other, if there is a path, we’ll find it.” However, everybody I spoke to literally said, “You have an incredible career in cardiology. You’re the head of many programs. You’re on the boards of the national cardiac societies. You’re doing medical device innovation, and have started companies in that space! You are just crazy to give that up and walk away from it!” That was nearly everybody that I knew. However, on the other side, the reality was, well, not everybody knows about my work in cardiology, but they were just looking at it objectively as an industry and said, “There is nothing there. I’ve never heard about growing meat from animal cells. No one has ever invested in this. There’s never been a company in this space. There is no regulatory pathway or approval. Everybody’s going to fight you because no one would want you to come up and compete with what exists on the market already.” So, we got laughed out of the room with comments like ”This is a pipe dream. This should remain in the laboratories as a side project.” Those were the early days.

Sonalie Figueiras: In those early days, the way you’ve explained your story, it feels very much that for you there was this kind of ethical element of watching how the animals were being slaughtered when you were a 12 year old, and then eventually you end up in a CAFO situation seeing industrial meat agriculture up close. Was there any inkling at this point or thinking from your side around the climate side of things, the environment side of things?

Uma Valeti: Very good question. The initial motivation for me was definitely ethical. My dad’s a veterinarian, I grew up around animals. We come from a farming family, we had animals, we had cows, I used to milk the cows, and there are a lot of my family members who still live in villages that are farming their land. So, that’s where I come from.

Sonalie Figueiras: That’s in India.

Uma Valeti: That’s in India, yes. My initial exposure to this birthday death day experience when I was 12 years old, and then later on when I was 17 or 18 in medical school, seeing intense confined animal feed operations and the mechanized slaughterhouse – that’s when I said, “Okay, look, I love eating meat, but I’m going to have to kind of pause,” and I’ve hit the pause button not thinking too much about it, but that pause button continued for 20 years.

However, during those 20 years, my life’s dream was to become a trained cardiologist at the Mayo Clinic. Not easy to get there, but I eventually ended up getting there and training. During the training, I started doing a lot of scientific work, and you know, in medical school, you learn about cell biology, biochemistry, microbiology, and then you start applying that in medicine, and cardiology, and we were doing the cutting-edge research on stem cells. So, the science and technology started coming together, and I think that initial ethical inclination helped us with the idea, but then I started exploring and asking, “Is this actually going to make sense on a business scale,” because by then I was starting to develop medical devices, be a part of innovations in medicine and cardiology, and understand the startup world (I was investing in the startup world myself).

I thought: “There is an opportunity, let me explore it!” That was when I learned about the incredible environmental footprint of raising animals (livestock) to feed humans. I did not know about that growing up. So, when I started looking at the environmental impacts, that just blew me completely out of the water, where I went, “Oh my gosh, we are raising 70 billion animals to feed 7 billion humans right now! So, that’s 10 animals per human every year, and that’s going to become 15 animals for each human in the next 30 years, that means doubling the demand for meat!” There’s just no room for any others like that. It became very stark in front of me. No matter what we dream up, we’re not going to be able to have that many animals to feed that much meat to humans. So, it felt like there was a significant environmental need, but also a business need, and because Minneapolis is a place where Cargill and Hormel and a lot of major food companies are based, I had already started talking to execs in these companies, they saw this coming as well.

It helped to have a background in medicine to look at the impact of meat on health. In general, in a lot of the food and diets that we have, it’s very clear that meat is a very nutritious product. It’s got lots of protein, it also has a lot of fat, it has a lot of things that are good for human development. However, there’s also the downside of meat being associated with cancers, cardiovascular disease, and a lot of other things, but I realized we were also confined by an animal to make improvements in making meat better because it would take about six to seven years to breed a single trait in an animal to make some feature or some trait better. However, to improve on every single trait- that would take time, much more than what we have right now. Plus, the animals we use are already highly selectively bred. For instance, the chickens we eat now – they’re three to four times heavier than the chickens we used to eat 40 years ago, and that’s through selective breeding. I felt like if we had an opportunity to make health better – explore the opportunities to improve the features of meat, improve the environmental footprint, and also improve the ethical cost of bringing meat to the table. I thought that would be a triple threat. That’s really what led to me writing to the VC investor.

Sonalie Figueiras: So it came in stages, as you learned more and as you explored more, that’s interesting.

Uma Valeti: That’s a good insight, [you are] absolutely right. It started with one thing, but as I started exploring, it became very clear that all of these trends, looking at the next 100 years or beyond, were pointing towards improving the ethical and environmental footprint, making production more efficient, being more available to more people, and opening up the opportunity to make meat better and healthier. The more I dug in, the more it became clear that this was something that should be out there in the world, and it came in phases.

Sonalie Figueiras: I want to go back to what you said about being in Minnesota, and around companies like Cargill and Hormel. You approached some of these execs, and you’re saying that they saw it was coming, in the sense of this kind of stress on the food supply, to give people more protein but with limited land, water, etc. Did they see the potential of what you were doing?

Uma Valeti: There’s a lot of really iconic food companies that come from the upper Midwest, and there are several execs who spend their careers there, people that have retired from there, and people that have families there. So, it’s a very rich community, and no matter who we spoke to, it was very clear that these very large companies that have grown over the past 50/100/150 years were in the business of supplying food and protein to people, and they were recognizing the enormous challenges in feeding people what they want.

As societies get more advanced, as GDPs increase across the world, the first thing people buy when they have some disposable money is meat for their families and kids, because it’s clear to them that meat is very nourishing to the family. So, when somebody has an extra dollar to spend, whether it’s in India, Indonesia, or China, that person is going to buy meat for their family, and to produce that requires an incredible amount of complexity to be orchestrated.

A part of that solution is the industrialization of agriculture with confined animal feed operations. Those were built by necessity, because the demand on the consumer side was so high, and these companies were trying to meet this demand. It became very clear that there was a significant demand building up, and there was a supply side where people were trying to figure out how to be more efficient. That’s where this opportunity came up. We don’t want to take away the choices of foods that people love to eat, but nearly everybody feels sorry about the process, except there wasn’t a better solution. A potential or partial solution is everybody starts using plants to make plant-based meat alternatives.

Sonalie Figueiras: Right, which was already happening as you were growing the company, right?

Uma Valeti: It was. Beyond Meat, Impossible Foods, Gardein and Boca Burgers- these were brands that were doing plant-based proteins for decades, so I looked into it. In fact, in 2009-2010, I thought about starting up a plant-based company to make something delicious and tasty. However, when I looked at it and saw how many people were doing it, I thought: there’s no need. There are really great entrepreneurs and existing food companies that are already doing fantastic work on it.

The thing that kept coming back to me, and kept bugging me was the possibility that we could make meat from real animal cells without having to raise animals, and if nobody was pushing that possibility and exploring it, that would always remain unexplored. In our minds, we set up this world, where you are either ignoring the perils of continuing to produce meat at the large scale that we are or you ration it, decrease it, or mandate people from having it, or in this case, take it away and force everybody to become vegetarian or vegan. I just did not think that kind of world was realistic. So, I wanted to explore this other side of trying to pop this balloon of thought that cultivated meat should exist in the world. That’s kind of where it started, as a tiny dot of an idea, and the more we thought about it, the more we started showing conceptual proof and actually growing these products and having people taste it. It’s increasingly becoming a magical moment for people when they taste it, and they understand what the taste of meat is. They are just completely blown away.

Then, when we invite them to tour our facility and have them see how the meat is made, that is another magical experience for them. I haven’t met anyone who’s walked out of a slaughterhouse without being scarred for the rest of their life. So when they walk out of a production facility that is producing cultivated meat, and see the facility that we have, they get inspired, they get motivated, and they start thinking: “What are the possibilities if this continues to grow? If this continues to become more and more efficient, and cost-effective, and in local, regional neighbourhoods you can grow meat, it offers an imagination and a vision that’s very powerful.” They leave inspired.

The third thing we noticed, which was a really magical moment, was when they talked to the people on the team doing the work [at the facility]. There, they realized that they are people just like them – very motivated, purposeful, putting meaningful commitment and time into much-needed solutions for problems that never had solutions like this before. They all leave really important, meaningful careers to be here, and to see that purpose and drive in that team, it feels like, “Yes, this is something to get excited about.”

Another thing is, we are seven years into it. We also have a track record of doing things that nearly everybody said were impossible or unachievable to do, and it gives the team a bit more confidence to say, “Hey, remember when we climbed that hill and nobody believed in us? Now we’ve climbed seven of those. We know there’s another 10, 20 to 30 more ahead, but we’re ready for this!” When they see that level of grit and optimism, as well as the real-world experience of having done these things that nearly everybody said were impossible, it just creates an environment of feelings that I think is a must-have for starting something like this.

Sonalie Figueiras: It must feel amazing to do things that everyone thought were impossible. I want to ask you though, why chicken, of all the meats? It’s one of the most affordable animal meats. So, in terms of reaching something like price parity and mass market, it is one of the more challenging options, what made you choose chicken?

Uma Valeti: I think a couple of things: One is, that chicken is the most consumed meat in the United States, and will soon be so across the world, which means that it’s very relatable – people know how to cook chicken and understand how it tastes, and it is something that is an easy thing to get behind, because you know how to cook it, no matter what ethnicity you are, what country or part of the world you are from. So, we wanted to kind of signify the importance of this innovation at that level. We purposefully took a different approach than maybe some other companies could very legitimately take and say, “Hey, we want to put out a product that is very rare, very exquisite. Most people have never tasted it and only aspire to taste it. So, we’ll start from a very small market segment.” We took the approach of doing something that is not familiar to people, not something that they have been thinking about, and it is so much more important for people to recognize the familiarity of it, the comfort of it, and understand the reasoning behind it, rather than saying we will go and put – I don’t know, pick any type of exquisite meat or cut of meat of our species or something that is just not scalable and does not have a very big market, but you can capture a tiny slice of a very small market – we chose the latter. The reason is familiarity.

The second one is just as important, because as we come into the market, let’s say the difference between the best quality organic chicken could be priced at something like $10 -$15 at a good retail store, and maybe some other high-end cut or species could be $50 or $80 a pound, for instance; in the initial days of Upside coming to market without chicken, what we felt was we’d be making quantities that will be sold out, no matter where the price of this is going to be set. So, let’s say the best chicken on the market is $10-$15 a pound and we chose to price it 30% or 50% premium on that, we still knew that we could not catch up on the supply and demand that was there for the chicken that was more expensive than the organic chicken. So, we felt that’s what our target was. We’re going to go after it. We’re going to make it very familiar to people. In the early days, we thought, as the price comes down, and we get down to parity with conventional, we’re going to accept that we’re going to have a premium on top of, you know, what a conventional chicken might cost.

We just said we’re going to accept these two things, that with time as we get to scale, we know inevitably that we are going to get to parity with conventional meat, and eventually better than that. I think that’s going to happen for two reasons: one is we’re going to keep getting more and more efficient, better and better at our production as we scale, and nearly all trends are in favor of supporting our production process. The price of conventional meat is going to continue going higher and higher with time, because of the amount of external costs, direct costs, subsidies and incentives, and all of those things that are needed to support that price to a consumer. It’s going to get unbearable at some point. We felt like as that keeps going up, our price is going to keep coming down, and there’s a sweet spot in which everything will be at parity with conventional and eventually better.

That’s why we chose chicken, and that has played out well because when people come and taste it, they immediately can relate it to another piece of chicken that they have tasted.

Sonalie Figueiras: When do you see that parity happening, at least on a production level, even if you were to still have that added premium?

Uma Valeti: I think there are many products you can do, whether it’s chicken or beef. By the way, our second product is beef, and we have a number of other luxury products that are coming to surround the offering. However, we think that price parity is generally going to happen in the next five to 15 years. That’s the range, because if there is a higher enrollment of public-private partnerships, and the government starts recognizing the opportunity and the potential here, and does similar things to what they’ve done with other transformative industries, whether it’s energy transformation or electrification of automobiles, or semiconductor fabrication units being set up. These are the kinds of things that, if they can recognize the opportunity here and accelerate that, they can help create favorable regulatory environments, and help create a level playing field with existing incumbents that have enormous advantages that are built over time, whether it’s efficiencies or trying to improve the education of their consumers.

Sonalie Figueiras: Or $38 billion in livestock subsidies…

Uma Valeti: Yeah, some industries are very lucky to have that. So, if we are given at least some type of that support, I think it’ll be closer to the five to 15-year range. If, in the absence of it, if the industry has to go by it alone, and compete on it alone, I think it’s going to be, you know, towards the later side of it. However, the opportunity cost is huge. If the industry or the public-private partners within the governments don’t recognize it, in that same time period they will have to keep bearing the externalities of the cost of intensive animal agriculture, bringing meat to the table, or having to deal with supply chain disruption. Plus, we are just coming out of that with COVID, so we are not even counting the enormously increased risks that we potentially face with zoonotic diseases in confined animal operations. I think we’re not even building an opportunity to build a hedge into that because if you have cultivated meat, along with conventional meat, it’s an “and solution”.

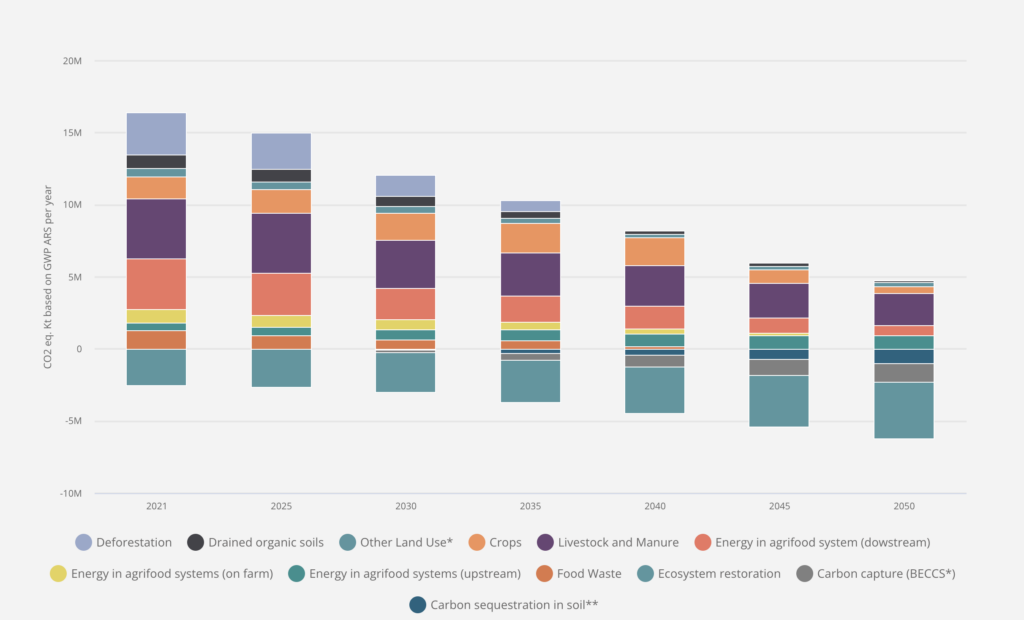

We’re not saying that cultivated meat is the only way to feed the world, we’re very clear in saying cultivated meat is a solution. It offers diversification of our food production sources, it offers improvement of our supply chain resiliency, and it protects the ability to keep the choice of eating animal-based meat on the table. With time, over the next several decades, there’ll be enormous amounts of innovations that can be set up on top of it to be able to improve health, make it more regional, and also help countries develop production facilities of their own. At scale, cultivated meat is projected to have a significantly better environmental footprint, with lower use of resources, lower use of water, significantly lower emissions of greenhouse gas emissions, and parts of the world that just cannot grow meat right now, because they don’t have enough water or resources. So, they can start thinking about, “What does it mean if we have cultivated meat production facilities in our region?” They may have enough water for it, they may have enough inputs for it to be locally sourced, for it to create a local economy. So, I think these are all things that get us excited.

Sonalie Figueiras: In that five to 15-year timeframe, where you feel with or without support, depending on whether you would achieve a sort of price parity, is that kind of a similar timeline for you in terms of a benchmark of getting cultivated meat to be a mass product or to be on shelves in supermarkets? Do you put those at the same thing?

Uma Valeti: Look, there’s a lot of meat that’s being produced, right? A very good analogy for this is we started getting behind electric vehicles approximately 20 years ago, and people started saying they’ll start buying them, and the largest company in that space, Tesla, went public in 2008, and about 10 years later, turned their first profitable quarter. They basically led the charge in converting all existing manufacturers to become believers in the electrification of transportation. They are now starting to invest more in it and make pledges that by 2025 or 2035 they’ll all become predominantly electric vehicle manufacturing entities. I’d like us to have the same impact on cultivated meat. Ultimately, we want to be able to have a lot of people in the ecosystem producing cultivated meat, with new and existing players saying, “Hey, I see an opportunity here, a portion of my business can be this,” and they can still keep the existing business, because of the one simple reason: the demand for meat is doubling. That means we’ve got to fill the ‘delta’ with production modalities, and if an existing new player starts thinking about that delta, that is very light. That’s a US$1+ trillion market every year, not even counting how to enter the market right now. So, in that space, I think a lot of people can live and coexist, collaborate, and do well economically, for all the other reasons we’ve talked about.

The first seven years have been successful. We’ve been able to lead, be a pioneer, and help create an environment where there are about 150 companies in the space across the world, in every major meat-producing or consuming country. We’ve got every major food university in the US, and mostly across the world, to start offering cultivated meat in their undergrad, and postgrad courses, and also offering it to PhD degree holders. The major governments, more than ten governments in the world right now – including the United States, Canada, the UK, Australia, China, India, and Israel, have started offering research grants for this area of study. California became the first state in America to offer research grants directly to the UC systems. The National Science Foundation and USDA started offering grants to local universities. We are behind supporting all those applications with those primary investigators, and also the legislators at the state and federal level.

We’re helping on the commercial side too, helping companies be formed, advising them, and collaborating with them. We’re working with education programs to help structure their teaching programs and internships, and offer jobs for their graduates. We are working with the governments to create funding and offer research funding to academia. We are working with, you know, the media to educate people, for example, telling the story of cultivated meat.

This is all in the early stages, but it’s making an incredible amount of progress, as a way of further being able to say we could be at the table, to further participate in feeding the world, and preserve the choice of eating what we love.

Sonalie Figueiras: Yeah, I hear you on all those things, but we are getting close to time, so there are three questions that I really want to explore with you before we go.

One is around the government. It’s super interesting to hear that behind the scenes, you’re working with the government in so many different ways and supporting newcomers, that’s exciting, and good to hear because we also hear a lot about the competition. How supportive do you feel the governments in the US and beyond have been, and what did you expect? Did you think there was going to be this kind of support, or did you expect more? Did you think there was going to be more public funding? Interestingly, unlike some of your peers, you did not go to Singapore, where there was more regulatory support and some funding support.

Uma Valeti: It’s a great question. I want to acknowledge that there could always be more, and we have a wish list, that it’d be incredibly exciting to have funding set aside for cultivated meat already, in amounts that are meaningful enough to move the needle. So, there’s a wish list. However, having said that, we are a US-based company, and we’ve always been laser-focused on working with the US regulators, the FDA and the USDA, and working with them closely from the earliest stages of building the industry, so they understand the work, the science, the technology, the products with us and help us develop those regulations. I could not be more happy or grateful that both agencies have engaged with us over many years and helped us build and bring this product with really great regulatory guidance – very thoughtful, focused on safety, and also focused on educating the consumer, so that they clearly understand what is being put on the plate. So, I’d say the US regulators have been incredibly supportive and rigorous in helping us think through these things.

Now, this is a very bold move for us to make and say, but we are not going to go anywhere outside of the US, because there are other jurisdictions that we could have gone to, then again, we decided on principle, to make the call that we are a US-based company, we want to work with the US-based regulators, who are held up as the most important, prominent, and credible food regulators across the world, with deep experience in food and science. So, that was a choice we made, and I’m very glad that it paid off because our team is still small. We couldn’t be distracted doing multiple jurisdictions at the same time. While we’re happy that Singapore and other jurisdictions are also excited about this, our plan is to stay laser-focused on the US, even for the foreseeable future.

However, it’s opened the pathway for almost every company in the world, they can come and apply in the United States, and it could be the place where innovation can move faster. We would like to have governments more involved in funding this though, because there is a manufacturing challenge. Building cultivated meat production facilities is not cheap, it is expensive because a lot of things have to come together under one roof. In the initial stages, it is expensive, but having governments come in with the funding or loans, or some type of grants would be incredibly helpful and accelerant to the industry. We are advocating for that, and we hope that similar to energy transition and the electrification of transportation, we may be able to also get some support from the government.

Sonalie Figueiras: Notably the IRA, which did not assign a large amount of funding to food systems decarbonization.

Uma Valeti: Well, we are exploring it, but I’d say we have to start somewhere, and keep in mind that this field is growing rapidly. We have to have enough production data to show that this is now ripe for commercial manufacturing. We believe we are very close to that because, at Upside, we have a production facility that we’ve been operating on a regular basis for the last year. We built it through the pandemic, it is something that we have a lot of data on that we’re working on sharing and starting to show that the time is ripe now to start building the next large-scale facility that becomes industrial-scale. I feel like industries need governmental support at that exact stage, because it’s a very difficult stage, as you can’t keep raising private capital to do that leap. You need to have some amount of private capital, some amount of loans, and some amount of government support, to be able to say, yes, now we are forming an industry, and that is literally why these programs are set up. So, we’re going to keep exploring how we can make this transition and set up manufacturing help, not just for us, but also for everybody in the ecosystem.

Sonalie Figueiras: My second big question is: a lot of folks in our industry make this analogy with the electrification of vehicles, his idea that cultivated meat and various forms of alternative protein are following the same trajectory, as Tesla et al, and we’re somewhat earlier on in the process, but that’s really the journey ahead.

I want to push back a little bit on that, just because cars are not food, and food is just such a different product for the average person. There’s tradition, there’s your grandmother’s chicken soup, there’s your identity as a nation, as a family.

The backlash to cultivated meat and new forms of producing food has been quite extreme in some ways. It’s become a bit of a culture war, you know, the term “lab-grown” is thrown around by the media as a way to kind of get people excited, but not always in a good way. How do you look at this idea of consumer acceptance? How do you think the industry should be thinking about it? Is this something that you worry about? Or do you see that as a distraction?

Uma Valeti: Look, I understand all of this, I understand the pushback, and I appreciate it. I think a field like ours, is in its early days of infancy, moving to becoming a toddler now requires a lot of nurturing, support, and continuous focus towards the North Star. We do have to accept that constructive criticism is par for the course, and it is okay to have skeptics that will say, “No, it’s not going to scale.” “It’s not going to be analogous to this industry, or that industry.” Also, “food is very different from everything else.” All that is fair, and par for the course, as long as it’s coming in the form of constructive criticism. For innovators that are in the arena, doing this work every single day, looking for that little tiny crack of opportunity to cross that hill of a challenge that people said you could never do- I think that’s all fair.

I think where the culture wars have gone is distinctly distracting. They are taking on a monster head of their own because it suddenly becomes a talking head or somebody wanting to prove their point is the only point of view and driving that to the ground, while they do that, they take everybody down with them, and I think it’s sad to see that. However, what I keep telling myself and our team is we have a North Star we’re pointing towards. Our goal is to keep working on making our favourite food and be a force for good. It’s not going to be easy, if it was, lots of people would have done it, and real transformative change will take time.

While we do that, let’s engage in constructive criticism. If we help people come in with the intent of literally proving their point or achieving, it could be a journalistic award, it could be some other award, they’re not presenting all of the facts, or are not interested in knowing except their point of view then I think: “Let’s do what we can, but let’s not spend too much time on that, because we are not going to change their minds, we have work to do.” That’s the direction we are taking because as we move more into the commercial, there will be lots of people who will be writing articles against us. If I step back, that’s happened throughout history for nearly every transformative thing that we take for granted right now. It happened with electric cars, right? Imagine the very early days of the electrification of transportation.

I’ll address this pushback you had: food and cars are different, of course, but there are a lot of similarities. We trust in both. We put our families in both. We have all our living experiences with both of them being part of our lives. If you look at electric cars, right now, when the very early versions first came out, they had a very short range: They were blowing up in garages catching fire, there were so many safety risks over that period, and there are people that have written the epitaph of that and saying, “This is never going to work, this is never going to scale.” However, look what happened, people figured out how to prevent those things from happening, minimize those things and increase the range. If I step back and offer the same thing, cultivated meat is offering a method for us to continue to eat meat without that choice, and we can’t be everything for everyone all at once.

Therefore, we’re focusing on what we can do really well to start with. We’ll put a product that we think is safe, and delicious, and has gone through the full force of regulatory reviewing. Then, we’ll put the next product out, and the next product out, and the next product out, and guess what, they’re going to continue to improve with every iteration. What they’re going to show is this incredible opportunity that should be on the table and that people should be aware of. We have to do a really good job educating, but when we take a fall, we also have to just get up and say, “Hey, that’s something we’re going to fix,” and we get up and fix it and keep moving forward.

I think that’s how I see cultivated meat progressing, because we’ve got to be at the table to put great products, and when the products don’t meet what the consumer is looking for, we can fix it to make it better. I think those are the analogies for cultivated meat that I think are very similar to the electrification of transportation. As I said, we feed our food to our families, and we put our families in these things and drive, right? That means we are trusting them, and that’s what we have to develop.

We have to continue to do a really good job educating people. Let’s not take the status quo for granted. That’s the third part. If we take it for granted, we know that the probability of us ending in an environmental disaster, rationing, or economic disaster, is very high. We already have an ethical disaster. So, we don’t need to prove any more of that. However, here’s this technology that can be very supportive in helping us transition gradually into better modes of production. Just because there are hurdles or bumps in the way, they should not stop us. If you look at the horizon of time, and what every major industry has had to go through, I’d say cultivated meat is not any different.

Sonalie Figueiras: Last question – you mentioned that it would be great if the government would focus a little bit more on funding opportunities. You’ve talked about ecosystem support and the idea of public-private collaborations to create progress. What’s needed in order for this industry and for Upside to get to scale? Is it more bioreactors, is the medium or the feed the issue? What’s standing in your way, if you have the money?

Uma Valeti: I don’t think anything is standing in our way. I believe this is something that requires us to build on the foundation, keep building it, keep getting in front of people, and have people experience those three magical things I’ve talked about.

We have got to get people to taste it. To get more people to taste it, we have to build cultivation production facilities. We have to build a lot of them, and to build a lot of them we will need funding and time to build them. Referring back to the second magical moment when I mentioned that people come and tour these in Virginia, Houston or Seattle, if you have a production facility that you can go and walk through, and imagine the kindergarten kids, middle schoolers, or high schoolers walking through and seeing how meat is made, that opens up their mind. Then, the last thing is meeting the people that are making it; similarly to when you can go and meet your vegetable producer or farmer, they’re going to go and meet the person who’s producing the cultivated meat – another type of farmer. When they develop those close relationships, these things become a must-have. For all this, you need both funding and time, and you need to be realistic and say these are going to go in phases.

We are delighted that it took us seven years to go from science fiction to reality, from an idea to the industry, but what we did on July 1st 2003 was simply “the opening bell”. We rang the bell saying, “Hey, we are out here on the market!” So, now we have to get ready for this next phase of the journey, which is going from the first sale of cultivated meat in the United States to a more formidable scale. This means starting to build production facilities that offer a blueprint for people to want these in their zip codes, invest in them, and create jobs with these things.

Our goal is very straightforward, it sounds simple, but we have to build the most efficient production infrastructure that brings sustainable production to the table while also offering an economic advantage compared to conventional production techniques. I think that’s a process that’s going to keep getting better and better with time because the methods of production we’re using will keep getting better and better as adjacent fields of renewable energy keep getting stronger, as fields that improve fluid handling, robotics, or rapid assays that we can do in the meat before we release it to the market keep getting better because you can’t do all of that in conventional meat.

So, all these trends are in our favor. We need time, we need funding, we need to be able to keep proving to people that we are worthy of a seat at the table, and all of these things are ahead of us, and that’s what I’m most excited about.

Sonalie Figueiras: Thank you so much, Uma. This has been such a wonderful conversation. There’s so much to learn from here. I appreciate your time and your openness.

Uma Valeti: Thank you, Sonalie. I think this has been one of my most relaxing conversations. Obviously, you’re asking good questions and pushing back, but you’re also someone who’s spent a lot of time in this field. You’ve talked to a lot of people in the field, particularly people that are critics in the field, and you experienced and are probably seeing the culture wars that are coming around it. I really appreciate you asking all those questions, because while all of those things are happening, it is our job to be laser-focused on the North Star, and saying that all of these hurdles are par for the course.

It requires a set of relentlessly committed people, leaders, and team members coming together to make things like this happen, because we’ve never said it was going to be easy, but we know that it’s completely worth it to go after an idea like this, and none of us should regret looking back 20-30 years from now, saying, “Oh my gosh, we wish we started this in 2015 or 2020,” and then wait till 2050. So, I think those are the kinds of horizons we are thinking of, and I appreciate you taking interest in this field.

Sonalie Figueiras: Thank you, Uma, that’s the whole point of this series, When I told Joanna, my producer, that I wanted to do it, I didn’t know that the USDA was going to grant you approval in June. I thought there might be more of a delay between FDA and USDA. I was thinking maybe it would come at the end of the year, but I felt that we were on the cusp of this major, as you say, moment in history.

As someone who’s been reporting on this for seven years, I’m also very aware of how misunderstood the industry is, and how people are making up all kinds of ideas about it, because they haven’t been to Upside’s production facility, and they haven’t tasted that piece of chicken in their mouth.

So, the idea here was to talk to the six pioneers in the space, and really humanize the story, and just have these open conversations. This series is really aimed at, not the industry but at regular folks. Even someone like Joanna, my producer, who didn’t know much about cultivated meat when we started- she is now so fascinated, because how can you not be when you listen to these stories? This is history being made, and people need to hear these stories and they need more information.

Uma Valeti: I think all of us have this professional side of the challenges and hurdles, and things we’ve had to put up with. We also have the personal side, our family supporting us no matter what, and lots of sacrifices for the families. We’ve been around for seven years, and half of our lifetime has been during COVID. Despite those challenges or the curveball of COVID that we never anticipated, we’ve been able to move this idea from science fiction to reality, from an idea to the industry, being able to build an entire production facility from the ground up and get to the market and bring along an entire ecosystem.

Of all the things that have been formed around this idea in the last seven years, there aren’t that many examples of industries that have been through this kind of rapid growth interest.

Whilst the idea was being developed into a product, whilst funding was being secured, whilst academic and training programs were being developed, whilst regulators were learning and trying to get guidance issued; simultaneously, the media, of all walks of life, was getting very interested in covering it from different angles, whilst we were getting pushback from many groups or entities or people that did not want us to exist at the same time. This kind of mix of events happens very rarely. I can’t think of the last time it has happened to food, but in general, it happens very rarely, and that’s the kind of moment that we’re living in.

We’re living it, and sometimes it feels like, “Oh my gosh, is this ever going to get better?” However, I think these are the moments of innovation that have to come together, and there is no precedent or blueprint. I think this is why it’s important to keep saying that none of us have the full knowledge or the full truth, but we have all seen that there is a problem here that needs to be solved.

This has never been attempted before, and it should coexist along with the way conventional meat is being produced, the way plant-based alternatives are coming up, and the way that we can protect choices of eating meat from animals, whilst preserving a lot of things that we care about in the world. I think they should coexist and not be set up as competitive entities. I think that’s the message I hope people covering this field and writing about it keep in mind, even if they’re critiquing the field, or if they’re sceptical, so it becomes a more constructive endeavour, versus some of the destructive things that we’re seeing. There’s a personal story to these entrepreneurs and the teams that are behind it, who are actually in the arena, toiling, struggling, sacrificing every single day, taking a shot, yeah.

Sonalie Figueiras: I think a lot of the storytelling is maybe too much on the tech and not enough on that human story.

Uma Valeti: Look, I really hope you explore both, because I mean, there is a human story for sure.

Sonalie Figueiras: Of course! That’s why for me, these interviews and this series has been much more about the human story? I can have another discussion with you about the medium, the FBS serum, and the bioreactors and the size of the production facility, but what I wanted to do is tell the story of the person, because you have all these incredible people, humans taking a shot, and everybody can empathize and be interested in that, which is someone taking a shot to make the world better. Who knows? We don’t know where it’s going. So we’re taking the shot, right?

Uma Valeti: Absolutely. Well, thank you.

Sonalie Figueiras: My favorite part of this interview was when you told me that your family told you that you should be doing this, I think that is so powerful. I usually hear the opposite, which is people saying, “Oh, my family was like, what are you doing? This is so crazy!” However, the fact that your kids said to you, “Dad, you should be doing this!” That’s amazing.

Uma Valeti: One of my favorite parts of this whole experience is when I went into my son’s room, and he was eight years old, and after I told him a story about how we were doing research, and there were animals being used in that and I told him it’s hard because you become really friendly with these animals. Then a terminal experiment is done. We had started talking about meat production just a couple of days before. Later, I went to his room and he was just sobbing by himself. Then he asked me the question, “Why does this have to happen?” I didn’t have an answer. So I saw him sobbing, I just held him and I said, “Look, I felt the same way, as you did,” and I told him the story of when I was 12. He said, “Why can’t it change?” That was my son when he was eight. After that, I kept going back to cardiology doing my thing, but I never forgot that moment.

When my wife and I were discussing this, my kid said, “Dad, why are you not doing it?” That was another big, profound moment in the family to say, “I’ve been asking others to start companies in this space. I’m trying to pick my safe path of: Hey, I’m a cardiologist. Now, I have a well-established path with the research of this company. I got a job. I’m not risking that and asking other people to do it.” They put a mirror on me and said, “Why are you not doing it?” That became a call to action.

The funny side of this was when we were moving to California, my daughter didn’t want to move. It was around the time this Pixar movie called Inside Out (2015) came out, where the same story of what was unfolding in our family was playing in a movie in front of us, where an entrepreneur dad from Minnesota was moving his entire family to San Francisco and his daughter was 11 years old, and she was fighting the move because all her friends were in Minnesota. That’s exactly what my daughter was going through. She was like, “I don’t want to move. You commute. You go there. I’m not moving.” Then, when she saw all of this, she said, “Okay, I don’t like it, but I’m coming, but you have to promise that you will get me fried chicken for my high school graduation.” [laughter] I made that promise to hurry her up. I had no idea if we would be able to produce anything at all, but that’s what she wanted: fried chicken for graduation. This was back in 2017.

Sonalie Figueiras: And how old is she now?

Uma Valeti: Well, she just graduated high school this summer, so on July 1st, 2023!

Sonalie Figueiras: You mean the cultivated meat restaurant debut was on the same day?

Uma Valeti: I’m not making this up, she graduated in June, and on July 1st, 2023, she was one of the first testers of cultivated fried chicken! [laughter]

Sonalie Figueiras: Oh my god, that’s incredible! That’s just incredible.

Uma Valeti: So, these personal stories are always what keeps us going, and you know, my dad was a veterinarian, he was a big inspiration. I lost him during COVID.

Sonalie Figueiras: I remember.

Uma Valeti: So, I wish he was here. These are all the things that keep us going. There’s bittersweetness. Yeah, but I’m really happy to be doing this. There’s still a long way to go in this industry, a lot more twists and turns and hurdles, but: one step at a time.

Sonalie Figueiras: Thank you so much!

Listen to this episode on Apple, Spotify or wherever you get your podcasts.

Green Queen In Conversation is a podcast about the food and climate story hosted by Sonalie Figueiras, the founder and editor-in-chief of Green Queen Media. The show’s first season, Pioneers of Cultivated Meat, explores cultivated meat, a future food technology on a mission to produce animal protein sustainability. In each of the six episodes, Sonalie interviews the pioneers of the industry, asking the hard questions about one of the most exciting food + climate innovations of our time and sharing the personal story behind each founder’s journey.

Green Queen In Conversation is a co-production from Green Queen Media and Cheeky Monkey Productions. This episode was produced by Joanna Bowers and hosted by Sonalie Figueiras.

The post Green Queen in Conversation: Cultivated Meat Pioneers – Uma Valeti of Upside Foods appeared first on Green Queen.

This post was originally published on Green Queen.