Welcome to Day 8 of #COP28. In Green Queen’s COP28 Daily Digest, our editorial team curates the must-reads, the must-bookmarks and the must-knows from around the interwebs to help you ‘skim the overwhelm’.

Catch up: DAY 1 – DAY 2 – DAYS 3 & 4 – DAY 5 – DAY 6 – DAY 7– DAY 8

Headlines You Need To Know

The COP-related news you cannot miss.

FOSSIL FUEL TALKS SET TO INTENSIFY: Following a day of much-needed rest, negotiations on greenhouse-gas-cutting measures are set to reach a new level of intensity as counties debate whether or not to phase out fossil fuels, with ministers holding a series of talks to break an impasse and come up with a roadmap to 1.5°C.

EX-UN CLIMATE CHIEF CALLS FOR FOSSIL FUEL PHASEOUT: Christiana Figueres, the UN’s climate chief during the 2015 Paris Agreement, has backed a complete fossil fuel phaseout. “If we want a step forward in this Cop, then we cannot compromise on phase out. It sends a political signal that has ramifications for companies that need to decide where they’re going to put their [investment],” she said.

CANADA MANDATES FOSSIL FUEL FIRMS TO CUT EMISSIONS BY 35% BY 2030: Justin Trudeau’s government has announced that fossil fuel companies will be required to cut their emisions by 35-38% by 2030 (from a 2019 baseline). The policy is part of Canada’s 2050 net-zero plan and sets a limit on emissions – companies that don’t meet this target trade emissions allowances with other firms.

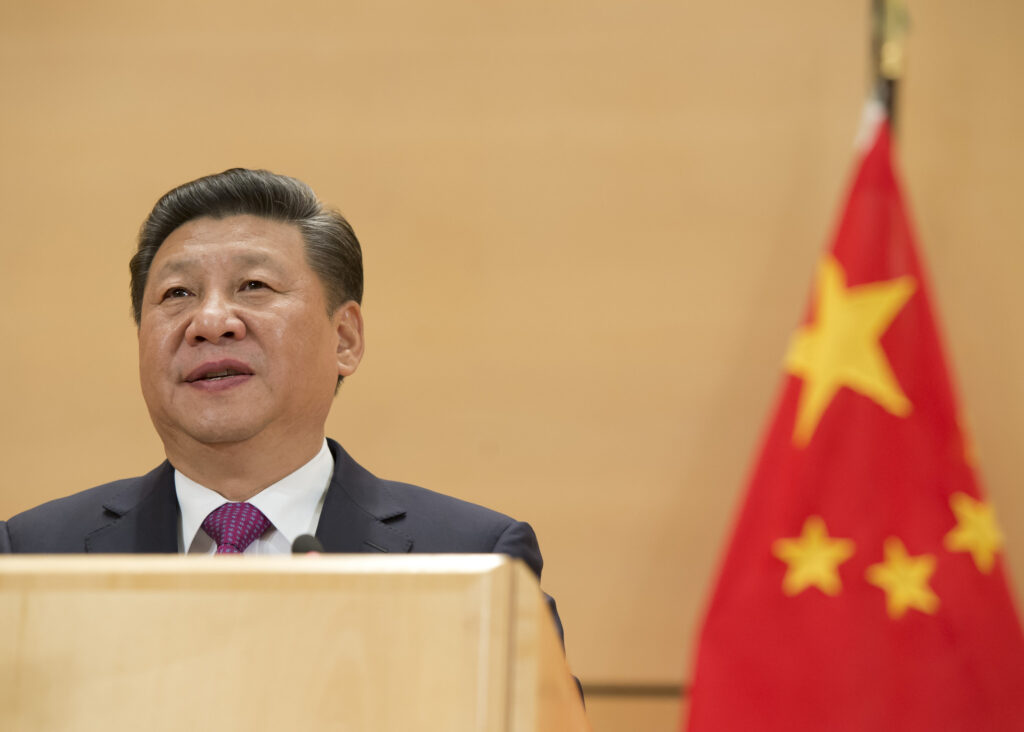

PUTIN NEGOTIATES OIL DEALS IN ABU DHABI AS COP28 CONTINUES IN DUBAI: Russian president Vladimir Putin is adding fossil fuel to the fire at the UN climate summit, landing discreetly in the capital city of Abu Dhabi – about 150km away from Dubai – to negotiate oil export deals with the UAE, in a two-part trip that will take him to Saudi Arabia next. The timing is… curious.

US URGED TO ABANDON SUPPORT FOR LIQUEFIED NATURAL GAS: Over 250 global organisations have published a letter calling on the US to stop permitting new facilities dedicated to liquefied natural gas, which is set to grow exponentially in the coming years, as well as withdraw financial and diplomatic support for the same. The US is the world’s largest exporter of the gas, and its numbers are set to double by 2027.

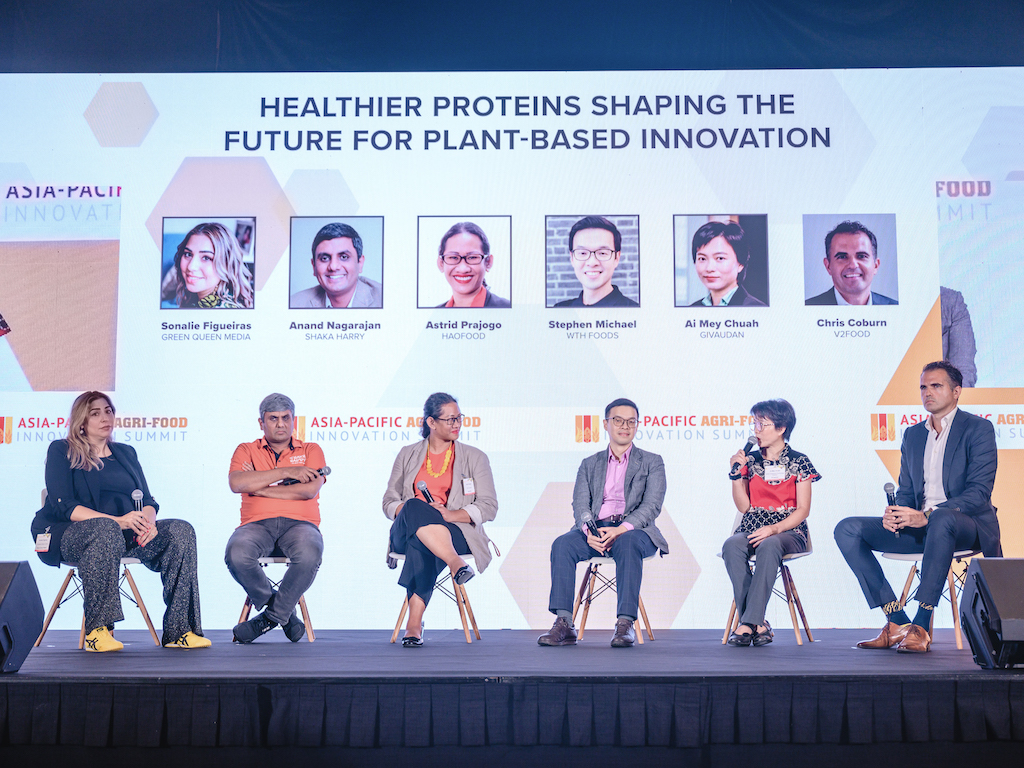

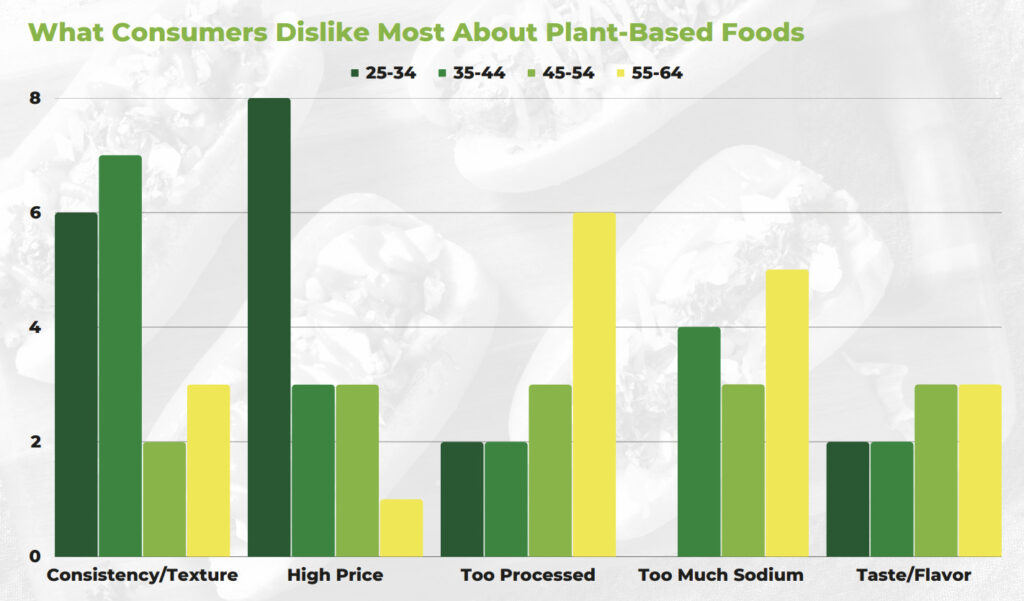

ALT-MEAT COMPANY TAKES TO LONDON STREETS FOR ‘NO MORE HOT AIR’ CAMPAIGN: British plant-based meat producer Meatless Farm has initiated a new ‘No More Hot Air’ campaign to urge leaders to “make COP matter”, highlighting how addressing the food system is just as important as stopping fossil fuels. It recommends governments to support farmer transition away from meat and shift subsides to plant-based food.

AUSTRALIA COMMITS AU$150M IN CLIMATE FINANCE: Australia has committed AU$150M ($100M) in climate finance – mainly for Pacific countries. But none of this will go to the new loss and damage fund. Instead, AU$100M will go to the Pacific Resilience Facility, a trust fund investing in small-scale climate and disaster resilience projects, and AU$50M is set aside for the Green Climate Fund.

AZERBAIJAN POISED TO BE COP29 HOST: There has been uncertainty over the host of next year’s climate conference, which rules state needs to be held in eastern Europe. Now, Azerbaijan appears to be the frontrunner, after striking a deal with Armenia to ensure the latter won’t veto the bid.

CALLS FOR PRIVATE SECTOR TRANSPARENCY AT FUTURE COPS: This year’s climate summit has welcomed an unprecedented number of private sector players, but have all of them disclosed their scope 1, 2 and 3 emissions? Industry leaders are being called upon to sign a pledge of transparency for emissions measurement and reporting at COP29, and target disclosures at COP30.

100 GLOBAL NATIVE GROUPS CALL FOR CLEAN ENERGY RIGHTS PROTECTION: In an open letter, 100 Native groups and allies have urged COP28 negotiators to protect Indigenous rights during the clean energy transition, including their right to engage in decision-making processes, access to full information, say “yes” or “no” to projects, and have the ability to withdraw consent at any stage if circumstances change.

Key #COP28 Reports

The food and climate reports you need to know about today.

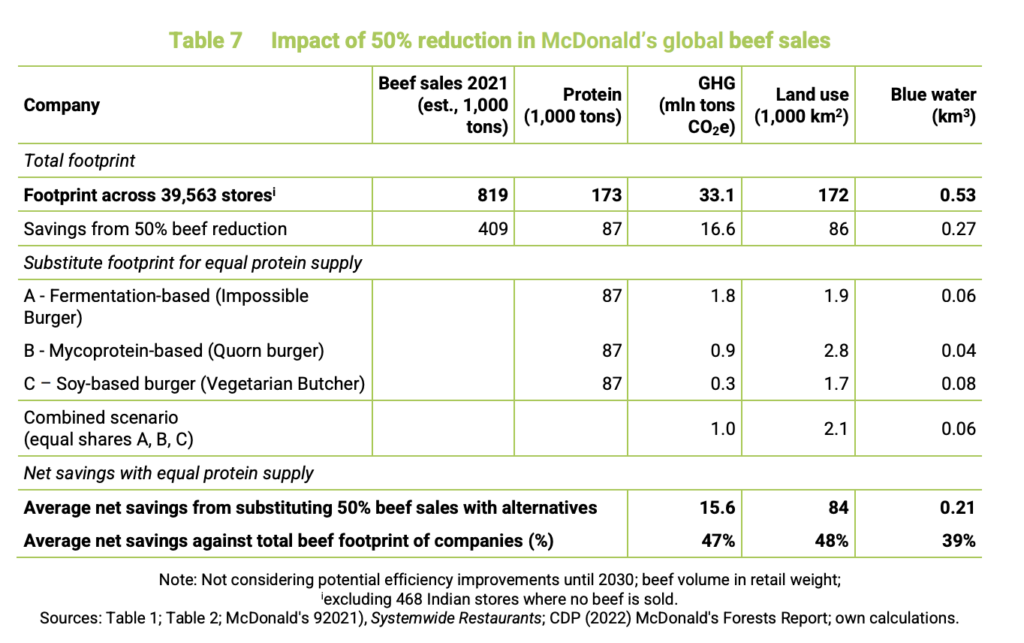

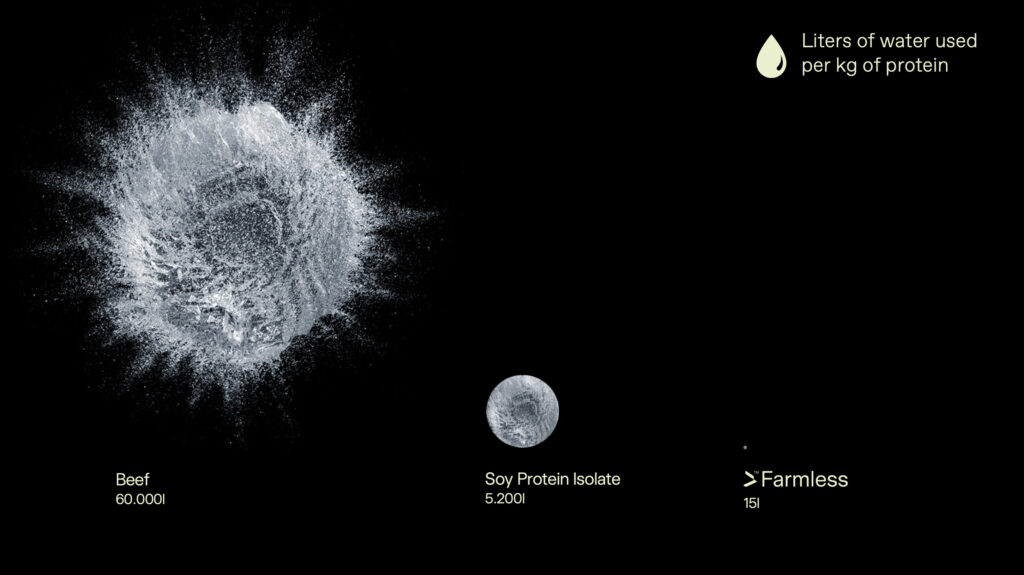

- The huge impact of animal agriculture: Ahead of its much-anticipated 1.5°C roadmap, the FAO has released a report highlighting the huge impact of livestock emissions on climate change. It found that animal agriculture produces 6.2 gigatonnes of CO2e per year, cattle contribute to 60% of total livestock emissions, two-thirds of this figure is linked to meat, and the demand for animal products is set to grow by a fifth by mid-century from 2050 levels.

- 2023 officially the hottest year on record: There were projections of this happening already, but the EU has confirmed that 2023 will be the hottest year ever. The numbers make for dark reading: last month was the warmest November ever, the year has been 0.13°C hotter than the warmest yet (2016), and between November and January, the average temperature was 1.46°C above pre-industrial levels. Even more alarming: November’s temperatures were 1.75°C warmer.

- A playbook for climate resilience: Climate resilience platform ClimateAi has launched a playbook that acts as a blueprint for turning environmental challenges into business opportunities. This includes determining risk exposure, developing better on-the-ground visibility into regional climates, and creating action plans for singular assets.

- An analysis of four worldviews on the future of farming: Green Alliance has launched a report titled ‘Crossing the divide’, which assesses the perspectives of four different groups of people on what the future of agriculture should look like: traditionalists, ‘technovegans’, agroecologists and sustainable intensifiers.

- Rethinking school meals and their climate connection: A new white paper outlines how school meal policies and menus can provide a unique chance to catalyse a transformation of the global food system and its impact on climate change, biodiversity and food sovereignty.

Awesome Resources From Media Friends

A curation of our favourite reads of the day – excellent guides, explainers and op-eds from around the web.

The best and the worst of COP: Need a refresher of the high and low points of the conference so far? The Guardian has you covered.

Climate optimism: Don’t be so down – for some bloom among the gloom and doom, the BBC has a list of five things you can be optimistic about for the climate summit.

What happens if we miss 1.5°C: Okay, back to doom. Jonathan Watts, the Guardian’s global environment editor, sat down with five climate scientists to explain what breaching 1.5°C temperature rises would mean, and how it’s different from 2°C.

Big Ag follows Big Oil’s lead: As we get closer to the first COP Food Day on Sunday, Greenpeace has an explainer out on how the agriculture lobby is borrowing tactics from the fossil fuel industry to influence proceedings.

Can food waste solve the climate crisis?: Food and climate experts Lisa Moon and Gonzalo Muñoz have penned an in-depth opinion piece for FairPlanet describing how food waste and loss can help tackle climate change.

Brazil’s intensive farming exit: Brazil was a signatory of the Declaration on Sustainable Agriculture, Resilient Food Systems and Climate Action on the second day of COP28. Jennifer Ann Thomas analyses how the beef-producing giant is charting its course away from factory farming in a story for Reuters’ Ethical Corporation Magazine.

Lighter Green Fun

Funny stuff, weird stuff, random stuff related to COP you may enjoy.

A literal emissions cap: The Canadian delegation’s emissions cap (get it?) is now a coveted fashion accessory in Dubai.

What to eat at COP: How do you decide what to eat at the largest ever UN climate conference, covering a mammoth area and with two-thirds of meatless food? TimeOut has an extensive guide to help you make your mind!

Follow all our #COP28 coverage. Like what you’re reading? Share it!

*Today is the ninth day since COP28 began, but officially the eighth day as yesterday as a rest day.

The post COP28 Daily Digest: Everything You Need To Know in Food and Climate News – Day 8 appeared first on Green Queen.

This post was originally published on Green Queen.