12 Mins Read

No single approach will offer a silver bullet solution to all problems within the food system — no matter how large the opportunity or dire the need.

When expectations exceed reality, outcomes that may normally be considered successes are seen as failures. I’ve been witnessing the disconnect between expectations and reality in sustainable food for a while now.

On one side, there’s the pitch that individual startups will save the planet and take over the multi-trillion dollar industrial animal agriculture industry along the way. This side pitches the idea of food companies growing in ways only seen in the tech space, since the need is so dire and the opportunity for disruption is so massive. This has inevitably led to food startups being valued like tech startups, with expectations that the size and rate of growth will be immense.

On the other side, there’s the reality that regardless of the amount of R&D, IP, or clever marketing tactics, all of these companies are simply producing food for people to eat. They take different amounts of time and money to scale, and they should be valued like….food companies. Maybe a premium can be applied to some with exceptional solutions to certain problems, but they are still food companies.

Recently Beyond Meat has been painted to have lost $13 billion dollars of value; however, I would argue that it never should have been valued that highly in the first place. Historically, CPG food companies are valued between 2–5x revenues. There are outliers to that, but generally, 2–5x is the norm. Knowing this, it’s clear that at a $14 billion market cap, which was over 35x revenues, Beyond Meat was highly overvalued.

Public market investors had expectations that were not based on reality. The reality is that Beyond Meat is a CPG food company generating ~$450M a year in revenue and selling food for consumers to eat. With 2–5x revenue being the norm, it is reasonable to expect Beyond Meat to trade at a market cap between $900M and $2.3B. If some want to price in rapid growth, then going a bit above $2.3B could make sense, but it’s hard to argue a 35x+ revenue multiple being grounded in reality.

Now imagine the perception of Beyond if the story went like this: Beyond Meat IPOs at $800M and steadily grows its market cap to $1 billion. Retail investors who bought in early are now up 25%+, and the decisions by the company to focus on profitability are welcomed in the difficult broader macro-economic environment that’s affecting all industries worldwide. Investors now feel quite positive about Beyond Meat as it goes from being a startup to a larger, more established CPG company.

The Reality

Today, Beyond Meat sits at ~$1 billion in market cap, representing an ~2.2x revenue multiple — right in the range of historical norms for CPG companies.

Despite this valuation being more appropriate, the story of Beyond Meat is one of failure and loss for those with greater expectations. To them, it doesn’t matter that this small food startup became a billion-dollar organization. Instead, it is a major letdown.

Now, when looking at other areas within the sustainable food ecosystem, the goal should be to set realistic expectations, so companies progressing our food system are not portrayed as meaningless failures.

So how do current expectations in cultivated meat mesh with reality? Let’s talk about it.

Big Things are Happening in Cultivated Meat

After many years of splashy headlines and big promises, the cultivated meat space has recently seen some major progress. In 2022 alone, there seemed to be a new major event happening worldwide on a continual basis.

Some developments to note are:

- January: San Diego-based cultivated seafood company BlueNalu collaborated with sushi restaurant operator Food & Life Companies to develop bluefin tuna for Food & Life Companies’ 1,000+ restaurants across Japan, South Korea, Taiwan, Hong Kong, Singapore, Thailand, and mainland China.

- February: One of Asia’s largest food and biotech companies, CJ CheilJedang, is entering the cultivated meat industry in partnership with KCell Biosciences, a startup focused on cell culture media. The companies will construct a cell culture media facility in Busan, South Korea.

- March: Israel-based SuperMeat announced a strategic partnership with large Japanese food manufacturing company Ajinomoto to pool R&D capabilities for the development of cultivated meat products.

- April: Mogale Meat and Mzanzi Meat develop Africa’s first cultivated chicken breast and beef burger, respectively.

- May: Israel-based cultivated meat company MeaTech 3D announced that its subsidiary Peace of Meat signed a strategic agreement with mycoprotein company ENOUGH to develop hybrid cultivated and fermentation-based products.

- June: China-based cultivated meat startup Joes Future Foods debuted China’s first cultivated pork belly at the New Technology Conference.

- July: Shiok Meats signs a partnership with Minh Phu Seafood, Vietnam’s largest conventional shrimp company, to develop a combined R&D facility focused on cultivated meat.

- August: Singapore-based Gaia Foods (a subsidiary of cultivated seafood company Shiok Meats) and Switzerland-based Mirai Foods have entered a strategic partnership to develop cultivated beef. The companies will collaborate on ingredients manufacturing and distribution, with plans to launch cultivated beef in Singapore and Switzerland.

- October: Vow Foods opened the largest cultivated meat facility in the southern hemisphere.

- November: APAC Cellular Agriculture signs MOU solidifying “cultivated” nomenclature.

- November: Tasting of GOOD Meat at COP27.

- December: GOOD Meat’s cultivated chicken becomes the first cultivated meat to be sold in a butchery.

*Thanks to our friends at The Good Food Institute for this list!*

With all of this buzz, it feels as if this potentially game-changing solution may be in the mouths of US consumers soon. This felt even more feasible after the US FDA gave the green light to UPSIDE Foods’ cultivated chicken, showing signs of major regulatory progress required for the sale of cultivated meat.

One additional announcement that caught major attention, including my own, was the move by Believer Meats to build the world’s largest cultivated meat plant in Wilson, North Carolina. This 200k square foot facility is expected to cost ~$124M to build (a fraction of the company’s most recent $347M Series B) and produce 10,000 metric tons of cultivated meat.

This Feels like a Big Deal

On an absolute basis, this is a big deal. Ten thousand metric tons of meat is a lot.

To put this into perspective, consider the following:

- 10k metric tons is equal to 11,023 US tons (because in the US, it’s always fun to make things make slightly less sense), or roughly 22M pounds (that’s a lot of chicken).

- How many chickens exactly? Since the average broiler chicken is 6.46 lbs and accounts for 20% loss during processing, the average amount of meat per chicken is roughly 5.17 lbs. Therefore, Believer Meats would be saving the lives of 4.27M chickens annually with this one facility. To put that into perspective, if all of those chickens were their own city in the US, they’d make up the second-largest city in the country, only behind New York City.

- As for feeding people, chicken consumption per capita in the US was at 100.6 lbs, meaning this facility could satisfy chicken demand for 219,147 people. That’s the same as feeding the entire city of Tacoma, Washington.

Saving over 4M lives and feeding over 200k people would be quite the achievement.

But What About the Financials?

Believer Meats is far from a charity, and there have been many question marks around the economics of cultivated meat companies, especially given the large amounts of investment dollars they’ve raised.

To understand what potential revenue from this plant could look like, we can apply a basic approach:

- Start with current chicken prices, which sit at $2.72 per pound for chicken breast

- Apply a premium to account for Believer Meats being one of the first companies in history to offer cultivated chicken to consumers. Picking this premium isn’t easy, but I’m making the assumption that much of the first chicken products created from this facility will be sold in high-end restaurants (or to consumers who can afford a major premium). If we apply a 5x premium, then we can assume Believer Meats is selling products for $13.60/pound. Maybe it will be higher, maybe it will be lower. I have no clue.

- At $13.60/pound, and 22M pounds, that represents annual revenues of ~$300M

That topline number of $300M from one facility can vary widely depending on the assumptions and the approach used by Believer. Pricing assumptions can be changed, and even slight changes in the expected inclusion rate of cultivated cells versus plant-based ingredients can drastically change the amount of product available for sale (i.e., 100% cultivated vs 50/50 cultivated/plant-based).

$300M may be both a high or low estimate, but either way, the path to real dollar creation is much more tangible. Considering Believer Meats mentioned an ability to create chicken breast for $1.70, as well as ~$6M of annual salaries for plant employees, it also seems positive unit economics are not out of the question (though I am a bit skeptical on the $1.70 number).

Additionally, while the company may have had to foot the bill for this first major facility, this will allow them to prove out the operations and economics of a cultivated meat facility, thus allowing them to tap into traditional capital market mechanisms for CAPEX financing needs for future builds (i.e., project finance/debt).

So it looks like the end of industrial animal agriculture is here, and that the economics are on the side of cultivated meat, right?!

Time to Reel In Those Expectations

As amazing as these achievements are for an individual company, it’s just the very beginning for the space in terms of true impact on the food system.

In terms of overall consumption, the Believer Meats production of 10k metric tons of chicken represents just 0.02% of the ~49M metric tons of meat produced in the US annually, and 0.008% of the ~133M metric tons of poultry produced globally.

And that’s just the US meat and global poultry market for comparison. When we look at the overall meat space, that number jumps up to almost 350M metric tons plus another ~200M metric tons of seafood.

Now if we assumed any cultivated meat facility could produce 10k metric tons of meat or seafood annually, then to fill the demand for the ~500M metric tons currently produced would require 50,000 facilities. At $100M per facility (~20% lower than the Believer Meats facility cost), that implies ~$5 trillion (with a “T”) of CAPEX costs for the facilities alone.

Let’s also not forget that meat consumption is not static and is expected to rise dramatically over the next few decades to 555M metric tons (from the ~350M today). This 205M metric ton increase, alone, would require ~$2 trillion of CAPEX costs for the facilities (this doesn’t account for increased seafood consumption).

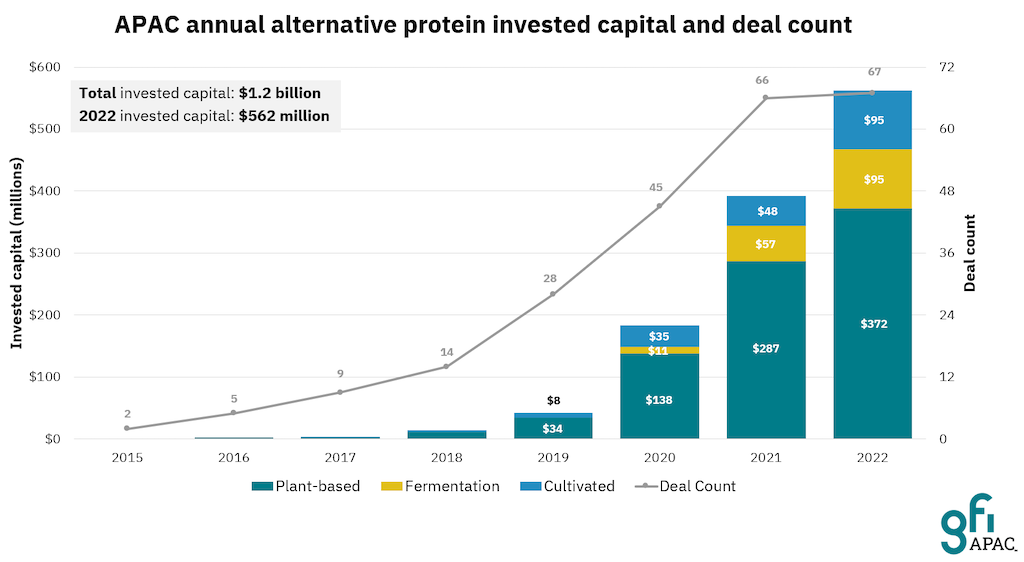

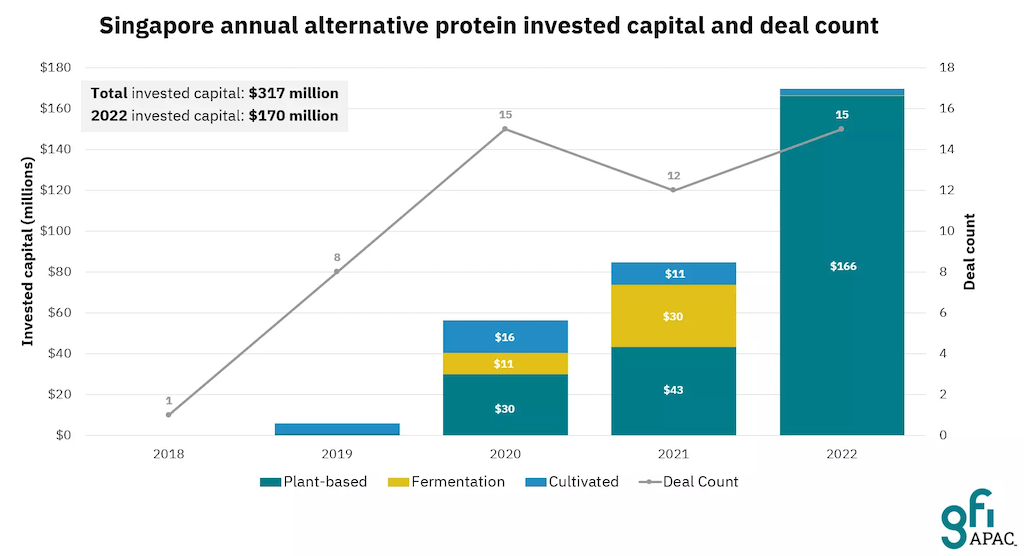

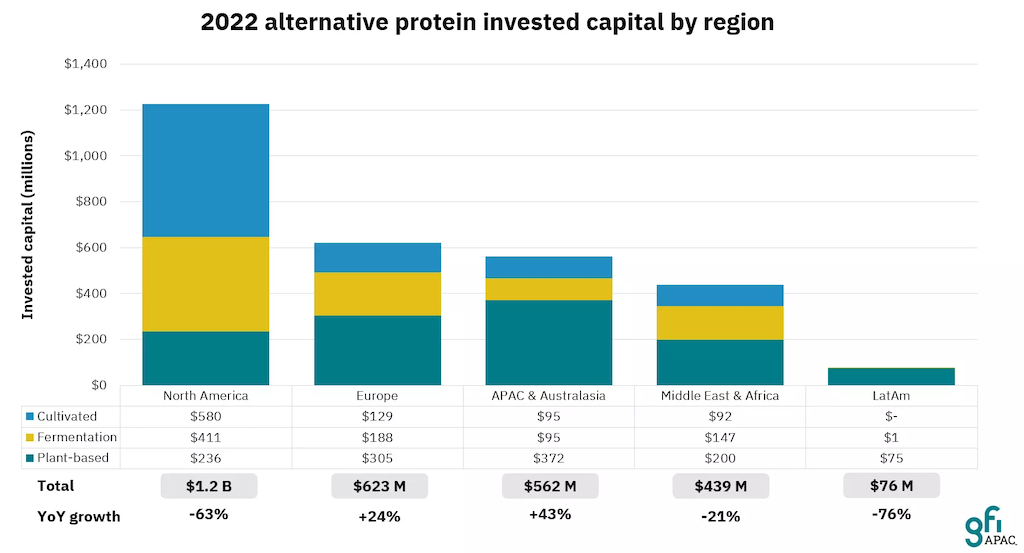

To date, total investments in alt proteins over a 12-year time frame are sitting around $15B. At this rate of investment, it will take about 3,000 years to fund the CAPEX needed to create enough cultivated meat facilities that would replace industrial animal ag in its entirety.

Yes, in reality, cultivated meat companies will be able to tap into traditional capital markets (i.e., project finance) once operations are more proven, so larger dollars will flow into the space faster.

And yes, these are all projections with major assumptions, and “garbage in, garbage out.” So just for the sake of it, let’s say I’m off wildly on the $7+ trillion CAPEX need and cut it by 85%. That’s still $1 trillion of CAPEX needed.

No matter how you look at it, the reality is that cultivated meat is not on the cusp of completely upending the traditional animal ag market.

Industry Insiders Know This

Every person I know in the cultivated meat industry is well aware this is only the beginning. There is not some false understanding from the sustainable food community thinking otherwise.

So What’s the Issue?

If industry insiders (i) know about the massive hurdles to be overcome in cultivated meat, AND (ii) that knowledge is widely shared with the public, expectations should be based on reality. This would also mean that no one will be disappointed with the progress of the cultivated meat space. Right?

Wrong.

The real problem that exists, resulting in widespread unrealistic expectations, is the portrayal of each sustainable food innovation as if it were the single, silver bullet solution to all issues facing the food system.

This means each time any new potential solution is presented, it is examined in a silo. This silo shows what it will take for that single solution to solve all of the problems that exist, which unsurprisingly results in the new solution facing impossibly large hurdles.

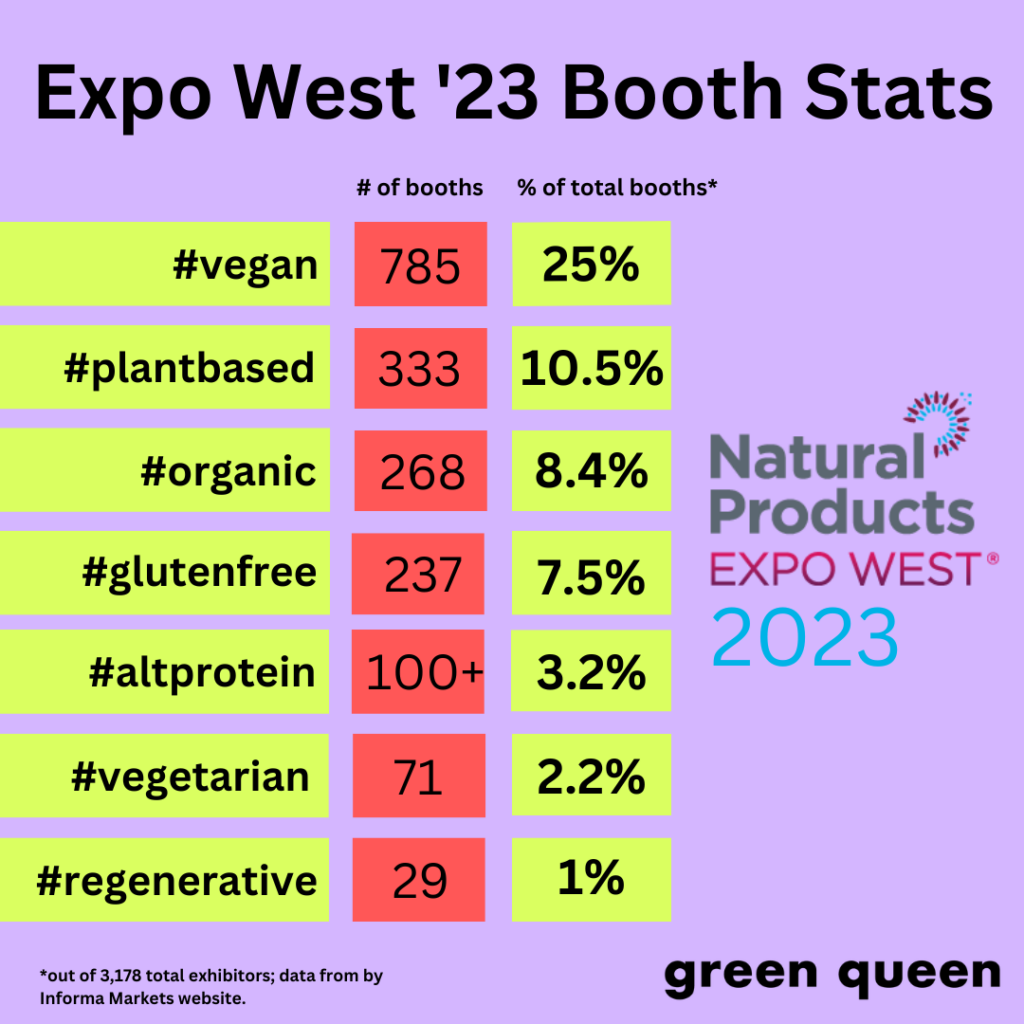

This first occurred with plant-based meat alternatives being portrayed as a silver bullet solution. When realism set in, it left the market viewing startups that turned into $1B+ organizations as failures.

This framing can be applied to any form of sustainable food solutions with the same outcome. Whether it’s plant-based meat, precision fermentation, biomass fermentation, molecular farming, vertical farming, etc. — there is an endless list of sustainable food innovations that will all be presented with impossibly high hurdles to overcome if they are expected to be the one, silver bullet solution to the food system’s problems.

The reality is that whether it’s plant-based meat or cultivated meat or precisions fermentation dairy, each of them is one of the many solutions needed to shift to a sustainable food system and it will serve its intended purpose — to reduce the reliance on industrial animal agriculture as the sole source of real, animal-based meat and seafood for those (i) not willing to give it up and (ii) open to eating products produced in this manner.

The New Expectation

Going forward, expectations for any sustainable food solution should be based on the reality that it will be one of many solutions filling a need in the food system. No single solution will take over the entire market, address every need, or attract every consumer. Instead, all solutions will collectively work together to take a bite out of the currently unsustainable multi-trillion-dollar global food system with the hope that they all help us reach a symbiotic relationship with the planet.

Additionally, continual innovation will occur within each industry, allowing them to become better, more efficient, and more desirable to consumers. There will also be new innovations that emerge, unlocking entirely novel opportunities that could improve our food system further. Maybe these new innovations will address major hurdles in existing segments (i.e., growth media costs, bioreactor scalability, downstream processing costs, etc.) or create new categories entirely.

As investors in the sustainable food space, we have seen first-hand how new innovations emerge over time, opening up entirely new opportunities. The types of companies and technologies in which we invest today are noticeably different than what we invested in back when the industry was first emerging. And, we fully expect to see opportunities five years from now being different from what we see today.

The one timeless consistency is that each new innovation has the potential to help catalyze a shift to a more sustainable food system.

Where Do We Go From Here?

For cultivated meat, for example, the new expectation should be that it will likely be a smaller fraction of the overall animal agriculture market. How small? — That’s not clear. Maybe it becomes 1% by 2050 (5M+ metric tons) and there are only a handful of successful companies in the space owning a share of the $50B+ cultivated meat industry. Or, maybe It’s 10% (50M+ metric tons) and there are many successful companies owning a share of a $500B+ industry.

A lot of that depends on continued innovation, cost reductions, and scale, but either way, the cultivated meat industry has a chance to be one of the many food system solutions our planet needs, while also creating a multi-billion dollar industry that does not currently exist.

The same can be said about the myriad of potential solutions — they may all have a chance to be one of the many food system innovations we need with the potential to create meaningful impact and value. And none offer a silver bullet solution.

Without question, hyperbolic statements will continue to be made making us think otherwise:

- Startups will continue to make grand claims to attract investors

- Investors will continue to hype up their portfolio companies

- Activists and non-profits will continue to emphasize the urgency

- And, reporters will continue to create clickbait headlines that are overly optimistic or pessimistic, because expectations based on reality are boring

Despite this, reality will sit somewhere within all of this noise, so we must constantly remind ourselves that (i) many solutions are needed and (ii) the opportunity is so large that all solutions have the chance to create meaningful impact and value.

A failure to shift our expectations will result in widespread disappointment and possibly lead to an underinvestment in innovations with legitimate potential for positive change.

Set expectations, accordingly.

A version of this article was previously published on Medium.

The post Expectations vs. Reality: It’s Time To Change The Investor Conversation Around Sustainable Food appeared first on Green Queen.

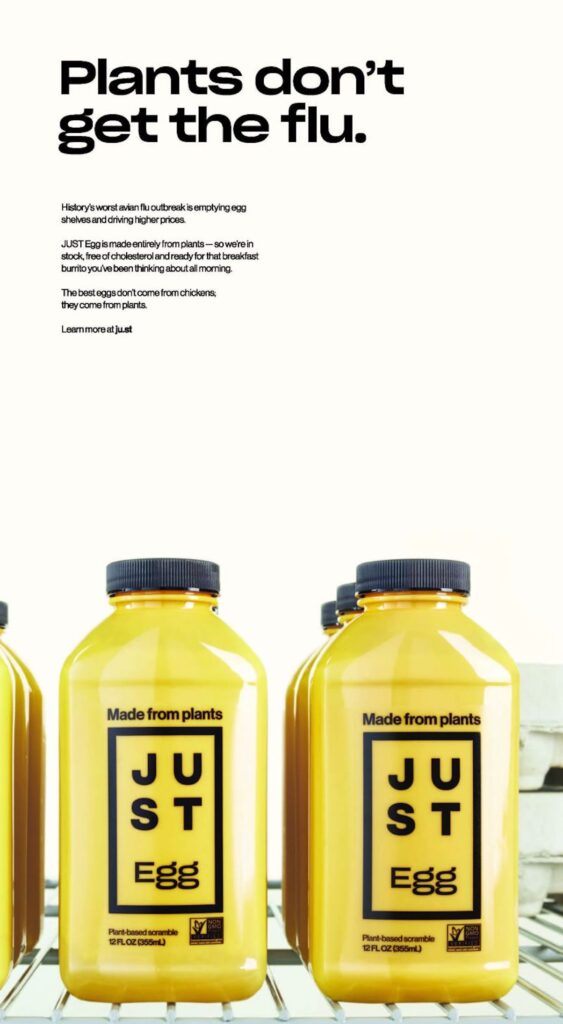

, has debuted a new line of frozen breakfast ready meals dubbed JUST Egg Meals featuring vegetables mixed with bites of its JUST Egg folded products in what the company describes as “only fully plant-based breakfast options available at major retailers”. The range will roll out at Whole Foods Market stores across the country this month, followed by a wide selection of other retailers over the next months.

, has debuted a new line of frozen breakfast ready meals dubbed JUST Egg Meals featuring vegetables mixed with bites of its JUST Egg folded products in what the company describes as “only fully plant-based breakfast options available at major retailers”. The range will roll out at Whole Foods Market stores across the country this month, followed by a wide selection of other retailers over the next months.