Californian food tech startup The Better Meat Co has raised $31M in Series A funding to reach commercial production of its mycoprotein ingredient.

With a view to beating the price of commodity beef by next year, US mycoprotein maker The Better Meat Co has secured $31M in a new Series A financing round.

The investment was co-led by Future Ventures and Resilience Reserve, with further contributions from Hickman’s Family Farms CEO Glenn Hickman, Epic Ventures, Sigma Ventures, and other returning and new investors. It takes the seven-year-old startup’s total raised to $43M.

The company plans to use the funds to “scale to commercial-volume production” of its Rhiza mycoprotein, founder and CEO Paul Shapiro tells Green Queen. It’s also eyeing new applications for the ingredient, which has so far been used in blended meat products and plant-based alternatives.

Asked what piqued investors’ interest in the firm, Shapiro says: “Rhiza is a unique, clean, whole-food protein that simply does a better job than any other ingredient when it comes to both meat enhancement and alt-meat production.”

The Better Meat Co teases new applications for Rhiza

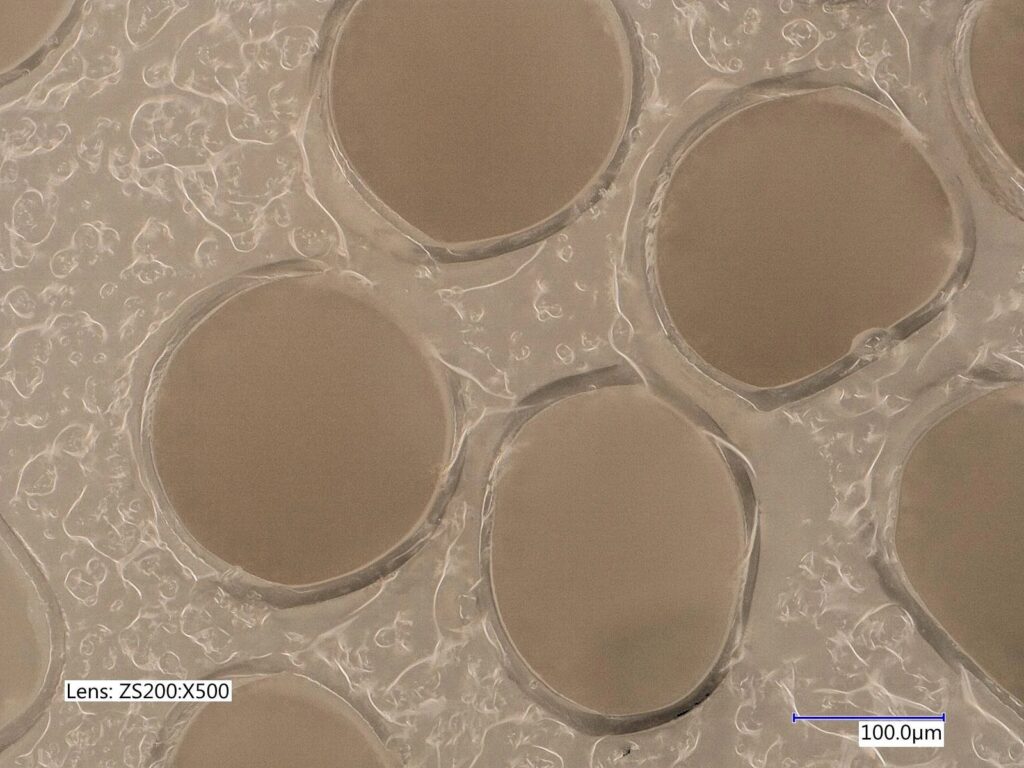

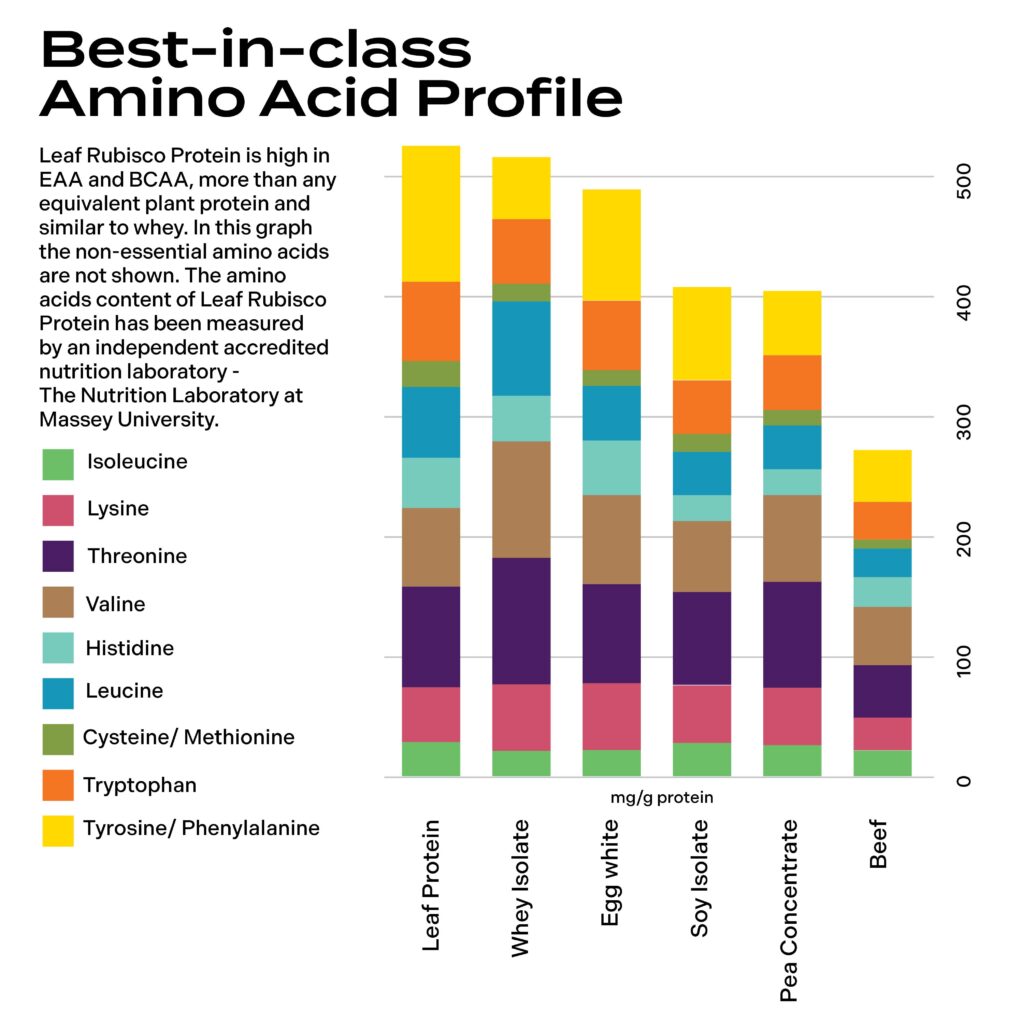

Rhiza is a whole-biomass ingredient, rather than a protein isolate, produced via the fermentation of fungi strain Neurospora crassa. The mycoprotein contains all essential amino acids and has a protein content of 50% by dry weight, which is higher than eggs.

The mycoprotein innovation has a protein digestibility score of 0.87-0.96 (close to casein, beef and eggs). Plus, it has more fibre than oats and more potassium than bananas, while containing no cholesterol and virtually no saturated fat.

Once hydrated, the ingredient can be complemented with fats and flavours for meat-free applications, or ground together with conventional meat. “We’ve primarily focused on Rhiza’s use as a meat enhancer, and most of our customers are meat companies, with some plant-based meat companies as well,” says Shapiro.

By combining Rhiza with animal protein, meat products deliver superior yields and texture after cooking, contain far less saturated fat, and boast more fibre. Some of The Better Meat Co’s clients include Hormel Foods, Maple Leaf Foods, and K12 caterer SFE.

To date, it has secured five agreements from major meat producers in North America, South America and Asia, which are collectively projected to bring $13M in annual revenue for the company.

The startup has also been working with Perdue Farms since 2019, supplying its legacy plant protein for the meat producer’s Chicken Plus range. This product “continues to sell well”, according to Shapiro.

But The Better Meat Co is now looking beyond meat too. Rhiza has previously been deemed useful in dairy alternatives like milk, cheese, coffee creamers, yoghurt, and ice cream. “We’re now realising that Rhiza flour has tremendous capabilities in baked goods too,” Shapiro says.

On its website, the company explains that Rhiza colour can replace eggs in many recipes, enhance moisture retention, and boost protein and fibre in products like tortillas, breads, brownies, and nutrition bars.

‘Building a food tech startup feels like Squid Game’

The company has been granted six patents in the US, alongside regulatory approval from both the US Food and Drug Administration (FDA) and Department of Agriculture (USDA). In fact, Rhiza is the only mycoprotein evaluated as “safe and suitable” for inclusion in conventional meat by the USDA. Additionally, the startup has also received approval for the ingredient in Singapore.

The Better Meat Co now operates a continuous fermentation approach, which entails putting materials into bioreactors at the same time the finished product is being harvested. This has improved yields and reduced production costs by over 30%, a key breakthrough in its goal to undercut commodity ground beef prices by 2026.

Shapiro did not disclose specific revenue numbers, but says the company sells 100% of the mycoprotein it produces. Over the next year, it plans to “tighten the belt and focus on solving customers’ problems”, in addition to scaling up.

“[Our] current capacity is our 9,000-litre bioreactor in Sacramento, where we can produce thousands of pounds of mycelium, but not millions. That’s the next step,” he says.

He has previously outlined plans to expand production with a co-manufacturer to 150,000-litre tanks, which is expected to deliver an eight-figure revenue in the first year. This effort is backed by a $1.5M grant from the US Department of Defense under the Biden-era Distributed Bioindustrial Manufacturing Program.

“The world needs better ways to make protein, and The Better Meat Co has invented one of the most efficient – and delicious – ways to do it,” said Future Ventures co-founder Steve Jurvetson, who is joining The Better Meat Co’s board of directors, alongside Glenn Hickman.

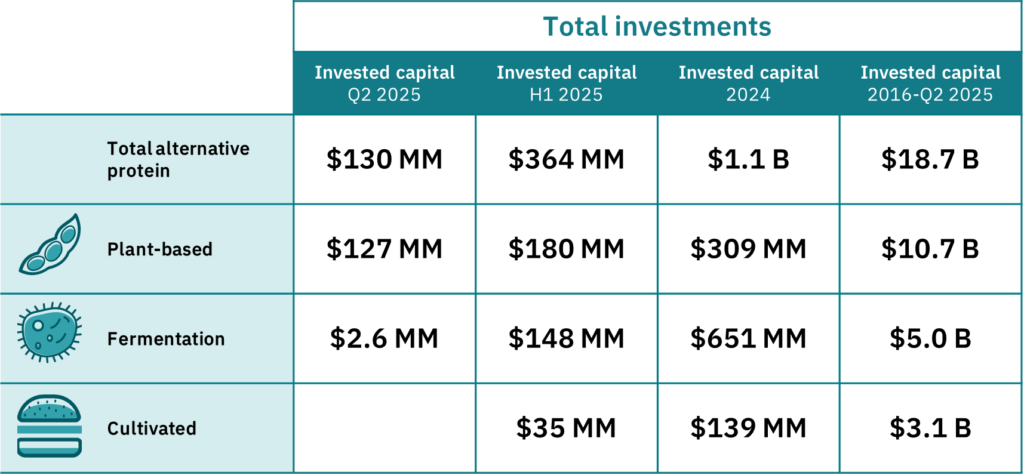

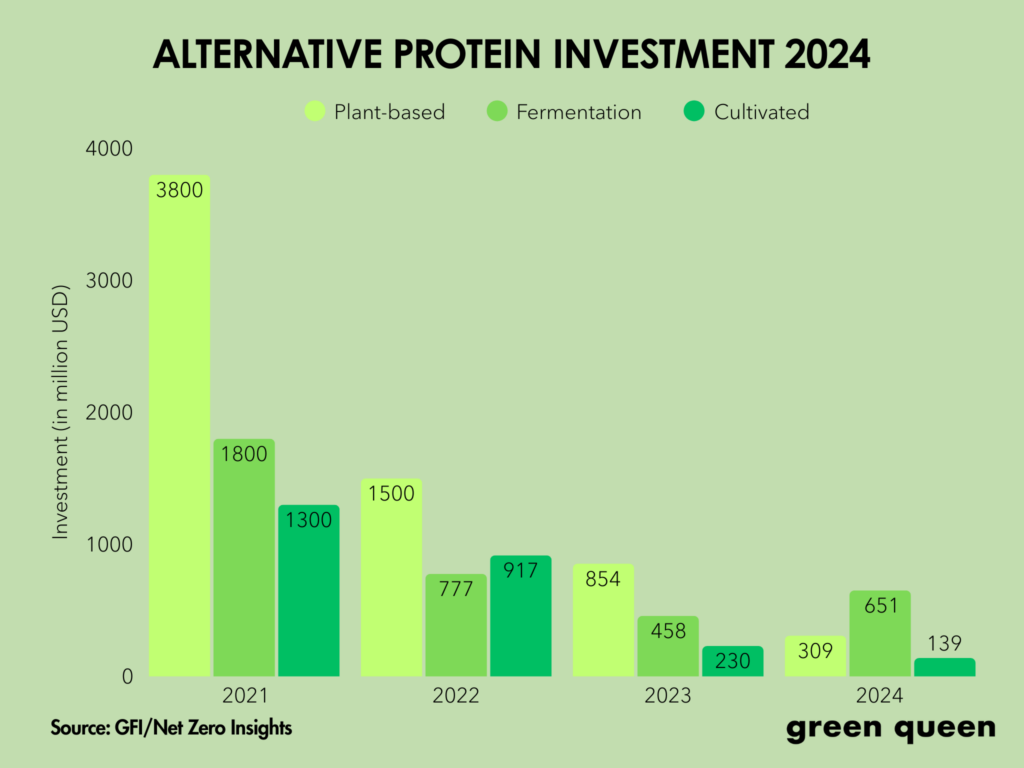

The Series A round comes during a bleak investment landscape for alternative proteins. Funding for this sector fell by 44% in 2023, and a further 27% last year. And in the first six months of 2025, it declined by 49% compared to the same period a year ago.

In that context, $31M is a large sum, especially when you consider that fermentation startups (which have otherwise bucked the declining trend) received just $2.6M in Q2. “Some days, building a startup in our sector can feel like being a player in Squid Game – with about the same odds of survival,” Shapiro says. “But deals are still getting done, including this one.

The post The Better Meat Co Brews Up $31M in Funding to Make Mycoprotein Cheaper Than Beef appeared first on Green Queen.

This post was originally published on Green Queen.