French startup Gourmey, which is awaiting regulatory approval for cultivated meat in six markets, is betting on AI to solve the industry’s greatest problem.

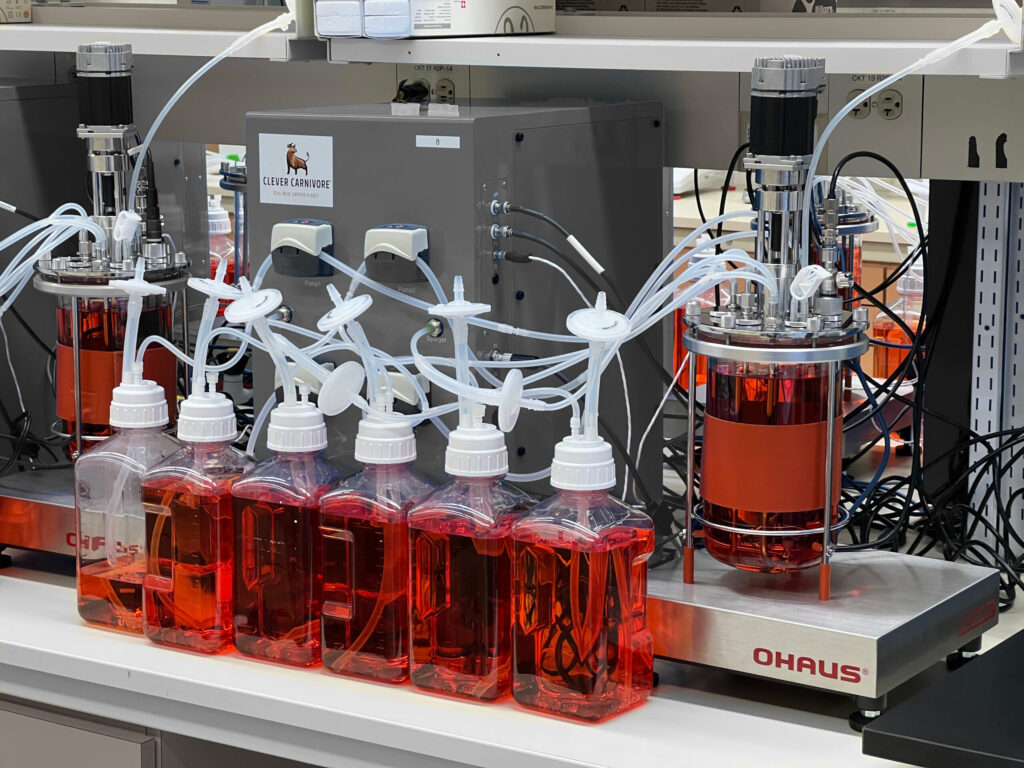

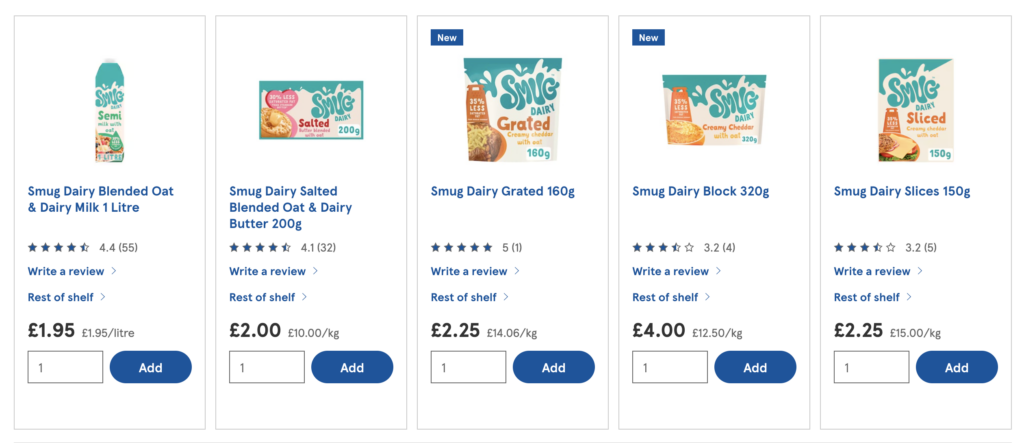

Gourmey, the Parisian firm producing foie gras by cultivating duck cells in bioreactors, is leveraging artificial intelligence (AI) to address the scale and cost challenges that have long plagued the future food sector.

The startup has partnered with DeepLife, an AI-led cellular digital twin tech company, to develop the world’s first avian digital twin. This is a virtual replica of poultry cells engineered to optimise growth conditions, nutrient density and flavour expression in cultivated meat.

“The digital twin is an AI-powered virtual replica of our cell cultivation process. We train the model using comprehensive ‘omics’ data, such as gene expression and cellular composition, collected throughout the production cycle,” Gourmey co-founder and CEO Nicolas Morin-Forest tells Green Queen.

“By integrating this data with first-principle models of cell metabolism, the digital twin enables us to run thousands of virtual experiments. This helps us identify the optimal feed formulations and bioreactor conditions to maximise yield, minimise resource use, and enhance the sensory qualities of our cultivated meat,” he adds.

“Much like how animal feed impacts the quality of conventional meat, our digital twin helps us precisely tune every aspect of cell nutrition to deliver consistently high-quality products.”

How DeepLife and Gourmey are leveraging AI to lower costs

The collaboration is initially centred on cultivated duck and poultry products, and combines DeepLife’s biology simulation engine with Gourmey’s proprietary cell cultivation platform. The goal is to produce cultivated meat on a large scale, at lower costs, and faster.

DeepLife’s systems biology engine simulates and enhances key cellular behaviours, enabling companies to tweak variables like media composition (which tends to be the most expensive part of producing cultivated meat) and metabolic efficiency, ahead of conducting costly wet lab experiments.

“Our goal is to tailor the feed and cultivation conditions to the exact needs of our cells. This optimisation increases yield and reduces feed waste, directly lowering our production costs. Moreover, the composition of the feed has a major influence on the sensory attributes, such as flavour and texture, of the final product,” says Morin-Forest.

“By using digital twin models, we can optimise feed formulations not only to maximise efficiency but also to deliver the highest nutritional and sensory quality. And because we can simulate these changes virtually, we accelerate our R&D cycles and reduce costs associated with traditional trial-and-error.”

The two firms are banking on the potential of an “integrative multi-omics approach” to optimise cultivated meat production. This combines studies of genomes, proteins, transcriptomes and metabolites to offer a powerful framework for characterising and validating cultivated meat at multiple biological levels.

“These approaches can help ensure the stability of cell lines, characterise cellular composition, identify potential allergens, metabolites and other bioactive compounds, and assess the bioavailability of key nutrients,” reads a study by the two companies.

“While many techniques can be adapted from pharma-oriented bioprocessing, cultivated meat production presents distinct challenges, including stricter cost constraints on culture media, constraints on the nutritional value of the cultured cells themselves, and a regulatory landscape that differs from that of pharmaceuticals,” it adds.

“Currently, integrative omics strategies are not widely used in novel food risk assessment, due to a lack of validated approaches, although they represent a potential powerful tool to complement risk assessment and regulatory science.”

Price reductions paramount for future of cultivated meat

Gourmey’s announcement of its partnership with DeepLife comes a month after a techno-economic analysis revealed that its 5,000-litre bioreactor system can potentially enable it to manufacture cultivated meat for as little as $3.43 per lb.

“Because our cells thrive without proteins or growth factors, we can bring our food-safe feed price down to around 20 cents per litre, just a fraction of what’s typical in the industry,” Morin-Forest explained in an interview with Green Queen at the time.

“This shows that cost-competitive, scalable, and economically viable cultivated meat is now within reach. Bringing costs down enables us to expand access, accelerate adoption, and maximise our positive impact across both premium and commodity protein markets,” he says now.

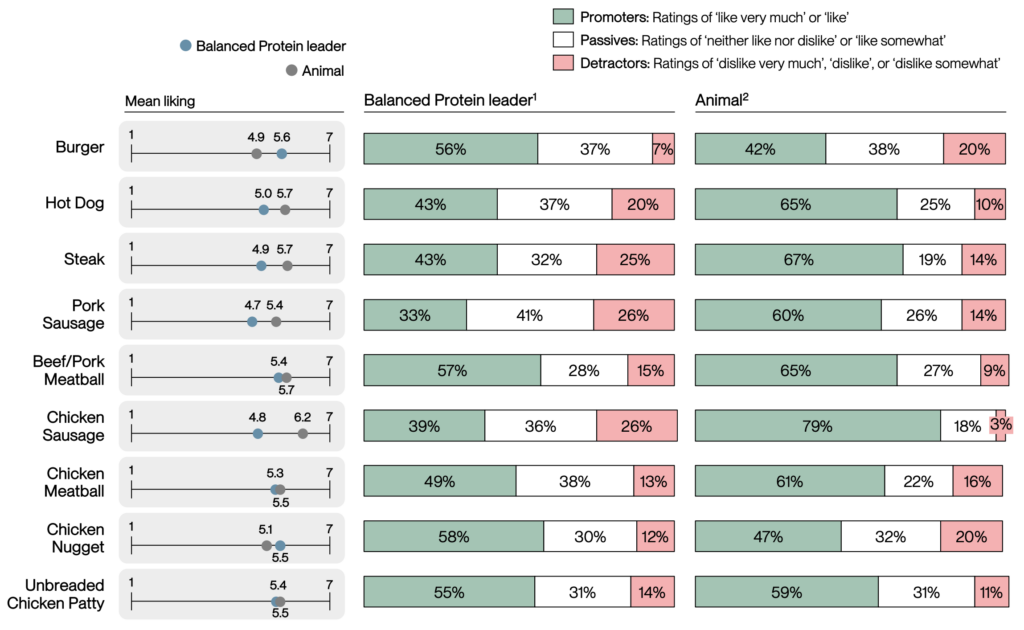

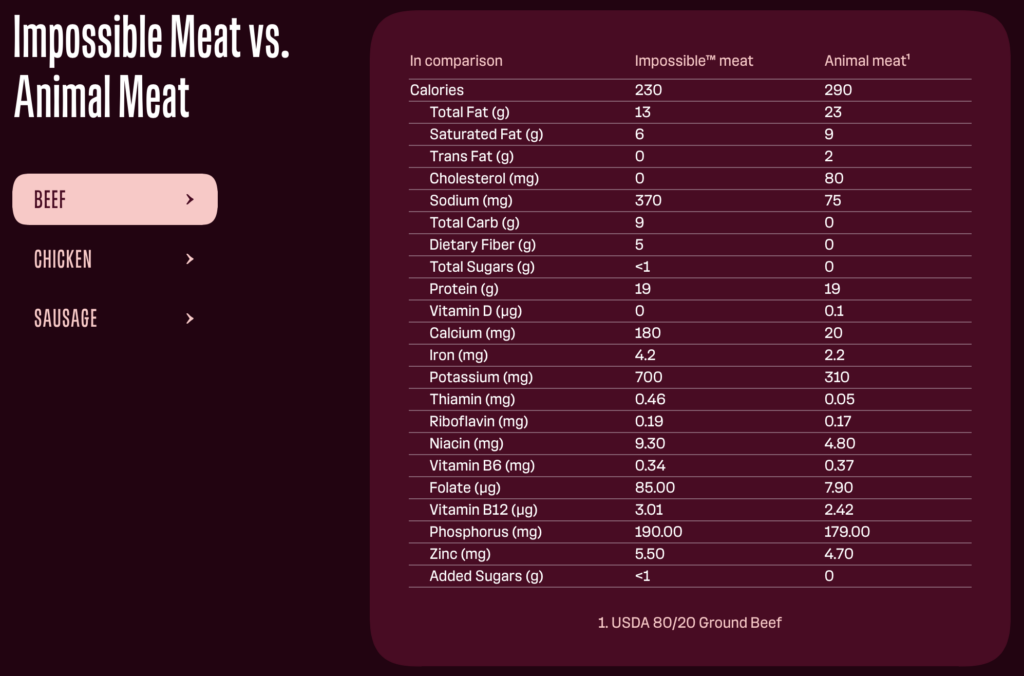

“Lowering costs is critical for cultivated meat to become a mainstream, sustainable protein,” he adds. According to a 4,000-person survey, three in five Europeans feel cultivated meat will only be successful if it’s affordable for everyone. In fact, nearly half expect it to be cheaper than conventional meat, and only 15% would buy it if it’s more expensive (versus 60% who wouldn’t).

Efforts to do so have been top of mind for companies in the space. Experts suggest that cultivated meat can compete with conventional animal protein at a production cost of $2.92 by 2030. The industry has already lowered this by 99% in the last decade or so.

Over the last year, several startups have achieved breakthroughs on this front. Meatly, which is approved to sell cultivated chicken to pets in the UK, recently reduced culture media costs to $0.30 per litre, which will further be lowered to just $0.02 at industrial scale.

Another cultivated pet food startup, BioCraft Pet Nutrition, has developed a plant-based growth medium that reduces the cost of its ingredient to $2-2.50 per lb. And in Israel, SuperMeat has made several breakthroughs to produce its cultivated chicken for $12 per lb, while Believer Meats has described how its continuous process can potentially produce cultivated chicken for $6 per lb at scale.

And last week, Chicago’s Clever Carnivore announced it has been operating with a media cost of $0.07 at pilot scale for over two years now.

How AI can support filings for regulatory approval

Gourmey is pursuing regulatory approval in six markets, including the US, the UK, Switzerland, and the EU, and expects the greenlight in Singapore soon. It is using these AI-led optimisations to inform commercial-scale production and support its regulatory filings.

“AI-powered digital twins provide a deep, data-driven understanding of our cell metabolism and production process. This allows us to demonstrate consistent product quality, traceability, and safety, key requirements for regulatory approval,” explains Morin-Forest.

“By having robust, predictive models, we can more effectively document and verify the nutritional and sensory attributes of our products, which supports our applications with regulators in Europe, the US, and Asia.”

Its partnership with DeepLife comes at a critical juncture for the cultivated meat industry. Seven countries have granted some form of approval for the sale of these proteins, and several others are evaluating applications. Currently, however, you can only buy cultivated meat in three nations (Singapore, Australia and the US).

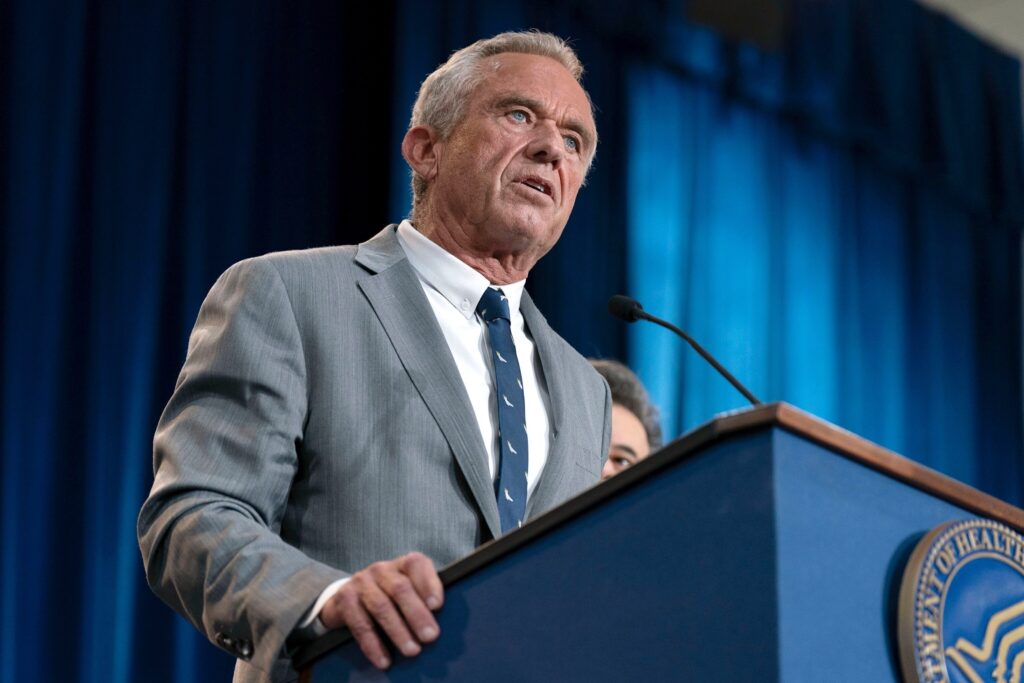

Meanwhile, in Italy and certain states in the US, politicians have banned the production and sale of cultivated meat, a move many others are trying to replicate. “We believe that consumers should have the freedom to choose foods that align with their values and preferences,” says Morin-Forest. “Rather than restricting choice, we encourage constructive dialogue and science-based regulation to ensure safety, transparency, and trust.”

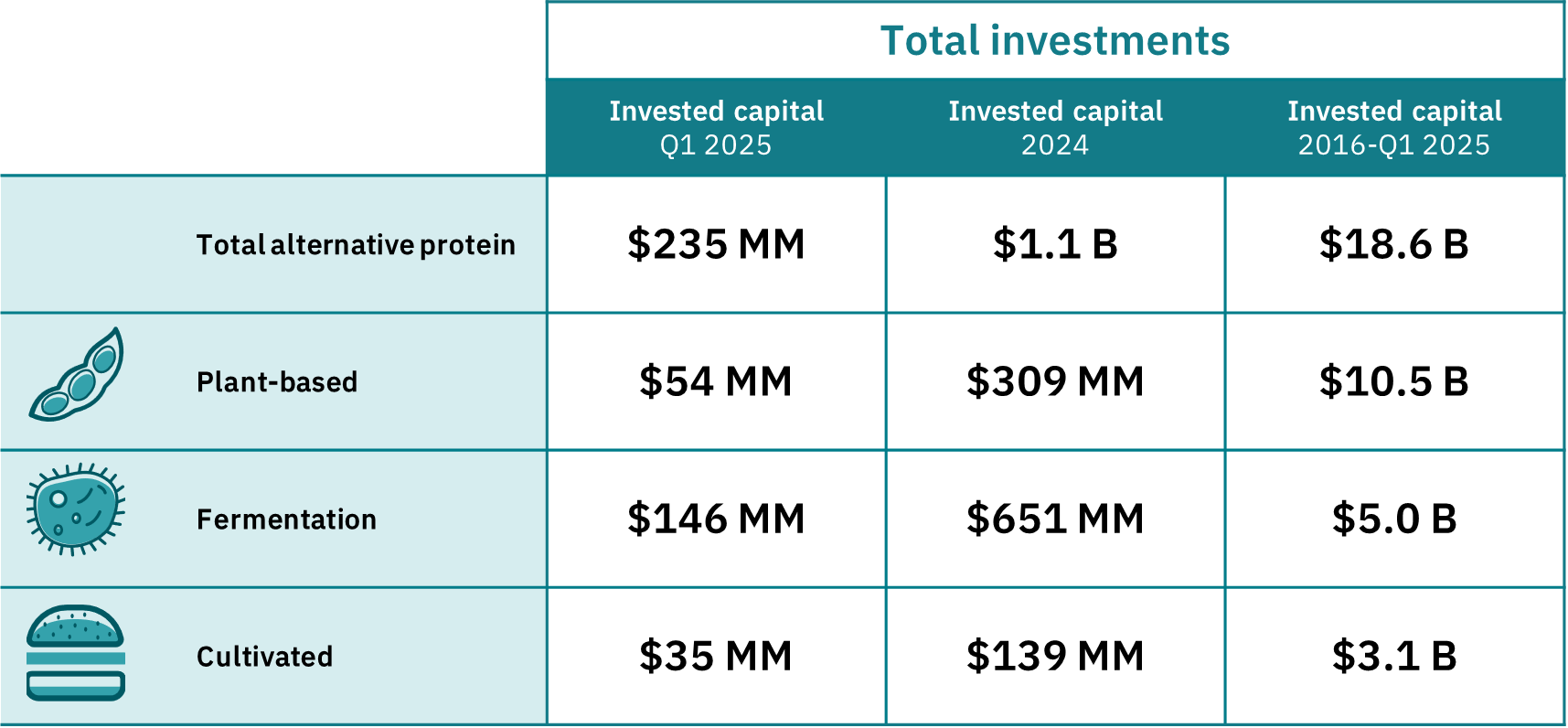

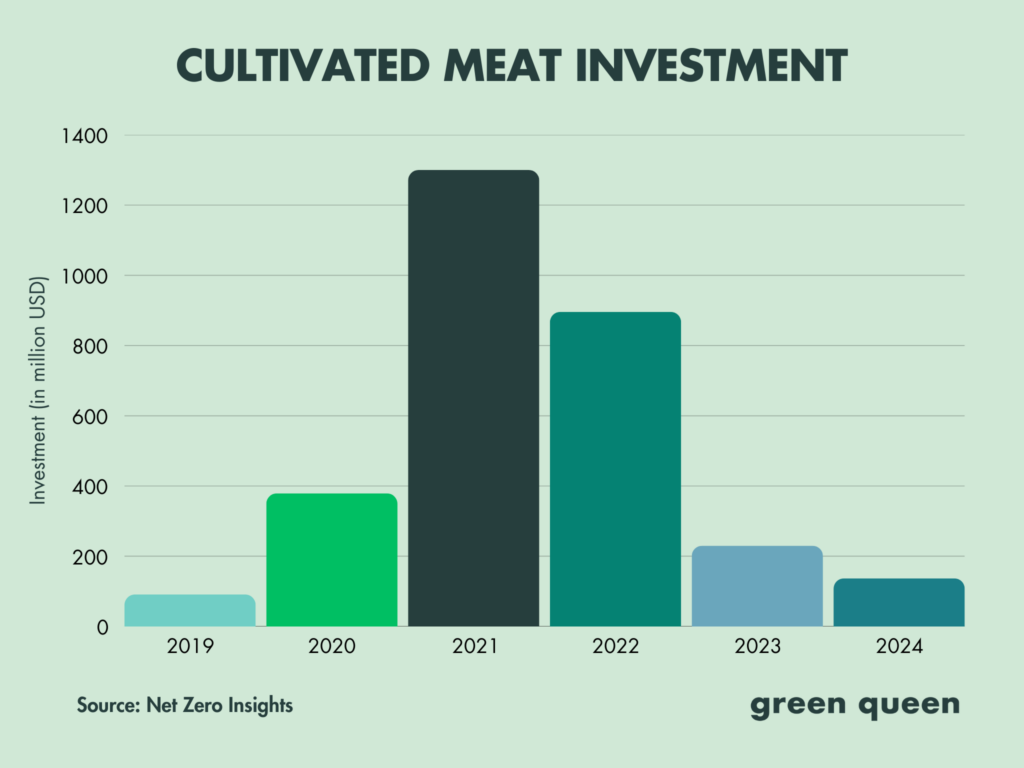

This is one of the many obstacles to large-scale, cost-competitive production of cultivated meat. And with investors no longer pouring sufficient capital into the industry to tackle these issues, it has prompted Gourmey to leverage their new favourite technology: AI.

“This isn’t just a new biotech innovation – it’s the first step toward a food revolution,” claims DeepLife CO Jonathan Baptista. “And we are delighted to launch this partnership with Gourmey to create the AI-native leader in this emerging market.”

The post Could AI Be the Solution for Cheap Cultivated Meat? This French Startup Is Betting On It appeared first on Green Queen.

This post was originally published on Green Queen.