Beyond Meat enjoyed a bit of a small rally recently, especially after its latest earnings call. However, there has been a lot of negative discussion about Beyond Meat and its stock price over the past year, which indeed continues to struggle.

Is the negativity justified? Is it accurate? Is the product to blame? Is it CEO Ethan Brown? Below, I share the ten reasons investors of all culinary persuasions might be wrong about BYND.

1. Ceci N’est Pas Un ‘Consumer Staple’

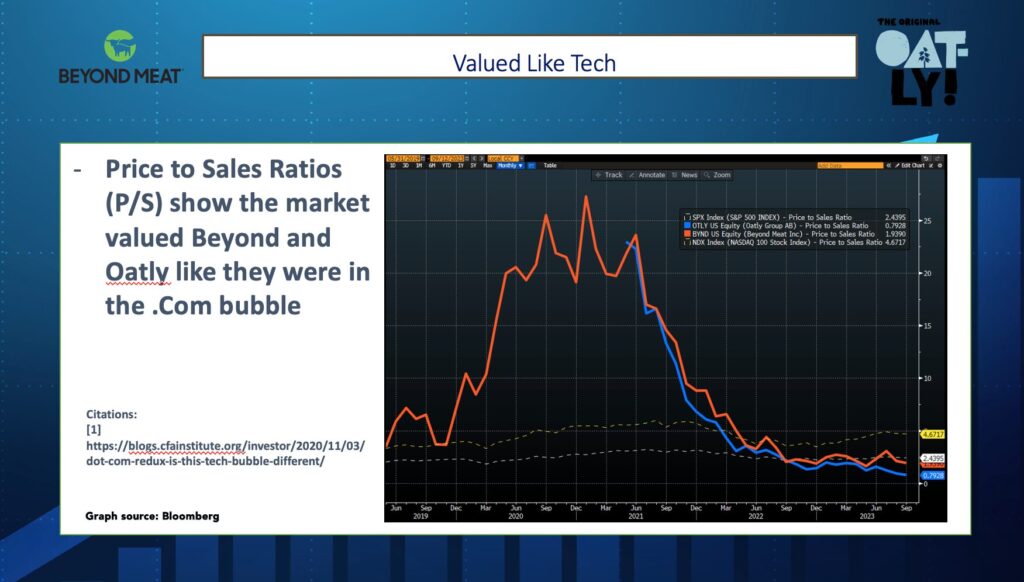

Beyond Meat’s IPO valuation was more aligned with tech companies during the dot-com bubble than with consumer staples/food companies, per the image below. This proved to be a real Achille’s heel for the stock, as tech companies trade at higher multiples and have faster growth trends. Food products are not SaaS, and these companies tend to have much slower growth than their tech counterparts. The markets eventually corrected for this, bringing the company’s stock price way down.

2. Path to Profitability: No P/E, No Love‘

The media loves a founder with a ‘save-the-world’ dream. From Steve Jobs to Sergey Brin, Silicon Valley has trained us to love a visionary. Beyond’s CEO Ethan Brown may indeed make his vision a reality of shifting the global food system away from livestock meat eventually, but Wall Street analysts don’t want to hear about a future dream. They want to see consumer demand, revolutionary IP, and, more than anything else, a realistic path to profitability.

Financial analysts usually rely on a P/E ratio (share price per earnings) to evaluate a company’s performance and in the case of Beyond Meat, which has not achieved profitability yet, the ratio is negative, leaving analysts flummoxed. Additionally, analysts want to see revenue growth, not revenue declines, as is the case for Beyond Meat. Add to this that most Street analysts may not see the need to shift away from an animal meat food system, and it’s not hard to see why the stock has been battered by downgrade ratings.

3. Consistency For The Win. Confidence For The Bigger Win.

If analysts aren’t interested in the plant-based dream and are deprived of their crucial revenue growth and P/E metrics, how exactly can they analyze a company accurately and provide fair stock ratings? The answer is earning calls. Wall Street analysts tend to look to the CEO to accurately guide for financial expectations: Will the company be profitable? And if so, by how much? And when? They expect the CEO to be able to know their business well enough to accurately predict growth (or loss) from three months to a year out.

Much of Wall Street is about managing expectations. Consistently hitting quarterly expectations in earnings calls gives analysts confidence that the CEO is in control of the business. Consistently missing quarterly expectations and not being able to right the ship quarter after quarter will do the exact opposite. This is what happened to Beyond Meat for too many quarters in a row.

4. ‘I Have a Dream’ vs. ‘Show Me The Money

Dreams are great but profitability is the holy grail. Beyond Meat IPOed during the exuberant 2019 bull market. The stock rose 163% in one day of trading, the largest bump for an IPO stock since the 2008 crash. While institutional investors make up 85% of the market, it’s the retail investors that got really excited about BYND, and this resulted in the stock’s price being driven way up. Irrationally so, some might say. Ever since, the company has struggled to show analysts a convincing path to profitability.

As of the last earnings call, the Street seems to have regained some confidence in Brown as a CEO and the stock in general. While U.S. sales were down, the company still beat expectations and sales were down less than expected ($73.7 million rather than $66.8 million in the fourth quarter of 2023). This is 10% better than expected for the US. Further, international sales were up 22% in retail and 34% in foodservice.

The stock was rewarded for this, but losing less sales than expected is hardly revenue growth. Even in forecasting out for 2024, the best the company could do was state that it would hold steady at around $345M, and lose no more. Not exactly growth. The company hasn’t been able to hold on to all of its gains, but there was a moment when it rallied for the company. So why did The Street react positively?

5. It’s The Spending, Stupid

What was so different about the Feb 27th earnings call? Well, Brown shared that in 2023 the company brought operating expenses down to $107.8 million for the year, compared with $320.2 million in 2022, a two-thirds reduction in spending!

It appears The Street had been waiting to see this kind of leadership from the company since its IPO. Could Beyond Meat run a fiscally responsible company?

BYND was up 31% the day after the earnings call (Feb 28th, 2024), trading at $9.83, up from $7.52. It then surged 106% in after-hours trading. As of writing ten days later, it is $8.07.

Less interested in big visions around the future of protein, analysts had been hoping for a solid balance sheet and a realistic path to profitability, or at least stopping the bleeding, controlled spending and management focused on the numbers, not the dream- all of which Beyond delivered.

6. What’s Up with Consumer Demand? Inflation.

While some vegans claim that Beyond Meat’s cleaner labels are the reason why the company is having trouble, the more likely explanation for declining domestic sales is inflation. The average grocery shopper is facing skyrocketing food prices.

The Beyond Meat brand is intended for meat eaters looking to make a smarter choice for themselves and the planet. With the cost of its plant-based patty up to double that of a heavily subsidized livestock meat burger, it’s no secret why mainstream consumers can’t afford them on a regular basis.

The company appears to be working hard on price parity, but it’s key not to ignore food inflation’s role when looking at the whole financial picture. According to the industry think tank the Good Food Institute, what matters most to alternative protein consumers is taste, price, and convenience. I have come to believe it is price, price, and price.

7. Covid, (Supply) Chains and China, Oh My!

Often missing from Beyond Meat analysis is the bigger contextual picture. Since going public in mid-2019, the company has faced Covid-related complications (including restaurant closures), supply chain disruptions due to wars and pandemics, China’s economic crash, global inflation, and general societal angst. Even one of these externalities would challenge a healthy company- and yet Beyond has weathered all of these simultaneously. To still be standing and on the way to profitability is a testament to the young public company’s staying power. Can it continue to weather the storm?

8. Big Meat vs. Beyond Meat

In the past 18 months, the mainstream media has been relentless in its attacks on the plant-based meat sector. While many see the negative narratives as directed against the entire industry, in reality, as the only public company in the space, Beyond Meat bears the brunt of the hits and it’s undoubtedly had an outsized impact on the stock performance.

Lately, a slew of reports and investigations have detailed how Big Meat lobbyists are behind the attacks. Will analysts start to price in the cost of this misinformation? Most likely not. It is not their problem. The sector and the company are going to have to continue to deliver against misinformation by lowering prices and critical innovation.

9. Innovate or Die

All is not lost. Given the choice between innovating and dying, Beyond Meat has chosen to innovate. Despite expenses decreasing by two-thirds in 2023, the company released new ‘clean label’ products: AMA-certified cholesterol-free plant-based steak tips and a new burger patty made with avocado oil and fava beans that offers its consumers the same taste at a fraction of the saturated fat content.

The company is making it clear that it is hyper-focused on what works (healthier versions of its star products) and unattached to what doesn’t (Beyond Jerky, ending a distribution agreement with PepsiCo that didn’t perform well) as it journeys to profitability. This is what Wall Street wants to see.

10. So What Now?

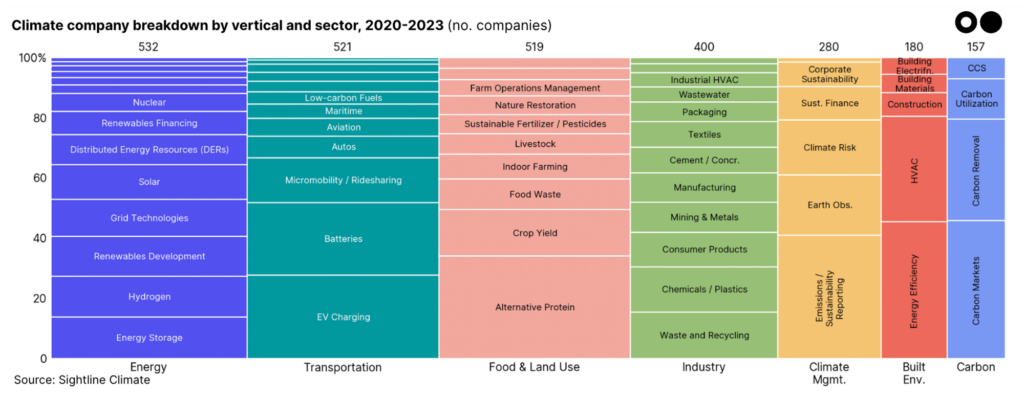

A few things are transpiring. Firstly, coming off of COP28 and the push for financing food system change fast, the Street is beginning to process what many in the plant-based industry have known for years: food tech IS climate tech. Society won’t achieve its collective global net zero goals without investing in meat reduction, given the livestock sector’s emissions footprint. Beyond Meat’s future trajectory is inextricably linked to this reality.

Secondly, if Ethan Brown can continue to manage earnings call expectations, then analysts may welcome the CEO they want to see: an Ethan Brown dialed into the priorities of The Street; marching towards profitability, fiscal control, a commitment to products at price parity with meat and innovation-led R&D.

No doubt, the company has a long way to go to get a justified stock price rally that can last, but with operational spending cuts and potential profitability on the horizon amidst the environmental messaging finally taking hold in the financial community, it may be a step closer to turning a corner.

The post BYND: 10 Things Everyone Gets Wrong About Beyond Meat appeared first on Green Queen.

This post was originally published on Green Queen.

(@kel_eats_chicago)

(@kel_eats_chicago)