For those of us forced to live with it, Labor’s first budget since 2013 is both a missed opportunity and a threat of worse things to come, argues Graham Matthews.

This post was originally published on Green Left.

For those of us forced to live with it, Labor’s first budget since 2013 is both a missed opportunity and a threat of worse things to come, argues Graham Matthews.

This post was originally published on Green Left.

Life is tougher at this point in time than it usually is. There are many reasons for this, but four stand out as cornerstones of perils that impact our lives. First of all, we have COVID. It hit us without warning and dominated our lives for two years. We had no previous experience upon which …

Continue reading COVID, UKRAINE, INFLATION, FLOODS

The post COVID, UKRAINE, INFLATION, FLOODS appeared first on Everald Compton.

President Joe Biden used a Wednesday speech at the White House to scold fossil fuel companies for raking in huge profits at the expense of U.S. consumers, who are being gashed by high prices at the pump.

But instead of calling for a specific policy solution that would force the industry’s hand, Biden asked oil companies to voluntarily stop padding their bottom lines and instead “pass the savings on to consumers.”

“So far, American oil companies are using that windfall, the windfall of profits, to buy back their own stock, passing that money on to their shareholders, not to consumers,” the president said. “When the cost of oil comes down, we should see the price at the gas station, at the pump, come down as well. That’s how it’s supposed to work. But that’s not what’s happening.”

The president’s latest energy address marked a continuation of his approach to countering fossil fuel industry profiteering thus far, one that has focused more on pleading with oil company executives to do what’s best for consumers than aggressively pursuing legislative and executive action to compel fossil fuel giants to constrain prices.

Jamie Henn, the director of Fossil Free Media, welcomed Biden’s direct call-out of the industry’s surging profits and ongoing share buybacks, but added that he now needs to “tell Congress to pass a Big Oil windfall profits tax!”

The Stop the Oil Profiteering campaign echoed that message.

“The price gouging from Big Oil is unacceptable and that’s exactly why we need a Big Oil windfall profits tax — the most simple first step to stop this profiteering and deliver immediate relief to working people across the country,” the campaign said.

Pres. Biden called out oil companies for using their ‘windfall of profits’ from high gas prices—$70 billion in just one quarter—to buy back their own stocks pic.twitter.com/sK7zDrsM7s

— NowThis (@nowthisnews) October 19, 2022

While the Biden White House has reportedly mulled supporting a windfall profits tax in private, the administration has yet to endorse legislation that Democrats in the House and Senate have introduced and forcefully advocated in recent months.

Survey data has shown that a windfall profits tax targeting oil giants is massively popular with the U.S. public, which has signaled it wants lawmakers and political candidates to crack down on corporate profiteering that is driving up prices across the economy.

With the midterms approaching, campaigners and strategists have implored the Biden administration to get behind a windfall profits tax as part of its economic messaging, particularly as Republicans hammer away on inflation attacks even as their party threatens to make the problem worse by pushing giveaways for the rich.

In a recent memo, Democratic strategist Mike Lux argued that “there is not a reason in the world Democrats need to be defensive or mushy about their plan for inflation,” noting that a “populist message on the issue has been tested repeatedly by the smartest pollsters in the business… and it works.”

Lux wrote that a top messaging point for Democrats should be that “wealthy corporations with monopoly power are jacking up their prices, and their profits are going through the roof.”

“Big oil, food, shipping, healthcare, and real estate companies have been making record profits over the last two years,” Lux implored Democratic candidates to say. “I will crack down on price gouging, but to be clear—my opponent has proposed nothing to combat this abuse.”

Earlier this year, the House passed the Consumer Fuel Price Gouging Prevention Act, Democratic legislation that proposes giving Biden emergency authority to combat “unconscionably excessive” price hikes by oil and gas companies. Not a single Republican voted for the bill, which hasn’t received a vote in the Senate.

And neither chamber of Congress has voted on windfall profits tax legislation, even as oil companies continue to report unprecedented profits.

Rep. Ro Khanna’s (D-Calif.) Big Oil Windfall Profits Tax Act, which would impose a per-barrel levy on profitable oil companies and use the revenue to pay out a quarterly rebate to consumers, has just 23 co-sponsors in the House.

A separate proposal introduced in August by Sen. Ron Wyden (D-Ore.), chair of the Senate Finance Committee, would “double the tax rate of Big Oil’s excess profits” and impose a tax on stock buybacks.

The bill has 13 co-sponsors in the Senate, including Majority Leader Chuck Schumer (D-N.Y.)—but it hasn’t come up for a vote.

“While you pay through the nose at the gas pump, Big Oil is lining its pockets,” former U.S. Labor Secretary Robert Reich said Wednesday. “How are they using their record profits? Not to increase production or lower gas prices. They’re spending billions on stock buybacks.”

“What can we do about it? Hit Big Oil with a windfall profits tax,” Reich added.

This post was originally published on Latest – Truthout.

An inflationary tsunami is passing through the world economy, creating economic disorder — in some cases acute political crisis — in every country it touches, writes John Ross.

This post was originally published on Green Left.

Rep. Ro Khanna announced Sunday that he is teaming up with Democratic Sen. Richard Blumenthal on a bill to block all U.S. weapons sales to Saudi Arabia in response to Saudi-led OPEC’s newly announced decision to slash oil production, driving up gas prices across the globe.

In an op-ed for Politico, Khanna (D-Calif.), Blumenthal (D-Conn.), and Yale School of Management professor Jeffrey Sonnenfeld argued that OPEC and Russia’s move to cut oil production by two million barrels per day starting in November will “worsen global inflation, undermine successful efforts in the U.S. to bring down the price of gas, and help fuel Putin’s unprovoked invasion of Ukraine.”

“The Saudi decision was a pointed blow to the U.S., but the U.S. also has a way to respond: It can promptly pause the massive transfer of American warfare technology into the eager hands of the Saudis,” the trio wrote. “That is why we are proposing bicameral legislation in the Senate and House on Tuesday that will immediately halt all U.S. arms sales to Saudi Arabia.”

“For several years now, our colleagues have been considering similar proposals, but those measures haven’t passed,” they added. “Due to intense bipartisan blowback to Saudi’s collusion with Russia, we think this time is different. Based on our conversation with colleagues, our legislation is already garnering bipartisan support in both chambers.”

.@SenBlumenthal @JeffSonnenfeld and I are working on a bipartisan, bicameral basis to stop all armed sales and sales of military parts to the Saudis. Their brutal war in Yemen and their fleecing of American consumers at the pump must have consequences. https://t.co/rDenapcOym

— Ro Khanna (@RoKhanna) October 10, 2022

According to one estimate, the U.S. agreed to sell roughly $64.1 billion worth of weapons — averaging over $10 billion a year — to Saudi Arabia between 2015 and 2020.

Arms sales to the Saudis, the largest purchaser of U.S. weaponry, have continued under the Biden administration despite its pledges to end the war on Yemen and render the oil kingdom a “pariah” over its assassination of journalist Jamal Khashoggi in 2018.

In the wake of OPEC’s announcement of a production cut aimed at propping up oil prices, calls for an end to U.S. arms sales to Saudi Arabia intensified, with Khanna and Sen. Bernie Sanders (I-Vt.) leading the chorus.

“We must end OPEC’s illegal price-fixing cartel, eliminate military assistance to Saudi Arabia, and move aggressively to renewable energy,” Sanders wrote in a social media post on Wednesday.

The Biden administration and Democratic leaders have said they’re exploring a range of responses to OPEC’s decision, but it’s unclear whether an end to military assistance to the Saudis is actively being discussed at the highest levels.

In their op-ed on Sunday, Khanna, Blumenthal, and Sonnenfeld noted that some members of Congress are proposing “extending domestic antitrust laws to international commerce” while others are calling for the revival of “a GOP initiative to withdraw U.S. troops from Saudi Arabia.”

“A simpler, far more urgent move to fortify U.S. national security would be to pause all U.S. military supplies, sales, and other weapons aid to Saudi Arabia,” Khanna, Blumenthal, and Sonnenfeld argued. “This includes the controversial, new, and hastily planned Red Sands testing facilities in Saudi Arabia.”

“U.S. military collaboration with the Saudi regime is more extensive than many realize, but that also gives the U.S. significant economic and security leverage over Riyadh,” they added. “Today, Saudi Arabia is hugely dependent on U.S. defense assistance, purchasing the vast majority of its arms from the United States… Saudi can do little to respond to this proposed legislation other than come back to the table and negotiate with the U.S. in good faith.”

This post was originally published on Latest – Truthout.

In the late summer of 2021, mortgage rates fell to near-all-time lows, even as the rate of inflation picked up. A borrower with good credit could borrow hundreds of thousands of dollars for 30 years at under 2.9 percent, despite the fact that the rate of inflation had already ticked up to above 5 percent.

Fourteen months later, that same 30-year mortgage is going for not far shy of 6.5 percent, with analysts predicting it could hit 7 percent within weeks. The average mortgage in the U.S. is just over $400,000. Thus, a hike in mortgage rates of 4 percent in the span of 15 months means that the average family with a new house will have to come up with $16,000 more in interest payments in late 2023 than they would have, had they locked in place a mortgage a year earlier.

And, because where the Federal Reserve goes, the rest of the world follows, interest rates are also soaring globally. Many international observers are worried. Indeed, in a report released earlier this week, the United Nations Conference on Trade and Development (UNCTAD) warned that rapidly tightening monetary conditions could impose a worse cost on the global economy than did either the 2008 crash or the COVID pandemic. Not surprisingly, it suggested that low-income families would bear the brunt of this downturn. UNCTAD called on the Fed to hit the pause button on interest rate hikes.

Inflation creates a climate uncertain for businesses, and when combined with the low unemployment levels currently seen in the U.S., it leads to wage increases that eventually have the potential to recalibrate the economy in organized workers’ favor. Since the Fed is determined to re-establish certainty for businesses and to rein in inflation at all costs, it is unlikely to heed UNCTAD’s warnings, and is likely to plow ahead with its regimen of rate increases.

In the U.S. — and, by extension, much of the rest of the world — two things are happening to the housing market in response to these hikes: the number of homes being bought and sold (and consequently the number of mortgages being taken out) is falling, and housing prices are starting to decline as purchasers feel more pinched by the cost of borrowing. Both will disproportionately hit lower-income families and new homeowners looking to move up the housing ladder.

For seven consecutive months now the number of home sales has declined. This means fewer people are currently able to enter the world of homeownership. It also means that it’s becoming harder for those who already own homes to sell in order to move either to a different city or into better or bigger accommodations in the cities they already live in.

And, while average home prices were still rising modestly into the early summer, in many high-cost cities, a fall-off in prices has now begun. Indeed, some studies have shown that in more than three-quarters of cities, home prices over the past month have retreated from their COVID-era highs. In Seattle, San Diego, Sacramento, San Jose and Las Vegas, Redfin data suggest double-digit drops in what homes are selling for as the Fed’s interest rate hikes ricochet through the broader economy.

Moody’s Analytics now predicts that over the next two years, housing prices will fall in just over half of the 414 major markets that it surveys. In the majority of these markets, especially in cities in the Sunbelt and in the West, it finds that home prices are overvalued by at least 25 percent, meaning that homeowners who bought in the last few years when interest rates were at rock-bottom levels and home prices were soaring are facing huge risks in getting stuck underwater as their real estate investments go south just at the same time as mortgage rates soar.

What makes this more infuriating is that this was an avoidable tragedy. Homeowners don’t make decisions in a vacuum; they buy and sell at least in part because of a financial environment determined by the monetary decisions of the Federal Reserve and the policy decisions of the U.S. government. The housing market was overheated in the last few years by a conscious effort to make money as cheap as possible for as long as possible; now, that housing bubble is being rapidly punctured by a panicked response to inflation by central bankers applying the lessons of the past several inflationary cycles to a pandemic- and war-impacted environment that looks nothing like the recent past. The interest rate hikes embraced by central banks essentially punish home buyers for the failure of expert economists to correctly game out inflationary pressures in the era of COVID and of Russian expansionist military adventures. Whether that punishment will even work, by the Fed’s own terms, and reduce inflation is very much an open question.

The Federal Reserve has gone on an interest-rate-raising spree in recent months as it belatedly attempts to put the inflation genie back in the bottle. There is, in this, an irony. The talking heads and maestros of finance — the experts whose every word markets hang on — spent months trying to calm rattled markets and investors by promising that inflation was transitory, that the fundamentals of the global economy were fine, and that once COVID-related supply chain glitches got sorted out, the world’s major economies would rapidly revert back to inflation in the desired 2 percent range.

They were, of course, hideously wrong. In hindsight, they ought to have gently raised interest rates and tapped the breaks on the housing market before the inflationary spiral took hold, instead of waiting until it was a crisis of such urgency that the massive and rapid interest rate hikes came to be seen as the only tool left in the Fed’s anti-inflation toolkit. But, of course, hindsight is everything. In the moment, their analysis of inflation in 2021 and early 2022 was ultimately as misguided as analyses made 15 years ago by those who waved off the increasingly urgent signs that the housing market was about to crash and pull down key pillars that propped up the global financial system.

In 2006 through 2008, as the housing market grew increasingly volatile, policy makers and those controlling monetary policy ignored the problem until it was too late to make only mild interventions and modest tweaks. When vast numbers of people started to default on their mortgages, and lenders began to suffer a liquidity crisis, it took trillions of dollars of coordinated international interventions to keep the world’s financial system from entirely seizing up and to stop the major industrial economies from sliding into a depression.

Now, in 2022, a similarly inept response by experts who should have known better threatens to crash the housing market in which tens of millions of American families have invested their life savings, following the encouragement of policy makers who kept interest rates artificially low for more than a decade.

The political repercussions from the crash of 2008 are still playing out today; it’s hard to imagine Trump’s ascendancy absent the aftereffects of the crash: the collapse in confidence in government agencies and elected officials, the distrust of self-proclaimed experts, the immiseration of millions of families, and the rage triggered by banks being bailed out while homeowners and ordinary workers were largely left to fend for themselves.

Today, the Fed is stampeding toward a regimen of ever-escalating rates. It is essentially declaring that large increases in unemployment are acceptable — possibly even desirable so as to curb worker power — as a way to rein in an economy it let overheat for years. As a result, the potential exists for a 2008-style sudden and calamitous failure of the housing market, a contraction in employment, and an unleashing of vast political furies in the wake of this.

Sometimes, as UNCTAD seems to have concluded, the medicine is worse than the ailment. In putting both the stability of the U.S. housing market and the employment of large numbers of Americans at risk with a rigid anti-inflation regimen that doesn’t take into account the very particular reasons for rising prices in 2022, the Fed risks fueling growing immiseration, and, in consequence, increased levels of societal upheaval. For months now, the Federal Reserve has talked up its ability to create a “soft landing” for the overheated economy. Now, in dramatically raising the costs of borrowing over the past few months, it has essentially accepted the necessity of a “hard landing” that triggers misery for millions of existing homeowners and puts the ability to purchase a home further out of reach for growing numbers of would-be first-time home buyers. That’s not sound economic policy making; rather, it’s decision-making via panic.

Yes, the Fed’s interest rate-raising frenzy of 2022 may ultimately curb inflation, but the collateral damage this time around, in terms of housing access and unemployment, could rival that of 2008. It could, if things really head south, be as unpleasant as the early 1980s, when monetary policy makers in Reagan’s U.S. and Thatcher’s U.K. sent interest rates and unemployment skyrocketing, in their efforts both to break the power of organized workers and also to tamp down inflation. That’s hardly the mark of a well-thought-out and humane monetary policy.

This post was originally published on Latest – Truthout.

The political and media representatives of the rich continue to promote maximum confusion on the economy. No coherent perspective on the economy is permitted under the existing political order. Everyone is expected to go along with what the rich and their allies repeat about the economy. Everyone has to use the same terms, the same framework, and the same outdated outlook when approaching the economy. Alternative vantage points are not tolerated.

False choices, bad options, and mixed messages abound. Week after week, one news source claims that everything is great while another says that the economic forecast looks gloomy for the next decade. Economic concepts like inflation, interest rates, costs, prices, and unemployment are rendered in the most tortured manner over and over again, with different representatives of the rich constantly making unscientific and confusing claims about what is “the real problem” and how to “get us back on track.”

Anticonsciousness has produced a stubborn refusal on the part of the superfluous political and economic elite to provide a concrete and lucid description, explanation, and evaluation of what is actually unfolding, leaving people disinformed and marginalized. This tiny ruling elite is plagued with old ideas and concepts about the economy. It has no interest in consciously investigating phenomena and reaching warranted conclusions.

This August 21, 2022 headline from The Register-Herald from West Virginia is one of endless examples of the mainstream media failing to empower people: “U.S. economy flashes signals of hope and concern in mixed data.” Like so many news items, this article leaves people riding the fence and unable to decipher real developments in the economy and society. This is usually done in the name of “balance,” which is really an attempt to conceal a multifaceted reality that can be grasped only when investigated consciously and objectively. One is left as powerless at the end of the article as when they started the article. Half-truths, incorrect information, hedging and waffling here and there—such common tactics leave people with no bearings or direction. It is not a serious approach.

Another confused source, The Nation, carries this headline: “Looming recession in 2023” (September 7, 2022). The article relies on capital-centered discourse with all its limitations. It provides no integrated coherent view on what is happening in the economy or why. It ignores the fact that the long depression started 12 years ago and that most economies have been running on gas fumes since then, if not before then. The “economic slowdown” started many years ago and will continue for years to come. Years later there is still no meaningful recovery and resilience in most countries, just worse living and working conditions for the majority year after year. Living and working standards are not rising in the U.S. and elsewhere. Endless chatter by the elite and their representatives about “recession” serves mainly to confuse and distract people. It seeks to embroil them in debates that do not serve their interests.

Conflating different concepts and trends, this September 1, 2022 headline from Bloomberg News, “Strong Economy Is Bad News for Fed’s Inflation Fight,” also leaves readers with no coherence about the economy. What “strong economy”? Why is a so-called “strong economy” a bad thing? And what about the fact that the Fed ran out of ammunition long ago and is only exacerbating things?

Other bizarre news headlines look like this one from the New York Times: “America’s Dueling Realities on a Key Question: Is the Economy Good or Bad?” (September 13, 2022). The presentation of the economy to the public in this irrational manner can be found everywhere today. Objectivity of consideration is absent and everything is reduced to what a handful of “registered voters” think. Everything is reduced to subjective interpretations, as if the economy does not exist independent of the will of individuals. On top of all this, the article openly admits that economists and journalists are bad at predicting economic phenomena. In other words, they are not scientific.

Many other examples of media disinformation on the economy can be given. Desperate attempts to find something positive in a dying and decaying economy are not going anywhere any time soon. Such efforts continue because the ruling elite are terrified of more people recognizing the illegitimacy, bankruptcy, and dysfunction of current arrangements and uniting with others to usher in a fresh new alternative.

Research and experience show that most Americans are very worried about the state of the economy. 1 Millions feel insecure. Everyone knows we have a bad economy, whether you call it a recession or not. High prices are everywhere and interest rate increases by the Federal Reserve and other central banks around the world are only creating more problems. Today many people have to work two full-time jobs just to survive. Millions live pay-check to pay-check, including many who make six figures. On top of all this, price-gouging, bankruptcies, evictions, hunger, homelessness, inequality, debt, anxiety, and crime are increasing. The fact is that “Rising costs force millions of Americans to choose between paying health care and utility bills” (August 31, 2022).

Yet Jerome Powell, head of the U.S. Federal Reserve, recently promised “more pain” for millions. More agony and unemployment, we are told, is the way forward.

Why? How is this a responsible and acceptable approach in 2022? Why should there be more suffering for everyone centuries after the scientific and technical revolution made it possible to meet the needs of all several times over? Why more pain for everyone when objectively there is an overabundance of wealth in society produced by workers? Is the public to believe that the approach embraced by economic “leaders” is the only viable approach to the problems confronting the economy, society, and humanity? And whose economy are we talking about? There is nothing bright or human-centered about the approach, outlook, and agenda of the rich and their representatives, which is why they have not solved any major problems in decades.

It is clear that what the rich mean by “economy” bears no resemblance to what an economy actually is: the relations people enter into with each other in the course of reproducing themselves and society. For the rich, the economy is anything that makes rich people richer, including war, price-gouging, wage cuts, stock buy-backs, aggressive advertising, and wild speculation on the stock market. These are not things the producers of wealth in society support. Working people are interested in using socially-produced wealth to advance society, not narrow private interests.

The ruling elite and their representatives view the economy in the most narrow and distorted way. They do not see the economy as an integrated whole whose many parts are run by millions of working people that produce all the wealth of society. Major owners of capital look at the world from their own narrow private interests and protect their “own turf” as they compete intensely with other owners of capital to maximize their profit, regardless of how damaging this might be to the natural and social environment. They do not care about how the economy as a whole operates. They do not look at the parts in relation to the whole or strive to ensure the proper extended reproduction of society. Chaos, anarchy, and violence prevail in this outdated set-up in which greed is cynically normalized as a virtue.

From a capital-centered perspective, workers are not seen as the source of value. Their labor-time is not recognized as the source of new value. Workers are viewed instead as a derogatory cost of production, a liability, a loss, a burden, a nuisance, a negative consequence; something to be suffered or grudgingly tolerated. In reality, though, it is owners of capital, those who “legally” seize the surplus value produced by workers, that are a burden and liability to society. They are a historically-exhausted force that drags society backward. They are a block to progress.

In this fractured context it is also troubling that humans and citizens are constantly reduced to consumers, and consumerism is given as that which defines the modern human personality. Buying and subordinating oneself to objects, things, and commodities is given as the core of the modern individual—a phenomenon further exacerbated by social media.

Capitalist ideology turns reality upside down. It mixes up who exploits who. It conceals the irreconcilable antagonistic interests between workers and the financial oligarchy. It hides the fact that wage-slavery is the main mode of profit maximization for owners of capital. It obscures severe contradictions between workers and the rich.

People can expect no clarity or guidance from the rich and their media, which is why they must rely on their own conscious acts of finding out and undertake their own efforts to disseminate information, analysis, and perspective.

There is no reason for today’s economies to be as chaotic, anarchic, and fragmented as they are. They must be brought under conscious human control and organized to advance the general interests of society, not a tiny ruling elite that uses its power to get richer while disinforming and marginalizing people.

This post was originally published on Dissident Voice.

Spain’s leftist coalition government on Thursday announced a series of downwardly redistributive fiscal reforms — including a temporary “solidarity” tax on the nation’s 23,000 wealthiest residents — that lawmakers hope will ease the cost-of-living crisis hurting millions of working people.

In 2023 and 2024, the 0.1% of Spanish taxpayers who own more than €3 million ($2.9 million) in assets will be subject to a new wealth tax.

According to The Associated Press: “People with holdings of €3 million to €5 million ($2.9 million to $4.9 million) will be taxed 1.7% and those whose personal worth is €5 million to €10 million ($4.9 million to $9.8 million) will be taxed at 2.1%. Individuals with fortunes above €10 million will pay 3.5%.”

This levy on 1 out of every 1,000 citizens, which Finance Minister María Jesús Montero described as a “solidarity” tax, is one of many changes to Spain’s upcoming budget that are intended to mitigate economic hardship as the prices of energy, food, and other essential goods continue to soar due to corporate profiteering and the destabilizing effects of the Covid-19 pandemic, the war in Ukraine, and the climate crisis on global supply chains.

As AP reported: “The government also plans to increase the income tax rate from 26% to 27% for people earning more than €200,000 ($196,000). The capital gains tax for incomes above €300,000 ($294,000) will go up to 28%, an increase of two percentage points.”

These measures — agreed upon by the Spanish Socialist Workers’ Party and its junior coalition partner, Unidas Podemos — are expected to raise €3.14 billion ($3.08 billion) over the next two years. The government plans to use this revenue to fund programs that are designed to assist those with modest incomes.

Spain says it will levy a temporary asset tax against 23,000 people (the wealthiest 0.1%) for the next two years as low-income families are struggling to afford food.

The average salary in Spain is around $20k/year and food prices have hit their highest point in over 20 years. pic.twitter.com/NiObinBA2k

— AJ+ (@ajplus) September 30, 2022

In addition to hiking taxes on its richest citizens, Spain is also poised to offer working people and small businesses more relief by trimming the levies they owe by an estimated €1.9 billion.

“The government plans to reduce the income tax on annual wages of up to €21,000 ($20,584),” AP noted. “Montero said this will benefit some 50% of the workforce given that the average annual salary in Spain is €21,000.”

Moreover, the government agreed to slash the sales tax on feminine hygiene products and contraceptives from 10% to 4%.

“We have to make this adjustment at this time to combat the effects of inflation,” Montero told reporters. Although the country’s inflation rate fell from 10.5% in August to 9% in September as energy prices declined, it remains high.

“There is the need to ask for a greater effort from those who are benefiting from energy prices and interest rates,” she added, referring to taxes on utilities and banks that are being prepared.

These changes to Spain’s tax code, said Montero, are bound to make it “more progressive, efficient, fair, and also enough to guarantee social justice and economic efficiency.”

Janine Jackson: In a section labeled “Core of the matter,” the Economist declared: “Despite rosier figures, America still has an inflation problem. Is higher unemployment the only cure?”

I guess we’re meant to find solace in the idea that the magazine thinks there might conceivably be other responses, in addition to what we are to understand is the proven one: purposely throwing people out of work, with all of the life-changing harms that come with that.

CNBC’s story, “Inflation Fears Spur Shoppers to Get an Early Jump on the Year-End Holidays,” encouraged us to think that “inflation is a Scrooge.”

So — an abstraction that is somehow stealing Christmas, to which the healthy response is to make more people jobless while corporate profits soar. It makes sense to corporate media, but if it doesn’t make sense to you, you are far from alone.

Chris Becker is the associate director of policy and research, and senior economist, at the Groundwork Collaborative. He joins us now by phone. Welcome to “CounterSpin,” Chris Becker.

Chris Becker: Thank you so much for having me, and just having this very important discussion.

I know that lots of people don’t really understand much about how the economy works, and I don’t hold it against them, frankly. I do hold it, in part, against corporate news media, who I think rely on that lack of knowledge to sell ideas that people wouldn’t buy if they understood them.

So if you’re having a first conversation with someone who says, “Boy, prices are high, this inflation is killing us. And, you know, the paper says it’s wages,” how would you try to reorient that conversation? Where would you start?

Right. I think there is a lot of misinformation and misunderstandings floating around that are perpetuated by the media at times. And so where I would start with the conversation is to say that when we’re thinking about inflation, we need to understand that there are stark differences in how American households and consumers are experiencing the post-pandemic economy, versus how corporations are faring.

So for consumers, what this has meant is higher prices: higher prices at the grocery store line, at the pump, even for essential goods like baby formula that are required for basic nutrition of infants. And so the bottom line for consumers is that it’s become harder and harder to make ends meet.

But corporations have turned consumers’ pain into their own gain. So what we’ve seen corporations do is that they’ve used all these crises as an excuse to pass on higher prices to consumers, padding their pockets in the process, and then funneling the extra money back to their wealthy shareholders and investors.

And like you mentioned, there are a lot of narratives going around that corporations were forced to raise these higher prices, that they had higher input costs, or that wage demands were simply too large, and they had to raise prices to compensate for that.

But what we’ve seen, actually, is that not only have corporate profits hit record highs, far exceeding what we saw prior to the pandemic, but also profit margins have hit their highest level in 70 years.

And so what that means is that for every dollar that these corporations are earning, a larger percentage of that is going to corporate profits, rather than paying off input costs or paying wages, than what we’ve seen since the 1950s. So not only are corporations making a lot of money, they’re actually squeezing consumers for more than they have in 70 years.

And so, yes, input costs have gone up, wages have gone up, but corporations have passed all of that onto consumers in the form of higher prices, and then a little bit more, so they’re actually making more and more profits than they used to.

And I just want to add, the way that media framing tends to talk about workers and consumers as though they were different people is very frustrating in terms of understanding what’s going on, right? I’m the one paying at the pump and at the grocery store, and I’m also the one working for wages. So it’s very obfuscating to separate those groups rhetorically.

Yes, absolutely. And one of the biggest problems is that wages are not rising fast enough. We’ve seen that wages have gone up, but not by as much as inflation has gone up.

So the purchasing power of these workers, in terms of what their wage actually buys them, has gone down. And so we actually need higher wages, not lower wages. We need to ensure that workers are being fairly compensated for the higher prices that they’re seeing. That’s exactly right.

When I see outlets like the Economist toss off phrases like the “remorseless mathematics” of economic policy-making, that’s sending a message, right, to readers that choices aren’t being made. It’s as if it’s the hand of God.

And as well as misrepresenting what you and I know is the very contested nature of economics — if you have different goals, you want different policies — it also seems to encourage a kind of passivity on the part of people. “There’s really nothing you can do about it. It’s just math, you know, it’s just math.” It’s very frustrating.

I think that’s exactly right. And when we’re thinking about corporations, they do have options. They do have other choices of how they want to go about making profits. We often frame it as if it’s this question of, should corporations be allowed to make profits or not? And, of course, in a strong economy, where everyone’s doing well and everyone’s making money, corporations will make profits too.

The real issue is how they’ve gone about making these profits. And so, unfortunately, we’ve incentivized these corporations to really go after this price-gouging, profiteering strategy, rather than pursuing other strategies that could be good for all of us.

So, for example, one option that corporations have is that it’s not obvious that higher prices are always better for corporations either; if corporations keep their prices low, consumers can afford to buy more from them, and they’ll make more money. But, unfortunately, they put all their eggs in this price-gouging basket instead.

In the long run, low prices could be good for corporations. If you keep your prices low and the products are affordable, consumers will see that, and they’re more likely to keep shopping with you. They’re able to expand your customer base.

So I think even the high prices could, in some ways, be short-sighted for corporations, too.

Another big problem is that corporations are not investing this money. We know that corporations are making all these profits. They could be taking this extra money and saying, “Let’s actually invest it so that we can have long-term profitability, long-term sustainability. Let’s try to bring our costs down. Let’s try to expand our productive capacity, so we can produce more in the future and make more money.”

Unfortunately, they’re not doing that either. What we’re seeing instead is that corporations are taking all those extra profits and doing share buybacks and dividends, and funneling extra money to their shareholders.

These shareholders don’t necessarily have the best interest of the corporations in the long run, or the economy as a whole, in mind. They want to see a short-run return right now, make sure they make their money while they can. And so they’re incentivizing these corporations to go all in on price-gouging; funnel the money back rather than taking the more risky investments in the long run that could benefit all of us.

We need to really move away from this model where corporations are so reliant on shareholders who are really prioritizing short-run profits and profiteering over far more investment.

I was struck by a recent tweet of yours in which you said we can continue arguing about precise causes of inflation, but we have to connect it to corporate profiteering. And you said:

Whether this profiteering is a cause of inflation or just a distributional consequence, we don’t have to accept this. We can build institutions that ensure everyday Americans get a bigger piece of that pie.

I wonder if you could just finally talk a little bit about that. What institutions need to be grown? How do we build them? Just tell us a little bit about that positive vision.

Sure. I think that a lot of it goes back to what you were talking about before, where the consumers are workers.

And, unfortunately, we have built a system that relies on exploitation of labor rather than building up workers’ rights and good pay. So corporations are not paying workers well, they’re not giving them proper rights, they’re not respecting their dignity in the workplace. And we see the consequences of this.

We’ve seen it very recently in the labor strike that we’ve seen in the railroad industry. Railroad workers are workers that our economy really depends on; they’re essential workers within our supply chains that allow consumers to access the goods and services that they need. If there’s one thing we’ve learned in this crisis, it’s how important our supply chains are.

But railroads, instead of treating these workers well and taking care of them, have assumed that they can continue to exploit them over and over again, and those workers will always be there when we need them.

And, finally, these railroad workers are saying enough is enough. They’re making very simple demands, just to have basic paid sick leave so that they don’t worry about losing all their income when they get sick.

And so now we are faced with this situation where we could have a railroad strike, which will throw our economy into disruption once again, and raise prices for everyone.

And so we should be investing in workers, investing in higher wages, investing in unions because it’s the right thing to do, but also because it will allow workers to focus on their jobs, get the essential tasks they do done without having to worry about having enough money, being able to make the right choices for their family.

So I think a lot of it just starts with investing in workers first instead of corporate exploitation.

We’re going to end on that note. We’ve been speaking with Chris Becker, associate director of policy and research, and senior economist, at the Groundwork Collaborative. Their work is online at GroundworkCollaborative.org. Thank you so much, Chris Becker, for joining us this week on CounterSpin.

Thank you.

This post was originally published on Latest – Truthout.

For the past several months, the Federal Reserve has used a traditional toolkit to attempt to rein in the high inflation that was unleashed by the pandemic and worsened by Russia’s attack on Ukraine.

This traditional model for responding to inflation, hewed to by economists for decades, posits that inflation is triggered by excess demand, and that the way to rein in demand (and thus to put the brakes on inflation) is to raise the cost of borrowing. Hence the rush upward in the interest rate set by the Federal Reserve, and, by extension, the increased cost of borrowing for companies looking to finance new investments and for consumers looking to get mortgages from banks. In the summer of 2021, for a buyer with good credit, a 30-year mortgage could be approved at a 2.75 percent interest rate. Last week, those mortgages headed north of 6 percent. For a family with, say, a $400,000 mortgage, that’s a difference of roughly $14,000 per year. Not surprisingly, millions of people are deferring home purchases. Between the moment when mortgage rates hit their lows last summer and now, the demand for mortgages has declined by nearly a third.

The idea is pretty straightforward: If it costs more — perhaps a lot more — to borrow, people will defer purchases. Fewer new cars, fewer house purchases and fewer big-spending items put on credit cards lead to companies needing fewer employees, which in turn recalibrates the labor market away from worker-power, making it harder for employees, in a soft labor market, to bargain up their wages. That particular circle will, the idea goes, rapidly put the squeeze on inflation.

The theory, which is epitomized by an economic graph known as the Phillips Curve, says that a little bit of short-term consumer pain, and a willingness to tolerate higher levels of unemployment for a few months or even a couple years, ought to do the trick in putting the inflation genie back in its bottle. Proponents of this model argue that workers’ short-term pain is more than compensated for by the longer-term gains that come with stable prices.

Yet, a strange thing is happening in this current bout with inflation, as many progressive economists, such as Joseph Stieglitz and Dean Baker, had predicted would be the case. As interest rates soar, housing demand is, indeed, easing back, as the model would predict. But the broader labor market remains tight — in part because so many Americans dropped out of the job market during the pandemic, either out of fear of exposure, because they couldn’t find child care, or in many instances, because they ended up suffering debilitating effects from long COVID. And, despite momentary optimism that inflation was peaking in June and July, the recently released numbers for August, which sent the stock market into a swoon last week, suggest that a higher-than-wanted level of inflation (the Federal Reserve aims for inflation in the 2 percent range) is firmly entrenched at the moment.

Similarly bad inflation numbers are also being posted by other major industrial democracies: The inflation rate in the U.K. is slightly higher than in the U.S., and some models predict it could hit as much as 18 percent by year’s end, although these worst-case scenarios are likely to have been muted somewhat by Prime Minister Liz Truss’s recent announcement that the government would cap energy prices. In the EU, the inflation rate is above 9 percent. In Canada, it is just under 8 percent. In Australia, inflation is hovering at around 6 percent. And even in Japan, which has extraordinarily low levels of inflation due in part to decades of stagnant growth, and in part to the government subsidizing a wide range of consumer products, all the inflation indicators have gone up in recent months, though price increases still remain far less of a problem there than in most other wealthy nations.

This stubborn persistence of inflation globally oughtn’t to be surprising: the traditional model assumes inflation is triggered by excess demand, and thus can be curbed by reining in demand. But the last couple years of supply chain disruptions have shown that when an unpredicted but catastrophic “black swan event” such as a pandemic holds the world in its grip, prices around the world get driven up by a cascading series of glitches that make it harder both to produce goods and then to ship the finished product to stores and to consumers.

Why, for example, are consumers paying so much more for cars? Not because there’s suddenly been a spike in the number of drivers on the road, but because at every level of the supply chain — from rubber and steel to semiconductors — there are shortages or delivery bottlenecks. In the globalized economy, a consumer in an import-heavy economy such as the U.S. is particularly vulnerable to, say, price spikes caused by supply shortages triggered by COVID lockdowns half a world away in China.

Given this, raising interest rates ad nauseam is an extraordinarily clumsy way to deal with the problem. Sure, eventually demand will be curbed so much by the unaffordability of borrowing money that it will tamp down inflation. But before it does that, it’s likely to cause a huge amount of pain. And that hurt won’t be evenly distributed.

Since the labor market remains tight, those higher up the economic ladder, those with more marketable skills and higher education qualifications, are more frequently able to largely neutralize the loss of purchasing power that comes with inflation through successfully negotiating for wage increases, for starting bonuses, and for other compensation.

As a result, the inflation spiral will most heavily impact poorer residents, who have less money saved; have less power to negotiate wage increases; and have poorer credit to begin with, meaning that they will pay disproportionately more when they seek to borrow during a moment of rising interest rates.

Meanwhile, low-income residents face particularly dire circumstances in poorer countries, mainly in the global South, whose governments lack the clout to intervene in the energy and food markets to try to lower costs or to cushion the blow on poorer people through implementing price subsidies for food and energy. In much of the world, inflation, triggered by the twinned dislocations of pandemic and of war, is soaring beyond anything experienced in the first world. Argentina’s inflation is roughly 80 percent, Lebanon’s 116 percent, Sri Lanka’s increased from 5.7 percent a year ago to over 60 percent today, and so on.

Last week, the head of the United Nations World Food Programme warned that up to 345 million people worldwide — or roughly 50 times the number known to have died from COVID so far — could face starvation as food prices soar and as shortages increase. This represents a doubling in global food insecurity since early 2020. Already, roughly 50 million people are facing acute malnutrition. With the recent catastrophic flooding in Pakistan, and the displacement of tens of millions from their homes, that number will surely increase over the coming months. The war in Ukraine, with the resulting disruptions to global markets in grain, wheat, soy and other staples has, the UN estimates, pushed 70 million people closer to starvation.

The UN’s stark warning ought to have generated headlines around the world; instead, it simply became a side story.

But, even while economics writers around the world fixate on spiraling inflation in economic powerhouses such as the U.S., the U.K. and the EU bloc, while ignoring even worse inflation — and the damage it causes — in poor countries, there are underlying similarities. To be poor anywhere on Earth is to bear a disproportionate brunt of the impact of failing, one-size-fits-all policies. To be poor is to bear the brunt of inflation spirals; but to be poor is also to bear the brunt of shock-and-awe policy responses designed to wrestle inflation back under control.

There are, however, alternatives ideas on the table for tackling inflation in a fairer way. Last week, the Center for American Progress released a report detailing how the supply chain could be strengthened so as to reduce disruptions and thus rein in prices. The authors called for ramping up COVID vaccine distribution; expanding the child care system so that parents could return to work; increasing immigration levels in countries such as the U.S. to fill jobs left empty by the contracting workforce; going after price-gouging trusts; and ramping up investments in renewable energy so as to wean the economy from fossil fuels and from the profiteering companies who have made such fortunes during the price-increase months since Russia attacked Ukraine in February.

The authors concluded that the Fed’s approach, looking to gently tamp down demand without sinking the economy into a deep recession, was unlikely to work to knock excess inflation out of the economy. They warned that if the Fed keeps raising interest rates, eventually the landing could be extremely hard and painful — in other words, this strategy risks crashing both the housing and the job markets, which would hurt poor Americans the most. Better, they argued, to craft an economic policy that “addresses the supply issues brought into high relief during this recovery.”

Because of the Fed’s outsized influence on global economic policy, the rest of the world is likely to follow where the U.S. goes on interest rates. Raising interest rates moderately may make sense as one tool among many to tackle this rather unique inflationary moment, but raising them immoderately — and excluding more unorthodox supply side anti-inflation interventions — risks doing long-term damage to those at the bottom of the economy. Doing so poses an acute threat to the poor both within the U.S. and in less affluent countries overseas, which could end up plagued by persistently high inflation, rising unemployment and ever-greater difficulties accessing loans for businesses and for house purchases. That’s the sort of lose-lose proposition that could create cascading problems for decades to come.

This post was originally published on Latest – Truthout.

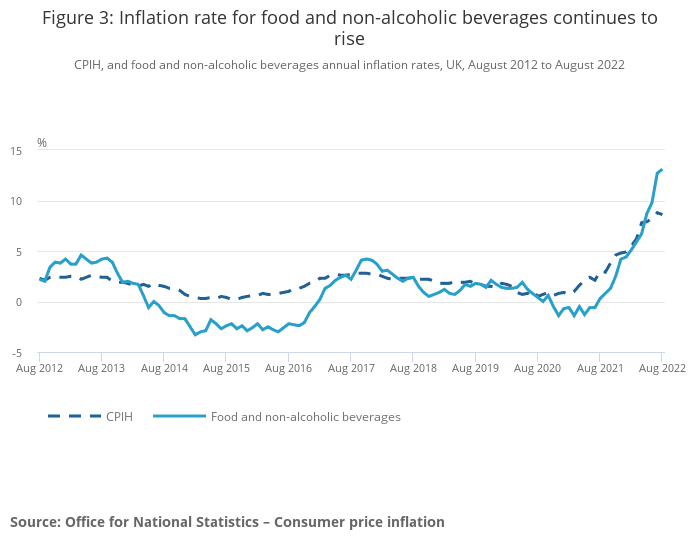

The Office for National Statistics (ONS) has said that inflation fell to 9.9% in August – down from 10.1% in July. But of course, this reduction only applies if you’re of a certain social class. Actually, the poorest people won’t see the same fall in inflation as the richest do.

On Wednesday 14 September, the ONS said that consumer price inflation (CPI) in August was down to 9.9%. This is still the highest it has been in 40 years. However, as the Guardian noted, there was one area that drove the reduction. This was:

petrol prices dropping by more than 14p a litre in August as a fall in global oil prices was finally reflected in cheaper motoring costs. The annual inflation rate for motor fuels eased from 43.7% to 32.1% between July and August.

‘Great’, you may think. However, lower petrol prices only help some people. As The Canary previously reported, just 35% of the poorest households own a car – versus 93% of the richest ones. This means that the majority of poor people won’t see any benefit from the drop in petrol prices. However, other price increases are still hitting them.

The ONS said that food inflation has continued to rise:

In August, the ONS said food inflation was 13.1% – 3.2% above the main CPI rate. It said that the biggest part of this rise was:

milk, cheese and eggs, where prices of milk and cheese rose between July and August 2022 by more than between the same two months a year ago.

It said the overall food inflation increase of 1.5%:

between July and August 2022 was the largest July to August rise since 1995, when… [figures] showed a 1.6% increase.

So, if you’re poor, your food is more expensive but you’re not seeing cheaper motoring costs. And just as it was time to buy school uniform, the inflation rate on clothes and footwear rose from 6.6% in July to 7.6% in August. Meanwhile, the cost of travelling on things like ferries went up by 3.9%, and bus and coach prices also went up by 1% – likely a direct result of the failing, privatised system.

Overall, what this means is that for the poorest people who don’t own cars, inflation is still 10.1%. As always, those the system pushes to the bottom of society are the ones who are bearing the brunt of this capitalist chaos.

Featured image via the ONS

By Steve Topple

The Trades Union Congress (TUC) made an all-singing, all-dancing announcement on Tuesday 23 August. It released its plan for a £15-an-hour minimum wage. Sadly, people are underwhelmed by it, and are calling for a general strike instead. No wonder, really, when the TUC is years behind trade unions.

As the Guardian reported, the TUC is calling for a £15 minimum wage. It wants this by 2030 at the latest. You can read the full TUC report here. The Guardian noted that:

In a move that opens a fresh policy gap between unions and Keir Starmer’s Labour party, the TUC has thrown its weight behind calls for a more ambitious legal floor on pay rates. The union body said the government needed to draw up plans to get wages rising as workers suffer the biggest hit to living standards on record.

It said too many workers were living “wage packet to wage packet”, and a £15 minimum should be in place by at least 2030 but could be achieved sooner with a government that was serious about getting wages rising after years of sluggish pay growth.

But, the TUC isn’t just calling for £15 an hour. It’s saying that the government should calculate the minimum wage as 75% of the national median pay. Currently, the minimum wage is 66% of the median. So, that would mean a higher average pay for the country. However, it’s really not good enough that its forecasts give the date that it will hit £15 as 2030.

Twitter summed the situation up nicely. People have been saying the TUC plan is weak. Much of the talk is that the TUC should have called for a general strike:

#GeneralStrike. TUC you are just not up to the job, just like the Tories. A petition ? Really? The government (

) must be rolling around laughing.

— GrumpyGranny11 (@HazelMSmith3) August 24, 2022

Anyone else disappointed with the #TUC announcement? We need a #GeneralStrike

— mags (@happymargy) August 23, 2022

Jorge Martin said:

You’ve oversold this. A 15 quid minimum wage by 2030 without any real campaign to mobilise for it means very little in the context of the worst cost of living crisis in two generations. What is needed is a united campaign of industrial action. #GeneralStrike

Meanwhile, Scott Miller echoed similar:

I’m underwhelmed. A £15 min wage is laudable but the UK is spiralling round the plughole. I was hoping for a much bigger announcement. We need to force a #GeneralElectionNow. Will there be a #GeneralStrike?

But the TUC arguing for something that many don’t see as radical is hardly surprising.

As The Canary‘s Tom Coburg tweeted:

The TUC has a long history of functioning as a break to any attempt to organise a general strike. The only way we will get a #GeneralStrike is if most if not all unions unilaterally go on strike simultaneously, combined with widespread community direct action.

As LibCom wrote about the TUC, it has been:

agents of [its] own decline through the very act of self-preservation. Taking on the role of mediator between the bosses and the workers saw [it] work to dampen down the very threat of workplace militancy which made [it] useful as mediators in the first place. Likewise, an unwillingness to organise where it isn’t cost effective to do so has seen [it] retreat into a cycle of declining membership and declining income.

Moreover, the £15-an-hour idea isn’t new. The Bakers, Food and Allied Workers Union (BFAWU) have been calling for it for at least three years. And with inflation set to hit a staggering 18%, the TUC giving people pie-in-the-sky for 2030 is not reading the room. As a minimum, we need a general strike – and perhaps a revolution should be on the cards too.

Featured image via the TUC – screengrab and Robert Prax – pixabay

By Steve Topple

By: Ramon Galindo

See original article here.

San Diego’s first guaranteed income program is a few months in, and it is already making a difference in many lives.

One hundred and fifty families are receiving $500 a month with no strings attached. The families chosen for the guaranteed income program come from four specific neighborhoods: Encanto, Paradise Hills, San Ysidro and National City. All the families have a child under the age of 12 in the home.

“We were able to go to Walmart and get brand new school supplies, ‘Get everything you need. Everything you need. Your highlighters your erasers, mechanical pencils your markers, whatever,’” said Kelvin Marshall, one of the first recipients of the guaranteed income money.

Marshall is a single father of three girls. He has a 15-year-old, a 12-year-old, and a youngest daughter who is just two years old.

During the pandemic, Marshall had trouble paying his bills.

“It helped me to not only get caught up on my bills but to get those bills where they’re supposed to be,” said Marshall

The extra cash also helps with diapers for Marshall’s youngest daughter.

“She’s growing like a bush, so I have to make sure she has adequate clothes.”

San Diego’s guaranteed income project began distributing payments in March and is being administered by the local non-profit, Jewish Family Service.

“The purpose and philosophy behind guaranteed income is that we trust the families to meet their basic needs if we just give them the resources and allow them to self-determine, take up their agency and spend it on the core necessities they need in this pandemic and beyond,” said Khea Pollard, Director of Economic Mobility and Opportunity, Jewish Family Services

“Forty-one percent of these families are spending the money on food. Twenty-eight percent on household essentials. And then 20% on transportation,” said Pollard.

The guaranteed income project will last two years. With the backing of the San Diego County Board of Supervisors, guaranteed income will be expanded to hundreds of more families in the future.

“Obviously, we don’t think $500 is going to cover the whole cost of living. Absolutely not. We’re really looking at families who are working hard doing their best to get by, but just need a little bit of extra help to keep their family together,” said Supervisor Terra Lawson-Remer.

For Marshall, it’s keeping his family healthy and he’s feeling less stress.

“It’s brought a whole big relief, a whole big relief,” said Marshall

The State of California has allocated $1.4 million for San Diego’s program. California is planning to spend $35 million on similar programs across the state, over the next five years.

The post Guaranteed Basic Income Helps Ease Inflation Pressures for San Diego Families appeared first on Basic Income Today.

This post was originally published on Basic Income Today.

Contradicting experience and research, various mainstream media sources continue to perpetuate the illusion that we have a “solid economy,” that “the fundamentals are sound,” that “things are not that bad,” and that “we can be optimistic” about the economy. In lock-step with the mainstream media, political and economic leaders at the highest levels are also uttering irrational and self-serving things about the economy.

But everyone can see and feel in direct and concrete ways that conditions at all levels are rapidly worsening every week. Every person has experienced the dramatic rise in just food and fuel costs alone. Further, wages and salaries are not keeping up with inflation, and debt, inequality, and insecurity are growing everywhere. All spheres are affected.

No amount of anti-consciousness can conquer the harsh reality of today’s conditions of life. What is forcefully unfolding cannot be concealed by disinformation or propaganda. Living and working standards continue to fall everywhere while detached world leaders engage in diversionary charades and false debates about the meaning of this or that economic data or this or that trend so as to prevent people from fighting for their rights.

Below is part 12, the final part, of the series titled “Booming” Economy Leaves Millions Behind. Like the previous 11 parts, it provides dozens of new and updated facts (65) that further confirm that economic and social conditions continue to decline rapidly worldwide while the rich get even richer. Taken together, all 12 parts contain a total of 430 statistics from dozens of different sources covering April 2022—August 2022. Future articles will continue to document the destructive effects of the neoliberal antisocial offensive and point the way forward. There is an alternative to the obsolete status quo. No one is under any obligation to tolerate inhuman conditions. Links to the previous 11 parts can be found at the end of this article.

*****

U.S. Conditions

“Public perception of the economy is the lowest since 2008.”

“Food prices rise fastest rate since 1970s.”

“Egg prices in US jump 47% as food inflation hits highs not seen since 1979.”

“US natural gas prices spike to 14-year high.”

“Up 43% over last decade, water rates rising faster than other household utility bills.”

“More Americans are going hungry, and it costs more to feed them.”

“98 Million in US skipped treatment or cut back on essentials to pay for healthcare this year.”

“Workers are picking up extra jobs just to pay for gas and food. Prices are rising faster than wages, and more Americans than ever are working two full-time jobs simultaneously.”

“‘I can’t even afford groceries.’ HALF of U.S. food banks report growing numbers of households needing handouts — Biden’s plan to end hunger by 2030 comes unstuck as prices of eggs, butter and other basics soar. More than 38 million people in the U.S. do not get enough food to live an active, healthy life, the Department of Agriculture says.”

“Around half of older Americans can’t afford essential expenses: report.”

“As many as 125,000 active-duty service members and their families experience food insecurity in the United States.”

“The value of the federal minimum wage is at its lowest point in 66 years.”

“54 billion for Ukraine while in the U.S. millions suffer in poverty.”

“Two-thirds of low-wage firms that cut worker pay in 2021 spent billions on stock buybacks.”

“Jobless claims at 8-month high as layoffs edge higher.”

“Layoffs are in the works at half of companies, PwC survey shows.”

“Walmart lays off corporate employees [about 200] after slashing forecast.”

“Peloton to slash 780 jobs and hike prices in push to turn profit.”

“Amazon’s 100,000 job cuts reflect industry-wide adjustments to economic uncertainty.”

“Small business owner confidence hits new low, survey says.”

“Over $540M Liquidated as Bitcoin, Ethereum Plummet.”

A June 2022 report from The Institute for Policy Studies (IPS) found that, “The average gap between CEO and median worker pay in our sample jumped to 670-to1, up from 604-to-1 in 2020. Forty-nine firms had ratios above 1,000-to-1.” IPS examined compensation at 300 corporations.

“The labor force participation—the proportion of the population over the age of 16 in work or seeking work—is continuing to fall. It was 62.1 percent in July [2022], down from 62.4 percent in March [2022]. Before the onset of the pandemic, it was 63.4 percent.”

“Americans loaded up on $40 billion more in debt in June [2022], Fed says.”

“Credit-card debt is soaring. Accounts for about $890 billion of Americans’ staggering $16 trillion in household debt.”

“Data shows number of low-income audits could triple as IRS grows.”

“”We’re Witnessing A Housing Recession”: Existing Home Sales Crater 20% In July As Affordability Collapses.”

“Rising housing costs have made housing largely inaccessible and unaffordable to most Americans, but have acutely impacted communities of color and low- to moderate-income families over the past several decades.”

“Buying a home in America is now the LEAST affordable it’s been in 33 years as average mortgage payments rose to $1,944 in June compared to $1,297 in January due to higher rates and record home prices.”

“Homebuyer Competition Falls to Lowest Level Since Early Months of Pandemic.”

“Americans born between 1981 and 1996, the most educated and most diverse generation in U.S. history, were once considered harbingers of economic progress and promise. But now, even well into their careers, most of them lag behind the financial and familial strides of previous generations.”

Nearly 75% of New York City (NYC) schools will experience big funding cuts in the coming weeks (Fall 2022). The NYC school system is the largest public school system in the country with about 1.1 million students and roughly 80,000 teachers.

“When kids go back to school this fall, pandemic-era free lunch will be gone. Debt incurred by US families who can’t pay lunch fees runs up $262 million a year.”

“‘Never seen it this bad’: America faces catastrophic teacher shortage.”

“A spate of horrific attacks in New York has people fearful of returning to work.”

“Starbucks must rehire 7 Memphis employees who supported a union, a judge says.”

International Conditions

“Low growth, high inflation: World faces increasingly challenging global environment.”

“There is a global debt crisis coming – and it won’t stop at Sri Lanka.”

“Growing recessionary trends in major economies.”

“IMF warns of ‘gloomy outlook’ for global economy, slashing growth estimates.”

“‘Grotesque greed’: UN chief Guterres slams oil and gas companies.”

“Shipping firm Maersk, a barometer for global trade, warns of weak demand and warehouses filling up.”

“The U.S. was the worst-performing of the major Group of Seven economies in the second quarter, the latest data show.”

“A winter energy reckoning looms for the west.”

“Railway workers in France go on strike [July 2022] demanding higher wages.”

“UK economy shrinks in 2nd quarter [2022], sharpening recession fear.”

“UK inflation rate rises to 40-year high of 10.1%.”

“UK is facing Dickens-style poverty, ex-PM warns.”

“Silent crisis of soaring excess deaths gripping Britain is only tip of the iceberg.”

“Millions will join breadline in recession-hit UK, NIESR warn.”

“UK energy bills to hit £4,200 in January [2023].”

“Bank of England launches biggest interest rate hike in 27 years, predicts lengthy recession.”

“Germany must cut gas use by 20% to avoid winter rationing, regulator says.”

“Norway’s central bank hikes rates by 50 basis points in bid to tackle surging inflation.”

“Turkey shocks markets with rate cut despite inflation near 80%.”

“Saudi Aramco profit surges 90% in second quarter amid energy price boom.”

“Tunisia: Unemployed graduates demand the Authority finds solution to their unemployment.”

“Zambia is a desperately hungry poor country.”

“More than 1,200 people are detained indefinitely in Australia with no criminal conviction.”

“New Zealand’s central bank raised interest rates on 17 August – a seventh hike in row. And it signaled that further increases will follow.”

“Japan wants young people to drink more alcohol.”

“Soaring unemployment in Myanmar follows junta rollback of labor rights.”

“Argentina hikes rate to 69.5% as inflation surges to 30-year high.”

“Bank of Mexico raises interest rates to record 8.5 percent.”

“Chile economy on brink of recession amid rampant inflation.”

*****

Collectively, the statistics in this 12-part series portray a deteriorating situation worldwide. People can’t seem to catch a break. The top-down assault on their rights is relentless and will continue next year and the year after. The ruling elite are unable and unwilling to solve any problems but they have many plans for arrangements that keep the majority of people marginalized and disempowered. New laws and acts like the Inflation Reduction Act (IRA), for example, will funnel billions of dollars to the rich, but do very little to improve living and working standards for ordinary people. The IRA will not solve inflation. And previous top-down fiscal and monetary policies, far from solving any problems, have only exacerbated already-high levels of income, wealth, and political inequality. They have not improved conditions.

Relying on the rich and their politicians will not advance the interests of working people and the general interests of society one iota. It will not give rise to a human-centered economy. It will not bring about security, stability, prosperity, and peace for all. Only the people themselves have an objective interest in opening the path of progress to society and must rely on themselves to do so. Constantly begging the politicians of the rich for a few crumbs here and there is the old way of doing things. It doesn’t work. It is time to build a new world where the people occupy center-stage and conduct all the affairs of society on a conscious human basis.

Part one (April 10, 2022); Part two (April 25, 2022); Part three (May 10, 2022); Part four (May 16, 2022); Part five (May 22, 2022); Part six (May 30, 2022); Part seven (June 6, 2022); Part eight (June 13, 2022); Part nine (June 17, 2022); Part ten (June 27, 2022); Part eleven (July 10, 2022).

The post “Booming” Economy Leaves Millions Behind: Part 12 first appeared on Dissident Voice.This post was originally published on Dissident Voice.

The Joseph Rowntree Foundation (JRF) has slammed the Tories over the so-called ‘cost of living crisis’. It accused Boris Johnson’s government of not “grasping the urgency” of the crisis. The JRF argued that current government support should be doubled for the poorest families.

As Sky News reported, inflation (the rate at which the price of everything rises) has hit a 40-year high. It said:

The Consumer Prices Index (CPI) rose to 10.1% in the 12 months to July, up from 9.4% in June and remaining at the highest level since February 1982, the Office for National Statistics (ONS) said.

Increased food costs were the biggest driver of the latest hike, according to the ONS, with annual inflation for these items now running at 12.7%, up from 9.8% in June, fuelled largely by price rises for basics such as bread, milk, cheese and eggs.

Then, wages fell in June at their fastest rate for 20 years. Plus, the Department for Work and Pensions (DWP) is making a real-terms cut to social security of around £10bn this year. And energy bills are likely to hit over £4,200 a year in January 2023. So, the situation is dire for millions of families.

Reacting to the news, JRF chief economist Rebecca McDonald said in a press release:

Inflation, which has risen to 10.1% today, is eating away at people’s pay and leaving millions adrift in a cost of living crisis. No one can disagree this is a national emergency. Today’s sobering reading means the next few months will be profoundly more difficult for low income families almost certainly experiencing a higher degree of inflation themselves.

People are looking for a sign that help is on the way. Yet the government doesn’t seem to have grasped the full scale and urgency of this situation.

So, what have the Tories done?

So far, the government has stuck to its £1,200 main ‘support package‘, plus other bits on top. But as The Canary previously reported, back in May – before inflation hit over 10% – this would still leave the poorest families around £300 a year worse off. So, the JRF has hit back.

McDonald said:

Energy bills for low-income households are expected to be £1,800 higher this year than last, and other costs such as food are expected to rise by £1,000 at the same period. That’s why JRF and 70 other charities called on the UK’s next prime minister to pledge the £1,200 in core support to households on means-tested benefits should be at least doubled.

It’s not just rising energy bills that are squeezing low-income families. Food prices have risen by 12.6% over the last year. So while today’s double digit analysis may come as a shock, it’s no surprise to people who can’t afford the same essentials they could a year ago.

Planning for a substantial support package, at least double what’s been offered, needs to start immediately. Without one, vulnerable people will face a catastrophe on a vast scale when winter sets in.

But will the UK’s next prime minister, either Rishi Sunak or Liz Truss, listen? Both candidates, along with Labour, have so-far just tinkered around the edges. So, it begs the question – just how bad do things have to get before anyone in power will act?

Featured image via 10 Downing Street – Wikimedia

By Steve Topple

Eugene Puryear of BreakThrough News analyzes the recently passed Inflation Reduction Act which seeks to address inflation, climate change, and healthcare.

The US Senate (and subsequently the House of Representatives) passed the Inflation Reduction Act that seeks to tackle issues of inflation, climate change and health care. Will the provisions in the law actually help address these issues? Will the Democrats gain an electoral advantage in the October mid-terms due to this law? Eugene Puryear of BreakThrough News explains.

The post Is The US Inflation Reduction Act A Case Of Too Little Too Late? appeared first on PopularResistance.Org.

This post was originally published on PopularResistance.Org.

Inflation cooled off and remained unchanged during the month of July, providing President Joe Biden and vulnerable Democrats a reason to celebrate ahead of the midterms. However, on Wednesday, the U.S. Bureau of Labor Statistics released its consumer price index, which reports that the cost of paying rent inflated by 6.3 percent over the past year, the largest increase in 35 years and a clear signal that the housing crisis enflamed by the COVID pandemic continues.

The rent inflation index reflects landlords raising rents on existing tenants; it does not include the prices of new leases when tenants move. A monthly report from Apartment List, a company that tracks rental data, found that when price hikes in new leases are included, rents actually grew by 12.3 percent over the past 12 months, down from a peak 18 percent in January. Nationally, the median cost of an apartment reached $2,000 for the first time ever in June.

Despite billions of dollars in federal assistance for renters and landlords, eviction rates in cities across the country climbed to pre-pandemic levels in 2022 after moratoriums on kicking people out during a health crisis expired last year.

Housing advocates say corporate landlords are knowingly profiting off the misery of tenants suffering under high prices for food, health care, school supplies, and other essentials, but Congress is not expected to act. The Inflation Reduction Act, passed by Senate Democrats this week, would invest $370 billion in climate, energy and environmental justice programs but notably does not include provisions focused on affordable housing.

Rev. Rhonda Thomas, a faith-based racial justice organizer in Florida, said the housing and climate crises are colliding, and policy makers must consider the “people who have suffered the most” from these intersecting emergencies as the nation transitions to cleaner energy.

“In Florida, the climate emergency has created a housing crisis that, again, adversely impacts communities of color,” Thomas said in a statement released by a coalition of Black women in response to the legislation this week. “Housing prices have skyrocketed even as wages have stagnated.”