Unemployed residents struggling to survive on low state benefits are a preview of what could come nationwide as federal pandemic aid programs expire

By: Yeganeh Torbati

By June, Meli Feliciano’s family appeared to have finally found a measure of stability after being jolted by the economic devastation of the coronavirus pandemic. Her husband had secured a good job in construction, and she was receiving hundreds of dollars in weekly federal and state unemployment aid, giving her some breathing roomwhile she submitted job applications each week. She kept records of it all in a pink binder that her daughter had once used in kindergarten.

That’s when calamity struck.

Her husband fell ill, temporarily wiping out his income. Florida Gov. Ron DeSantis (R) slashed her jobless aid by more than half to $197 per week, arguing that the federal boost to unemployment insurance was keeping people like Feliciano from getting back to work. The bill for her daughter’s college tuition and textbooks is due soon, nearly $1,000 that the family doesn’t have. And just as her husband was cleared to go back to work in August, her stepson Julian tested positive for the coronavirus, requiring the household to isolate for two weeks.

Last year, when their jobless aid briefly lapsed, the couple sold one of their cars to get by. But now they are running out of options. Do they draw further on the generosity of neighbors? Sacrifice tuition? Delay paying rent as long as possible?

“When you’re stressed as a parent, you don’t want it to show, but sometimes it shows,” said Feliciano, 42. “It’s a different issue going on every day. You just take it day by day and do the best you can.”

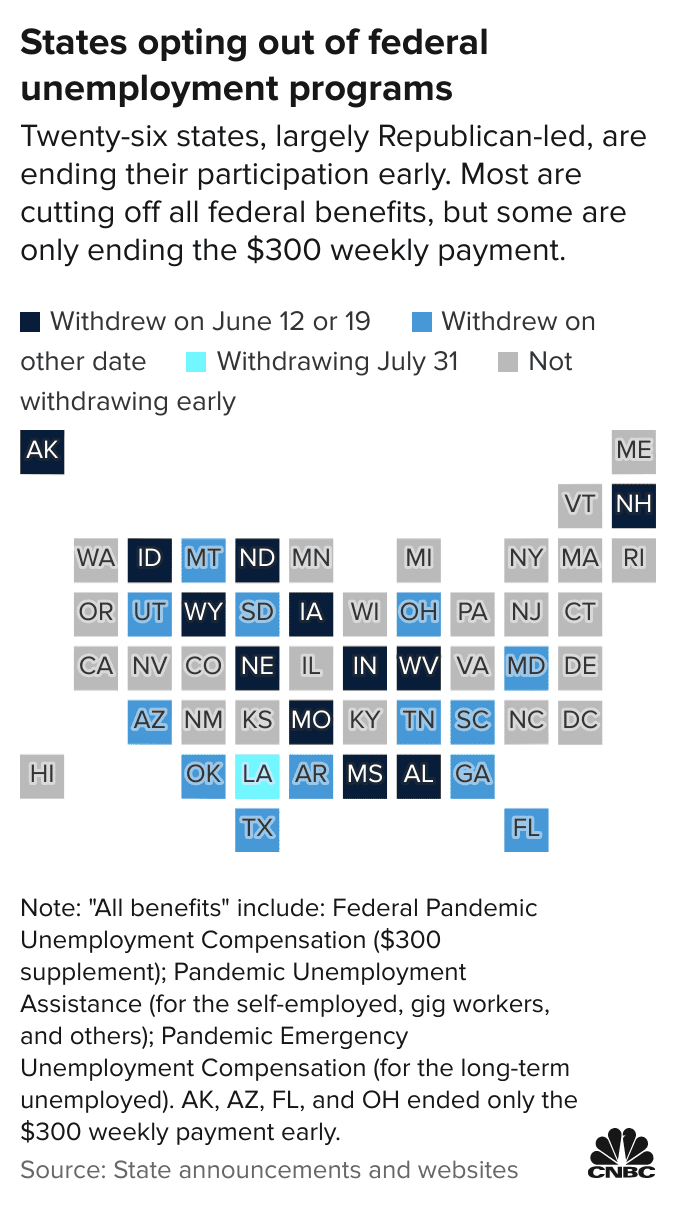

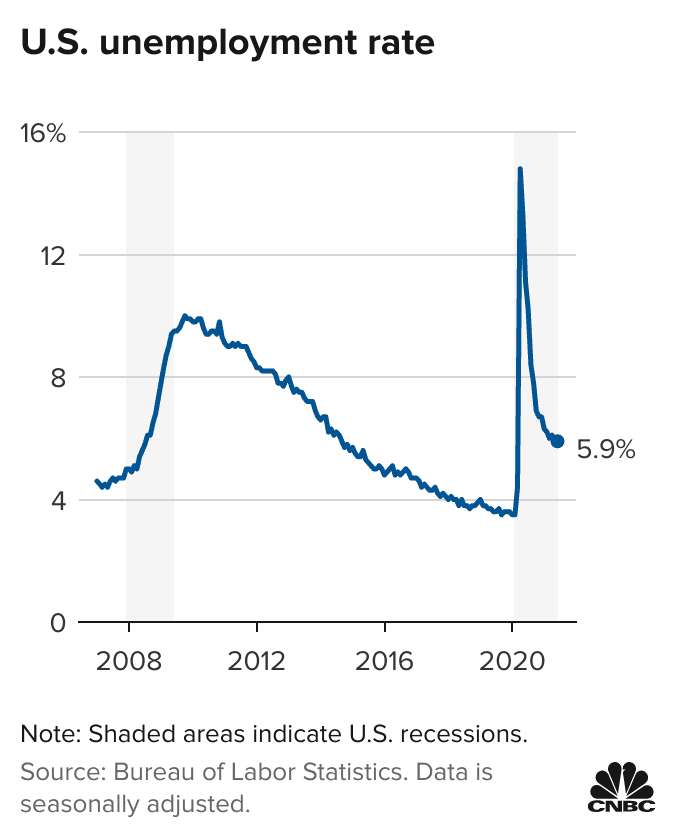

Feliciano and her family have been thrust squarely into a vast social, political and economic experiment that has no parallel or precedent. DeSantis and 25 other governors nationwide, all but one of them Republican, opted this spring and summer to reject extra federal aid intended for people who lost their jobs because of the coronavirus, contending that the more robust social safety net was leading to widespread labor shortages. But the coronavirus’s deadly delta variant, which has overwhelmed Florida in recent weeks, shows just how fragile the economic recovery still is. Some people, like Feliciano, can’t even envision moving forward. They are worried about losing what little they have.

“We really have no say,” she said. “The only say we have is who we get to elect for whatever position. But once they get there, they forget that entirely.”

Few political leaders have rebuffed federal economic aid and public health guidance as much as DeSantis, a presumptive 2024 presidential candidate whose political campaign sold T-shirts that read, “Don’t Fauci My Florida.” His derision of Anthony S. Fauci, the nation’s leading infectious-disease expert, and virtually any other public health expert he disagrees with has made him a conservative hero but a divisive figure in his home state, which is now leading the nation in the number of people hospitalized with covid-19.

DeSantis, also 42, has attempted to restrict mask mandates in schools and banned businesses from requiring vaccination, enraging some companies, parents, school districts, and people like Feliciano. He has trumpeted many of his policy changes in news conferences and cable news appearances while brushing aside the inevitable impact, dismissing the rising infections as a “seasonal pattern.”

Christina Pushaw, a spokeswoman for DeSantis, said his decision to end the federal benefits early stemmed from conversations with “countless” small-business owners, who had found it nearly impossible to hire workers.

“Small-business owners pointed to the federal benefits as the major reason for these challenges, and it makes sense — small businesses should not be forced to compete with the government printing money to pay people to stay home,” Pushaw said.

But as the virus extends its grip over Florida, interviews with unemployed workers show the economy here is not as strong as the governor has suggested. And for some people, it’s only getting worse.

Twenty-five miles west of Tampa, in the coastal town of Dunedin, several dozen people lined up at a food bank in a grassy lot behind a church on a recent Thursday morning. The food bank, Dunedin Cares, sits just across the street from Dunedin High School, where a young DeSantis excelled on the baseball field more than two decades ago. Joe Mackin, president of the food bank’s board, said the organization is serving 40 percent more people this year than last year, something he attributed to wider awareness about its offerings.

“There’s a lot of people out there that need food,” he said.

One of those people is Nicole Pinkel, whose husband had been making good money as a bartender for local theaters when the coronavirus shuttered their programs. Now he is back to work but receives far fewer shifts than he used to. And looming over the family is the risk of new closures of entertainment venues, given the sharp rise in infections.

The extra $300 per week in federal unemployment benefits that her husband received through June was helping the family get by, Pinkel said. Then it stopped. “That’s what we were paying our bills on and living on,” she said.

The economic tensions that have confounded policymakers for months are evident all over Central Florida.

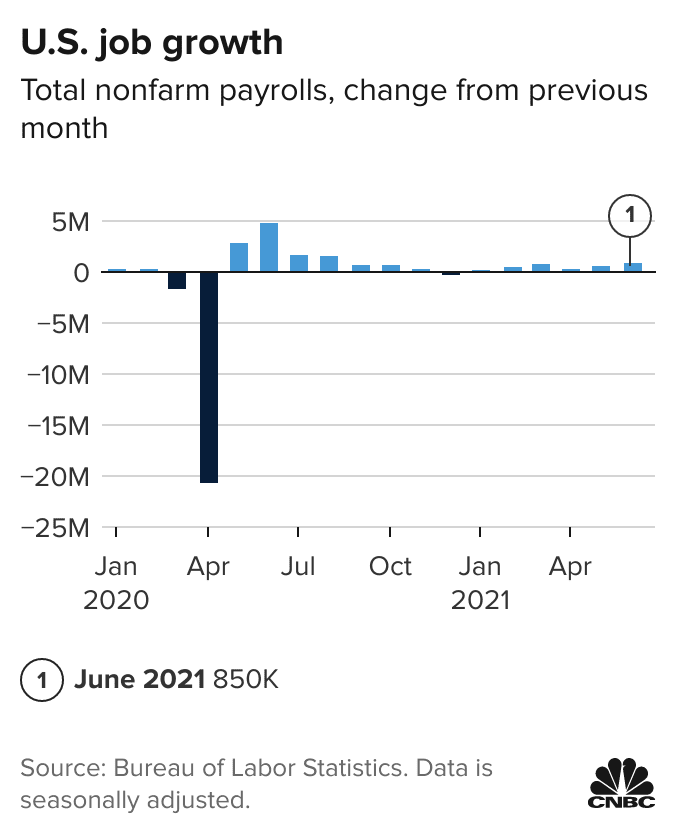

“Help Wanted” signs are staked outside many restaurants, and some hotels now warn guests that their rooms will be cleaned only every few days because of a shortage of housekeepers. Nationwide, there were more than 10 million job openings as of June, according to data from the Bureau of Labor Statistics.

But many Floridians said there are complicated realities behind those headline figures. People from all walks of life said they are still struggling to find work, stymied by a lack of child care, the new wave of covid infections and some employers who seem uninterested in hiring older workers or those without a college degree.

The unfolding situation in Florida and other mostly GOP-led states that cut off extra aid early is a taste of what may be in store soon for the rest of the country when federal benefits expire for millions next month, even as more than 8 million people remain jobless.

“We know that the job market is improving, but we don’t know how quickly people are going to be able to find those jobs and how well-matched the unemployed are to the available jobs that are open,” said Andrew Stettner, a senior fellow at the Century Foundation, a liberal think tank.

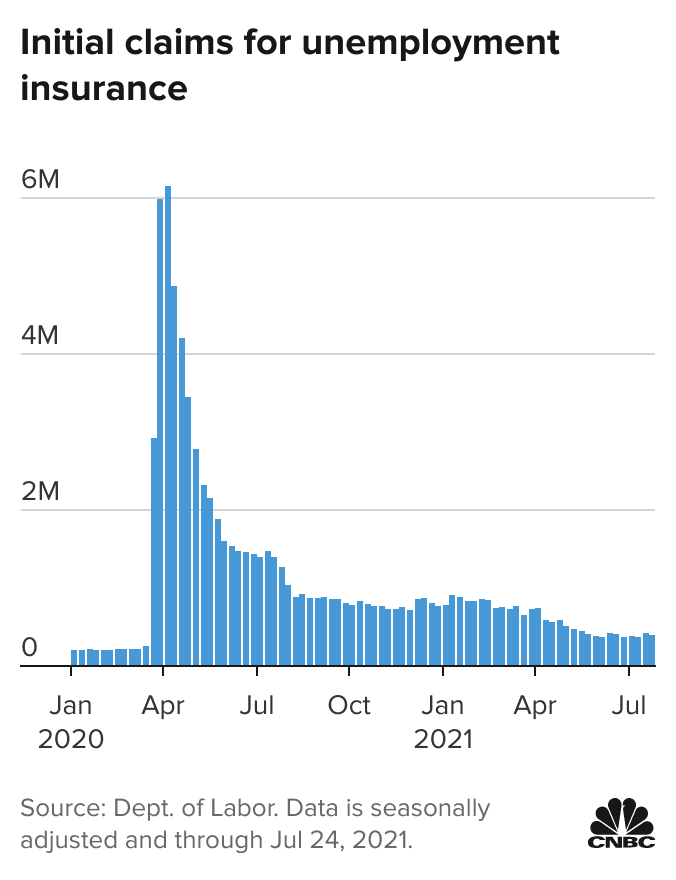

An analysis by Stettner this month found that some 7.5 million people stand to lose their jobless benefits as of Sept. 6, when three federal pandemic-related benefits programs expire. They include 4.2 million people traditionally ineligible for jobless aid, such as gig workers and the self-employed. Another 3.3 million people would be cut off from a program that had been helping those who had exhausted their state aid without finding work. The stories from Florida suggest that the vast majority of those people will not simply return to work. In fact, many of them could face dire financial hardships.

While pressure from activists and liberal lawmakers spurred the Biden administration to renew a moratorium on evictions, there is almost no chance at this point that a similar extension is in store for the jobless benefits. Congress is unlikely to even vote on any proposal until well after the benefits expire, and President Biden said in June that it “makes sense” that the $300 weekly payments will expire next month.

“The evidence so far shows that the pandemic programs have had little impact on job growth, and so I’m surprised that the Biden administration and Democrats in Congress are not doing more to push for a policy that so many workers continue to rely on,” said Peter Ganong, a public policy professor at the University of Chicago.

The administration has opened the door for state-by-state extensions of some of the programs using federal funds, and a White House official pointed to Biden’s wider economic agenda, including an expansion of the child tax credit and support for schools and local governments.

After she prepares her 7-year-old daughter for the school day, Feliciano settles in around 8 a.m. for a round of calls and emails with potential employers, the property management company that liaises between her and her landlord, and hunting through a tangled, complex web for any aid that may help them get by. She posts frequently on local Facebook unemployment groups, offering her hard-won knowledge to people navigating the same system.

“I have to call about this application. I have to call about rental assistance. I have to get in touch with the landlord. I have to call and reschedule this bill and post it out further so I can juggle it,” she said. “It’s like playing chess, and I suck at playing chess.”

She closely followed the tense last-minute efforts by Democrats to extend a federal eviction moratorium this month, knowing that her family’s ability to stay in their home would depend on it.

Feliciano’s evenings are filled with her job search. Before she was laid off in April 2020, she worked as an office manager. She estimated she has applied for around 10 jobs per week in the time she has been unemployed, mostly through the job search site Indeed.

But though there are lots of advertised openings, they seem to evaporate with no concrete offers. In one recent example that she said was emblematic of her overall experience, she applied for a role as a recruitment coordinator July 21 and received a reply from the company Aug. 11 asking for her preferred salary. She responded the next day and followed up a week later but has yet to hear back.

All the while, she has to balance her need for a paycheck with practical limitations: Until recently, the kids were home for the summer, so she was looking for jobs she could do from home. The school year has now begun, so she has more options. But given that the couple now has only one working vehicle, she has to look for positions close to home, where her neighbors might be able to help her with rides.

And Feliciano, who did not go to college, is painfully aware of the fact that even some entry-level jobs require an associate’s degree.

As Republican governors across the country, including DeSantis, cut off federal aid this summer, they contended that it was dissuading people from going back to work. Dane Eagle, executive director of Florida’s Department of Economic Opportunity, said the decision would “help meet the demands of small and large businesses who are ready to hire and expand their workforce.” But labor experts and economists say the evidence that has emerged thus far contradicts the assertions of Republican leaders.

Data from Homebase, which makes a time-tracking tool used by small businesses, found that employment in small businesses was down 3 percent nationwide in early August compared with the same period in July. States that ended the extra benefits early saw employment decline by 5.6 percent, while in states that did not end the benefits early, employment declined by 4.3 percent, said Adam Beasley, manager of data products at Homebase.

Ganong’s research shows that extra unemployment aid has proved to be a small disincentive for people to go back to work — far less than many economists expected before 2020.

An analysis of anonymous banking data for more than 18,000 mostly low-income people, released by academic researchers on Friday, found that for every eight workers who lost their benefits in states that cut them early, just one worker found a new job. The average worker affected by the cuts lost $278 each week and reduced their spending by $145 per week in response, leading to a collective $2 billion in lost spending between June and early August in the 19 states analyzed.

“An abrupt stop in that assistance really does not benefit families. It does not in any way force people back into the workforce,” said Cindy Huddleston, a senior policy analyst at the Florida Policy Institute. “And it has the effect of pushing people into poverty and feeling hopeless with no end in sight to the pandemic.”

Asked for evidence that employment has grown in Florida since the benefits were cut off, DEO spokeswoman Emilie Oglesby pointed to state data showing that more than 17,000 online job ads were added between June and July, for a total of over 545,000 postings — although job ads do not equate to actual employment. Florida’s current unemployment rate of 5.1 percent is below the national rate of 5.4 percent, though it has ticked up slightly since January.

A few miles south of Dunedin, outside an employment office in Clearwater this month, workers described a range of obstacles to finding a job. Morg DeJesus, a 31-year-old single mother of two, said she lost her job at a local factory last month when a covid-19 outbreak forced it to close.

St. Petersburg resident John Surprenant, 63, lost his position at a large retailer in February. He estimates that he has applied for 40 to 50 jobs since then, while he tries to get by on a little over $100 a week in state unemployment benefits in addition to his Social Security check.

“I get no response,” he said. “I don’t know if it’s because of my age or what.”

He had been receiving the extra $300 each week before DeSantis cut it off in June, and that money was helping him get by.

“Now I have to sit home, watch my meals. Like I don’t eat breakfast, I’ll have a light lunch and then have a good dinner,” Surprenant said. “I don’t know why the governor is doing all this.”

Deiondrick Roberts, 32, estimates he has applied to between 200 and 300 positions since he lost his job in June. He is trained as a digital user experience and interface designer, and said he is finding those positions in short supply.

“I know there are jobs being created but it depends on what type of jobs are being created,” he said. “That kind of adds to the frustration and competitiveness of trying to get a job.”

Roberts receives around $575 every two weeks in state unemployment benefits. That’s not enough to pay his bills, so his family and roommate have stepped in to help in the meantime, help he is not accustomed to needing.

“I’ve never been the type of person to ask others for assistance,” he said.

Some out-of-work Floridians have banded together to sue DeSantis in an effort to win back the federal benefits. They are buoyed by the recent success of such efforts in other states, including Arkansas and Maryland. If they win, unemployed workers throughout Florida could retroactively receive federal benefits owed since late June, said one of the attorneys for the plaintiffs, Scott Behren. A judge is set to hear arguments in the case this coming week.

A hearing for the case took place last week, and Feliciano followed via live stream. That morning, she had checked on her stepson, still recovering from his covid infection, then followed up on a rental assistance application and checked for updates on her job search. As she listened to the judge lay out his view of the issues at stake, she sipped her coffee and answered messages from strangers seeking her advice with their unemployment claims.

_________________________________________________

Original article posted in Washington Post: https://www.washingtonpost.com/business/2021/08/22/unemployment-economy-desantis-florida/

The post In Florida, DeSantis cut jobless aid just as virus began terrifying new wave appeared first on Basic Income Today.

This post was originally published on Basic Income Today.