New research finds a big rise in new businesses despite the pandemic, particularly in predominantly Black neighborhoods.

By: Quoctrung Bui

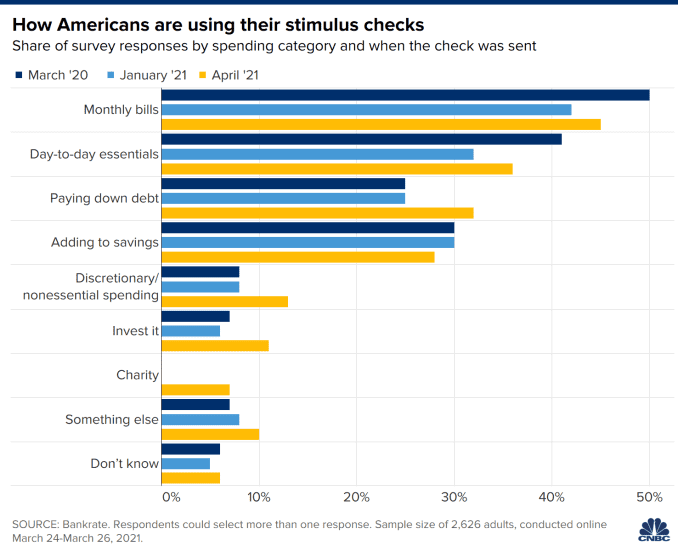

Over the last year, multiple stimulus measures from the federal government have helped families buy groceries, pay rent and build a financial cushion. This aid might have also helped start a new era of entrepreneurship.

There has been a surge in start-ups in America that experts have yet to fully explain. But a new study — using data that allows researchers to more precisely track new businesses across time and place — finds that the surge coincides with federal stimulus, and is strongest in Black communities.

Across a number of states, the pace of weekly business registrations more than doubled in the months after the CARES Act was signed in March 2020. Business registrations rose again, by 60 percent, around the period of the supplementary aid package signed in December. Coinciding with the third wave of stimulus in March, weekly business registrations have been up by 20 percent, but the data is less complete.

The pandemic might mark the end of a slump in entrepreneurship that has lasted for several decades. Steep job losses, a widespread shift in how people work and a big influx of federal spending could prompt the kind of disruption that changes how people think about work and what they want to do with their lives.

“The idea that the pandemic has kind of restarted America’s start-up engine is a real thing,” said Scott Stern, an economist at M.I.T. and one of the authors of the research. “Sometimes you need to turn off the car in order to turn it back on.”

The researchers caution that they can’t yet say that the stimulus measures caused the growth in new businesses, but they think that the timing and the rise are so stark that it’s hard to insist that it’s merely coincidence.

The rise in registrations began shortly before the second and third bills were passed, but new entrepreneurs might have started anticipating the result after the first stimulus. “People had already been through this once and had a better understanding of how this would work,”said Catherine Fazio, director of M.B.A. programs at Boston University.

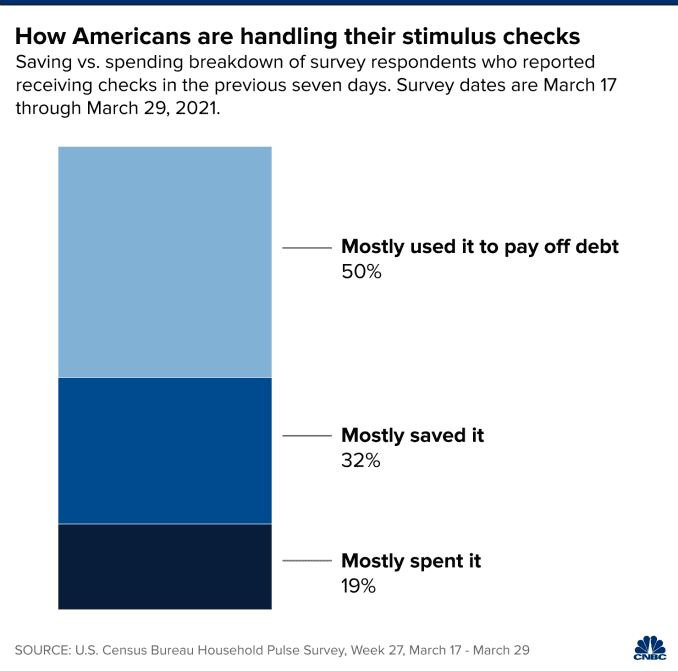

Although there might be other factors at work, the researchers say the stimulus checks and increased unemployment benefits shored up confidence in the economy enough that millions felt comfortable in starting a business despite being uncertain about when the pandemic would end.

“Start-ups have always fallen in recessions,” said John Haltiwanger, an economist at the University of Maryland who studies business formation. “This is the only one I know where start-ups grew.

These results are based on an analysis of more than two years of business registration records from eight states (Florida, Georgia, Kentucky, New York, Tennessee, Texas, Vermont and Washington) by a team of economists from Boston University, Columbia, Rice University and M.I.T. The researchers chose the states because they had the most up-to-date records and together represented a reasonably large proportion of the national population.

The state-level registrations gave the researchers information on start-up activity by week and ZIP code, a detailed view not normally available to the public. Most experts get their entrepreneurship data from the census, which is derived from tax identification numbers. That data is available only monthly and by state.

For aspiring business owners, registering a business with a state is a key step. In some states, it can cost a person a few hundred dollars to file. In return, the registration protects personal assets in the event of a bankruptcy; confers tax and banking benefits; and makes hiring workers easier.

The registrations were filed mostly as L.L.C.s or partnerships — the entities typically associated with small businesses — and didn’t generally include people engaged in gig work.

Some part of the boom may be a catching-up process. At the start of the pandemic, the researchers estimate, the average ZIP code had an average of three fewer businesses registered a week than is typical. For comparison, when Hurricane Katrina hit the New Orleans area in 2005, affected ZIP codes registered only one fewer business a week than usual.

But after the CARES act was signed, registrations in those eight states reached their 2019 levels as early as July.

A large part of this surge was in businesses providing services for people struggling to adapt to the pandemic, with the biggest shifts in online retail and personal services (like day care).

When the researchers mapped the data, they found that the ZIP codes that experienced the greatest increase in business registrations were in Black areas, particularly higher median-income Black neighborhoods. Even after controlling for other variables, the proportion of Black residents in a ZIP code had the strongest impact on the start-up growth rate.

While the data doesn’t directly tell us the race of the entrepreneur, it does provide an address listed with the registration. Though that address isn’t necessarily the address of the establishment, for small businesses it tends to be.

To Andre Perry, a fellow at the Brookings Institution, this flurry of small-business activity in Black communities may actually be a sign of struggle: “This is more about survival than it is about wealth creation. There’s lots of people who have lost their jobs and lost their businesses. People are starting to realize that side hustles are businesses.”

You can see some evidence of this in the data. Robert Fairlie, an economist at the University of California, Santa Cruz, tracks what he defines as necessity businesses and opportunity businesses. Necessity businesses are those whose owners were previously unemployed.

The share of businesses born out of necessity more than doubled, he said, to 30 percent in 2020 from 13 percent in 2019.

Last summer, Pilar Donnelly started making playhouses in Houston for her two 6-year-old boys. She had been laid off from her job in sports marketing and wanted to give them something for their birthday. With no background in woodworking, she started off with a design she liked online and watched YouTube to learn woodworking techniques. After making a number of playhouses for her friends and family, she realized it could be a business. That business, which she registered in June, is called Wish You Wood Custom Creations.

She said it was her personal savings and the unemployment benefits that really helped give her peace of mind last summer; the stimulus check wasn’t enough by itself to make a huge difference in her decision to start a business.

“I did buy a saw with some of that money,” she said. “That did help a little bit.”

Ms. Fazio says it’s telling that entrepreneurship is on the rise in Black communities at precisely a moment when economic support is at its most universal.

“It feels significant that we saw this big response in neighborhoods where it doesn’t typically happen,” she said. “When you remove those gateways that have worked in some ways to limit access for certain communities, then you really do unleash potential.”

It’s uncertain how these new registrations will translate into businesses that will continue to operate after the pandemic. If many of them are born out of necessity, it’s natural to expect them to wind down as workers return to their old jobs.

But given how drastically the pandemic has disrupted the economy, and how businesses operate more broadly, there may be opportunities in the post-pandemic economy for entrepreneurs to take advantage of what didn’t exist before.

Kaaryn Simmons, the director of the Columbia-Harlem Small Business Development Center, says that in this year of economic upheaval, the barriers of maintaining a small business have changed, allowing people to run operations that were unimaginable in the old economy.

“You don’t have to do a storefront anymore — ghost restaurants, pop-up restaurants, online stores,” she said. “There’s more opportunity because there are different models that we didn’t see before.”

Ms. Donnelly is sticking with her new path. She says her woodworking business has now become her full-time job.

“Everyone I encountered either had a really good year or a really bad year — and for me I had a good year,” she said. “Now I’m working outside in the grass and the dirt. I have a workshop in the garage; I have scrap wood everywhere. My life is really different.”

___________________________________________________

Originally published in New York Times: https://www.nytimes.com/2021/05/24/upshot/stimulus-covid-startups-increase.html

The post Stimulus checks appear to how led to a surge in startups, especially in Black communities appeared first on Basic Income Today.

This post was originally published on Basic Income Today.