Livekindly Collective has made its latest acquisition in the plant-based meat sector, taking over TiNDLE Foods’ foodservice business in the US, the UK and Germany.

A month after announcing its plans to divest from the US and focus on private-label meat alternatives in Europe, TiNDLE Foods has handed over parts of its business across the two regions.

Livekindly Collective – owner of brands like Oumph, Like and Fry’s – has acquired TiNDLE Foods’s foodservice operations in the US, the UK and Germany.

The former will manufacture and distribute the latter’s products across foodservice and online channels in these three key markets, including on the meal kit platform Hungryroot.

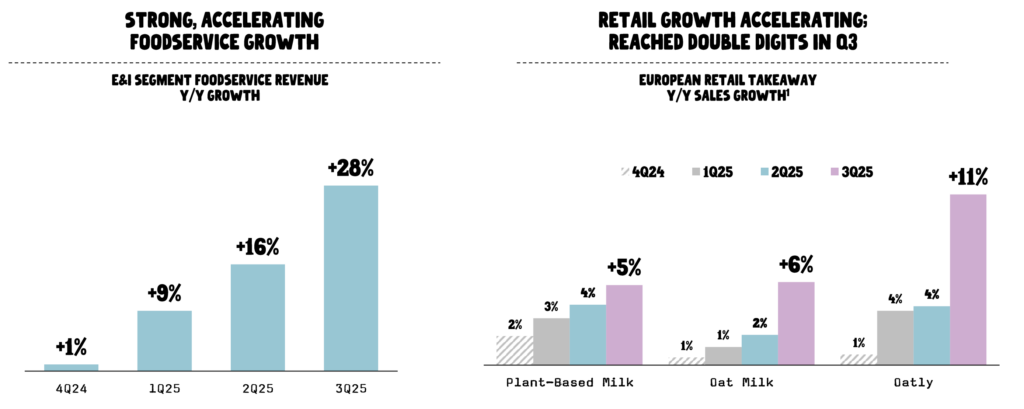

It comes three months after Livekindly Collective recorded its first month of profitability, on the back of single-digit year-on-year growth in the first half of 2025. The deal adds to the company’s flourishing B2B business, which achieved 48% growth in 2024 and is on course to increase by 120% this year.

“We are enthusiastic about the partnership with TiNDLE,” said Livekindly Collective CEO David Suarez. “This move represents a considerable opportunity, and we are ready to tap into it and bring tasty plant-based protein to people on a bigger scale, through foodservice and emerging channels.”

Why TiNDLE Foods revamped its business model

Best known for its vegan chicken, TiNDLE Foods’s products have appeared in thousands of retail stores and restaurants across several markets, including the three in question.

In an interview with Green Queen this summer, co-founder and CEO Timo Recker suggested that retail was TiNDLE Foods’s most profitable channel, having witnessed a steady rise in sales in this area.

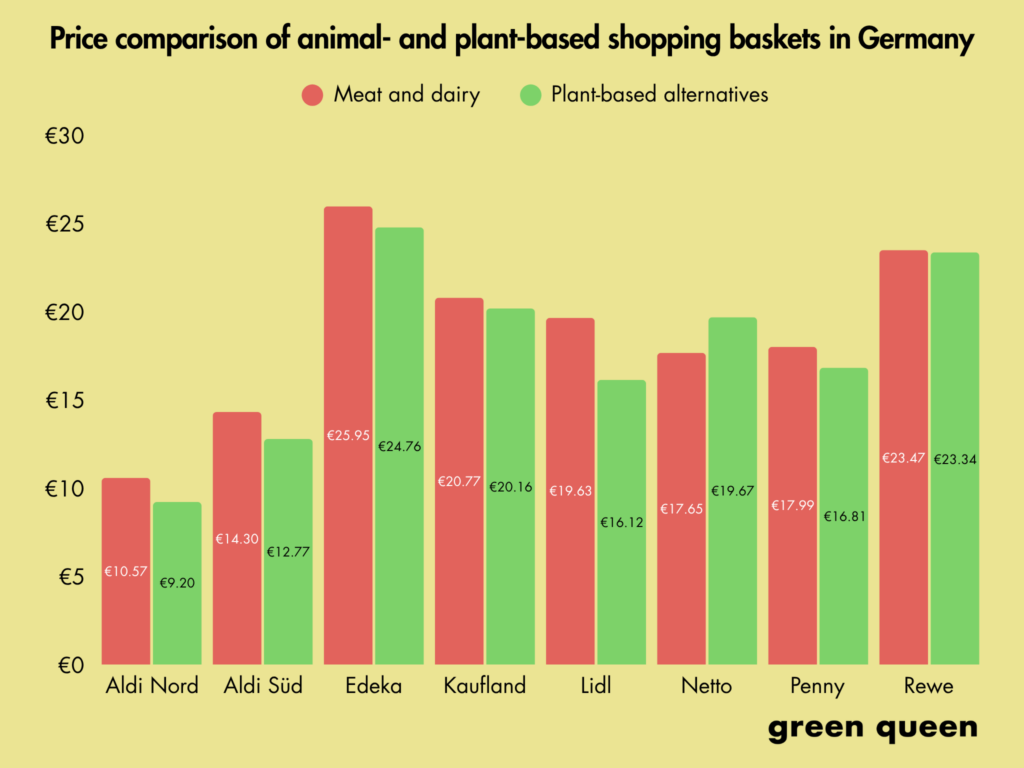

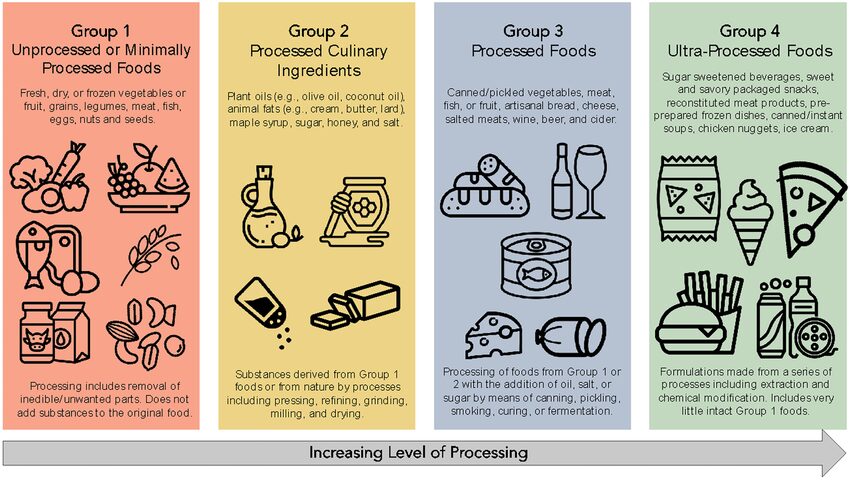

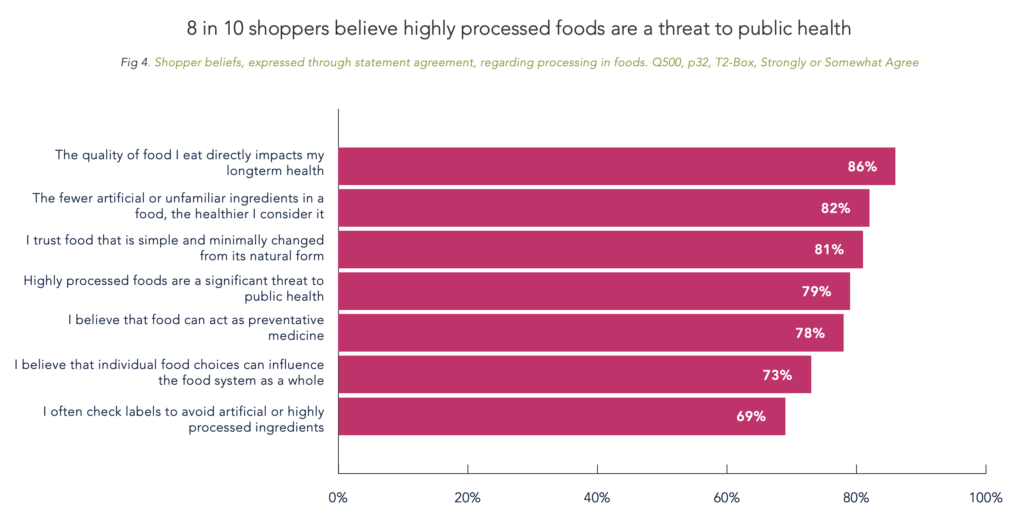

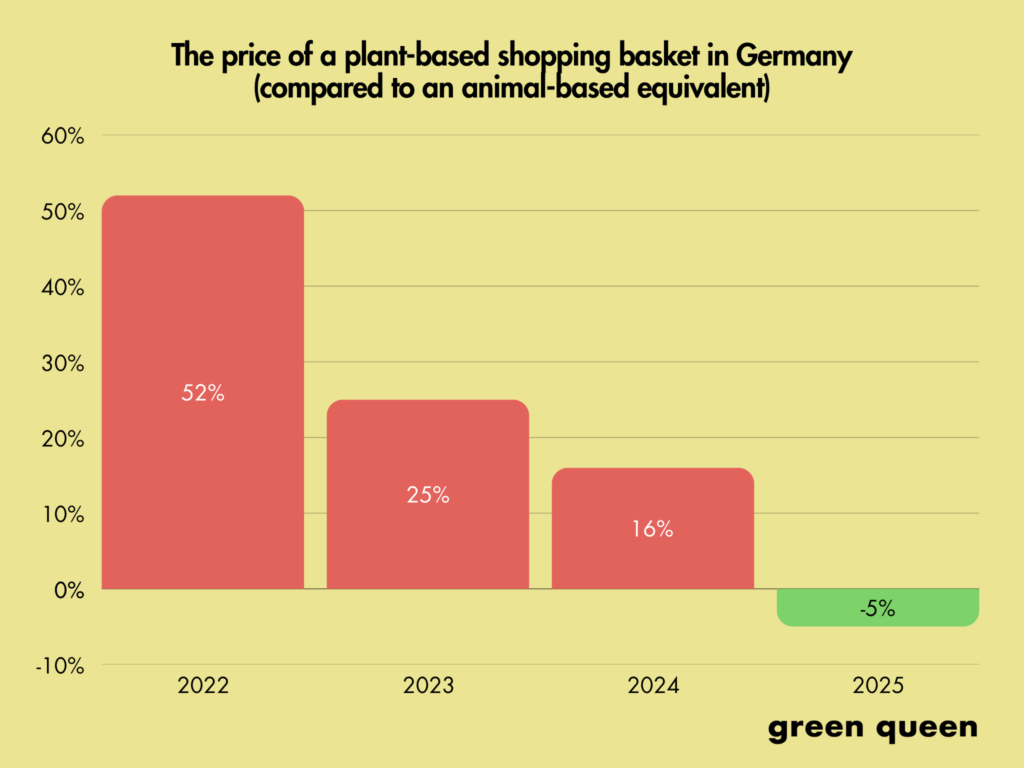

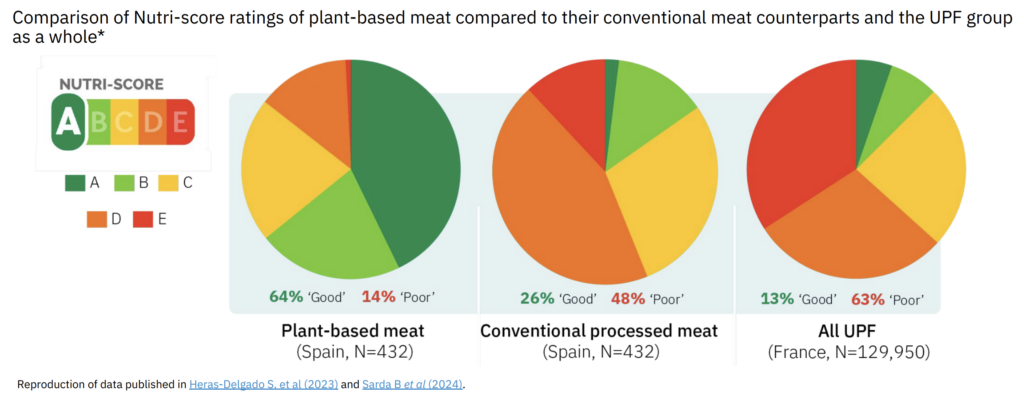

But as many alternatives struggled to capture wallet share, thanks in large part to concerns around ultra-processing and high prices, the company decided to pull out of the US and pivot its model to exclusively producing affordable private-label options for B2B customers in Europe.

“The plant-based category has become increasingly price-driven, and we’re seeing that private-label products are capturing a growing share,” Recker said last month. “We are well-positioned to lead this shift by producing best-in-class, innovative products, while also making the necessary adjustments to maintain value and accessibility for our customers.”

Under the new strategy, TiNDLE Foods said it would sell unbranded plant proteins to major food manufacturers, retailers, and restaurant groups, giving them the flexibility to brand, formulate, and price the products according to the local market.

Moreover, the company suggested that the business maintained a solid capital base and remained positioned for long-term growth “despite challenging market environments”.

Following this week’s transaction, TiNDLE Foods’ strong foodservice presence will help boost Livekindly Collective’s offerings in Germany, the US, and the UK, which represent the three largest markets for meat alternatives globally.

Financial security boosts Livekindly Collective’s acquisition drive

Owned by Blue Horizon, Livekindly Collective has built its business on the M&A model, having bought six brands in various markets over the years, which have propelled its growth.

The company’s B2B division has been expanding rapidly since its launch two years ago. It has boosted its production and now ships to 19 countries across five continents, serving more than 40 customers with both private-label and branded products. This is supported by its three pure-play factories in Oss (Netherlands), Stora Levene (Sweden), and Pinetown (South Africa).

“Liveindly Collective fosters brands as well as serving B2B customers with private-label products, but we are also strong in foodservice,” said Suarez. “Until recently, we have been focused on growing organically by utilising our assets, with brands and B2B production leading the charge, but being financially secure allowed us to explore inorganic growth opportunities, too.”

He added: “With the backing of our network, production capabilities, and operational know-how, we will continue to expand our plant-based food portfolios and advance our mission to transform the food system.”

Livekindly Collective is projecting a growth of up to 200% for its B2B business in 2026. Its acquisition of TiNDLE Foods’s foodservice business is the latest in an ever-expanding list of M&A deals in the alternative protein industry.

Since September 2024, more than 50 alternative protein companies have been acquired or fallen into insolvency. This includes leading players like The Vegetarian Butcher (bought by JBS-owned Vivera), Miyoko’s Creamery (acquired out of liquidation by Melt Organic owner Prosperity Organic Foods), Daring Foods (bought by v2food), and Meati Foods (snapped up by Inventel founder Yasir Abdul following financial troubles).

In an interview with Green Queen in September, Suarez noted the category would keep consolidating: “Given our strong position in the market, [this] always gives us the opportunity to consider acquiring an organisation that could help us disproportionately accelerate growth and profitability.”

And speaking to this publication last month, he laid out Livekindly Collective’s strategy for the upcoming year: “As we enter 2026, the priority is profitable growth. Profitability gives us the confidence and stability to expand where it makes sense, whether that means new markets, channels, or products.”

The post Exclusive: Livekindly Collective Snaps Up TiNDLE Foods’s Plant-Based Meat Business in Three Countries appeared first on Green Queen.

This post was originally published on Green Queen.