Mumbai-based Prot has released Prot Block, a shelf-stable ingredient offering health-conscious Indians a new format of plant-based protein.

Walk into metropolitan India right now, and you might begin wondering whether you have a protein deficiency.

Protein is everywhere right now, from chocolates and coffee to kulfi and even water. It has given a boost to functional health startups and forced dairy giants like Amul and Mother Dairy to innovate and introduce protein-rich offerings.

Swathes of studies suggest that India has a protein problem—according to one survey, 73% of the country has a deficiency. That said, a separate analysis of household food intakes reveals that the risk of protein deficiency, when adjusted for digestible quality, is low in adults and non-existent in young Indians.

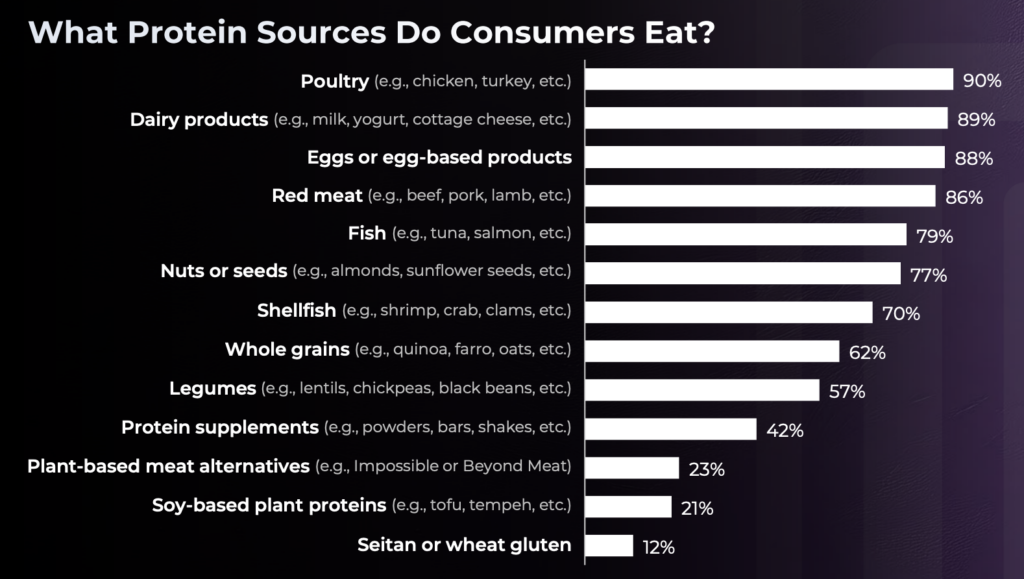

Either way, the protein trend isn’t going anywhere. And in a country with the world’s largest vegetarian population, it’s an opportunity for plant-based companies.

The challenge? Meat alternatives are still ultra-niche, and tofu (often marketed as ‘soy paneer’) is only just emerging into tier 2 cities. The industry’s USP, however, is health and nutrition.

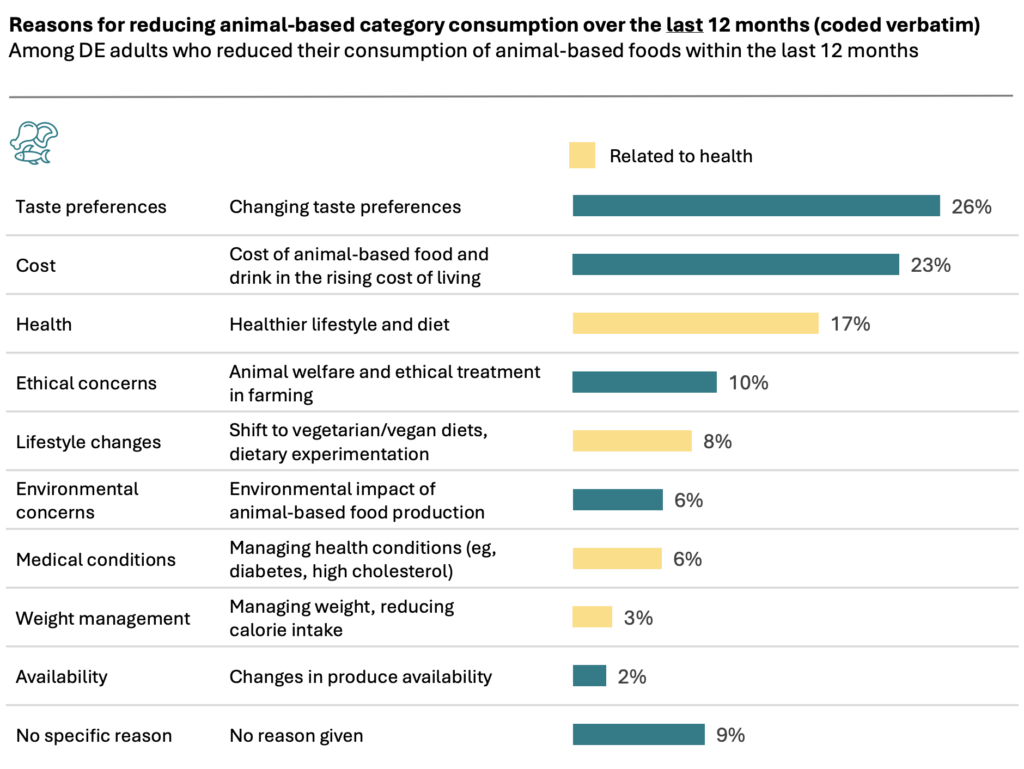

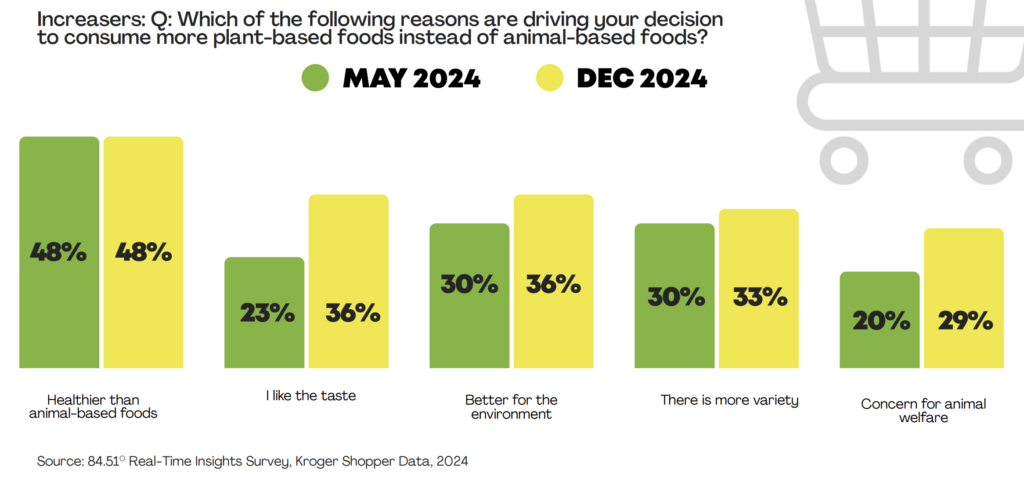

Polling shows that protein and health benefits are the most influential purchase drivers of plant-based meat and dairy in India, even more so than affordability. It’s what spurred the 18% growth of the vegan market between 2021 and 2024.

According to market research firm Ipsos, this value is expected to expand 18-fold in the next decade, with plant proteins “set to be woven into everyday meals and snacks, attracting a wider audience beyond vegans”.

It leaves room for new, innovative products that pack a punch with protein and fibre, all while satisfying the taste buds of a food-loving population.

Not an alternative to tofu or paneer

Prot, a Mumbai-based startup formerly known as Seaspire, is tapping into the opportunity. It has released Prot Block, a novel format of plant-based protein that isn’t quite a meat alternative or tofu, and holds its own on the culinary and nutrition fronts.

“The motivation for us in developing this product actually came from an unintended blind test, where we just had some test consumers give insights on how they feel about the texture and early iterations of this product without any positioning… [except only] if they were given the option to eat plant protein,” co-founder Varun Gadodia tells Green Queen.

“And this got us a strongly positive early feedback that vegetarian consumers in India and some Western markets are looking for a protein texture that can be incorporated easily in their daily food habits without sounding like any alternative or plant-based meat positioning.”

Indeed, we’re already seeing this shift in Europe, where whole-food options and new formats are taking over the plant-based space. In the UK, Oh So Wholesome’s Veg’chop and This’s Super Superfood both offer protein blocks made from legumes and vegetables. Meanwhile, Austria’s Revo Foods uses mycoprotein to deliver The Prime Cut, which doesn’t mimic meat and is designed for functional nutrition instead.

Prot Block – available in plain and tandoori flavours – contains 15g of protein (on par with tofu) and 10g of fibre per 100g, as well as 7g of fat sourced from coconuts and sunflower. In fact, both the overall and saturated fat content are over three times lower than paneer.

“In the short to medium term, we don’t intend to raise this as a rival of traditional paneer or tofu, but more of an option in the vegetarian protein textures, as consumers don’t really have much to look at and they are looking for options more actively,” suggests Gadodia.

“The commoditisation of soy and paneer in India within a very complex yet mature supply chain has left consumers with a choice paralysis with a cluttered marketplace of paneer, tofu and other soy derivatives,” he adds.

“In order to meet the differentiated positioning, we took the road to break out of that clutter,” he continues. “An allergen-free offering is just another value-added category [in which] we aim to position this product as a counter.”

Prot Block spotlights peas over soy

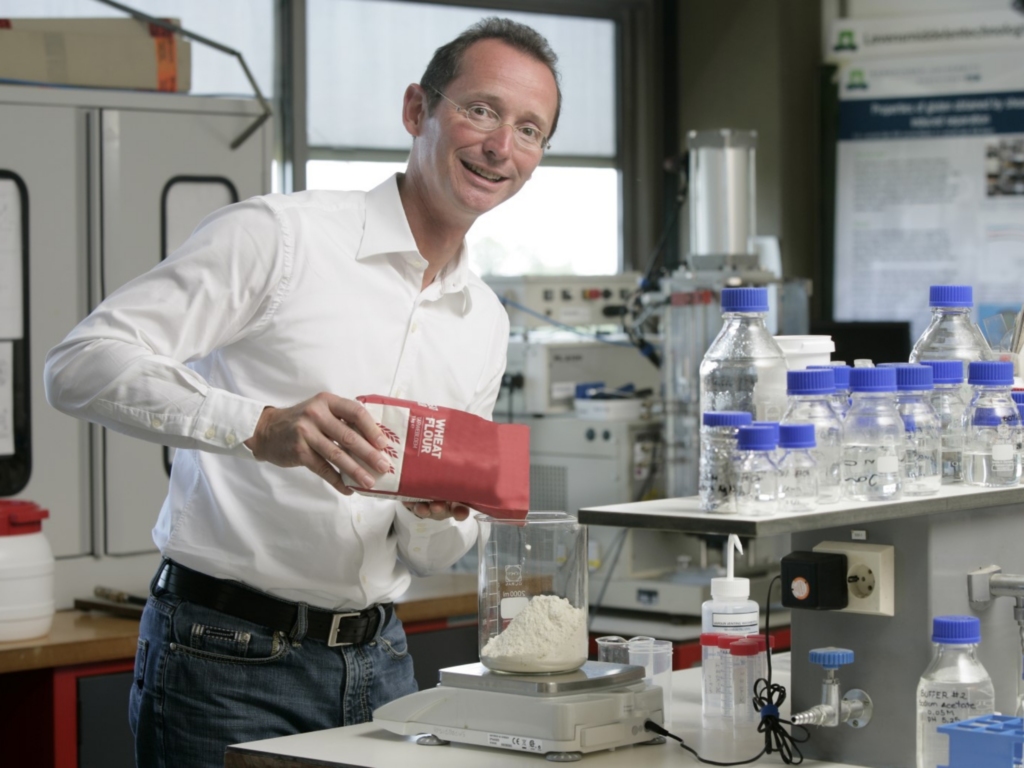

Peas are the star ingredient, with the Prot Block comprising textured pea protein and pea protein isolate. Wheat fibre and spices close out the ingredient list.

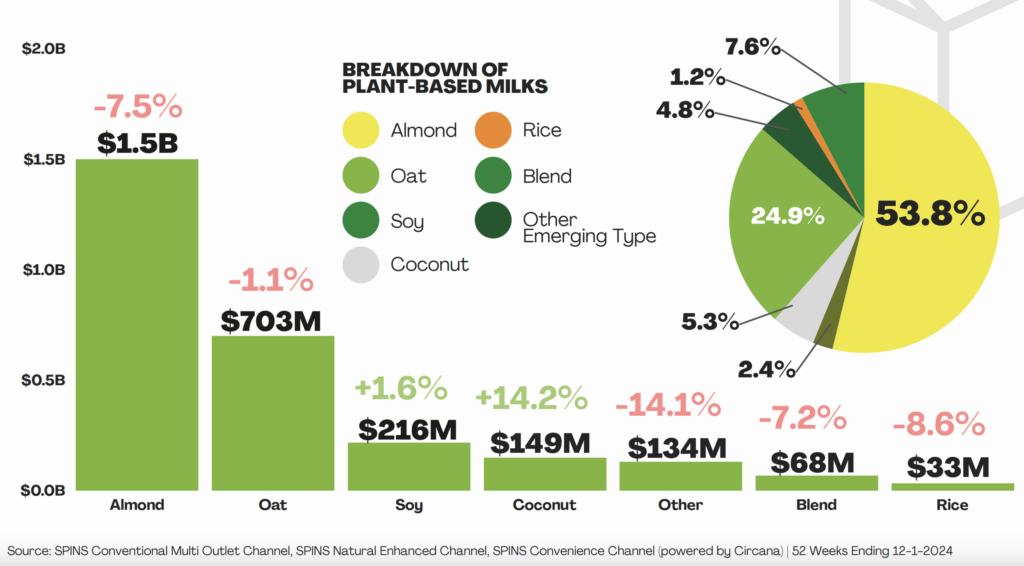

Using pea protein was a strategic choice to reduce the Asian market’s reliance on soy. “Reinventing the wheel with any soy-derived texture doesn’t compel consumers enough to look over the likes of tofu and tempeh, and soy granules, chunks or chaap (heavily consumed in many parts of India as a vegetarian protein),” Gadodia says.

“The opportunity here is to establish bench standards for wider adoption of pea protein, which unfortunately has remained restricted to the supplement space,” he adds, contends that this will ultimately help lead to improved standards of protein processing and commercialisation.

Prot describes the product as a versatile option suited to both local and international cooking styles, as well as a range of applications, from curries and rice to wraps and barbecue. “But this is just the beginning,” he says.

“We are in the process of some process tweaks in the product, which can get us to position it as an on-the-go snack that can be consumed directly. The hint lies in packed halloumi sticks and cheese sticks,” Gadodia adds. “While the product is pre-cooked during the course of processing and can be consumed raw, we are not positioning this as a use case.”

By offering a shelf-stable format, Prot is tackling a key bottleneck for India’s plant protein sector—the cold supply chain—while offering a long shelf life and potentially mitigating food waste.

Government support is critical to tackling India’s protein deficiency

The release of the product follows a closed-group pilot with more than 500 fitness enthusiasts, home cooks, and health-conscious, food-savvy early adopters. According to Prot, the feedback on taste, texture, nutrition and usability was “overwhelmingly positive”, underscoring the need for functional, high-protein options in the country.

“India is largely protein-deficient, despite heavy dairy consumption,” says Gadodia. “The environment around plant-based protein as a healthier choice is offering a great stage. However, the motivators are high-protein, allergen-free, affordable, low-cholesterol, in contrast to slow or underperforming categories like plant-based meat alternatives.”

Two in five Indians (21%) are looking to cut back on meat, while only 11% have given vegan alternatives a go (despite them being nutritionally equivalent or superior to animal protein). The space for new formats, therefore, is wide open.

“The low-hanging fruit, even for us, is the audience seeking high-protein offerings and willing to try more value-added products, [whether] out of need or simply boredom,” he says.

“The fact that plant protein products are still a niche is [reflective of] the consumer behaviour in India, which varies between a wide spectrum of cultural differences. While consumption in many regional markets is getting an upgrade with more disposable incomes, when it comes to food, consumers have a taste for traditional offerings,” the Prot co-founder explains.

“Many of these traditional foods already include a good chunk of plant protein derived from lentils, etc., but clean and additive-free packaged foods that solve for convenience are still a white space.”

The government, he believes, has a crucial role to play. Gadodia likens it to the promotion of the millet-based trade: “More formative policies can support the growth of plant-based foods, which need a robust supply chain and processing support to overcome scaling challenges.”

This chimes with calls from other experts, who have urged the government to launch a national plant protein mission to scale the sector and build a dedicated policy framework for plant-based foods.

Prot attracts pre-seed investment

Prot’s protein block is priced at ₹199 ($2.3) per 200g product. That’s several degrees higher than what Indians pay for paneer and, in many cities, tofu.

Gadodia admits that there’s an initial premium, though he insists that it is “well-gauged to a number that consumers are willing to pay for a value-added and differentiated protein offering that not only serves their need, but also hooks an aspiration to include a new product in their lifestyles”.

“The current pricing is slightly higher than good-quality paneer offerings, yet it’s in a ballpark of what an early consumer is actively looking to spend to find a valuable offering. We have our early consumers who have found the product reasonable,” he says.

“Our pricing strategy has been gauged carefully by understanding the value creation, early customers, unit economics and supply chain costs,” he adds. “Yet we have plans to improve pricing further with greater traction and quick turnaround times that could enable us to improve operational margins.”

Prot Block is currently selling the ingredient on its website and via foodservice. “We have great foodservice partnerships in place with curated menus, kitchen takeovers, etc. taking place to raise consumer awareness, and driving it all to the B2C channel,” says Gadodia.

To boost the startup’s plans, Gadodia and co-founder Shantanu Dhangar are now fundraising. “We have just closed a pre-seed funding round to support our growth plans with Prot Block and our growing presence in the retail and CPG space,” Gadodia says, hinting at an investor announcement in the coming weeks.

In another example of the effort to diversify India’s plant protein sources, plant-based meat brand Blue Tribe Foods – backed by Indian actress Anushka Sharma and cricketer Virat Kohli – has just unveiled Klaw, a brand of protein puffs derived from “supergrains”.

The post Plant-Based Startup Prot Targets India’s Protein Deficiency with Category-First Block appeared first on Green Queen.

This post was originally published on Green Queen.