Beyond Meat posted another poor quarter as sales fell by nearly 20%, prompting the plant-based company to lay off 6% of its staff and refresh its identity.

Californian plant-based giant Beyond Meat endured another “tough quarter”, with year-on-year sales falling sharply by 19.6% in the April-June period.

The company’s revenue reached just $75M in Q2 2025, below the lower end of its revised outlook for the quarter. Volume of products sold decreased by 19%, while gross profit shrank by 37%. While it suffered a decrease in operating losses too, its net losses totalled $33M, a 4% improvement on Q2 2024, thanks primarily to foreign exchange gains.

vCEO Ethan Brown described the results as “disappointing”, coming on the back of a poor first quarter and amid widening losses for the overall plant-based meat sector. Beyond Meat blamed the performance on softening demand and reduced distribution in US retail, and low sales of its burger products to restaurants internationally.

The company is now kickstarting another round of layoffs, impacting 44 employees in North America (amounting to 6% of its global workforce). This will incur a one-time charge between $800,000 and $1.3M, mainly in severance payments, employee benefits and related costs, though the move is expected to save the company up to $7M over the next 12 months.

“It is truly with a heavy heart that we made these reductions, and my deep appreciation and respect for these teammates and friends extends far beyond any comments I can make today,” Brown said in an earnings call.

Beyond Meat has also appointed John Boken, managing director of corporate restructuring consultancy AlixPartners, as its interim chief transformation officer. He will be tasked with driving the firm’s operational footprint into the current revenue environment and accelerating margin improvements, with the goal of becoming EBITDA-positive within the second half of 2026.

“We are responding by accelerating our transformation activities, including more rapidly and aggressively reducing our operating expenses to fit anticipated near-term revenues; prioritising increased distribution of our core product lines; and investing in margin expansion initiatives across these core products,” said Brown.

The news sent shares of the company down by 4% at the end of trading. In other news for publicly traded plant-based companies, Oatly’s stock has rebounded by 31% this month, reaching levels last seen a year ago.

High costs, misinformation and meat revival hurt retail sales

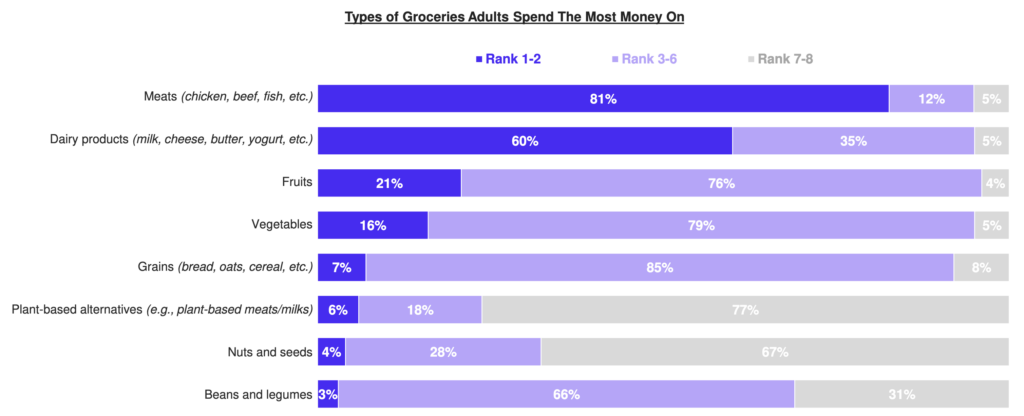

The lowlight of Beyond Meat’s Q2 performance was US retail, where revenues plunged by nearly 27%, thanks in large part to a decrease in product volumes, which the company attributed to “weak category demand” and reduced distribution points.

It’s reflective of the wider decline in sales of plant-based meat in American supermarkets, which have dipped by 17% in the refrigerated section so far this year, and 8% in the freezer, according to Spins data cited by Reuters.

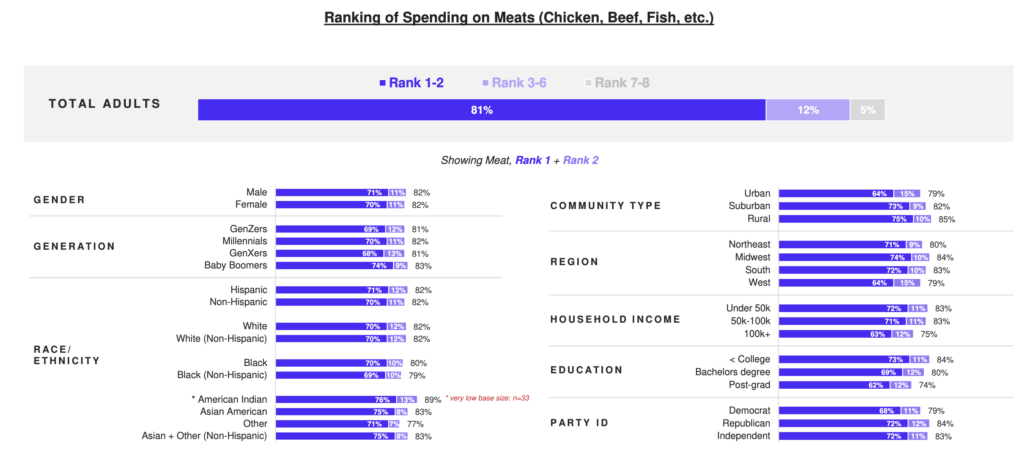

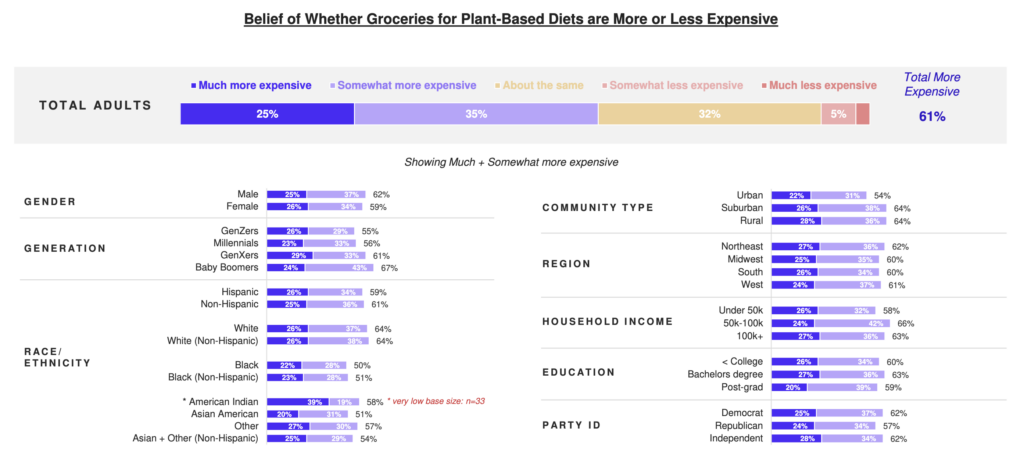

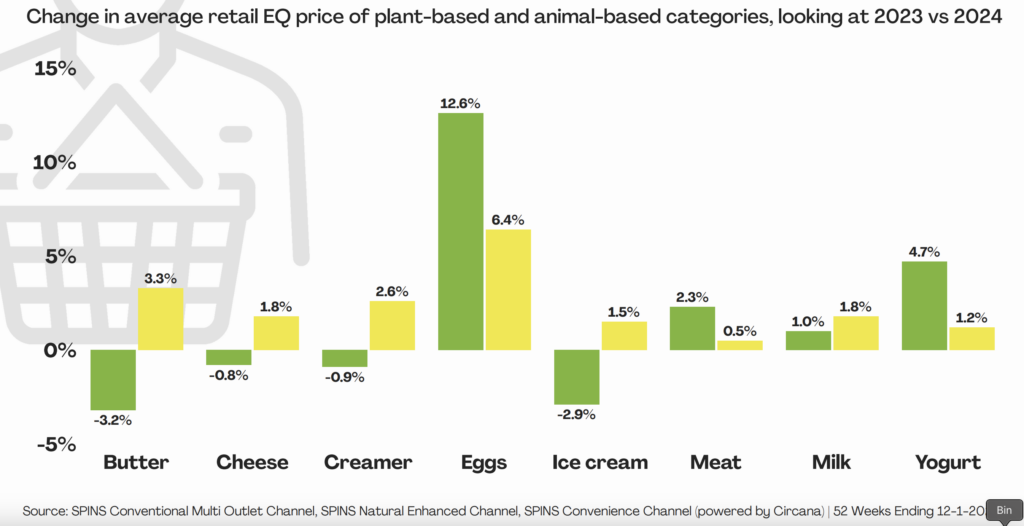

Brown pointed to several factors that led to the poor performance in this channel: the higher price than conventional beef puts it a disadvantage among cash-strapped consumers; the “negative narrative” around the sector is “sufficiently ingrained to outlast initial efforts to dispel this information“; and conventional meat is “having a moment that currently leaves less room” vegan alternatives.

“This has been an enormously disruptive period for our category and brand across US grocery, with instability being the consistent theme for quite some time, from multiple entrants flooding the market only to be delisted, to a general shrinking of shelf space, to a disruptive relocation of the category from refrigerated to frozen aisle in certain large retailers,” said Brwn.

“As we seek to rebuild our presence across this critically important channel, we are prioritising consolidated offerings at high-impact chains so we might drive results that are similar to some of our higher-performing current retailers.”

It’s not just US supermarkets where Beyond Meat is underperforming. Internationally, retail revenues narrowed by 9%, with the company blaming low sales of its burger, sausage and ground beef products in Canada, and reduced burger sales in Europe.

When it came to foodservice, revenues were up by 7% in the US, mainly due to price hikes and changes in product sales mix. But internationally, foodservice sales fell by 26%, with Beyond Meat suffering from low burger sales to quick-service restaurants. Reports suggest that McDonald’s has removed the McPlant from its Austrian menu, opting to run out its contract with Beyond Meat.

‘Not the moment’ for plant-based meat

When asked by one analyst if Beyond Meat can win back consumers who have stopped purchasing vegan alternatives, Brown said it was “not the moment for plant-based meat right now”.

“You’ve got these cultural moments that occur, and we happen to be on the other side of the particular moment,” he explained. “That won’t always be the case, but what we shouldn’t do is use a lot of dry powder trying to force growth right now.

“What we should be doing is stabilising the business, getting the operating expense to where it needs to be, fixing the margins so we can reach the audience that we need to reach.”

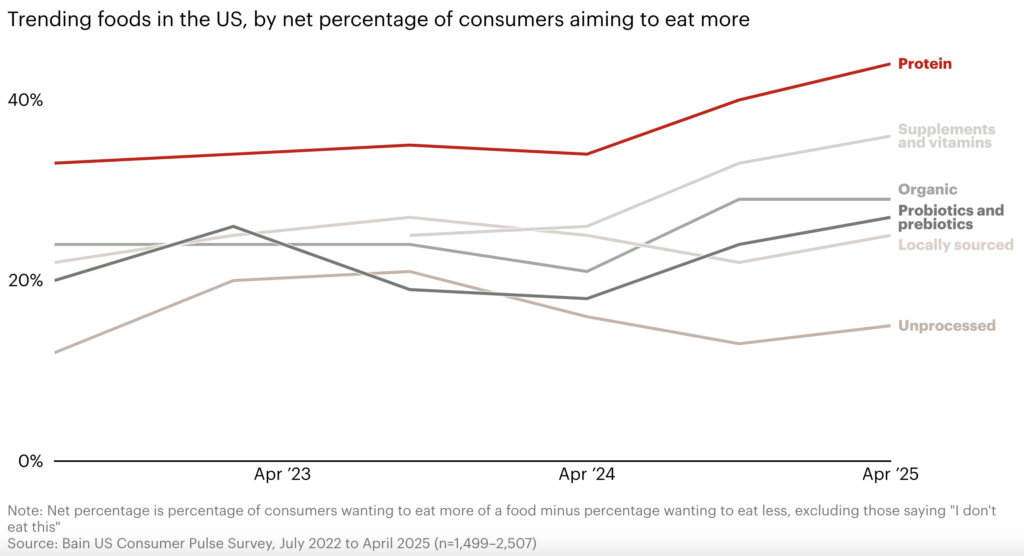

The company is now focusing on giving consumers value for money while meeting the heightened demand for protein and fibre. It will begin offering six-pack offerings for the Beyond Burger, which will help drive down the price of each individual patty for the consumer.

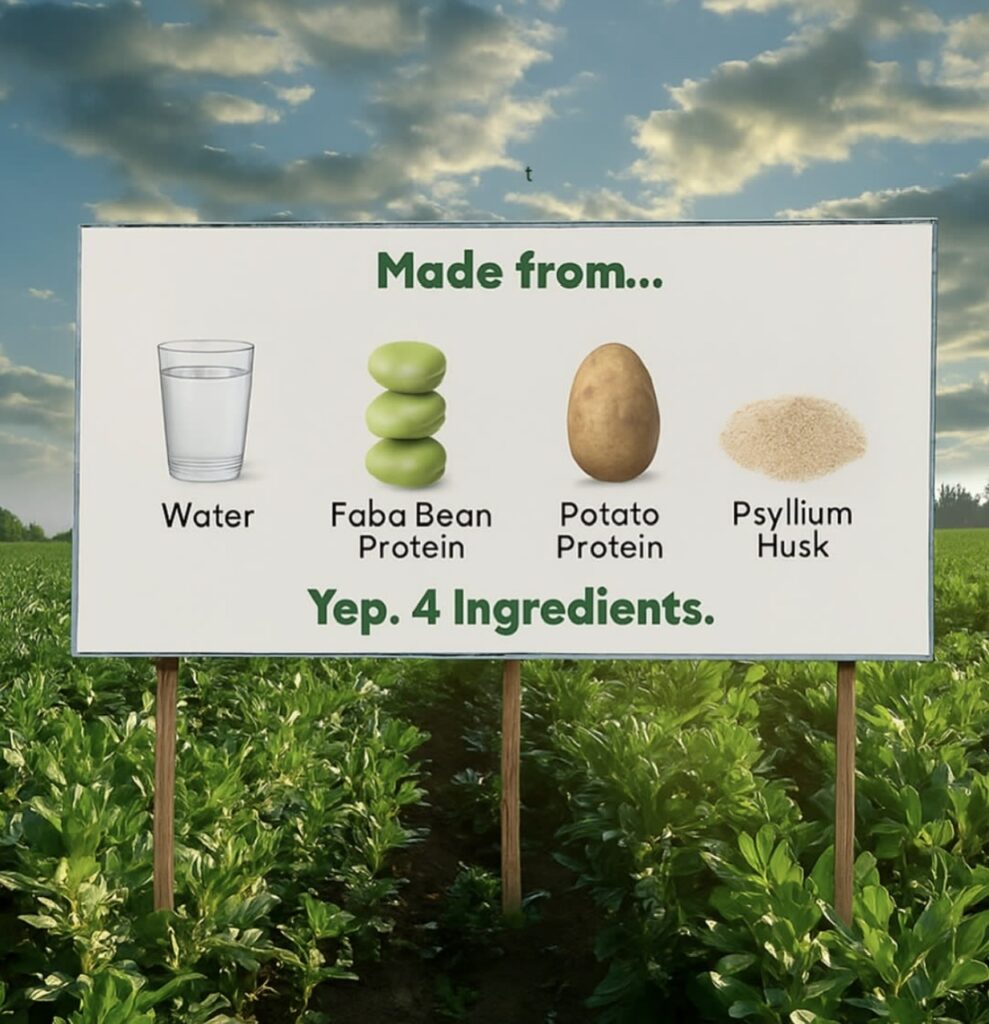

Meanwhile, even as it launched a whole-cut mycelium steak filet, Beyond Meat’s next product has nothing to do with meat. Called Beyond Ground, the innovation is an answer to critiques about ultra-processing, long ingredient lists, and poor nutritional value.

The mince-like protein only has four ingredients: fava beans, potato starch, water, and psyllium husk. Each serving contains 140 calories, 4g of fibre, 1.5g of fat, and 27g of protein (higher than beef). Plus, it has zero cholesterol, saturated fat, or added oils. The product “represents an early foray beyond beef, pork and poultry replication”, Brown said, and has been “met with considerable enthusiasm, albeit with a very narrow consumer set”.

Despite the resurgence of animal protein, Beyond Meat remains optimistic. “We know that the extreme nature of the current renaissance around animal protein will, as consumer trends do, moderate. This moderation may occur solely with time, new information or new trends or may be spurred on by a set of related factors, including pricing pressure, droughts and genetic disease outbreaks,” said Brown.

“Over time, facts do have a way of overcoming fiction. Consumers do, in fact, bristle at being misled at the expense of their own health, and our products will have the opportunity to be more fairly evaluated for what they are,” he added.

Scrapping ‘Meat’ gives Beyond the freedom to meet broader protein needs

The Beyond Ground product represents a major refresh of the company’s identity. In response to the substandard performance, the firm is dropping ‘Meat’ from its brand to highlight traditional plant proteins, starting with the fava bean mince. Later iterations could include chickpea hot dogs and lentil sausages, Brown has teased.

“Going forward, we intend to increasingly use ‘Beyond’ as the primary brand. We have been formally using the shortened mark in certain instances for some time now, and believe it provides for reduced emphasis on facsimile, a now-complicated frame that overshadows the real high-quality protein offerings we provide to consumers, and a widening of our aperture beyond animal protein replicates,” he said.

This would allow Beyond Meat to “have the freedom” to meet broader consumer protein needs and deliver the nutritional gains they’re after.

The company will provide more details about the use of ‘Beyond’ as its brand in the coming months, which it’s implementing on a rolling basis. “The necessity of this reset does not, however, reduce or diminish our conviction or enthusiasm for the future that awaits,” stated Brown.

“The factors that encumber our success today are transient. Just as we recognise that we are a higher-priced item in a period of economic uncertainty and stress, we know that on a material basis, our cost structure will change as we achieve scale.

“We are, in fact, already in one limited but important instance, producing and supplying product at a cost price that is roughly equal to the corresponding animal protein equivalent. As we get to much higher volumes across our core products, the efficiency of our system will prevail. And all other things being equal, we should be able to underprice animal protein in many offerings.”

Brown labelled it a “tough quarter” that the company took “on the chin”. “It wasn’t what we wanted, but I think the reaction is what matters,” he said. “We’ve obviously known about these results and have been fast after it.

“Between the intensified cost reduction, the gross margin expansion initiatives, really focusing on expanding our core distribution (particularly in US retail), and then this opportunity to potentially live outside some of the confines we’ve been in recently, around looking at things like Beyond Ground and the use of the Beyond brand and protein occasions for consumers, I’m very optimistic [about] where we’re headed.”

The post More Layoffs, More Losses in Bleak Q2 for Beyond Meat Amid Brand Refresh appeared first on Green Queen.

This post was originally published on Green Queen.