Californian food tech startup MeliBio, known for its plant-based Mellody honey, has been acquired by Swiss innovation hub FoodYoung Labs.

US bee-free honey startup MeliBio has been snapped up by FoodYoung Labs, a Swiss venture studio and innovation hub.

The deal includes MeliBio’s consumer brand Mellody, which sells plant-based honey, its Generation 1 technology and related IP. It doesn’t involve the Generation 2 precision fermentation technology, which would have enabled the firm to produce bioidentical honey without the bees.

It comes months after the Californian startup bagged an undisclosed sum in a pre-Series A round, taking its total raised to around $10M. The financing was a pivot from a planned Series A round that would have netted the business another $10M, but the funding challenges of the food tech market meant this never materialised.

Co-founder and CEO Darko Mandich told Green Queen in October that the firm would open the Series A again this year. However, the company’s assets have now been acquired to expand the reach of its plant-based honey.

“For food. tech to thrive, it needs the kind of deep roots that only experienced food companies can offer,” said Mandich about the sale. “With FoodYoung’s longstanding heritage and expertise, I’m confident this is the right environment for MeliBio’s mission to grow and flourish.”

From Michelin-starred eateries to discount retailers

Mandich established MeliBio with CTO Aaron Schaller in 2020 to commercialise a precision-fermented honey, before adding the plant-based version to its portfolio with the launch of Mellody.

Unlike other vegan honey products, which make use of apples and lemons, elderflower, carob, or other ingredients, Mellody replicates honey through a combination of fructose and glucose, complemented by a range of plant extracts (red clover, jasmine, passionflower, chamomile, and seaberry), gluconic acid and natural flavours.

The brand made a big splash by securing New York City’s three-Michelin-starred eatery, Eleven Madison Park, as its first customer. It later debuted the product in the D2C channel via a partnership with the restaurant’s online store.

Mellody has since been expanded across the US (alongside a new hot honey variety), and is available at independent retailers and a growing list of restaurants, such as Palmetto Superfoods and Joyride Pizza in California and Moto Pizza in Seattle. Moreover, it has expanded its distribution through KeHE, UNFI, Greco and Sons, and ACE Natural.

MeliBio has also launched vegan honey in Europe through a $10M, four-year partnership with Slovenia’s Narayan Foods. In the UK, this is in the form of Vegan H*ney under the Better Foodie brand, while in Austria and Switzerland, it sells as Vegan Hanny or Ohney under Aldi’s private label, Just Veg. The distribution deal aims to put MeliBio’s plant-based honey into 75,000 stores eventually.

“It has been a pleasure taking the concept of real honey made without bees to a reality… into 400+ locations worldwide and countless palates,” Schaller wrote on social media. “It is amazing what can be achieved when pairing innovative science with time-tested business strategy and operations.”

What’s next for precision-fermented honey?

FoodYoung Labs operates an innovation facility in Balerna, Switzerland, with a focus on confectionery, baked goods, snacks and bars. Its portfolio of brands includes ZAZ, Kakoo, Bonnap, Frÿze, Man, and CimaNorma.

“With our Swiss full-stack innovation lab and US commercial powerhouse, we’re taking MeliBio’s bee-free innovation to the next level – making Mellody truly clean-label and unrefined,” said FoodYoung Labs founder and CEO Abouzar Rahmani.

The fate of MeliBio’s precision fermentation tech is not known for now, though the firm has made several tech advancements on this front in the last year. It has taken at least three of its protein and enzyme targets from ideation to proof-of-concept to bioreactors, and increased the titer – the amount of product per unit volume at the end of the fermentation process – of its main enzyme target by 1,300%.

This was a result of its collaboration with AI-led biomanufacturing startup Pow.Bio; Melibio had been engaging in scale-up efforts with the latter since March 2024. As of October, MeliBio was evaluating further biomanufacturing partners for the next phase of its precision-fermented honey, though the future of this partnership is currently unknown.

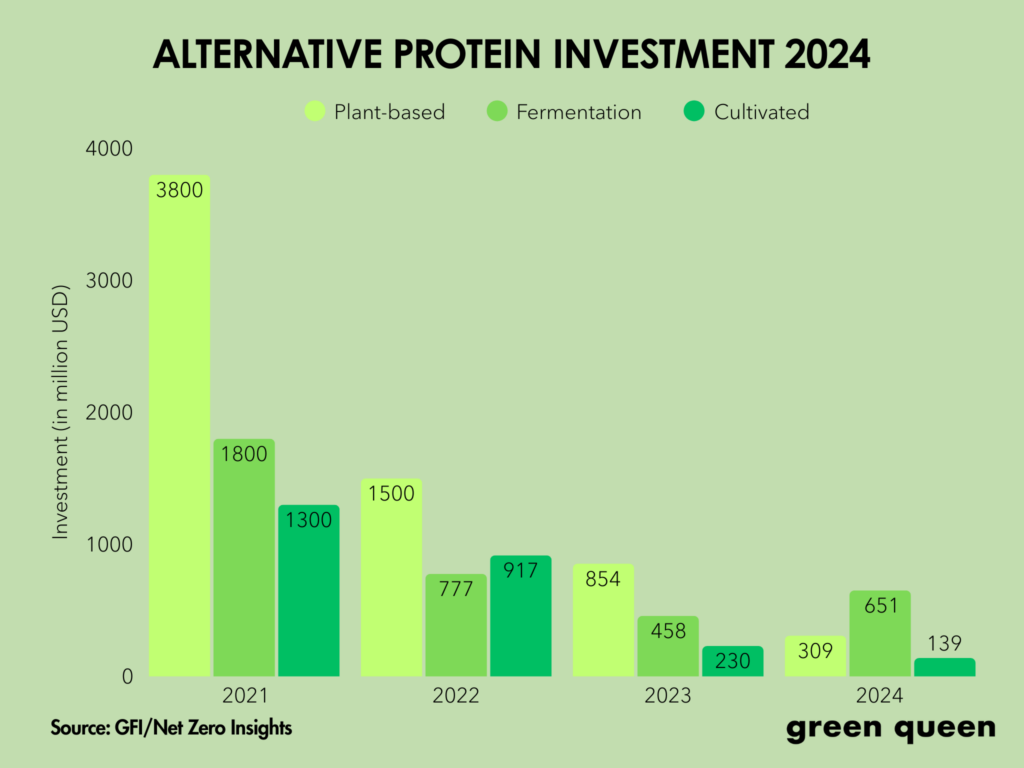

MeliBio’s sale comes amid a dire investment landscape for food and climate tech. Global agrifoodtech funding fell by 51% in 2023, and another 4% last year. The wider climate tech sector, meanwhile, suffered a 38% dip in venture funding in 2024.

This new reality has forced several future food companies to either cease operations or seek acquisition deals. This year alone, vegan pet food company Wild Earth has filed for bankruptcy, while mycelium cheese maker Bolder Foods recently shut down too.

And this month, dairy giant Danone bought dairy-free kids nutrition brand Kate Farms, while yoghurt leader Chobani snapped up frozen ready meal maker Daily Harvest.

The post Bee-Free Honey Startup MeliBio Acquired by Switzerland’s FoodYoung Labs appeared first on Green Queen.

This post was originally published on Green Queen.