Christine Wong, author of plant-based cookbook The Vibrant Hong Kong Table, talks about our meat-eating culture, vegan alternatives, and marrying tradition with future-forward cooking.

With roots in one of the world’s most meat-eating cities and a home in one of the US’s most-eating cities, being a plant-based chef must be hard work.

Or so you’d think, but for Christine Wong, it comes easy. The chef’s new plant-based cookbook, The Vibrant Hong Kong Table, is an homage to the city she grew up in, written from her home in New York City.

Over 88 recipes – ranging from pineapple buns and curry puffs to milk tea and steamed eggs – Wong showcases how local classics from Hong Kong can be futureproofed with animal-free ingredients. The book, in her words, is a “love letter to the city’s culinary heritage”, and an “opportunity to create longevity for these nostalgic dishes”.

We spoke to Wong about the ideas behind her recipes, what vegan food means to a meat-loving culture, why meat alternatives took a backseat in her cookbook, and the things her pantry will never run out of.

This interview has been edited for clarity and concision.

Green Queen: Having lived in New York for the last two decades, what sparked the idea for the book, and how long did it take you to write it?

Christine Wong: Ever since I left Hong Kong, whenever I was homesick, I would head over to Pearl River Mart (where I now work part-time as their creative manager), an iconic Asian emporium in Manhattan that has been around for over 50 years.

I would eat dim sum or some of my favourite dishes, like bitter melon and rice, and go to the Asian markets to load up on Chinese groceries, observing the Chinatown aunties scrutinising produce before making their selections – from these daily life moments to festive Lunar New Year celebrations, Chinatown has become my home away from Hong Kong.

During the pandemic, not only was the Asian American community suffering from xenophobia and Asian hate, I watched from afar as Hong Kong was also changing… with unrest and strict lockdown, and iconic restaurants and landmarks disappearing. There was a point when I thought I might never be able to return home.

My book, The Vibrant Hong Kong Table, was inspired by my desire to encapsulate and honour the history and culture of the city that has been home to my family for four generations, and to celebrate all of our iconic foods. The dishes are nostalgic, yet future-forward with a sustainable plant-based twist.

Having embraced a plant-predominant diet since 2014, it’s hard to find vegan versions of these dishes, so it’s also for selfish reasons to have written this book. It took me two years to thoroughly research and create all the recipes.

GQ: What was the inspiration behind the recipes in your book?

CW: Hong Kong is known for so many incredible dishes, but I went back in time to focus mainly on the culmination of the city’s unique West-Meets-East cuisine, or Soy Sauce Western, that sprung out of bing sutts and cha chaan tengs, which met the demand for affordable Western-style dishes using inexpensive shelf-stable ingredients and Chinese techniques.

The recipes in The Vibrant Hong Kong Table use plant-based ingredients with traditional techniques, and are structured on a timeline of eating throughout the day in Hong Kong, from a dim sum or congee breakfast to siu yeh (late-night snacks).

GQ: In the book, you grapple with the idea of using meat alternatives – can you give us an insight into your thinking, and why you chose to spotlight vegetables for the most part?

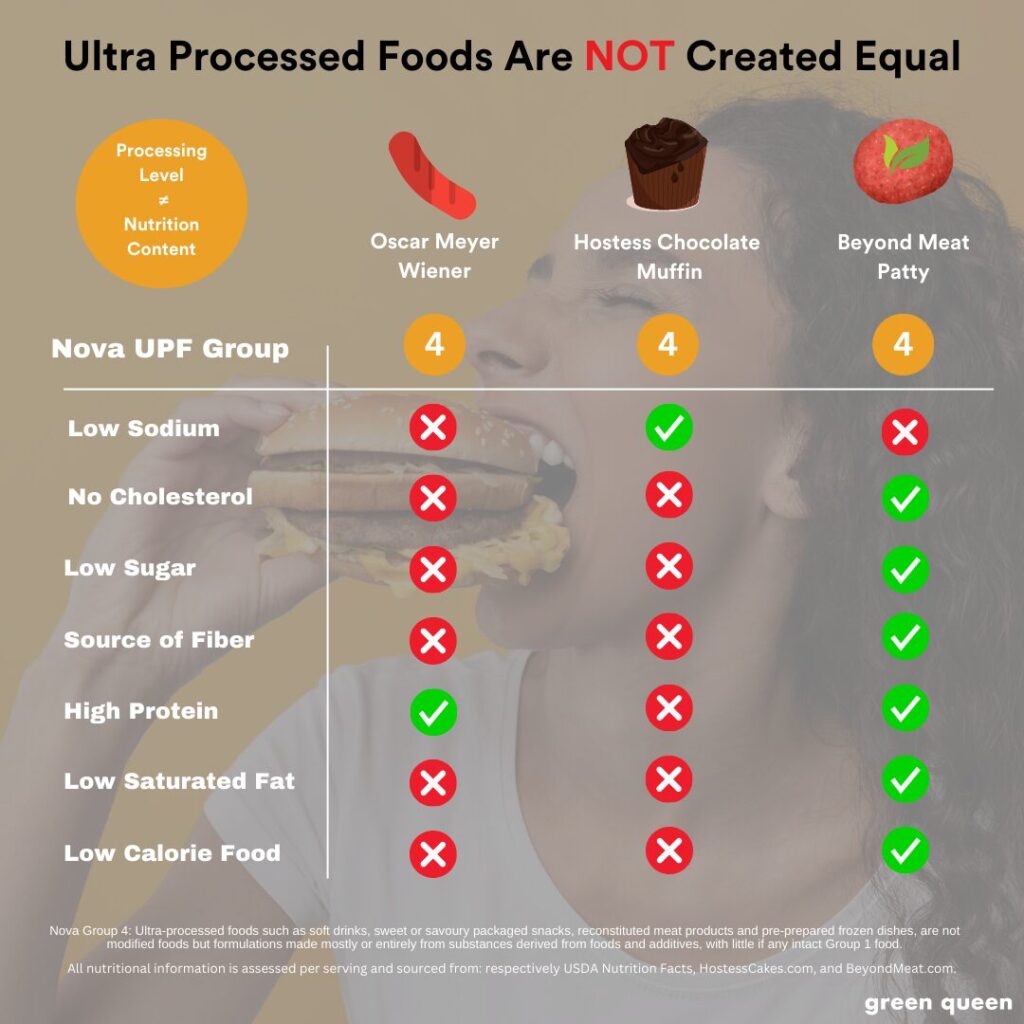

CW: I prefer to use whole ingredients and vegetables as meat replacements, as mock meats tend to be overly processed. There’s so much that the plant world has to offer like cabbage, cauliflower, sweet potatoes, and young jackfruit. I made sure to include these, rather than only subbing meat with tofu and mushrooms.

GQ: Many local restaurants in Hong Kong tend to use traditional soy- or wheat-based meat analogues (which, to many, taste better than their western counterparts). What’s your view on them, and do you think there’s a place for these centuries-old alternatives in helping people cut back on meat?

CW: The key to cutting back on meat is to keep an open mind and not to scrutinise and compare plant-based dishes with the original. It will never quite be the same, though most modern meat replacements try to – some western plant-based meat brands even bleed!

Traditional soy- and wheat gluten-based alternatives are tasty, and less processed – however, even as a kid, seeing the Buddhist vegetarian foods my Maa Maa (paternal grandmother) would eat, I never understood why all the dishes were brown, and not colorufully vibrant. The focus should be on integrating more vegetables into your diet rather than only replacing the meat.

GQ: Do you think Hong Kongers – who love their meat – would be receptive to a vegan cookbook and its non-traditional recipes?

CW: Whenever I tell people about my book and mention that The Vibrant Hong Kong Table is plant-based, I can see/hear “approval” and know that I’ve captured interest in the book.

I think Hong Kongers are more open to vegan cookbooks these days, especially this one, since many of the recipes are iconic Hong Kongese dishes. People glancing through my book often don’t realise that the dishes are vegan.

GQ; What do you think people get most wrong about vegan cooking?

CW: Vegan food does not always equate to rabbit food and isn’t limited to salads and smoothies. It can be culturally nostalgic and satisfyingly flavourful, with the added benefit of being nutritiously good for you – and good for the planet.

When prepared with the same attention and care as other dishes, one would not even miss the meat. Protein can be found in plant foods with the benefit of a plethora of nutrients and fibre, which lends to being satiated.

GQ: What are some of your favourite recipes from the book?

CW: My Steamed ‘Egg’, Black-Pink Pepper Cabbage Steak, Jackfruit ‘Brisket’ Noodles and Grandma’s Hong Kong Curry bring me comfort, satisfying some of my most poignant food memories.

GQ: What was the most difficult dish to veganise in the book, and why?

CW: Fishballs! I really wanted to capture that distinct bouncy texture, and played around with countless variations of flours and combinations. It was the first and last recipe I tested, with multiple iterations in between.

GQ: What are three things that you recommend people always have in their pantry, and why?

CW: Rice is a pantry staple that complements any dish, especially saucy and soupy ones. Whether it’s freshly steamed, fried with chopped ingredients, boiled into a congee, or even soaked, blended and steamed to make cheung fun (rice noodle rolls), rice is a versatile grain – especially if you include glutinous rice too.

Dried mushrooms are full of umami and a perfect substitute for meat both in terms of flavour and texture. They are one of the most convenient pantry items, only requiring water to soak and rehydrate them.

Soybeans are not only a great source of protein – these dried legumes are so versatile that making soy milk and tofu is easy. And if you have the time and patience, tofu skin.

GQ: Your book is an ode to Hong Kong – what do you hope readers take away from your book?

CW: I would like The Vibrant Hong Kong Table to preserve and celebrate Hong Kong’s culture and identity. It is a culinary exploration for the vegan community who want to “travel the world” through food while opening up the mindset of meat-eaters that vegan recipes can be culturally appropriate, satisfyingly delicious, and equally nostalgic.

The Vibrant Hong Kong Table by Christine Wong (Chronicle Books) is available online and at bookstores worldwide for $32.50.

The post The Vibrant Hong Kong Table’s Christine Wong: ‘Don’t Just Replace Meat – Eat More Vegetables’ appeared first on Green Queen.

This post was originally published on Green Queen.