On Friday, March 10, Silicon Valley Bank (SVB) collapsed and was taken over by federal regulators. SVB was the 16th largest bank in the country and its bankruptcy was the second largest in U.S. history, following Washington Mutual in 2008. Despite its size, SVB was not a “systemically important financial institution” (SIFI) as defined in the Dodd-Frank Act, which requires insolvent SIFIs to “bail in” the money of their creditors to recapitalize themselves.

Technically, the cutoff for SIFIs is $250 billion in assets. However, the reason they are called “systemically important” is not their asset size but the fact that their failure could bring down the whole financial system. That designation comes chiefly from their exposure to derivatives, the global casino that is so highly interconnected that it is a “house of cards.” Pull out one card and the whole house collapses. SVB held $27.7 billion in derivatives, no small sum, but it is only .05% of the $55,387 billion ($55.387 trillion) held by JPMorgan, the largest U.S. derivatives bank.

SVB could be the canary in the coal mine foreshadowing the fate of other over-extended banks, but its collapse is not the sort of “systemic risk” predicted to trigger “contagion.” As reported by CNN:

Despite initial panic on Wall Street, analysts said SVB’s collapse is unlikely to set off the kind of domino effect that gripped the banking industry during the financial crisis.

“The system is as well-capitalized and liquid as it has ever been,” Moody’s chief economist Mark Zandi said. “The banks that are now in trouble are much too small to be a meaningful threat to the broader system.”

No later than Monday morning, all insured depositors will have full access to their insured deposits, according to the FDIC. It will pay uninsured depositors an “advance dividend within the next week.”

The FDIC, Federal Reserve and U.S. Treasury have now agreed on an interim fix that will the subject of another article. Meanwhile, this column focuses on derivatives and is a followup to my Feb. 23 column on the “bail in” provisions of the 2010 Dodd Frank Act, which eliminated taxpayer bailouts by requiring insolvent SIFIs to recapitalize themselves with the funds of their creditors. “Creditors” are defined to include depositors, but deposits under $250,000 are protected by FDIC insurance. However, the FDIC fund is sufficient to cover only about 2% of the $9.6 trillion in U.S. insured deposits. A nationwide crisis triggering bank runs across the country, as happened in the early 1930s, would wipe out the fund. Today, some financial pundits are predicting a crisis of that magnitude in the quadrillion dollar-plus derivatives market, due to rapidly rising interest rates. This column looks at how likely that is and what can be done either to prevent it or dodge out of the way.

“Financial Weapons of Mass Destruction”

In 2002, mega-investor Warren Buffett wrote that derivatives were “financial weapons of mass destruction.” At that time, their total “notional” value (the value of the underlying assets from which the “derivatives” were “derived”) was estimated at $56 trillion. Investopedia reported in May 2022 that the derivatives bubble had reached an estimated $600 trillion according to the Bank for International Settlements (BIS), and that the total is often estimated at over $1 quadrillion. No one knows for sure, because most of the trades are done privately.

As of the third quarter of 2022, according to the “Quarterly Report on Bank Trading and Derivatives Activities” of the Office of the Comptroller of the Currency (the federal bank regulator), a total of 1,211 insured U.S. national and state commercial banks and savings associations held derivatives, but 88.6% of these were concentrated in only four large banks: J.P. Morgan Chase ($54.3 trillion), Goldman Sachs ($51 trillion), Citibank ($46 trillion), Bank of America ($21.6 trillion), followed by Wells Fargo ($12.2 trillion). A full list is here. Unlike in 2008-09, when the big derivative concerns were mortgage-backed securities and credit default swaps, today the largest and riskiest category is interest rate products.

The original purpose of derivatives was to help farmers and other producers manage the risks of dramatic changes in the markets for raw materials. But in recent times they have exploded into powerful vehicles for leveraged speculation (borrowing to gamble). In their basic form, derivatives are just bets – a giant casino in which players hedge against a variety of changes in market conditions (interest rates, exchange rates, defaults, etc.). They are sold as insurance against risk, which is passed off to the counterparty to the bet. But the risk is still there, and if the counterparty can’t pay, both parties lose. In “systemically important” situations, the government winds up footing the bill.

Like at a race track, players can bet although they have no interest in the underlying asset (the horse). This has allowed derivative bets to grow to many times global GDP and has added another element of risk: if you don’t own the barn on which you are betting, the temptation is there to burn down the barn to get the insurance. The financial entities taking these bets typically hedge by betting both ways, and they are highly interconnected. If counterparties don’t get paid, they can’t pay their own counterparties, and the whole system can go down very quickly, a systemic risk called “the domino effect.”

That is why insolvent SIFIs had to be bailed out in the Global Financial Crisis (GFC) of 2007-09, first with $700 billion of taxpayer money and then by the Federal Reserve with “quantitative easing.” Derivatives were at the heart of that crisis. Lehman Brothers was one of the derivative entities with bets across the system. So was insurance company AIG, which managed to survive due to a whopping $182 billion bailout from the U.S. Treasury; but Lehman was considered too weakly collateralized to salvage. It went down, and the Great Recession followed.

Risks Hidden in the Shadows

Derivatives are largely a creation of the “shadow banking” system, a group of financial intermediaries that facilitates the creation of credit globally but whose members are not subject to regulatory oversight. The shadow banking system also includes unregulated activities by regulated institutions. It includes the repo market, which evolved as a sort of pawn shop for large institutional investors with more than $250,000 to deposit. The repo market is a safe place for these lenders, including pension funds and the U.S. Treasury, to park their money and earn a bit of interest. But its safety is insured not by the FDIC but by sound collateral posted by the borrowers, preferably in the form of federal securities.

As explained by Prof. Gary Gorton:

This banking system (the “shadow” or “parallel” banking system) – repo based on securitization – is a genuine banking system, as large as the traditional, regulated banking system. It is of critical importance to the economy because it is the funding basis for the traditional banking system. Without it, traditional banks will not lend and credit, which is essential for job creation, will not be created.

While it is true that banks create the money they lend simply by writing loans into the accounts of their borrowers, they still need liquidity to clear withdrawals; and for that they largely rely on the repo market, which has a daily turnover just in the U.S. of over $1 trillion. British financial commentator Alasdair MacLeod observes that the derivatives market was built on cheap repo credit. But interest rates have shot up and credit is no longer cheap, even for financial institutions.

According to a December 2022 report by the BIS, $80 trillion in foreign exchange derivatives that are off-balance-sheet (documented only in the footnotes of bank reports) are about to reset (roll over at higher interest rates). Financial commentator George Gammon discusses the threat this poses in a podcast he calls, “BIS Warns of 2023 Black Swan – A Derivatives Time Bomb.”

Another time bomb in the news is Credit Suisse, a giant Swiss derivatives bank that was hit with an $88 billion run on its deposits by large institutional investors late in 2022. The bank was bailed out by the Swiss National Bank through swap lines with the U.S. Federal Reserve at 3.33% interest.

The Perverse Incentives Created by “Safe Harbor” in Bankruptcy

In The New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) Consequences, Prof. David Skeel refutes what he calls the “Lehman myth”—the widespread belief that Lehman’s collapse resulted from the decision to allow it to fail. He blames the 2005 safe harbor amendment to the bankruptcy law, which says that the collateral posted by insolvent borrowers for both repo loans and derivatives has “safe harbor” status exempting it from recovery by the bankruptcy court. When Lehman appeared to be in trouble, the repo and derivatives traders all rushed to claim the collateral before it ran out, and the court had no power to stop them.

So why not repeal the amendment? In a 2014 article titled “The Roots of Shadow Banking,” Prof. Enrico Perotti of the University of Amsterdam explained that the safe harbor exemption is a critical feature of the shadow banking system, one it needs to function. Like traditional banks, shadow banks create credit in the form of loans backed by “demandable debt”—short-term loans or deposits that can be recalled on demand. In the traditional banking system, the promise that the depositor can get his money back on demand is made credible by government-backed deposit insurance and access to central bank funding. The shadow banks needed their own variant of “demandable debt,” and they got it through the privilege of “super-priority” in bankruptcy. Perotti wrote:

Safe harbor status grants the privilege of being excluded from mandatory stay, and basically all other restrictions. Safe harbor lenders, which at present include repos and derivative margins, can immediately repossess and resell pledged collateral.

This gives repos and derivatives extraordinary super-priority over all other claims, including tax and wage claims, deposits, real secured credit and insurance claims. [Emphasis added.]

The dilemma of our current banking system is that lenders won’t advance the short-term liquidity needed to fund repo loans without an ironclad guarantee; but the guarantee that makes the lender’s money safe makes the system itself very risky. When a debtor appears to be on shaky ground, there will be a predictable stampede by favored creditors to grab the collateral, in a rush for the exits that can propel an otherwise-viable debtor into bankruptcy; and that is what happened to Lehman Brothers.

Derivatives were granted “safe harbor” because allowing them to fail was also considered a systemic risk. It could trigger the “domino effect,” taking the whole system down. The error, says Prof. Skeel, was in passage of the 2005 safe harbor amendment. But the problem with repealing it now is that we will get the domino effect, in the collapse of both the quadrillion dollar derivatives market and the more than trillion dollars traded daily in the repo market.

The Interest Rate Shock

Interest rate derivatives are particularly vulnerable in today’s high interest rate environment. From March 2022 to February 2023, the prime rate (the rate banks charge their best customers) shot up from 3.5% to 7.75%, a radical jump. Market analyst Stephanie Pomboy calls it an “interest rate shock.” It won’t really hit the market until variable-rate contracts reset, but $1 trillion in U.S. corporate contracts are due to reset this year, another trillion next year, and another trillion the year after that.

A few bank bankruptcies are manageable, but an interest rate shock to the massive derivatives market could take down the whole economy. As Michael Snyder wrote in a 2013 article titled “A Chilling Warning About Interest Rate Derivatives:”

Will rapidly rising interest rates rip through the U.S. financial system like a giant lawnmower blade? Yes, the U.S. economy survived much higher interest rates in the past, but at that time there were not hundreds of trillions of dollars worth of interest rate derivatives hanging over our financial system like a Sword of Damocles.

… [R]ising interest rates could burst the derivatives bubble and cause “massive bankruptcies around the globe” [quoting Mexican billionaire Hugo Salinas Price]. Of course there are a whole lot of people out there that would be quite glad to see the “too big to fail” banks go bankrupt, but the truth is that if they go down, our entire economy will go down with them. … Our entire economic system is based on credit, and just like we saw back in 2008, if the big banks start failing, credit freezes up and suddenly nobody can get any money for anything.

There are safer ways to design the banking system, but they are not likely to be in place before the quadrillion dollar derivatives bubble bursts. Snyder was writing 10 years ago, and it hasn’t burst yet; but this was chiefly because the Fed came through with the “Fed Put” – the presumption that it would backstop “the market” in any sort of financial crisis. It has performed as expected until now, but the Fed Put has stripped it of its “independence” and its ability to perform its legislated duties. This is a complicated subject, but two excellent books on it are Nik Bhatia’s Layered Money (2021) and Lev Menand’s The Fed Unbound: Central Banking in a Time of Crisis (2022).

Today the Fed appears to be regaining its independence by intentionally killing the Fed Put, with its push to raise interest rates. (See my earlier article here.) It is still backstopping the offshore dollar market with “swap lines,” arrangements between central banks of two countries to keep currency available for member banks, but the latest swap line rate for the European Central Bank is a pricey 4.83%. No more “free lunch” for the banks.

Alternative Solutions

Alternatives that have been proposed for unwinding the massive derivatives bubble include repealing the safe harbor amendment and imposing a financial transaction tax, typically a 0.1% tax on all financial trades. But those proposals have been around for years and Congress has not taken up the call. Rather than waiting for Congress to act, many commentators say we need to form our own parallel alternative monetary systems.

Crypto proponents see promise in Bitcoin; but as Alastair MacLeod observes, Bitcoin’s price is too volatile for it to serve as a national or global reserve currency, and it does not have the status of enforceable legal tender. MacLeod’s preferred alternative is a gold-backed currency, not of the 19th century variety that led to bank runs when the banks ran out of gold, but of the sort now being proposed by Sergey Glazyev for the Eurasian Economic Union. The price of gold would be a yardstick for valuing national currencies, and physical gold could be used as a settlement medium to clear trade balances.

Lev Menand, author of The Fed Unbound, is an Associate Professor at Columbia Law School who has worked at the New York Fed and the U.S. Treasury. Addressing the problem of the out-of-control unregulated shadow banking system, he stated in a July 2022 interview with The Hill, “I think that one of the great possible reforms is the public banking movement and the replication of successful public bank enterprises that we have now in some places, or that we’ve had in the past.”

Certainly, for our local government deposits, public banks are an important solution. State and local governments typically have far more than $250,000 deposited in SIFI banks, but local legislators consider them protected because they are “collateralized.” In California, for example, banks taking state deposits must back them with collateral equal to 110% of the deposits themselves. The problem is that derivative and repo claimants with “supra-priority” can wipe out the entirety of a bankrupt bank’s collateral before other “secured” depositors have access to it.

Our tax dollars should be working for us in our own communities, not capitalizing failing SIFIs on Wall Street. Our stellar (and only) state-owned model is the Bank of North Dakota, which carried North Dakota through the 2008-09 financial crisis with flying colors. Post-GFC (the Global Financial Crisis of ’07-’09), it earned record profits reinvesting the state’s revenues in the state, while big commercial banks lost billions in the speculative markets. Several state legislatures currently have bills on their books following the North Dakota precedent.

For a federal workaround, we could follow the lead of Jesse Jones’ Reconstruction Finance Corporation, which funded the New Deal that pulled the country out of the Great Depression. A bill for a national investment bank currently in Congress that has widespread support is based on that very effective model, avoiding the need to increase taxes or the federal debt.

All those alternatives, however, depend on legislation, which may be too late. Meanwhile, self-sufficient “intentional” communities are growing in popularity, if that option is available to you. Community currencies, including digital currencies, can be used for trade. They can be “Labor Dollars” or “Food Dollars” backed by the goods and services for which the community has agreed to accept them. (See my earlier article here.) The technology now exists to form a network of community cryptocurrencies that are asset-backed and privacy-protected, but that is a subject for another column.

The current financial system is fragile, volatile and vulnerable to systemic shocks. It is due for a reset, but we need to ensure that the system is changed in a way that works for the people whose labor and credit support it. Our hard-earned deposits are now the banks’ only source of cheap liquidity. We can leverage that power by collaborating in a way that serves the public interest.

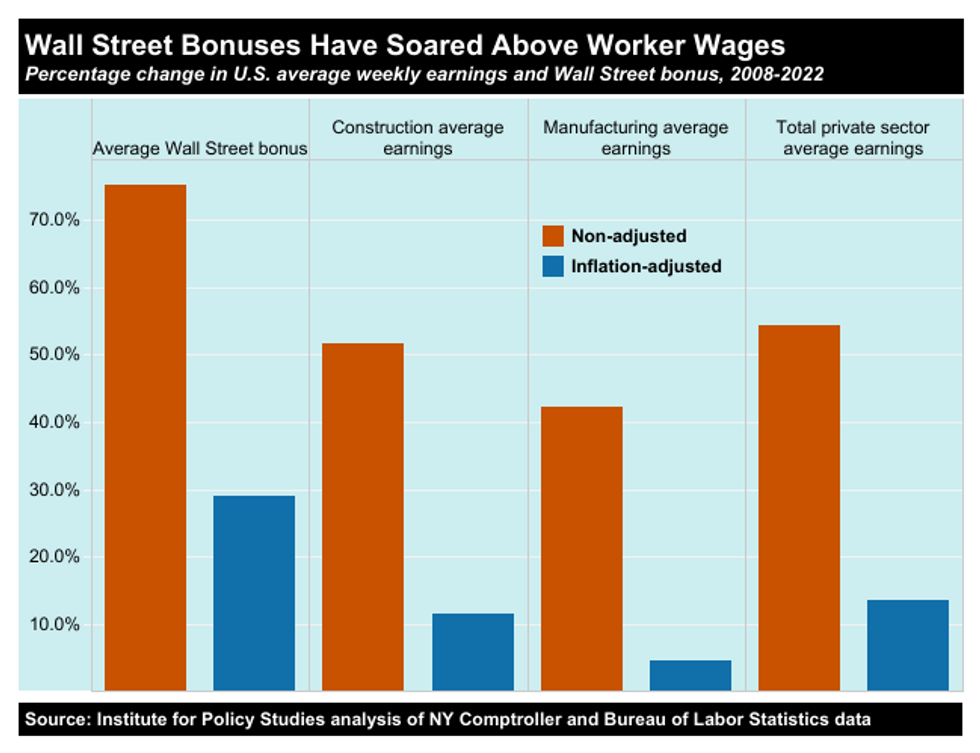

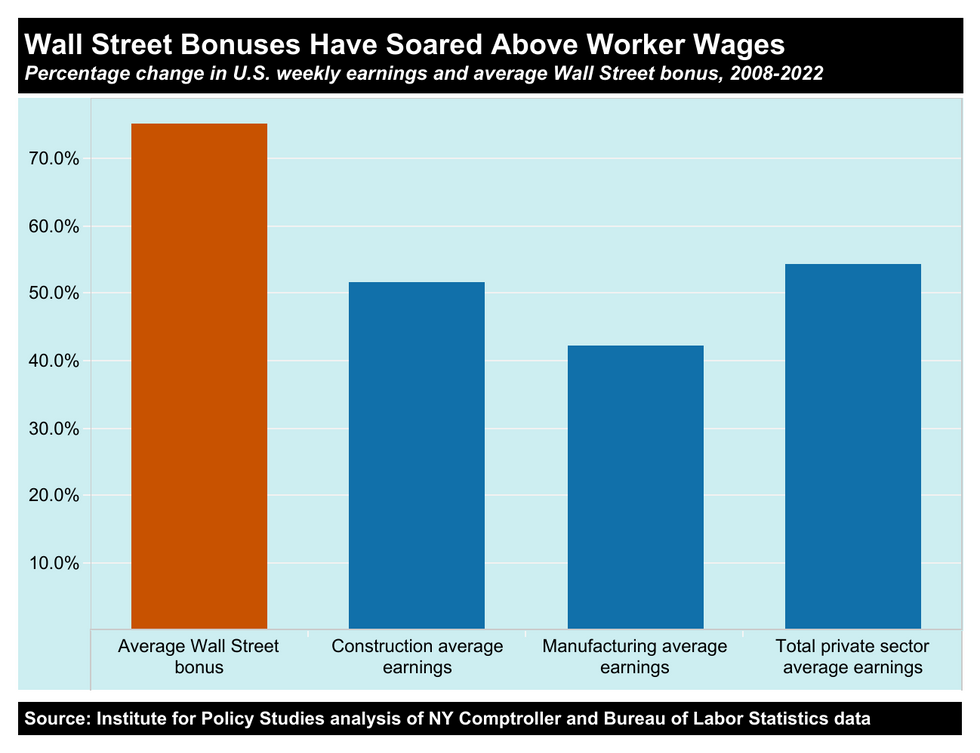

Source: Institute for Policy Studies analysis of NY Comptroller and Bureau of Labor Statistics data

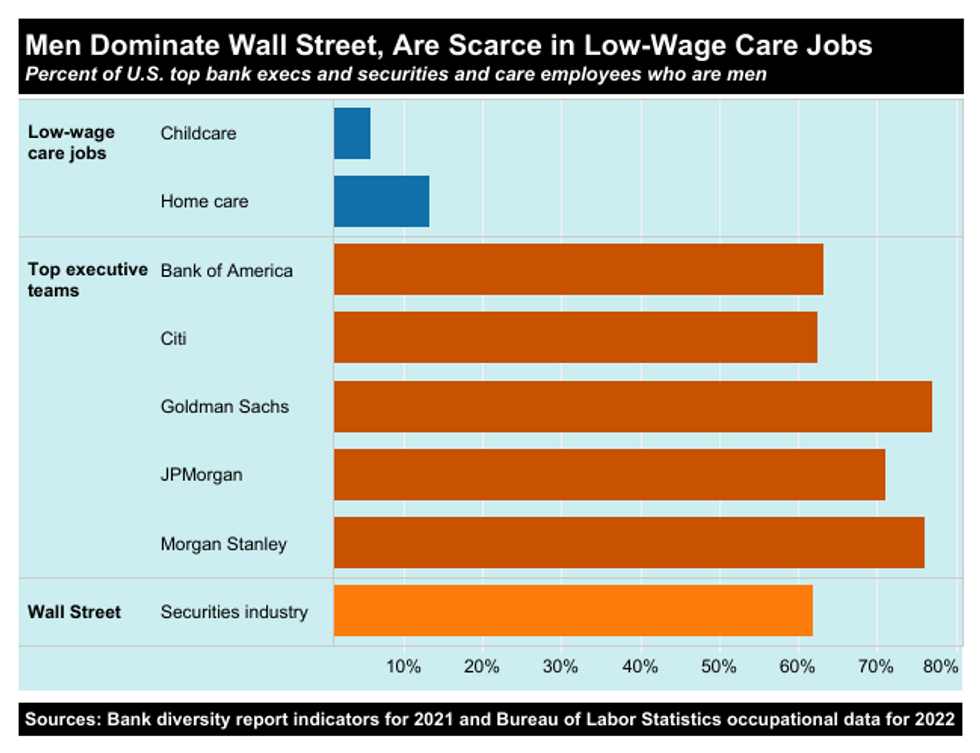

Source: Institute for Policy Studies analysis of NY Comptroller and Bureau of Labor Statistics data  Sources: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

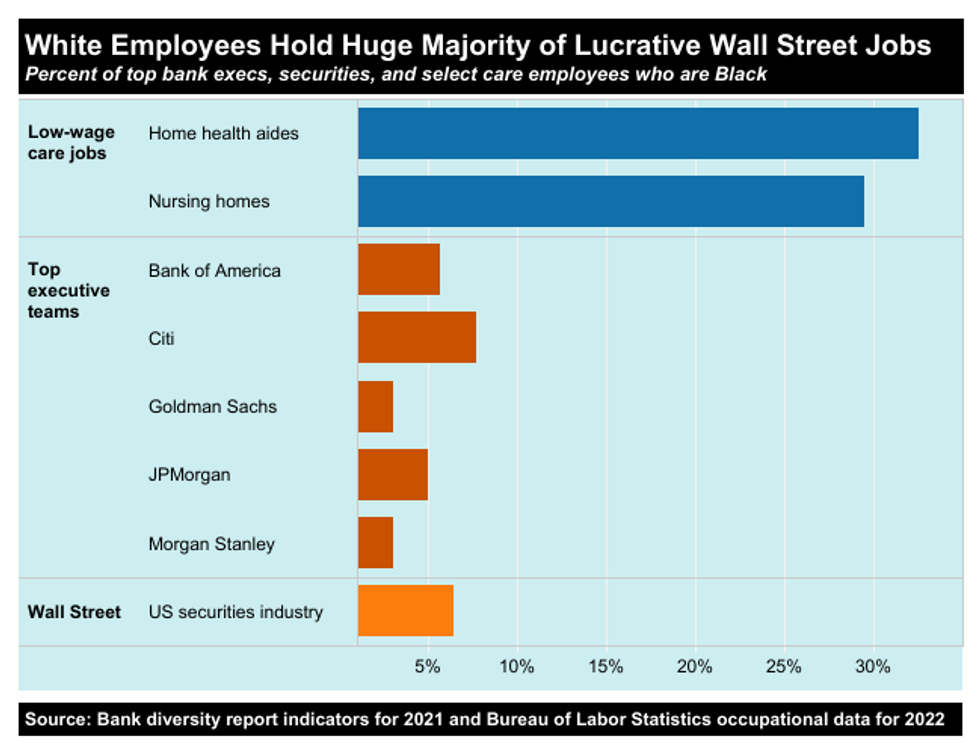

Sources: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022  Source: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

Source: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

(@TaraSetmayer)

(@TaraSetmayer)