Plant-based giant Beyond Meat has kicked off the Beyond Test Kitchen, releasing its clean-label Ground products and whole-cut mycelium steak to quick success.

As it works to turn around its sales and eliminate its debt, US plant-based pioneer Beyond Meat has debuted a new strategy to launch its innovations.

The company has unveiled Beyond Test Kitchen, a customer-led approach to product development, gi giving them an exclusive first taste of its new proteins before wider rollout.

Each product is produced in limited quantities and sold in fashion-industry-style ‘drops exclusively on Beyond Test Kitchen’s direct-to-consumer website.

Its first products are the much-anticipated Beyond Ground and the mycelium-based steak that has only been available in restaurants, and they’ve been selling fast.

Beyond Test Kitchen debuts Ground range and mycelium steak for home use

Beyond Ground was first announced in July, when CEO Ethan Brown announced that the company would begin dropping the word ‘Meat’ from its brand name to spotlight traditional plant proteins that go beyond replicating animal-based foods.

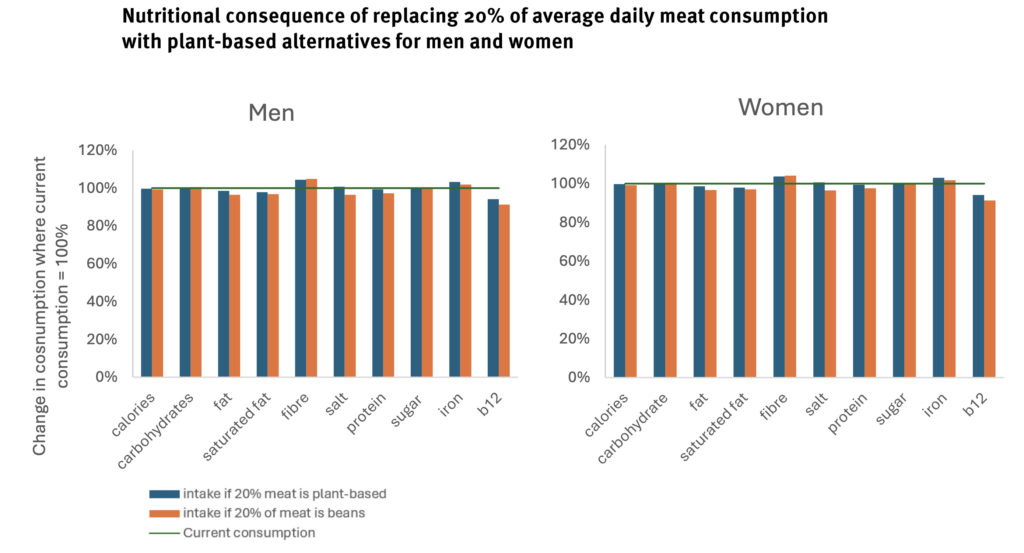

In its original form, the product contains just four ingredients: water, fava bean protein, potato protein, and psyllium husk. It is intended as a response to the category’s biggest criticisms, from ultra-processing and long ingredient lists.

The mince-like protein will boost the nutritional perceptions of plant proteins. Each 4oz serving of the uneasoned Beyond Ground contains 140 calories, 4g of fibre, 1.5g of fat, and 27g of protein (higher than beef). Plus, it has zero cholesterol, saturated fat, or added oils. Home cooks can add any seasonings, marinades, or sauces to build their meals around the product.

As part of the Beyond Test Kitchen, the company has also launched the Ground product in three flavours: Chipotle Pineapple, Korean BBQ Style, and Tuscan Style Tomato. These do contain more fat, saturated fat, and sodium, but don’t need further seasoning during cooking.

Meanwhile, the whole-cut Beyond Steak Filet has so far been confined to eateries like Boa Steakhouse, Ladybird, and Next Level Veggie Grill. But after feedback from its custmers, Beyond Meat is opening up the mycelium-derived protein to home cooks for the first time through this approach.

The whole-cut steak is comprised of a base of wheat gluten, fava bean protein, avocado oil and mycelium, with a small amount of brown rice powder, oat bran, malted barley flour, beet juice colour, apple extract, spices and natural flavours, starter culture, and salt. Each 127g fillet delivers 28g of protein and 3g of fibre, with just 1g of saturated fat.

Most Beyond Test Kitchen bundles sold out amid financial unrest

On the Beyond Test Kitchen, the products are available in four bundles. Three of them – comprising an eight-pack of the steak or combining it with the Beyond Ground products – have already sold out. A variety pack of the latter is still up for grabs.

The products are priced similarly to Beyond Meat’s existing range, with the eight-packs starting from $71.20. The bundle with just the Beyond Ground is $72.50, putting each product at just over $9, while the all-steak option costs $84 (or $10.50 per fillet).

Beyond Meat said information on future Test Kitchen products, including how customers can get involved with feedback on new ideas and tasting products early, will be available on its social channels. Brown has previously teased products like chickpea hot dogs and lentil sausages.

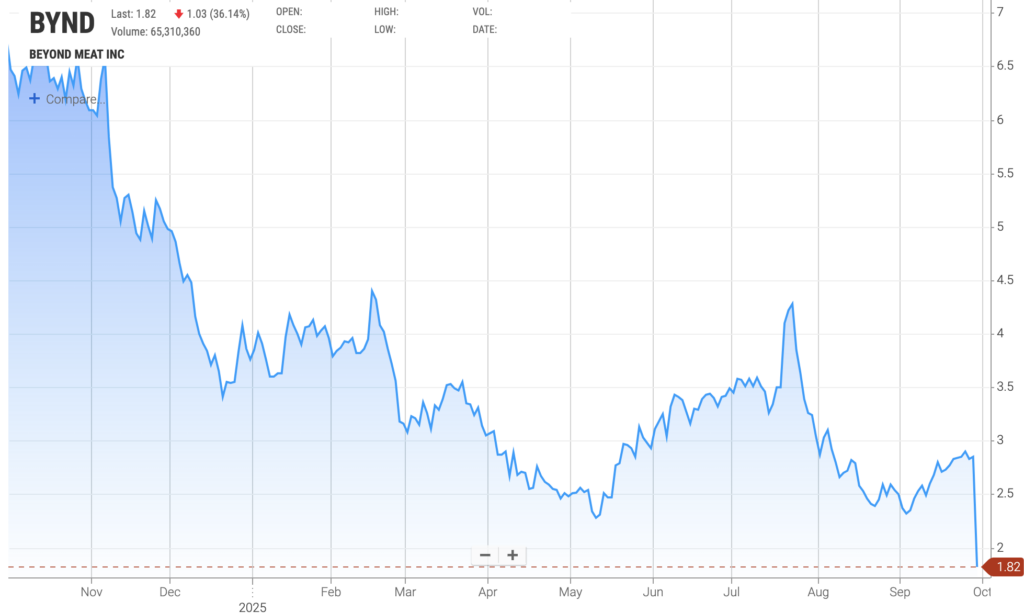

The move comes amid a media storm for the company. Its stock fell to an all-time low of 85 cents last week, after announcing the early settlement of an exchange offer for convertible bonds to eliminate over $800M of debt.

Beyond Meat is currently $1.15B in debt, thanks to 0% convertible notes that will mature in 2027. But the proposal would see them swapped for higher-interest 7% notes that are due in 2030, plus stock shares. The firm needed 85% of its holders to agree to this by the end of October, but 97% did so by last week.

The firm recorded its lowest quarterly revenue in Q1 2025, reaching $69M. It also secured $100M in debt financing from Unprocessed Foods, a subsidiary of Ahimsa Foundation, a non-profit advancing plant-based diets. In the ensuing three months, Beyond Meat’s sales fell by 20% compared to the year-ago period.

In February, it announced that it would lay off 9% of its global workforce, or 64 employees, which included all its staff in China, where it has suspended operations. And in August, it said it would let go of 44 employees in North America, though it isn’t clear if this is part of the same job cuts as above, or an additional round of layoffs.

However, Brown said the “opportunity to potentially live outside some of the confines we’ve been in recently”, with Beyond Ground and “the use of the Beyond brand and protein occasions for consumers”, makes him “very optimistic” about the future. With Beyond Test Kitchen, the company is doubling down on this approach.

The post Beyond Meat Launches Test Kitchen to Give At-Home Cooks a Taste of Its New Products appeared first on Green Queen.

This post was originally published on Green Queen.